Deck 13: Money Creation and Deposit Insurance

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/115

العب

ملء الشاشة (f)

Deck 13: Money Creation and Deposit Insurance

1

Economists generally agree that there is a relationship between the rate of growth of the money supply and

A)government spending.

B)planned investment.

C)the Toronto stock exchange.

D)inflation.

A)government spending.

B)planned investment.

C)the Toronto stock exchange.

D)inflation.

government spending.

2

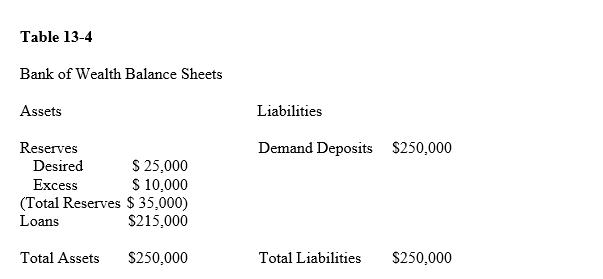

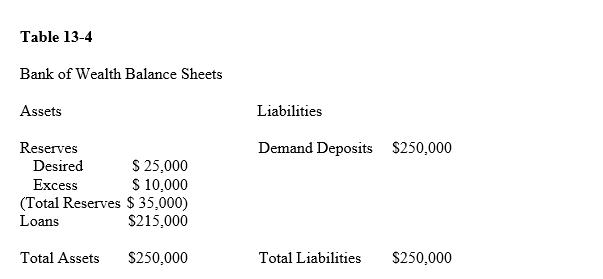

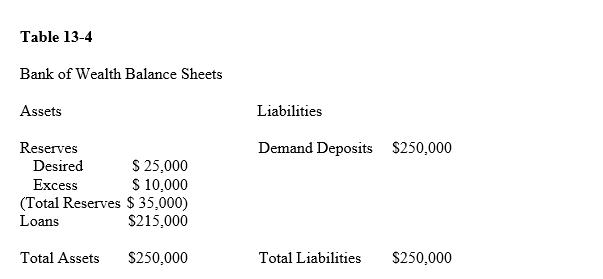

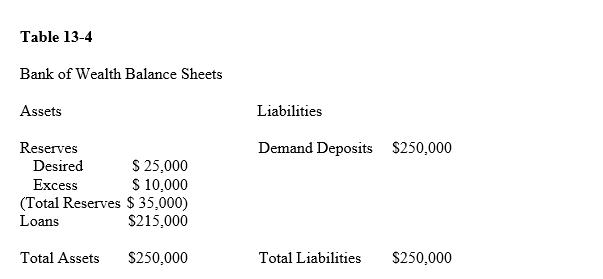

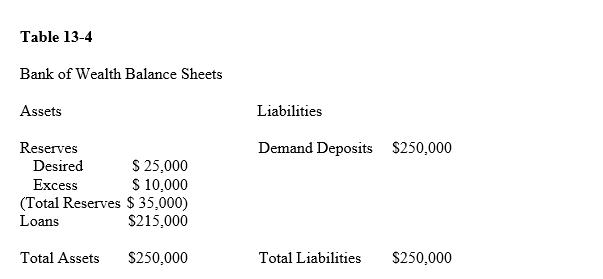

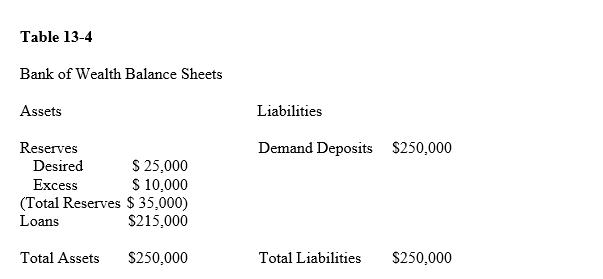

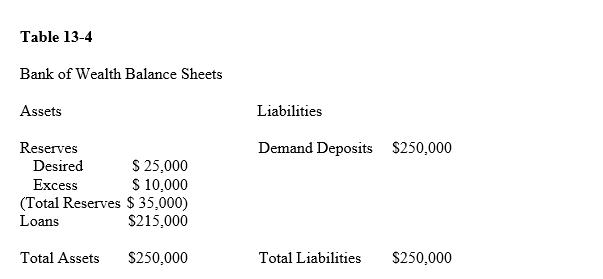

Table 13-4

In Table 13-4,if the Bank of Wealth purchases a $25,000 government security

A)the bank would still have $10,000 in excess reserves.

B)the bank would have a reserve deficiency of $25,000.

C)the bank would have a reserve deficiency of $15,000.

D)the bank would have no excess reserves.

In Table 13-4,if the Bank of Wealth purchases a $25,000 government security

A)the bank would still have $10,000 in excess reserves.

B)the bank would have a reserve deficiency of $25,000.

C)the bank would have a reserve deficiency of $15,000.

D)the bank would have no excess reserves.

the bank would have a reserve deficiency of $15,000.

3

Which of the following is a TRUE statement?

A)Decreases in the money supply lead to increases in the inflation rate.

B)Increases in the money supply lead to a decrease in the price level.

C)Changes in the rate of growth of the money supply lead to increases in the inflation rate.

D)There is no relationship between money supply and inflation.

A)Decreases in the money supply lead to increases in the inflation rate.

B)Increases in the money supply lead to a decrease in the price level.

C)Changes in the rate of growth of the money supply lead to increases in the inflation rate.

D)There is no relationship between money supply and inflation.

Changes in the rate of growth of the money supply lead to increases in the inflation rate.

4

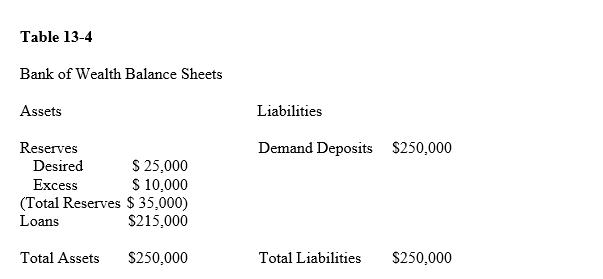

Table 13-4

In Table 13-4,the Bank of Wealth is subject to a desired reserve ratio of

A)20 percent.

B)15 percent.

C)10 percent.

D)5 percent.

In Table 13-4,the Bank of Wealth is subject to a desired reserve ratio of

A)20 percent.

B)15 percent.

C)10 percent.

D)5 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

5

Fractional reserve banking refers to a banking system in which

A)bank deposits are less than bank reserves.

B)bank reserves are only a fraction of total deposits.

C)bank reserves are only a fraction of desired reserves.

D)bank loans are less than bank reserves.

A)bank deposits are less than bank reserves.

B)bank reserves are only a fraction of total deposits.

C)bank reserves are only a fraction of desired reserves.

D)bank loans are less than bank reserves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

6

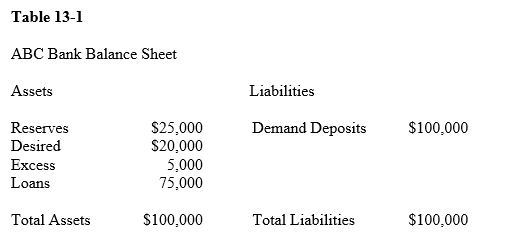

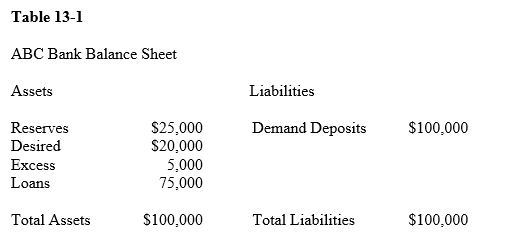

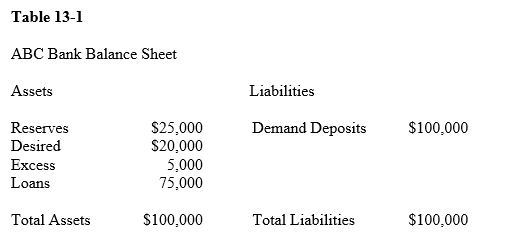

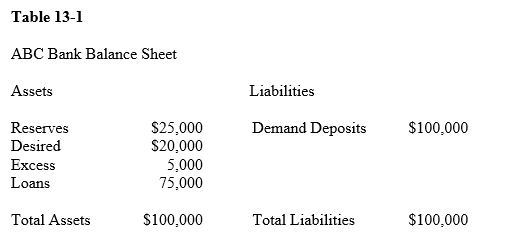

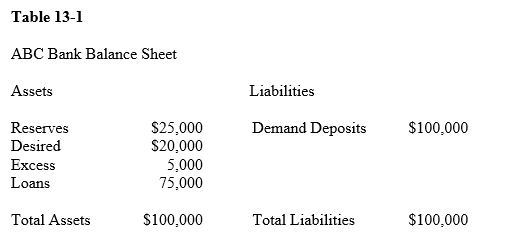

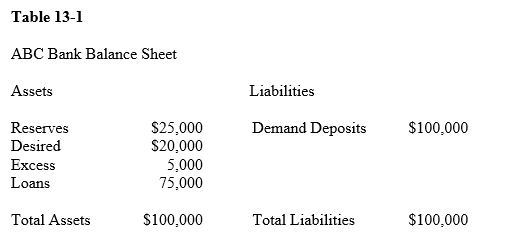

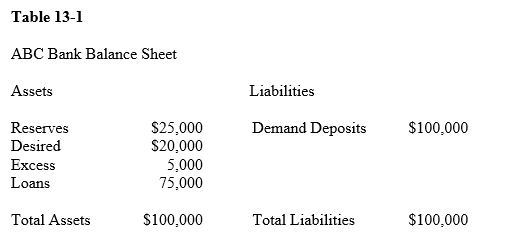

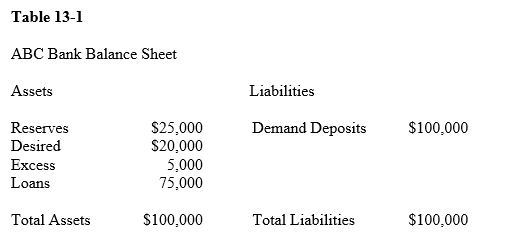

Table 13-1

In Table 13-1,suppose that $20,000 in new deposits is received by the bank.If there were no other changes in the balance sheet,then the bank would be in a position to make new loans in the amount of

A)$17,000.

B)$15,000.

C)$21,000.

D)$8,000.

In Table 13-1,suppose that $20,000 in new deposits is received by the bank.If there were no other changes in the balance sheet,then the bank would be in a position to make new loans in the amount of

A)$17,000.

B)$15,000.

C)$21,000.

D)$8,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

7

Changes in the money supply are important because

A)there is a relationship between changes in the money supply and changes in government spending.

B)there is a relationship between changes in the money supply and changes in nominal GDP.

C)there is an inverse relationship between changes in the money supply and the inflation rate.

D)there is a direct relationship between changes in the money supply and changes in interest rates.

A)there is a relationship between changes in the money supply and changes in government spending.

B)there is a relationship between changes in the money supply and changes in nominal GDP.

C)there is an inverse relationship between changes in the money supply and the inflation rate.

D)there is a direct relationship between changes in the money supply and changes in interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

8

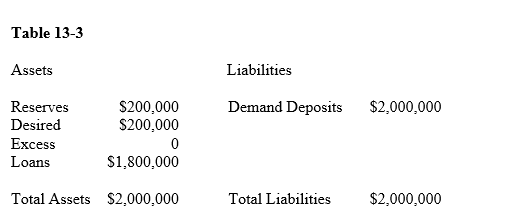

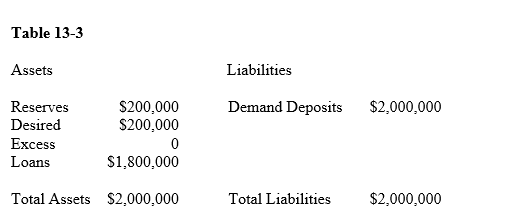

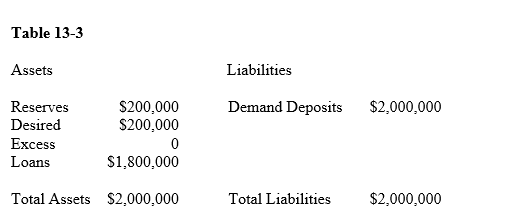

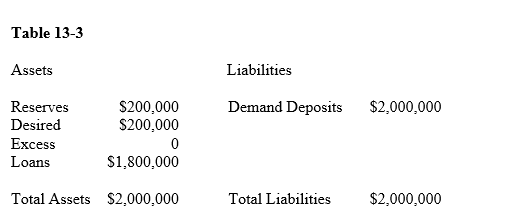

Table 13-3

In Table 13-3,the desired reserve ratio for the entire banking system is

A)20 percent.

B)10 percent.

C)15 percent.

D)1 percent.

In Table 13-3,the desired reserve ratio for the entire banking system is

A)20 percent.

B)10 percent.

C)15 percent.

D)1 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

9

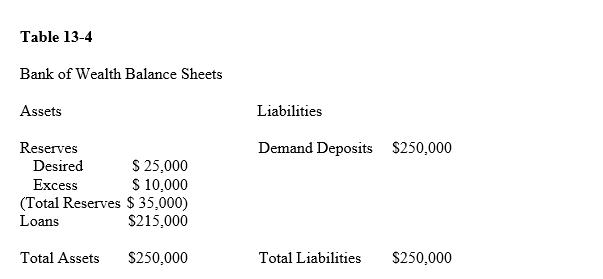

Table 13-4

In Table 13-4,if a customer withdrew $10,000 the bank would

A)have to borrow money to meet the desired reserve ratio.

B)have excess reserves of $5,000.

C)have zero excess reserves.

D)have $1,000 in excess reserves.

In Table 13-4,if a customer withdrew $10,000 the bank would

A)have to borrow money to meet the desired reserve ratio.

B)have excess reserves of $5,000.

C)have zero excess reserves.

D)have $1,000 in excess reserves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

10

Most economists would argue that a significant increase in the supply of money will

A)decrease technological change.

B)reduce the price level.

C)be inflationary.

D)help the manufacturing sector at the expense of the service sector.

A)decrease technological change.

B)reduce the price level.

C)be inflationary.

D)help the manufacturing sector at the expense of the service sector.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

11

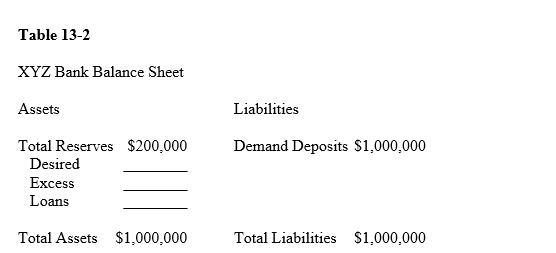

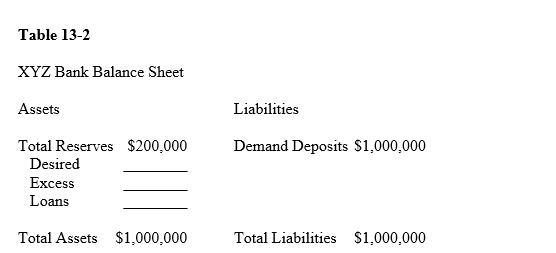

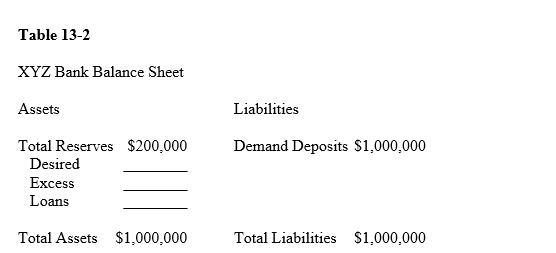

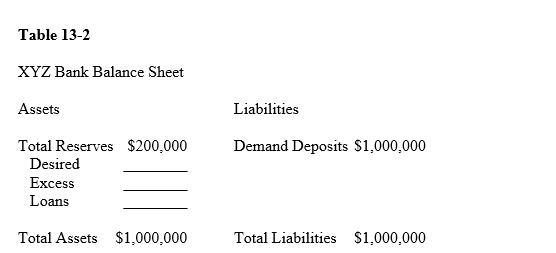

Table 13-2

In Table 13-2,if desired reserves are $150,000,the desired reserve ratio for XYZ Bank is

A)15 percent.

B)1)5 percent.

C)20 percent.

D)25 percent.

In Table 13-2,if desired reserves are $150,000,the desired reserve ratio for XYZ Bank is

A)15 percent.

B)1)5 percent.

C)20 percent.

D)25 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

12

Table 13-1

In Table 13-1,suppose that $10,000 in new deposits is received by the bank.If there were no other changes in the balance sheet,then the bank would be in a position to make new loans in the amount of

A)$13,000.

B)$15,000.

C)$10,000.

D)$8,000.

In Table 13-1,suppose that $10,000 in new deposits is received by the bank.If there were no other changes in the balance sheet,then the bank would be in a position to make new loans in the amount of

A)$13,000.

B)$15,000.

C)$10,000.

D)$8,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

13

Goldsmiths were able to practice an early form of fractional reserve banking because they knew that

A)people were relatively unsophisticated in their financial transactions.

B)gold was the major form of money.

C)not all depositors would claim their gold at the same time.

D)gold did not serve as a unit of account.

A)people were relatively unsophisticated in their financial transactions.

B)gold was the major form of money.

C)not all depositors would claim their gold at the same time.

D)gold did not serve as a unit of account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

14

Table 13-2

In Table 13-2,if excess reserves for XYZ Bank are $30,000,the desired reserve ratio

A)is 20 percent.

B)is 17 percent.

C)is 30 percent.

D)cannot be determined without more information.

In Table 13-2,if excess reserves for XYZ Bank are $30,000,the desired reserve ratio

A)is 20 percent.

B)is 17 percent.

C)is 30 percent.

D)cannot be determined without more information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

15

Table 13-3

In Table 13-3,the money multiplier for the banking system is

A)5)

B)9)

C)1)

D)10.

In Table 13-3,the money multiplier for the banking system is

A)5)

B)9)

C)1)

D)10.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

16

Under a system of fractional reserve banking,the desired reserve ratio is the ratio of

A)assets to net worth.

B)desired reserves to total chequable deposits.

C)desired reserves to net worth.

D)excess reserves to desired reserves.

A)assets to net worth.

B)desired reserves to total chequable deposits.

C)desired reserves to net worth.

D)excess reserves to desired reserves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

17

Table 13-1

According to Table 13-1,the desired reserve ratio for the ABC Bank is

A)5 percent.

B)15 percent.

C)20 percent.

D)10 percent.

According to Table 13-1,the desired reserve ratio for the ABC Bank is

A)5 percent.

B)15 percent.

C)20 percent.

D)10 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

18

Table 13-1

In Table 13-1,suppose that $15,000 in new deposits is received by the bank.If there were no other changes in the balance sheet,then the bank would be in a position to make new loans in the amount of

A)$17,000.

B)$15,000.

C)$10,000.

D)$8,000.

In Table 13-1,suppose that $15,000 in new deposits is received by the bank.If there were no other changes in the balance sheet,then the bank would be in a position to make new loans in the amount of

A)$17,000.

B)$15,000.

C)$10,000.

D)$8,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

19

Desired reserves consist of

A)deposits in the Bank of Canada plus vault currency cash.

B)deposits in the Bank of Canada only.

C)vault cash only.

D)savings and chequing accounts only.

A)deposits in the Bank of Canada plus vault currency cash.

B)deposits in the Bank of Canada only.

C)vault cash only.

D)savings and chequing accounts only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

20

Economists generally agree that there is a longstanding relationship between the rate of growth of the money supply and

A)government spending.

B)planned investment.

C)the value of the Canadian dollar.

D)economic growth.

A)government spending.

B)planned investment.

C)the value of the Canadian dollar.

D)economic growth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

21

Suppose a bank has $1,500,000 in deposits and the desired reserve ratio is 12 percent.If the bank is currently holding $200,000 in reserves,the excess reserves are equal to

A)zero.

B)$40,000.

C)$120,000.

D)$20,000.

A)zero.

B)$40,000.

C)$120,000.

D)$20,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

22

A bank with $200 million in deposits keeps $20 million of cash in the bank vault,$10 million in deposits at the Bank of Canada,and $5 million in government securities in the bank vault.Its actual reserves equal

A)$10 million.

B)$20 million.

C)$30 million.

D)$35 million.

A)$10 million.

B)$20 million.

C)$30 million.

D)$35 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

23

If a bank holds $20,000 in desired reserves in order to meet a desired reserve ratio of 40 percent,demand deposits must equal

A)$20,000.

B)$40,000.

C)$50,000.

D)$100,000.

A)$20,000.

B)$40,000.

C)$50,000.

D)$100,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

24

The desired reserve requirement for commercial banks

A)is actually less than that needed to prevent a run on bank deposits.

B)has a direct impact on how much money can be created from a new deposit.

C)is set by the Prime Minister.

D)is set by Parliament.

A)is actually less than that needed to prevent a run on bank deposits.

B)has a direct impact on how much money can be created from a new deposit.

C)is set by the Prime Minister.

D)is set by Parliament.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

25

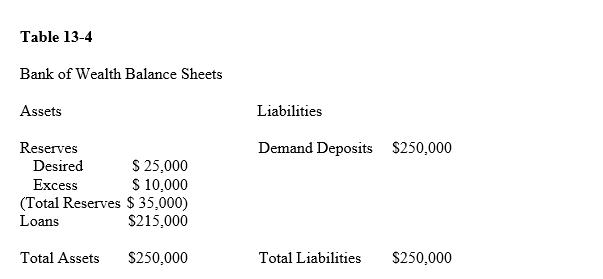

Table 13-4

In Table 13-4,the Bank of Wealth can make additional loans up to

A)$25,000.

B)$10,000.

C)$5,000.

D)$250,000.

In Table 13-4,the Bank of Wealth can make additional loans up to

A)$25,000.

B)$10,000.

C)$5,000.

D)$250,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

26

When banks have excess reserves,their reserve holdings exceed

A)their desired holdings.

B)legal reserves.

C)desired reserves.

D)chequable deposits.

A)their desired holdings.

B)legal reserves.

C)desired reserves.

D)chequable deposits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

27

With the fractional banking system in Canada,a commercial bank with $1,000 of deposits generally would

A)maintain $1,000 of cash reserves.

B)have no reserves.

C)maintain less than $1,000 but more than $0 in cash reserves.

D)maintain more than $1,000 of cash reserves.

A)maintain $1,000 of cash reserves.

B)have no reserves.

C)maintain less than $1,000 but more than $0 in cash reserves.

D)maintain more than $1,000 of cash reserves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

28

Table 13-4

In Table 13-4,the Bank of Wealth could

A)use its excess reserves to make more loans or buy government securities.

B)use its excess reserves to decrease its liabilities.

C)use all reserves to make more loans or buy government securities.

D)not change its assets portfolio.

In Table 13-4,the Bank of Wealth could

A)use its excess reserves to make more loans or buy government securities.

B)use its excess reserves to decrease its liabilities.

C)use all reserves to make more loans or buy government securities.

D)not change its assets portfolio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

29

Excess reserves are defined as

A)actual reserves plus vault cash.

B)actual reserves minus desired reserves.

C)actual reserves minus vault cash.

D)actual reserves plus desired reserves.

A)actual reserves plus vault cash.

B)actual reserves minus desired reserves.

C)actual reserves minus vault cash.

D)actual reserves plus desired reserves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

30

A bank with $500 million in deposits holds $35 million in vault cash,has $40 million on deposit with the Bank of Canada,and owns $50 million in government securities.If a fall in the desired reserve ratio generates excess reserves of $25 million,and prior to the fall the bank had no excess reserves,then the former desired reserve ratio was ________ and the new desired reserve ratio is ________.

A)15 percent;10 percent

B)20 percent;15 percent

C)20 percent;10 percent

D)14 percent;10 percent

A)15 percent;10 percent

B)20 percent;15 percent

C)20 percent;10 percent

D)14 percent;10 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

31

A commercial bank with negative excess reserves

A)cannot legally make additional loans.

B)has deposited too much money at the Bank of Canada.

C)should loan reserves to other banks.

D)is technically bankrupt.

A)cannot legally make additional loans.

B)has deposited too much money at the Bank of Canada.

C)should loan reserves to other banks.

D)is technically bankrupt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

32

Following a new deposit of $50 when the desired reserve ratio is 10 percent,the maximum increase in the assets of commercial banks will be

A)$50.

B)$400.

C)$500.

D)$40,000.

A)$50.

B)$400.

C)$500.

D)$40,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

33

Actual reserves are

A)stocks and bonds that depository institutions are desired by law to hold as reserves.

B)anything that depository institutions are allowed to hold as reserves.

C)the same thing as desired reserves.

D)the percentage of total deposits that depository institutions are allowed to loan out.

A)stocks and bonds that depository institutions are desired by law to hold as reserves.

B)anything that depository institutions are allowed to hold as reserves.

C)the same thing as desired reserves.

D)the percentage of total deposits that depository institutions are allowed to loan out.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

34

Given a desired reserve ratio of 20 percent,a commercial bank which has received a new deposit of $100 can make additional loans of

A)$0.

B)$20.

C)$80.

D)$400.

A)$0.

B)$20.

C)$80.

D)$400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

35

When banks have positive excess reserves,this indicates that

A)banks can expand their loans.

B)banks must contract their deposits.

C)nothing will happen since banks will always try to keep large amounts of excess reserves.

D)a run on the bank is impossible.

A)banks can expand their loans.

B)banks must contract their deposits.

C)nothing will happen since banks will always try to keep large amounts of excess reserves.

D)a run on the bank is impossible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

36

Suppose a bank is exactly meeting its desired reserve ratio of 10 percent and a new deposit of $75,000 is made.Immediately after the deposit is made,the excess reserves will equal

A)zero.

B)$7,500.

C)$67,500.

D)impossible to determine given the limited information.

A)zero.

B)$7,500.

C)$67,500.

D)impossible to determine given the limited information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

37

When all banks have zero excess reserves to start and you write a cheque that is deposited in another bank,it is true that

A)the system will still have the same amount of reserves.

B)the system will have increased its reserves.

C)the system will have decreased its reserves.

D)two banks will now have positive excess reserves.

A)the system will still have the same amount of reserves.

B)the system will have increased its reserves.

C)the system will have decreased its reserves.

D)two banks will now have positive excess reserves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

38

Following a new deposit of $500,the loans of a commercial bank increase by $400.In this situation,the desired reserve ratio is most likely

A)0 percent.

B)20 percent.

C)80 percent.

D)180 percent.

A)0 percent.

B)20 percent.

C)80 percent.

D)180 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

39

Suppose that the desired reserve ratio is 20 percent and that a bank is just meeting that requirement when $10,000 in cash is withdrawn from a demand deposit.The bank must now

A)decrease its reserves by $2,000.

B)increase its reserves by $8,000.

C)make $200,000 in new loans.

D)do nothing since both its assets and liabilities are affected equally.

A)decrease its reserves by $2,000.

B)increase its reserves by $8,000.

C)make $200,000 in new loans.

D)do nothing since both its assets and liabilities are affected equally.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

40

If a bank has $100,000 in demand deposits and $30,000 on reserve with a 20 percent reserve requirement,the bank

A)has desired reserves of $30,000.

B)has legal reserves of $10,000.

C)has excess reserves of $10,000.

D)has desired reserves of $10,000.

A)has desired reserves of $30,000.

B)has legal reserves of $10,000.

C)has excess reserves of $10,000.

D)has desired reserves of $10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

41

If a bank's deposits at the Bank of Canada increase by $10 million,then

A)both the bank's assets and the Bank of Canada's assets increase by $10 million.

B)both the bank's liabilities and the Bank of Canada's liabilities increase by $10 million.

C)the bank's assets increase by $10 million and the Bank of Canada's liabilities increase by $10 million.

D)the bank's assets increase by $10 million,but there is no change at the Bank of Canada since it doesn't really have assets or liabilities.

A)both the bank's assets and the Bank of Canada's assets increase by $10 million.

B)both the bank's liabilities and the Bank of Canada's liabilities increase by $10 million.

C)the bank's assets increase by $10 million and the Bank of Canada's liabilities increase by $10 million.

D)the bank's assets increase by $10 million,but there is no change at the Bank of Canada since it doesn't really have assets or liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

42

Other things equal,a higher interest rate on loans would encourage banks to

A)borrow less from the federal funds market.

B)ask for an increase in the desired reserve ratio.

C)hold fewer excess reserves.

D)hold more total reserves.

A)borrow less from the federal funds market.

B)ask for an increase in the desired reserve ratio.

C)hold fewer excess reserves.

D)hold more total reserves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

43

The desired reserve ratio is 10 percent.A bank with $10 million in deposits has $700,000 in vault cash and $200,000 on deposit with the Bank of Canada.A person deposits a cheque for $1 million in the bank.The excess reserves of the bank are now

A)$1 million.

B)$900,000.

C)$800,000.

D)-$100,000.

A)$1 million.

B)$900,000.

C)$800,000.

D)-$100,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

44

If all banks have zero excess reserves,the desired reserve ratio is 10 percent,and a cheque for $1 million on Bank XYZ is deposited in Bank ABC,then excess reserves now equal

A)$1 million.

B)$900,000.

C)$450,000.

D)0)

A)$1 million.

B)$900,000.

C)$450,000.

D)0)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

45

Banks have an incentive to

A)minimize excess reserves because the bank has to pay a fee to the Bank of Canada for holding excess reserves.

B)minimize excess reserves because reserves produce no income.

C)hold substantial excess reserves in case there is an unexpectedly heavy demand for withdrawals.

D)hold substantial excess reserves because the bank's profits come from excess reserves.

A)minimize excess reserves because the bank has to pay a fee to the Bank of Canada for holding excess reserves.

B)minimize excess reserves because reserves produce no income.

C)hold substantial excess reserves in case there is an unexpectedly heavy demand for withdrawals.

D)hold substantial excess reserves because the bank's profits come from excess reserves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

46

If a bank has zero excess reserves,the required reserve ratio is 20 percent,and a check for $100,000 is deposited in Bank ABC,excess reserves for Bank ABC now equal

A)0)

B)$20,000.

C)$80,000.

D)$100,000.

A)0)

B)$20,000.

C)$80,000.

D)$100,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

47

A bank with $100 million in deposits has $6 million in vault cash,$6 million on deposit with the Bank of Canada,and $6 million in government securities.The reserve requirement is 20 percent.A person deposits a check for $10 million drawn on another bank.The maximum loan this bank can now make is

A)0)

B)$6 million.

C)$8 million.

D)$10 million.

A)0)

B)$6 million.

C)$8 million.

D)$10 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

48

If banks have zero excess reserves,then the net effect on the money supply of any cheque writing from one commercial bank to another is

A)positive since the desired reserve ratio is always less than one.

B)zero since the gain in excess reserves at one bank is offset by a reduction in excess reserves of the same amount at another bank.

C)negative since the loss in excess reserves at one bank is always greater than the gain in excess reserves at another bank.

D)positive as long as the person who makes a deposit does not take out cash.

A)positive since the desired reserve ratio is always less than one.

B)zero since the gain in excess reserves at one bank is offset by a reduction in excess reserves of the same amount at another bank.

C)negative since the loss in excess reserves at one bank is always greater than the gain in excess reserves at another bank.

D)positive as long as the person who makes a deposit does not take out cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

49

There are zero excess reserves at all banks and the required reserve ratio is 20 percent.If a check for $100,000 on Bank ABC is deposited in Bank XYZ,then excess reserves at Bank ABC equal ________ and excess reserves at Bank XYZ equal ________.

A)-$20,000;+$80,000

B)-$100,000;+$80,000

C)-$80,000;+$100,000

D)-$80,000;+$80,000

A)-$20,000;+$80,000

B)-$100,000;+$80,000

C)-$80,000;+$100,000

D)-$80,000;+$80,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

50

A bank currently has $50 million in deposits,$6 million in cash in the vault,$4 million on deposit with the Bank of Canada,and $5 million in government securities.The required reserve ratio is 20 percent.A new deposit is made of $1 million.What is the maximum size loan the bank can now make?

A)0

B)$800,000

C)$1 million

D)$5.8 million

A)0

B)$800,000

C)$1 million

D)$5.8 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

51

A bank currently has $100 million in deposits,$6 million in cash in the vault,deposits with the Bank of Canada of $4 million,and other assets equal to $90 million.The desired reserve ratio is 10 percent.A new deposit is made of $1 million.What is the maximum sized loan the bank can now make?

A)$1.8 million

B)$1 million

C)$900,000

D)0

A)$1.8 million

B)$1 million

C)$900,000

D)0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

52

If banks have zero excess reserves,then the net effect of any check writing and depositing on the money supply is

A)positive since the required reserve ratio is less than one.

B)positive as long as no one takes cash out of the system.

C)zero,since the gain in excess reserves at one bank are exactly offset by a reduction in excess reserves at another bank.

D)negative since one bank loses more in total reserves than the other bank gets in excess reserves.

A)positive since the required reserve ratio is less than one.

B)positive as long as no one takes cash out of the system.

C)zero,since the gain in excess reserves at one bank are exactly offset by a reduction in excess reserves at another bank.

D)negative since one bank loses more in total reserves than the other bank gets in excess reserves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

53

A bank has a withdrawal of $1,000.If the bank has no excess reserves and if there is a 15 percent reserve requirement,

A)it must reduce its loans by $1,000.

B)it must reduce its loans by $850.

C)it must reduce its loans by $150.

D)it need not reduce its loans.

A)it must reduce its loans by $1,000.

B)it must reduce its loans by $850.

C)it must reduce its loans by $150.

D)it need not reduce its loans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

54

A bank with deposits of $200 million keeps $20 million in cash in its vault,$15 million of deposits at the Bank of Canada,and $10 million in government securities.The desired reserve requirement is 15 percent.The bank has excess reserves of

A)0)

B)$5 million.

C)$15 million.

D)$20 million.

A)0)

B)$5 million.

C)$15 million.

D)$20 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

55

A bank with deposits of $500 million has $75 million in cash on hand,$50 million in deposits with the Bank of Canada,and $80 million in government securities.If the reserve requirement is 15 percent,the bank has excess reserves of

A)0)

B)$5 million.

C)$50 million.

D)$130 million.

A)0)

B)$5 million.

C)$50 million.

D)$130 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

56

The desired reserve ratio is 10 percent.All banks have zero excess reserves.A cheque for $500,000 is deposited in Bank A,written on an account at Bank B.By how much does the money supply change if all banks make loans so that they have zero excess reserves?

A)$500,000

B)0

C)$450,000

D)$4,500,000

A)$500,000

B)0

C)$450,000

D)$4,500,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

57

The desired reserve ratio is 10 percent.A bank with $100 million in deposits has $5 million in vault cash,$6 million on deposit with the Bank of Canada,government securities of $9 million,and other assets of $80 million.If someone deposits a cheque for $1 million in the bank,the maximum loan the bank can now make is

A)$1 million.

B)$2 million.

C)$1.9 million.

D)$900,000.

A)$1 million.

B)$2 million.

C)$1.9 million.

D)$900,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

58

A bank holding only deposits of $800 and loans of $1000 would have a net worth of

A)-$200.

B)$200.

C)$1,000.

D)$1,800.

A)-$200.

B)$200.

C)$1,000.

D)$1,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

59

Following a new deposit of $200,a commercial bank subject to a 15 percent desired reserve ratio will have what eventual change to its balance sheet?

A)increases in reserves of $30,in loans of $170,and in demand deposits of $200

B)increases in loans of $200 and in demand deposits of $200

C)increases in loans of $850,in reserves of $150 and in deposits of $1000

D)increases in reserves of $170,in demand deposits of $200 and in net worth of $30

A)increases in reserves of $30,in loans of $170,and in demand deposits of $200

B)increases in loans of $200 and in demand deposits of $200

C)increases in loans of $850,in reserves of $150 and in deposits of $1000

D)increases in reserves of $170,in demand deposits of $200 and in net worth of $30

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

60

The required reserve ratio is 20 percent.All banks have zero excess reserves.A check for $1 million is deposited in Bank A,written on an account from Bank B.What are the new excess reserves at Bank A,and by how much does the money supply change if all banks make loans so that they have zero excess reserves?

A)$200,000;$800,000

B)$800,000;$1 million

C)$800,000;$800,000

D)$800,000;0

A)$200,000;$800,000

B)$800,000;$1 million

C)$800,000;$800,000

D)$800,000;0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

61

Assuming there are no excess reserves,if the banks increase the desired reserve ratio from 10 percent to 20 percent,the money multiplier

A)increases from 10 to 20.

B)increases from 0.10 to 0.20.

C)decreases from 10 to 5.

D)decreases from 20 to 10.

A)increases from 10 to 20.

B)increases from 0.10 to 0.20.

C)decreases from 10 to 5.

D)decreases from 20 to 10.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

62

If the desired reserve ratio is 10 percent,the money multiplier is

A)10 percent.

B)10.

C)100.

D)1)

A)10 percent.

B)10.

C)100.

D)1)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of the following would reduce the money multiplier?

A)reducing the desired reserve ratio

B)bond purchases by the Bank of Canada

C)cash drains from banks

D)bank reductions in excess reserve holdings

A)reducing the desired reserve ratio

B)bond purchases by the Bank of Canada

C)cash drains from banks

D)bank reductions in excess reserve holdings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

64

If the desired reserve ratio is 10 percent and reserves in the commercial banking system increase by $10,000,the maximum possible expansion of demand deposits is

A)$10,000.

B)$90,000.

C)$100,000.

D)$1,000,000.

A)$10,000.

B)$90,000.

C)$100,000.

D)$1,000,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

65

To reach the maximum money multiplier,it is assumed that

A)commercial banks keep excess reserves.

B)all loans get redeposited in a chequing account.

C)there is insufficient loan demand.

D)loans are diverted into circulating currency.

A)commercial banks keep excess reserves.

B)all loans get redeposited in a chequing account.

C)there is insufficient loan demand.

D)loans are diverted into circulating currency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

66

If the desired reserve ratio is 25 percent,the maximum money multiplier is

A)1)

B)4)

C)8)

D)25.

A)1)

B)4)

C)8)

D)25.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

67

A decrease in the desired reserve ratio will

A)cause the money supply to decrease.

B)cause the money supply to increase.

C)not affect the money supply.

D)decrease the money multiplier.

A)cause the money supply to decrease.

B)cause the money supply to increase.

C)not affect the money supply.

D)decrease the money multiplier.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

68

The reason that the commercial banking system can generate a multiple expansion or contraction of the money supply is that

A)banks desire to hold only a fraction of their deposit liabilities as reserves.

B)most banks maintain a relatively large stock of excess reserves.

C)banks hold reserves equal to their net worth.

D)banks generally have surplus funds on deposit with other banks.

A)banks desire to hold only a fraction of their deposit liabilities as reserves.

B)most banks maintain a relatively large stock of excess reserves.

C)banks hold reserves equal to their net worth.

D)banks generally have surplus funds on deposit with other banks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

69

If the desired reserve requirement is raised,the money multiplier

A)is lowered.

B)is increased.

C)stays the same.

D)is doubled.

A)is lowered.

B)is increased.

C)stays the same.

D)is doubled.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following actions has no effect on the total money supply?

A)the Bank of Canada buys government securities

B)the Bank of Canada sells government securities

C)a transfer of deposits from one bank to another bank

D)change in the money multiplier

A)the Bank of Canada buys government securities

B)the Bank of Canada sells government securities

C)a transfer of deposits from one bank to another bank

D)change in the money multiplier

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

71

The money multiplier is equal to

A)the reserve ratio.

B)the inverse of the reserve ratio.

C)the reserve requirement.

D)the number of dollars on reserve.

A)the reserve ratio.

B)the inverse of the reserve ratio.

C)the reserve requirement.

D)the number of dollars on reserve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

72

The more excess reserves banks decide to keep,then

A)the smaller the money multiplier.

B)the greater the money supply.

C)the greater the money multiplier.

D)the greater the currency drain.

A)the smaller the money multiplier.

B)the greater the money supply.

C)the greater the money multiplier.

D)the greater the currency drain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

73

The actual multiplier is often less than what one would calculate using the desired reserve ratio because

A)some loans earn more interest than other loans.

B)people may keep cash and banks may keep excess reserves.

C)there may already have been some excess reserves in the banking system.

D)banks keep some of their desired reserves as vault cash.

A)some loans earn more interest than other loans.

B)people may keep cash and banks may keep excess reserves.

C)there may already have been some excess reserves in the banking system.

D)banks keep some of their desired reserves as vault cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

74

Currently,there are $10 million in excess reserves in the banking system.If the desired reserve ratio is 25 percent,the maximum amount the money supply can change is

A)$10 million.

B)$50 million.

C)$40 million.

D)$25 million.

A)$10 million.

B)$50 million.

C)$40 million.

D)$25 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

75

The larger the desired reserve ratio,

A)the greater the increase in the money supply for an increase in bank deposits.

B)the more apt there will be currency drains.

C)the smaller the maximum money multiplier.

D)the more difficult for the Bank of Canada to control the money supply.

A)the greater the increase in the money supply for an increase in bank deposits.

B)the more apt there will be currency drains.

C)the smaller the maximum money multiplier.

D)the more difficult for the Bank of Canada to control the money supply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

76

Which of the following will limit the expansion of the money supply following a new deposit?

A)the bank's keeping no excess reserves

B)a strong demand for new loans

C)a redepositing of all loan proceeds

D)a strong demand for holding currency outside of commercial banks

A)the bank's keeping no excess reserves

B)a strong demand for new loans

C)a redepositing of all loan proceeds

D)a strong demand for holding currency outside of commercial banks

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

77

With a desired reserve ratio of 10 percent,the maximum money multiplier is

A)1)

B)5)

C)10.

D)100.

A)1)

B)5)

C)10.

D)100.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

78

The actual change in the money supply equals

A)the actual change in excess reserves.

B)the change in excess reserves times the money multiplier.

C)the change in required reserves times the money multiplier.

D)the change in reserves times the reserve requirement ratio.

A)the actual change in excess reserves.

B)the change in excess reserves times the money multiplier.

C)the change in required reserves times the money multiplier.

D)the change in reserves times the reserve requirement ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

79

The actual change in the money supply equals

A)the actual change in reserves.

B)the actual change in excess reserves times the desired reserve ratio.

C)the change in excess reserves times the money multiplier.

D)the change in desired reserves times the money multiplier.

A)the actual change in reserves.

B)the actual change in excess reserves times the desired reserve ratio.

C)the change in excess reserves times the money multiplier.

D)the change in desired reserves times the money multiplier.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

80

When the desired reserve ratio is 20 percent,a withdrawal of $500 can ultimately lead to a maximum reduction in the money supply of

A)$100.

B)$500.

C)$2,500.

D)$5,000.

A)$100.

B)$500.

C)$2,500.

D)$5,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck