Deck 24: Cost Allocation and Responsibility Accounting

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/189

العب

ملء الشاشة (f)

Deck 24: Cost Allocation and Responsibility Accounting

1

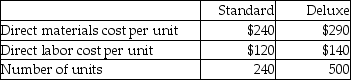

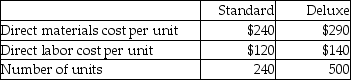

A furniture corporation manufactures two models of furniture-Standard and Deluxe.The total estimated manufacturing overhead costs are $64,350.The following estimates are available:

The company uses direct labor costs as the base to allocate manufacturing overhead.Calculate the predetermined overhead rate.(Round your answer to two decimal places. )

A)31.76%

B)33.94%

C)191.52%

D)65.13%

The company uses direct labor costs as the base to allocate manufacturing overhead.Calculate the predetermined overhead rate.(Round your answer to two decimal places. )

A)31.76%

B)33.94%

C)191.52%

D)65.13%

D

Explanation:D)Total direct labor cost = ($120 × 240 units)+ ($140 × 500 units)= $98,800

Predetermined overhead allocation rate = $64,350 / $98,800 = 65.13% of direct labor costs

Explanation:D)Total direct labor cost = ($120 × 240 units)+ ($140 × 500 units)= $98,800

Predetermined overhead allocation rate = $64,350 / $98,800 = 65.13% of direct labor costs

2

Why is using multiple predetermined overhead allocation rates more accurate than using a single plantwide allocation rate?

The allocation process is the same,except there are multiple cost pools and multiple allocation bases.Having more than one allocation rate more accurately reflects the way products actually use a company's resources.

3

When a manufacturer changes from using a single plantwide predetermined overhead rate to multiple predetermined overhead allocation rates,the product unit cost may be more accurate.

True

4

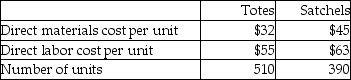

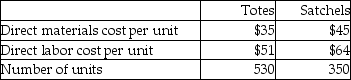

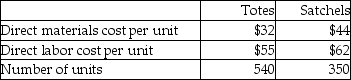

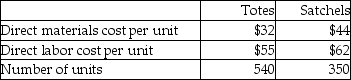

Modiste,Inc.manufactures two kinds of bags-totes and satchels.The company allocates manufacturing overhead using a single plantwide rate with direct labor cost as the allocation base.Estimated overhead costs for the year are $26,000.Additional estimated information is given below.

Calculate the predetermined overhead allocation rate.(Round your answer to two decimal places. )

A)92.69%

B)49.41%

C)94.50%

D)1.58%

Calculate the predetermined overhead allocation rate.(Round your answer to two decimal places. )

A)92.69%

B)49.41%

C)94.50%

D)1.58%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

5

A modification of the overhead allocation method which uses a single plantwide rate,is to use multiple predetermined overhead allocation rates that have different allocation bases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

6

In selecting machine usage as the primary cost driver for the Production Department,management feels that there is a direct relationship between the number of machine hours used and the amount of overhead costs incurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

7

A furniture manufacturer has decided that its use of a single plantwide predetermined overhead allocation rate is no longer accurate.In making the transition to using multiple predetermined overhead allocation rates,which of the following statements is incorrect?

A)In selecting machine usage as the primary cost driver for the Production Department,management feels that there is a direct relationship between the number of machine hours used and the amount of overhead costs incurred.

B)Management must analyze the expected overhead costs and separate them into a cost pool for each department.

C)The allocation process changes because there are now multiple cost pools and multiple allocation bases.

D)The use of multiple predetermined overhead allocation rates is more complex,but it may be more accurate.

A)In selecting machine usage as the primary cost driver for the Production Department,management feels that there is a direct relationship between the number of machine hours used and the amount of overhead costs incurred.

B)Management must analyze the expected overhead costs and separate them into a cost pool for each department.

C)The allocation process changes because there are now multiple cost pools and multiple allocation bases.

D)The use of multiple predetermined overhead allocation rates is more complex,but it may be more accurate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

8

A modification of the overhead allocation method which uses a single plantwide rate,is to use multiple predetermined overhead allocation rates that have a single allocation base.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following statements is true?

A)Indirect costs must be allocated based on a single plant wide rate.

B)Manufacturing overhead costs are individually assigned to products.

C)Managers cannot wait until the end of the accounting period for product cost information.

D)Managers can choose to wait until the end of the accounting period to allocate manufacturing overhead costs.

A)Indirect costs must be allocated based on a single plant wide rate.

B)Manufacturing overhead costs are individually assigned to products.

C)Managers cannot wait until the end of the accounting period for product cost information.

D)Managers can choose to wait until the end of the accounting period to allocate manufacturing overhead costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

10

Oscar,Inc. ,a manufacturer of gift articles,uses a single plantwide rate to allocate indirect costs with machine hours as the allocation base.Estimated overhead costs for the year are $7,000,000.Estimated machine hours are 25,000.During the year,the actual machine hours used were 43,000.Calculate the predetermined overhead allocation rate.(Round your answer to the nearest dollar. )

A)$163

B)$109

C)$280

D)$82

A)$163

B)$109

C)$280

D)$82

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

11

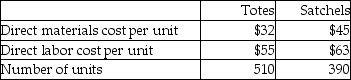

Bag Ladies,Inc.manufactures two kinds of bags-totes and satchels.The company allocates manufacturing overhead using a single plantwide rate with direct labor cost as the allocation base.Estimated overhead costs for the year are $25,500.Additional estimated information is given below.

Calculate the amount of overhead to be allocated to Totes.(Round any percentages to two decimal places and your final answer to the nearest dollar. )

A)$500

B)$330

C)$11,556

D)$13,945

Calculate the amount of overhead to be allocated to Totes.(Round any percentages to two decimal places and your final answer to the nearest dollar. )

A)$500

B)$330

C)$11,556

D)$13,945

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

12

Fill in the blanks:

Direct materials cost and direct labor cost can be ________ ________ to products.Manufacturing overhead costs are ________ in cost pools and then ________ to products.

Direct materials cost and direct labor cost can be ________ ________ to products.Manufacturing overhead costs are ________ in cost pools and then ________ to products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

13

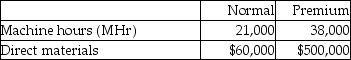

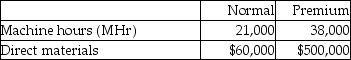

Moonrays,Inc.manufactures both normal and premium tube lights.The company allocates manufacturing overhead using a single plantwide rate with machine hours as the allocation base.Estimated overhead costs for the year are $106,000.Additional estimated information is given below.

Calculate the predetermined overhead allocation rate.(Round your answer to the nearest cent. )

A)$5.05 per direct labor hour

B)$1.80 per machine hour

C)$2.79 per machine hour

D)$0.19 per direct labor hour

Calculate the predetermined overhead allocation rate.(Round your answer to the nearest cent. )

A)$5.05 per direct labor hour

B)$1.80 per machine hour

C)$2.79 per machine hour

D)$0.19 per direct labor hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

14

Direct material costs and direct labor costs cannot be easily traced to products.Therefore,they are allocated to products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

15

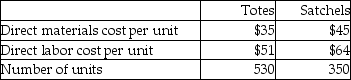

Powers,Inc.manufactures two kinds of bags-totes and satchels.The company allocates manufacturing overhead using a single plantwide rate with direct labor cost as the allocation base.Estimated overhead costs for the year are $25,500.Additional estimated information is given below.

Calculate the amount of overhead to be allocated to Satchels,if the actual units produced and direct labor costs equal the estimated amounts.(Round any percentages to two decimal places and your final answer to the nearest dollar. )

A)$464

B)$14,734

C)$10,765

D)$21,700

Calculate the amount of overhead to be allocated to Satchels,if the actual units produced and direct labor costs equal the estimated amounts.(Round any percentages to two decimal places and your final answer to the nearest dollar. )

A)$464

B)$14,734

C)$10,765

D)$21,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

16

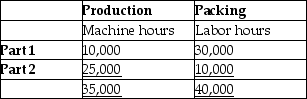

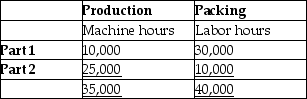

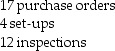

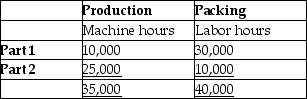

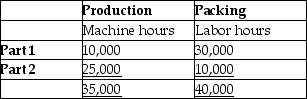

Brisbane,Inc. ,a leading manufacturer of car spare parts,divided its manufacturing process into two Departments - Production and Packing.The estimated overhead costs for the Production and Packing departments amounted to $14,000,000 and $20,000,000,respectively.The company produces two types of parts - Part 1 and Part 2.The total estimated labor hours for the year were 40,000,and estimated machine hours were 35,000.The Production department is mechanized,whereas the Packing department is labor oriented.Calculate the amount of manufacturing overhead costs allocated to Part 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

17

The predetermined overhead allocation rate is an estimated overhead cost per unit of the allocation base and is calculated at the beginning of the accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

18

Manufacturing overhead costs,which are also known as indirect costs,cannot be cost-effectively traced to products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

19

A radial tire manufacturer produces products in two departments-Divisions A and B.The company uses separate predetermined overhead allocation rates for each department to allocate its overhead.Divisions A and B have estimated manufacturing overhead costs of $170,000 and $350,000,respectively.Division A uses machine hours as the allocation base,and Division B uses direct labor hours as the allocation base.The total estimated machine hours were 34,000,and direct labor hours were 20,000 for the year.Calculate the departmental predetermined overhead allocation rates.(Round your answer to the nearest cent. )

A)Division A-$5.00,Division B-$17.50

B)Division A-$17.50,Division B-$5.00

C)Division A-$8.50,Division B-$10.29

D)Division A-$10.29,Division B-$8.50

A)Division A-$5.00,Division B-$17.50

B)Division A-$17.50,Division B-$5.00

C)Division A-$8.50,Division B-$10.29

D)Division A-$10.29,Division B-$8.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

20

Companies calculate the predetermined overhead rate at the beginning of an accounting period using the actual values of overhead costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

21

Archid,Inc. ,a manufacturer of spare parts,has two production departments-Assembling and Packaging.The Assembling department is mechanized,while the Packaging department is labor oriented.Estimated manufacturing overhead costs for the year were $17,700,000 for Assembling and $10,000,000 for Packaging.Calculate the department predetermined overhead allocation rates for the Assembling and Packaging departments,respectively,if the total estimated machine hours were 50,000 and labor hours were 22,000 for the year.(Round your answer to the nearest cent. )

A)$804.55,$200.00

B)$354.00,$454.55

C)$200.00,$804.55

D)$354.00,$804.55

A)$804.55,$200.00

B)$354.00,$454.55

C)$200.00,$804.55

D)$354.00,$804.55

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

22

Activity-based management (ABM)focuses on the primary activities a business performs,determines the costs of the activities,and then uses the cost information to make decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which would be an appropriate cost driver for the shipping and receiving activity?

A)number of inspections

B)number of machine hours

C)number of batches

D)number of pounds of product shipped

A)number of inspections

B)number of machine hours

C)number of batches

D)number of pounds of product shipped

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

24

Why is using a single plantwide predetermined overhead allocation rate not always accurate?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

25

In a decentralized company,all the planning and controlling decisions are made by top management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

26

Summarize the four steps in an activity-based costing system:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

27

Companies with diverse products can obtain better costing information using multiple departmental rates rather than using activity-based costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

28

Discuss the difference between a centralized company and a decentralized company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

29

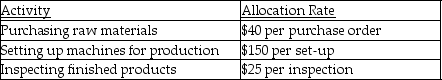

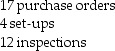

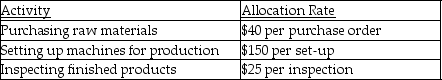

Aimee Cosmetics Company uses the following allocation rates from its activity-based costing system to assign overhead costs to products:

Product A1 uses the following:

How much overhead cost would be assigned to Product A1?

A)$7,095

B)$215

C)$600

D)$1,580

Product A1 uses the following:

How much overhead cost would be assigned to Product A1?

A)$7,095

B)$215

C)$600

D)$1,580

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

30

Centralized companies split their operations into segments and top management delegates decision making to the segment managers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which would be an appropriate cost driver for the warranty services activity?

A)direct labor hours

B)number of service calls

C)number of purchase orders

D)number of batches

A)direct labor hours

B)number of service calls

C)number of purchase orders

D)number of batches

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

32

Activity-based costing (ABC)focuses on the costs of activities when allocating indirect costs to products and services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

33

For a centralized company,the major planning and controlling decisions are made by top management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

34

One of the advantages of decentralization is that it allows top management to concentrate on long-term strategic planning.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following is not an advantage of activity-based costing?

A)Activity-based costing is easier and less time consuming to calculate.

B)Activity-based costing information can be used to make decisions that will lead to improved customer satisfaction and greater profits.

C)More accurate cost information can be obtained by using activity-based costing.

D)Activity based costing considers the resources each product actually uses,so management can better control overhead costs.

A)Activity-based costing is easier and less time consuming to calculate.

B)Activity-based costing information can be used to make decisions that will lead to improved customer satisfaction and greater profits.

C)More accurate cost information can be obtained by using activity-based costing.

D)Activity based costing considers the resources each product actually uses,so management can better control overhead costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

36

The number of inspections,number of service calls and number of batches are all examples of ________.

A)direct labor costs

B)service costs

C)cost drivers

D)allocable costs

A)direct labor costs

B)service costs

C)cost drivers

D)allocable costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

37

In activity-based costing,the predetermined overhead allocation rate can be computed by ________.

A)dividing the total estimated overhead costs by the total estimated quantity of the overhead allocation base

B)multiplying the actual quantity of the allocation based used by the allocated manufacturing overhead cost

C)dividing the total estimated overhead costs by the total estimated direct labor costs

D)dividing each product's total manufacturing cost by the associated number of units

A)dividing the total estimated overhead costs by the total estimated quantity of the overhead allocation base

B)multiplying the actual quantity of the allocation based used by the allocated manufacturing overhead cost

C)dividing the total estimated overhead costs by the total estimated direct labor costs

D)dividing each product's total manufacturing cost by the associated number of units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

38

Cardec,Inc. ,a leading manufacturer of car spare parts,divided its manufacturing process into two Departments - Production and Packing.The estimated overhead costs for the Production and Packing departments amounted to $14,000,000 and $20,000,000,respectively.The company produces two types of parts - Part 1 and Part 2.The total estimated labor hours for the year were 40,000,and estimated machine hours were 35,000.The Production department is mechanized,whereas the Packing department is labor oriented.Calculate departmental predetermined overhead allocation rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

39

Centralized operations are better for small companies due to the smaller scope of their operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

40

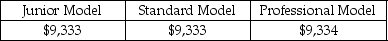

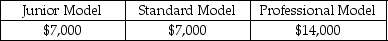

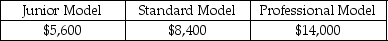

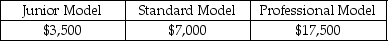

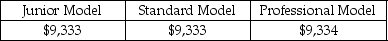

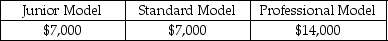

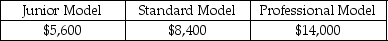

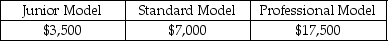

Louie's Music Co.produces three types of harmonicas: the junior model,the standard model and the professional model.The junior model requires 8 setups,the standard model requires 12 setups and the professional model requires 20 setups.The company expects to incur overhead costs of $28,000 where the cost driver is machine setups.How much overhead is assigned to each product?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

41

In a ________,the manager is responsible for generating revenues and controlling costs.

A)cost center

B)profit center

C)revenue center

D)transfer pricing center

A)cost center

B)profit center

C)revenue center

D)transfer pricing center

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following would most likely be evaluated using residual income?

A)cost center

B)profit center

C)revenue center

D)investment center

A)cost center

B)profit center

C)revenue center

D)investment center

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

43

The manager of a revenue center is responsible for generating profits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

44

Decentralized companies rarely struggle to achieve goal congruence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following is a disadvantage of decentralization?

A)It results in increased customer response time.

B)It allows only the top management to make decisions.

C)It does not motivate employees because the decision-making powers are not delegated.

D)It results in problems with achieving goal congruence.

A)It results in increased customer response time.

B)It allows only the top management to make decisions.

C)It does not motivate employees because the decision-making powers are not delegated.

D)It results in problems with achieving goal congruence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

46

Profit center responsibility reports include ________.

A)revenues only

B)invested capital

C)both revenues and expenses

D)returns on investments

A)revenues only

B)invested capital

C)both revenues and expenses

D)returns on investments

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

47

An investment center manager is responsible for generating profits and managing invested capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

48

The manager of a profit center is responsible for generating revenues and managing the center's invested capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following is not an advantage of decentralization?

A)provides training

B)frees top management time

C)works to achieve goal congruence

D)supports the use of expert knowledge

A)provides training

B)frees top management time

C)works to achieve goal congruence

D)supports the use of expert knowledge

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

50

The responsibility report of Keith Parker,the manager of one of the divisions of an auto parts manufacturing company,includes profits as well as return on investment and residual income.Keith is most likely the manager of a(n)________.

A)investment center

B)profit center

C)cost center

D)revenue center

A)investment center

B)profit center

C)cost center

D)revenue center

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

51

Long-term investments are made by the investment center manager for the purpose of ________.

A)increasing profits

B)decreasing profits

C)increasing interest expense

D)decreasing plant assets

A)increasing profits

B)decreasing profits

C)increasing interest expense

D)decreasing plant assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

52

A responsibility accounting system evaluates the performance of each responsibility center and its manager.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

53

The manager of a cost center is responsible for controlling costs and generating revenues for the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

54

The term goal congruence refers to the ________.

A)matching of financial goals of the company with its nonfinancial goals

B)aligning the goals of business segment managers with the goals of top management

C)achievement of the goals set by the management by utilizing the resources available

D)duplication of costs as a result of decentralization

A)matching of financial goals of the company with its nonfinancial goals

B)aligning the goals of business segment managers with the goals of top management

C)achievement of the goals set by the management by utilizing the resources available

D)duplication of costs as a result of decentralization

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

55

In a decentralized company,segment managers may not fully understand the big picture when making decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

56

Managerial accountants can design performance evaluation systems that encourage goal congruence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following is an advantage of decentralization?

A)Managers' motivation and retention can be increased by empowering segment managers to make decisions.

B)Certain costs of activities may be duplicated.

C)Customer response time is generally decreased.

D)Top management can concentrate on decisions that relate to day-to-day operations of segments.

A)Managers' motivation and retention can be increased by empowering segment managers to make decisions.

B)Certain costs of activities may be duplicated.

C)Customer response time is generally decreased.

D)Top management can concentrate on decisions that relate to day-to-day operations of segments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

58

Decentralization may cause the company to duplicate certain costs or activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

59

Brad Turret,one of the managers of a multi-national company,is responsible for generating revenues and controlling costs in order to increase the operating income of his division.However,he is not concerned about investment-related decisions.Brad is most likely to be the manager of a(n)________.

A)cost center

B)investment center

C)profit center

D)revenue center

A)cost center

B)investment center

C)profit center

D)revenue center

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

60

The production line of a manufacturing company is most likely to be considered as a(n)________.

A)cost center

B)profit center

C)revenue center

D)investment center

A)cost center

B)profit center

C)revenue center

D)investment center

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

61

Qvoware,Inc.sells cosmetic products in the United States.Which one of the following is most likely to be a cost center for Qvoware?

A)a Qvoware retail store in Dallas

B)the Qvoware human resource department

C)a Qvoware kiosk at a mall for selling its products

D)the Qvoware product lines

A)a Qvoware retail store in Dallas

B)the Qvoware human resource department

C)a Qvoware kiosk at a mall for selling its products

D)the Qvoware product lines

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

62

List the four types of responsibility centers.For each center,state the responsibility of the manager.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of the following best describes the manager of a profit center?

A)The manager is only responsible for controlling costs.

B)The manager is responsible for generating profits and efficiently managing the center's invested capital.

C)The manager is only responsible for generating revenues.

D)The manager is responsible for generating revenues and controlling costs.

A)The manager is only responsible for controlling costs.

B)The manager is responsible for generating profits and efficiently managing the center's invested capital.

C)The manager is only responsible for generating revenues.

D)The manager is responsible for generating revenues and controlling costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following managers is likely to have the least amount of responsibilities?

A)the manager of a cost center

B)the manager of a profit center

C)the manager of an investment center

D)the manager of a transfer pricing center

A)the manager of a cost center

B)the manager of a profit center

C)the manager of an investment center

D)the manager of a transfer pricing center

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

65

The balanced scorecard is a performance evaluation system that requires management to consider financial measures of performance,but not nonfinancial measures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following managers is likely to have the most diverse responsibilities?

A)the manager of a cost center

B)the manager of a profit center

C)the manager of an investment center

D)the manager of a revenue center

A)the manager of a cost center

B)the manager of a profit center

C)the manager of an investment center

D)the manager of a revenue center

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

67

Communicating top management's expectations to segment managers improves goal congruence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

68

Key performance indicators (KPIs)are summary performance measures that help managers assess whether the company is achieving its goals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

69

The balanced scorecard focuses only on lead indicators,because lag indicators are not important for performance evaluation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

70

The payroll department of a manufacturing company is most likely to be a(n)________.

A)cost center

B)revenue center

C)investment center

D)profit center

A)cost center

B)revenue center

C)investment center

D)profit center

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

71

A lag indicator is a performance measure that forecasts future performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

72

The performance evaluation system should provide incentives to segment managers for coordinating the activities of the subunits and directing them toward the overall company goals.Which of the following performance measurement goals has been described by this statement?

A)motivating segment managers

B)promoting goal congruence

C)providing feedback

D)benchmarking

A)motivating segment managers

B)promoting goal congruence

C)providing feedback

D)benchmarking

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

73

A company uses a balanced scorecard and has established a key performance indicator for product quality.If the actual warranty claims are higher than expected,there is an indication that the quality standards have been met.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

74

Uniox,Inc.intends to increase its profits by 50% in the next fiscal year.Which of the following is most likely to be a lag indicator in Uniox's performance report?

A)return on investment

B)number of repeat customers

C)rate of on-time deliveries

D)defect rate

A)return on investment

B)number of repeat customers

C)rate of on-time deliveries

D)defect rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

75

The practice of comparing a company's achievements against the best practices in the industry is known as goal congruence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

76

Madsen,Inc.intends to increase its profits by 50% in the next fiscal year.Which of the following is most likely to be a lead indicator in Madsen's performance report?

A)return on investment

B)number of repeat customers

C)net profit margin

D)sales revenue growth

A)return on investment

B)number of repeat customers

C)net profit margin

D)sales revenue growth

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following is a responsibility that is common to the managers of cost,profit,and investment centers?

A)generating revenues

B)generating profits

C)managing the invested capital

D)controlling costs

A)generating revenues

B)generating profits

C)managing the invested capital

D)controlling costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

78

Performance evaluation systems provide top management with a framework for maintaining control over the entire organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

79

List the primary goals of performance evaluation systems.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

80

Bernaise,Inc.sells cosmetic products in the United States.Which one of the following is most likely to be a revenue center for Bernaise?

A)a Bernaise retail store in Dallas

B)the Bernaise human resource department

C)a Bernaise kiosk at a mall for selling its products

D)the Bernaise product lines

A)a Bernaise retail store in Dallas

B)the Bernaise human resource department

C)a Bernaise kiosk at a mall for selling its products

D)the Bernaise product lines

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck