Deck 14: Statement of Cash Flows

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/153

العب

ملء الشاشة (f)

Deck 14: Statement of Cash Flows

1

Determining the cash flows from operating activities generally requires analyzing each item on the income statement as well as the current asset and current liability accounts.

True

2

Cash inflows that enter into the determination of net income are classified as financing activities on a statement of cash flows.

False

3

Cash received on the sale of equipment would be considered a financing activity on a statement of cash flows.

False

4

A statement of cash flows indicates the sources and uses of a firm's cash during a period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

5

On the statement of cash flows, the indirect method adjusts net income to determine the net cash flows from operating activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

6

The activity from the balance sheet to be presented in the financing activities section of the statement of cash flows is based on an analysis of stockholders' equity only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

7

Investments in stock are reported as an investing activity on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

8

Under the indirect method of determining the net cash from operating activities on the statement of cash flows, increases in current assets such as accounts receivable are added to net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

9

The sale of land for cash would be classified as a cash inflow from a financing activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

10

The issuance of common stock in exchange for a building would appear both as a cash inflow in the financing activities section of the cash flow statement and also as a cash outflow in the investing activities section.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

11

The amount for "net cash from operating activities" will be different depending on if the direct method or the indirect method is used to construct the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

12

The indirect method of reporting the cash flows from operating activities on the statement of cash flows is the method most widely used in practice.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

13

Noncash investing and financing transactions, such as the exchange of common stock to purchase assets, represent significant investing and financing activities and are disclosed in a supplementary schedule that is attached to the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

14

A decrease in accounts payable is added to net income in the operating activities section of the statement of cash flows prepared under the indirect method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

15

Under the indirect method of determining the net cash from operating activities on the statement of cash flows, depreciation is subtracted from the net income for the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

16

Companies can use two different methods to report the amount of cash flow from their operating activities on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

17

Transactions that involve the acquisition or sale of long-term assets are generally classified as investing activities on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

18

For a statement of cash flows, firms are required to classify their cash activities into three categories: operating, investing, and borrowing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

19

All SEC-registered firms must issue a statement of cash flows, in addition to the income statement and balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

20

Cash flow activities that include the cash effect of transactions that create revenues and expenses and thus enter into the determination of net income are classified as operating activities on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

21

Activities that decrease cash are uses of cash and are referred to as ___________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

22

An advantage to using a worksheet to organize the information of preparation of the statement of cash flows is that it uses a spreadsheet format allowing the preparer to use a PC and spreadsheet software.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

23

A loss on the sale of equipment is subtracted from net income in determining net cash from operating activities under the indirect method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

24

When an investing or financing activity takes place without affecting cash it is referred to as _________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

25

Income statements are prepared on a (n) ______________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

26

Issuing shares of common stock, paying dividends and paying off debt are all examples of _______________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

27

All firms that are registered with the ______________________ must issue a statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

28

If a firm uses the direct method for reporting operating activities on the statement of cash flows, it must present a separate schedule which reconciles net income to net cash from operating activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

29

The two approaches to calculating operating cash flows are the _______________ and the _____________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

30

Activities that increase cash are sources of cash and are referred to as ___________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

31

The ______________ computes operating cash flow by adjusting net income for items that do not affect cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

32

Under the indirect method, the net cash flow from operating activities is computed by adjusting net income to remove the effect of all deferrals of past operating cash receipts and payments, and all accruals of future operating cash receipts or payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

33

________________ are the ongoing, day-to-day, revenue-generating activities of an organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

34

The indirect method and the direct method differ only on how the cash flows from ________________ are calculated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

35

Highly liquid investments such as Treasury bills, money market funds, and commercial paper are examples of ___________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

36

Acquiring new equipment, selling long-term investments, and purchasing land are all examples of _______________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

37

The _____________________ provides information regarding the sources and uses of a firm's cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

38

The direct method of reporting cash flows from operating activities involves reporting major classes of cash receipts and cash payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

39

The format that should be followed in preparing the statement of cash flows is known as the ______________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

40

The __________________ computes operating cash flows by adjusting each line on the income statement to reflect cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

41

Worksheets offer increased ____________ in form and the added convenience of spreadsheet software packages.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following investing activities results in a cash inflow?

A) selling treasury stock.

B) retirement of bonds.

C) disposal of a building.

D) paying cash dividends.

A) selling treasury stock.

B) retirement of bonds.

C) disposal of a building.

D) paying cash dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following is the order of presentation of activities on the statement of cash flows?

A) Operating, investing, financing

B) Marketing, financing, manufacturing

C) Financing, outsourcing, investing

D) Manufacturing, investing, operating

A) Operating, investing, financing

B) Marketing, financing, manufacturing

C) Financing, outsourcing, investing

D) Manufacturing, investing, operating

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following activities is an example of a financing activity?

A) The payment of utility bills

B) The collection of sales revenue

C) The sale of investments

D) The purchase of treasury stock

A) The payment of utility bills

B) The collection of sales revenue

C) The sale of investments

D) The purchase of treasury stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following activities include acquiring and selling land?

A) Research activities

B) Investing activities

C) Financing activities

D) Warehouse activities

A) Research activities

B) Investing activities

C) Financing activities

D) Warehouse activities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following transactions does not affect cash during a period?

A) increase in amortization expense

B) payment of an accounts payable

C) issuance of bonds

D) purchase of a long-term investment

A) increase in amortization expense

B) payment of an accounts payable

C) issuance of bonds

D) purchase of a long-term investment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

47

The most widely used method for calculating operating cash flows is the _____.

A) indirect method

B) accrual method

C) direct method

D) high-low method

A) indirect method

B) accrual method

C) direct method

D) high-low method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which one of the following affects cash during a period?

A) payment of an account payable

B) declaration of a cash dividend

C) write-off of an uncollectible account receivable

D) recording depreciation expense

A) payment of an account payable

B) declaration of a cash dividend

C) write-off of an uncollectible account receivable

D) recording depreciation expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

49

Using the ________________ of reporting cash flow, each line on the income statement is adjusted to produce a cash flow income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

50

The difference between the indirect and direct methods of preparing a statement of cash flows is reflected in the:

A) manufacturing activities section.

B) investing activities section.

C) operating activities section.

D) selling activities section.

A) manufacturing activities section.

B) investing activities section.

C) operating activities section.

D) selling activities section.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

51

Preparation of the statement of cash flows relies on the beginning and ending ____________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following activities includes cash flows from acquiring and retiring long-term debt?

A) Selling activities

B) Investing activities

C) Financing activities

D) Manufacturing activities

A) Selling activities

B) Investing activities

C) Financing activities

D) Manufacturing activities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which balance sheet accounts are affected by financing activities?

A) current assets and current liabilities.

B) long-term assets.

C) long-term liabilities.

D) intangible assets.

A) current assets and current liabilities.

B) long-term assets.

C) long-term liabilities.

D) intangible assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

54

The acquisition of land by issuing common stock is

A) only reported if the statement of cash flows is prepared using the direct method.

B) a cash transaction that is reported in the investing section in the body of the statement of cash flows.

C) a noncash transaction that is reported in the operating section in the body of the statement of cash flows.

D) a noncash transaction that is disclosed in a supplementary schedule attached to the statement of cash flows.

A) only reported if the statement of cash flows is prepared using the direct method.

B) a cash transaction that is reported in the investing section in the body of the statement of cash flows.

C) a noncash transaction that is reported in the operating section in the body of the statement of cash flows.

D) a noncash transaction that is disclosed in a supplementary schedule attached to the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

55

Some individuals prefer to show operating cash flows as the difference between ___________ and ____________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

56

The primary purpose of the statement of cash flows is to

A) provide information about the investing and financing activities during the period.

B) prove that revenues exceed expenses if there is a net income.

C) provide information about the sources and uses of cash during a period.

D) facilitate banking relationships.

A) provide information about the investing and financing activities during the period.

B) prove that revenues exceed expenses if there is a net income.

C) provide information about the sources and uses of cash during a period.

D) facilitate banking relationships.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

57

The balance sheet accounts affected by operating activities are:

A) current assets and current liabilities.

B) retained earnings and long-term assets.

C) long-term assets and owner's equity.

D) long-term liabilities and long-term assets.

A) current assets and current liabilities.

B) retained earnings and long-term assets.

C) long-term assets and owner's equity.

D) long-term liabilities and long-term assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

58

The statement of cash flows does not report the

A) sources of cash in the current period.

B) uses of cash in the current period.

C) amount of checks outstanding at the end of the period.

D) change in the cash balance for the current period.

A) sources of cash in the current period.

B) uses of cash in the current period.

C) amount of checks outstanding at the end of the period.

D) change in the cash balance for the current period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

59

As transactions increase in number and complexity, a ____________ becomes a useful aid in preparing the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following is included in operating activities?

A) An increase in long-term debt

B) An increase in equity

C) An increase in accounts receivable

D) All of these.

A) An increase in long-term debt

B) An increase in equity

C) An increase in accounts receivable

D) All of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

61

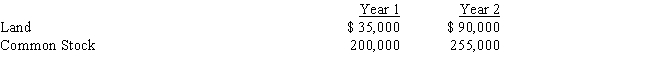

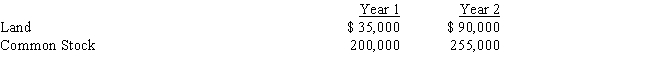

Tracy Company reported the following information at the end of Year 1 and Year 2:

An analysis of the company's records indicated that there were no cash flow effects resulting from the changes in the two accounts presented above.How should Tracy report the changes in these accounts on a statement of cash flows?

A) The company should report $55,000 for the acquisition of land as an investing activity and $55,000 for the issuance of stock as a financing activity.

B) The company should report $55,000 as a noncash investing and financing activity for the acquisition of land by issuing common stock.

C) The company should report the issuance of common stock to acquire land in the financing activity section with a net cash flow effect of zero.

D) The company should report the acquisition of land by issuing common stock in the investing activity section with a net cash flow effect of zero.

An analysis of the company's records indicated that there were no cash flow effects resulting from the changes in the two accounts presented above.How should Tracy report the changes in these accounts on a statement of cash flows?

A) The company should report $55,000 for the acquisition of land as an investing activity and $55,000 for the issuance of stock as a financing activity.

B) The company should report $55,000 as a noncash investing and financing activity for the acquisition of land by issuing common stock.

C) The company should report the issuance of common stock to acquire land in the financing activity section with a net cash flow effect of zero.

D) The company should report the acquisition of land by issuing common stock in the investing activity section with a net cash flow effect of zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

62

If a company has both an inflow and an outflow of cash related to property, plant, and equipment,

A) the two cash effects can be netted and presented as one item in the investing activities section of the statement of cash flows.

B) the cash inflow and the cash outflow should be reported separately in the investing activities section of the statement of cash flows.

C) the two cash effects can be netted and presented as one item in the financing activities section of the statement of cash flows.

D) the cash inflow and the cash outflow should be reported in the financing activities section of the statement of cash flows.

A) the two cash effects can be netted and presented as one item in the investing activities section of the statement of cash flows.

B) the cash inflow and the cash outflow should be reported separately in the investing activities section of the statement of cash flows.

C) the two cash effects can be netted and presented as one item in the financing activities section of the statement of cash flows.

D) the cash inflow and the cash outflow should be reported in the financing activities section of the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which method of preparing the operating activities section of the statement of cash flows adjusts net income to remove the effects of deferrals and accruals for revenues and expenses?

A) the direct method

B) the indirect method

C) both direct and indirect methods

D) neither the direct method nor the indirect method

A) the direct method

B) the indirect method

C) both direct and indirect methods

D) neither the direct method nor the indirect method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following is used in determining the change in cash for a period?

A) An owner's equity statement

B) A purchase statement

C) Comparative balance sheets

D) Comparative income statements

A) An owner's equity statement

B) A purchase statement

C) Comparative balance sheets

D) Comparative income statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

65

Smith and Company reported net income for the current year.Which of the following business transactions would cause cash from operating activities to be higher than the amount of net income?

A) Cash dividends were paid to stockholders during the year.

B) Depreciation expense was recorded for the year.

C) A bank loan was repaid during the year.

D) Equipment was purchased for cash during the year.

A) Cash dividends were paid to stockholders during the year.

B) Depreciation expense was recorded for the year.

C) A bank loan was repaid during the year.

D) Equipment was purchased for cash during the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which one of the following items is not necessary in preparing a statement of cash flows?

A) Determine the change in cash.

B) Determine the cash provided by operating activities.

C) Determine cash from financing and investing activities.

D) Determine the cash in all bank accounts.

A) Determine the change in cash.

B) Determine the cash provided by operating activities.

C) Determine cash from financing and investing activities.

D) Determine the cash in all bank accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following influences the decision of using the direct or the indirect method on a statement of cash flows?

A) Operating activities only

B) Research activities only

C) Financing activities only

D) All of these

A) Operating activities only

B) Research activities only

C) Financing activities only

D) All of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

68

An increase in accounts payable is _____ while calculating cash flows from operating activities using indirect method.

A) added to net income

B) deducted from gross income

C) added to earnings before tax

D) deducted from depreciation expense

A) added to net income

B) deducted from gross income

C) added to earnings before tax

D) deducted from depreciation expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following is added to net income to compute net cash from operating activities using the indirect method?

A) A loss on sale of equipment

B) A gain on sale of a long-term investment

C) An increase in accounts receivable

D) An increase in goodwill

A) A loss on sale of equipment

B) A gain on sale of a long-term investment

C) An increase in accounts receivable

D) An increase in goodwill

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

70

The _____ is a financing activity that results in cash inflow.

A) purchase of long-term investments

B) collection of accounts receivable

C) payment of dividends

D) issuance of bonds

A) purchase of long-term investments

B) collection of accounts receivable

C) payment of dividends

D) issuance of bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

71

Using the indirect method, patent amortization expense for the period

A) is deducted from net income.

B) has no impact on cash flows.

C) causes cash to decrease.

D) is added to net income.

A) is deducted from net income.

B) has no impact on cash flows.

C) causes cash to decrease.

D) is added to net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following would not be needed to determine net cash provided by operating activities?

A) depreciation expense

B) change in accounts receivable

C) payment of cash dividends

D) change in prepaid expenses

A) depreciation expense

B) change in accounts receivable

C) payment of cash dividends

D) change in prepaid expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

73

Using the indirect method, if equipment is sold at a gain, the

A) sale proceeds received are deducted in the operating activities section.

B) sale proceeds received are added in the operating activities section.

C) amount of the gain is added in the operating activities section.

D) amount of the gain is deducted in the operating activities section.

A) sale proceeds received are deducted in the operating activities section.

B) sale proceeds received are added in the operating activities section.

C) amount of the gain is added in the operating activities section.

D) amount of the gain is deducted in the operating activities section.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following would be subtracted from net income using the indirect method?

A) an increase in inventories.

B) loss on sale of investments.

C) depreciation expense.

D) a decrease in accounts payable.

A) an increase in inventories.

B) loss on sale of investments.

C) depreciation expense.

D) a decrease in accounts payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

75

Starting with net income and adjusting it for items that affected reported net income but which did not affect cash is called the

A) direct method.

B) indirect method.

C) cost-benefit method.

D) working capital method.

A) direct method.

B) indirect method.

C) cost-benefit method.

D) working capital method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

76

An increase in inventories is _____ while computing cash flows from operating activities using the indirect method.

A) added to selling expense

B) deducted from net income

C) added to depreciation expense

D) deducted from retained earnings

A) added to selling expense

B) deducted from net income

C) added to depreciation expense

D) deducted from retained earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following would not be an adjustment to net income using the indirect method?

A) depreciation expense

B) an increase in prepaid expenses

C) amortization expense

D) an increase in land

A) depreciation expense

B) an increase in prepaid expenses

C) amortization expense

D) an increase in land

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

78

In calculating cash flows from operating activities using the indirect method, a loss on the sale of equipment will appear as a(n)

A) subtraction from net income.

B) addition to net income.

C) addition to cash flow from investing activities.

D) subtraction from cash flow from investing activities.

A) subtraction from net income.

B) addition to net income.

C) addition to cash flow from investing activities.

D) subtraction from cash flow from investing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

79

The cash during a period is affected when:

A) a depreciation expense is incurred.

B) a stock dividend is declared.

C) a bad debt expense is written off.

D) a discount is given to creditors.

A) a depreciation expense is incurred.

B) a stock dividend is declared.

C) a bad debt expense is written off.

D) a discount is given to creditors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

80

A depreciation expense is _____ to calculate net cash from operating activities using the indirect method.

A) deducted from gross income

B) added to net income

C) deducted from tax expense

D) added to selling expense

A) deducted from gross income

B) added to net income

C) deducted from tax expense

D) added to selling expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck