Deck 5: Interest Rates and Bond Valuation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/85

العب

ملء الشاشة (f)

Deck 5: Interest Rates and Bond Valuation

1

Which type of bond grants its holder the right to force repayment of the bond at a stated price prior to maturity?

A)Income

B)Call

C)Put

D)Structured note

E)Convertible

A)Income

B)Call

C)Put

D)Structured note

E)Convertible

Put

2

A bond with a 5 percent coupon that pays interest semiannually and is priced at par will have a market price of _____ and interest payments in the amount of _____ each.

A)$1,005;$50

B)$1,050;$25

C)$1,050;$50

D)$1,000;$50

E)$1,000;$25

A)$1,005;$50

B)$1,050;$25

C)$1,050;$50

D)$1,000;$50

E)$1,000;$25

$1,000;$25

3

Interest rate risk increases with:

A)both increases in time to maturity and coupon rates.

B)increases in time to maturity and decreases in coupon rates.

C)increases in coupon rates and decreases in market rates.

D)decreases in market rates and increases in time to maturity.

E)both decreases in coupon rates and market rates.

A)both increases in time to maturity and coupon rates.

B)increases in time to maturity and decreases in coupon rates.

C)increases in coupon rates and decreases in market rates.

D)decreases in market rates and increases in time to maturity.

E)both decreases in coupon rates and market rates.

increases in time to maturity and decreases in coupon rates.

4

Which formula computes the actual real rate of return on an investment?

A)C/FV

B)C/PV

C)r = (1 + R)- (1 + h)- 1

D)r = (1 + R)/(1 + h)- 1

E)R = (1 + r)× (1 + h)- 1

A)C/FV

B)C/PV

C)r = (1 + R)- (1 + h)- 1

D)r = (1 + R)/(1 + h)- 1

E)R = (1 + r)× (1 + h)- 1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

5

All else constant,a bond will sell at _____ when the yield to maturity is _____ the coupon rate.

A)at par;less than

B)a premium;equal to

C)at par;higher than

D)a discount;higher than

E)a premium;higher than

A)at par;less than

B)a premium;equal to

C)at par;higher than

D)a discount;higher than

E)a premium;higher than

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

6

The yield to maturity on a bond is the rate:

A)computed as annual interest divided by the bond's market price.

B)an investor earns if the bond is sold prior to the maturity date.

C)of annual interest initially offered when the bond was issued.

D)of return currently required by the market.

E)of annual interest paid on the bond.

A)computed as annual interest divided by the bond's market price.

B)an investor earns if the bond is sold prior to the maturity date.

C)of annual interest initially offered when the bond was issued.

D)of return currently required by the market.

E)of annual interest paid on the bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

7

For tax purposes,the implicit annual interest for any one year on a zero coupon bond is equal to:

A)zero.

B)the annual change in the bond's value as determined by amortizing the loan.

C)the current yield.

D)the face value divided by the number of years to maturity.

E)the face value minus the current market value.

A)zero.

B)the annual change in the bond's value as determined by amortizing the loan.

C)the current yield.

D)the face value divided by the number of years to maturity.

E)the face value minus the current market value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

8

A bond with both a face value and a market value of $1,000 is called a _____ bond.

A)par value

B)premium

C)discount

D)zero coupon

E)floating rate

A)par value

B)premium

C)discount

D)zero coupon

E)floating rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

9

A deferred call provision is designed to:

A)guarantee a bond will be repaid on a certain date prior to maturity.

B)prohibit the calling of a bond prior to a certain date.

C)ensure bond holders receive full value when a bond is called.

D)ensure any bankruptcy of the issuer is deferred until a bond is repaid in full.

E)ensure the owner of a bond agrees to the call before a bond is called.

A)guarantee a bond will be repaid on a certain date prior to maturity.

B)prohibit the calling of a bond prior to a certain date.

C)ensure bond holders receive full value when a bond is called.

D)ensure any bankruptcy of the issuer is deferred until a bond is repaid in full.

E)ensure the owner of a bond agrees to the call before a bond is called.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

10

The _____ premium is that portion of a nominal interest rate or bond yield that represents compensation for the possibility of nonpayment by the bond issuer.

A)interest rate risk

B)taxability

C)liquidity

D)inflation

E)default risk

A)interest rate risk

B)taxability

C)liquidity

D)inflation

E)default risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

11

The relationship between nominal interest rates on default-free,pure discount securities and the time to maturity is called the:

A)liquidity effect.

B)Fisher effect.

C)term structure of interest rates.

D)inflation premium.

E)interest rate risk premium.

A)liquidity effect.

B)Fisher effect.

C)term structure of interest rates.

D)inflation premium.

E)interest rate risk premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which one of these definitions is correct?

A)Negative covenant: a "thou shalt" agreement within an indenture

B)Premium bond: bond that sells for less than face value

C)Dirty price: market price,excluding accrued interest

D)Call provision: issuer's right to repurchase a bond prior to maturity

E)Unfunded debt: long-term corporate debt

A)Negative covenant: a "thou shalt" agreement within an indenture

B)Premium bond: bond that sells for less than face value

C)Dirty price: market price,excluding accrued interest

D)Call provision: issuer's right to repurchase a bond prior to maturity

E)Unfunded debt: long-term corporate debt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

13

The part of an indenture that protect the interests of the lender by limiting certain actions that a company might take during the term of the loan are called:

A)deferred call provisions.

B)sinking funds provisions.

C)protective covenants.

D)trustee relationships.

E)bond ratings.

A)deferred call provisions.

B)sinking funds provisions.

C)protective covenants.

D)trustee relationships.

E)bond ratings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

14

A "make-whole" call provision on a bond provides for:

A)call prices that vary with the funds available in a sinking fund.

B)a call price equal to the bond's approximate market value at the time of call.

C)decreasing call prices as interest rates decrease.

D)a call price equal to the face value plus all accrued interest to date.

E)a call price equal to the face value.

A)call prices that vary with the funds available in a sinking fund.

B)a call price equal to the bond's approximate market value at the time of call.

C)decreasing call prices as interest rates decrease.

D)a call price equal to the face value plus all accrued interest to date.

E)a call price equal to the face value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

15

Interest rates or rates of return on investments that have been adjusted for the effects of inflation are called _____ rates.

A)real

B)nominal

C)effective

D)stripped

E)coupon

A)real

B)nominal

C)effective

D)stripped

E)coupon

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

16

The upper and lower limits on the coupon rate of a floating-rate bond are referred to as the bond's:

A)put.

B)"make-whole" provision.

C)call.

D)income limit.

E)collar.

A)put.

B)"make-whole" provision.

C)call.

D)income limit.

E)collar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

17

A discount bond has a coupon rate that:

A)exceeds its current yield.

B)is less than the bond's yield to maturity.

C)exceeds both its current yield and its yield to maturity.

D)equals its current yield.

E)equals its current yield provided the bond pays interest annually.

A)exceeds its current yield.

B)is less than the bond's yield to maturity.

C)exceeds both its current yield and its yield to maturity.

D)equals its current yield.

E)equals its current yield provided the bond pays interest annually.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

18

All else constant,a coupon bond that is selling at a premium,must have:

A)a yield to maturity that is less than the coupon rate.

B)a coupon rate that is equal to the yield to maturity.

C)a market price that is less than par value.

D)semiannual interest payments.

E)a coupon rate that is less than the yield to maturity.

A)a yield to maturity that is less than the coupon rate.

B)a coupon rate that is equal to the yield to maturity.

C)a market price that is less than par value.

D)semiannual interest payments.

E)a coupon rate that is less than the yield to maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which one of these is most apt to be repaid first if a firm encounters financial distress and goes out of business?

A)Junior debt

B)Unsecured debt

C)Blanket mortgage

D)Subordinated debenture

E)Subordinated debt

A)Junior debt

B)Unsecured debt

C)Blanket mortgage

D)Subordinated debenture

E)Subordinated debt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

20

The written,legally binding agreement between a corporate borrower and its lenders detailing all of the terms of a bond issue is called the:

A)indenture.

B)covenant.

C)terms of trade.

D)put provision.

E)call provision.

A)indenture.

B)covenant.

C)terms of trade.

D)put provision.

E)call provision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which one of the following statements concerning bonds is correct?

A)Bondholders are generally granted voting rights.

B)Zero coupon bonds are sold at par.

C)The repayment of bond principal is tax-deductible.

D)A "bellwether" bond is the yield on the shortest outstanding Treasury security.

E)Both corporate and Treasury bonds are quoted as a percentage of par.

A)Bondholders are generally granted voting rights.

B)Zero coupon bonds are sold at par.

C)The repayment of bond principal is tax-deductible.

D)A "bellwether" bond is the yield on the shortest outstanding Treasury security.

E)Both corporate and Treasury bonds are quoted as a percentage of par.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which bond has interest that is taxed only at the federal level?

A)Municipal bond

B)Corporate,unsecured bond

C)Treasury bond

D)Corporate,secured bond

E)Corporate,zero coupon bond

A)Municipal bond

B)Corporate,unsecured bond

C)Treasury bond

D)Corporate,secured bond

E)Corporate,zero coupon bond

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

23

You own a fixed-rate bond that has a coupon rate of 6.5 percent and matures in 12 years.You purchased this bond at par value when it was originally issued.If the current market rate for this type and quality of bond is 6.8 percent,then you would expect:

A)the bond issuer to increase the amount of each interest payment.

B)the yield to maturity to remain constant due to the fixed coupon rate.

C)the current yield today to be less than 6.5 percent.

D)today's market price to exceed the face value of the bond.

E)to realize a capital loss if you sold the bond at the market price today.

A)the bond issuer to increase the amount of each interest payment.

B)the yield to maturity to remain constant due to the fixed coupon rate.

C)the current yield today to be less than 6.5 percent.

D)today's market price to exceed the face value of the bond.

E)to realize a capital loss if you sold the bond at the market price today.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

24

Protective covenants:

A)are primarily designed to protect bondholders from future actions of the bond issuer.

B)only apply to bonds that have a deferred call provision.

C)are limited to stating actions that a firm must take.

D)are consistent for all bonds issued by a corporation within the United States.

E)are designed to protect the issuer should it default.

A)are primarily designed to protect bondholders from future actions of the bond issuer.

B)only apply to bonds that have a deferred call provision.

C)are limited to stating actions that a firm must take.

D)are consistent for all bonds issued by a corporation within the United States.

E)are designed to protect the issuer should it default.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

25

A bond has a coupon rate of 6 percent and matures in ten years.The next semiannual interest payment will be paid one month from now.Which one of the following do you know with certainty concerning this bond?

A)The bond sells at a discount.

B)The bond sells at a premium.

C)The dirty price is higher than the clean price.

D)The clean price is higher than the dirty price.

E)The market price exceeds the par value.

A)The bond sells at a discount.

B)The bond sells at a premium.

C)The dirty price is higher than the clean price.

D)The clean price is higher than the dirty price.

E)The market price exceeds the par value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

26

The term structure of interest rates reflects the:

A)pure time value of money for various lengths of time.

B)actual risk premium being paid for corporate bonds of varying maturities.

C)pure inflation adjustment applied to bonds of various maturities.

D)interest rate risk premium applicable to bonds of varying maturities.

E)nominal interest rates applicable to coupon bonds of varying maturities.

A)pure time value of money for various lengths of time.

B)actual risk premium being paid for corporate bonds of varying maturities.

C)pure inflation adjustment applied to bonds of various maturities.

D)interest rate risk premium applicable to bonds of varying maturities.

E)nominal interest rates applicable to coupon bonds of varying maturities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which one of the following statements is correct concerning interest rate risk as it relates to bonds,all else equal?

A)The shorter the time to maturity,the greater the interest rate risk.

B)The higher the coupon,the greater the interest rate risk.

C)For a bond selling at par,there is no interest rate risk.

D)The greater the number of semiannual interest payments,the greater the interest rate risk.

E)The lower the amount of each interest payment,the lower the interest rate risk.

A)The shorter the time to maturity,the greater the interest rate risk.

B)The higher the coupon,the greater the interest rate risk.

C)For a bond selling at par,there is no interest rate risk.

D)The greater the number of semiannual interest payments,the greater the interest rate risk.

E)The lower the amount of each interest payment,the lower the interest rate risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

28

Interest rate risk _____ as the time to maturity increases.

A)increases at an increasing rate

B)increases at a decreasing rate

C)increases at a constant rate

D)decreases at an increasing rate

E)decreases at a decreasing rate

A)increases at an increasing rate

B)increases at a decreasing rate

C)increases at a constant rate

D)decreases at an increasing rate

E)decreases at a decreasing rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

29

All else constant,as the market price of a bond increases the current yield _____ and the yield to maturity _____

A)decreases;decreases.

B)increases;decreases.

C)increases;increases.

D)decreases;increases.

E)remains constant;increases.

A)decreases;decreases.

B)increases;decreases.

C)increases;increases.

D)decreases;increases.

E)remains constant;increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

30

Assume a discount bond has a few years until maturity and a positive yield.All else constant,the bonds' yield to maturity is:

A)directly related to the time to maturity.

B)equal to the coupon rate.

C)inversely related to the bond's market price.

D)unrelated to the time to maturity.

E)less than its coupon rate.

A)directly related to the time to maturity.

B)equal to the coupon rate.

C)inversely related to the bond's market price.

D)unrelated to the time to maturity.

E)less than its coupon rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which one of the following statements concerning bond ratings is correct?

A)Moody's is the sole provider of bond ratings.

B)Bond ratings only assess the possibility of default.

C)Investment grade bonds include only those bonds receiving an A or higher rating.

D)Bond ratings consider the potential price volatility of a bond.

E)A "fallen angel" is a bond that fell from an A rating or above to a BBB rating.

A)Moody's is the sole provider of bond ratings.

B)Bond ratings only assess the possibility of default.

C)Investment grade bonds include only those bonds receiving an A or higher rating.

D)Bond ratings consider the potential price volatility of a bond.

E)A "fallen angel" is a bond that fell from an A rating or above to a BBB rating.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

32

Bonds issued by the U.S.government:

A)are considered to be default-free.

B)are exempt from interest rate risk.

C)provide totally tax-free income.

D)pay interest that is exempt from federal income tax.

E)are taxed the same as municipal bonds.

A)are considered to be default-free.

B)are exempt from interest rate risk.

C)provide totally tax-free income.

D)pay interest that is exempt from federal income tax.

E)are taxed the same as municipal bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following are common characteristics of floating-rate bonds?

I.Adjustable coupon rates

II.Adjustable maturity dates

III.Put provision

IV.Coupon cap

A)I and II only

B)II and III only

C)I,II,and IV only

D)I,III,and IV only

E)I,II,III,and IV

I.Adjustable coupon rates

II.Adjustable maturity dates

III.Put provision

IV.Coupon cap

A)I and II only

B)II and III only

C)I,II,and IV only

D)I,III,and IV only

E)I,II,III,and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which one of these is included in the term structure of interest rates and remains constant over the term?

A)Default risk premium

B)Interest rate risk premium

C)Liquidity premium

D)Real rate of interest

E)Inflation premium

A)Default risk premium

B)Interest rate risk premium

C)Liquidity premium

D)Real rate of interest

E)Inflation premium

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

35

Today,July 15,you are buying a bond from a dealer with a quoted price of 100.023.The bond pays interest on February 1 and August 1.The invoice price you pay for this purchase will equal:

A)the clean price.

B)the asked price.

C)the dirty price.

D)par value.

E)the bid price.

A)the clean price.

B)the asked price.

C)the dirty price.

D)par value.

E)the bid price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which one of these bonds is subject to the greatest interest rate risk?

A)5-year,zero coupon bond

B)5-year bond with a 4.5 percent coupon rate

C)5-year bond with a 5 percent coupon rate

D)10-year,zero coupon bond

E)10-year,5 percent coupon bond

A)5-year,zero coupon bond

B)5-year bond with a 4.5 percent coupon rate

C)5-year bond with a 5 percent coupon rate

D)10-year,zero coupon bond

E)10-year,5 percent coupon bond

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following items are generally included in a bond indenture?

I.Sinking fund requirements

II.Security description

III.Bid and asked prices

IV.Total amount of bonds issued

A)I and II only

B)II and IV only

C)II,III,and IV only

D)I,II,and IV only

E)I,II,III,and IV

I.Sinking fund requirements

II.Security description

III.Bid and asked prices

IV.Total amount of bonds issued

A)I and II only

B)II and IV only

C)II,III,and IV only

D)I,II,and IV only

E)I,II,III,and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

38

The increase you realize in buying power as a result of owning a bond is referred to as the _____ rate of return.

A)inflated

B)market

C)nominal

D)real

E)risk-free

A)inflated

B)market

C)nominal

D)real

E)risk-free

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

39

Municipal bonds:

A)primarily appeal to high tax-bracket investors.

B)generally pay a higher pretax rate of return than corporate bonds.

C)are issued only by local municipalities,such as a city or a borough.

D)are rarely callable.

E)pay interest that is exempt from all income tax.

A)primarily appeal to high tax-bracket investors.

B)generally pay a higher pretax rate of return than corporate bonds.

C)are issued only by local municipalities,such as a city or a borough.

D)are rarely callable.

E)pay interest that is exempt from all income tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

40

What does the spread between the bid and asked bond prices represent?

A)Difference between the coupon rate and the current yield

B)Difference between the current yield and the yield to maturity

C)Accrued interest

D)Dealer's profit

E)Bondholder's profit

A)Difference between the coupon rate and the current yield

B)Difference between the current yield and the yield to maturity

C)Accrued interest

D)Dealer's profit

E)Bondholder's profit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

41

A Treasury bond matures in 17 years,pays interest semiannually,and carries a coupon rate of 3.5 percent.How much are you willing to pay for a $1,000 face value bond if you desire a rate of return of 4.25 percent?

A)$701.67

B)$909.86

C)$554.64

D)$946.96

E)$1,330.50

A)$701.67

B)$909.86

C)$554.64

D)$946.96

E)$1,330.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

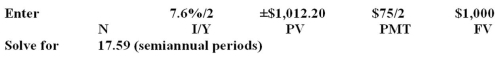

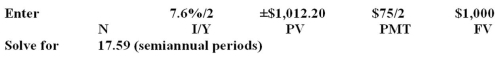

42

River Tours has 7.5 percent coupon bonds that pay interest semiannually.The face value of each bond is $1,000 and the current market price is $1,012.20.If the yield to maturity is 7.6 percent,how many years is it until these bonds mature?

A)8.22 years

B)8.80 years

C)10.46 years

D)16.43 years

E)17.59 years

A)8.22 years

B)8.80 years

C)10.46 years

D)16.43 years

E)17.59 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

43

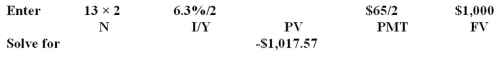

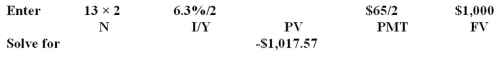

Webster's has a 12-year bond issue outstanding that pays a coupon rate of 6.5 percent.The bond is currently priced at $938.76 and has a par value of $1,000.Interest is paid semiannually.What is the yield to maturity?

A)7.27%

B)7.80%

C)8.01%

D)14.56%

E)14.07%

A)7.27%

B)7.80%

C)8.01%

D)14.56%

E)14.07%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

44

Antonio's offers a 10-year bond that has a coupon rate of 5 percent and semiannual payments.The face value is $1,000 and the yield to maturity is 12.6 percent.What is the current value of this bond?

A)$273.09

B)$580.92

C)$574.56

D)$605.92

E)$854.46

A)$273.09

B)$580.92

C)$574.56

D)$605.92

E)$854.46

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

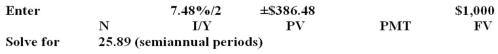

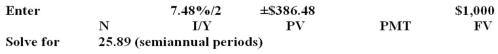

45

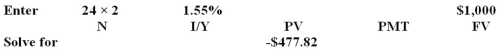

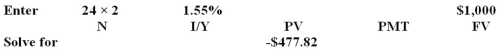

A zero coupon bond has a yield to maturity of 7.48 percent,semiannual compounding,a $1,000 face value,and a market price of $386.48.How many years is it until this bond matures?

A)11.58 years

B)13.18 years

C)12.95 years

D)23.16 years

E)25.89 years

A)11.58 years

B)13.18 years

C)12.95 years

D)23.16 years

E)25.89 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

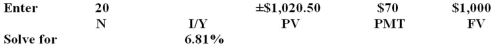

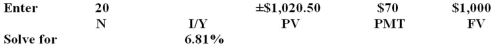

46

A General Co.bond has a coupon rate of 7 percent and pays interest annually.The face value is $1,000 and the current market price is $1,020.50.The bond matures in 20 years.What is the yield to maturity?

A)6.59%

B)6.81%

C)7.00%

D)7.04%

E)7.12%

A)6.59%

B)6.81%

C)7.00%

D)7.04%

E)7.12%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

47

A 20-year zero coupon bond has a $1,000 face value,a required rate of return of 5 percent,and semiannually compounding.What is this bond worth today?

A)$372.43

B)$610.27

C)$208.29

D)$376.89

E)$626.30

A)$372.43

B)$610.27

C)$208.29

D)$376.89

E)$626.30

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

48

Gugenheim offers a 15-year coupon bond with semiannual payments.The yield to maturity is 5.85 percent and the bonds sell at 94 percent of par.What is the coupon rate?

A)3.09%

B)2.62%

C)2.22%

D)5.24%

E)5.61%

A)3.09%

B)2.62%

C)2.22%

D)5.24%

E)5.61%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

49

Autos and More offers a zero coupon bond with a yield to maturity of 11.3 percent.The bond matures in 15 years and has a face value of $1,000.What is this bond worth today? (Assume semiannual compounding. )

A)$192.27

B)$161.90

C)$208.36

D)$201.71

E)$184.09

A)$192.27

B)$161.90

C)$208.36

D)$201.71

E)$184.09

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

50

The bonds offered by Leo's Pumps are callable in 4 years at a quoted price of 102.What is the amount of the call premium on a $1,000 par value bond?

A)$2.00

B)$8.00

C)$20.00

D)$23.33

E)$43.49

A)$2.00

B)$8.00

C)$20.00

D)$23.33

E)$43.49

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

51

A 15-year,4 percent coupon bond with a face value of $1,000 pays interest semiannually.Assume the bond currently sells at par.What will the percentage change in the price of this bond be if market rates increase by 10 percent?

A)1.32%

B)-1.32%

C)1.96%

D)-1.96%

E)-1.13%

A)1.32%

B)-1.32%

C)1.96%

D)-1.96%

E)-1.13%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

52

The bonds issued by North & South bear a coupon rate of 7.5 percent,payable semiannually.The bonds mature in 6.5 years,sell at par,and have a $1,000 face value.What is the yield to maturity?

A)7.59%

B)7.86%

C)7.50%

D)7.42%

E)15.00%

A)7.59%

B)7.86%

C)7.50%

D)7.42%

E)15.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

53

Your firm offers a 20-year,semiannual coupon bond with a yield to maturity of 8.35 percent,a face value of $1,000,and a market price of $1,054.What is the coupon rate?

A)8.91%

B)4.46%

C)17.64%

D)8.82%

E)17.82%

A)8.91%

B)4.46%

C)17.64%

D)8.82%

E)17.82%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

54

A 12-year,5 percent coupon bond with a face value of $1,000 pays interest semiannually.What is the percentage change in the price of this bond if the market yield rises to 6 percent from its current level of 4.5 percent?

A)12.49%

B)-12.49%

C)12.38%

D)14.13%

E)-14.13%

A)12.49%

B)-12.49%

C)12.38%

D)14.13%

E)-14.13%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

55

The Rose Shoppe offers 10-year,8 percent coupon bonds with semiannual payments and a yield to maturity of 8.24 percent.What is the market price of a $1,000 face value bond?

A)$990.32

B)$983.86

C)$1,108.16

D)$1,521.75

E)$591.04

A)$990.32

B)$983.86

C)$1,108.16

D)$1,521.75

E)$591.04

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

56

Two of the primary differences between a corporate bond and a Treasury bond with identical maturity dates are related to:

A)interest rate risk and time value of money.

B)time value of money and inflation.

C)taxes and potential default.

D)taxes and inflation.

E)inflation and interest rate risk.

A)interest rate risk and time value of money.

B)time value of money and inflation.

C)taxes and potential default.

D)taxes and inflation.

E)inflation and interest rate risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

57

Delray bonds offer a coupon rate of 5 percent and currently sell at 96.5 percent of face value.What is the current yield on these bonds?

A)4.83%

B)4.97%

C)5.00%

D)5.06%

E)5.18%

A)4.83%

B)4.97%

C)5.00%

D)5.06%

E)5.18%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

58

A corporate bond is quoted at a current price of 101.352.What is the market price of a bond with a $1,000 face value?

A)$1,001.35

B)$1,013.52

C)$1,000.14

D)$1,135.20

E)$1,100.35

A)$1,001.35

B)$1,013.52

C)$1,000.14

D)$1,135.20

E)$1,100.35

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

59

The Doolittle bonds have a face value of $1,000,a current market price of $1,048.50,a coupon rate of 4.6 percent,compounded semiannually.What is the current yield on these bonds?

A)4.51%

B)4.39%

C)4.42%

D)4.60%

E)4.64%

A)4.51%

B)4.39%

C)4.42%

D)4.60%

E)4.64%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

60

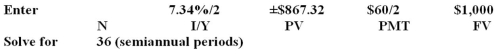

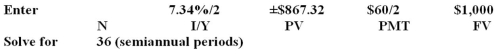

A $1,000 face value bond has a current market price of $867.32,a coupon rate of 6 percent,a yield to maturity of 7.34 percent,and semiannual interest payments.How many years is it until this bond matures?

A)16 years

B)18 years

C)24 years

D)30 years

E)36 years

A)16 years

B)18 years

C)24 years

D)30 years

E)36 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

61

A bond that pays interest annually yields a rate of return of 7.25 percent.The inflation rate for the same period is 2.31 percent.What is the actual real rate of return on this bond?

A)4.79%

B)4.87%

C)4.83%

D)4.94%

E)4.91%

A)4.79%

B)4.87%

C)4.83%

D)4.94%

E)4.91%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

62

A $1,000 face value corporate bond matures in 28 years,pays interest semiannually,and has a market quote of 98.625.The coupon rate is 7.25 percent,the current yield is ___ percent,and the yield to maturity is ____ percent.

A)7.16;7.12

B)7.16;7.09

C)7.25;7.22

D)7.35;7.37

E)7.35;7.41

A)7.16;7.12

B)7.16;7.09

C)7.25;7.22

D)7.35;7.37

E)7.35;7.41

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

63

If the nominal rate of return on a bond is 8.59 percent and the real rate is 3.87 percent,what is the rate of inflation?

A)4.54%

B)5.39%

C)6.87%

D)12.46%

E)13.82%

A)4.54%

B)5.39%

C)6.87%

D)12.46%

E)13.82%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

64

Eastern Sports bonds have a face value of $1,000,mature in 7 years,pay interest semiannually,and have a coupon rate of 7.25 percent.The next interest payment will be paid two months from today.What is the dirty price of this bond if the market rate of return is 7.5 percent?

A)$986.58

B)$998.66

C)$1,003.45

D)$1,010.75

E)$1,071.16

A)$986.58

B)$998.66

C)$1,003.45

D)$1,010.75

E)$1,071.16

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

65

A $1,000 face value Treasury bond matures in 16 years,pays interest semiannually,and has a market quote of 101.0210.The coupon rate is 3.5 percent,the current yield is ___ percent,and the yield to maturity is ____ percent.

A)3.46;3.42

B)3.46;3.39

C)3.50;3.58

D)3.54;3.62

E)3.54;3.59

A)3.46;3.42

B)3.46;3.39

C)3.50;3.58

D)3.54;3.62

E)3.54;3.59

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

66

Deep Hollow Welding's bond pays a coupon rate of 6.5 percent,has a yield to maturity of 6.98 percent,and a face value of $1,000.The current rate of inflation is 2.68 percent.What is the real rate of return on these bonds?

A)4.31%

B)4.19%

C)3.82%

D).48%

E)1.48%

A)4.31%

B)4.19%

C)3.82%

D).48%

E)1.48%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

67

A corporate bond yields 7.3 percent.What municipal bond rate is equivalent to the corporate rate for an investor with a 25 percent marginal tax rate?

A)5.84%

B)9.13%

C)5.48%

D)6.08%

E)9.73%

A)5.84%

B)9.13%

C)5.48%

D)6.08%

E)9.73%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

68

A $5,000 face value zero coupon bond is quoted at a price of 46.874.What is the amount you would pay to purchase this bond today?

A)$4,687.40

B)$46.87

C)$2,343.70

D)$234.37

E)$468.74

A)$4,687.40

B)$46.87

C)$2,343.70

D)$234.37

E)$468.74

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

69

Assume a bond yields a real rate of return of 3.6 percent during a time when inflation is 1.87 percent.What would the actual nominal rate of return be?

A)5.61%

B)5.46%

C)5.49%

D)5.54%

E)5.57%

A)5.61%

B)5.46%

C)5.49%

D)5.54%

E)5.57%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

70

Atlas bonds have a face value of $1,000,mature in 6 years,pay interest semiannually,and have a coupon rate of 4.5 percent.The next interest payment will be paid two months from today.What is the clean price of this bond if the market rate of return is 5.1 percent?

A)$954.32

B)$969.32

C)$971.08

D)$984.32

E)$986.08

A)$954.32

B)$969.32

C)$971.08

D)$984.32

E)$986.08

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

71

Toy World bonds have a face value of $1,000,mature in13 years,pay interest semiannually,and have a coupon rate of 6.5 percent.The next interest payment will be paid four months from today.What is the dirty price of this bond if the market rate of return is 6.3 percent?

A)$1,028.40

B)$1,021.18

C)$1,017.57

D)$1,027.76

E)$1,039.24

A)$1,028.40

B)$1,021.18

C)$1,017.57

D)$1,027.76

E)$1,039.24

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

72

A Treasury bond is quoted at a price of 101.2462 with a current yield of 3.68 percent.What is the coupon rate?

A)3.61%

B)3.68%

C)3.73%

D)3.77%

E)3.82%

A)3.61%

B)3.68%

C)3.73%

D)3.77%

E)3.82%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

73

A $1,000 face value bond has a bid quote of 101.087 and a bid-ask spread of .185.What price will you receive if you sell your bond today? Ignore any accrued interest or trading costs.

A)$1,010.87

B)$1,012.72

C)$1,009.02

D)$1,008.28

E)$1,010.27

A)$1,010.87

B)$1,012.72

C)$1,009.02

D)$1,008.28

E)$1,010.27

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

74

You are purchasing a bond with a face value of $1,000 and a coupon rate of 6.65 percent.The bond pays interest semiannually and has a yield to maturity of 7.23 percent.The bond matures in 6.5 years and pays its next interest payment in four months.What amount you accrued interest must you pay to purchase this bond today?

A)$5.54

B)$11.08

C)$16.63

D)$22.16

E)$27.71

A)$5.54

B)$11.08

C)$16.63

D)$22.16

E)$27.71

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

75

Assume a taxable bond yields 8.25 percent and a comparable municipal bond yields 6.85 percent.At what tax rate would an investor be indifferent between the bonds?

A)18.31%

B)16.97%

C)20.44%

D)12.41%

E)15.65%

A)18.31%

B)16.97%

C)20.44%

D)12.41%

E)15.65%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

76

A $1,000 face value bond has a bid quote of 101.123 and a bid-ask spread of .205.What price must you pay to purchase this bond? Ignore any accrued interest or trading costs.

A)$1,011.23

B)$1,001.33

C)$1,009.18

D)$1,013.28

E)$1,026.56

A)$1,011.23

B)$1,001.33

C)$1,009.18

D)$1,013.28

E)$1,026.56

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

77

A 25-year zero coupon bond with a face value of $1,000 is issued at an initial price of $463.34.What is the implicit interest,in dollars,for the first year of the bond's life? Assume semiannual interest.

A)$14.44

B)$37.00

C)$14.48

D)$21.47

E)$31.25

A)$14.44

B)$37.00

C)$14.48

D)$21.47

E)$31.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

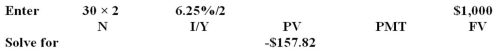

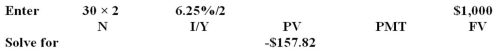

78

Westover Company needs $2.5 million to expand its business.To accomplish this,the firm plans to sell 30-year,$1,000 face value zero-coupon bonds.The bonds will be priced to yield 6.25 percent with interest compounded semiannually.What is the minimum number of bonds the company must sell? Ignore all issue costs.

A)15,841 bonds

B)16,429 bonds

C)40,000 bonds

D)2,500 bonds

E)15,410 bonds

A)15,841 bonds

B)16,429 bonds

C)40,000 bonds

D)2,500 bonds

E)15,410 bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

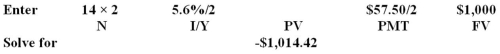

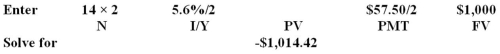

79

LIAS Inc.bonds have a face value of $1,000,mature in 14 years,pay interest semiannually,and have a coupon rate of 5.75 percent.The next interest payment will be paid four months from today.What is the clean price of this bond if the market rate of return is 5.6 percent?

A)$1,033.58

B)$1,004.84

C)$1,024.00

D)$1,009.47

E)$1,014.42

A)$1,033.58

B)$1,004.84

C)$1,024.00

D)$1,009.47

E)$1,014.42

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

80

A U.S.Treasury bond has a face value of $10,000,a coupon rate of 4 percent compounded semiannually,a yield to maturity of 4.15 percent,and 18 years until maturity.What is the clean price quote of this bond?

A)99.9585

B)97.6480

C)98.0091

D)100.0415

E)98.1112

A)99.9585

B)97.6480

C)98.0091

D)100.0415

E)98.1112

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck