Deck 8: Flexible Budgets, overhead Cost Variances, and Management Control

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/171

العب

ملء الشاشة (f)

Deck 8: Flexible Budgets, overhead Cost Variances, and Management Control

1

The major challenge when planning fixed overhead is ________.

A)calculating total costs

B)calculating the cost-allocation rate

C)choosing the appropriate level of capacity

D)choosing the appropriate planning period

A)calculating total costs

B)calculating the cost-allocation rate

C)choosing the appropriate level of capacity

D)choosing the appropriate planning period

C

2

Effective planning of fixed overhead costs includes ________.

A)planning day-to-day operational decisions

B)eliminating value-added costs

C)determining which products are to be produced

D)choosing the appropriate level of investment in productive assets

A)planning day-to-day operational decisions

B)eliminating value-added costs

C)determining which products are to be produced

D)choosing the appropriate level of investment in productive assets

D

3

Which of the following best defines standard costing?

A)It is the same as actual costing but done in real time.

B)It is a system that traces direct cost to output by multiplying actual process or rates by actual quantities of inputs + allocates overhead by on the basis of actual quantities of the allocation base used.

C)It is a system that traces direct costs to output produced by multiplying the standard prices or rates by the standard quantities of inputs allowed for the actual output produced.

D)It is a system that allocates overhead costs on the basis of standard overhead cost rates times the actual quantities of the allocation based used.

A)It is the same as actual costing but done in real time.

B)It is a system that traces direct cost to output by multiplying actual process or rates by actual quantities of inputs + allocates overhead by on the basis of actual quantities of the allocation base used.

C)It is a system that traces direct costs to output produced by multiplying the standard prices or rates by the standard quantities of inputs allowed for the actual output produced.

D)It is a system that allocates overhead costs on the basis of standard overhead cost rates times the actual quantities of the allocation based used.

C

4

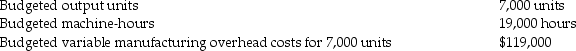

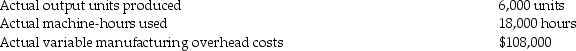

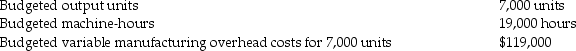

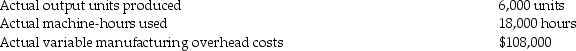

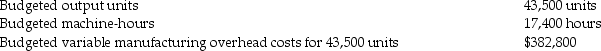

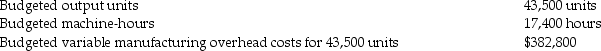

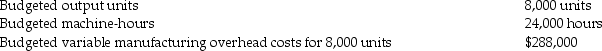

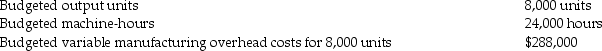

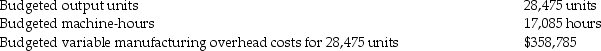

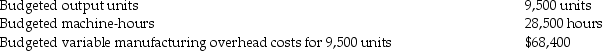

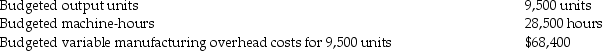

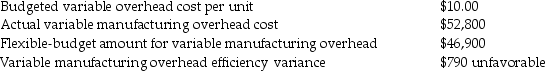

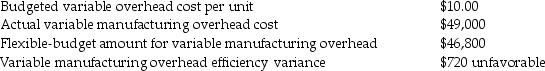

Home Plate Corporation manufactures baseball uniforms and uses budgeted machine-hours to allocate variable manufacturing overhead.The following information pertains to the company's manufacturing overhead data:

What is the budgeted variable overhead cost rate per output unit?

A)$6.26

B)$6.00

C)$17.00

D)$18.00

What is the budgeted variable overhead cost rate per output unit?

A)$6.26

B)$6.00

C)$17.00

D)$18.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

5

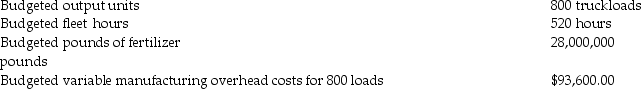

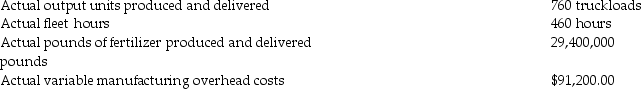

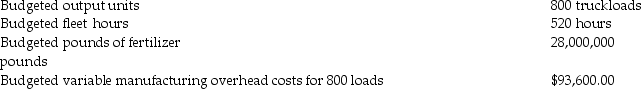

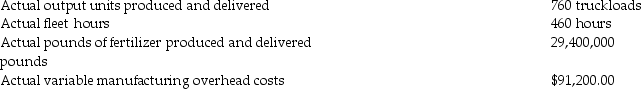

Healthy Earth Products Inc.produces fertilizer and distributes the product by using company trucks.The controller of the company uses budgeted fleet hours to allocate variable manufacturing overhead.The following information relates to the company's manufacturing overhead data:

What is the budgeted variable overhead cost rate per output unit?

A)$114.00

B)$117.00

C)$123.16

D)$120.00

What is the budgeted variable overhead cost rate per output unit?

A)$114.00

B)$117.00

C)$123.16

D)$120.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following is a true statement of energy costs?

A)Energy costs are not controllable

B)Strategies to reduce energy costs will not impact variable cost budgets.

C)Energy costs are a fixed cost of doing business for a manufacturer.

D)Energy costs are a growing component of variable overhead costs.

A)Energy costs are not controllable

B)Strategies to reduce energy costs will not impact variable cost budgets.

C)Energy costs are a fixed cost of doing business for a manufacturer.

D)Energy costs are a growing component of variable overhead costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

7

The planning of fixed overhead costs differs from the planning of variable overhead costs in terms of timing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

8

An effective plan for variable overhead costs will eliminate activities that do not add value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following mathematical expression is used to calculate budgeted variable overhead cost rate per output unit?

A)Budgeted output allowed per input unit × Budgeted variable overhead cost rate per input unit

B)Budgeted input allowed per output unit ÷ Budgeted variable overhead cost rate per input unit

C)Budgeted output allowed per input unit ÷ Budgeted variable overhead cost rate per input unit

D)Budgeted input allowed per output unit × Budgeted variable overhead cost rate per input unit

A)Budgeted output allowed per input unit × Budgeted variable overhead cost rate per input unit

B)Budgeted input allowed per output unit ÷ Budgeted variable overhead cost rate per input unit

C)Budgeted output allowed per input unit ÷ Budgeted variable overhead cost rate per input unit

D)Budgeted input allowed per output unit × Budgeted variable overhead cost rate per input unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

10

While calculating the costs of products and services,a standard costing system ________.

A)allocates overhead costs on the basis of the actual overhead-cost rates

B)uses standard costs to determine the cost of products

C)does not keep track of overhead cost

D)traces direct costs to output by multiplying the standard prices or rates by the actual quantities

A)allocates overhead costs on the basis of the actual overhead-cost rates

B)uses standard costs to determine the cost of products

C)does not keep track of overhead cost

D)traces direct costs to output by multiplying the standard prices or rates by the actual quantities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

11

Fixed overhead costs include ________.

A)the cost of sales commissions

B)Leasing of machinery used in a factory

C)energy costs

D)indirect materials

A)the cost of sales commissions

B)Leasing of machinery used in a factory

C)energy costs

D)indirect materials

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

12

The costs related to buildings (such as rent and insurance),equipment (such as lease payments or straight-line depreciation),and salaried labor in a factory are all examples of cost items that would be part of the fixed overhead budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

13

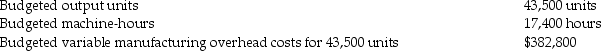

Really Great Corporation manufactures industrial-sized landscaping trailers and uses budgeted machine-hours to allocate variable manufacturing overhead.The following information pertains to the company's manufacturing overhead data:

What is the budgeted variable overhead cost rate per output unit?

A)$9.60

B)$12.40

C)$7.75

D)$31.00

What is the budgeted variable overhead cost rate per output unit?

A)$9.60

B)$12.40

C)$7.75

D)$31.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

14

In flexible budgets the costs that are not "flexed" because they remain the same within a relevant range of activity (such as sales or output)are called ________.

A)total overhead costs

B)total budgeted costs

C)fixed costs

D)variable costs

A)total overhead costs

B)total budgeted costs

C)fixed costs

D)variable costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

15

Most of the decisions determining the level of fixed overhead costs to be incurred will be made ________.

A)by the end of a budget period

B)by the middle of a budget period

C)on a day-to-day ongoing basis

D)at the start of a budget period

A)by the end of a budget period

B)by the middle of a budget period

C)on a day-to-day ongoing basis

D)at the start of a budget period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

16

Effective planning of variable overhead costs includes ________.

A)choosing the appropriate level of investment

B)eliminating value-added costs

C)redesigning products or processes to use fewer resources

D)reorganizing management structure

A)choosing the appropriate level of investment

B)eliminating value-added costs

C)redesigning products or processes to use fewer resources

D)reorganizing management structure

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

17

Compared to variable overhead costs planning,fixed overhead cost planning has an additional strategic issue beyond undertaking only essential activities and efficient operations.That additional requirement is best described as:

A)focusing on the highest possible quality

B)increasing the linearity between total costs and volume of production

C)choosing the appropriate level of capacity that will benefit the company in the long-run

D)identifying essential value-adding activities

A)focusing on the highest possible quality

B)increasing the linearity between total costs and volume of production

C)choosing the appropriate level of capacity that will benefit the company in the long-run

D)identifying essential value-adding activities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

18

Effective planning of variable overhead costs means that managers must

A)increase the expenditures in the variable overhead budgets

B)focus on activities that add value for the customer and eliminate nonvalue-added activities

C)increase the linearity between total costs and volume of production

D)identify the product advertising requirements and factor those into the variable overhead budget

A)increase the expenditures in the variable overhead budgets

B)focus on activities that add value for the customer and eliminate nonvalue-added activities

C)increase the linearity between total costs and volume of production

D)identify the product advertising requirements and factor those into the variable overhead budget

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

19

At the start of the budget period,management will have made most decisions regarding the level of fixed overhead costs to be incurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following is the mathematical expression for the budgeted fixed overhead cost per unit of cost allocation base?

A)Budgeted fixed overhead cost per unit of cost allocation base = Actual total costs in fixed overhead cost pool ÷ Budgeted total quantity of cost allocation base

B)Budgeted fixed overhead cost per unit of cost allocation base = Budgeted total costs in fixed overhead cost pool ÷ Budgeted total quantity of cost allocation base

C)Budgeted fixed overhead cost per unit of cost allocation base = Actual total costs in fixed overhead cost pool ÷ Actual total quantity of cost allocation base

D)Budgeted fixed overhead cost per unit of cost allocation base = Budgeted total costs in fixed overhead cost pool ÷ Actual total quantity of cost allocation base

A)Budgeted fixed overhead cost per unit of cost allocation base = Actual total costs in fixed overhead cost pool ÷ Budgeted total quantity of cost allocation base

B)Budgeted fixed overhead cost per unit of cost allocation base = Budgeted total costs in fixed overhead cost pool ÷ Budgeted total quantity of cost allocation base

C)Budgeted fixed overhead cost per unit of cost allocation base = Actual total costs in fixed overhead cost pool ÷ Actual total quantity of cost allocation base

D)Budgeted fixed overhead cost per unit of cost allocation base = Budgeted total costs in fixed overhead cost pool ÷ Actual total quantity of cost allocation base

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

21

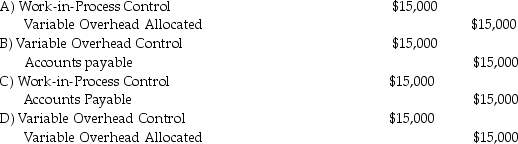

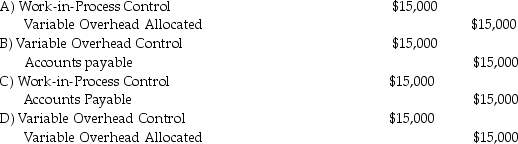

A company is using a standard cost system and receives its electricity bill.Electricity is considered a variable cost of operations for this company.The bill is for $15,000 and will be paid next month.Which of the following entries would be the correct recording of the electricity bill?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

22

The variable overhead spending variance measures the difference between ________,multiplied by the actual quantity of variable overhead cost-allocation base used.

A)the actual variable overhead cost per unit and the budgeted variable overhead cost per unit

B)the standard variable overhead cost rate and the budgeted variable overhead cost rate

C)the actual variable overhead cost per unit and the budgeted fixed overhead cost per unit

D)the actual quantity per unit and the budgeted quantity per unit

A)the actual variable overhead cost per unit and the budgeted variable overhead cost per unit

B)the standard variable overhead cost rate and the budgeted variable overhead cost rate

C)the actual variable overhead cost per unit and the budgeted fixed overhead cost per unit

D)the actual quantity per unit and the budgeted quantity per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

23

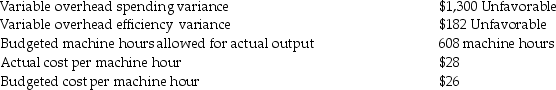

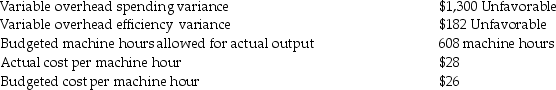

Majestic Corporation manufactures wheel barrows and uses budgeted machine hours to allocate variable manufacturing overhead.The following information relates to the company's manufacturing overhead data:

What is the flexible-budget variance for variable manufacturing overhead?

A)$35,309 unfavorable

B)$52,909 unfavorable

C)$35,309 favorable

D)$52,909 favorable

What is the flexible-budget variance for variable manufacturing overhead?

A)$35,309 unfavorable

B)$52,909 unfavorable

C)$35,309 favorable

D)$52,909 favorable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

24

A $5,000 unfavorable flexible-budget variance indicates that ________.

A)the flexible-budget amount exceeded actual variable manufacturing overhead by $5,000

B)the actual variable manufacturing overhead exceeded the flexible-budget amount by $5,000

C)the flexible-budget amount exceeded standard variable manufacturing overhead by $5,000

D)the standard variable manufacturing overhead exceeded the flexible-budget amount by $5,000

A)the flexible-budget amount exceeded actual variable manufacturing overhead by $5,000

B)the actual variable manufacturing overhead exceeded the flexible-budget amount by $5,000

C)the flexible-budget amount exceeded standard variable manufacturing overhead by $5,000

D)the standard variable manufacturing overhead exceeded the flexible-budget amount by $5,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

25

Standard costing is a cost system that allocates overhead costs on the basis of overhead cost rates based on actual overhead costs times the standard quantities of the allocation bases allowed for the actual outputs produced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

26

Lancelot Corporation manufactures tennis gear and uses budgeted machine-hours to allocate variable manufacturing overhead.The following information relates to the company's manufacturing overhead data:

What is the flexible-budget variance for variable manufacturing overhead?

A)$49,000 unfavorable

B)$49,000 favorable

C)$70,000 unfavorable

D)$70,000 favorable

What is the flexible-budget variance for variable manufacturing overhead?

A)$49,000 unfavorable

B)$49,000 favorable

C)$70,000 unfavorable

D)$70,000 favorable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

27

J&J Materials and Construction Corporation produces mulch and distributes the product by using dump trucks.The company uses budgeted fleet hours to allocate variable manufacturing overhead.The following information pertains to the company's manufacturing overhead data:

What is the budgeted variable manufacturing overhead cost per unit?

A)$154.50 per unit

B)$177.13 per unit

C)$130.54 per unit

D)$123.60 per unit

What is the budgeted variable manufacturing overhead cost per unit?

A)$154.50 per unit

B)$177.13 per unit

C)$130.54 per unit

D)$123.60 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

28

J&J Materials and Construction Corporation produces fertilizer and distributes the product by using dump trucks.The company uses budgeted fleet hours to allocate variable manufacturing overhead.The following information pertains to the company's manufacturing overhead data:

What is the flexible-budget variance for variable manufacturing overhead?

A)$4,800 favorable

B)$4,800 unfavorable

C)$2,139 favorable

D)$2,139 unfavorable

What is the flexible-budget variance for variable manufacturing overhead?

A)$4,800 favorable

B)$4,800 unfavorable

C)$2,139 favorable

D)$2,139 unfavorable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

29

Standard costing is a costing system that allocates overhead costs on the basis of the standard overhead-cost rates times the standard quantities of the allocation bases allowed for the actual outputs produced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

30

Lancelot Corporation manufactures tennis gear and uses budgeted machine-hours to allocate variable manufacturing overhead.The following information relates to the company's manufacturing overhead data:

What is the flexible-budget amount for variable manufacturing overhead?

A)$250,000

B)$306,000

C)$288,000

D)$235,294

What is the flexible-budget amount for variable manufacturing overhead?

A)$250,000

B)$306,000

C)$288,000

D)$235,294

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

31

The variable overhead flexible-budget variance can be further explained by calculating the:

A)price variance and the efficiency variance

B)static-budget variance and sales-volume variance

C)spending variance and the efficiency variance

D)sales-volume variance and the spending variance

A)price variance and the efficiency variance

B)static-budget variance and sales-volume variance

C)spending variance and the efficiency variance

D)sales-volume variance and the spending variance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

32

Fixed costs automatically increase or decrease with the level of activity within a relevant range of activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

33

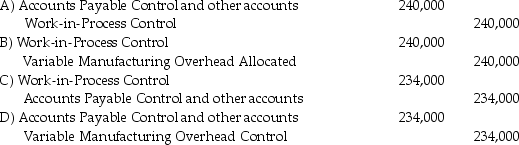

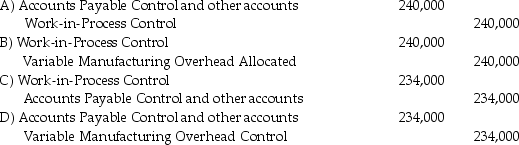

Teddy Company uses a standard cost system.In May,$234,000 of variable manufacturing overhead costs were incurred and the flexible-budget amount for the month was $240,000.Which of the following variable manufacturing overhead entries would have been recorded for May?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

34

Majestic Corporation manufactures wheel barrows and uses budgeted machine hours to allocate variable manufacturing overhead.The following information relates to the company's manufacturing overhead data:

What is the flexible-budget amount for variable manufacturing overhead?

A)$358,785

B)$409,185

C)$384,060

D)$336,755

What is the flexible-budget amount for variable manufacturing overhead?

A)$358,785

B)$409,185

C)$384,060

D)$336,755

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

35

Computing standard costs at the start of the budget period results in a complex record keeping system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

36

What is a standard costing system?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

37

List the four steps to develop budgeted variable overhead cost-allocation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

38

Majestic Corporation manufactures wheel barrows and uses budgeted machine hours to allocate variable manufacturing overhead.The following information relates to the company's manufacturing overhead data:

What is the amount of the budgeted variable manufacturing overhead cost per unit? (Do not round any intermediary calculations.Round your final answer to the nearest cent. )

A)$8.91

B)$8.06

C)$8.80

D)$8.16

What is the amount of the budgeted variable manufacturing overhead cost per unit? (Do not round any intermediary calculations.Round your final answer to the nearest cent. )

A)$8.91

B)$8.06

C)$8.80

D)$8.16

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

39

J&J Materials and Construction Corporation produces mulch and distributes the product by using dump trucks.The company uses budgeted fleet hours to allocate variable manufacturing overhead.The following information pertains to the company's manufacturing overhead data:

What is the flexible-budget amount for variable manufacturing overhead? (Round intermediary calculations two decimal places and your final answer to the nearest whole dollar. )

A)$81,801

B)$94,392

C)$86,184

D)$89,592

What is the flexible-budget amount for variable manufacturing overhead? (Round intermediary calculations two decimal places and your final answer to the nearest whole dollar. )

A)$81,801

B)$94,392

C)$86,184

D)$89,592

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

40

Lancelot Corporation manufactures tennis gear and uses budgeted machine-hours to allocate variable manufacturing overhead.The following information relates to the company's manufacturing overhead data:

What is the amount of the budgeted variable manufacturing overhead cost per unit?

A)$2.40 per unit

B)$6.98 per unit

C)$7.20 per unit

D)$25.51 per unit

What is the amount of the budgeted variable manufacturing overhead cost per unit?

A)$2.40 per unit

B)$6.98 per unit

C)$7.20 per unit

D)$25.51 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

41

Cold Products Corporation manufactured 34,000 ice chests during September.The variable overhead cost-allocation base is $14.50 per machine-hour.The following variable overhead data pertain to September:

What is the actual variable overhead cost?

A)$156,600

B)$177,480

C)$212,800

D)$220,400

What is the actual variable overhead cost?

A)$156,600

B)$177,480

C)$212,800

D)$220,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

42

Russo Corporation manufactured 15,000 air conditioners during November.The overhead cost-allocation base is $33.25 per machine-hour.The following variable overhead data pertain to November:

What is the flexible-budget amount?

A)$441,394

B)$399,000

C)$396,000

D)$475,200

What is the flexible-budget amount?

A)$441,394

B)$399,000

C)$396,000

D)$475,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

43

Russo Corporation manufactured 17,000 air conditioners during November.The overhead cost-allocation rate is $35.50 per machine-hour.The following variable overhead data pertain to November:

What is the variable overhead efficiency variance?

A)$6,212.50 favorable

B)$6,212.50 unfavorable

C)$4,750.00 favorable

D)$4,750.00 unfavorable

What is the variable overhead efficiency variance?

A)$6,212.50 favorable

B)$6,212.50 unfavorable

C)$4,750.00 favorable

D)$4,750.00 unfavorable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

44

The variable overhead efficiency variance measures the difference between the ________,multiplied by the budgeted variable overhead cost per unit of the cost-allocation base.

A)budgeted quantity of the cost-allocation base used and the budgeted quantity of the cost-allocation base that should have been used to produce the actual output

B)actual quantity of the cost-allocation base used and the budgeted quantity of the cost-allocation base that should have been used to produce the actual output

C)actual cost incurred and the budgeted quantity of the cost-allocation base that should have been used to produce the actual output

D)budgeted cost and the actual cost used to produce the actual output

A)budgeted quantity of the cost-allocation base used and the budgeted quantity of the cost-allocation base that should have been used to produce the actual output

B)actual quantity of the cost-allocation base used and the budgeted quantity of the cost-allocation base that should have been used to produce the actual output

C)actual cost incurred and the budgeted quantity of the cost-allocation base that should have been used to produce the actual output

D)budgeted cost and the actual cost used to produce the actual output

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

45

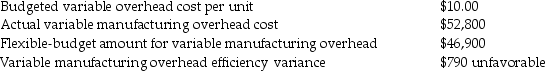

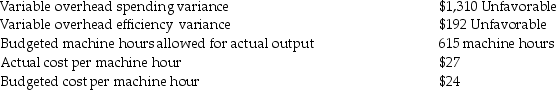

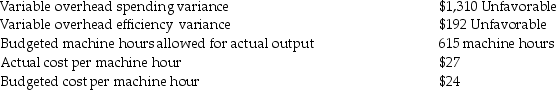

Outdoor Gear Corporation manufactured 1,000 coolers during October.The following variable overhead data relates to October:

Calculate the variable overhead flexible-budget variance.

A)$1,118 unfavorable

B)$1,118 favorable

C)$1,482 unfavorable

D)$1,482 favorable

Calculate the variable overhead flexible-budget variance.

A)$1,118 unfavorable

B)$1,118 favorable

C)$1,482 unfavorable

D)$1,482 favorable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

46

Cold Products Corporation manufactured 27,000 ice chests during September.The variable overhead cost-allocation base is $15.00 per machine-hour.The following variable overhead data pertain to September:

What is the flexible-budget amount?

A)$90,000

B)$121,500

C)$318,600

D)$324,000

What is the flexible-budget amount?

A)$90,000

B)$121,500

C)$318,600

D)$324,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

47

Russo Corporation manufactured 21,000 air conditioners during November.The overhead cost-allocation base is $34.25 per machine-hour.The following variable overhead data pertain to November:

What is the variable overhead spending variance?

A)$3,600.00 unfavorable

B)$3,325.00 unfavorable

C)$3,600.00 favorable

D)$3,325.00 favorable

What is the variable overhead spending variance?

A)$3,600.00 unfavorable

B)$3,325.00 unfavorable

C)$3,600.00 favorable

D)$3,325.00 favorable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

48

Russo Corporation manufactured 21,000 air conditioners during November.The overhead cost-allocation base is $34.50 per machine-hour.The following variable overhead data pertain to November:

What is the total variable overhead variance?

A)$2,900.00 unfavorable

B)$3,450.00 unfavorable

C)$2,900.00 favorable

D)$3,450.00 favorable

What is the total variable overhead variance?

A)$2,900.00 unfavorable

B)$3,450.00 unfavorable

C)$2,900.00 favorable

D)$3,450.00 favorable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

49

Zitrik Corporation manufactured 110,000 buckets during February.The variable overhead cost-allocation base is $5.45 per machine-hour.The following variable overhead data pertain to February:

What is the variable overhead spending variance?

A)$1,050 favorable

B)$1,000 unfavorable

C)$1,050 unfavorable

D)$1,000 favorable

What is the variable overhead spending variance?

A)$1,050 favorable

B)$1,000 unfavorable

C)$1,050 unfavorable

D)$1,000 favorable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

50

Zitrik Corporation manufactured 90,000 buckets during February.The variable overhead cost-allocation base is $5.00 per machine-hour.The following variable overhead data pertain to February:

What is the flexible-budget amount?

A)$54,000

B)$50,000

C)$50,500

D)$54,540

What is the flexible-budget amount?

A)$54,000

B)$50,000

C)$50,500

D)$54,540

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

51

Russo Corporation manufactured 17,000 air conditioners during November.The overhead cost-allocation base is $34.75 per machine-hour.The following variable overhead data pertain to November:

What is the actual variable overhead cost?

A)$439,450

B)$476,000

C)$449,144

D)$486,500

What is the actual variable overhead cost?

A)$439,450

B)$476,000

C)$449,144

D)$486,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

52

Cold Products Corporation manufactured 27,000 ice chests during September.The variable overhead cost-allocation base is $11.75 per machine-hour.The following variable overhead data pertain to September:

What is the variable overhead efficiency variance?

A)$6,750 favorable

B)$63,450 unfavorable

C)$56,700 unfavorable

D)$66,975 unfavorable

What is the variable overhead efficiency variance?

A)$6,750 favorable

B)$63,450 unfavorable

C)$56,700 unfavorable

D)$66,975 unfavorable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

53

Lazy Guy Corporation manufactured 6,000 chairs during June.The following variable overhead data relates to June:

What is the variable overhead spending variance?

A)$5,110 favorable

B)$5,900 favorable

C)$5,900 unfavorable

D)$5,110 unfavorable

What is the variable overhead spending variance?

A)$5,110 favorable

B)$5,900 favorable

C)$5,900 unfavorable

D)$5,110 unfavorable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

54

Outdoor Gear Corporation manufactured 5,000 coolers during October.The following variable overhead data relates to October:

Calculate the actual machine hours used by Stark during October.

A)623 hours

B)615 hours

C)607 hours

D)622 hours

Calculate the actual machine hours used by Stark during October.

A)623 hours

B)615 hours

C)607 hours

D)622 hours

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

55

When variable overhead efficiency variance is favorable,it can be safely assumed that the ________.

A)actual rate per unit of the cost-allocation base is higher than the budgeted rate

B)actual quantity of the cost-allocation base used is higher than the budgeted quantity

C)actual rate per unit of the cost-allocation base is lower than the budgeted rate

D)actual quantity of the cost-allocation base used is lower than the budgeted quantity

A)actual rate per unit of the cost-allocation base is higher than the budgeted rate

B)actual quantity of the cost-allocation base used is higher than the budgeted quantity

C)actual rate per unit of the cost-allocation base is lower than the budgeted rate

D)actual quantity of the cost-allocation base used is lower than the budgeted quantity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

56

Zitrik Corporation manufactured 130,000 buckets during February.The variable overhead cost-allocation base is $5.30 per machine-hour.The following variable overhead data pertain to February:

What is the variable overhead efficiency variance?

A)$2,650 unfavorable

B)$2,675 favorable

C)$2,650 favorable

D)$2,675 unfavorable.

What is the variable overhead efficiency variance?

A)$2,650 unfavorable

B)$2,675 favorable

C)$2,650 favorable

D)$2,675 unfavorable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

57

Lazy Guy Corporation manufactured 4,000 chairs during June.The following variable overhead data relates to June:

What is the variable overhead flexible-budget variance?

A)$2,200 favorable

B)$1,480 favorable

C)$2,200 unfavorable

D)$1,480 unfavorable

What is the variable overhead flexible-budget variance?

A)$2,200 favorable

B)$1,480 favorable

C)$2,200 unfavorable

D)$1,480 unfavorable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

58

When machine-hours are used as an overhead cost-allocation base,the most likely cause of a favorable variable overhead spending variance is ________.

A)excessive machine breakdowns

B)the production scheduler efficiently scheduled jobs

C)a decline in the cost of energy

D)strengthened demand for the product

A)excessive machine breakdowns

B)the production scheduler efficiently scheduled jobs

C)a decline in the cost of energy

D)strengthened demand for the product

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

59

Zitrik Corporation manufactured 90,000 buckets during February.The variable overhead cost-allocation base is $5.10 per machine-hour.The following variable overhead data pertain to February:

What is the actual variable overhead cost?

A)$472,500

B)$459,000

C)$51,450

D)$49,980

What is the actual variable overhead cost?

A)$472,500

B)$459,000

C)$51,450

D)$49,980

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

60

Cold Products Corporation manufactured 32,000 ice chests during September.The variable overhead cost-allocation base is $13.45 per machine-hour.The following variable overhead data pertain to September:

What is the variable overhead spending variance?

A)$3,040 favorable

B)$25,658 unfavorable

C)$22,618 unfavorable

D)$59,180 unfavorable

What is the variable overhead spending variance?

A)$3,040 favorable

B)$25,658 unfavorable

C)$22,618 unfavorable

D)$59,180 unfavorable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

61

All of the following are possible causes of actual machine hours exceeding budgeted machine hours except:

A)Poor scheduling

B)Actual leasing costs for the machine were higher than expected

C)Machines were not maintained in good operating condition

D)Budgeted standards were set to tight

A)Poor scheduling

B)Actual leasing costs for the machine were higher than expected

C)Machines were not maintained in good operating condition

D)Budgeted standards were set to tight

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

62

Comfort Company manufactures pillows.The 2015 operating budget is based on production of 25,000 pillows with 0.75 machine-hour allowed per pillow.Budgeted variable overhead per hour was $25.

Actual production for 2015 was 27,000 pillows using 19,050 machine-hours.Actual variable costs were $23 per machine-hour.

Required:

Calculate the variable overhead spending and efficiency variances.

Actual production for 2015 was 27,000 pillows using 19,050 machine-hours.Actual variable costs were $23 per machine-hour.

Required:

Calculate the variable overhead spending and efficiency variances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

63

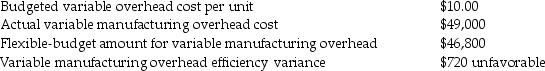

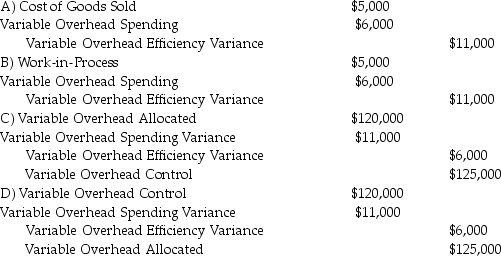

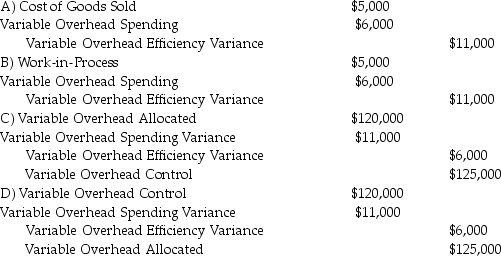

The balances in the variable overhead control account and the variable overhead control account are $120,000 and $125,000 respectively.The variable overhead spending variance is $6,000 and the variable overhead efficiency variance is $11,000.Which of the following entries would be required to record the variances in a standard costing system?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

64

Skytalk Company manufactures weathervanes.The 2015 operating budget is based on the production of 5,300 weathervanes with 1.25 machine-hour allowed per weathervane.Variable manufacturing overhead is anticipated to be $145,750.

Actual production for 2015 was 5,250 weathervanes using 6,050 machine-hours.Actual variable costs were $21.75 per machine-hour.

Required:

Calculate the variable overhead spending and the efficiency variances.

Actual production for 2015 was 5,250 weathervanes using 6,050 machine-hours.Actual variable costs were $21.75 per machine-hour.

Required:

Calculate the variable overhead spending and the efficiency variances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

65

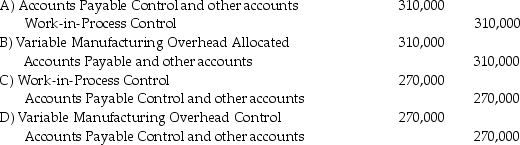

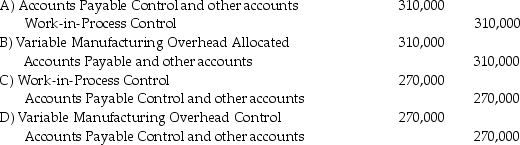

Marshall Company uses a standard cost system.In March,$270,000 of variable manufacturing overhead costs were incurred and the flexible-budget amount for the month was $310,000.Which of the following variable manufacturing overhead entries would have been recorded for March?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

66

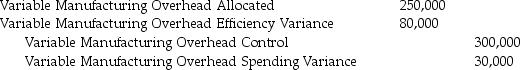

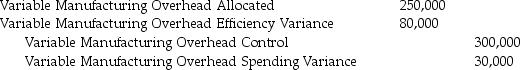

Osium Company made the following journal entry:

Which of the following statements is true of the given journal entry?

A)Osium overallocated variable manufacturing overhead.

B)A $30,000 unfavorable spending variance was recorded.

C)Work-in-Process is currently overstated.

D)A $80,000 unfavorable efficiency variance was recorded.

Which of the following statements is true of the given journal entry?

A)Osium overallocated variable manufacturing overhead.

B)A $30,000 unfavorable spending variance was recorded.

C)Work-in-Process is currently overstated.

D)A $80,000 unfavorable efficiency variance was recorded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

67

Managers can always view a favorable variable overhead spending variance as desirable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

68

Mendel Company makes the following journal entry:

Which of the following statements is true of the given journal entry?

A)A variable manufacturing overhead cost of $179,000 is written-off.

B)An unfavorable spending variance of $57,000 is recorded.

C)A favorable efficiency variance of $7,000 is recorded.

D)A favorable flexible-budget variance of $50,000 is recorded.

Which of the following statements is true of the given journal entry?

A)A variable manufacturing overhead cost of $179,000 is written-off.

B)An unfavorable spending variance of $57,000 is recorded.

C)A favorable efficiency variance of $7,000 is recorded.

D)A favorable flexible-budget variance of $50,000 is recorded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

69

Tightly budgeted machine time standards can lead to unfavorable variable overhead efficiency variance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

70

Causes of a favorable variable overhead efficiency variance might include using lower-skilled workers than expected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

71

The variable overhead efficiency variance is computed ________ and interpreted ________ the direct-cost efficiency variance.

A)the same as;the same as

B)the same as;differently than

C)differently than;the same as

D)differently than;differently than

A)the same as;the same as

B)the same as;differently than

C)differently than;the same as

D)differently than;differently than

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following journal entries is used to record actual variable overhead costs incurred?

A)Accounts Payable

B)Variable Overhead Control

C)Work-in-Process Control

D)Variable Overhead Control

A)Accounts Payable

B)Variable Overhead Control

C)Work-in-Process Control

D)Variable Overhead Control

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

73

The variable overhead efficiency variance is the difference between actual quantity of the

cost-allocation base used and budgeted quantity of the cost-allocation base allowed for actual output,multiplied by the budgeted variable overhead cost per unit of the cost-allocation base.

cost-allocation base used and budgeted quantity of the cost-allocation base allowed for actual output,multiplied by the budgeted variable overhead cost per unit of the cost-allocation base.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

74

The flexible budget highlights the differences between budgeted costs and budgeted quantities versus actual costs and actual quantities for the budgeted output level.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

75

If the production planners set the budgeted machine hours standards too tight,one could anticipate there would be a favorable variable overhead efficiency variance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

76

Briefly explain the meaning of the variable overhead efficiency variance and the variable overhead spending variance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

77

When variances are immaterial,which of the following statements is true of the journal entry to write-off the variable overhead variance accounts?

A)Cost of Goods Sold account will always be debited.

B)Unfavorable efficiency variance will be credited.

C)Favorable efficiency variance will be credited.

D)Cost of Goods Sold account will always be credited.

A)Cost of Goods Sold account will always be debited.

B)Unfavorable efficiency variance will be credited.

C)Favorable efficiency variance will be credited.

D)Cost of Goods Sold account will always be credited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

78

If budgeted and actual machine hours are equal,spending variance will always be nil.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following is the correct mathematical expression is used to calculate variable overhead efficiency variance?

A)(Actual rate − Budgeted rate)× Budgeted quantity

B)(Actual quantity × Budgeted rate)- (Budgeted input quantity allowed for actual output × Budgeted rate)

C)(Actual quantity ÷ Budgeted rate)− (Budgeted quantity ÷ Budgeted rate)

D)(Actual quantity ÷ Budgeted rate)× Budgeted quantity allowed for actual output

A)(Actual rate − Budgeted rate)× Budgeted quantity

B)(Actual quantity × Budgeted rate)- (Budgeted input quantity allowed for actual output × Budgeted rate)

C)(Actual quantity ÷ Budgeted rate)− (Budgeted quantity ÷ Budgeted rate)

D)(Actual quantity ÷ Budgeted rate)× Budgeted quantity allowed for actual output

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

80

Unskilled work force can lead to unfavorable efficiency variance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck