Deck 24: The Budgeting Process

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/116

العب

ملء الشاشة (f)

Deck 24: The Budgeting Process

1

Static budgets are prepared on quarterly basis and require frequent change during the annual budget period.

False

2

A budget need not contain both revenue and expense components.

True

3

Budgets assign resources and the responsibility to use them wisely to managers who are held accountable for their results.

True

4

A budget can contain nonfinancial information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

5

Only the lowest levels of management can be evaluated by the use of a budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

6

Responsibility accounting authorizes managers to take control of and be held accountable for the revenues and expenses in their budgets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

7

Participative budgeting seeks to motivate employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

8

Budgets facilitate congruence between organizational and personal goals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

9

Budgets are synonymous with managing an organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

10

The Budget Committee oversees each stage in the preparation of a master budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

11

Projected financial statements are the final product of the budgeting process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

12

A master budget consists of a set of operating budgets and a set of financial budgets for a specific accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

13

As part of the budgeting process, managers evaluate operational, tactical, value chain, and capacity issues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

14

Budgets do not take into account potential constraints.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

15

Participative budgeting involves only personnel at top levels of the organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

16

Budgeting is the process of identifying, gathering, summarizing, and communicating financial and nonfinancial information about an organization's future activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

17

Zero-based budgeting requires the preparation of budget from scratch.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

18

The short-term plan or budget involves every part of the enterprise and is much more detailed than the long-term plan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

19

Successful budget implementation depends on two factors-clear communication and the support of top management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

20

A continuous budget is a 12-month forward rolling budget that summarizes budgets for the next 12 months.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

21

The key factor to remember is that the sales unit forecast provides the catalyst for all the period budgets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

22

Only manufacturing organizations need a set of operating budgets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

23

Budgets

A) should contain both revenues and expenses.

B) contain as much information as possible.

C) are presented in dollars only; nondollar data should be excluded.

D) are synonymous with managing an organization.

A) should contain both revenues and expenses.

B) contain as much information as possible.

C) are presented in dollars only; nondollar data should be excluded.

D) are synonymous with managing an organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

24

Once cash receipts and cash payments have been established, the cash increase or decrease is added to the period's beginning balance to arrive at a projected cash balance at period end.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

25

Budgets identify, gather, summarize, and communicate

A) financial data only.

B) financial and nonfinancial data.

C) nonfinancial data only.

D) none of these.

A) financial data only.

B) financial and nonfinancial data.

C) nonfinancial data only.

D) none of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

26

The cost of goods manufactured budget is based on the results of the direct materials purchases, direct labor, and selling and administrative expense budgets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

27

The direct labor budget is needed to prepare the production budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

28

Managers do not need to know why a budget is being prepared.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

29

A company seeks to have as much cash as possible on hand. Cash budgeting helps to accomplish this.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

30

A sales forecast is expressed in units and dollars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

31

The selling and administrative expense budget is typically separated into variable and fixed cost components.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

32

In estimating cash receipts and cash payments for the cash budget, many organizations prepare supporting schedules.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

33

The direct materials purchases budget reflects both the quantity and cost of direct materials purchases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

34

The budgeting function begins with the preparation of the direct materials purchases budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

35

Each period's ending cash balance becomes the beginning cash balance for the next period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

36

The main difference in the master budget process for manufacturing, retail, and service organizations is found in the preparation of the operating budgets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

37

Preparation of a production budget requires knowledge of the sales target in sales dollars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

38

Operating budgets are plans used in daily operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

39

The cash budget is derived exclusively from the sales and production budgets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

40

Depreciation is included in the cash budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

41

The main difference in the master budget process for the three types of organizations involves the preparation of the

A) cash budget.

B) capital expenditures budget.

C) financial budgets.

D) operating budgets.

A) cash budget.

B) capital expenditures budget.

C) financial budgets.

D) operating budgets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

42

Financial budgets include

A) pro forma statements, a sales budget, and a cost of goods manufactured budget.

B) a budgeted income statement and budgeted balance sheet only.

C) a budgeted income statement, budgeted balance sheet, and cash budget.

D) pro forma statements, a capital expenditures budget, and a cash budget.

A) pro forma statements, a sales budget, and a cost of goods manufactured budget.

B) a budgeted income statement and budgeted balance sheet only.

C) a budgeted income statement, budgeted balance sheet, and cash budget.

D) pro forma statements, a capital expenditures budget, and a cash budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following provides the catalyst for all operating budgets?

A) Firm's ten-year plan

B) Production budget (units)

C) Capital expenditures budget

D) Unit sales forecast

A) Firm's ten-year plan

B) Production budget (units)

C) Capital expenditures budget

D) Unit sales forecast

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

44

A master budget is a compilation of forecasts for the coming year or operating cycle made by various departments or functions within an organization. What is the most basic forecast made in a master budget?

A) Sales forecast

B) Production forecast

C) Labor forecast

D) Materials forecast

A) Sales forecast

B) Production forecast

C) Labor forecast

D) Materials forecast

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following is a true statement?

A) The direct materials purchases budget is determined from the direct labor budget.

B) The only budget providing input into the revenue budget is the sales budget.

C) The direct materials purchases budget and the capital expenditures budget are both determined from the production budget.

D) The selling and administrative expense budget is input into the forecasted cost of goods sold.

A) The direct materials purchases budget is determined from the direct labor budget.

B) The only budget providing input into the revenue budget is the sales budget.

C) The direct materials purchases budget and the capital expenditures budget are both determined from the production budget.

D) The selling and administrative expense budget is input into the forecasted cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following is not true about the direct materials purchases budget?

A) It is determined by the anticipated change in the direct materials inventory level and the production budget.

B) The direct materials purchases budget does not affect the forecasted balance sheet.

C) The direct materials purchases budget is expressed in units and dollars.

D) It is used in preparing the budgeted income statement.

A) It is determined by the anticipated change in the direct materials inventory level and the production budget.

B) The direct materials purchases budget does not affect the forecasted balance sheet.

C) The direct materials purchases budget is expressed in units and dollars.

D) It is used in preparing the budgeted income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

47

A combined set of operational budgets and a set of financial budgets for the entire organization is known as a

A) master budget.

B) flexible budget.

C) month-to-month budget.

D) continuous budget.

A) master budget.

B) flexible budget.

C) month-to-month budget.

D) continuous budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

48

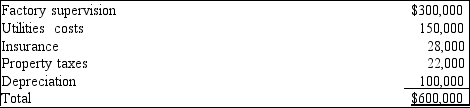

Ceiling Fans by Ike's overhead budget for 2009 was as follows:  600,000 units were produced in 2009.

600,000 units were produced in 2009.

Direct labor cost is $18,000,000.

For both 2009 and 2010, each unit required 3 direct labor hours at $10 per hour.

In 2010, property taxes, insurance, and depreciation are expected to stay at 2009 levels.

Utilities costs vary proportionally with units produced.

Factory supervision increases by increments of $30,000 for every 200,000 increase in direct labor hours.

The 2010 expected production is 1,200,000 units.

What will be the value for utilities costs in the 2010 overhead budget?

A) $420,000

B) $150,000

C) $300,000

D) $450,000

600,000 units were produced in 2009.

600,000 units were produced in 2009.Direct labor cost is $18,000,000.

For both 2009 and 2010, each unit required 3 direct labor hours at $10 per hour.

In 2010, property taxes, insurance, and depreciation are expected to stay at 2009 levels.

Utilities costs vary proportionally with units produced.

Factory supervision increases by increments of $30,000 for every 200,000 increase in direct labor hours.

The 2010 expected production is 1,200,000 units.

What will be the value for utilities costs in the 2010 overhead budget?

A) $420,000

B) $150,000

C) $300,000

D) $450,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

49

Purchases of buildings and equipment are formally planned in the

A) depreciation budget.

B) budgeted balance sheet.

C) selling and administrative expense budget.

D) capital expenditures budget.

A) depreciation budget.

B) budgeted balance sheet.

C) selling and administrative expense budget.

D) capital expenditures budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

50

The first budget to be prepared when making a master budget is the

A) sales budget.

B) production budget.

C) cash budget.

D) direct labor budget.

A) sales budget.

B) production budget.

C) cash budget.

D) direct labor budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following is not a guideline for budget preparation?

A) Include financial data only.

B) Know the sources of budget information.

C) Know the purpose of the budget.

D) Identify the format of the budget.

A) Include financial data only.

B) Know the sources of budget information.

C) Know the purpose of the budget.

D) Identify the format of the budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following budgets probably would be prepared immediately after the preparation of the production budget?

A) Cash budget

B) Capital expenditures budget

C) Selling and administrative expense budget

D) Direct materials purchases budget

A) Cash budget

B) Capital expenditures budget

C) Selling and administrative expense budget

D) Direct materials purchases budget

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which type of budgeting utilizes employees at all levels of the company?

A) Group budgeting

B) Selective budgeting

C) Target budgeting

D) Participative budgeting

A) Group budgeting

B) Selective budgeting

C) Target budgeting

D) Participative budgeting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

54

After management has set short-term goals, the budgeting process typically starts with

A) a clearly defined timetable of events.

B) input only from the accounting personnel.

C) the naming of an efficient coordinator or director.

D) a set of procedures or instructions.

A) a clearly defined timetable of events.

B) input only from the accounting personnel.

C) the naming of an efficient coordinator or director.

D) a set of procedures or instructions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

55

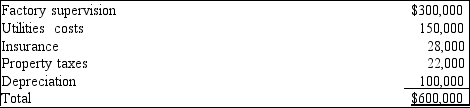

Ceiling Fans by Ike's overhead budget for 2009 was as follows:  600,000 units were produced in 2009.

600,000 units were produced in 2009.

Direct labor cost is $18,000,000.

For both 2009 and 2010, each unit required 3 direct labor hours at $10 per hour.

In 2010, property taxes, insurance, and depreciation are expected to stay at 2009 levels.

Utilities costs vary proportionally with units produced.

Factory supervision increases by increments of $30,000 for every 200,000 increase in direct labor hours.

The 2010 expected production is 1,200,000 units.

What will be the value for factory supervision in the 2010 overhead budget?

A) $570,000

B) $270,000

C) $450,000

D) $400,000

600,000 units were produced in 2009.

600,000 units were produced in 2009.Direct labor cost is $18,000,000.

For both 2009 and 2010, each unit required 3 direct labor hours at $10 per hour.

In 2010, property taxes, insurance, and depreciation are expected to stay at 2009 levels.

Utilities costs vary proportionally with units produced.

Factory supervision increases by increments of $30,000 for every 200,000 increase in direct labor hours.

The 2010 expected production is 1,200,000 units.

What will be the value for factory supervision in the 2010 overhead budget?

A) $570,000

B) $270,000

C) $450,000

D) $400,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

56

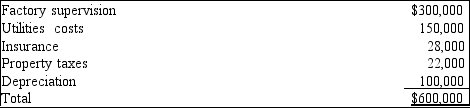

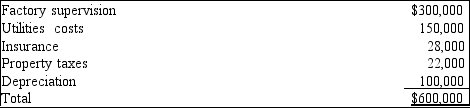

Ceiling Fans by Ike's overhead budget for 2009 was as follows: 600,000 units were produced in 2009.

Direct labor cost is $18,000,000.

For both 2009 and 2010, each unit required 3 direct labor hours at $10 per hour.

In 2010, property taxes, insurance, and depreciation are expected to stay at 2009 levels.

Utilities costs vary proportionally with units produced.

Factory supervision increases by increments of $30,000 for every 200,000 increase in direct labor hours.

The 2010 expected production is 1,200,000 units.

If the expected 2010 expense for factory supervision and for utilities costs is $500,000 and $250,000, respectively, then the total for the 2010 overhead budget is

A) $900,000.

B) $800,000.

C) $650,000.

D) $750,000.

Direct labor cost is $18,000,000.

For both 2009 and 2010, each unit required 3 direct labor hours at $10 per hour.

In 2010, property taxes, insurance, and depreciation are expected to stay at 2009 levels.

Utilities costs vary proportionally with units produced.

Factory supervision increases by increments of $30,000 for every 200,000 increase in direct labor hours.

The 2010 expected production is 1,200,000 units.

If the expected 2010 expense for factory supervision and for utilities costs is $500,000 and $250,000, respectively, then the total for the 2010 overhead budget is

A) $900,000.

B) $800,000.

C) $650,000.

D) $750,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

57

A continuous budget is prepared

A) annually

B) semi-annually

C) monthly

D) quarterly

A) annually

B) semi-annually

C) monthly

D) quarterly

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which budgets must managers prepare before they can prepare a direct materials purchases budget?

A) Labor budget

B) Overhead budget

C) Production budget

D) Cost of goods manufactured budget

A) Labor budget

B) Overhead budget

C) Production budget

D) Cost of goods manufactured budget

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following would most likely be considered a short-term goal?

A) Modernization and expansion of the plant

B) A product line change

C) A unit sales forecast

D) A marketing plan to gain a higher percentage of control of the market in five years

A) Modernization and expansion of the plant

B) A product line change

C) A unit sales forecast

D) A marketing plan to gain a higher percentage of control of the market in five years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following budgets should be prepared before the others listed?

A) Cost of goods manufactured budget

B) Cash budget

C) Production budget

D) Overhead budget

A) Cost of goods manufactured budget

B) Cash budget

C) Production budget

D) Overhead budget

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

61

Fantastic Futons manufactures futons. The estimated number of futon sales for the first three months of 2010 are as follows: Finished goods inventory at the end of 2009 was 12,000 units. On average, 25 percent of the futons are produced during the month before they are sold, which normally accounts for the ending balance in finished goods inventory. The planned selling price is $150 per unit.

How many futons are budgeted to be produced in February?

A) 37,500

B) 65,000

C) 52,500

D) 55,000

How many futons are budgeted to be produced in February?

A) 37,500

B) 65,000

C) 52,500

D) 55,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

62

Operating budgets for the DiP Company reveal the following information: net sales, $400,000; beginning materials inventory, $23,000; materials purchased, $185,000; beginning work in process inventory, $64,700; beginning finished goods inventory, $21,600; direct labor costs, $34,000; overhead applied, $67,000; ending work in process inventory, $61,200; ending materials inventory, $18,700; and ending finished goods inventory, $16,300. Compute DiP Company's budgeted gross margin.

A) $299,800

B) $293,800

C) $150,900

D) $100,900

A) $299,800

B) $293,800

C) $150,900

D) $100,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

63

United Insurance Company specializes in term life insurance contracts. Cash collection experience shows that 30 percent of billed premiums are collected in the month before they are due, 60 percent are collected in the month they are due, and 6 percent are collected in the month following their due date. Four percent of the billed premiums are collected late (in the second month following their due date). Total billing notices in January were $50,000; in February, $60,000; in March, $66,000; in April, $65,000; in May, $60,000; and in June, $70,000. How much cash does the company expect to collect in May?

A) $63,540

B) $66,750

C) $60,000

D) $56,000

A) $63,540

B) $66,750

C) $60,000

D) $56,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

64

Fantastic Futons manufactures futons. The estimated number of futon sales for the first three months of 2010 are as follows: Finished goods inventory at the end of 2009 was 12,000 units. On average, 25 percent of the futons are produced during the month before they are sold, which normally accounts for the ending balance in finished goods inventory. The planned selling price is $150 per unit.

Fantastic Futons buys direct materials for the futons in cloth rolls priced at $80 each. Each roll provides direct material for 40 futons. There was one roll in the direct materials inventory at the beginning of January, and the company expects to have four rolls in inventory at the end of the month. Assuming the production budget calls for 60,000 units to be produced in January, what would be the amount of the cloth rolls direct materials purchases budget for that month?

A) $119,760

B) $114,000

C) $120,000

D) $120,240

Fantastic Futons buys direct materials for the futons in cloth rolls priced at $80 each. Each roll provides direct material for 40 futons. There was one roll in the direct materials inventory at the beginning of January, and the company expects to have four rolls in inventory at the end of the month. Assuming the production budget calls for 60,000 units to be produced in January, what would be the amount of the cloth rolls direct materials purchases budget for that month?

A) $119,760

B) $114,000

C) $120,000

D) $120,240

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

65

Fallgatter, Inc., expects to sell 18,000 units. Each unit requires 3 pounds of direct materials at $12 per pound and 2 direct labor hours at $10 per direct labor hour. The overhead rate is $8 per direct labor hour. The beginning inventories are as follows: direct materials, 2,000 pounds; finished goods, 2,500 units. The planned ending inventories are as follows: direct materials, 3,900 pounds; finished goods, 3,000 units. What is the planned production?

A) 15,500

B) 18,500

C) 18,000

D) 17,500

A) 15,500

B) 18,500

C) 18,000

D) 17,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

66

The projections of direct materials purchases that follow are for the Sombo Corporation. The company pays for 60 percent of purchases on account in the month of purchase and 40 percent in the month following the purchase. What is the expected cash payment for direct materials for the month of February?

A) $52,000

B) $72,000

C) $89,000

D) $95,000

A) $52,000

B) $72,000

C) $89,000

D) $95,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

67

Wean Corporation's budgeted balance sheet for the coming year shows total assets of $5,000,000 and total liabilities of $2,000,000. Common stock and retained earnings make up the entire stockholders' equity section of the balance sheet. Common stock remains at its beginning balance of $1,500,000. The projected net income for the year is $333,000. The company pays no cash dividends. What is the balance of retained earnings at the beginning of the budget period?

A) $1,067,000

B) $1,167,000

C) $1,833,000

D) $1,500,000

A) $1,067,000

B) $1,167,000

C) $1,833,000

D) $1,500,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

68

J. J. Johnson has decided to supplement his income by selling beehives. He expects to sell 25,000 hives in 2010. He ended 2009 with 2,500 completed hives in inventory and would like to complete operations in 2010 with at least 2,800 completed hives in inventory. There is no ending work in process inventory. One beehive holds about 250 bees. The bees are purchased for $4.00 per 1,000 bees. The hives sell for $15.00 each. What would be the yearly total on the direct materials purchases budget for bee purchases? (Assume for this question that 40,000 beehives will be produced.)

A) $44,000

B) $16,000

C) $64,000

D) $40,000

A) $44,000

B) $16,000

C) $64,000

D) $40,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

69

J. J. Johnson has decided to supplement his income by selling beehives. He expects to sell 25,000 hives in 2010. He ended 2009 with 2,500 completed hives in inventory and would like to complete operations in 2010 with at least 2,800 completed hives in inventory. There is no ending work in process inventory. One beehive holds about 250 bees. The bees are purchased for $4.00 per 1,000 bees. The hives sell for $15.00 each. How many beehives would the 2010 production budget identify as needing to be produced?

A) 25,300

B) 25,000

C) 30,300

D) 24,700

A) 25,300

B) 25,000

C) 30,300

D) 24,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

70

Fantastic Futons manufactures futons. The estimated number of futon sales for the first three months of 2010 are as follows: Finished goods inventory at the end of 2009 was 12,000 units. On average, 25 percent of the futons are produced during the month before they are sold, which normally accounts for the ending balance in finished goods inventory. The planned selling price is $150 per unit.

How many futons are budgeted to be produced in January?

A) 44,500

B) 28,000

C) 40,500

D) 52,500

How many futons are budgeted to be produced in January?

A) 44,500

B) 28,000

C) 40,500

D) 52,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

71

Fantastic Futons goes through two departments in the production process. Each futon requires two direct labor hours in Department A and one hour in Department B. Labor cost is $8 per hour in Department A and $10 per hour in Department B. Assuming the amount budgeted to be produced in January is 30,000 units, what is the budgeted direct labor cost for January?

A) $810,000

B) $840,000

C) $780,000

D) $540,000

A) $810,000

B) $840,000

C) $780,000

D) $540,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

72

XYZ Company expects to sell 51,000 units of its product in the coming year. Each unit sells for $45. Sales brochures and supplies for the year are expected to cost $7,000. Three sales representatives cover the Southeast region. Each one's base salary is $25,000, and each earns a sales commission of 5 percent of the selling price of the units he or she sells. The sales representatives supply their own transportation; they are reimbursed for travel at a rate of $0.40 per mile. The company estimates that the sales representatives will drive a total of 75,000 miles next year. From the information provided, calculate XYZ Company's budgeted selling expenses for the coming year.

A) $226,750

B) $176,750

C) $151,750

D) $114,750

A) $226,750

B) $176,750

C) $151,750

D) $114,750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

73

Hang 12 manufactures surfboards. During the upcoming quarter, it expects to sell 4,100 surfboards, after which it plans to have 500 surfboards remaining in inventory. If it currently has 200 surfboards on hand, how many surfboards will Hang 12 have to produce for the upcoming quarter?

A) 4,400

B) 3,800

C) 4,100

D) 3,400

A) 4,400

B) 3,800

C) 4,100

D) 3,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

74

J. J. Johnson has decided to supplement his income by selling beehives. He expects to sell 25,000 hives in 2010. He ended 2009 with 2,500 completed hives in inventory and would like to complete operations in 2010 with at least 2,800 completed hives in inventory. There is no ending work in process inventory. One beehive holds about 250 bees. The bees are purchased for $4.00 per 1,000 bees. The hives sell for $15.00 each. What would be the total of the 2010 period sales budget?

A) $378,000

B) $375,000

C) $379,500

D) $376,500

A) $378,000

B) $375,000

C) $379,500

D) $376,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

75

The projections of direct materials purchases that follow are for the Sombo Corporation. The company pays for 60 percent of purchases on account in the month of purchase and 40 percent in the month following the purchase. What is the expected cash payment for direct materials for the month of January?

A) $27,000

B) $79,000

C) $96,000

D) $102,000

A) $27,000

B) $79,000

C) $96,000

D) $102,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

76

Fantastic Futons manufactures futons. The estimated number of futon sales for the first three months of 2010 are as follows: Finished goods inventory at the end of 2009 was 12,000 units. On average, 25 percent of the futons are produced during the month before they are sold, which normally accounts for the ending balance in finished goods inventory. The planned selling price is $150 per unit.

What would be the sales budget for March?

A) $7,200,000

B) $8,000,000

C) $6,750,000

D) $9,000,000

What would be the sales budget for March?

A) $7,200,000

B) $8,000,000

C) $6,750,000

D) $9,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

77

Fallgatter, Inc., expects to sell 18,000 units. Each unit requires 3 pounds of direct materials at $12 per pound and 2 direct labor hours at $10 per direct labor hour. The overhead rate is $8 per direct labor hour. The beginning inventories are as follows: direct materials, 2,000 pounds; finished goods, 2,500 units. The planned ending inventories are as follows: direct materials, 3,900 pounds; finished goods, 3,000 units. Given a planned production of 10,000 units, what are the planned direct materials purchases?

A) $310,800

B) $274,800

C) $346,800

D) $382,800

A) $310,800

B) $274,800

C) $346,800

D) $382,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

78

Selling and administrative expenses are billed and paid the month after they occur. Selling and administrative expenses have both a fixed and a variable component. The fixed component is a constant $4,700 a month. The variable component equals 5 percent of revenues. Given revenues of $300,000 for January, $350,000 for February, and $400,000 for March, what would be the budgeted selling and administrative expenses that would be paid in March?

A) $4,700

B) $13,200

C) $22,200

D) $19,700

A) $4,700

B) $13,200

C) $22,200

D) $19,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

79

Fantastic Futons goes through two departments in the production process. Each futon requires two direct labor hours in Department A and one hour in Department B. Labor cost is $8 per hour in Department A and $10 per hour in Department B. The budgeted overhead rate is $5 per direct labor hour. What is the budgeted overhead cost for January given a budgeted production of 30,000 units?

A) $450,000

B) $150,000

C) $330,000

D) $300,000

A) $450,000

B) $150,000

C) $330,000

D) $300,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

80

Fantastic Futons goes through two departments in the production process. Each futon requires two direct labor hours in Department A and one hour in Department B. Labor cost is $8 per hour in Department A and $10 per hour in Department B. The labor capacity for a normal eight-hour shift for a month is 50,000 direct labor hours each for both Departments A and B. Overtime is paid at time and a half. What would be the budgeted direct labor cost for January, assuming a budgeted production of 30,000 units?

A) $900,000

B) $780,000

C) $820,000

D) $420,000

A) $900,000

B) $780,000

C) $820,000

D) $420,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck