Deck 21: Costing Systems Process Costing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/136

العب

ملء الشاشة (f)

Deck 21: Costing Systems Process Costing

1

A process costing system first accumulates the costs of direct materials, direct labor, and overhead for each process, department, or work cell and then assigns those costs to the products produced during a particular period.

True

2

In order to be classified as a process costing system, the product flow must represent a series of processes in which only one process has input into the next process.

False

3

In a process costing system, product costs are traced to individual products.

False

4

Managers track product and cost flows of the entire organization and prepare process cost reports to assign production costs to the products manufactured.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

5

Only one Work in Process Inventory account is used with the process costing system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

6

The number of possible combinations of product flows and production processes is limitless.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

7

The FIFO costing method is a costing method in which the cost flow follows the logical product flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

8

Because process costing is normally associated with a continuous production flow, products that are in process at the beginning of the period are assumed to be the first products completed during the current period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

9

A company that manufactures potato chips would probably use a process costing system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

10

It is difficult to track costs to individual products in a continuous flow manufacturing process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

11

The types of computations for costs to be transferred out of Work in Process Inventory differ if the production process involves multiple departments rather than a single department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

12

Because process costing is normally associated with a continuous production flow, products that are in process at the beginning of the period are assumed to be the first products completed during the current period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

13

The most commonly used method to assign costs to products in process costing is the FIFO costing method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

14

Unlike a job order costing system, a process costing system is not restricted to one Work in Process Inventory account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

15

Regardless of the cost accounting system used, when the products are completed, they are transferred from work in process inventory to finished goods inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

16

A process costing system is used by companies that manufacture large amounts of similar products or liquid products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

17

The FIFO approach to process costing assumes that items in beginning inventory were started and completed in the current period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

18

In a process costing system, each product is assigned the same amount of costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

19

The cost of producing each gallon of paint differs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

20

Production processes that lend themselves to the use of process cost analysis usually have a FIFO product flow within the process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

21

When the FIFO costing method is used in process costing, the number of units in beginning inventory is multiplied by 100 percent to determine the equivalent units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

22

The number of equivalent units produced for direct materials cost using the FIFO costing procedure is the sum of the units in beginning work in process inventory, units started and completed during the period, and the productive effort applied to ending work in process inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

23

In many instances, direct materials are added at the beginning of the process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

24

Regardless of the cost approach used, in a process costing system, costs attached to units in beginning inventory are included in the computation of costs per equivalent unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

25

Conversion costs are defined as the combined total of direct materials costs and direct labor costs incurred by a production department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

26

In a process costing system, products flow in a LIFO manner, from department to department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

27

The FIFO process costing method assumes that the items in ending work in process inventory were started and completed during the current period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

28

Separate equivalent units of production usually are calculated for materials and conversion costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

29

In a process costing system, all production costs are assigned to departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

30

In a process costing system, each department's production costs are transferred to the next department and ultimately to the Finished Goods Inventory account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

31

The product unit cost is the sum of the cost elements added in all production department processes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

32

Equivalent units are defined as the number of units completed and transferred out of work in process inventory during the current period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

33

Total product costs for the period include direct materials, direct labor, and overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

34

Under the FIFO cost flow assumption, separate unit cost analyses are not used for each accounting period because costs of different periods are averaged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

35

Equivalent production is a measure of productive output of units for a period of time, expressed in terms of fully completed or equivalent whole units produced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

36

When the FIFO cost flow assumption is used, the equivalent units will always equal the actual units in beginning work in process inventory, plus the actual units started and completed during the current period plus the percent of ending work in process inventory completed during the current period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

37

The number of equivalent units of production may be larger than the number of completed units during the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

38

In process costing, all costs incurred by a department or production process are divided by the equivalent units produced during the period to determine the average cost per unit produced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

39

If 45,000 units of ending work in process inventory are 60 percent complete as to conversion costs, 27,000 equivalent units of conversion costs must be incurred to complete these units during the next period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

40

The amount of equivalent production units for direct materials is always the same as that for conversion costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

41

The equivalent units of production must be computed before the value of ending inventory can be determined in a process costing system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

42

The basis used in computing unit cost for the process costing system is made up of certain specific jobs worked on during the fiscal year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

43

One of the steps in preparing the process cost report requires dividing current costs charged to the Work in Process Inventory account of each department or production process by equivalent units to calculate the cost per equivalent unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

44

Process costing is a system of

A) inventory costing.

B) cost flow assumptions.

C) product costing.

D) product pricing.

A) inventory costing.

B) cost flow assumptions.

C) product costing.

D) product pricing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following items most likely would be manufactured using a process costing system?

A) Income tax services

B) Soup

C) A hotel

D) Wedding invitations

A) Income tax services

B) Soup

C) A hotel

D) Wedding invitations

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

46

Under the average costing method in process costing system, the costs in beginning inventory are combined with current period costs to compute an average product unit cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

47

In a process costing system, the amount of total costs to be accounted for is made up of direct materials and conversion costs incurred during the current period plus those costs included in the beginning Work in Process Inventory account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

48

The type of product costing system used by a company is dictated by the

A) project manager.

B) production process.

C) company president.

D) plant supervisor.

A) project manager.

B) production process.

C) company president.

D) plant supervisor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

49

In process costing system, the average costing method assumes that cost flows do follow the logical physical flow of production.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

50

The average process costing method disregards the ending inventory assuming that direct material costs and conversion costs are pertaining to the immediate next period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

51

It is not necessary to ascertain the portion of ending Work in Process Inventory applicable to direct materials costs versus conversion costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

52

In a process cost report, accounting for physical units excludes the physical units in beginning inventory to arrive at "units to be accounted for."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

53

Process costing information can inform managers about the amounts and types of products ordered by specific customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

54

One reason for preparing a process cost report for a particular department is to determine the amount of costs to transfer to the next department or to the Finished Goods Inventory account at the end of the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

55

Process costing is applicable to production operations that

A) utilize several processes, departments, or work cells in a series.

B) do not assign overhead costs to operations.

C) produce products that are made to order.

D) are found in only a few industries.

A) utilize several processes, departments, or work cells in a series.

B) do not assign overhead costs to operations.

C) produce products that are made to order.

D) are found in only a few industries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

56

A company should use process costing rather than job order costing if

A) production is only partially completed during the accounting period.

B) the product is produced in batches only as orders are received.

C) the product is composed of mass-produced homogeneous units.

D) the product goes through single stage of production.

A) production is only partially completed during the accounting period.

B) the product is produced in batches only as orders are received.

C) the product is composed of mass-produced homogeneous units.

D) the product goes through single stage of production.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

57

Regardless of beginning inventory levels, the unit costs are determined by dividing the equivalent units by the total costs of the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

58

Under the average process costing method, both the direct materials costs

and the conversion costs of beginning inventory as if they were incurred in the current period.

and the conversion costs of beginning inventory as if they were incurred in the current period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

59

A process costing system accounts for product costs

A) for a specific period of time.

B) almost always in a single Work in Process Inventory account.

C) without regard to the process that created the cost.

D) for specific orders.

A) for a specific period of time.

B) almost always in a single Work in Process Inventory account.

C) without regard to the process that created the cost.

D) for specific orders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

60

Unit costs are determined by dividing the total costs of the period by the equivalent units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

61

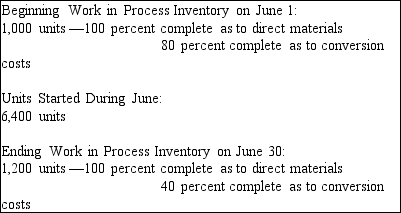

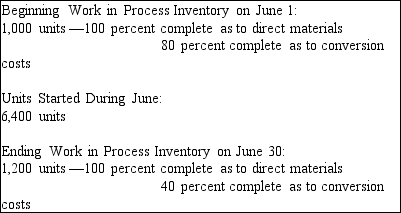

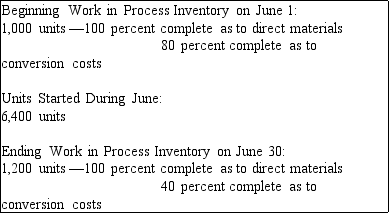

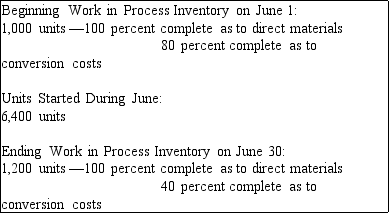

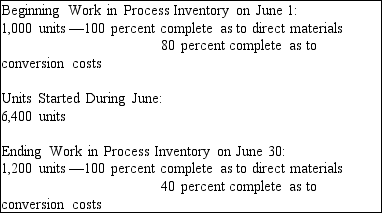

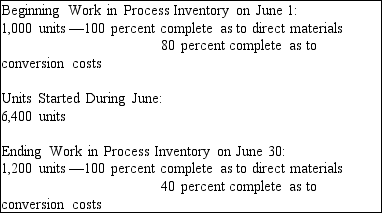

Use the following data from a company using a process costing system to answer the question(s) below.  The FIFO process costing method is used by the company.

The FIFO process costing method is used by the company.

Units completed and transferred out of the department during the month totaled

A) 6,600.

B) 6,400.

C) 6,200.

D) 5,200.

The FIFO process costing method is used by the company.

The FIFO process costing method is used by the company.Units completed and transferred out of the department during the month totaled

A) 6,600.

B) 6,400.

C) 6,200.

D) 5,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

62

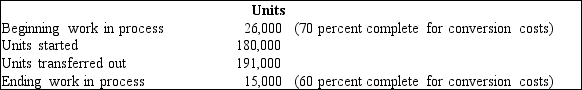

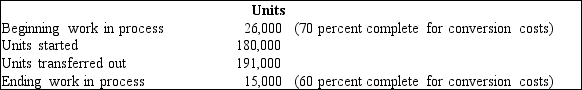

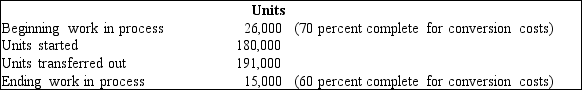

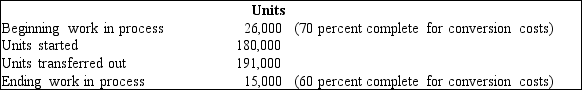

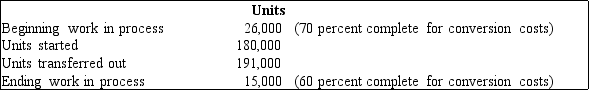

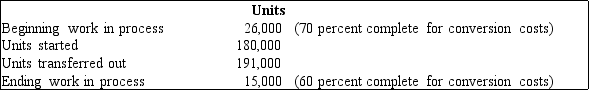

The Taylor Company uses a process costing system. Assume that direct materials are added at the beginning of the period and that direct labor and overhead are added continuously throughout the process. The company uses the FIFO costing method. The following data are available for one of its accounting periods  Equivalent units for direct materials are

Equivalent units for direct materials are

A) 180,000.

B) 202,000.

C) 176,000.

D) 191,000.

Equivalent units for direct materials are

Equivalent units for direct materials areA) 180,000.

B) 202,000.

C) 176,000.

D) 191,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of the following is not included in conversion costs?

A) Indirect labor

B) Direct labor

C) Direct materials

D) Overhead

A) Indirect labor

B) Direct labor

C) Direct materials

D) Overhead

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

64

Use the following data from a company using a process costing system to answer the question(s) below.  The FIFO process costing method is used by the company.

The FIFO process costing method is used by the company.

Equivalent units for conversion costs during the month totaled

A) 7,920.

B) 7,680.

C) 6,880.

D) 5,880.

The FIFO process costing method is used by the company.

The FIFO process costing method is used by the company.Equivalent units for conversion costs during the month totaled

A) 7,920.

B) 7,680.

C) 6,880.

D) 5,880.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

65

Use the following data from a company using a process costing system to answer the question(s) below.  The FIFO process costing method is used by the company.

The FIFO process costing method is used by the company.

Equivalent units for direct materials during the month totaled

A) 6,400.

B) 8,600.

C) 6,600.

D) 7,600.

The FIFO process costing method is used by the company.

The FIFO process costing method is used by the company.Equivalent units for direct materials during the month totaled

A) 6,400.

B) 8,600.

C) 6,600.

D) 7,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following entities probably would use a process costing system?

A) An oil refinery

B) A yacht builder

C) A custom furniture company

D) A custom screw manufacturer

A) An oil refinery

B) A yacht builder

C) A custom furniture company

D) A custom screw manufacturer

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

67

During March, Department A started 300,000 units of product in a particular production process. The beginning work in process inventory was 50,000 units, and the ending inventory was 40,000 units. Direct materials are introduced at the start of processing, and beginning and ending inventories are considered to be 40 percent complete with respect to conversion costs. Department A uses the FIFO costing method. The number of units started and completed during March was

A) 300,000.

B) 260,000.

C) 324,000.

D) 276,000.

A) 300,000.

B) 260,000.

C) 324,000.

D) 276,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

68

Measures of equivalent production are necessary in process costing because

A) job order costing procedures cannot be applied.

B) unit costs are computed by departments or processes at fixed time intervals.

C) perpetual inventories are not employed in process plants.

D) production methods are more complex than in job order costing systems.

A) job order costing procedures cannot be applied.

B) unit costs are computed by departments or processes at fixed time intervals.

C) perpetual inventories are not employed in process plants.

D) production methods are more complex than in job order costing systems.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following products probably would be produced by a company using a process costing system?

A) A house

B) A customized ice cream

C) Paper

D) A movie

A) A house

B) A customized ice cream

C) Paper

D) A movie

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

70

During March, Department A started 300,000 units of product in a particular production process. The beginning work in process inventory was 50,000 units, and the ending inventory was 40,000 units. Direct materials are introduced at the start of processing, and beginning and ending inventories are considered to be 40 percent complete with respect to conversion costs. Department A uses the FIFO costing method. The number of equivalent units produced with respect to conversion costs was

A) 296,000.

B) 306,000.

C) 336,000.

D) 316,000.

A) 296,000.

B) 306,000.

C) 336,000.

D) 316,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

71

The Taylor Company uses a process costing system. Assume that direct materials are added at the beginning of the period and that direct labor and overhead are added continuously throughout the process. The company uses the FIFO costing method. The following data are available for one of its accounting periods  Equivalent units for conversion costs are

Equivalent units for conversion costs are

A) 207,800.

B) 192,200.

C) 181,800.

D) 200,000.

Equivalent units for conversion costs are

Equivalent units for conversion costs areA) 207,800.

B) 192,200.

C) 181,800.

D) 200,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following cost flow assumptions most closely follows the logical product flow in a process costing environment?

A) Average

B) LIFO

C) FIFO

D) HIFO

A) Average

B) LIFO

C) FIFO

D) HIFO

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

73

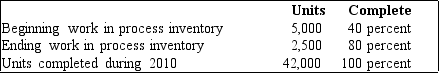

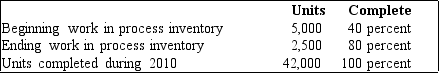

The Finishing Department of Garr Company has the following information available for 2010:  Assuming that Garr Company uses the FIFO process costing method, what are the equivalent units for conversion costs for 2010?

Assuming that Garr Company uses the FIFO process costing method, what are the equivalent units for conversion costs for 2010?

A) 41,000

B) 46,000

C) 47,000

D) 42,000

Assuming that Garr Company uses the FIFO process costing method, what are the equivalent units for conversion costs for 2010?

Assuming that Garr Company uses the FIFO process costing method, what are the equivalent units for conversion costs for 2010?A) 41,000

B) 46,000

C) 47,000

D) 42,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

74

During March, Department A started 300,000 units of product in a particular production process. The beginning work in process inventory was 50,000 units, and the ending inventory was 40,000 units. Direct materials are introduced at the start of processing, and beginning and ending inventories are considered to be 40 percent complete with respect to conversion costs. Department A uses the FIFO costing method. Units transferred out during March were

A) 310,000.

B) 290,000.

C) 320,000.

D) 350,000.

A) 310,000.

B) 290,000.

C) 320,000.

D) 350,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

75

Direct materials for 8,000 units were added at the beginning of the second process during November. During the month, 8,300 units were completed and transferred to the third process. On November 1, there were 600 units in beginning inventory, and on November 30, there were 300 units still remaining in the process. Compute the equivalent units for direct materials for the second process for November using the FIFO costing method.

A) 8,600

B) 8,000

C) 8,300

D) 8,900

A) 8,600

B) 8,000

C) 8,300

D) 8,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

76

If a company uses a process costing system to account for costs in its four production departments, how many Work in Process accounts will it use?

A) 5

B) 3

C) 1

D) 4

A) 5

B) 3

C) 1

D) 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

77

In a process costing system, the cost of ending work in process inventory for a period can be verified by reference to supporting analysis in

A) materials requisitions and labor time tickets.

B) cost recap included in the statement of production.

C) cost recap included in the process cost report.

D) none of the above.

A) materials requisitions and labor time tickets.

B) cost recap included in the statement of production.

C) cost recap included in the process cost report.

D) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

78

The Taylor Company uses a process costing system. Assume that direct materials are added at the beginning of the period and that direct labor and overhead are added continuously throughout the process. The company uses the FIFO costing method. The following data are available for one of its accounting periods  Assume that you have calculated a direct materials cost per unit of $4 and a conversion cost per unit of $7. Under this assumption, the ending balance for Work in Process Inventory would be

Assume that you have calculated a direct materials cost per unit of $4 and a conversion cost per unit of $7. Under this assumption, the ending balance for Work in Process Inventory would be

A) $82,000.

B) $165,000.

C) $99,000.

D) $123,000.

Assume that you have calculated a direct materials cost per unit of $4 and a conversion cost per unit of $7. Under this assumption, the ending balance for Work in Process Inventory would be

Assume that you have calculated a direct materials cost per unit of $4 and a conversion cost per unit of $7. Under this assumption, the ending balance for Work in Process Inventory would beA) $82,000.

B) $165,000.

C) $99,000.

D) $123,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following is not a characteristic of a process costing system?

A) A specific time period is used.

B) Several Work in Process Inventory accounts are used.

C) Product costs are grouped by processes, departments, or work cells.

D) Customized products are manufactured.

A) A specific time period is used.

B) Several Work in Process Inventory accounts are used.

C) Product costs are grouped by processes, departments, or work cells.

D) Customized products are manufactured.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

80

In a process costing system, some of the increases to Department B's Work in Process Inventory account would come from Department A's

A) Finished Goods Inventory account.

B) Materials Inventory account.

C) Cost of Goods Sold account.

D) Work in Process Inventory account.

A) Finished Goods Inventory account.

B) Materials Inventory account.

C) Cost of Goods Sold account.

D) Work in Process Inventory account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck