Deck 17: Partnerships

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/129

العب

ملء الشاشة (f)

Deck 17: Partnerships

1

The entities forming joint ventures usually involve companies, but can sometimes involve governments.

True

2

A partner who invests assets into a partnership retains control over those specified assets.

False

3

A partnership agreement should include the procedure for ending the business.

True

4

A partnership is easy to form and to dissolve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

5

Before a partnership can legally conduct business, it must obtain permission from the state.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

6

As long as the action is within the scope of the partnership, any partner can bind the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

7

Only not-for-profit organizations form joint ventures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

8

Bankruptcy of a partner will dissolve the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

9

An advantage of the partnership form of business is that each partner's potential loss is limited to that partner's investment in the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

10

There is no income tax imposed on a partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

11

Ownership is easily transferred in a partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

12

The potential loss of all partners in an ordinary partnership is limited only by personal bankruptcy laws.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

13

In a limited partnership, the general partner's liability is limited to his or her investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

14

A partnership is a legal entity separate and apart from its owners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

15

Under the partnership form of business, large amounts of capital can be raised easily.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

16

A partnership has a limited life, because any change in the relationship of the partners dissolves the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

17

A partnership agreement must be in writing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

18

Each partner is personally liable for all debts of the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

19

An informational tax return must be filed for a partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

20

A limited partnership normally has one or more general partners whose liability is unlimited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

21

Partner X purchases Partner Y's $25,000 interest from Partner Y for $30,000. The entry to record the transaction is for $30,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

22

Liabilities related to assets invested in a partnership by a new partner cannot be transferred to the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

23

It is possible for a partner's Capital account to increase as a result of the allocation of a net loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

24

When a partner invests assets in a partnership, the assets are recorded at the partner's book value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

25

When a loss is closed into the partners' Capital accounts, Income Summary is credited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

26

It is possible to allocate income or loss to partners based solely on interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

27

It is possible to invest no tangible assets into a partnership, yet be given a positive opening capital balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

28

If a partnership agreement does not specify how income and losses are to be distributed, they should be allocated based on relative Capital account balances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

29

When salary and interest allocations exceed net income, a net loss has occurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

30

The salary, interest, and stated ratio method of allocation cannot be applied when a net loss has occurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

31

It is possible to allocate income or loss to partners based solely on salaries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

32

Income and losses are divided equally among the partners unless the partnership agreement specifies otherwise.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

33

When the existing partners pay a bonus to a newly admitted partner, the existing partners' accounts are debited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

34

Partners' Withdrawals accounts have normal credit balances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

35

It is possible to allocate income or loss to partners based solely on average capital balances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

36

The use of salaries in the allocation of income or loss allows for the differences in the services that partners provide the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

37

Each partner has a separate Capital and Withdrawals account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

38

Accounting for a partnership comes closer to accounting for a sole proprietorship than to accounting for a corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

39

It is possible to allocate income or loss to partners based solely on the stated ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

40

The salary allocation to partners also appears as Salaries Expense on the partnership income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

41

After selling all the assets and paying the liabilities in a liquidation of a partnership, the partners share any remaining cash according to the stated ratios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

42

The death of a partner dissolves the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

43

A partner who withdraws from a partnership is always entitled to the balance in his or her Capital account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

44

The admission of a partner does not change the composition of partners' equity if the new partner purchases the old partner's interest by paying the old partner directly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

45

There is no impact on the income statement of a partnership when a partner withdraws from the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

46

A new partner must have the consent of all the partners before being admitted into the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

47

A partnership is dissolved when a new partner is admitted to the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

48

If the asset accounts did not reflect their current values, the asset accounts would need to be adjusted before admitting the new partner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

49

When M purchases N's $10,000 capital interest for $10,000, the ensuing entry on the books of the partnership would contain a debit to Cash for $10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

50

Partner A purchases partner B's $3,000 interest from partner B for $5,000. The entry to record the transaction is for $3,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

51

In a liquidation, one partner may have to make up the deficit in another partner's account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

52

Liquidation of a partnership is the process of ending the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

53

When a new partner invests more than the proportionate share he or she receives in the partnership, a bonus is recorded to his or her account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

54

When a partner withdraws from a partnership, an audit might be performed and the assets reappraised.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

55

When a partner leaves a partnership, it is possible that total assets will be unaffected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

56

When a new partner is admitted, a new partnership agreement should be in place.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

57

When a partner withdraws assets greater than his or her capital balance, the excess is treated as a bonus to the remaining partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

58

When a newly admitted partner pays a bonus to the existing partners, the new partner's capital account is debited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

59

Admission of a new partner never has an impact on net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

60

If liquidation of a partnership results in a negative balance in a partner's account, the partner must pay into the partnership the amount of the negative balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

61

In a liquidation, partners are given back the assets that they originally invested.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

62

Joint ventures

A) have become outmoded

B) are a form of partnership

C) are used only in the United States

D) have unlimited life

A) have become outmoded

B) are a form of partnership

C) are used only in the United States

D) have unlimited life

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of the following is not a characteristic of partnerships?

A) Limited life

B) Limited liability

C) Voluntary association

D) Mutual agency

A) Limited life

B) Limited liability

C) Voluntary association

D) Mutual agency

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

64

The most appropriate place to look for relationships among partners is in the

A) partnership agreement

B) accounting records

C) relevant state law

D) voluntary association

A) partnership agreement

B) accounting records

C) relevant state law

D) voluntary association

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

65

A partner will not bind the partnership to an outside purchase contract when the

A) the item purchased is considered immaterial in amount

B) item purchased is not within the normal scope of the business

C) partner was not authorized by the other partners to make the purchase

D) partner who made the purchase withdraws from the partnership

A) the item purchased is considered immaterial in amount

B) item purchased is not within the normal scope of the business

C) partner was not authorized by the other partners to make the purchase

D) partner who made the purchase withdraws from the partnership

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

66

In a partnership gain or Loss from Realization is debited for a loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

67

Claim to the partners' personal assets by creditors if the partnership cannot pay its debts refers to

A) liquidation

B) mutual agency

C) unlimited liability

D) dissolution

A) liquidation

B) mutual agency

C) unlimited liability

D) dissolution

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following partnership characteristics is an advantage?

A) Unlimited liability

B) Mutual agency

C) Ease of formation

D) Limited life

A) Unlimited liability

B) Mutual agency

C) Ease of formation

D) Limited life

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

69

In a limited partnership

A) the general partners have limited liability

B) all partners have limited liability

C) all but the general partners have unlimited liability

D) all but the general partners have limited liability

A) the general partners have limited liability

B) all partners have limited liability

C) all but the general partners have unlimited liability

D) all but the general partners have limited liability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following does not result in the dissolution of a partnership?

A) Death of a partner

B) Admission of a new partner

C) Withdrawal of a partner

D) Sale of partnership assets

A) Death of a partner

B) Admission of a new partner

C) Withdrawal of a partner

D) Sale of partnership assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

71

When a partner invests assets other than cash into a partnership, those assets should be listed on the balance sheet at

A) their original cost

B) their carrying (book) value

C) their fair market value

D) the value the investing partner assigns to them

A) their original cost

B) their carrying (book) value

C) their fair market value

D) the value the investing partner assigns to them

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

72

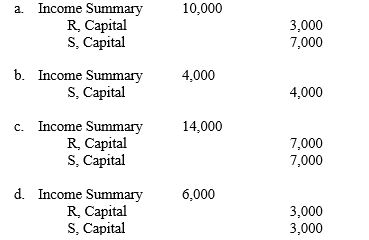

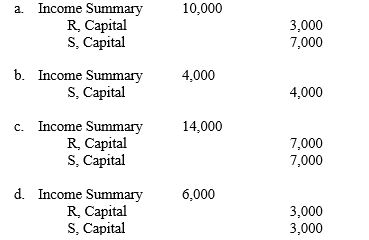

Partners R and S receive a salary allowance of $3,000 and $7,000, respectively, and share the remainder equally. If the company earned $4,000 during the period, the entry to close the income or loss into their capital accounts is:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

73

A partnership agreement should include

A) the method of allocating profits and losses

B) each partner's duties

C) the purpose of the business

D) all of these

A) the method of allocating profits and losses

B) each partner's duties

C) the purpose of the business

D) all of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

74

Gains and losses on the sale of assets in a liquidation are divided equally among partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

75

Noncash assets invested into a partnership are recorded at

A) their fair market value

B) their carrying value

C) zero

D) their original cost

A) their fair market value

B) their carrying value

C) zero

D) their original cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

76

Which of the following partnership characteristics is a disadvantage?

A) Participation in partnership income

B) Ease of dissolution

C) Unlimited liability

D) Voluntary association

A) Participation in partnership income

B) Ease of dissolution

C) Unlimited liability

D) Voluntary association

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

77

The ability of a partner to enter into a contract on behalf of all partners is called

A) the partnership agreement

B) voluntary association

C) mutual agency

D) unlimited liability

A) the partnership agreement

B) voluntary association

C) mutual agency

D) unlimited liability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

78

Partnership liquidation is the same as partnership dissolution.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

79

A partner's inability to meet his or her obligations at the time of liquidation relieves that individual of his or her liabilities to the other partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

80

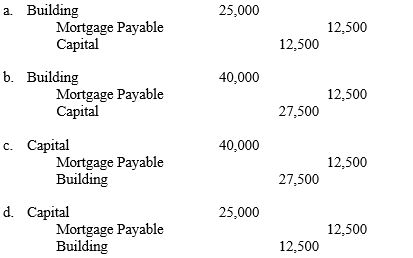

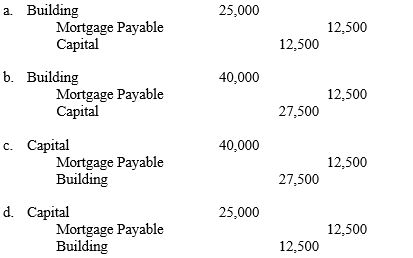

A partner invests into a partnership a building with a $25,000 carrying value and $40,000 fair market value. The related mortgage payable of $12,500 is assumed by the partnership. The entry to record the investment in partnership is:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck