Deck 8: Accounts Receivable and Further Record-Keeping

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/29

العب

ملء الشاشة (f)

Deck 8: Accounts Receivable and Further Record-Keeping

1

Which of the following statements about the Allowance for doubtful debts account is true?

A) The Allowance for doubtful debts account represents cash available to meet losses incurred when customers are unable to pay their accounts.

B) The Allowance for doubtful debts account functions to adjust the net value of accounts receivable down to the lower of cost and current estimated collectable amount.

C) The Allowance for doubtful debts account represents the total of accounts written off as uncollectable for the current period.

D) None of the answers provided.

A) The Allowance for doubtful debts account represents cash available to meet losses incurred when customers are unable to pay their accounts.

B) The Allowance for doubtful debts account functions to adjust the net value of accounts receivable down to the lower of cost and current estimated collectable amount.

C) The Allowance for doubtful debts account represents the total of accounts written off as uncollectable for the current period.

D) None of the answers provided.

B

2

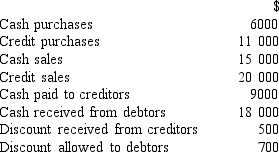

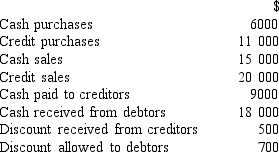

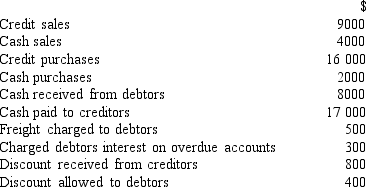

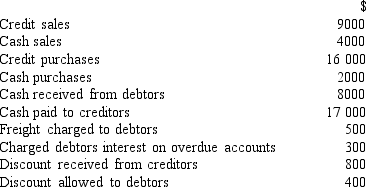

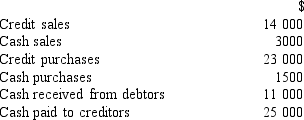

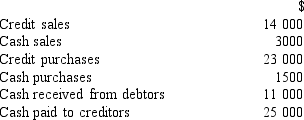

Wrigley Ltd uses subsidiary ledgers for debtors and creditors.At 1 July 2015 debtors owed $7000 and creditors were owed $4000.Transactions for year ended 30 June 2016 were as follows:

- What was the balance of the creditors control account at 30 June 2016?

A) $11 500

B) $6500

C) $5500

D) $6000

- What was the balance of the creditors control account at 30 June 2016?

A) $11 500

B) $6500

C) $5500

D) $6000

$5500

3

In posting the total of the cash column in a cash receipts journal,the entry that would be made is:

A) Dr Cash.

B) Cr Cash.

C) Dr each of the specific accounts that comprise the total.

D) Cr each of the specific accounts that comprise the total.

A) Dr Cash.

B) Cr Cash.

C) Dr each of the specific accounts that comprise the total.

D) Cr each of the specific accounts that comprise the total.

A

4

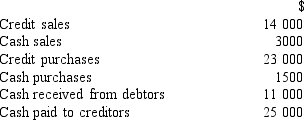

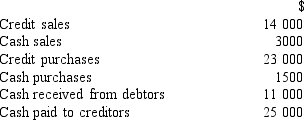

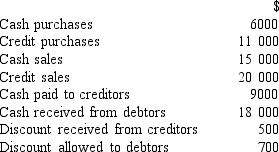

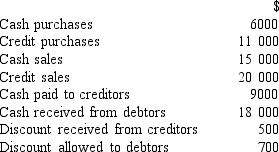

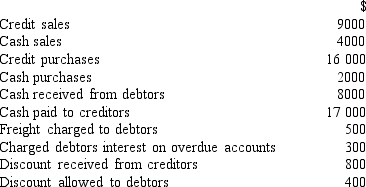

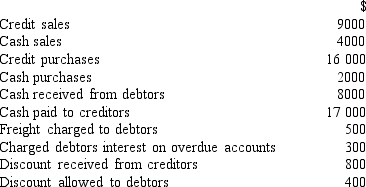

Gum Ltd maintains subsidiary ledgers for debtors and creditors.At 1 July 2015,debtors owed $4000,and $7200 was owing to creditors.Transactions for year ended 30 June 2016 were as follows:

- What was the balance of the creditors control account at 30 June 2016?

A) $5200

B) $5500

C) $6000

D) $9200

- What was the balance of the creditors control account at 30 June 2016?

A) $5200

B) $5500

C) $6000

D) $9200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

5

Plume Ltd maintains subsidiary ledgers for debtors and creditors.At 1 January 2016,debtors owed $3000 and creditors were owed $5600.Transactions for the month of January 2016 were as follows:

-What was the balance of the debtors control account at 31 January 2016?

A) $8400

B) $4100

C) $3900

D) $4400

-What was the balance of the debtors control account at 31 January 2016?

A) $8400

B) $4100

C) $3900

D) $4400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

6

Wrigley Ltd uses subsidiary ledgers for debtors and creditors.At 1 July 2015 debtors owed $7000 and creditors were owed $4000.Transactions for year ended 30 June 2016 were as follows:

- What was the balance of the debtors control account at 30 June 2016?

A) $8300

B) $9700

C) $21 300

D) $9000

- What was the balance of the debtors control account at 30 June 2016?

A) $8300

B) $9700

C) $21 300

D) $9000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

7

A credit balance in a customer's account in the debtors' ledger could be due to:

A) increased credit sales in the period.

B) an overpayment by the customer.

C) a bad debt.

D) return of goods purchased by the customer.

A) increased credit sales in the period.

B) an overpayment by the customer.

C) a bad debt.

D) return of goods purchased by the customer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following is NOT a purpose served by special journals?

A) Reduces the number of postings to the general ledger.

B) Eliminates the general journal.

C) Reduces the number of entries requiring narrations.

D) Makes it easier to find errors.

A) Reduces the number of postings to the general ledger.

B) Eliminates the general journal.

C) Reduces the number of entries requiring narrations.

D) Makes it easier to find errors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

9

Griffin Ltd made a sale of $800 to a customer on terms of 2/10,n/30 on 1 July.The account was paid on 8 July.Griffin Ltd would make which of the following postings to the ledger on 8 July?

A) Dr Discount expense $16

B) Dr Accounts receivable $800

C) Cr Discount revenue $16

D) Cr Discount expense $16

A) Dr Discount expense $16

B) Dr Accounts receivable $800

C) Cr Discount revenue $16

D) Cr Discount expense $16

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following statements about subsidiary ledgers and control accounts is NOT true?

A) Every entry made to an account in the subsidiary ledger is also reflected in the control account in the general ledger.

B) All credit entries will be the same in aggregate between the subsidiary ledger and the control account.

C) The total of the balances appearing in the accounts in the subsidiary ledger should equal the balance appearing in the control account.

D) If the total of the subsidiary ledger accounts fails to agree with the balance of the control account,the subsidiary ledger must be in error.

A) Every entry made to an account in the subsidiary ledger is also reflected in the control account in the general ledger.

B) All credit entries will be the same in aggregate between the subsidiary ledger and the control account.

C) The total of the balances appearing in the accounts in the subsidiary ledger should equal the balance appearing in the control account.

D) If the total of the subsidiary ledger accounts fails to agree with the balance of the control account,the subsidiary ledger must be in error.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

11

The general ledger account representing the subsidiary ledger is known as a control account because:

A) inclusion of both control accounts and subsidiary ledger accounts in the general ledger improves control.

B) the accuracy of the detailed accounts in the subsidiary ledger can be checked against the aggregate data and the balance contained in it.

C) subsidiary ledgers eliminate the need to record totals in the general ledger.

D) it includes all transactions in the subsidiary ledger.

A) inclusion of both control accounts and subsidiary ledger accounts in the general ledger improves control.

B) the accuracy of the detailed accounts in the subsidiary ledger can be checked against the aggregate data and the balance contained in it.

C) subsidiary ledgers eliminate the need to record totals in the general ledger.

D) it includes all transactions in the subsidiary ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of these items is the source document for the purchase journal?

A) Purchase order

B) Invoice from supplier

C) Duplicate of invoice sent to customer

D) Copy of receipt sent to customer

A) Purchase order

B) Invoice from supplier

C) Duplicate of invoice sent to customer

D) Copy of receipt sent to customer

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

13

Gum Ltd maintains subsidiary ledgers for debtors and creditors.At 1 July 2015,debtors owed $4000,and $7200 was owing to creditors.Transactions for year ended 30 June 2016 were as follows:

- What was the balance of the debtors control account at 30 June 2016?

A) $3000

B) $7000

C) $10 000

D) $14 000

- What was the balance of the debtors control account at 30 June 2016?

A) $3000

B) $7000

C) $10 000

D) $14 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

14

'Accounts receivable' is a credit column in the:

A) sales journal.

B) purchase journal.

C) cash receipts journal.

D) cash payments journal.

A) sales journal.

B) purchase journal.

C) cash receipts journal.

D) cash payments journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

15

Plume Ltd maintains subsidiary ledgers for debtors and creditors.At 1 January 2016,debtors owed $3000 and creditors were owed $5600.Transactions for the month of January 2016 were as follows:

- What was the balance of the creditors control account at 31 January 2016?

A) $5800

B) $4600

C) $3800

D) $7400

- What was the balance of the creditors control account at 31 January 2016?

A) $5800

B) $4600

C) $3800

D) $7400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

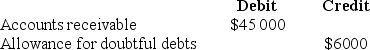

16

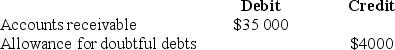

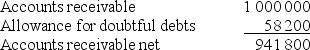

The trial balance of Anderson Ltd included the following balances:  On 1 October 2016,an account for $1600 was determined to be uncollectable.The journal entry to be made on that date would include a debit to:

On 1 October 2016,an account for $1600 was determined to be uncollectable.The journal entry to be made on that date would include a debit to:

A) Bad debts expense.

B) Accounts receivable.

C) Allowance for doubtful debts.

D) none of the answers provided.

On 1 October 2016,an account for $1600 was determined to be uncollectable.The journal entry to be made on that date would include a debit to:

On 1 October 2016,an account for $1600 was determined to be uncollectable.The journal entry to be made on that date would include a debit to:A) Bad debts expense.

B) Accounts receivable.

C) Allowance for doubtful debts.

D) none of the answers provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

17

The trial balance of Allen Ltd at balance date showed a credit balance of $80 000 in the Allowance for doubtful debts account.Although the account of a customer standing at $16 000 had been determined to be uncollectable,this had not been written off.What was the effect of this neglect on the year-end balance sheet?

A) There was an understatement of total liabilities.

B) There was an overstatement of total assets and shareholders' equity.

C) There was an understatement of total assets and shareholders' equity.

D) There was no effect on total liabilities,assets or shareholders' equity.

A) There was an understatement of total liabilities.

B) There was an overstatement of total assets and shareholders' equity.

C) There was an understatement of total assets and shareholders' equity.

D) There was no effect on total liabilities,assets or shareholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

18

The balance in the Allowance for doubtful debts account represents:

A) bad debts written off in the current accounting period.

B) liquid funds available to meet losses arising from customers becoming insolvent.

C) an amount that is deducted from the Accounts receivable account to reduce it to the estimated realisable value.

D) bad debts written off as Accounts receivable considered uncollectable.

A) bad debts written off in the current accounting period.

B) liquid funds available to meet losses arising from customers becoming insolvent.

C) an amount that is deducted from the Accounts receivable account to reduce it to the estimated realisable value.

D) bad debts written off as Accounts receivable considered uncollectable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

19

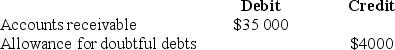

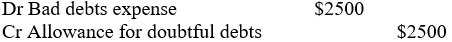

At year end Dodgy Ltd had a balance in Accounts receivable of $40 000 and an Allowance for doubtful debts of $2000.It was decided to write off as irrecoverable the debt of Houdini Ltd totalling $3500.It was further decided that the Allowance for doubtful debts should stand at 10 per cent of Accounts receivable.

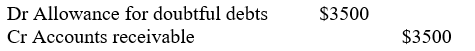

-What was the journal entry needed to write off the debt of Houdini Ltd as irrecoverable?

A)

B)

C)

D) None of the answers provided

-What was the journal entry needed to write off the debt of Houdini Ltd as irrecoverable?

A)

B)

C)

D) None of the answers provided

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of these items is the source document for the sales journal?

A) Purchase order

B) Invoice from supplier

C) Duplicate of invoice sent to customer

D) Copy of receipt sent to customer

A) Purchase order

B) Invoice from supplier

C) Duplicate of invoice sent to customer

D) Copy of receipt sent to customer

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

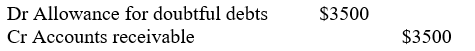

21

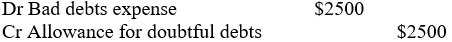

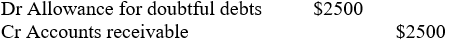

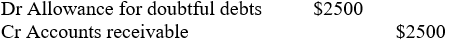

At 30 June 2016 Shifty Ltd had a balance of Accounts receivable of $90 000 and an Allowance for doubtful debts of $4000.It was decided to write off the debt of Wriggler,totalling $2500,as irrecoverable.It was further decided that the Allowance for doubtful debts should stand at 5 per cent of Accounts receivable.What was the journal entry needed to write off the debt of Wriggler as irrecoverable?

A)

B)

C)

D) None of the answers provided

A)

B)

C)

D) None of the answers provided

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

22

Blue Shoes Ltd has gone bankrupt and will not pay $10 000 to XYZ.XYZ has accounts receivable of $12 million and an allowance for doubtful debts of $500 000.XYZ does not adjust its accounts for the $10 000 that will not be paid by Blue Shoes Ltd.Which of the following remarks is true about the financial statements?

A) There is an understatement of net profit.

B) There is an overstatement of total assets and net profit.

C) There is an understatement of total assets and net profit.

D) There is no effect on total liabilities,assets or net profit.

A) There is an understatement of net profit.

B) There is an overstatement of total assets and net profit.

C) There is an understatement of total assets and net profit.

D) There is no effect on total liabilities,assets or net profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

23

Management uses the percentage-of-sales approach method to calculate the allowance for doubtful debts.Management calculated the allowance for doubtful debts on the basis of 2 per cent of sales.However,by year-end it was aware that the rate should have really been 3 per cent of sales.Management does not adjust the allowance for doubtful debts at year-end.As a result:

A) assets are overstated,and net profit is overstated.

B) assets are overstated,and net profit is understated.

C) assets are understated,and net profit is overstated.

D) assets are understated,and net profit is understated.

A) assets are overstated,and net profit is overstated.

B) assets are overstated,and net profit is understated.

C) assets are understated,and net profit is overstated.

D) assets are understated,and net profit is understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

24

The Allowance for doubtful debts account would appear in the balance sheet under:

A) current assets.

B) current liabilities.

C) shareholders' equity.

D) property,plant and equipment.

A) current assets.

B) current liabilities.

C) shareholders' equity.

D) property,plant and equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

25

K Ltd reported beginning and ending balances in the Allowance for doubtful debts account of $723 000 and $904 000 respectively.It also reported that write-offs of bad debts amounted to $648 000.Assuming that no previously written-off accounts had been collected,what amount did K Ltd record as bad debt expense for the period?

A) $467 000

B) $648 000

C) $829 000

D) $904 000

A) $467 000

B) $648 000

C) $829 000

D) $904 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

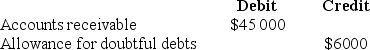

26

The trial balance of Wentworth Ltd included the following balances:  An account for $3000 was determined to be uncollectable.The journal entry to be made on that date would include a debit to:

An account for $3000 was determined to be uncollectable.The journal entry to be made on that date would include a debit to:

A) Bad debts expense.

B) Accounts receivable.

C) Allowance for doubtful debts.

D) none of the above

An account for $3000 was determined to be uncollectable.The journal entry to be made on that date would include a debit to:

An account for $3000 was determined to be uncollectable.The journal entry to be made on that date would include a debit to:A) Bad debts expense.

B) Accounts receivable.

C) Allowance for doubtful debts.

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

27

Management uses the ageing approach method to calculate the allowance for doubtful debts.An analysis of the ageing of accounts receivable shows a substantial increase in the accounts receivable in the over-90-days category.Management does not adjust the allowance for doubtful debts at year-end.As a result:

A) assets are overstated,and net income is overstated.

B) assets are overstated,and net income is understated.

C) assets are understated,and net income is overstated.

D) assets are understated,and net income is understated.

A) assets are overstated,and net income is overstated.

B) assets are overstated,and net income is understated.

C) assets are understated,and net income is overstated.

D) assets are understated,and net income is understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

28

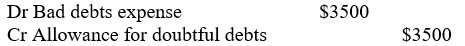

At year end Dodgy Ltd had a balance in Accounts receivable of $40 000 and an Allowance for doubtful debts of $2000.It was decided to write off as irrecoverable the debt of Houdini Ltd totalling $3500.It was further decided that the Allowance for doubtful debts should stand at 10 per cent of Accounts receivable.

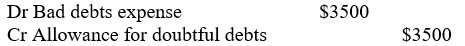

- What was the journal entry needed to bring the Allowance for doubtful debts to the required level after writing off the debt of Houdini Ltd?

A)

B)

C)

D)

- What was the journal entry needed to bring the Allowance for doubtful debts to the required level after writing off the debt of Houdini Ltd?

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

29

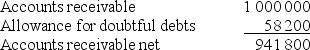

S Ltd has the following balance sheet information on 28 February 2016: $

On 28 February 2016,the company receives notification from R Ltd that it has filed for bankruptcy.The controller of S Ltd decides to write off R Ltd's account for $10 600.Which of the following statements is true?

On 28 February 2016,the company receives notification from R Ltd that it has filed for bankruptcy.The controller of S Ltd decides to write off R Ltd's account for $10 600.Which of the following statements is true?

A) Net income and net accounts receivable will decrease.

B) Net income will decrease but no change will occur in net accounts receivable.

C) No change will occur in net income but net accounts receivable will decrease.

D) Neither net income or net accounts receivable will decrease.

On 28 February 2016,the company receives notification from R Ltd that it has filed for bankruptcy.The controller of S Ltd decides to write off R Ltd's account for $10 600.Which of the following statements is true?

On 28 February 2016,the company receives notification from R Ltd that it has filed for bankruptcy.The controller of S Ltd decides to write off R Ltd's account for $10 600.Which of the following statements is true?A) Net income and net accounts receivable will decrease.

B) Net income will decrease but no change will occur in net accounts receivable.

C) No change will occur in net income but net accounts receivable will decrease.

D) Neither net income or net accounts receivable will decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck