Deck 3: The Double-Entry System

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/71

العب

ملء الشاشة (f)

Deck 3: The Double-Entry System

1

For the following transaction,identify the type of change that would have occurred in the accounting equation: Assets = Liabilities + Issued Capital + Opening retained profits + Revenue - Expenses - Dividends

-

The business made a loan to the sales manager.

A) An asset increased and another asset decreased.

B) An asset decreased and an expense increased.

C) An asset decreased and a liability decreased.

D) A liability increased and an expense increased.

-

The business made a loan to the sales manager.

A) An asset increased and another asset decreased.

B) An asset decreased and an expense increased.

C) An asset decreased and a liability decreased.

D) A liability increased and an expense increased.

An asset increased and another asset decreased.

2

Consider the following transactions:

(i)issued share capital for cash of $250 000

(ii)received $50 000 from accounts receivable

(iii)paid $30 000 to accounts payable

(iv)purchased new equipment for $160 000 on credit

Total assets increased by:

A) $220 000.

B) $230 000.

C) $380 000.

D) $430 000.

(i)issued share capital for cash of $250 000

(ii)received $50 000 from accounts receivable

(iii)paid $30 000 to accounts payable

(iv)purchased new equipment for $160 000 on credit

Total assets increased by:

A) $220 000.

B) $230 000.

C) $380 000.

D) $430 000.

$380 000.

3

For the following transaction,identify the type of change that would have occurred in the accounting equation: Assets = Liabilities + Issued Capital + Opening retained profits + Revenue - Expenses - Dividends

-

A customer was invoiced for services rendered.

A) A liability increased and another liability decreased.

B) An asset decreased and a liability decreased.

C) An asset increased and revenue increased.

D) An asset increased and another asset decreased.

-

A customer was invoiced for services rendered.

A) A liability increased and another liability decreased.

B) An asset decreased and a liability decreased.

C) An asset increased and revenue increased.

D) An asset increased and another asset decreased.

An asset increased and revenue increased.

4

The assets of ALS Ltd increased by $5476 during year ended 30 June 2016 and during the same period liabilities decreased by $3019.Consequently shareholders' equity must have:

A) increased by $2457.

B) increased by $8495.

C) decreased by $2457.

D) decreased by $8495.

A) increased by $2457.

B) increased by $8495.

C) decreased by $2457.

D) decreased by $8495.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

5

For the following transaction,identify the type of change that would have occurred in the accounting equation: Assets = Liabilities + Issued Capital + Opening retained profits + Revenue - Expenses - Dividends

12 months' depreciation was charged on the office building.

A) An asset increased and another asset decreased.

B) An asset decreased and an expense increased.

C) An asset decreased and a liability decreased.

D) A liability increased and an expense increased.

12 months' depreciation was charged on the office building.

A) An asset increased and another asset decreased.

B) An asset decreased and an expense increased.

C) An asset decreased and a liability decreased.

D) A liability increased and an expense increased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

6

If a company borrows money to purchase equipment:

A) one asset increases and another asset decreases.

B) an asset increases and a liability increases.

C) an asset decreases and a liability decreases.

D) an asset increases and shareholders' equity increases.

A) one asset increases and another asset decreases.

B) an asset increases and a liability increases.

C) an asset decreases and a liability decreases.

D) an asset increases and shareholders' equity increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

7

An account for advertising that had appeared in a local newspaper was received.There was no previous record of the charge.

A) An asset increased and another asset decreased.

B) An asset decreased and an expense increased.

C) An asset decreased and a liability decreased.

D) A liability increased and an expense increased.

A) An asset increased and another asset decreased.

B) An asset decreased and an expense increased.

C) An asset decreased and a liability decreased.

D) A liability increased and an expense increased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

8

For the following transaction,identify the type of change that would have occurred in the accounting equation: Assets = Liabilities + Issued Capital + Opening retained profits + Revenue - Expenses - Dividends

-

Inventory was purchased on credit.

A) An asset increased and another asset decreased.

B) An asset decreased and an expense increased.

C) An asset decreased and a liability decreased.

D) A liability increased and an asset increased.

-

Inventory was purchased on credit.

A) An asset increased and another asset decreased.

B) An asset decreased and an expense increased.

C) An asset decreased and a liability decreased.

D) A liability increased and an asset increased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

9

For the following transaction,identify the type of change that would have occurred in the accounting equation: Assets = Liabilities + Issued Capital + Opening retained profits + Revenue - Expenses - Dividends

-

Inventory was purchased for cash.

A) An asset increased and another asset decreased.

B) An asset decreased and an expense increased.

C) An asset decreased and a liability decreased.

D) A liability increased and an expense increased.

-

Inventory was purchased for cash.

A) An asset increased and another asset decreased.

B) An asset decreased and an expense increased.

C) An asset decreased and a liability decreased.

D) A liability increased and an expense increased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

10

If equipment is purchased for cash:

A) one asset increases and another asset decreases.

B) an asset increases and a liability increases.

C) an asset decreases and a liability decreases.

D) an asset decreases and shareholders' equity decreases.

A) one asset increases and another asset decreases.

B) an asset increases and a liability increases.

C) an asset decreases and a liability decreases.

D) an asset decreases and shareholders' equity decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

11

For the following transaction,identify the type of change that would have occurred in the accounting equation: Assets = Liabilities + Issued Capital + Opening retained profits + Revenue - Expenses - Dividends

-

The company received cash dividends on investments.

A) A liability increased and another liability decreased.

B) An asset decreased and a liability decreased.

C) An asset increased and revenue increased.

D) An asset increased and equity increased.

-

The company received cash dividends on investments.

A) A liability increased and another liability decreased.

B) An asset decreased and a liability decreased.

C) An asset increased and revenue increased.

D) An asset increased and equity increased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

12

If equipment is purchased on credit:

A) one asset increases and another asset decreases.

B) an asset increases and a liability increases.

C) an asset decreases and a liability decreases.

D) an asset decreases and shareholders' equity decreases.

A) one asset increases and another asset decreases.

B) an asset increases and a liability increases.

C) an asset decreases and a liability decreases.

D) an asset decreases and shareholders' equity decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

13

A $10 000 receipt was received from an accounts receivable;as a result:

A) an asset decreased and an expense decreased.

B) an asset decreased and another asset increased.

C) an asset decreased and an expense increased.

D) a liability decreased and an expense increased.

A) an asset decreased and an expense decreased.

B) an asset decreased and another asset increased.

C) an asset decreased and an expense increased.

D) a liability decreased and an expense increased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

14

For the following transaction,identify the type of change that would have occurred in the accounting equation: Assets = Liabilities + Issued Capital + Opening retained profits + Revenue - Expenses - Dividends

-

A payment was made to a creditor.

A) A liability increased and another liability decreased.

B) An asset decreased and a liability decreased.

C) An asset increased and revenue increased.

D) An asset decreased and an expense increased.

-

A payment was made to a creditor.

A) A liability increased and another liability decreased.

B) An asset decreased and a liability decreased.

C) An asset increased and revenue increased.

D) An asset decreased and an expense increased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

15

If a year's depreciation is charged on a piece of equipment,the effect on the accounting equation is that:

A) an asset increases and another asset decreases.

B) an asset decreases and shareholders' equity decreases.

C) an asset decreases and a liability decreases.

D) a liability increases and shareholders' equity decreases.

A) an asset increases and another asset decreases.

B) an asset decreases and shareholders' equity decreases.

C) an asset decreases and a liability decreases.

D) a liability increases and shareholders' equity decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

16

If a payment is received from accounts receivable:

A) shareholders' equity increases and an asset decreases.

B) an asset increases and a liability increases.

C) an asset decreases and a liability decreases.

D) one asset increases and another asset decreases.

A) shareholders' equity increases and an asset decreases.

B) an asset increases and a liability increases.

C) an asset decreases and a liability decreases.

D) one asset increases and another asset decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

17

If the owner contributed cash as additional capital:

A) one asset increased and another asset decreased.

B) a liability increased and shareholders' equity decreased.

C) an asset increased and shareholders' equity increased.

D) a liability decreased and shareholders' equity increased.

A) one asset increased and another asset decreased.

B) a liability increased and shareholders' equity decreased.

C) an asset increased and shareholders' equity increased.

D) a liability decreased and shareholders' equity increased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

18

For the following transaction,identify the type of change that would have occurred in the accounting equation: Assets = Liabilities + Issued Capital + Opening retained profits + Revenue - Expenses - Dividends

-

An account for advertising was received.There was no previous record of the charge.

A) An asset increased and another asset decreased.

B) An asset decreased and an expense increased.

C) An asset decreased and a liability decreased.

D) A liability increased and an expense increased.

-

An account for advertising was received.There was no previous record of the charge.

A) An asset increased and another asset decreased.

B) An asset decreased and an expense increased.

C) An asset decreased and a liability decreased.

D) A liability increased and an expense increased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

19

For the following transaction,identify the type of change that would have occurred in the accounting equation: Assets = Liabilities + Issued Capital + Opening retained profits + Revenue - Expenses - Dividends

-

An electricity account was paid.There was no previous record of the charge.

A) An asset increased and another asset decreased.

B) An asset decreased and an expense increased.

C) An asset decreased and a liability decreased.

D) A liability increased and an expense increased.

-

An electricity account was paid.There was no previous record of the charge.

A) An asset increased and another asset decreased.

B) An asset decreased and an expense increased.

C) An asset decreased and a liability decreased.

D) A liability increased and an expense increased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

20

An invoice from a consultant was received for work done in May 2016.There was no previous record of the transaction.It will be paid in July 2016.In May 2016:

A) an asset decreased and an expense increased.

B) an asset decreased and a liability decreased.

C) a liability increased and an expense increased.

D) no entry is required until the next accounting period.

A) an asset decreased and an expense increased.

B) an asset decreased and a liability decreased.

C) a liability increased and an expense increased.

D) no entry is required until the next accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

21

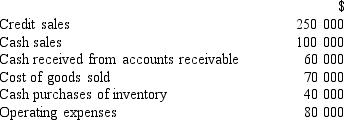

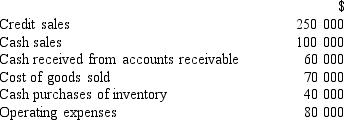

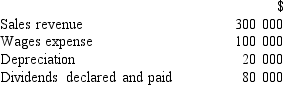

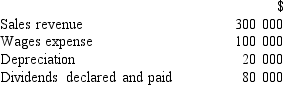

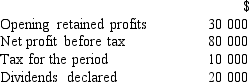

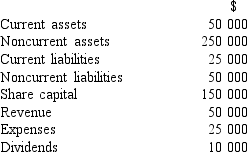

Using the following information,calculate net profit before tax.

A) $160 000.

B) $200 000.

C) $220 000.

D) $260 000.

A) $160 000.

B) $200 000.

C) $220 000.

D) $260 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

22

For the following transaction,identify the type of change that would have occurred in the accounting equation: Assets = Liabilities + Issued Capital + Opening retained profits + Revenue - Expenses - Dividends

-

An account was paid for stationery purchased in the previous accounting period.

A) A liability increased and another liability decreased.

B) An asset decreased and a liability decreased.

C) An asset increased and revenue increased.

D) An asset decreased and an expense increased.

-

An account was paid for stationery purchased in the previous accounting period.

A) A liability increased and another liability decreased.

B) An asset decreased and a liability decreased.

C) An asset increased and revenue increased.

D) An asset decreased and an expense increased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

23

During the accounting period there were no share issues,liabilities increased by $45 000,assets increased by $90 000 and net profit was $115 000.Therefore,dividends declared must have been:

A) $15 000.

B) $45 000.

C) $60 000.

D) $70 000.

A) $15 000.

B) $45 000.

C) $60 000.

D) $70 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

24

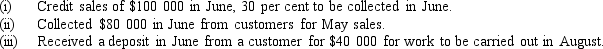

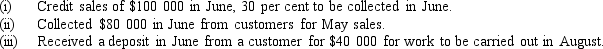

Given the following information,how much revenue would be recognised in June?

A) $90 000.

B) $100 000.

C) $120 000.

D) $130 000.

A) $90 000.

B) $100 000.

C) $120 000.

D) $130 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

25

ABC has no opening inventory.During the year,it buys 2000 microwave ovens at $300 each and sells 1500 of them for $500 each.Cash operating expenses are $40 000 and it owes wages of $10 000 at year-end.What is accrual profit for the year?

A) $250 000.

B) $260 000.

C) $100 000.

D) $110 000.

A) $250 000.

B) $260 000.

C) $100 000.

D) $110 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

26

A company's first event in the year commencing 1 July 2016 was to pay $250 cash for stationery purchased in June 2016;this was recognised as an expense in that month.Which of the following changes took place as a consequence of this event?

A) Assets increased by $250.

B) Liabilities decreased by $250.

C) Expenses increased by $250.

D) None of the above changes occurred.

A) Assets increased by $250.

B) Liabilities decreased by $250.

C) Expenses increased by $250.

D) None of the above changes occurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following items would decrease profit for the year?

A) Purchase of equipment for cash

B) Payment of a dividend

C) Purchase of equipment on credit

D) None of the answers provided

A) Purchase of equipment for cash

B) Payment of a dividend

C) Purchase of equipment on credit

D) None of the answers provided

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

28

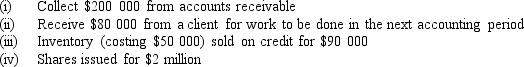

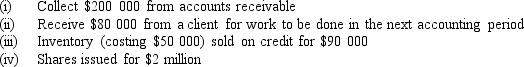

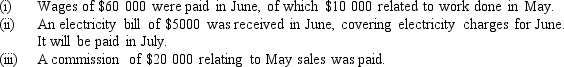

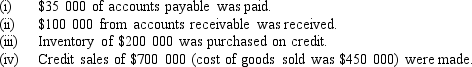

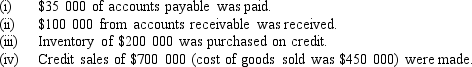

Consider the following transactions:  Which of the above transactions do NOT increase revenue?

Which of the above transactions do NOT increase revenue?

A) (i)and (ii)only.

B) (ii)and (iii)only.

C) (i)and (iii)only.

D) (i), (ii)and (iv).

Which of the above transactions do NOT increase revenue?

Which of the above transactions do NOT increase revenue?A) (i)and (ii)only.

B) (ii)and (iii)only.

C) (i)and (iii)only.

D) (i), (ii)and (iv).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

29

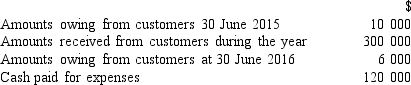

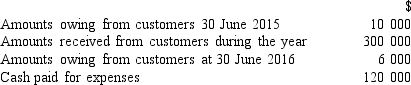

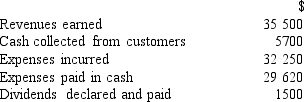

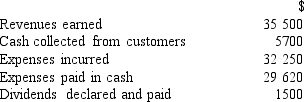

Using the following information,calculate accrual profit for the year ended 30 June 2016.

A) $296 000.

B) $176 000.

C) $180 000.

D) $184 000.

A) $296 000.

B) $176 000.

C) $180 000.

D) $184 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

30

During the year,the liabilities of a company decreased by $32 034 and the assets decreased by $16 035.Consequently the shareholders' equity must have:

A) decreased by $15 999.

B) increased by $15 999.

C) increased by $48 069.

D) decreased by $48 069.

A) decreased by $15 999.

B) increased by $15 999.

C) increased by $48 069.

D) decreased by $48 069.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

31

For the following transaction,identify the type of change that would have occurred in the accounting equation: Assets = Liabilities + Issued Capital + Opening retained profits + Revenue - Expenses - Dividends

-

At the end of the accounting period,3 months' interest is owing to the company from the bank on a term deposit with the bank.

A) A liability increases and another liability decreases.

B) An asset decreases and a liability decreases.

C) An asset increases and revenue increases.

D) An asset increases and another asset decreases.

-

At the end of the accounting period,3 months' interest is owing to the company from the bank on a term deposit with the bank.

A) A liability increases and another liability decreases.

B) An asset decreases and a liability decreases.

C) An asset increases and revenue increases.

D) An asset increases and another asset decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

32

For the following transaction,identify the type of change that would have occurred in the accounting equation: Assets = Liabilities + Issued Capital + Opening retained profits + Revenue - Expenses - Dividends

-

Commission was earned which will be paid for in 4 months' time.

A) A liability increased and another liability decreased.

B) An asset decreased and a liability decreased.

C) An asset increased and revenue increased.

D) An asset increased and a liability increased.

-

Commission was earned which will be paid for in 4 months' time.

A) A liability increased and another liability decreased.

B) An asset decreased and a liability decreased.

C) An asset increased and revenue increased.

D) An asset increased and a liability increased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

33

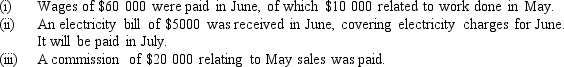

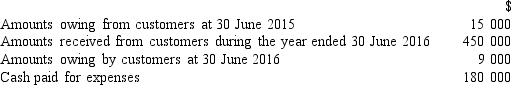

Using the following information,calculate total expenses for the month of June.

A) $55 000.

B) $60 000.

C) $65 000.

D) $85 000.

A) $55 000.

B) $60 000.

C) $65 000.

D) $85 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following statements is NOT true?

A) If the total assets owned by a business total $110 000 and shareholders' equity totals $30 000,liabilities total $80 000.

B) If total assets decreased by $30 000 during a specific period and shareholders' equity decreased by $35 000 during the same period,the period's change in total liabilities was a $65 000 increase.

C) If total assets decreased by $50 000 during a specific period and shareholders' equity decreased by $40 000 during the same period,the period's change in total liabilities was a $10 000 decrease.

D) If total assets increased by $75 000 during a specific period and liabilities decreased by $10 000 during the same period,the period's change in total shareholders' equity was an $85 000 increase.

A) If the total assets owned by a business total $110 000 and shareholders' equity totals $30 000,liabilities total $80 000.

B) If total assets decreased by $30 000 during a specific period and shareholders' equity decreased by $35 000 during the same period,the period's change in total liabilities was a $65 000 increase.

C) If total assets decreased by $50 000 during a specific period and shareholders' equity decreased by $40 000 during the same period,the period's change in total liabilities was a $10 000 decrease.

D) If total assets increased by $75 000 during a specific period and liabilities decreased by $10 000 during the same period,the period's change in total shareholders' equity was an $85 000 increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

35

Using the following information,calculate accrual profit for the year ended 30 June 2016.

A) $444 000.

B) $276 000.

C) $270 000.

D) $264 000.

A) $444 000.

B) $276 000.

C) $270 000.

D) $264 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

36

For the following transaction,identify the type of change that would have occurred in the accounting equation: Assets = Liabilities + Issued Capital + Opening retained profits + Revenue - Expenses - Dividends

-

A cheque was drawn to pay an account payable.

A) A liability increased and another liability decreased.

B) An asset decreased and a liability decreased.

C) An asset decreased and an expense increased.

D) None of the above is correct.

-

A cheque was drawn to pay an account payable.

A) A liability increased and another liability decreased.

B) An asset decreased and a liability decreased.

C) An asset decreased and an expense increased.

D) None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

37

Patrick is a part-time accounting student who does tennis coaching during the day.He receives $31 000 from clients for coaching and ball sales during the year.At year-end,one client owes him $500.He paid out $10 000 for court hire and purchase of tennis balls for resale.He owes $1000 to the court owner at year-end.Depreciation on his equipment amounts to $400.Accrual profit is:

A) $20 500.

B) $20 100.

C) $20 300.

D) $19 900.

A) $20 500.

B) $20 100.

C) $20 300.

D) $19 900.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

38

For the following transaction,identify the type of change that would have occurred in the accounting equation: Assets = Liabilities + Issued Capital + Opening retained profits + Revenue - Expenses - Dividends

-

A new CEO was appointed to commence in 3 months' time on a salary of $400 000 per annum.

A) A liability increased and another liability decreased.

B) An asset decreased and a liability decreased.

C) An asset increased and revenue increased.

D) This had no effect on the accounting equation.

-

A new CEO was appointed to commence in 3 months' time on a salary of $400 000 per annum.

A) A liability increased and another liability decreased.

B) An asset decreased and a liability decreased.

C) An asset increased and revenue increased.

D) This had no effect on the accounting equation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

39

Using the following information,calculate net profit before tax.

A) $50 000.

B) $100 000.

C) $180 000.

D) None of the above.

A) $50 000.

B) $100 000.

C) $180 000.

D) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

40

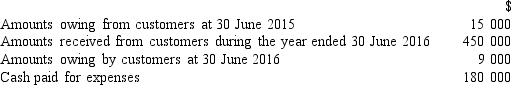

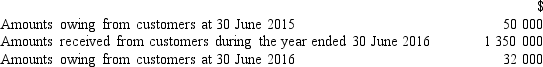

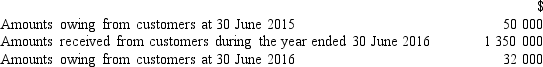

Using the following information,calculate credit sales for the year ended 30 June 2016.

A) $1 332 000

B) $1 350 000

C) $1 368 000

D) None of the answers provided

A) $1 332 000

B) $1 350 000

C) $1 368 000

D) None of the answers provided

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

41

A credit balance in which of the following accounts would indicate a likely error?

A) Sales revenue

B) Inventory

C) Share capital

D) Accounts payable

A) Sales revenue

B) Inventory

C) Share capital

D) Accounts payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

42

Identify the journal entry required to correctly record the following transaction. Depreciation expense on motor vehicles for the year incurred.

A) Dr Motor vehicles

Cr Accumulated depreciation

B) Dr Accumulated depreciation

Cr Depreciation expense

C) Dr Depreciation expense

Cr Motor vehicles

D) Dr Depreciation expense

Cr Accumulated depreciation

A) Dr Motor vehicles

Cr Accumulated depreciation

B) Dr Accumulated depreciation

Cr Depreciation expense

C) Dr Depreciation expense

Cr Motor vehicles

D) Dr Depreciation expense

Cr Accumulated depreciation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following require a credit entry?

A) Increases in expenses

B) Decreases in liabilities

C) Increases in assets

D) Increases in shareholders' equity

A) Increases in expenses

B) Decreases in liabilities

C) Increases in assets

D) Increases in shareholders' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following require a debit entry?

A) Contributions of capital

B) Increases in revenues

C) Increases in liabilities

D) Decreases in shareholders' equity

A) Contributions of capital

B) Increases in revenues

C) Increases in liabilities

D) Decreases in shareholders' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

45

If goods are purchased on credit for resale,the accountant:

A) debits inventory and credits debtors.

B) debits creditors and credits inventory.

C) debits inventory and credits shareholders' equity.

D) debits inventory and credits creditors.

A) debits inventory and credits debtors.

B) debits creditors and credits inventory.

C) debits inventory and credits shareholders' equity.

D) debits inventory and credits creditors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

46

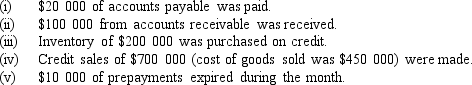

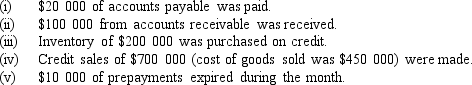

Consider the following information:  What is the profit for the period?

What is the profit for the period?

A) $130 000

B) $250 000

C) $260 000

D) None of the answers provided

What is the profit for the period?

What is the profit for the period?A) $130 000

B) $250 000

C) $260 000

D) None of the answers provided

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

47

Identify the journal entry required to correctly record the following transaction. Income tax for the year estimated.

A) Dr Income tax expense

Cr Retained profits

B) Dr Taxes payable

Cr Income tax expense

C) Dr Income tax expense

Cr Taxes payable

D) Dr Income tax expense

Cr Cash at bank

A) Dr Income tax expense

Cr Retained profits

B) Dr Taxes payable

Cr Income tax expense

C) Dr Income tax expense

Cr Taxes payable

D) Dr Income tax expense

Cr Cash at bank

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

48

Inventory was purchased by a business for $3000;$2000 was paid in cash and the rest was put on account.The journal entry will include:

A) a debit to inventory of $1000.

B) a credit to accounts payable of $2000.

C) a credit to cash of $3000.

D) a credit to accounts payable of $1000.

A) a debit to inventory of $1000.

B) a credit to accounts payable of $2000.

C) a credit to cash of $3000.

D) a credit to accounts payable of $1000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

49

Identify the journal entry required to correctly record the following transaction. Received cash from customer.

A) Dr Accounts receivable

Cr Cash

B) Dr Cash

Cr Accounts payable

C) Dr Cash

Cr Accounts receivable

D) Dr Cash

Cr Share capital

A) Dr Accounts receivable

Cr Cash

B) Dr Cash

Cr Accounts payable

C) Dr Cash

Cr Accounts receivable

D) Dr Cash

Cr Share capital

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following accounts does NOT normally have a credit balance?

A) Accounts payable

B) Retained profits

C) Tax payable

D) Wages expense

A) Accounts payable

B) Retained profits

C) Tax payable

D) Wages expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

51

A company's first transaction in 2016 was to pay $9000 cash for wages earned and recognised as an expense in 2015.Which of the following changes took place as a consequence of that transaction?

A) Revenue decreased by $9000.

B) Liabilities decreased by $9000.

C) Profit decreased by $9000.

D) Assets increased by $9000.

A) Revenue decreased by $9000.

B) Liabilities decreased by $9000.

C) Profit decreased by $9000.

D) Assets increased by $9000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

52

Identify the journal entry required to correctly record the following transaction. Purchased goods on credit.

A) Dr Inventory

Cr Accounts payable

B) Dr Inventory

Cr Accounts receivable

C) Dr Accounts receivable

Cr Inventory

D) Dr Purchases

Cr Cash at bank

A) Dr Inventory

Cr Accounts payable

B) Dr Inventory

Cr Accounts receivable

C) Dr Accounts receivable

Cr Inventory

D) Dr Purchases

Cr Cash at bank

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

53

The amount of income tax previously estimated now paid.

A) Dr Taxes payable

Cr Income tax expense

B) Dr Income tax expense

Cr Taxes payable

C) Dr Income tax expense

Cr Cash at bank

D) Dr Taxes payable

Cr Cash at bank

A) Dr Taxes payable

Cr Income tax expense

B) Dr Income tax expense

Cr Taxes payable

C) Dr Income tax expense

Cr Cash at bank

D) Dr Taxes payable

Cr Cash at bank

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

54

A business purchases inventory for $220,paying $50 cash and owing the rest.The journal entry will include:

A) a debit to accounts payable of $170.

B) a debit to inventory of $170.

C) a credit to accounts payable of $50.

D) a credit to accounts payable of $170.

A) a debit to accounts payable of $170.

B) a debit to inventory of $170.

C) a credit to accounts payable of $50.

D) a credit to accounts payable of $170.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

55

A debit balance in which of the following accounts would indicate a likely error?

A) Salaries expense

B) Accounts payable

C) Inventory

D) Equipment

A) Salaries expense

B) Accounts payable

C) Inventory

D) Equipment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

56

Consider the following information:  Assets increased during the period by:

Assets increased during the period by:

A) $220 000.

B) $250 000.

C) $420 000.

D) $430 000.

Assets increased during the period by:

Assets increased during the period by:A) $220 000.

B) $250 000.

C) $420 000.

D) $430 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

57

Received cash from customer.

A) Dr Accounts receivable Cr Cash

B) Dr Cash Cr Accounts payable

C) Dr Cash Cr Accounts receivable

D) None of the answers are correct.

A) Dr Accounts receivable Cr Cash

B) Dr Cash Cr Accounts payable

C) Dr Cash Cr Accounts receivable

D) None of the answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following entries correctly records the receipt of an electricity bill from the power company?

A) Dr Electricity expense

Cr Accounts payable

B) Dr Electricity payable

Cr Accounts payable

C) Dr Accounts payable

Cr Electricity expense

D) Dr Accounts payable

Cr Electricity payable

A) Dr Electricity expense

Cr Accounts payable

B) Dr Electricity payable

Cr Accounts payable

C) Dr Accounts payable

Cr Electricity expense

D) Dr Accounts payable

Cr Electricity payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

59

If money is borrowed from the bank on a long-term loan,the accountant:

A) debits cash and debits long-term bank loan.

B) debits long-term bank loan and credits cash.

C) debits cash and credits long-term bank loan.

D) does none of the above.

A) debits cash and debits long-term bank loan.

B) debits long-term bank loan and credits cash.

C) debits cash and credits long-term bank loan.

D) does none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

60

Cash was paid by XYZ to creditors.Which of the following entries for XYZ correctly records this transaction?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

61

A company declares and pays an interim dividend.This transaction will:

A) decrease total assets and total shareholders' equity but have no effect on profit.

B) decrease total assets,total shareholders' equity and profit.

C) decrease total assets but have no effect on profit or shareholders' equity.

D) none of the answers provided.

A) decrease total assets and total shareholders' equity but have no effect on profit.

B) decrease total assets,total shareholders' equity and profit.

C) decrease total assets but have no effect on profit or shareholders' equity.

D) none of the answers provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

62

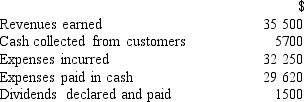

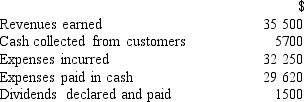

Retained profits of Livermore Pty Ltd at 1 July 2015 were $5500.The accounting records for year ended 30 June 2016 showed the following information:

- What were Livermore's retained profits at 30 June 2016?

A) $3750

B) $7250

C) $8750

D) $5500

- What were Livermore's retained profits at 30 June 2016?

A) $3750

B) $7250

C) $8750

D) $5500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

63

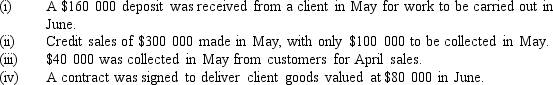

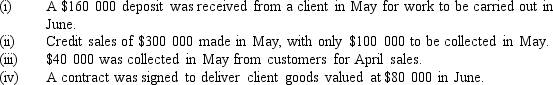

Given only the following information,how much revenue would L Ltd recognise in May 2016?

A) $200 000

B) $300 000

C) $380 000

D) $460 000

A) $200 000

B) $300 000

C) $380 000

D) $460 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

64

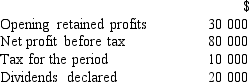

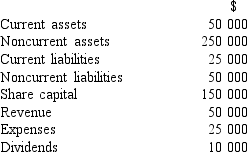

Using the following information,calculate retained profits.

A) $80 000.

B) $90 000.

C) $100 000.

D) $30 000.

A) $80 000.

B) $90 000.

C) $100 000.

D) $30 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

65

Given only the following information,how much revenue would P Ltd recognise in April 2016? (i)Received a deposit in April from a client for $80 000 for work to be carried out during May.

(ii)Credit sales of $150 000 in April,only $50 000 to be collected in April.

(iii)Collected $20 000 in April from customers for March sales.

(iv)Sold client goods valued at $30 000 on last day of April,will invoice client in early May.

(v)Signed contract to deliver client goods valued at $40 000 in May.

A) $130 000

B) $180 000

C) $200 000

D) $260 000

(ii)Credit sales of $150 000 in April,only $50 000 to be collected in April.

(iii)Collected $20 000 in April from customers for March sales.

(iv)Sold client goods valued at $30 000 on last day of April,will invoice client in early May.

(v)Signed contract to deliver client goods valued at $40 000 in May.

A) $130 000

B) $180 000

C) $200 000

D) $260 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

66

Additional credit sales of $2m (cost price $1.5m)are made on credit.This transaction will:

A) increase net profit,increase cash and increase total assets.

B) increase net profit,increase total assets but not affect cash.

C) increase net profit,and not affect cash or total assets.

D) increase net profit,increase cash.

A) increase net profit,increase cash and increase total assets.

B) increase net profit,increase total assets but not affect cash.

C) increase net profit,and not affect cash or total assets.

D) increase net profit,increase cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

67

Retained profits of Livermore Pty Ltd at 1 July 2015 were $5500.The accounting records for year ended 30 June 2016 showed the following information:

-What was Livermore's net profit for the year ended 30 June 2016?

A) $1750

B) $2000

C) $3250

D) $8950

-What was Livermore's net profit for the year ended 30 June 2016?

A) $1750

B) $2000

C) $3250

D) $8950

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

68

Consider the following transactions: (i)Borrows $1m from the bank.

(ii)Collects $100 000 from accounts receivable.

(iii)Receives $90 000 from a client for work to be done in the next accounting period.

(iv)Sale of inventory (costing $70 000)on credit for $200 000.

Which of the above transactions do NOT increase revenue?

A) (ii)and (iii)only

B) (iii)and (iv)only

C) (ii)and (iv)only

D) (i), (ii)and (iii)

(ii)Collects $100 000 from accounts receivable.

(iii)Receives $90 000 from a client for work to be done in the next accounting period.

(iv)Sale of inventory (costing $70 000)on credit for $200 000.

Which of the above transactions do NOT increase revenue?

A) (ii)and (iii)only

B) (iii)and (iv)only

C) (ii)and (iv)only

D) (i), (ii)and (iii)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

69

Using the following information,what is the balance of retained profits at 1 January 2016?

A) $35 000

B) $40 000

C) $60 000

D) $140 000

A) $35 000

B) $40 000

C) $60 000

D) $140 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

70

A customer provides a deposit of $500 000 near year-end.The product will not be delivered until next year.This transaction will:

A) increase net profit,total assets and cash.

B) increase net profit and cash but not total assets.

C) increase total assets and cash but not net profit.

D) increase cash but not increase net profit or total assets.

A) increase net profit,total assets and cash.

B) increase net profit and cash but not total assets.

C) increase total assets and cash but not net profit.

D) increase cash but not increase net profit or total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

71

A business sells inventory for $220,receiving $100 cash as a deposit with the customer owing the remainder.The journal entry will include:

A) a debit to accounts receivable of $120.

B) a debit to inventory of $120.

C) a credit to accounts receivable of $100.

D) a credit to inventory for $220.

A) a debit to accounts receivable of $120.

B) a debit to inventory of $120.

C) a credit to accounts receivable of $100.

D) a credit to inventory for $220.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck