Deck 7: Fixed Assets and Intangible Assets

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

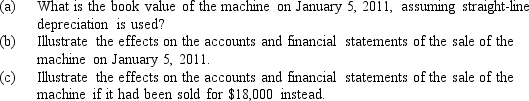

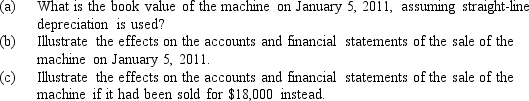

سؤال

سؤال

سؤال

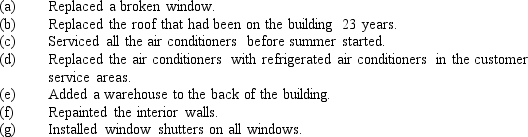

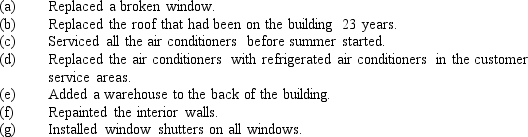

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/86

العب

ملء الشاشة (f)

Deck 7: Fixed Assets and Intangible Assets

1

Physical depreciation occurs when a fixed asset is no longer able to provide services at the level for which it was intended.

False

2

When selling a piece of equipment for cash,a loss will result when the proceeds of the sale are greater than the book value of the asset.

False

3

The double-declining-balance method of depreciation is referred to as an accelerated method.

True

4

The Accumulated Depreciation account is deducted from the cost of fixed assets on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

5

Long-lived assets that are intangible in nature,used in the operations of the business,and not held for sale in the ordinary course of business are called fixed assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

6

A current asset account must be increased for revenue expenditures since they only benefit the current period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

7

An estimate of the amount that an asset can be sold for at the end of its useful life is called book value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

8

If a company sells a fixed asset where the book value is less than the cash received,a gain must be recognized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

9

Goodwill equals the purchase price of a company over the fair market value of its net assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

10

The amount of depreciation expense for the first full year of use of a fixed asset costing $95,000,with an estimated residual value of $5,000 and a useful life of 5 years,is $18,000 by the straight-line method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

11

An intangible asset is one that has a physical existence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

12

If an asset is discarded,a loss is recognized equal to the salvage value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

13

Expenditures made to extend an asset's life are deemed revenue expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

14

Amortization refers to the systematic transfer of fixed assets to expense accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

15

Depreciation on a yearly basis differs between the double-declining-balance method and the straight-line method.However,total depreciation across the years of an asset's life is the same under the double-declining-balance method or the straight-line method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

16

Companies usually compute depletion by using the double-declining-balance method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

17

The straight-line method is appropriate if usage of the asset varies considerably from year to year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

18

Depletion is the process of transferring the cost of intangible assets to an expense account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

19

The acquisition costs of property,plant,and equipment should include all normal,reasonable,and necessary costs to get the asset in place and ready for use.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

20

Residual value is ignored under double-declining-balance depreciation except for the final year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

21

If a revenue expenditure is treated as a capital expenditure,then

A)expenses are overstated and owners' equity is understated.

B)expenses are overstated and assets are overstated.

C)expenses are understated and owners' equity is overstated.

D)net income is overstated and owners' equity is understated.

A)expenses are overstated and owners' equity is understated.

B)expenses are overstated and assets are overstated.

C)expenses are understated and owners' equity is overstated.

D)net income is overstated and owners' equity is understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

22

All amounts paid to get an asset in place and ready for use are referred to as

A)capital expenditures.

B)revenue expenditures.

C)residual value.

D)cost of an asset.

A)capital expenditures.

B)revenue expenditures.

C)residual value.

D)cost of an asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

23

Salvage value has a similar meaning as

A)residual value.

B)scrap value.

C)book value.

D)both residual value and scrap value.

A)residual value.

B)scrap value.

C)book value.

D)both residual value and scrap value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

24

Land improvements include

A)fences.

B)trees and shrubs.

C)outdoor lighting.

D)All of the above.

A)fences.

B)trees and shrubs.

C)outdoor lighting.

D)All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

25

Depreciable cost equals

A)cost less accumulated depreciation.

B)book value less residual value.

C)cost less residual value.

D)market value less residual value.

A)cost less accumulated depreciation.

B)book value less residual value.

C)cost less residual value.

D)market value less residual value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following is NOT characteristic of the accumulated depreciation account?

A)Accumulated depreciation represents cash reserved for asset replacement.

B)Accumulated depreciation is a contra-asset account.

C)Accumulated depreciation may be disclosed in the notes to the financial statements.

D)All of these are characteristic of the accumulated depreciation account.

A)Accumulated depreciation represents cash reserved for asset replacement.

B)Accumulated depreciation is a contra-asset account.

C)Accumulated depreciation may be disclosed in the notes to the financial statements.

D)All of these are characteristic of the accumulated depreciation account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following is an example of a capital expenditure?

A)Cleaning the carpet in the front room

B)Tune-up for a company truck

C)Replacing an engine in a company car

D)Replacing all burned-out light bulbs in the factory

A)Cleaning the carpet in the front room

B)Tune-up for a company truck

C)Replacing an engine in a company car

D)Replacing all burned-out light bulbs in the factory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which method of depreciation considers residual value in computing the normal periodic depreciation?

A)Straight-line

B)MACRS

C)Double-declining-balance

D)All of these

A)Straight-line

B)MACRS

C)Double-declining-balance

D)All of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

29

The removal of an old building to make the land ready for its intended use is charged to

A)land.

B)land improvements.

C)buildings.

D)operating expenses.

A)land.

B)land improvements.

C)buildings.

D)operating expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following expenditures would NOT be included in the cost of an asset?

A)Freight costs

B)Vandalism

C)Sales tax

D)Surveying fees

A)Freight costs

B)Vandalism

C)Sales tax

D)Surveying fees

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

31

If a capital expenditure is treated as a revenue expenditure,then

A)expenses are overstated and owners' equity is understated.

B)expenses are overstated and assets are overstated.

C)expenses are understated and owners' equity is overstated.

D)net income is overstated and owners' equity is understated.

A)expenses are overstated and owners' equity is understated.

B)expenses are overstated and assets are overstated.

C)expenses are understated and owners' equity is overstated.

D)net income is overstated and owners' equity is understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

32

A company acquired some land for $80,000 to construct a new office complex.Legal fees paid were $2,300,delinquent taxes assumed were $3,400,and $5,850 was paid to remove an old building from which salvaged materials sold for $1,950.What is the cost basis for the land?

A)$93,500

B)$91,550

C)$85,700

D)$89,600

A)$93,500

B)$91,550

C)$85,700

D)$89,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

33

Fixed assets may be shown at book value on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

34

A capital expenditure would appear on the

A)income statement under operating expenses.

B)balance sheet under fixed assets.

C)balance sheet under current assets.

D)income statement under other expenses.

A)income statement under operating expenses.

B)balance sheet under fixed assets.

C)balance sheet under current assets.

D)income statement under other expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

35

Other descriptive titles for fixed assets would include

A)plant assets.

B)property,plant,and equipment.

C)other long-term assets

D)both plant assets and property,plant,and equipment.

A)plant assets.

B)property,plant,and equipment.

C)other long-term assets

D)both plant assets and property,plant,and equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following should be included in the acquisition cost of a piece of equipment?

A)Transportation costs

B)Installation costs

C)Testing costs prior to placing the equipment into production

D)All of these

A)Transportation costs

B)Installation costs

C)Testing costs prior to placing the equipment into production

D)All of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

37

Book value is defined as

A)current market value less residual value.

B)cost less residual value.

C)current market value less accumulated depreciation.

D)cost less accumulated depreciation.

A)current market value less residual value.

B)cost less residual value.

C)current market value less accumulated depreciation.

D)cost less accumulated depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

38

Expenditures that add to the utility of fixed assets for more than one accounting period are

A)committed expenditures.

B)revenue expenditures.

C)current expenditures.

D)capital expenditures.

A)committed expenditures.

B)revenue expenditures.

C)current expenditures.

D)capital expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

39

What type of depreciation occurs when an asset can no longer provide services at the level originally intended?

A)Physical depreciation

B)Market depreciation

C)Cost depreciation

D)Functional depreciation

A)Physical depreciation

B)Market depreciation

C)Cost depreciation

D)Functional depreciation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following is NOT a fixed asset?

A)Equipment

B)Buildings

C)Land held for investment

D)All of these are fixed assets.

A)Equipment

B)Buildings

C)Land held for investment

D)All of these are fixed assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

41

The Drilling Company purchased a mining site for $500,000 on July 1,2010.The company expects to mine ore for the next 10 years and anticipates that a total of 100,000 tons will be recovered.The estimated residual value of the property is $80,000.During 2010 the company extracted 6,500 tons of ore.The depletion expense for 2010 is

A)$37,700.

B)$42,000.

C)$32,500.

D)$27,300.

A)$37,700.

B)$42,000.

C)$32,500.

D)$27,300.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

42

Equipment was purchased for $18,000.It has a useful life of 5 years and a residual value of $2,000.What is depreciation expense for year one under the double-declining-balance method?

A)$6,400

B)$3,200

C)$7,200

D)$3,600

A)$6,400

B)$3,200

C)$7,200

D)$3,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

43

A fully depreciated asset must be

A)removed from the books.

B)kept on the books until sold or discarded.

C)disclosed only in the notes to the financial statements.

D)recognized on the income statement as a loss.

A)removed from the books.

B)kept on the books until sold or discarded.

C)disclosed only in the notes to the financial statements.

D)recognized on the income statement as a loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

44

A company purchased an oil well for $25 million with a residual value of $500,000.It is estimated that 10 million barrels can be extracted from the well.Determine depletion expense assuming 3 million barrels are extracted and sold.

A)$7,350,000

B)$7,500,000

C)$5,000,000

D)$7,650,000

A)$7,350,000

B)$7,500,000

C)$5,000,000

D)$7,650,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

45

A company sold office furniture costing $16,500 with accumulated depreciation of $14,000 for $1,800 cash.The entry to record the sale would include

A)a loss for $700.

B)an increase in accumulated depreciation for $14,000.

C)a decrease in office furniture for $2,500.

D)a decrease in cash for $1,800.

A)a loss for $700.

B)an increase in accumulated depreciation for $14,000.

C)a decrease in office furniture for $2,500.

D)a decrease in cash for $1,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

46

A company sold a delivery truck for $18,000 cash.The truck cost $47,500 and had accumulated depreciation of $36,000 as of the date of sale.The entry to record the sale would include

A)an increase in accumulated depreciation for $36,000.

B)a decrease in delivery truck for $11,500.

C)a loss for $6,500.

D)a gain for $6,500.

A)an increase in accumulated depreciation for $36,000.

B)a decrease in delivery truck for $11,500.

C)a loss for $6,500.

D)a gain for $6,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

47

Computer equipment was acquired at the beginning of the year at a cost of $56,000 with an estimated residual value of $5,000 and an estimated useful life of 5 years.Determine the second year's depreciation using straight-line depreciation.

A)$10,200

B)$22,400

C)$11,200

D)$12,200

A)$10,200

B)$22,400

C)$11,200

D)$12,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

48

Equipment was purchased for $30,000.It has a useful life of 5 years and a residual value of $4,000.What is depreciation expense for year two under the double-declining-balance method?

A)$5,200

B)$6,000

C)$6,240

D)$7,200

A)$5,200

B)$6,000

C)$6,240

D)$7,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

49

To measure depreciation,all of the following must be known EXCEPT

A)market value.

B)residual value.

C)historical cost.

D)estimated life.

A)market value.

B)residual value.

C)historical cost.

D)estimated life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

50

A gain is recorded on the sale of fixed assets when

A)the asset is sold for a price less than its book value.

B)the asset's book value is less than the cash received.

C)accumulated depreciation is less than the cash received.

D)None of the above.

A)the asset is sold for a price less than its book value.

B)the asset's book value is less than the cash received.

C)accumulated depreciation is less than the cash received.

D)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

51

A machine with a useful life of 10 years and a residual value of $4,000 was purchased for $30,000.What is annual depreciation under the straight-line method?

A)$3,000

B)$3,400

C)$2,600

D)$5,200

A)$3,000

B)$3,400

C)$2,600

D)$5,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

52

Accelerated depreciation is primarily used for

A)the financial statements of large companies.

B)the financial statements of small companies.

C)income tax purposes.

D)both financial reporting and income taxes by most companies.

A)the financial statements of large companies.

B)the financial statements of small companies.

C)income tax purposes.

D)both financial reporting and income taxes by most companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

53

The process of transferring the cost of metal ores and other minerals removed from the earth to an expense account is called

A)depletion.

B)deferral.

C)amortization.

D)depreciation.

A)depletion.

B)deferral.

C)amortization.

D)depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

54

If a fixed asset is sold and the book value is less than cash received,the company must

A)recognize a loss on the income statement under other expenses.

B)recognize a loss on the income statement under operating expenses.

C)recognize a gain on the income statement under other revenues.

D)Gains and losses are not to be recognized upon the sell of fixed assets.

A)recognize a loss on the income statement under other expenses.

B)recognize a loss on the income statement under operating expenses.

C)recognize a gain on the income statement under other revenues.

D)Gains and losses are not to be recognized upon the sell of fixed assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

55

On September 1,a machine with a useful life of 8 years and a residual value of $3,000 was purchased for $47,000.What is depreciation expense in the year of purchase under straight-line depreciation assuming a December 31 year-end?

A)$3,917

B)$3,667

C)$1,958

D)$1,833

A)$3,917

B)$3,667

C)$1,958

D)$1,833

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

56

A machine was purchased for $60,000.It has a useful life of 5 years and a residual value of $6,000.Under the straight-line method,what is annual depreciation expense?

A)$13,200

B)$12,000

C)$11,000

D)$10,800

A)$13,200

B)$12,000

C)$11,000

D)$10,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

57

Recording depreciation

A)decreases net income and cash flows.

B)decreases net income and has no effect on cash flows.

C)decreases net income,assets,and cash flows.

D)decreases net income and has no effect on assets and cash flows.

A)decreases net income and cash flows.

B)decreases net income and has no effect on cash flows.

C)decreases net income,assets,and cash flows.

D)decreases net income and has no effect on assets and cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

58

The accounting term depreciation measures

A)an asset's market value decline.

B)the amount of cash a company sets aside for asset replacement.

C)the amount of asset cost allocated to expense over periods benefited.

D)anticipated losses if sold in the used market.

A)an asset's market value decline.

B)the amount of cash a company sets aside for asset replacement.

C)the amount of asset cost allocated to expense over periods benefited.

D)anticipated losses if sold in the used market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

59

If a fixed asset with an original cost of $18,000 and accumulated depreciation of $2,000 is sold for $15,000,the company must

A)recognize a loss on the income statement under other expenses.

B)recognize a loss on the income statement under operating expenses.

C)recognize a gain on the income statement under other revenues.

D)Gains and losses are not to be recognized upon the sell of fixed assets.

A)recognize a loss on the income statement under other expenses.

B)recognize a loss on the income statement under operating expenses.

C)recognize a gain on the income statement under other revenues.

D)Gains and losses are not to be recognized upon the sell of fixed assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

60

A fixed asset with a cost of $30,000 and accumulated depreciation of $25,000 is sold for $3,500.What is the amount of the gain or loss on disposal of the fixed asset?

A)$2,500 loss

B)$1,500 loss

C)$2,500 gain

D)$1,500 gain

A)$2,500 loss

B)$1,500 loss

C)$2,500 gain

D)$1,500 gain

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

61

Fixed assets are ordinarily presented in the balance sheet

A)at current market values.

B)at replacement costs.

C)at cost less accumulated depreciation.

D)in a separate section along with intangible assets.

A)at current market values.

B)at replacement costs.

C)at cost less accumulated depreciation.

D)in a separate section along with intangible assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following is NOT an intangible asset?

A)Goodwill

B)Trademark

C)Copyrights

D)Long-term receivable

A)Goodwill

B)Trademark

C)Copyrights

D)Long-term receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

63

A company purchased a photocopy machine for $16,000.It has a useful life of 4 years and a residual value of $1,000.Compute depreciation for the second year under each of the following methods: (a)straight-line and (b)double-declining-balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

64

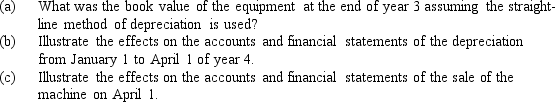

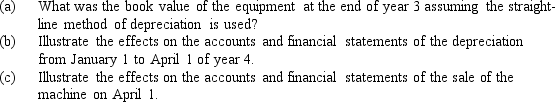

A machine with a useful life of 6 years and a residual value of $3,000 was purchased at the beginning of year 1 for $30,000.The machine was sold for $15,000 on April 1 in year 4.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

65

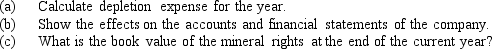

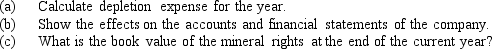

A company acquired mineral rights for $7,500,000.The mineral deposit is estimated at 600,000 tons and during the year 100,000 tons were extracted and sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

66

The cost of a patent should be amortized

A)over 20 years.

B)over its economic life.

C)over 20 years or its economic life,whichever is shorter.

D)only if an impairment occurs.

A)over 20 years.

B)over its economic life.

C)over 20 years or its economic life,whichever is shorter.

D)only if an impairment occurs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

67

Expenditures for research and development are generally recorded as

A)current operating expenses.

B)assets and amortized over their estimated useful life.

C)assets and amortized over 40 years.

D)current assets.

A)current operating expenses.

B)assets and amortized over their estimated useful life.

C)assets and amortized over 40 years.

D)current assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

68

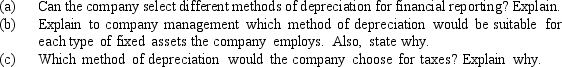

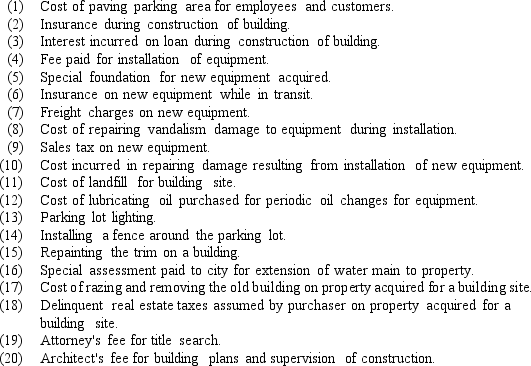

You have been hired by a high-growth startup company to assist in the determination of what depreciation method to employ for financial reporting.The company's fixed assets are equally divided among buildings and high-tech equipment (heavily used in the initial years).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

69

Intangible assets are used in operations but

A)cannot be specifically identified.

B)cannot be sold.

C)lack physical substance.

D)cannot be long-lived.

A)cannot be specifically identified.

B)cannot be sold.

C)lack physical substance.

D)cannot be long-lived.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

70

NBC Company purchased a patent from ABC for $144,000.At the time of purchase the patent had been in existence for 10 years.What is the first year's amortization?

A)$7,200

B)$18,000

C)$12,000

D)$14,400

A)$7,200

B)$18,000

C)$12,000

D)$14,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

71

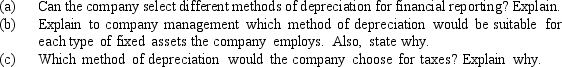

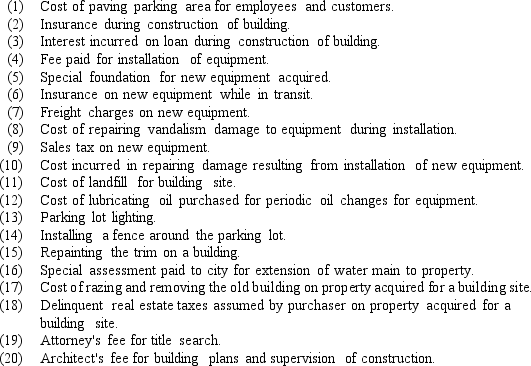

Identify each of the following expenditures as chargeable to (a)Land, (b)Land Improvements, (c)Buildings, (d)Machinery and Equipment,or (e)other account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

72

A patent was purchased for $670,000 with a legal life of 20 years.Management estimates that the patent has an 12-year economic life.The entry to record amortization would include

A)an increase in amortization expense for $33,500.

B)an increase in research and development expense for $670,000.

C)a decrease in patent for $55,833.

D)an increase in accumulated amortization for $670,000.

A)an increase in amortization expense for $33,500.

B)an increase in research and development expense for $670,000.

C)a decrease in patent for $55,833.

D)an increase in accumulated amortization for $670,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

73

Goodwill is

A)amortized similar to other intangibles.

B)only written down if an impairment in value occurs.

C)charged to expense immediately.

D)amortized over 40 years or its economic life,whichever is shorter.

A)amortized similar to other intangibles.

B)only written down if an impairment in value occurs.

C)charged to expense immediately.

D)amortized over 40 years or its economic life,whichever is shorter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

74

Equipment with a useful life of 5 years and a residual value of $6,000 was purchased on January 3,2006,for $48,500.The machine was sold on January 5,2011,for $13,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

75

A pressurized spray painter was purchased on April 1 of the fiscal year for $3,900.It has a useful life of 4 years and a residual value of $300.Determine depreciation expense for the first two years,assuming a fiscal year end of December 31 and using (a)the straight-line method and (b)the double-declining-balance method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

76

A company acquired a truck for $79,000 at the beginning of the fiscal year.It has a useful life of 5 years and a residual value of $9,000.The company uses the straight-line method of depreciation.After owning the truck for two years,the company sold it for $34,000.(a)Determine depreciation expense for each of the first two years,and (b)determine the gain or loss resulting from the sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

77

Cook Co.incurred the following costs related to the office building used in operating its sports supply company:

Classify each of the costs as a capital expenditure or a revenue expenditure.For those costs identified as capital expenditures,classify each as an additional or replacement component.

Classify each of the costs as a capital expenditure or a revenue expenditure.For those costs identified as capital expenditures,classify each as an additional or replacement component.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

78

The exclusive right to use a certain name or symbol is called a

A)franchise.

B)patent.

C)trademark.

D)copyright.

A)franchise.

B)patent.

C)trademark.

D)copyright.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

79

A company made some expensive repairs to equipment and buildings during the past year.(a)What criteria is used in determining whether the repairs are capital expenditures or revenue expenditures,and (b)what is the effect on the company's financial statements if they are incorrectly recorded as capital expenditures?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which intangible assets are amortized over their useful life?

A)Trademarks

B)Goodwill

C)Patents

D)All of these

A)Trademarks

B)Goodwill

C)Patents

D)All of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck