Deck 5: Employee Net Pay and Pay Methods

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

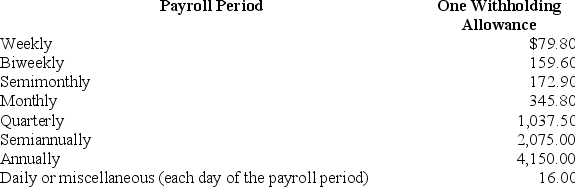

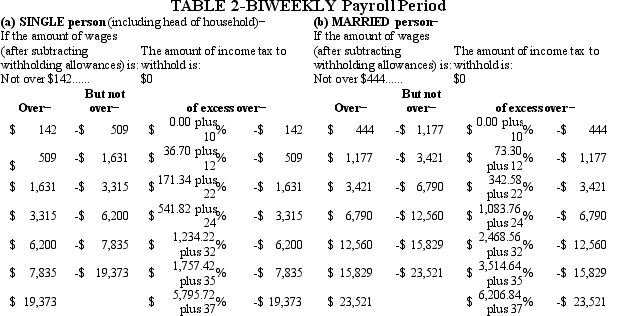

سؤال

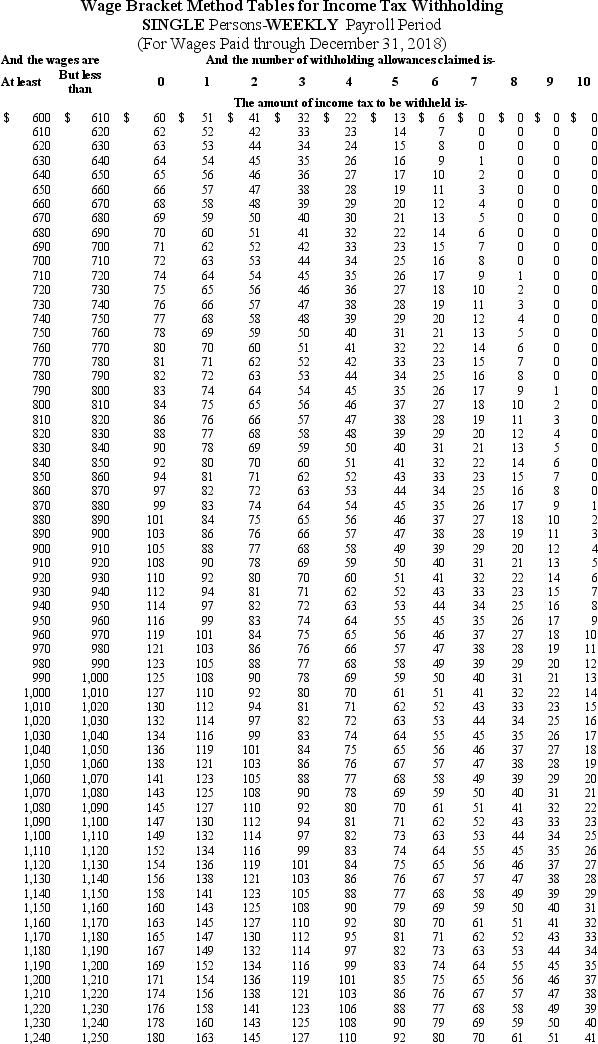

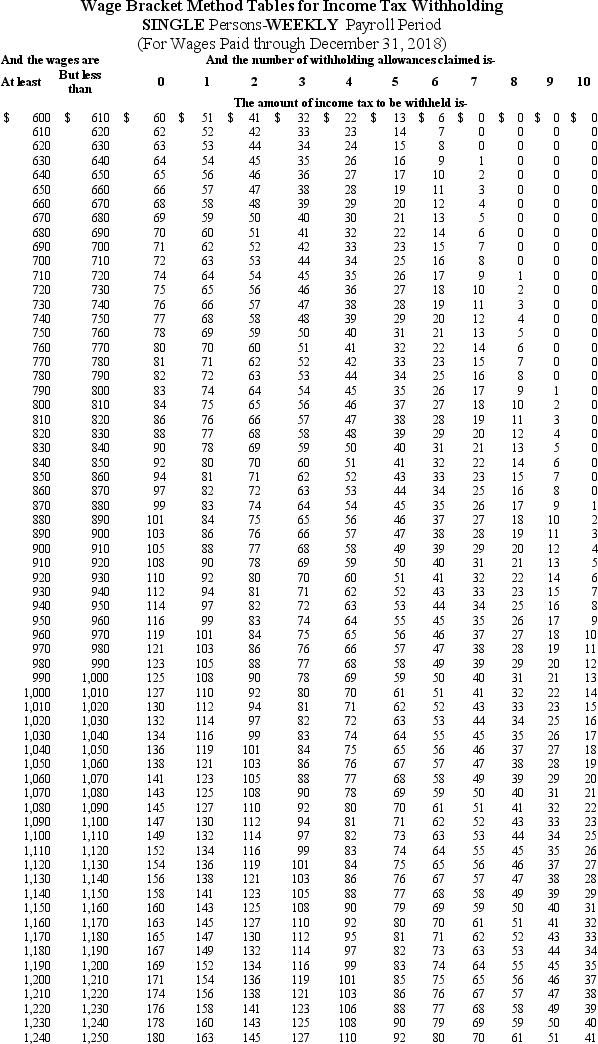

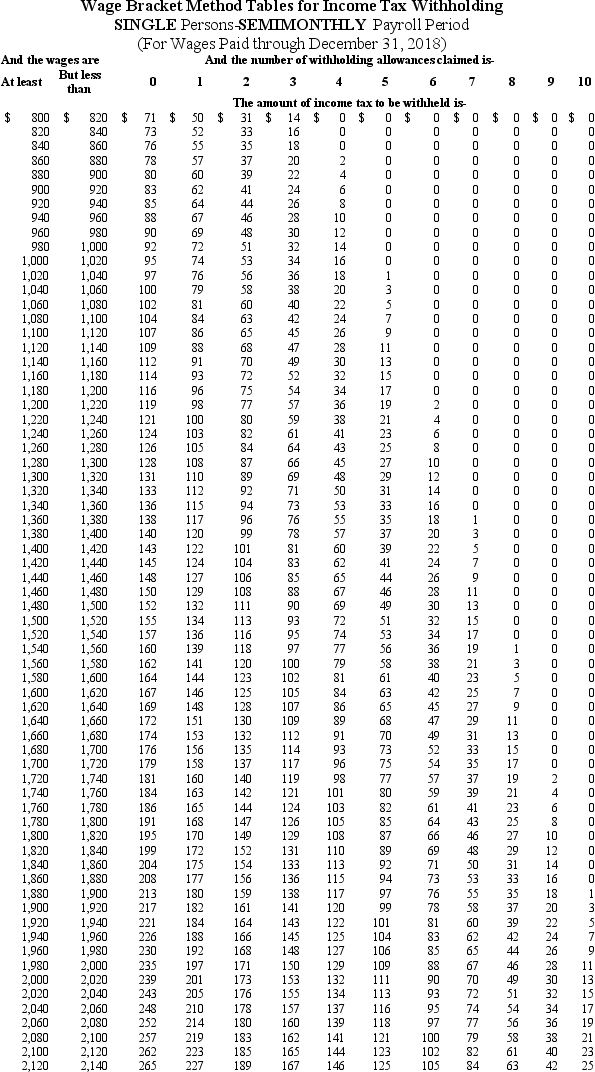

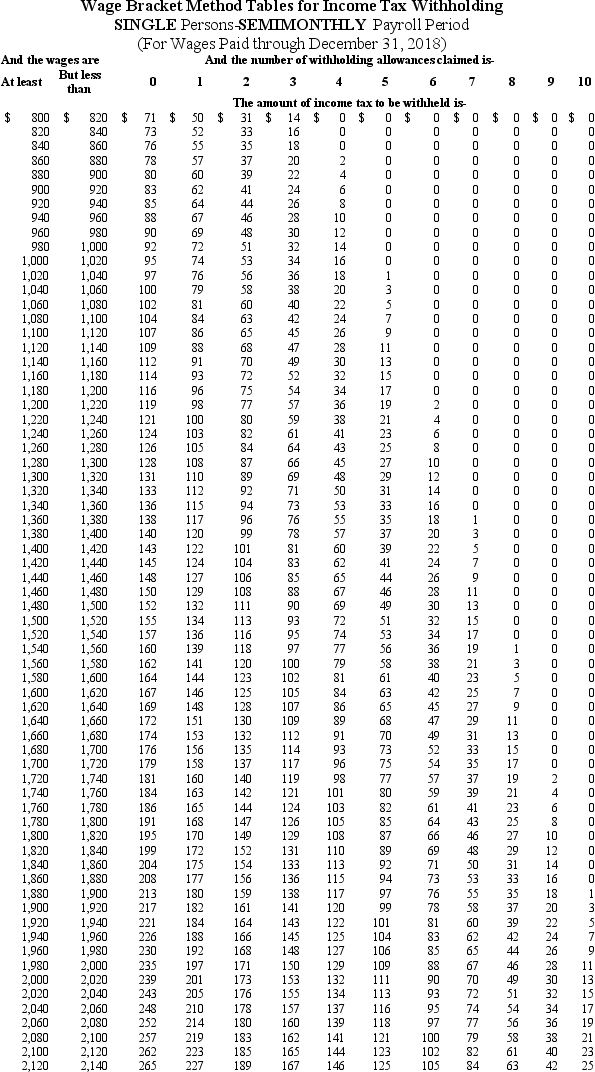

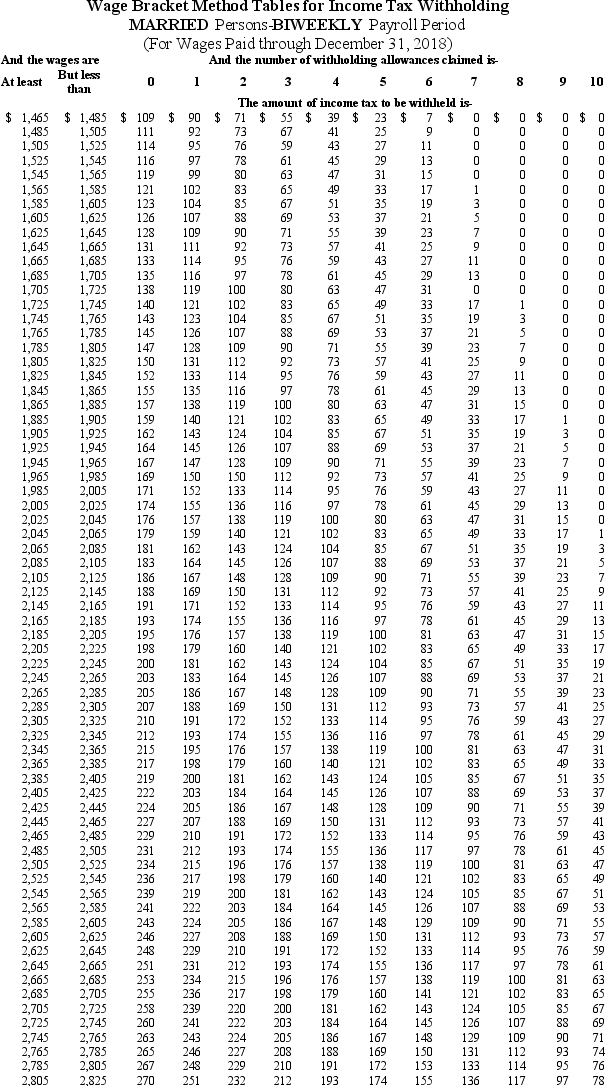

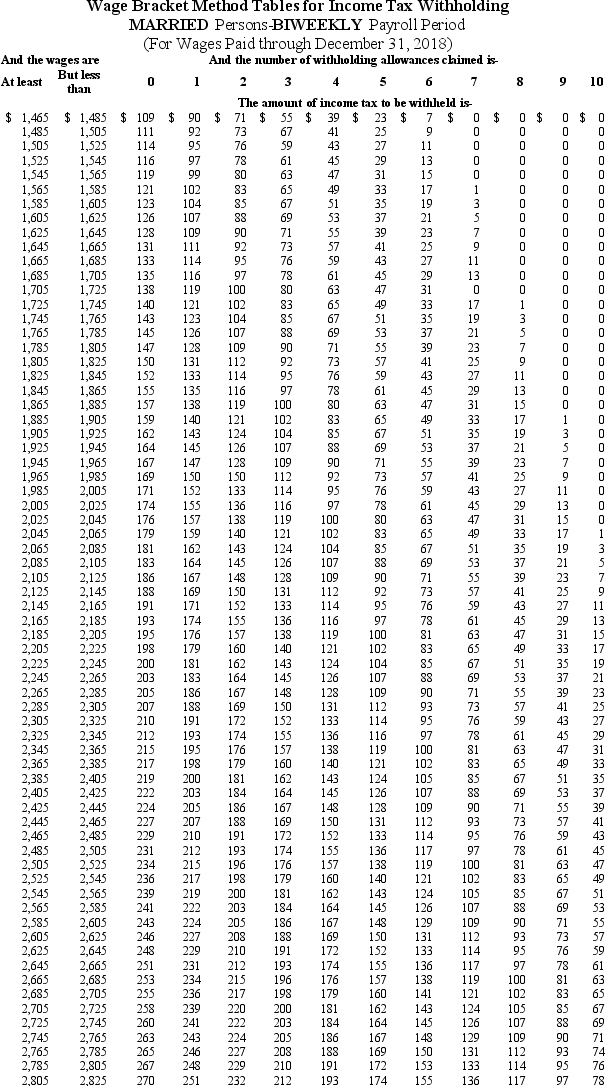

سؤال

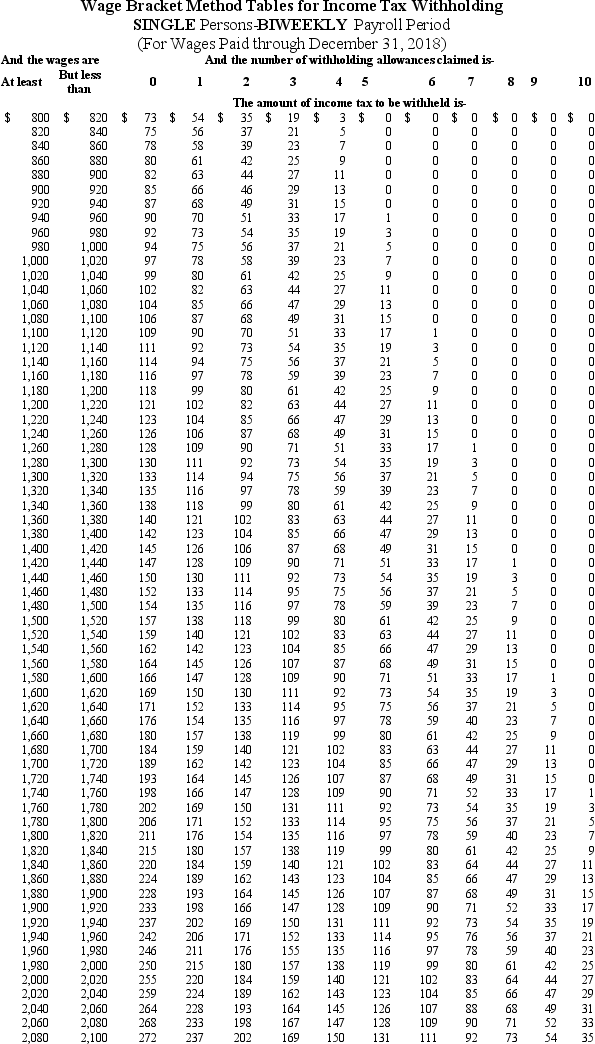

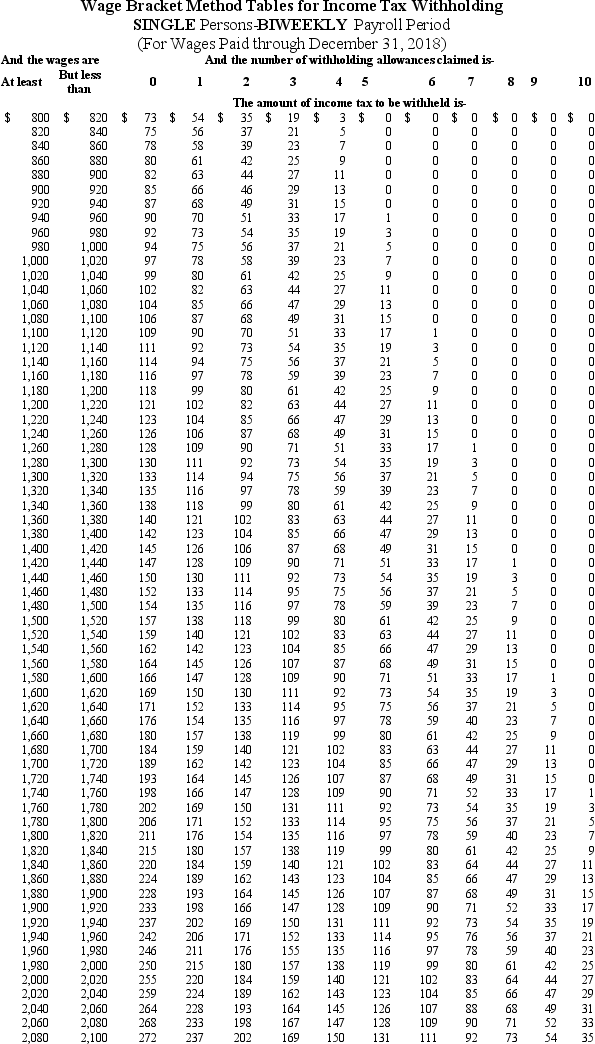

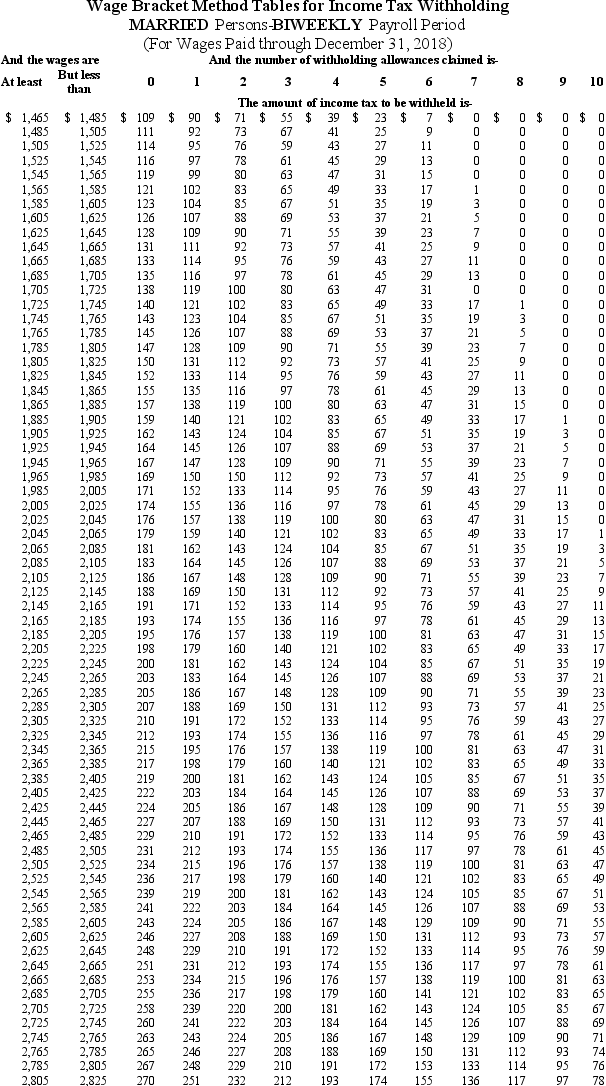

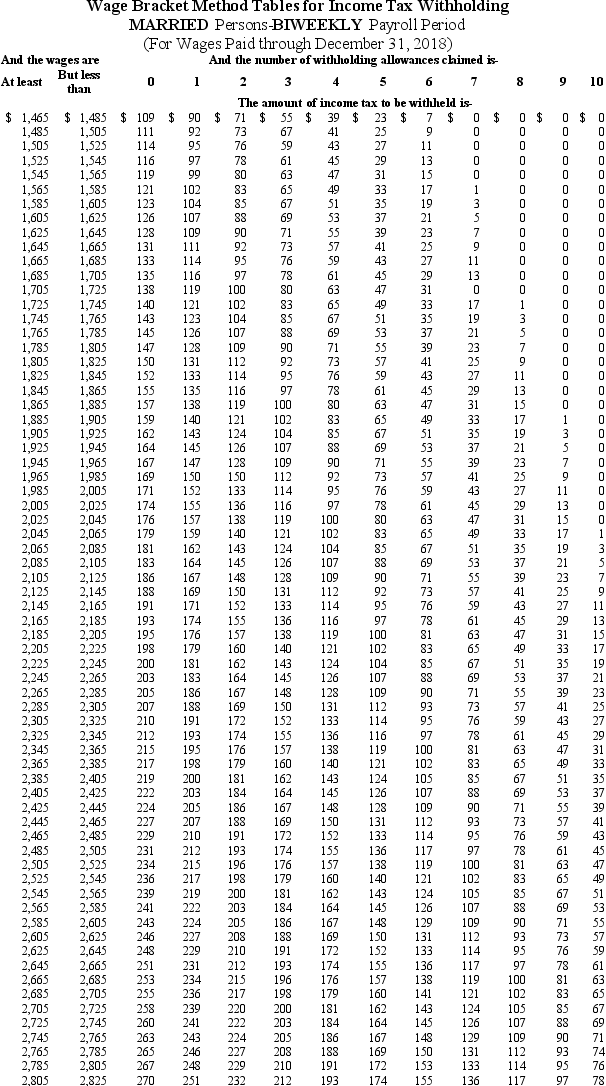

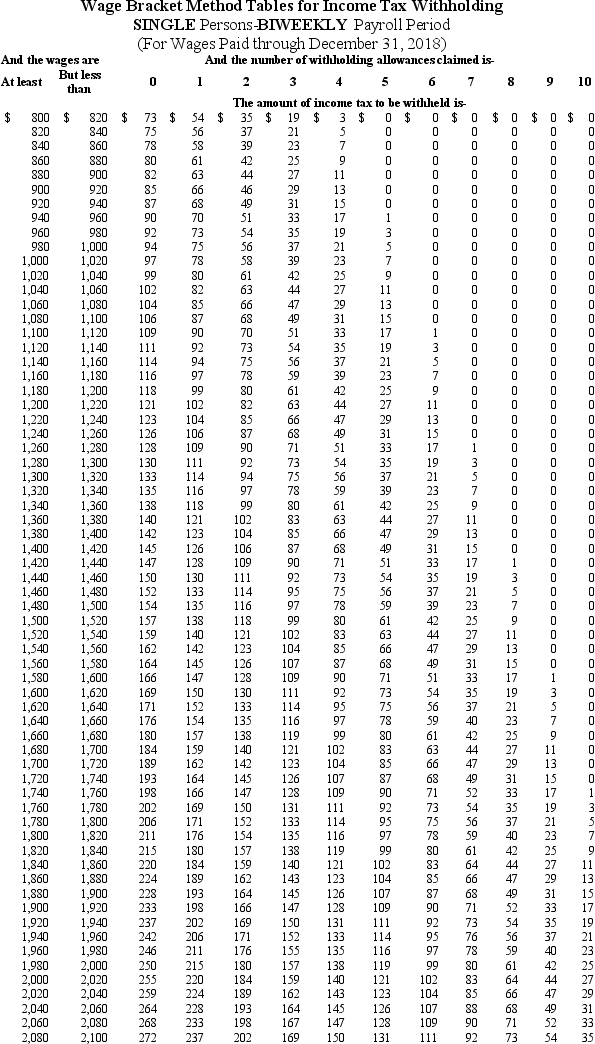

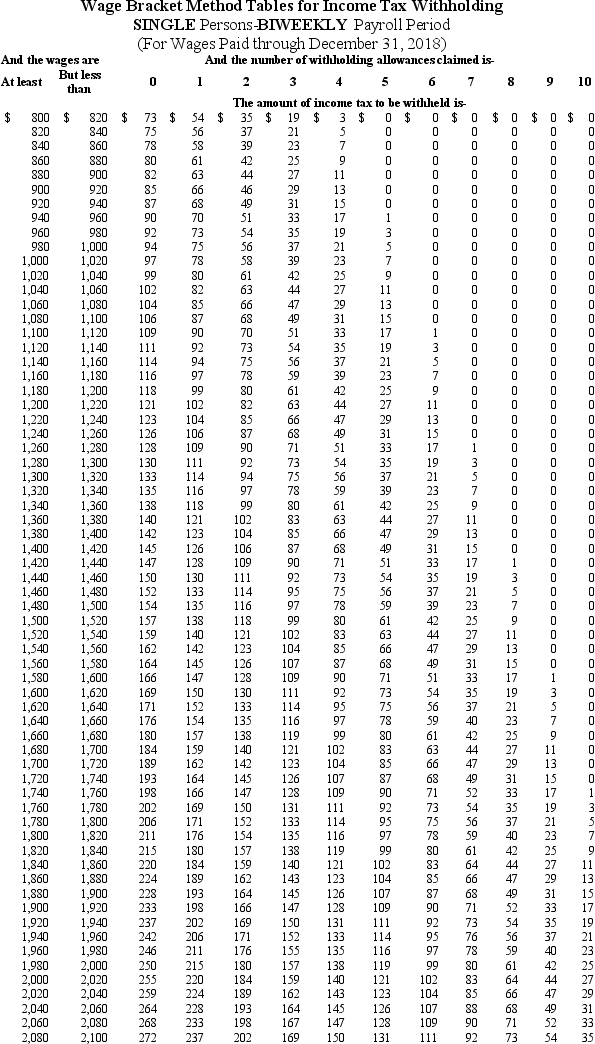

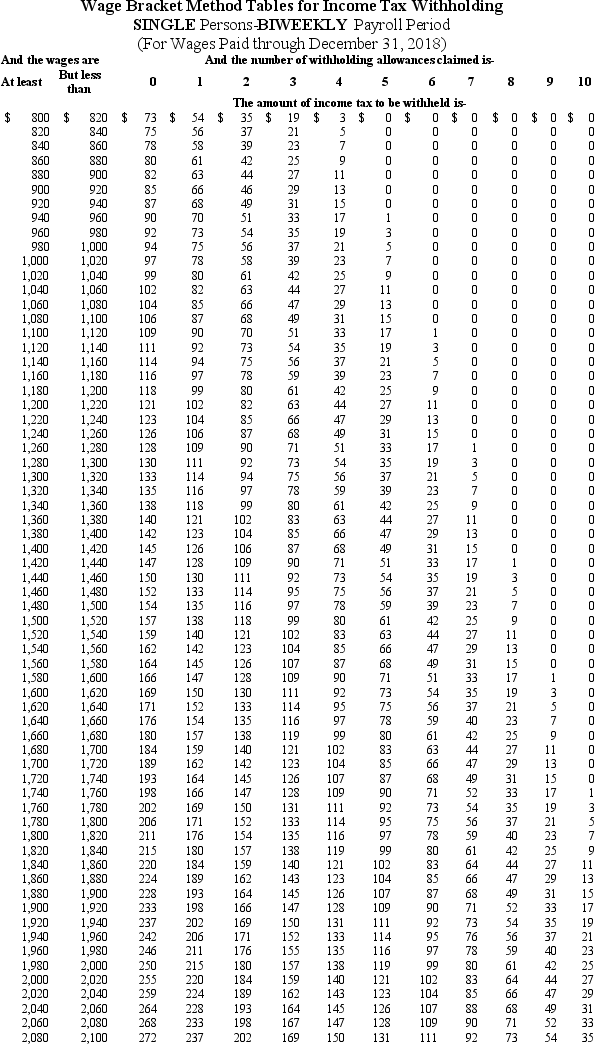

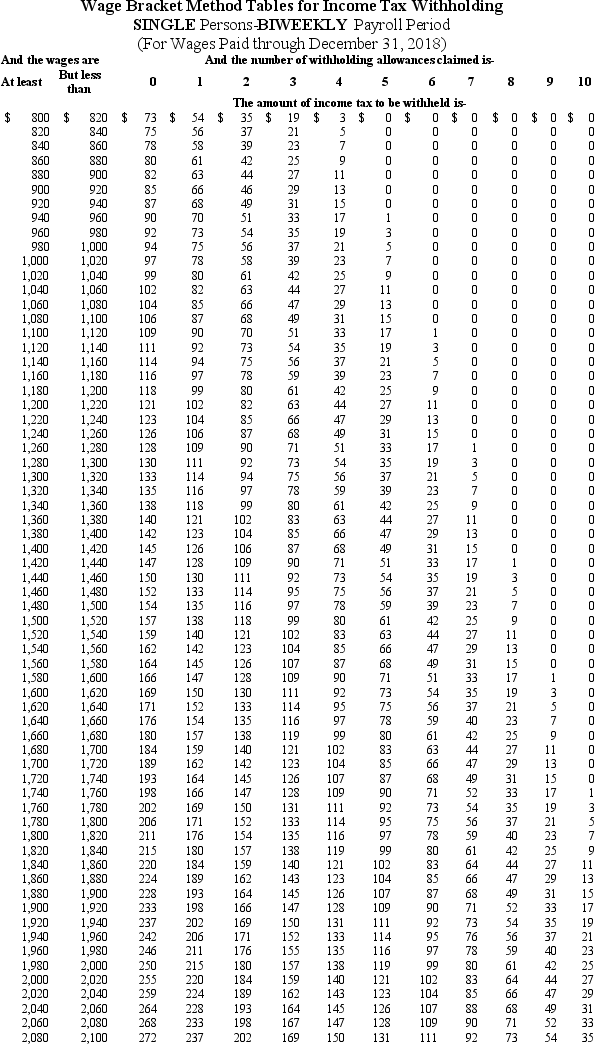

سؤال

سؤال

سؤال

سؤال

سؤال

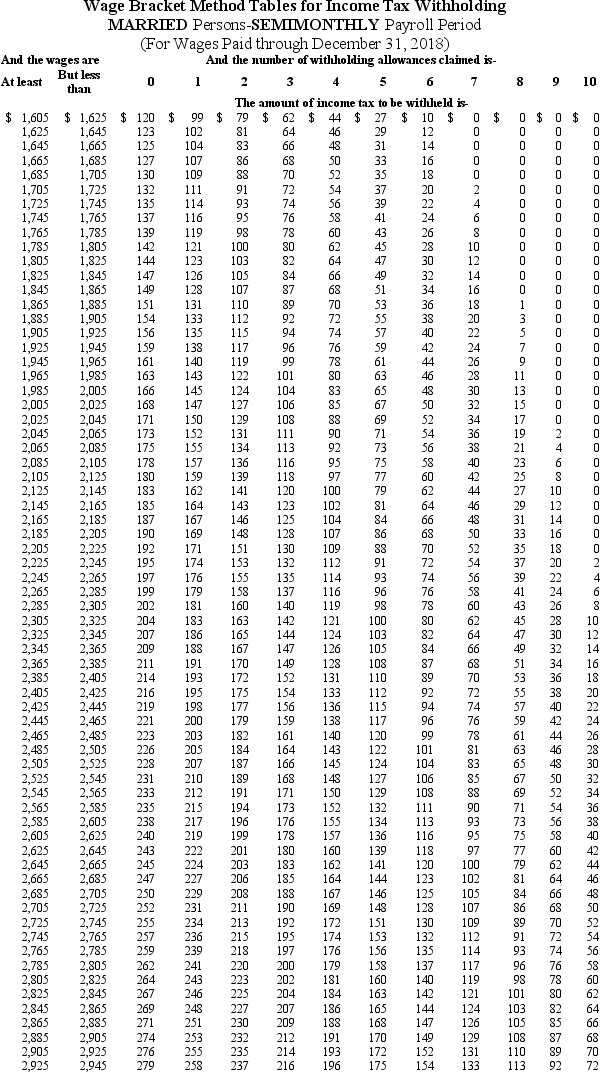

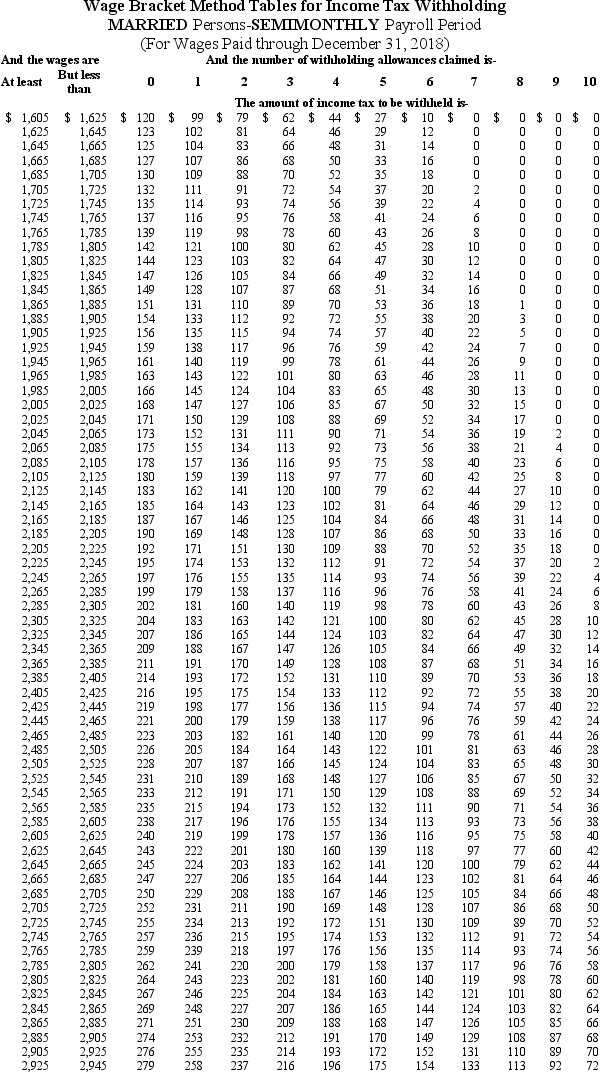

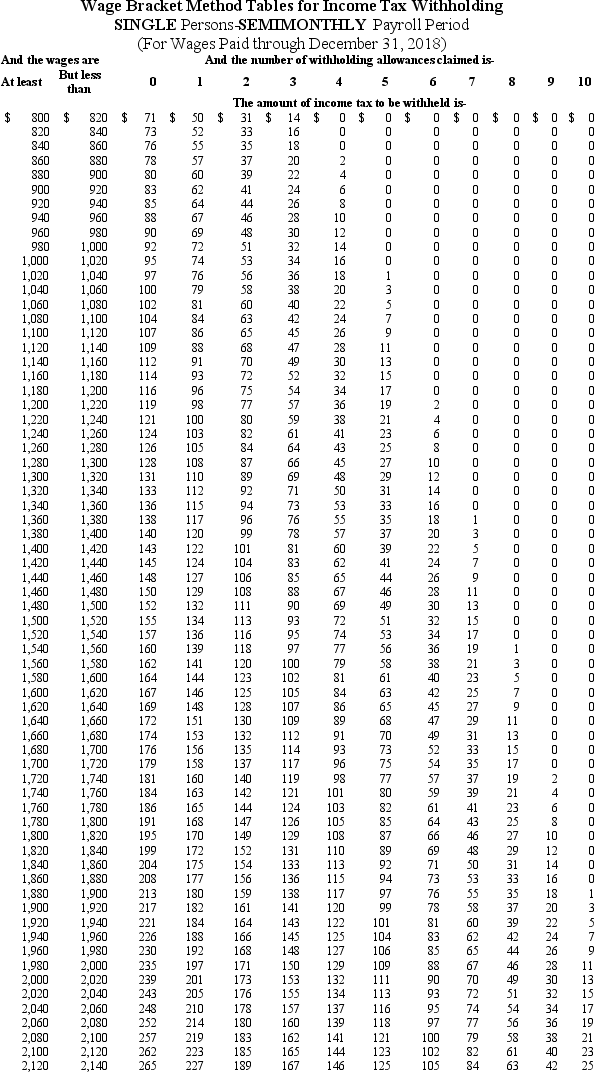

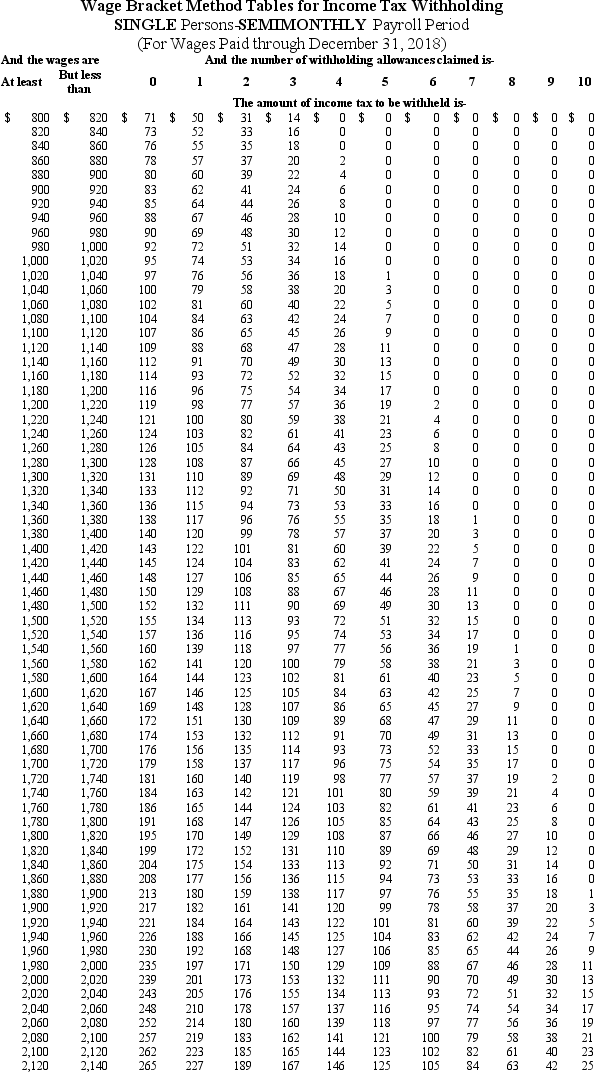

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/70

العب

ملء الشاشة (f)

Deck 5: Employee Net Pay and Pay Methods

1

Which of the following states do not have state income tax deducted from employee pay? (You may select more than one answer. )

A)Montana

B)Alaska

C)Maine

D)New Hampshire

A)Montana

B)Alaska

C)Maine

D)New Hampshire

B,D

2

Which of the following federal withholding allowance scenarios will have the highest income tax?

A)Single,1 allowance

B)Married,3 allowances

C)Single,5 allowances

D)Married,0 allowances

A)Single,1 allowance

B)Married,3 allowances

C)Single,5 allowances

D)Married,0 allowances

A

3

Computation of net pay involves deducting mandatory and voluntary deductions from gross pay.

True

4

A firm has headquarters in Indiana,but has offices in California and Utah.For employee taxation purposes,it may choose which of those three states income tax laws it wishes to use.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following statements is/are true about Social Security tax deductions from gross pay? (You may select more than one answer. )

A)Section 125 deductions are not subject to Social Security tax.

B)The tax rate is 6.0%.

C)The tax is computed on all earnings.

D)The wage base is $128,400.

A)Section 125 deductions are not subject to Social Security tax.

B)The tax rate is 6.0%.

C)The tax is computed on all earnings.

D)The wage base is $128,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following is used in the determination of the amount of federal income tax to be withheld from an employee per pay period? (You may select more than one answer. )

A)Date of birth

B)Period salary

C)Marital status

D)Prior year's tax return

A)Date of birth

B)Period salary

C)Marital status

D)Prior year's tax return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

7

The amount of federal income tax withheld decreases as the number of allowances increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which are steps in the net pay computation process? (You may select more than one answer. )

A)Update employee records.

B)Report fringe benefit balances.

C)Compute gross pay.

D)Compute taxes to be withheld.

A)Update employee records.

B)Report fringe benefit balances.

C)Compute gross pay.

D)Compute taxes to be withheld.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

9

Federal income tax,Medicare tax,and Social Security tax amounts withheld from employee pay are computed based on gross pay,less pre-tax deductions,and deducted to arrive at net pay.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

10

Social Security tax has a wage base,which is the minimum amount an employee must earn before they will have the Social Security tax deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

11

The wage-bracket of determining federal tax withholding yields more accurate amounts than the percentage method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following statements is/are true about Medicare tax? (You may select more than one answer. )

A)All employee earnings less pre-tax deductions are subject to Medicare tax.

B)Employers match all Medicare taxes withheld.

C)The Medicare tax rate is 1.45%.

D)Additional Medicare tax is withheld for employees who earn more than $150,000 annually.

A)All employee earnings less pre-tax deductions are subject to Medicare tax.

B)Employers match all Medicare taxes withheld.

C)The Medicare tax rate is 1.45%.

D)Additional Medicare tax is withheld for employees who earn more than $150,000 annually.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

13

The regular Medicare tax deduction is 1.45% for employee and employer and must be paid by all employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

14

What role does the employer play regarding an employee's federal withholding tax?

A)Collector and depositor

B)Reporter and depositor

C)Collector and verifier

D)Verifier and reporter

A)Collector and depositor

B)Reporter and depositor

C)Collector and verifier

D)Verifier and reporter

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

15

Charitable contributions are an example of post-tax voluntary deductions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

16

The use of paycards as a means of transmitting employee pay began in the 1990s with over-the-road drivers out of a need to transmit funds reliably on payday.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

17

What payroll-specific tool is used to facilitate computation of net pay?

A)Employee Information Form

B)Payroll Register

C)Form I-9

D)Supervisor Payroll Report

A)Employee Information Form

B)Payroll Register

C)Form I-9

D)Supervisor Payroll Report

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

18

Garnishments are court-ordered amounts that an employer must withhold from an employee's pre-tax pay and remit to the appropriate authority.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

19

Amity is an employee with a period gross pay of $2,000.She elects to have 3% of her gross pay withheld for her 401(k)contribution.What will be her taxable income be for federal income taxes?

A)$2,000

B)$1,970

C)$1,940

D)$1,910

A)$2,000

B)$1,970

C)$1,940

D)$1,910

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

20

How are income taxes and FICA taxes applied to grossed-up pay? (You may select more than one answer. )

A)Subtract the sum of the income tax rate and FICA tax rate from 100 percent.

B)Compute the sum of the income tax and FICA tax rates.

C)Divide the net pay by the net tax rate.

D)Multiply the gross pay by the sum of the income tax and FICA tax rates.

A)Subtract the sum of the income tax rate and FICA tax rate from 100 percent.

B)Compute the sum of the income tax and FICA tax rates.

C)Divide the net pay by the net tax rate.

D)Multiply the gross pay by the sum of the income tax and FICA tax rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

21

Jeannie is an adjunct faculty at a local college,where she earned $680.00 during the most recent semimonthly pay period.Her prior year-to-date pay is $18,540.She is single and has one withholding allowance.What is her Social Security tax for the pay period?

A)$48.02

B)$39.24

C)$44.18

D)$42.16

A)$48.02

B)$39.24

C)$44.18

D)$42.16

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

22

Wyatt is a full-time exempt music engineer who earns $130,000 annually and is paid semimonthly.As of December 15,his year-to-date gross pay was $124,583.33.How much will be withheld for FICA taxes for the December 31 pay date? (Social Security maximum wage is $128,400.Do not round intermediate calculations.Round your final answer to 2 decimal places. )

A)$335.83

B)$414.38

C)$352.88

D)$315.18

A)$335.83

B)$414.38

C)$352.88

D)$315.18

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

23

Disposable income is defined as:

A)An employee's net pay less living expenses like rent and utilities.

B)An employee's taxable income less Understand Post-Tax Deductions.

C)An employee's gross pay less Identify Pre-Tax Deductions.

D)An employee's pay after legally required deductions have been withheld.

A)An employee's net pay less living expenses like rent and utilities.

B)An employee's taxable income less Understand Post-Tax Deductions.

C)An employee's gross pay less Identify Pre-Tax Deductions.

D)An employee's pay after legally required deductions have been withheld.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

24

Steve is a full-time exempt employee at a local electricity co-operative.He earns an annual salary of $43,325 and is paid biweekly.What is his Social Security tax deduction for each pay period? (Do not round intermediate calculations.Round your final answer to 2 decimal places. )

A)$123.95

B)$103.31

C)$98.67

D)$106.34

A)$123.95

B)$103.31

C)$98.67

D)$106.34

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

25

Sammy contributes 4% of her salary to a 401(k)plan,$50 per pay period to a charitable contribution,$140 per pay period to union dues,and $50 per pay period to a section 125 qualified insurance plan offered by her employer.Which contributions must be taken on a post-tax basis? (You may select more than one answer. )

A)401(k)contribution

B)Section 125 insurance plan

C)Union dues

D)Charitable contribution

A)401(k)contribution

B)Section 125 insurance plan

C)Union dues

D)Charitable contribution

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

26

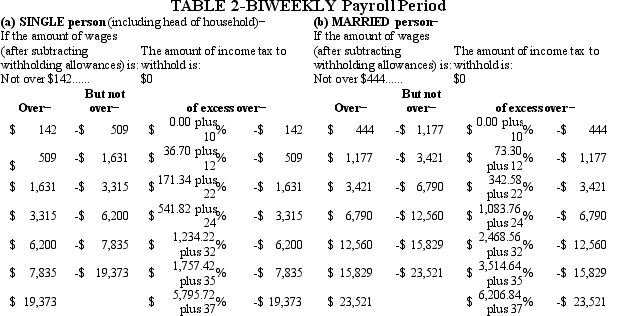

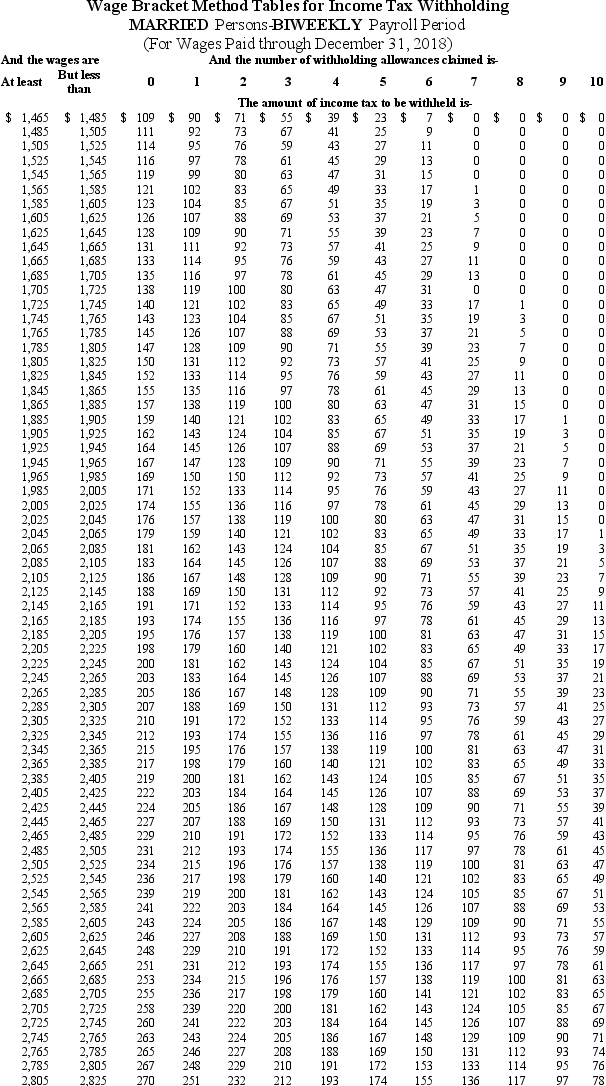

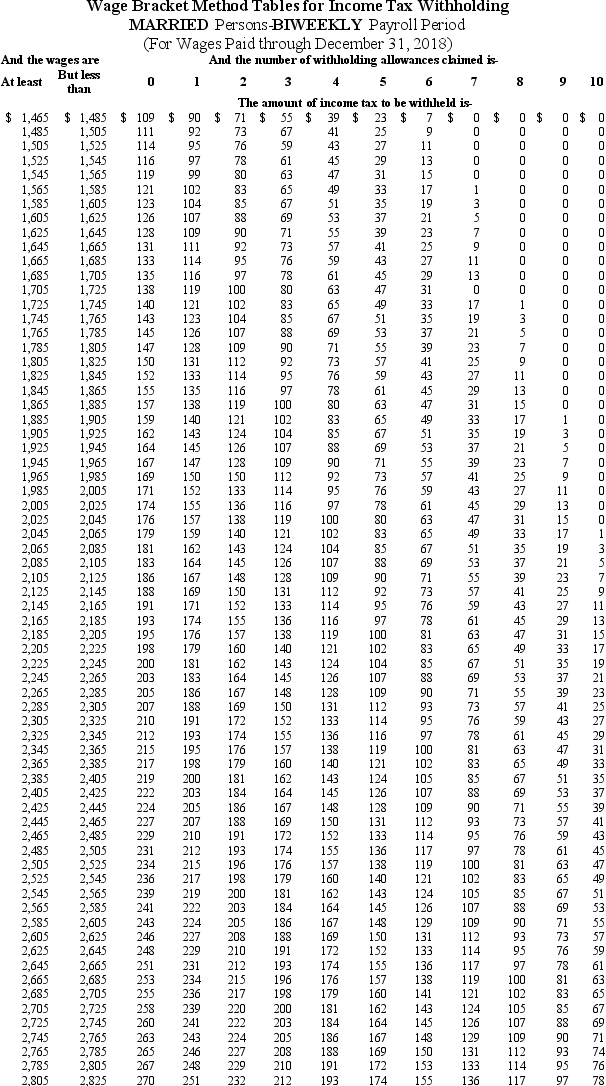

Warren is a married employee with six withholding allowances.During the most recent biweekly pay period,he earned $9,450.00.Using the percentage method,compute Warren's federal income tax.(Do not round intermediate calculations.Round your final answer to 2 decimal places. )

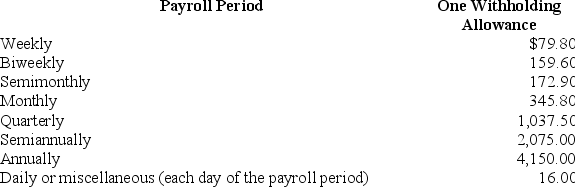

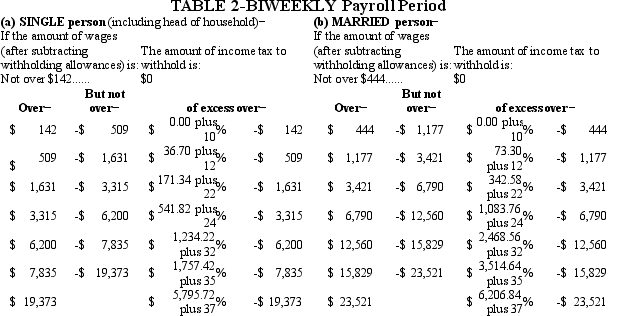

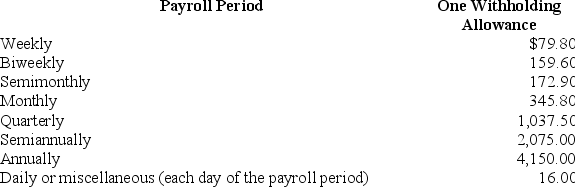

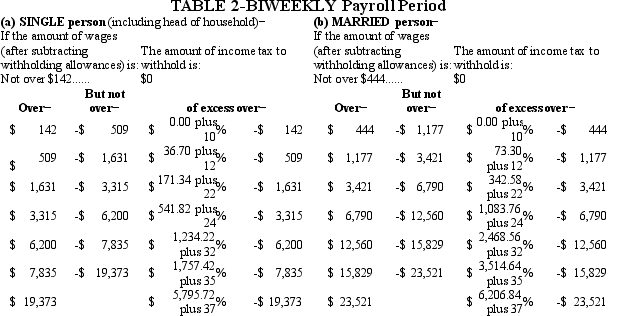

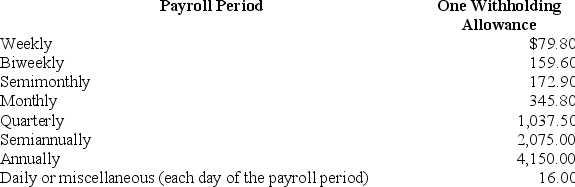

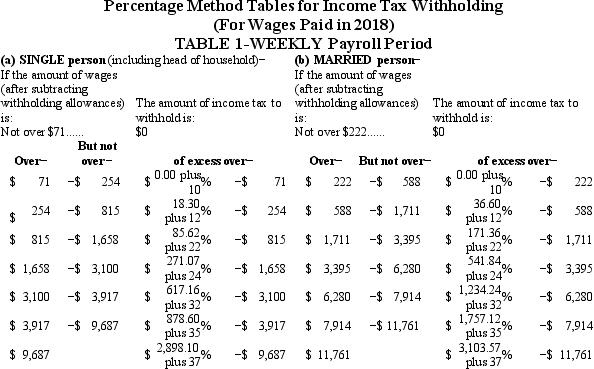

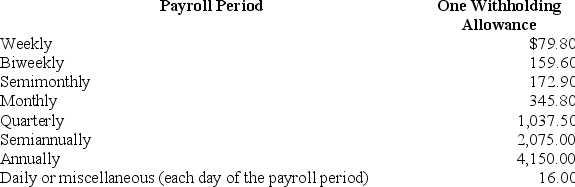

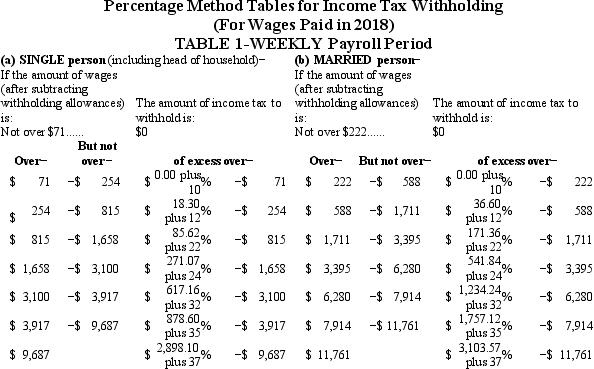

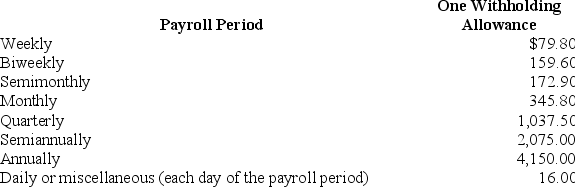

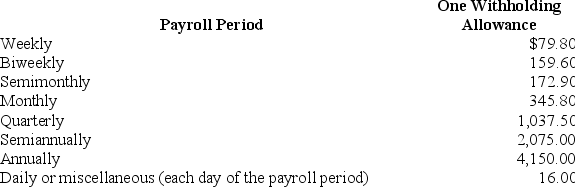

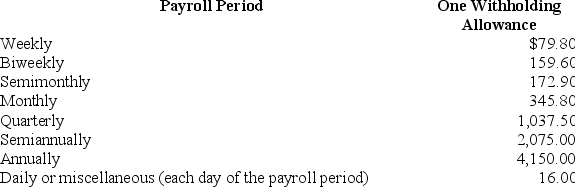

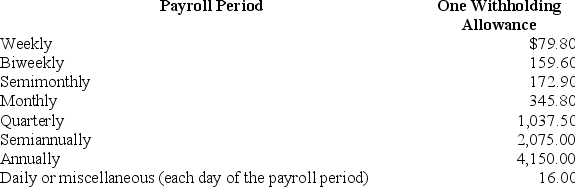

Table 5.Percentage Method-2018 Amount for one Withholding Allowance

A)$1,490.15

B)$1,456.90

C)$1,512.91

D)$1,492.34

Table 5.Percentage Method-2018 Amount for one Withholding Allowance

A)$1,490.15

B)$1,456.90

C)$1,512.91

D)$1,492.34

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

27

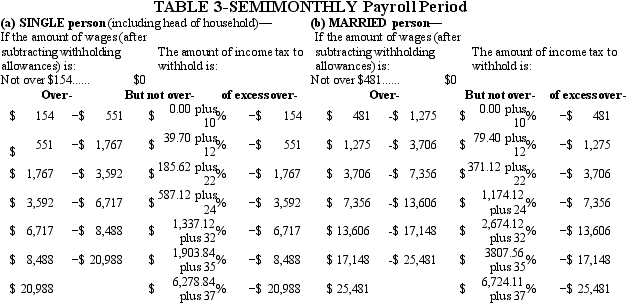

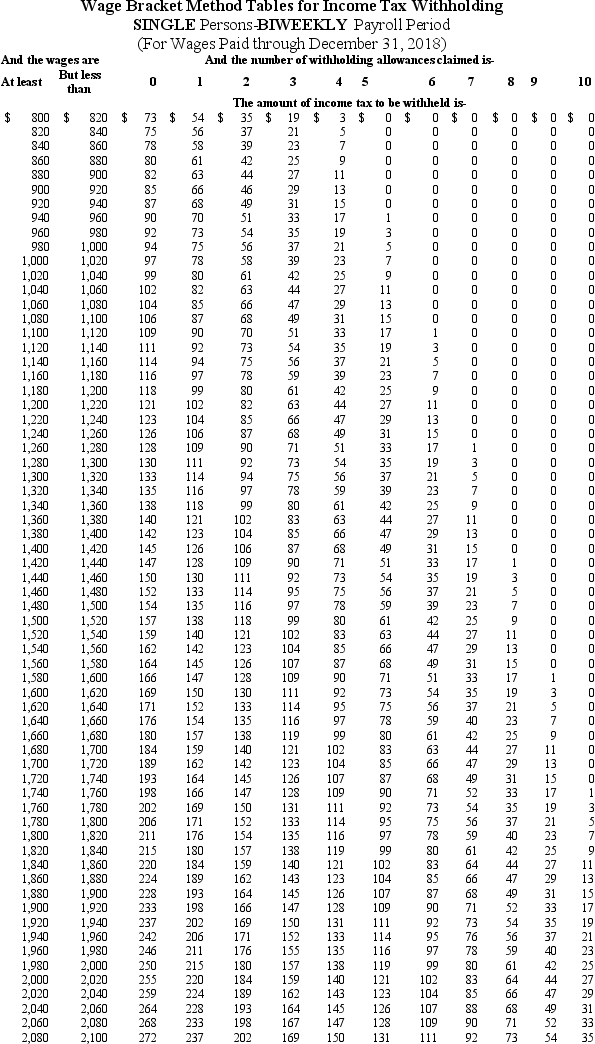

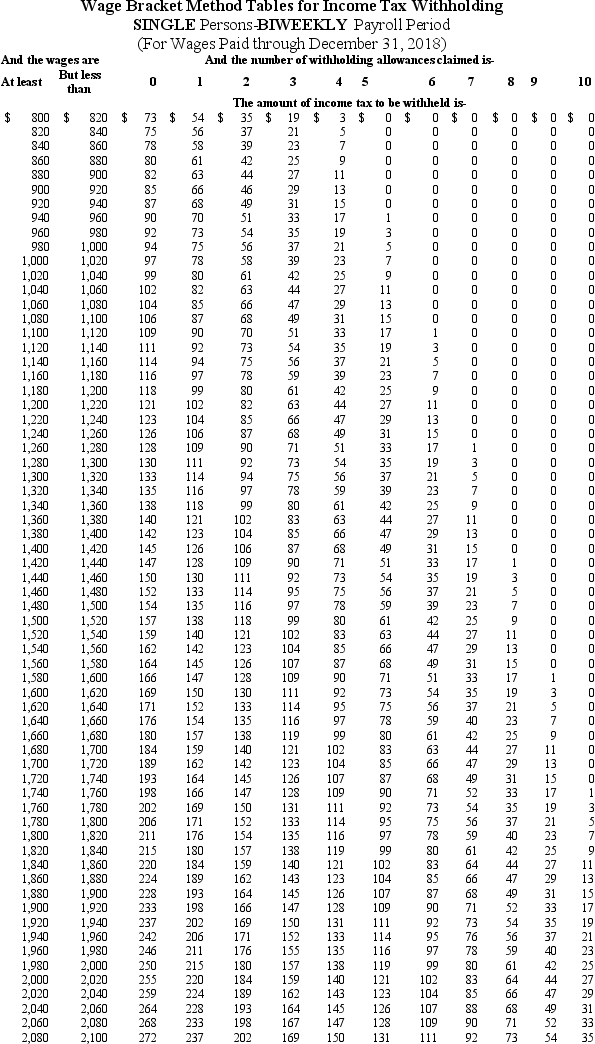

Andie earned $680.20 during the most recent weekly pay period.She is single with 3 withholding allowances and needs to decide between contributing 2.5% and $25 to her 401(k)plan.If she chooses the method that results in the lowest taxable income,how much will be withheld for Federal income tax (based on the following table)?

A)$40.00

B)$48.00

C)$38.00

D)$39.00

A)$40.00

B)$48.00

C)$38.00

D)$39.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

28

Caroljane earned $1,120 during the most recent pay biweekly pay period.She contributes 4% of her gross pay to her 401(k)plan.She is single and has 1 withholding allowance.Based on the following table,how much Federal income tax should be withheld from her pay?

A)$106.00

B)$104.00

C)$87.00

D)$85.00

A)$106.00

B)$104.00

C)$87.00

D)$85.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

29

Garnishments may include deductions from employee wages on a post-tax basis for items such as: (You may select more than one answer. )

A)Charitable contributions.

B)Union Dues.

C)Child Support payments.

D)Consumer Credit liens.

A)Charitable contributions.

B)Union Dues.

C)Child Support payments.

D)Consumer Credit liens.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

30

Renee is a salaried exempt employee who earns an annual salary of $64,200,which is paid semimonthly.She is married with four withholding allowances.What is her total FICA tax liability per pay period? (Do not round intermediate calculations.Round your final answer to 2 decimal places. )

A)$165.85

B)$38.79

C)$204.64

D)$409.28

A)$165.85

B)$38.79

C)$204.64

D)$409.28

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

31

Adam is a part-time employee who earned $495.00 during the most recent pay period.He is married with two withholding allowances.Prior to this pay period,his year-to-date pay is $6,492.39.How much should be withheld from Adam's gross pay for Social Security tax?

A)$40.02

B)$30.69

C)$37.92

D)$28.46

A)$40.02

B)$30.69

C)$37.92

D)$28.46

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

32

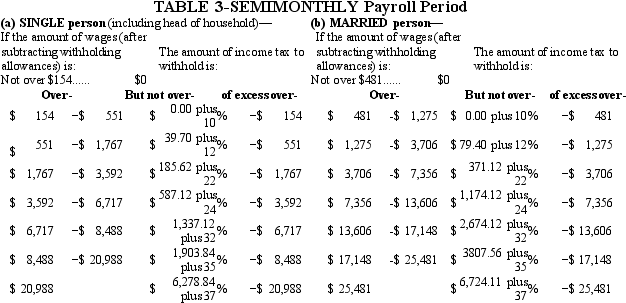

Olga earned $1,558.00 during the most recent weekly pay period.She is single with 2 withholding allowances and no pre-tax deductions.Using the percentage method,compute Olga's federal income tax for the period.(Do not round intermediate calculations.Round final answer to 2 decimal places. )

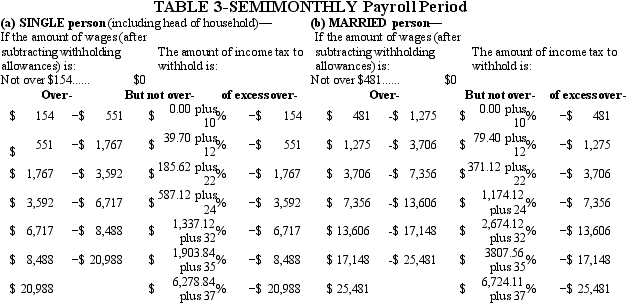

Table 5.Percentage Method-2018 Amount for one Withholding Allowance

A)$217.93

B)$239.25

C)$213.97

D)$214.75

Table 5.Percentage Method-2018 Amount for one Withholding Allowance

A)$217.93

B)$239.25

C)$213.97

D)$214.75

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

33

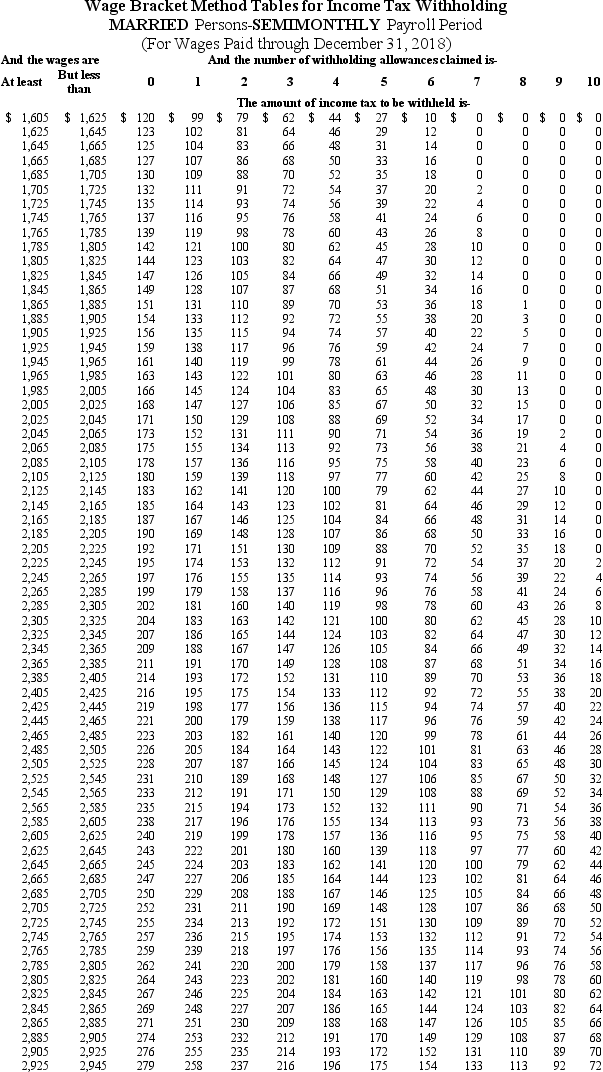

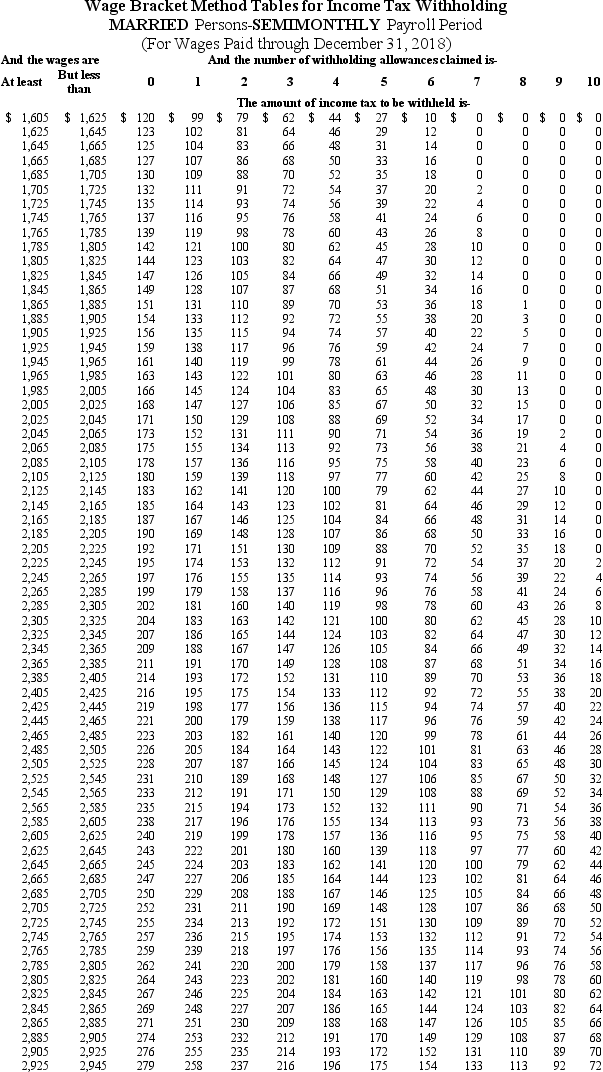

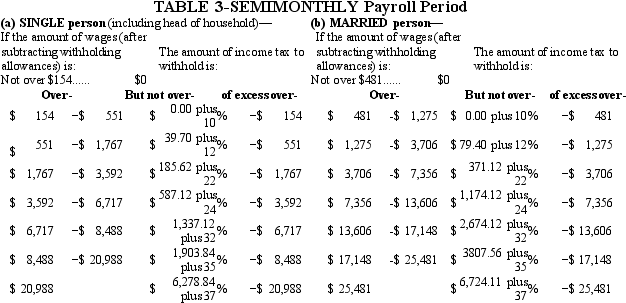

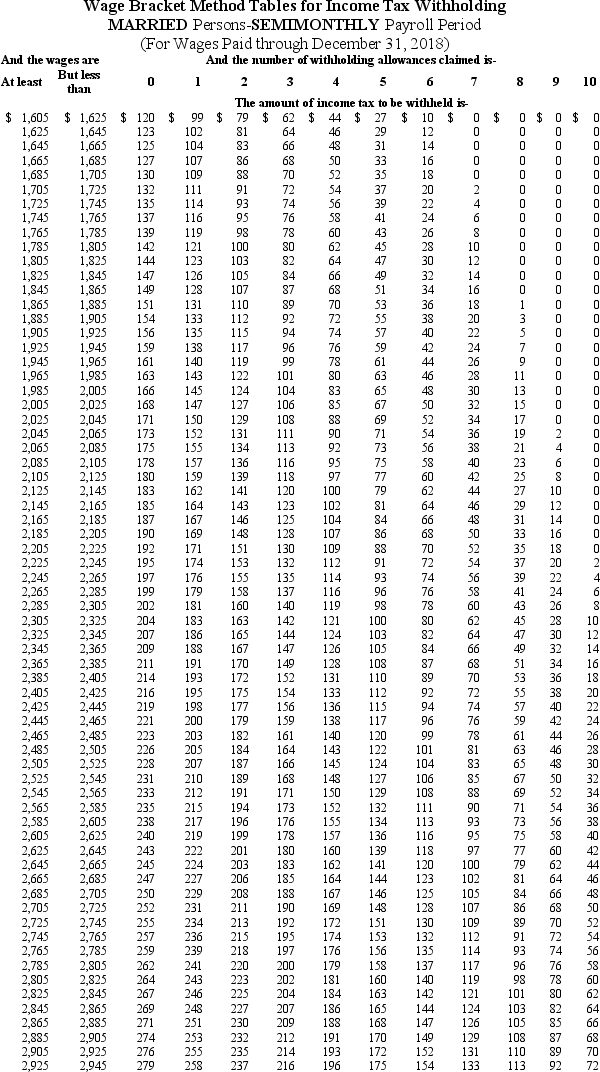

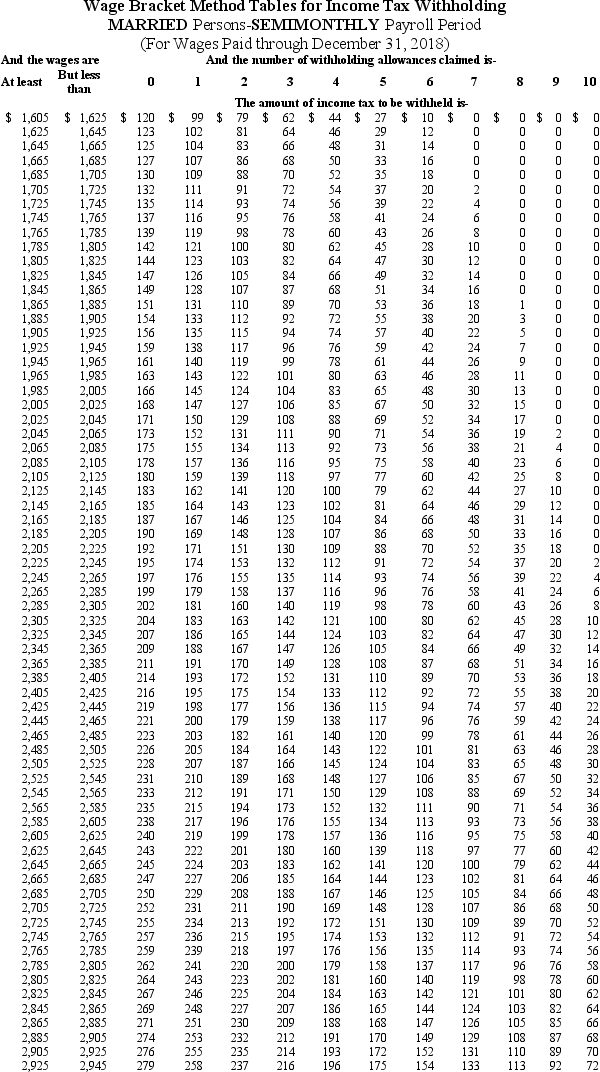

Melody is a full-time employee in Sioux City,South Dakota,who earns $3,600 per month and is paid semimonthly.She is married with 1 withholding allowance (use the wage-bracket tables).She has a qualified health insurance deduction of $50 per pay period and contributes 3% to her 401(k),both of which are pre-tax deductions.What is her net pay? (Round your intermediate calculations and final answer to 2 decimal places. )

A)$1,696.00

B)$1,524.27

C)$1,453.12

D)$1,394.87

A)$1,696.00

B)$1,524.27

C)$1,453.12

D)$1,394.87

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

34

Ramani earned $1,698.50 during the most recent biweekly pay period.He contributes $100 to his 401(k)plan.He is married and claims 3 withholding allowances.Based on the following table,how much Federal income tax should be withheld from his pay?

A)$78.00

B)$73.00

C)$69.00

D)$67.00

A)$78.00

B)$73.00

C)$69.00

D)$67.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

35

Julian is a part-time nonexempt employee in Nashville,Tennessee,who earns $21.50 per hour.During the last biweekly pay period he worked 45 hours,5 of which are considered overtime.He is single with one withholding allowance (use the wage-bracket table).What is his net pay? (Do not round intermediate calculations.Round your final answer to 2 decimal places. )

A)$818.40

B)$797.18

C)$825.99

D)$863.12

A)$818.40

B)$797.18

C)$825.99

D)$863.12

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

36

Paolo is a part-time security guard for a local facility.He earned $298.50 during the most recent weekly pay period and has earned $5,296.00 year-to-date.He is married with four withholding allowances.What is his Medicare tax liability for the pay period?

A)$43.23

B)$10.54

C)$8.65

D)$4.33

A)$43.23

B)$10.54

C)$8.65

D)$4.33

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

37

Natalia is a full-time exempt employee who earns $215,000 annually,paid monthly.Her year-to-date pay as of November 30 is $197,083.33.How much will be withheld from Natalia for FICA taxes for the December 31 pay date? (Social Security maximum wage is $128,400.Do not round intermediate calculations.Round your final answer to 2 decimal places. )

A)$292.04

B)$394.79

C)$1,370.63

D)$421.04

A)$292.04

B)$394.79

C)$1,370.63

D)$421.04

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

38

Julio is single with 1 withholding allowance.He earned $1,025.00 during the most recent semimonthly pay period.He needs to decide between contributing 3% and $30 to his 401(k)plan.If he chooses the method that results in the lowest taxable income,how much will be withheld for Federal income tax (based on the following table)?

A)$79.00

B)$86.00

C)$74.00

D)Both yield the same tax amount

A)$79.00

B)$86.00

C)$74.00

D)Both yield the same tax amount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

39

Max earned $1,019.55 during the most recent semimonthly pay period.He is single with 1 withholding allowance and has no pre-tax deductions.Using the following table,how much should be withheld for federal income tax?

A)$95.00

B)$76.00

C)$51.00

D)$74.00

A)$95.00

B)$76.00

C)$51.00

D)$74.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

40

Trish earned $1,734.90 during the most recent semimonthly pay period.She is married and has 3 withholding allowances and has no pre-tax deductions.Based on the following table,how much should be withheld from her gross pay for Federal income tax?

A)$74.00

B)$93.00

C)$76.00

D)$95.00

A)$74.00

B)$93.00

C)$76.00

D)$95.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

41

What is an advantage of direct deposit from the employee's perspective?

A)Long processing times for pay disbursements.

B)Secure access to compensation.

C)The requirement to have a bank account.

D)Access to payroll data on non-secured website.

A)Long processing times for pay disbursements.

B)Secure access to compensation.

C)The requirement to have a bank account.

D)Access to payroll data on non-secured website.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

42

Danny is a full-time exempt employee in Alabama,where the state income tax rate is 5%.He earns $78,650 annually and is paid semimonthly.He is married with four withholding allowances.His health insurance is $100.00 per pay period and is deducted on a pre-tax basis.Danny contributes 5% of his pay to his 401(k).Assuming that he has no other deductions,what is Danny's net pay for the period? (Use the percentage method for the federal income tax and the wage-bracket table for the state income tax.Do not round intermediate calculations.Round your final answer to 2 decimal places. )

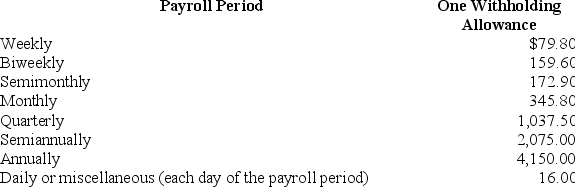

Table 5.Percentage Method-2018 Amount for one Withholding Allowance

A)$2,245.53

B)$2,403.95

C)$2,414.53

D)$2,178.90

Table 5.Percentage Method-2018 Amount for one Withholding Allowance

A)$2,245.53

B)$2,403.95

C)$2,414.53

D)$2,178.90

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

43

Maile is a full-time exempt employee in Boca Raton,Florida,who earns $1,370.15 per biweekly payday.She is married with seven withholding allowances,so her federal income tax is $0.She contributes 4% of her gross pay to her 401(k)and has her health insurance premium of $50 deducted on a pre-tax basis.She has $10 deducted per pay period for a Salvation Army contribution and has union dues of $40 per pay period.What is her net pay? (Do not round intermediate calculations.Round your final answer to 2 decimal places. )

A)$1,160.53

B)$1,114.35

C)$1,124.23

D)$1,137.93

A)$1,160.53

B)$1,114.35

C)$1,124.23

D)$1,137.93

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

44

Why do employers use checks as an employment payment method?

A)Paying employees by check allows the employer flexibility with its bank accounts.

B)Paying employees by check increases the complexity of the payroll process.

C)Paying employees by check requires the employer to keep currency on the premises.

D)Paying employees by check offers a level of security of employee payments.

A)Paying employees by check allows the employer flexibility with its bank accounts.

B)Paying employees by check increases the complexity of the payroll process.

C)Paying employees by check requires the employer to keep currency on the premises.

D)Paying employees by check offers a level of security of employee payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following payment methods is growing in popularity among employees?

A)Cash

B)Check

C)Direct Deposit

D)Paycard

A)Cash

B)Check

C)Direct Deposit

D)Paycard

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which body issued Regulation E to protect consumers from loss of deposited funds?

A)Department of Homeland Security

B)Internal Revenue Service

C)American Banking Association

D)Federal Deposit Insurance Corporation

A)Department of Homeland Security

B)Internal Revenue Service

C)American Banking Association

D)Federal Deposit Insurance Corporation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

47

Collin is a full-time exempt employee in Juneau,Alaska,who earns $135,000 annually and has not yet reached the Social Security wage base.He is single with 1 withholding allowance and is paid semimonthly.He contributes 3% per pay period to his 401(k)and has pre-tax health insurance and AFLAC deductions of $150 and $25,respectively.Collin has a child support garnishment of $300 per pay period.What is his net pay? (Use the percentage method.Do not round intermediate calculations.Round your final answer to 2 decimal places. )

Table 5.Percentage Method-2018 Amount for one Withholding Allowance

Federal Income tax using percentage method

A)$3,653.05

B)$3,613.28

C)$3,974.60

D)$3,885.14

Table 5.Percentage Method-2018 Amount for one Withholding Allowance

Federal Income tax using percentage method

A)$3,653.05

B)$3,613.28

C)$3,974.60

D)$3,885.14

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following is the correct sequence for computing net pay?

A)Compute gross pay then deduct withholding and add FICA taxes to obtain net pay.

B)Compute gross pay,compute FICA,deduct pre-tax amounts,and deduct taxes.

C)Compute gross pay,deduct taxes,and add voluntary deductions.

D)Compute gross pay,deduct pre-tax amounts,compute FICA,deduct taxes,and deduct post-tax amounts.

A)Compute gross pay then deduct withholding and add FICA taxes to obtain net pay.

B)Compute gross pay,compute FICA,deduct pre-tax amounts,and deduct taxes.

C)Compute gross pay,deduct taxes,and add voluntary deductions.

D)Compute gross pay,deduct pre-tax amounts,compute FICA,deduct taxes,and deduct post-tax amounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

49

What is a disadvantage to using paycards as a method of transmitting employee compensation?

A)Convenience of retrieving pay disbursements.

B)Potential withdrawal and point-of-sale limitations.

C)Ease of paying traveling employees.

D)Acceptance of paycards at many locations.

A)Convenience of retrieving pay disbursements.

B)Potential withdrawal and point-of-sale limitations.

C)Ease of paying traveling employees.

D)Acceptance of paycards at many locations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

50

Janna is a salaried nonexempt employee in Laramie,Wyoming,who earns $30,000 per year for a standard 40-hour workweek and is paid biweekly.She is single with one withholding allowance.During the last pay period,she worked 5 hours of overtime.She contributes 3% of her gross pay to her 401(k)on a pre-tax basis and has a garnishment of 10% of her disposable income for a consumer credit garnishment.What is her net pay? (Use the wage-bracket method.Do not round intermediate calculations.Round your final answer to 2 decimal places. )

A)$998.90

B)$913.90

C)$917.46

D)$886.96

A)$998.90

B)$913.90

C)$917.46

D)$886.96

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

51

From the employer's perspective,which of the following is a challenge of paying employees by direct deposit?

A)Reduction in payroll processing costs.

B)Secure processing of employee compensation.

C)Vulnerability of data to computer attacks.

D)Employee self-maintenance of personnel records.

A)Reduction in payroll processing costs.

B)Secure processing of employee compensation.

C)Vulnerability of data to computer attacks.

D)Employee self-maintenance of personnel records.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

52

Best practices for paying employees by check include which of the following? (You may select more than one answer. )

A)Maintenance of a separate checking account for payroll purposes.

B)Keeping a single check register for the firm's checking accounts.

C)Logging the number,amount,and purpose of each check used.

D)Establishing an unclaimed property account for uncashed checks.

A)Maintenance of a separate checking account for payroll purposes.

B)Keeping a single check register for the firm's checking accounts.

C)Logging the number,amount,and purpose of each check used.

D)Establishing an unclaimed property account for uncashed checks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following is true about cash as a method of paying employees?

A)Cash is the most secure payment method.

B)Cash is the most widely used payment method.

C)Cash is readily transferable and highly liquid.

D)Cash is the most convenient pay method for employers.

A)Cash is the most secure payment method.

B)Cash is the most widely used payment method.

C)Cash is readily transferable and highly liquid.

D)Cash is the most convenient pay method for employers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

54

Amanda is a full-time exempt employee in Sparks,Nevada,who earns $84,000 annually.She is married with 1 deduction and is paid biweekly.She contributes $150.00 per pay period to her 401(k)and has pre-tax health insurance and AFLAC deductions of $50.00 and $75.00,respectively.Amanda contributes $25.00 per pay period to the United Way.What is her net pay? (Use the percentage method.Do not round intermediate calculations.Round final answers to 2 decimal places. )

Table 5.Percentage Method-2018 Amount for one Withholding Allowance

A)$2,394.47

B)$2,193.60

C)$2,425.58

D)$2,605.44

Table 5.Percentage Method-2018 Amount for one Withholding Allowance

A)$2,394.47

B)$2,193.60

C)$2,425.58

D)$2,605.44

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

55

Tierney is a full-time nonexempt salaried employee who earns $990 per biweekly pay period.She is single with 1 withholding allowance and both lives and works in Maryland.Assuming that she had no overtime,what is the total of her Federal and state taxes for a pay period? (Use the wage-bracket tables.Maryland state income rate is 2.0%.Round final answer to 2 decimal places. )

A)$84.25

B)$94.80

C)$95.95

D)$100.78

A)$84.25

B)$94.80

C)$95.95

D)$100.78

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

56

Jesse is a part-time nonexempt employee in Austin,Texas,who earns $12.50 per hour.During the last biweekly pay period he worked 35 hours.He is married with zero withholding allowances,which means his federal income tax deduction is $10.00,and has additional federal tax withholding of $30 per pay period.What is his net pay? (Do not round intermediate calculations.Round your final answer to 2 decimal places. )

A)$354.28

B)$374.03

C)$364.03

D)$378.03

A)$354.28

B)$374.03

C)$364.03

D)$378.03

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

57

Manju is a full-time exempt employee living in Illinois who earns $43,680 annually and is paid biweekly.She is married with three withholding allowances.What is the total of her Federal and state income tax deductions for the most recent pay period? (Use the wage bracket tables.Illinois state income tax rate is 3.75%. )

A)$139

B)$142

C)$148

D)$151

A)$139

B)$142

C)$148

D)$151

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

58

Why might an employee elect to have additional federal income tax withheld? (You may select more than one answer. )

A)Charitable contributions.

B)Union Dues.

C)Child Support payments.

D)Consumer Credit liens.

A)Charitable contributions.

B)Union Dues.

C)Child Support payments.

D)Consumer Credit liens.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

59

Brent is a full-time exempt employee in Clark County,Indiana.He earns an annual salary of $45,000 and is paid semimonthly.He is married with 3 withholding allowances.His state income tax per pay period is $57.38,and Clark County income tax is $33.75 per pay period.What is the total of FICA,Federal,state,and local deductions per pay period,assuming no Pre-Tax Deductions? (Use the wage-bracket table to determine Federal taxes.Do not round intermediate calculations.Round your final answer to 2 decimal places. )

A)$303.36

B)$306.45

C)$318.13

D)$323.57

A)$303.36

B)$306.45

C)$318.13

D)$323.57

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

60

Vivienne is a full-time exempt employee in DeKalb County,Indiana,and is paid biweekly.She earns $39,000 annually,and is married with 2 withholding allowances.Her state income tax deduction is $44.46,and the DeKalb County income tax deduction is $19.62.What is the total amount of her FICA,federal,state,and local taxes per pay period,assuming no Pre-Tax Deductions? (Use the wage-bracket table to determine the federal tax deduction.Do not round intermediate calculations.Round your final answer to 2 decimal places. )

A)$239.25

B)$227.12

C)$265.47

D)$251.83

A)$239.25

B)$227.12

C)$265.47

D)$251.83

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

61

The annual payroll tax guide that the IRS distributes is called ________.

A)The IRS tax guide

B)Publication E

C)Circular 15

D)Publication 15

A)The IRS tax guide

B)Publication E

C)Circular 15

D)Publication 15

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

62

The purpose of paycards as a pay method is to ________.

A)prevent employees from opening bank accounts

B)promote accessibility and portability of employee compensation

C)protect payroll processes against embezzlement

D)promote debit card use as a means of economic stimulus

A)prevent employees from opening bank accounts

B)promote accessibility and portability of employee compensation

C)protect payroll processes against embezzlement

D)promote debit card use as a means of economic stimulus

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

63

The factors that determine an employee's federal income tax are ________.

A)Marital status,birth date,taxable pay,and pay frequency

B)Number of children,pay frequency,marital status,and gross pay

C)Marital status,number of withholdings,taxable pay,and pay frequency

D)Pay frequency,number of dependents,taxable pay,and marital status

A)Marital status,birth date,taxable pay,and pay frequency

B)Number of children,pay frequency,marital status,and gross pay

C)Marital status,number of withholdings,taxable pay,and pay frequency

D)Pay frequency,number of dependents,taxable pay,and marital status

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

64

The percentage of the Medicare tax withholding ________.

A)is the same for every employee,regardless of income

B)is subject to change based on the firm's profitability

C)changes every year in response to industry needs

D)remains the same for all employees who earn less than $200,000

A)is the same for every employee,regardless of income

B)is subject to change based on the firm's profitability

C)changes every year in response to industry needs

D)remains the same for all employees who earn less than $200,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

65

The percentage method of determining an employee's Federal income tax deductions ________.

A)is used to promote complexity in payroll practices

B)allows payroll accountants to determine Federal income tax for the firm itself

C)is used primarily for high wage earners and computerized payroll programs

D)is less accurate than the results gained from using the wage-bracket method

A)is used to promote complexity in payroll practices

B)allows payroll accountants to determine Federal income tax for the firm itself

C)is used primarily for high wage earners and computerized payroll programs

D)is less accurate than the results gained from using the wage-bracket method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

66

Nickels Company is located in West Virginia has employees who live in Ohio,Florida,Tennessee,and West Virginia.For which state(s)should the company collect and remit state income tax? (You may select more than one answer. )

A)Florida

B)Tennessee

C)Ohio

D)West Virginia

A)Florida

B)Tennessee

C)Ohio

D)West Virginia

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

67

The purpose of the wage base used for the Social Security tax is ________.

A)to determine when to start withholding the tax from an employee's pay

B)to establish a maximum salary level for application of the tax to employee pay

C)to determine the amount of Social Security tax to withhold from an employee's pay

D)to compute the total amount of Social Security tax that a firm must pay

A)to determine when to start withholding the tax from an employee's pay

B)to establish a maximum salary level for application of the tax to employee pay

C)to determine the amount of Social Security tax to withhold from an employee's pay

D)to compute the total amount of Social Security tax that a firm must pay

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

68

State and Local Income Tax rates ________.

A)exist at the same level in every state

B)differ among states and localities

C)are mandated by Federal law

D)are paid by the employer to the Federal government

A)exist at the same level in every state

B)differ among states and localities

C)are mandated by Federal law

D)are paid by the employer to the Federal government

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

69

When a payroll check is subject to escheatment,who handles the distribution of the money?

A)The employee.

B)The company.

C)The IRS.

D)It depends on state laws.

A)The employee.

B)The company.

C)The IRS.

D)It depends on state laws.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

70

Post-Tax Deductions are amounts ________.

A)That are voluntarily chosen by the employee

B)That the employer chooses to withhold after assessing the employee's tax liability

C)That Include both mandatory and voluntary deductions

D)That are only mandatory deductions like garnishments and union dues

A)That are voluntarily chosen by the employee

B)That the employer chooses to withhold after assessing the employee's tax liability

C)That Include both mandatory and voluntary deductions

D)That are only mandatory deductions like garnishments and union dues

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck