Deck 5: Unemployment Compensation Taxes

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/66

العب

ملء الشاشة (f)

Deck 5: Unemployment Compensation Taxes

1

For FUTA purposes,the cash value of remuneration paid in any medium other than cash is not considered taxable wages.

False

2

Insurance agents paid solely on a commission basis are not considered employees under FUTA.

True

3

Christmas gifts,excluding noncash gifts of nominal value,are taxable wages for unemployment purposes.

True

4

Every employer is entitled to a 5.4 percent credit against the gross FUTA tax of 6.0 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

5

For FUTA purposes,an employer must pay a higher FUTA tax rate on executives than on nonsupervisory personnel.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

6

FUTA and SUTA coverages extend to U.S.citizens working abroad for American employers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

7

The Social Security Act ordered every state to set up an unemployment compensation program.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

8

If an employee works in more than one state,the employer must pay a separate SUTA tax to each of those states in which the employee earns wages.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

9

If an employee has more than one employer during the current year,the taxable wage base applies separately to each of those employers,unless one employer has transferred the business to the second.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

10

Unemployment taxes (FUTA and SUTA)do not have to be paid by an employer who has only part-time employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

11

Services performed in the employ of a religious organization that is exempt from federal income tax are also exempt from FUTA coverage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

12

Partnerships do not have to pay unemployment taxes on the wages of their employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

13

Services performed by a child under the age of 21 for a parent-employer are excluded from FUTA coverage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

14

Directors of corporations who only attend and participate in board of directors' meetings are not covered as employees under FUTA.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

15

A traveling salesperson who solicits and transmits to the principal orders for merchandise for resale is considered an employee under FUTA.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

16

Once a company attains the status of employer for FUTA purposes,that status continues for four calendar years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

17

In the case of a part-time employee,the employer is not liable to pay any of the employee's earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

18

Retirement pay is taxable wages for FUTA purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

19

Advance payments for work done in the future are not taxable wages for FUTA purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

20

Educational assistance payments made to workers to improve skills required of their jobs are nontaxable for unemployment purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

21

FUTA tax deposits cannot be paid electronically.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

22

The mailing of Form 940 is considered timely if it is postmarked on or before the due date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

23

If a company is liable for a credit reduction (due to Title XII advance),this extra tax must be paid along with each of the required deposits made during the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

24

An employer can use a credit card to pay the balance with Form 940 (under $500. )

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

25

Schedule A of Form 940 only has to be completed by employers who are subject to the Title XII credit reduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

26

"Dumping" is legal in all but a few states.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

27

Even if a state repays its Title XII advances,all employers in that state are subject to a credit reduction in the year of the advance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

28

In some states,employers may obtain reduced unemployment compensation rates by making voluntary contributions to the state fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

29

Unlike Form 941,there is no penalty for the late filing of Form 940.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

30

In order to obtain the maximum credit allowed against the federal unemployment tax,the employer must have paid its SUTA contributions by the due date of Form 940.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

31

Form 940 must be mailed to the IRS by January 15.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

32

In most states,the contribution reports and the wage information reports are filed quarterly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

33

If an employer's quarterly tax liability is $525,it must be paid on or before the last day of the month following the end of the quarter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

34

Currently,none of the states imposes an unemployment tax on employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

35

If an employer pays unemployment taxes to two states,it will have the same SUTA tax rate in both states.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

36

On Form 940,even if the total FUTA tax is more than $500,there is no listing of quarterly federal unemployment tax liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

37

If an employer is subject to a credit reduction because of Title XII advances,the penalty for the entire year will be paid only with the deposit for the last quarter of the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

38

An employer can use a credit card to pay the quarterly deposit of FUTA taxes during the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

39

There is a uniform rate of unemployment benefits payable by all states.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

40

Even if the duties of depositing the FUTA taxes and filing Form 940 have been outsourced,the employer is still the responsible party.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

41

Refer to Instruction 5-1.Michael Mirer worked for Dawson Company for six months this year and earned $11,200.The other six months he earned $6,900 working for McBride Company (a separate company).The amount of FUTA taxes to be paid on Mirer's wages by the two companies is:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following types of payments are not taxable wages for federal unemployment tax?

A) Retirement pay

B) Cash prizes and awards for doing outstanding work

C) Dismissal pay

D) Bonuses as remuneration for services

E) Payment under a guaranteed annual wage plan

A) Retirement pay

B) Cash prizes and awards for doing outstanding work

C) Dismissal pay

D) Bonuses as remuneration for services

E) Payment under a guaranteed annual wage plan

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

43

The person who is not an authorized signer of Form 940 is:

A) the individual,if a sole proprietorship.

B) the accountant from the company's independent auditing firm.

C) the president,if a corporation.

D) a fiduciary,if a trust.

E) All of the above are authorized signers.

A) the individual,if a sole proprietorship.

B) the accountant from the company's independent auditing firm.

C) the president,if a corporation.

D) a fiduciary,if a trust.

E) All of the above are authorized signers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

44

An employer must pay the quarterly FUTA tax liability if the liability is more than:

A) $3,000.

B) $500.

C) $1,000.

D) $1.

E) $100.

A) $3,000.

B) $500.

C) $1,000.

D) $1.

E) $100.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

45

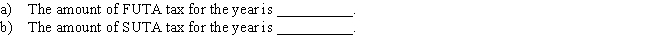

Refer to Instruction 5-1.Stys Company's payroll for the year is $1,210,930.Of this amount,$510,710 is for wages paid in excess of $7,000 to each individual employee.The SUTA tax rate for the company is 3.2% on the first $7,000 of each employee's earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

46

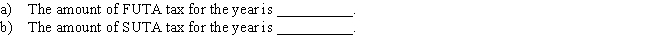

Refer to Instruction 5-1.Niemann Company has a SUTA tax rate of 7.1%.The taxable payroll for the year for FUTA and SUTA is $82,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following payments are taxable payments for federal unemployment tax?

A) Christmas gifts,excluding noncash gifts of nominal value

B) Caddy fees

C) Courtesy discounts to employees and their families

D) Workers' compensation payments

E) Value of meals and lodging furnished employees for the convenience of the employer

A) Christmas gifts,excluding noncash gifts of nominal value

B) Caddy fees

C) Courtesy discounts to employees and their families

D) Workers' compensation payments

E) Value of meals and lodging furnished employees for the convenience of the employer

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

48

If the employer has made timely deposits that pay the FUTA tax liability in full,the filing of Form 940 can be delayed until:

A) December 31.

B) February 15.

C) February 10.

D) February 1.

E) March 31.

A) December 31.

B) February 15.

C) February 10.

D) February 1.

E) March 31.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

49

A federal unemployment tax is levied on:

A) employees only.

B) both employers and employees.

C) employers only.

D) government employers only.

E) no one.

A) employees only.

B) both employers and employees.

C) employers only.

D) government employers only.

E) no one.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following provides for a reduction in the employer's state unemployment tax rate based on the employer's experience with the risk of unemployment?

A) Voluntary contribution

B) Title XII advances

C) Pooled-fund laws

D) Experience-rating plan

E) None of the above

A) Voluntary contribution

B) Title XII advances

C) Pooled-fund laws

D) Experience-rating plan

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

51

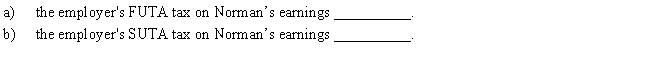

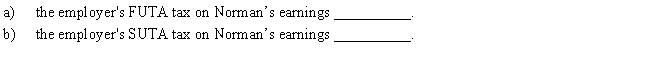

Refer to Instruction 5-1.Aaron Norman earned $24,900 for the year from Marcus Company.The company is subject to a SUTA tax of 4.7% on the first $9,900 of earnings.Determine:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

52

An aspect of the interstate reciprocal arrangement concerns:

A) the status of Americans working overseas.

B) the taxability of dismissal payments.

C) the determination of an employer's experience rating.

D) the transfer of an employee from one state to another during the year.

E) none of the above.

A) the status of Americans working overseas.

B) the taxability of dismissal payments.

C) the determination of an employer's experience rating.

D) the transfer of an employee from one state to another during the year.

E) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

53

Refer to Instruction 5-1.John Gercke is an employee of The Woolson Company.During the first part of the year,he earned $6,800 while working in State A.For the remainder of the year,the company transferred him to State B where he earned $16,500.The Woolson Company's tax rate in State A is 4.2%,and in State B it is 3.15% on the first $7,000.Assuming that reciprocal arrangements exist between the two states,determine the SUTA tax that the company paid to:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

54

Voluntary contributions to a state's unemployment department are:

A) allowed in all states.

B) designed to increase an employer's reserve account in order to lower the employer's contribution rate.

C) capable of being paid at any time with no time limit.

D) returned to the employer at the end of the following year.

E) sent directly to the IRS.

A) allowed in all states.

B) designed to increase an employer's reserve account in order to lower the employer's contribution rate.

C) capable of being paid at any time with no time limit.

D) returned to the employer at the end of the following year.

E) sent directly to the IRS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

55

If the employer is tardy in paying the state contributions,the credit against the federal tax is limited to what percent of the late payments that would have been allowed as a credit if the contributions had been paid on time?

A) 6.2%

B) 90%

C) 5.13%

D) 20%

E) 0%

A) 6.2%

B) 90%

C) 5.13%

D) 20%

E) 0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

56

For FUTA purposes,an employer can be any one of the following except:

A) an individual.

B) a partnership.

C) a trust.

D) a corporation.

E) All of the above can be employers.

A) an individual.

B) a partnership.

C) a trust.

D) a corporation.

E) All of the above can be employers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

57

Included under the definition of employees for FUTA purposes are:

A) independent contractors.

B) insurance agents paid solely on commission.

C) student nurses.

D) officers of a corporation.

E) members of partnerships.

A) independent contractors.

B) insurance agents paid solely on commission.

C) student nurses.

D) officers of a corporation.

E) members of partnerships.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

58

When making a payment of FUTA taxes,the employer must make the payment by the:

A) end of the month after the quarter.

B) 15th of the month after the quarter.

C) 10th of the month after the quarter.

D) end of the following quarter.

E) same day of the FICA and FIT deposits.

A) end of the month after the quarter.

B) 15th of the month after the quarter.

C) 10th of the month after the quarter.

D) end of the following quarter.

E) same day of the FICA and FIT deposits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

59

In order to avoid a credit reduction for Title XII advances,a state must repay the loans by:

A) the end of the year of the loans.

B) the end of the year the credit reduction is scheduled to take effect.

C) the end of the third year after the year of the loans.

D) November 10 of the year the credit reduction is scheduled to take effect.

E) June 30 of the year after the loans.

A) the end of the year of the loans.

B) the end of the year the credit reduction is scheduled to take effect.

C) the end of the third year after the year of the loans.

D) November 10 of the year the credit reduction is scheduled to take effect.

E) June 30 of the year after the loans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following is not a factor considered in determining coverage of interstate employees?

A) Location of base of operations

B) Place where work is localized

C) Location of company's payroll department

D) Location of employee's residence

E) Location of place from which operations are controlled

A) Location of base of operations

B) Place where work is localized

C) Location of company's payroll department

D) Location of employee's residence

E) Location of place from which operations are controlled

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

61

Refer to Instruction 5-1.Queno Company had FUTA taxable wages of $510,900 during the year.Determine its:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

62

Refer to Instruction 5-1.Faruga Company had FUTA taxable payrolls for the four quarters of

2018 of $28,400;$19,600;$16,500;and $8,900,respectively.The company was located in a state

that was subject to a FUTA credit reduction of 1.5%.What was the amount of Faruga's first required

deposit of FUTA taxes?

2018 of $28,400;$19,600;$16,500;and $8,900,respectively.The company was located in a state

that was subject to a FUTA credit reduction of 1.5%.What was the amount of Faruga's first required

deposit of FUTA taxes?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

63

Refer to Instruction 5-1.Sparks Company's SUTA rate for next year is 3.25% because its reserve ratio falls into the state's 10% to less than 12% category [(contributions - benefits paid)÷ average payroll = $414,867 ÷ $3,521,790 = 11.78%].If the next bracket (12% to less than 14%)would give the company a lower tax rate of 3.05%,what would be the least amount of the voluntary contribution needed to qualify the company for the 3.05% SUTA tax rate?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

64

Refer to Instruction 5-1.Ted Carman worked for Rivertide Country Club and earned $28,500 during the year.He also worked part time for Harrison Furniture Company and earned $12,400 during the year.The SUTA tax rate for Rivertide Country Club is 4.2% on the first $8,000,and the rate for Harrison Furniture Company is 5.1% on the first $8,000.Calculate the FUTA and SUTA taxes paid by the employers on Carman's earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

65

Refer to Instruction 5-1.In the first quarter of the year,Henry Gibson earned $3,000 in wages and reported $2,400 in tips to his employer.How much would the employer's FUTA tax be for the first quarter on Gibson?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

66

Refer to Instruction 5-1.Hunter Company had a FUTA taxable payroll of $192,700 for the year.Since the company is located in a state that has 1.5% FUTA credit reduction due to unpaid loans,determine Hunter's FUTA tax liability for the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck