Deck 9: Long-Term Liabilities

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

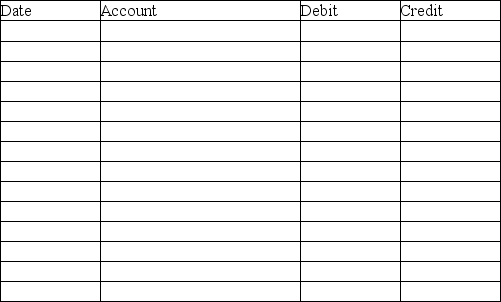

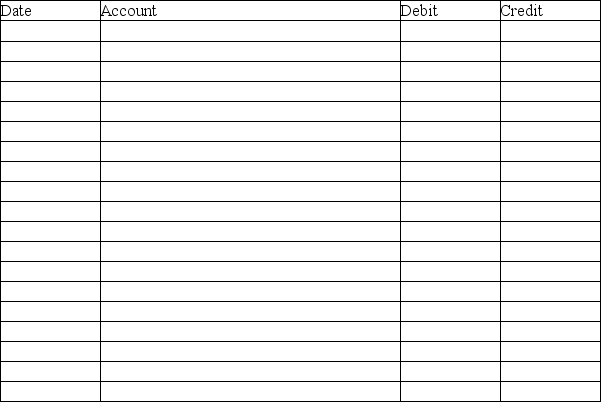

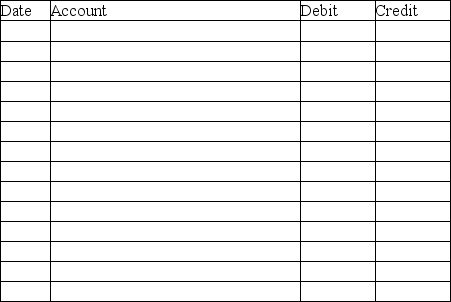

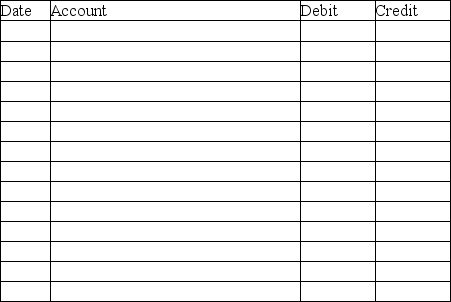

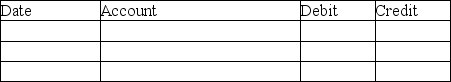

سؤال

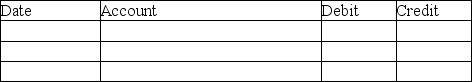

سؤال

سؤال

سؤال

سؤال

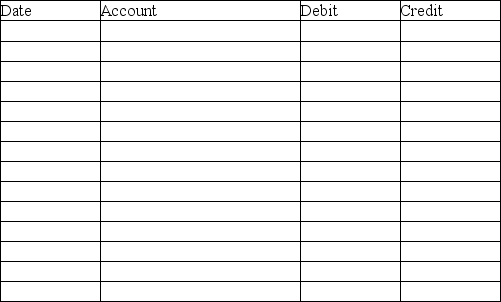

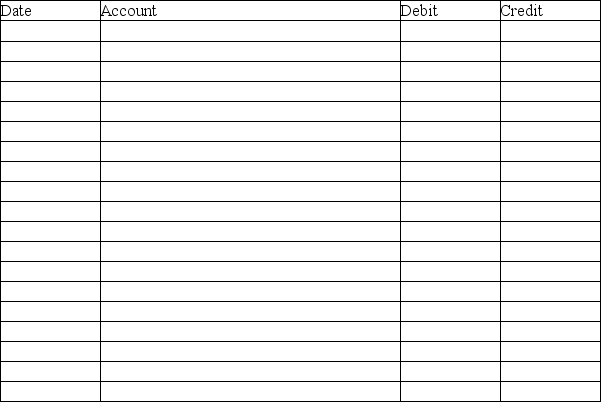

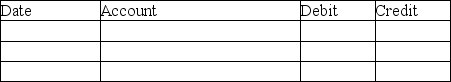

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

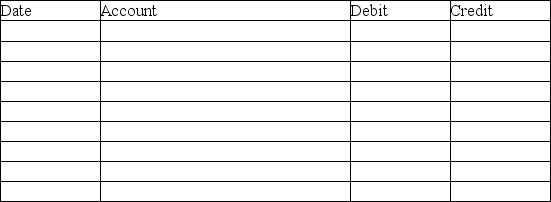

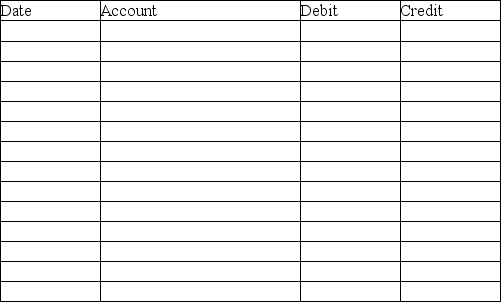

سؤال

سؤال

سؤال

سؤال

سؤال

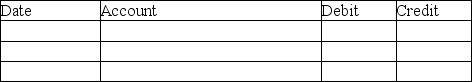

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

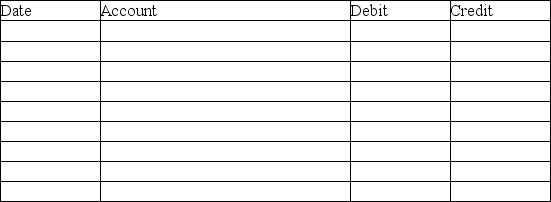

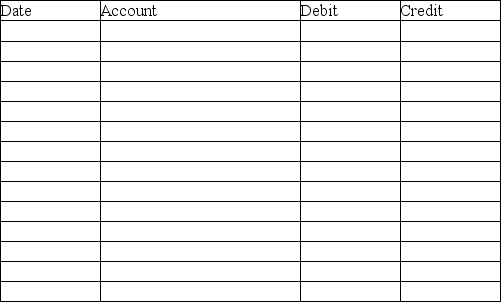

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

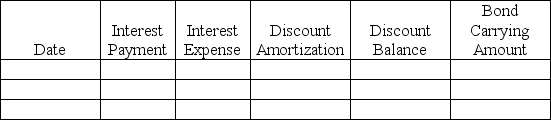

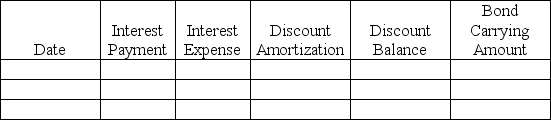

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/120

العب

ملء الشاشة (f)

Deck 9: Long-Term Liabilities

1

The account Premium on Bonds Payable increases the issuer's liabilities.

True

2

If $120,000 face value bonds are issued at 104,the proceeds received will be $104,000.

False

3

Premium on bonds payable is a contra account to bonds payable.

False

4

Corporations borrow large amounts of money by issuing (selling)bonds to the public.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

5

The carrying amount of bonds is calculated by adding the balance of the Discount on Bonds Payable account to the balance in the Bonds Payable account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

6

If the market interest rate is greater than the stated interest rate,the bonds will sell at a discount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

7

The stated interest rate is always equal to the market interest rate on the date the bonds are issued.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

8

The straight-line amortization method keeps interest expense at the same dollar amount for each interest payment over the bond's life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

9

If bonds are issued at a premium,the carrying value of the bonds will be greater than the face value of the bonds for all interest periods prior to the bond's maturity date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

10

If the stated interest rate on a bond is 8% and the market interest rate is 7%,the bond will be issued at a price above the par value of the bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

11

At maturity,the premium on bonds payable will have been amortized to zero,and the bonds carrying value will be the face value of the bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

12

If $500,000,6% bonds are issued on January 1 and pay interest semiannually,the amount of the interest payment on July 1 will be $15,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

13

Bonds that are secured by real estate are called:

A)term bonds.

B)secured bonds.

C)mortgage bonds.

D)B and C.

A)term bonds.

B)secured bonds.

C)mortgage bonds.

D)B and C.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

14

If bonds are issued at a discount,it means that the:

A)market interest rate is higher than the stated interest rate.

B)market interest rate is lower than the stated interest rate.

C)financial strength of the issuer is weak.

D)bond is convertible.

A)market interest rate is higher than the stated interest rate.

B)market interest rate is lower than the stated interest rate.

C)financial strength of the issuer is weak.

D)bond is convertible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

15

The carrying value of bonds decreases over the term of the bonds if the bonds were issued at a discount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

16

Bonds in a particular issue which mature in installments over a period of time are called:

A)serial bonds.

B)term bonds.

C)callable bonds.

D)convertible bonds.

A)serial bonds.

B)term bonds.

C)callable bonds.

D)convertible bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

17

At maturity,the carrying amount of bonds should equal the face value of the bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

18

If bonds are issued at a discount,the issuing corporation will pay an amount greater than the face amount of the bonds on the maturity date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

19

Bonds which are backed only by the good faith of the borrower are referred to as:

A)junk bonds.

B)uncertified bonds.

C)debenture bonds.

D)callable bonds.

A)junk bonds.

B)uncertified bonds.

C)debenture bonds.

D)callable bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

20

If the market interest rate is greater than the stated interest rate on bonds,the bonds will sell:

A)at face value.

B)at a discount.

C)at a premium.

D)at the stated interest rate.

A)at face value.

B)at a discount.

C)at a premium.

D)at the stated interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

21

The carrying amount of bonds issued at a discount is calculated by:

A)subtracting Discount on Bonds Payable from Bonds Payable.

B)subtracting the sum of Discount on Bonds Payable and Interest Payable from Bonds Payable.

C)subtracting Interest Payable from Bonds Payable.

D)subtracting Interest Expense from Bonds Payable.

A)subtracting Discount on Bonds Payable from Bonds Payable.

B)subtracting the sum of Discount on Bonds Payable and Interest Payable from Bonds Payable.

C)subtracting Interest Payable from Bonds Payable.

D)subtracting Interest Expense from Bonds Payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

22

If bonds have been issued at a premium,over the life of the bonds,the:

A)carrying value of the bonds will decrease.

B)carrying value of the bonds will increase.

C)interest expense will increase.

D)interest payment will increase.

A)carrying value of the bonds will decrease.

B)carrying value of the bonds will increase.

C)interest expense will increase.

D)interest payment will increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

23

A bond will sell at a premium when:

A)the coupon rate is equal to the effective rate.

B)the coupon rate is greater than the effective rate.

C)the coupon rate is less than the effective rate.

D)the stated rate is less than the market rate of interest.

A)the coupon rate is equal to the effective rate.

B)the coupon rate is greater than the effective rate.

C)the coupon rate is less than the effective rate.

D)the stated rate is less than the market rate of interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

24

A bond was issued at par.The journal entry to record payment of this bond payable at maturity will include a:

A)debit to Bonds Payable,credit to Discount on Bonds Payable and a credit to Cash.

B)debit to Cash and a credit to Bonds Payable.

C)debit to Bonds Payable and a credit to Cash.

D)debit to Bonds Payable,debit to Discount on Bonds Payable and a credit to Cash.

A)debit to Bonds Payable,credit to Discount on Bonds Payable and a credit to Cash.

B)debit to Cash and a credit to Bonds Payable.

C)debit to Bonds Payable and a credit to Cash.

D)debit to Bonds Payable,debit to Discount on Bonds Payable and a credit to Cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

25

If the market interest rate is 6%,a $10,000,7%,5-year bond,that pays interest semiannually would sell at an amount:

A)less than face value.

B)equal to face value.

C)greater than face value.

D)less than the maturity value.

A)less than face value.

B)equal to face value.

C)greater than face value.

D)less than the maturity value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

26

Maybelline Corporation issues $2,700,000,10-year,8% bonds dated January 1 at 101.The journal entry to record the issuance will include a:

A)credit to Cash for $2,727,000.

B)debit to Cash for $2,700,000.

C)credit to Premium on Bonds Payable for $27,000.

D)credit to Bonds Payable for $2,727,000.

A)credit to Cash for $2,727,000.

B)debit to Cash for $2,700,000.

C)credit to Premium on Bonds Payable for $27,000.

D)credit to Bonds Payable for $2,727,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

27

Bonds with a face value of $200,000 were sold at an effective interest rate of 8% to yield cash proceeds in excess of $200,000.It is apparent that the bonds had a:

A)stated interest rate less than the market rate.

B)stated interest rate greater than the market rate.

C)effective interest rate less than the stated rate.

D)effective interest rate greater than the market rate.

A)stated interest rate less than the market rate.

B)stated interest rate greater than the market rate.

C)effective interest rate less than the stated rate.

D)effective interest rate greater than the market rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

28

A bond with a face value of $80,000 and a quoted price of 104 has a selling price of: (Round your final answer to the nearest dollar. )

A)$76,923.

B)$80,000.

C)$83,200.

D)$88,000.

A)$76,923.

B)$80,000.

C)$83,200.

D)$88,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

29

Premium on Bonds Payable:

A)has a debit balance.

B)is a contra account to bonds payable.

C)has a credit balance.

D)is deducted from bonds payable on the balance sheet.

A)has a debit balance.

B)is a contra account to bonds payable.

C)has a credit balance.

D)is deducted from bonds payable on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

30

The market interest rate is also referred to as the:

A)contractual rate.

B)coupon rate.

C)effective rate.

D)stated rate.

A)contractual rate.

B)coupon rate.

C)effective rate.

D)stated rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

31

Smith Corporation issues $1,800,000,10-year,6% bonds payable at a price of 95.The journal entry to record the issuance will include a:

A)debit to Cash of $1,800,000.

B)credit to Discount on Bonds Payable for $90,000.

C)credit to Bonds Payable for $1,710,000.

D)debit to Cash for $1,710,000.

A)debit to Cash of $1,800,000.

B)credit to Discount on Bonds Payable for $90,000.

C)credit to Bonds Payable for $1,710,000.

D)debit to Cash for $1,710,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

32

The interest rate that investors demand for loaning their money is referred to as:

A)the coupon rate of interest.

B)the market rate of interest.

C)the stated rate of interest.

D)the debenture rate of interest.

A)the coupon rate of interest.

B)the market rate of interest.

C)the stated rate of interest.

D)the debenture rate of interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

33

The journal entry to record a semiannual interest payment on a bond payable issued at par:

A)debits Interest Expense and credits Bonds Payable.

B)debits Interest Expense and credits Cash.

C)debits Cash and credits Interest Payable.

D)debits Cash and credits Interest Expense.

A)debits Interest Expense and credits Bonds Payable.

B)debits Interest Expense and credits Cash.

C)debits Cash and credits Interest Payable.

D)debits Cash and credits Interest Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

34

The carrying value of a bond immediately after the bond was issued was $225,000.The bond price was 96.The face value of the bond was: (Round your final answer to the nearest dollar. )

A)$216,000.

B)$225,000.

C)$234,000.

D)$234,375.

A)$216,000.

B)$225,000.

C)$234,000.

D)$234,375.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

35

Bonds with a 7% stated interest rate were issued when the market rate of interest was 6%.This bond was issued at:

A)par value.

B)a premium.

C)a discount.

D)face value.

A)par value.

B)a premium.

C)a discount.

D)face value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

36

In the balance sheet,the account,Premium on Bonds Payable,is:

A)added to bonds payable.

B)deducted from bonds payable.

C)classified as a liability account.

D)A and C.

A)added to bonds payable.

B)deducted from bonds payable.

C)classified as a liability account.

D)A and C.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

37

On January 1,Hanley Corporation issued $2,300,000,10-year,9% bonds at 103.The journal entry to record this transaction would include a:

A)credit to Bonds Payable $2,369,000.

B)debit to Discount on Bonds Payable $69,000.

C)debit to Cash $2,300,000.

D)credit to Premium on Bonds Payable $69,000.

A)credit to Bonds Payable $2,369,000.

B)debit to Discount on Bonds Payable $69,000.

C)debit to Cash $2,300,000.

D)credit to Premium on Bonds Payable $69,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

38

A $4,000,6% bond is sold at 93.When the bond is issued,the Cash account will be increased by:

A)$3,720.

B)$4,000.

C)$3,960.

D)$4,280.

A)$3,720.

B)$4,000.

C)$3,960.

D)$4,280.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

39

Bonds with a 6% interest rate were issued when the market rate of interest was 7%.The quoted bond price will be:

A)greater than 100.

B)less than 100.

C)100.

D)greater than 1000.

A)greater than 100.

B)less than 100.

C)100.

D)greater than 1000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

40

Basil Company issued $610,000,8%,5-year bonds for 107,with interest paid annually.Assuming straight-line amortization,what is the carrying value of the bonds after one year?

A)$652,700

B)$610,000

C)$644,160

D)$658,800

A)$652,700

B)$610,000

C)$644,160

D)$658,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

41

Cubs Corporation issues $550,000,10%,5-year bonds on January 1,2019 for $489,000.Interest is paid annually on January 1.If Cubs Corporation uses the straight-line method of amortization of bond discount,the amount of interest expense recorded at December 31,2019 would be:

A)$61,000.

B)$42,800.

C)$55,000.

D)$67,200.

A)$61,000.

B)$42,800.

C)$55,000.

D)$67,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

42

Over the term of a bond,the amortization of the premium on bonds payable:

A)increases the amount of cash paid to bondholders annually.

B)decreases the amount of cash paid to bondholders annually.

C)increases interest expense.

D)decreases interest expense.

A)increases the amount of cash paid to bondholders annually.

B)decreases the amount of cash paid to bondholders annually.

C)increases interest expense.

D)decreases interest expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

43

On January 1,2019,Tarantino Corporation issued $4,000,000,9%,5-year bonds at 96.The bonds pay semiannual interest on January 1 and July 1.Tarantino uses the straight-line method of amortization and has a calendar year end.

Required:

Prepare all the journal entries that Tarantino Corporation would make related to this bond issue through January 1,2020.Omit explanations.

Required:

Prepare all the journal entries that Tarantino Corporation would make related to this bond issue through January 1,2020.Omit explanations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

44

On January 1,2019,Paulsen Company issued $600,000,6%,5-year bonds at face value.Interest is payable semiannually on July 1 and January 1.

Required:

Prepare journal entries on:

1.January 1,2019

2.July 1,2019

3.December 31,2019,the fiscal year end

Omit explanations.

Required:

Prepare journal entries on:

1.January 1,2019

2.July 1,2019

3.December 31,2019,the fiscal year end

Omit explanations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

45

On January 1,2019,Always Corporation issues $2,800,000,5-year,11% bonds for $2,720,000.Interest is paid semiannually on January 1 and July 1.Always Corporation uses the straight-line method of amortization.The company's fiscal year ends on December 31.The amount of discount amortized on July 1,2019 is:

A)$4,000.

B)$8,000.

C)$16,000.

D)$80,000.

A)$4,000.

B)$8,000.

C)$16,000.

D)$80,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

46

Secured bonds are:

A)also called mortgage bonds.

B)also called serial bonds.

C)bonds that give the bondholder the right to take specified assets of the issuer in the event the issuer fails to pay interest or principal.

D)A and C.

A)also called mortgage bonds.

B)also called serial bonds.

C)bonds that give the bondholder the right to take specified assets of the issuer in the event the issuer fails to pay interest or principal.

D)A and C.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

47

On January 1,2019,Brewers Corporation issued $600,000 of 6%,5-year bonds at 99,with interest paid annually.Using the straight-line amortization method,what is the carrying value of the bonds on January 1,2019? (Round your final answer to the nearest dollar. )

A)$594,000

B)$606,061

C)$595,200

D)$636,000

A)$594,000

B)$606,061

C)$595,200

D)$636,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

48

Darla's Cookie Emporium borrowed money by issuing $200,000 of bonds at 96 on January 1,2019.The bonds pay interest on January 1 and July 1.The stated rate of interest is 5% and the bonds mature in 10 years.Any discount or premium is amortized using the straight-line method.

Required:

Prepare journal entries on the following dates:

1.January 1,2019.

2.July 1,2019.

3.December 31,2019,the fiscal year end.

4.January 1,2020.

5.January 1,2029.

Omit explanations.

Required:

Prepare journal entries on the following dates:

1.January 1,2019.

2.July 1,2019.

3.December 31,2019,the fiscal year end.

4.January 1,2020.

5.January 1,2029.

Omit explanations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

49

Schmid Corporation issues $450,000,12%,5-year bonds on January 1,2019 for $439,000.Interest is paid semiannually on January 1 and July 1.If Schmid uses the straight-line method of amortization of bond discount,the amount of bond interest expense on July 1,2019 is:

A)$25,900.

B)$27,000.

C)$28,100.

D)$55,100.

A)$25,900.

B)$27,000.

C)$28,100.

D)$55,100.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

50

On April 1,2020,Eiche Company issues $2,500,000 of 6%,5-year bonds,with interest payments made each October 1 and April 1.The bonds are issued at 98.Eiche Company amortizes any premium or discount using the straight-line method.

Required:

Prepare journal entries on the following dates:

1.April 1,2020.

2.October 1,2020.

3.December 31,2020,the fiscal year end.

Omit explanations.

Required:

Prepare journal entries on the following dates:

1.April 1,2020.

2.October 1,2020.

3.December 31,2020,the fiscal year end.

Omit explanations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

51

Over the term of the bonds,the balance in the Premium on Bonds Payable account will:

A)increase or decrease if the market is unstable.

B)increase.

C)decrease.

D)not change until the bonds mature.

A)increase or decrease if the market is unstable.

B)increase.

C)decrease.

D)not change until the bonds mature.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

52

Generally accepted accounting principles (GAAP)allow businesses to use the straight-line amortization method for bond discounts and premiums only when the amounts calculated do not differ significantly from the amounts calculated using the effective-interest method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

53

Fenway Corporation issued a $24,000,10-year,11% bond dated January 1,at 102.The journal entry to record the issuance of the bond will include a:

A)debit to Cash for $24,000.

B)debit to Cash for $24,480.

C)credit to Bonds Payable for $24,480.

D)debit to Discount on Bonds Payable for $480.

A)debit to Cash for $24,000.

B)debit to Cash for $24,480.

C)credit to Bonds Payable for $24,480.

D)debit to Discount on Bonds Payable for $480.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

54

Unsecured bonds are called ________.Secured bonds are called ________.

A)convertible bonds;callable bonds

B)term bonds;serial bonds

C)debentures;mortgage bonds

D)regular bonds;special bonds

A)convertible bonds;callable bonds

B)term bonds;serial bonds

C)debentures;mortgage bonds

D)regular bonds;special bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

55

On July 1,2019,Brownlee Corporation issues $1,200,000 of 10-year,9% bonds dated July 1,2019 at 88.Brownlee uses the straight-line method of amortization.Interest is paid each July 1 and January 1.Brownlee Corporation's fiscal year end is June 30.The interest expense recognized for the first semiannual interest payment on January 1,2020 is:

A)$46,800.

B)$54,000.

C)$61,200.

D)$108,000.

A)$46,800.

B)$54,000.

C)$61,200.

D)$108,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

56

Bonds that mature on a single date are called ________.Bonds that mature on multiple dates are called ________.

A)mortgage bonds;serial bonds

B)serial bonds;mortgage bonds

C)debentures;special bonds

D)term bonds;serial bonds

A)mortgage bonds;serial bonds

B)serial bonds;mortgage bonds

C)debentures;special bonds

D)term bonds;serial bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

57

On January 1,2018,a bond was issued at a discount.The journal entry to record the semiannual interest payment on July 1,2018 would include a:

A)debit to Interest Expense,a credit to Discount on Bonds Payable and a credit to Cash.

B)debit to Interest Expense,a debit to Discount on Bonds Payable and a credit to Cash.

C)debit to Interest Expense,a debit to Cash and a credit to Discount on Bonds Payable.

D)debit to Discount on Bonds Payable and a credit to Cash.

A)debit to Interest Expense,a credit to Discount on Bonds Payable and a credit to Cash.

B)debit to Interest Expense,a debit to Discount on Bonds Payable and a credit to Cash.

C)debit to Interest Expense,a debit to Cash and a credit to Discount on Bonds Payable.

D)debit to Discount on Bonds Payable and a credit to Cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

58

On January 1,2019,Anthony Corporation issued $1,000,000 of 6%,5-year bonds at 98,with interest paid annually.Using the straight-line amortization method,what is the carrying value of the bonds one year later on January 1,2020? (Round any intermediary calculations to two decimal places and your final answer to the nearest dollar. )

A)$980,000

B)$992,000

C)$984,000

D)$1,016,408

A)$980,000

B)$992,000

C)$984,000

D)$1,016,408

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

59

On January 1,2019,Las Vegas Company issued 8%,20-year bonds with a face amount of $3,000,000 at 101.Interest is payable semiannually on June 30 and December 31.Las Vegas Company uses the straight-line method to amortize bond premium or discount.The company's fiscal year ends December 31.

Required:

Prepare the journal entries to record the issuance of the bonds and the first semiannual interest payment.Omit explanations.

Required:

Prepare the journal entries to record the issuance of the bonds and the first semiannual interest payment.Omit explanations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

60

The effective-interest method of amortizing a bond discount or premium results in different amounts of interest expense for every interest payment over the bond's life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

61

If bonds have been issued at a discount and the effective-interest method is used,the journal entry for payment of bond interest would include:

A)a debit to cash.

B)a debit to discount on bonds payable.

C)a credit to interest expense.

D)a debit to interest expense.

A)a debit to cash.

B)a debit to discount on bonds payable.

C)a credit to interest expense.

D)a debit to interest expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

62

Under the effective-interest method,the amount of bond discount amortized each interest period is equal to the:

A)amount of interest expense less the cash paid for interest.

B)amount of interest expense plus the cash paid for interest.

C)face value of the bond times the stated interest rate.

D)face value of the bond times the market interest rate at the date of issue.

A)amount of interest expense less the cash paid for interest.

B)amount of interest expense plus the cash paid for interest.

C)face value of the bond times the stated interest rate.

D)face value of the bond times the market interest rate at the date of issue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

63

Under the effective-interest method,if bonds are issued at a discount,the amount of interest expense:

A)increases each period as the bonds move towards maturity.

B)decreases each period as the bonds move towards maturity.

C)remains the same over the term of the bonds.

D)is less than the cash interest payment.

A)increases each period as the bonds move towards maturity.

B)decreases each period as the bonds move towards maturity.

C)remains the same over the term of the bonds.

D)is less than the cash interest payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

64

On January 1,2019,Fleming Corporation issued 9%,10-year bonds with a face value of $900,000 at 93.78.Interest is payable semiannually on January 1 and July 1.The effective-interest rate when the bonds were issued was 10%.Any discount or premium is amortized using the effective-interest method.

Required:

Prepare journal entries on:

1.January 1,2019

2.July 1,2019

Omit explanations.

Required:

Prepare journal entries on:

1.January 1,2019

2.July 1,2019

Omit explanations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

65

Callable bonds allow the issuer to pay off the bonds whenever the issuer chooses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

66

The straight-line amortization method is the most theoretically correct way to amortize bond discount and premium because it recognizes the impact that the time value of money has on the interest expense recognized each interest payment period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

67

Under the effective-interest method of amortization,the bond cash payment on each interest date is calculated by multiplying the:

A)face value of the bonds times the effective-interest rate for the appropriate time period.

B)face value of the bonds times the stated interest rate for the appropriate time period.

C)carrying value of the bonds times the stated interest rate for the appropriate time period.

D)carrying value of the bonds times the effective-interest rate for the appropriate time period.

A)face value of the bonds times the effective-interest rate for the appropriate time period.

B)face value of the bonds times the stated interest rate for the appropriate time period.

C)carrying value of the bonds times the stated interest rate for the appropriate time period.

D)carrying value of the bonds times the effective-interest rate for the appropriate time period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

68

NBC Corporation issued $610,000,9%,5-year bonds on January 1,2019 for $660,731 when the market interest rate was 7%.Interest is paid semiannually on January 1 and July 1.The corporation uses the effective-interest method to amortize bond premium.The total amount of bond interest expense recognized on July 1,2019 is:

A)$21,350.

B)$23,126.

C)$29,733.

D)$27,450.

A)$21,350.

B)$23,126.

C)$29,733.

D)$27,450.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

69

If bonds have been issued at a discount and the effective-interest method is used,the ________ over the life of the bonds.

A)carrying value of the bonds will decrease

B)interest payment will increase

C)interest expense will decrease

D)interest expense will increase

A)carrying value of the bonds will decrease

B)interest payment will increase

C)interest expense will decrease

D)interest expense will increase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

70

Bonds that the issuer may pay off at a prearranged price whenever the issuer chooses before the maturity date are:

A)serial bonds.

B)callable bonds.

C)convertible bonds.

D)debenture bonds.

A)serial bonds.

B)callable bonds.

C)convertible bonds.

D)debenture bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

71

On January 1,2019,Patterson Corporation issued $100,000,9%,5-year bonds with semiannual interest payments on June 30 and December 31.The bonds were issued at $96,149 yielding an effective-interest rate of 10%.Patterson uses the effective-interest method of amortization.The company's fiscal year ends on December 31.

Required:

Prepare the journal entries that Patterson would make on January 1,June 30 and December 31,2019.Round all amounts to the nearest dollar.Omit explanations.

Required:

Prepare the journal entries that Patterson would make on January 1,June 30 and December 31,2019.Round all amounts to the nearest dollar.Omit explanations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

72

If a bond is retired before maturity,the journal entry to record the retirement by the issuer will include a credit to Cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

73

Lisle Corporation issued $200,000 of 10% bonds on January 1,2019.The bonds pay interest semiannually on January 1 and July 1.The company has a fiscal year end of May 31.On May 31,2019,the Lisle Corporation will:

A)make a journal entry to accrue interest expense from July 1 through December 31.

B)make a journal entry to accrue interest expense from January 1 through July 1.

C)make a journal entry to accrue interest expense from January 1 through May 31.

D)make a journal entry to record cash interest paid on May 31.

A)make a journal entry to accrue interest expense from July 1 through December 31.

B)make a journal entry to accrue interest expense from January 1 through July 1.

C)make a journal entry to accrue interest expense from January 1 through May 31.

D)make a journal entry to record cash interest paid on May 31.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which is the most theoretically correct method to use when amortizing a bond discount or premium?

A)market-interest rate method of amortization

B)straight-line method of amortization

C)effective-interest method of amortization

D)Both straight-line and market-interest rate methods of amortization are equally preferred.

A)market-interest rate method of amortization

B)straight-line method of amortization

C)effective-interest method of amortization

D)Both straight-line and market-interest rate methods of amortization are equally preferred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

75

When a corporation converts bonds payable into common stock,its equity increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

76

Under the effective-interest method of amortization,interest expense for each interest period can be calculated by multiplying the:

A)face value of the bonds times the effective-interest rate for the appropriate time period.

B)carrying value of the bonds times the effective-interest rate for the appropriate time period.

C)face value of the bonds times the stated interest rate for the appropriate time period.

D)carrying value of the bonds times the stated interest rate for the appropriate time period.

A)face value of the bonds times the effective-interest rate for the appropriate time period.

B)carrying value of the bonds times the effective-interest rate for the appropriate time period.

C)face value of the bonds times the stated interest rate for the appropriate time period.

D)carrying value of the bonds times the stated interest rate for the appropriate time period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

77

On January 1,2019,Naperville Corporation issued $2,300,000,12%,5-year bonds with interest payable on January 1 and July 1.The bonds sold for $2,446,400.The market rate of interest was 10%.Using the effective-interest method,the debit entry to interest expense on July 1,2019 is (round to the nearest dollar):

A)$115,000.

B)$146,784.

C)$122,320.

D)$138,000.

A)$115,000.

B)$146,784.

C)$122,320.

D)$138,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

78

On July 1,2019,Bobby's Building Corp.issued $1,000,000 of 11% bonds dated July 1,2019 for $1,062,771.The bonds were sold to yield 10% and pay interest semiannually on July 1 and January 1.Bobby's Building Corp.uses the effective interest method of amortization.The company's fiscal year ends on February 28.

Required:

1.Prepare the journal entry on July 1,2019.

2.Prepare the amortization table for the first two interest periods.

3.Prepare the journal entry on January 1,2020.

Round all amounts to the nearest dollar.Omit explanations for all journal entries.

1.

2.

2.

3.

3.

Required:

1.Prepare the journal entry on July 1,2019.

2.Prepare the amortization table for the first two interest periods.

3.Prepare the journal entry on January 1,2020.

Round all amounts to the nearest dollar.Omit explanations for all journal entries.

1.

2.

2. 3.

3.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

79

Solderman Company issued $510,000,7%,10-year bonds for $422,800 with a market rate of 9%.The effective interest method of amortization is used and interest is paid annually.The journal entry on the first interest payment date would include a:

A)credit to Interest Expense of $35,700.

B)credit to Cash of $38,052.

C)credit to Cash of $35,700.

D)credit to Interest Expense of $38,052.

A)credit to Interest Expense of $35,700.

B)credit to Cash of $38,052.

C)credit to Cash of $35,700.

D)credit to Interest Expense of $38,052.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

80

On January 1,2019,Chin Corporation issued $2,900,000,16%,5-year bonds.The bond interest is payable on January 1 and July 1.The bonds sold for $3,119,600.The market rate of interest for these bonds was 14%.Under the effective-interest method,what is the interest expense for the six months ending July 1,2019?

A)$203,000

B)$249,568

C)$218,372

D)$232,000

A)$203,000

B)$249,568

C)$218,372

D)$232,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck