Deck 8: Current and Contingent Liabilities

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

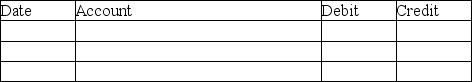

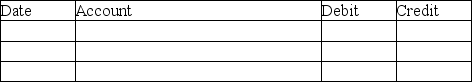

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

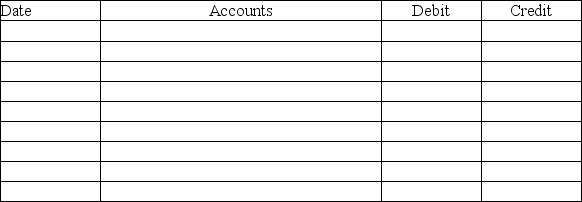

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/111

العب

ملء الشاشة (f)

Deck 8: Current and Contingent Liabilities

1

Long-term liabilities are incurred mostly for operating activities.

False

2

Which is NOT a current liability?

A)unearned revenue

B)accounts payable

C)service revenue

D)accrued liabilities

A)unearned revenue

B)accounts payable

C)service revenue

D)accrued liabilities

C

3

Current liabilities are usually associated with various day-to-day operating activities.

True

4

Unearned Service Revenue relating to services to be provided in one month,is reported on the balance sheet as:

A)a revenue account.

B)a current liability.

C)a component of stockholders' equity.

D)a long-term liability.

A)a revenue account.

B)a current liability.

C)a component of stockholders' equity.

D)a long-term liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

5

Current liabilities are expected to be paid within one year or the operating cycle,whichever is shorter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

6

Accounts payable turnover measures the number of times per day the company is able to pay its accounts payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

7

Companies with longer payment periods are usually better credit risks than those with shorter payment periods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

8

The most frequently used current liabilities are accounts receivable and notes receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

9

Large companies,like Amazon,typically pay most of their financing expenses through accounts payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

10

Accounts payable turnover is an important measure of liquidity for a retail business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

11

Large companies,like Amazon,typically purchase all of their inventory through accounts payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

12

Notes payable due in six months are reported as:

A)a reduction to notes receivable on the balance sheet.

B)current assets on the balance sheet.

C)current liabilities on the balance sheet.

D)long-term liabilities on the balance sheet.

A)a reduction to notes receivable on the balance sheet.

B)current assets on the balance sheet.

C)current liabilities on the balance sheet.

D)long-term liabilities on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

13

Long-term liabilities are usually associated with:

A)purchase of a building

B)purchase of equipment

C)payment of wages owed.

D)both A and B.

A)purchase of a building

B)purchase of equipment

C)payment of wages owed.

D)both A and B.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following liability accounts is usually NOT an accrued liability:

A)Warranties Payable.

B)Wages Payable.

C)Taxes Payable.

D)Notes Payable.

A)Warranties Payable.

B)Wages Payable.

C)Taxes Payable.

D)Notes Payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

15

Long-term liabilities are mostly for:

A)operating activities

B)financing activities.

C)investing activities.

D)both A and B.

A)operating activities

B)financing activities.

C)investing activities.

D)both A and B.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

16

Current liabilities are usually associated with:

A)purchase of a building.

B)purchase of equipment.

C)payment of wages owed.

D)both A and B.

A)purchase of a building.

B)purchase of equipment.

C)payment of wages owed.

D)both A and B.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

17

Current liabilities are mostly for:

A)operating activities

B)financing activities.

C)investing activities.

D)both A and B.

A)operating activities

B)financing activities.

C)investing activities.

D)both A and B.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

18

All of the following are reported as current liabilities EXCEPT:

A)unearned revenues for services to be provided in 16 months.

B)payroll tax payable.

C)accounts payable.

D)notes payable due in 6 months.

A)unearned revenues for services to be provided in 16 months.

B)payroll tax payable.

C)accounts payable.

D)notes payable due in 6 months.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

19

The most frequently used current liabilities are:

A)accounts payable,accounts receivable,and accrued liabilities.

B)accounts payable,notes payable,and accrued liabilities.

C)cash,notes payable,and accrued liabilities.

D)accounts payable,notes payable,and inventories.

A)accounts payable,accounts receivable,and accrued liabilities.

B)accounts payable,notes payable,and accrued liabilities.

C)cash,notes payable,and accrued liabilities.

D)accounts payable,notes payable,and inventories.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

20

Amounts owed for products or services purchased on account are accounts payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

21

If the accounts payable turnover is 5.4,what is the days' payable outstanding? (Round your answer to the nearest day. )

A)58 days

B)18 days

C)68 days

D)55 days

A)58 days

B)18 days

C)68 days

D)55 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

22

If Cost of Goods Sold is $240,000,beginning inventory is $57,000,and ending inventory is $40,000,then the purchases from suppliers (assume all on account)would be:

A)$337,000.

B)$257,000.

C)$223,000.

D)$240,000.

A)$337,000.

B)$257,000.

C)$223,000.

D)$240,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

23

On December 31st,Goliath Corporation has cost of goods sold of $114,000,ending inventory is $15,000,beginning inventory is $18,000;and average accounts payable is $25,000.

Required:

1.What is the accounts payable turnover (take all answers to two decimal places)?

2.What is the accounts payable turnover in days (take to the nearest day)?

Required:

1.What is the accounts payable turnover (take all answers to two decimal places)?

2.What is the accounts payable turnover in days (take to the nearest day)?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

24

The accounts payable turnover is calculated by purchases from suppliers divided by:

A)average accounts payable

B)beginning accounts payable.

C)ending accounts payable.

D)average accounts receivable.

A)average accounts payable

B)beginning accounts payable.

C)ending accounts payable.

D)average accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which number is needed in calculating the accounts payable turnover that is NOT normally reported on the financial statements?

A)purchases from suppliers

B)cost of goods sold

C)ending inventory

D)beginning inventory

A)purchases from suppliers

B)cost of goods sold

C)ending inventory

D)beginning inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

26

On December 31st,Datton,Inc.has cost of goods sold of $550,000,ending inventory is $102,000,beginning inventory is $120,000;and average accounts payable is $114,000.What is the accounts payable turnover? (Round your answer two decimal places. )

A)4.98

B)7.77

C)4.67

D)2.88

A)4.98

B)7.77

C)4.67

D)2.88

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

27

On December 31st,Datton,Inc.has cost of goods sold of $550,000,ending inventory is $112,000,beginning inventory is $129,000;and average accounts payable is $107,000.What is the accounts payable turnover expressed as days? (Round any intermediary calculations to two decimal places,and round your final answer to the nearest day. )

A)69

B)73

C)44

D)126

A)69

B)73

C)44

D)126

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

28

On December 31st,Baxtor,Inc.has cost of goods sold of $310,000,ending inventory is $18,000,beginning inventory is $23,000;and average accounts payable is $89,000.What is the accounts payable turnover expressed as days?

A)106

B)103

C)74

D)121

A)106

B)103

C)74

D)121

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

29

A note is a written promise to pay a certain amount of money at a given date in the future along with interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

30

The accounts payable turnover expressed in days is 365 divided by:

A)accounts payable turnover.

B)beginning accounts payable.

C)ending accounts payable.

D)average accounts payable.

A)accounts payable turnover.

B)beginning accounts payable.

C)ending accounts payable.

D)average accounts payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

31

If Cost of Goods Sold is $300,000,beginning inventory is $29,000,and ending inventory is $30,000,then the purchases from suppliers (assume all on account)would be:

A)$359,000.

B)$299,000.

C)$301,000.

D)$59,000.

A)$359,000.

B)$299,000.

C)$301,000.

D)$59,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

32

Typically,the hard part about computing the accounts payable turnover is getting the:

A)purchases from suppliers.

B)beginning inventory.

C)ending inventory.

D)average inventory.

A)purchases from suppliers.

B)beginning inventory.

C)ending inventory.

D)average inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

33

A typical credit period for payment is:

A)10 days.

B)15 days.

C)30 days.

D)45 days.

A)10 days.

B)15 days.

C)30 days.

D)45 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

34

On December 31st,Smith Corporation has cost of goods sold of $124,000,ending inventory is $25,000,beginning inventory is $28,000;and average accounts payable is $15,000.

Required:

1.What is the accounts payable turnover (take all answers to two decimal places)?

2.What is the accounts payable turnover in days (take to the nearest day)?

Required:

1.What is the accounts payable turnover (take all answers to two decimal places)?

2.What is the accounts payable turnover in days (take to the nearest day)?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

35

When calculating accounts payable turnover,if there is not a material difference between the company's beginning inventory and ending inventory,then:

A)an adjustment still must be made for the difference to reduce or increase purchases.

B)it should just be noted in the footnotes.

C)it is not necessary to adjust for the inventory.

D)an adjustment still must be made for the difference to reduce cost of goods sold.

A)an adjustment still must be made for the difference to reduce or increase purchases.

B)it should just be noted in the footnotes.

C)it is not necessary to adjust for the inventory.

D)an adjustment still must be made for the difference to reduce cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

36

If the accounts payable turnover is 7.9,what is the days' payable outstanding? (Round your answer to the nearest day. )

A)46 days

B)16 days

C)56 days

D)33 days

A)46 days

B)16 days

C)56 days

D)33 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

37

How do you compute the purchases from suppliers:

A)Cost of goods sold + ending inventory + beginning inventory.

B)Cost of goods sold - ending inventory - beginning inventory.

C)Cost of goods sold + ending inventory - beginning inventory.

D)Cost of goods sold - ending inventory + beginning inventory.

A)Cost of goods sold + ending inventory + beginning inventory.

B)Cost of goods sold - ending inventory - beginning inventory.

C)Cost of goods sold + ending inventory - beginning inventory.

D)Cost of goods sold - ending inventory + beginning inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

38

Short-term notes payable are notes payable due in more than one year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

39

When calculating accounts payable turnover,if there is not a material difference between the company's beginning inventory and ending inventory,then the accounts payable turnover will be ________ whether purchases or cost of goods sold are used.

A)similar

B)unavailable

C)drastically different

D)noncomparable

A)similar

B)unavailable

C)drastically different

D)noncomparable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

40

On December 31st,Baxtor,Inc.has cost of goods sold of $380,000,ending inventory is $12,000,beginning inventory is $28,000;and average accounts payable is $89,000.What is the accounts payable turnover? (Round your answer two decimal places. )

A)4.45

B)5.72

C)3.82

D)4.09

A)4.45

B)5.72

C)3.82

D)4.09

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

41

Short-term notes payable would typically be used to purchase inventory or pay operating expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

42

Michigan Bank lends Detroit Furniture Company $110,000 on December 1.Detroit Furniture Company signs a $110,000,9%,4-month note.The total cash paid for interest (only)at maturity of the note is: (Round your final answer to the nearest dollar. )

A)$1,100.

B)$3,300.

C)$6,600.

D)$9,900.

A)$1,100.

B)$3,300.

C)$6,600.

D)$9,900.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

43

Madison Bank lends Neenah Paper Company $120,000 on January 1,2017.Neenah signs a $120,000,10%,6-month note.The journal entry made by Neenah on January 1,2017 will debit:

A)Cash for $108,000 and credit Note Payable for $108,000.

B)Interest Expense for $12,000 and credit Cash for $12,000.

C)Cash for $120,000 and credit Notes Payable for $120,000.

D)Interest Expense for $12,000 and credit Interest Payable for $12,000.

A)Cash for $108,000 and credit Note Payable for $108,000.

B)Interest Expense for $12,000 and credit Cash for $12,000.

C)Cash for $120,000 and credit Notes Payable for $120,000.

D)Interest Expense for $12,000 and credit Interest Payable for $12,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

44

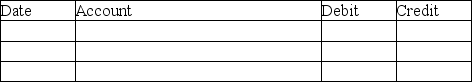

On July 1st,Smith Corporation purchased $10,000 of inventory using a short-term note payable due in one year at 10% interest.Smith Corporation's fiscal year ends on December 31.

Required:

1.Journalize the purchase of the inventory.Omit explanation.

2.Journalize the accrued interest expense on December 31st.Omit explanation.

3.Journalize the payment of the note payable the following year on June 30th.Omit explanation.

1.

2.

2.

3.

3.

Required:

1.Journalize the purchase of the inventory.Omit explanation.

2.Journalize the accrued interest expense on December 31st.Omit explanation.

3.Journalize the payment of the note payable the following year on June 30th.Omit explanation.

1.

2.

2. 3.

3.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

45

Long-term notes payable are usually used to buy items such as:

A)building.

B)equipment.

C)equity investments.

D)all of the above.

A)building.

B)equipment.

C)equity investments.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

46

Short-term notes payable typically increase liabilities and equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which is NOT an example of long-term debt?

A)notes payable

B)accounts payable

C)bonds payable

D)All of the above are examples of long-term debt.

A)notes payable

B)accounts payable

C)bonds payable

D)All of the above are examples of long-term debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

48

Wisconsin Bank lends Local Furniture Company $110,000 on November 1.Local Furniture Company signs a $110,000,6%,4-month note.The fiscal year end of Local Furniture Company is December 31.The journal entry made by Local Furniture Company on December 31 is:

A)debit Interest Expense and credit Interest Payable for $1,100.

B)debit Interest Payable and credit Interest Expense for $1,100.

C)debit Interest Expense and credit Cash for $1,100.

D)debit Interest Payable and credit Cash for $1,100.

A)debit Interest Expense and credit Interest Payable for $1,100.

B)debit Interest Payable and credit Interest Expense for $1,100.

C)debit Interest Expense and credit Cash for $1,100.

D)debit Interest Payable and credit Cash for $1,100.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

49

Most long-term debt agreements are structured to be paid in installments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

50

Short-term notes payable to banks are often used to finance business operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

51

To record the accrued interest on a note payable at the end of the accounting period,a journal entry should be written to credit:

A)Cash.

B)Interest Payable.

C)Notes Payable.

D)Interest Expense.

A)Cash.

B)Interest Payable.

C)Notes Payable.

D)Interest Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which account would be reported on the income statement?

A)Wages Payable

B)Interest Payable

C)Notes Payable

D)Interest Expense

A)Wages Payable

B)Interest Payable

C)Notes Payable

D)Interest Expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

53

At the end of the year,a company makes a journal entry to accrue the interest expense on a short-term note payable.As a result of this transaction:

A)current liabilities increase and current assets increase.

B)current liabilities increase and stockholders' equity increases.

C)current liabilities decrease and stockholders' equity decreases.

D)current liabilities increase and stockholders' equity decreases.

A)current liabilities increase and current assets increase.

B)current liabilities increase and stockholders' equity increases.

C)current liabilities decrease and stockholders' equity decreases.

D)current liabilities increase and stockholders' equity decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

54

To record the accrued interest on a note payable at the end of the accounting period,a journal entry should be written to debit:

A)Cash.

B)Interest Payable.

C)Notes Payable.

D)Interest Expense.

A)Cash.

B)Interest Payable.

C)Notes Payable.

D)Interest Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

55

Interest expense on a note payable is only recorded at maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

56

A current liability would include all EXCEPT:

A)Wages Payable.

B)Interest Payable.

C)Notes Payable.

D)Interest Expense.

A)Wages Payable.

B)Interest Payable.

C)Notes Payable.

D)Interest Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

57

Examples of long term debt would include:

A)Notes Payable.

B)Bonds Payable.

C)Accounts Payable.

D)A and B.

A)Notes Payable.

B)Bonds Payable.

C)Accounts Payable.

D)A and B.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

58

The journal entry to record accrued interest on a short-term note payable includes a debit to:

A)Interest Payable and a credit to Cash.

B)Interest Expense and a credit to Cash.

C)Interest Expense and a credit to Interest Payable.

D)Interest Payable and a credit to Notes Payable.

A)Interest Payable and a credit to Cash.

B)Interest Expense and a credit to Cash.

C)Interest Expense and a credit to Interest Payable.

D)Interest Payable and a credit to Notes Payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

59

Illinois Bank lends Lisle Furniture Company $90,000 on December 1.Lisle Furniture Company signs a $90,000,10%,4-month note.The total cash paid at maturity of the note is: (Round your final answer to the nearest dollar. )

A)$90,000.

B)$93,000.

C)$94,500.

D)$99,000.

A)$90,000.

B)$93,000.

C)$94,500.

D)$99,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

60

The current portion of a long-term note payable refers to the amount of interest on a note payable that must be paid in the current year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

61

Employers must match employee contributions (up to a maximum amount)for:

A)social security.

B)income tax.

C)medicare.

D)A and C.

A)social security.

B)income tax.

C)medicare.

D)A and C.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

62

Payroll is also called employee compensation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

63

A bonus is an amount over and above regular compensation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

64

Some liabilities,such as accrued salaries and rent,are recognized at the end of the next accounting period in the form of adjustments to the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

65

Employee compensation is the major expense for most service companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

66

For a merchandising company,cost of goods sold is generally the largest expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which account is NOT an example of an accrued liability?

A)sales tax payable

B)wages payable

C)interest payable

D)accounts payable

A)sales tax payable

B)wages payable

C)interest payable

D)accounts payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

68

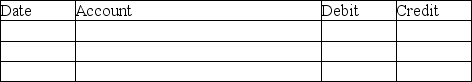

On December 1,2019,Goliath Corporation borrowed $120,000 on a three-month,10% note.Goliath Corporation's year end is December 31.

Required:

1.Prepare the journal entries in 2019 and 2020 for Goliath Corporation.Omit explanations.

2.At December 31,2019,what is reported on the balance sheet as current liabilities?

1.

2.

2.

Current Liabilities:

Required:

1.Prepare the journal entries in 2019 and 2020 for Goliath Corporation.Omit explanations.

2.At December 31,2019,what is reported on the balance sheet as current liabilities?

1.

2.

2.Current Liabilities:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

69

Some accrued liabilities,such as sales taxes and commissions,are incurred at the point of sale and must be recognized in the same period as those sales are made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

70

The balance of the Unearned Revenue account becomes zero when a company has earned all of the revenue it had collected in advance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

71

FICA tax includes:

A)social security and medicare.

B)social security and income tax.

C)income tax and medicare.

D)medicare and salaries payable

A)social security and medicare.

B)social security and income tax.

C)income tax and medicare.

D)medicare and salaries payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

72

Warranties and income taxes are examples of expenses that must be estimated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

73

Failure to record an accrued liability for wages earned by employees causes a company to:

A)understate net income.

B)overstate assets.

C)overstate liabilities.

D)overstate stockholders' equity.

A)understate net income.

B)overstate assets.

C)overstate liabilities.

D)overstate stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

74

The accrual method of accounting requires that expenses be recognized as they are incurred and matched against revenues earned in the same period or in the next period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

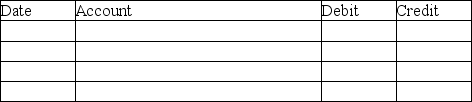

75

On April 1st,Jones Corporation purchased $15,000 of inventory using a short-term note payable due in one year at 8% interest.Jones Corporation's fiscal year ends on December 31.

Required:

1.Journalize the purchase of the inventory.Omit explanation.

2.Journalize the accrued interest expense on December 31st.Omit explanation.

3.Journalize the payment of the note payable the following year on March 31st.Omit explanation.

1.

2.

2.

3.

3.

Required:

1.Journalize the purchase of the inventory.Omit explanation.

2.Journalize the accrued interest expense on December 31st.Omit explanation.

3.Journalize the payment of the note payable the following year on March 31st.Omit explanation.

1.

2.

2. 3.

3.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

76

The journal entry to accrue salaries earned by employees will debit:

A)Salary Expense and credit Salary Payable for net pay.

B)Salary Expense and credit Salary Payable for gross pay.

C)Salary Expense for gross pay,credit FICA Tax Payable,credit Employee Income Tax Payable and credit Salary Payable for net pay.

D)Salary Expense for net pay,debit FICA Tax Payable,debit Employee Income Tax Payable,and credit Salary Payable for gross pay.

A)Salary Expense and credit Salary Payable for net pay.

B)Salary Expense and credit Salary Payable for gross pay.

C)Salary Expense for gross pay,credit FICA Tax Payable,credit Employee Income Tax Payable and credit Salary Payable for net pay.

D)Salary Expense for net pay,debit FICA Tax Payable,debit Employee Income Tax Payable,and credit Salary Payable for gross pay.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

77

For a service organization,compensation is not generally a major operating expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

78

A wage is employee pay at a monthly or yearly rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

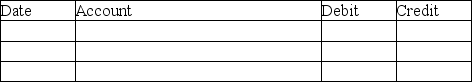

79

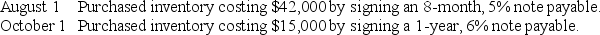

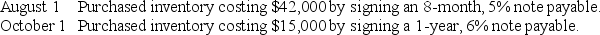

Davies Accessories Company entered into the following transactions relating to notes payable:

Required:

Required:

Prepare journal entries to record the above transactions.Also,prepare journal entries needed on December 31,the company's fiscal year end.Omit explanations.

Required:

Required:Prepare journal entries to record the above transactions.Also,prepare journal entries needed on December 31,the company's fiscal year end.Omit explanations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

80

When a business receives cash from customers before earning the revenue,the ________ account is credited.

A)Accounts Receivable

B)Sales Tax Payable

C)Accounts Payable

D)Unearned Revenue

A)Accounts Receivable

B)Sales Tax Payable

C)Accounts Payable

D)Unearned Revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck