Deck 13: Investments

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/83

العب

ملء الشاشة (f)

Deck 13: Investments

1

Unrealized gains and losses on equity securities when the investor has insignificant influence are reported on the income statement.

True

2

An unrealized gain on an equity security when the investor has insignificant influence:

A)is recorded when an investment is sold for more than its cost.

B)is recorded when an investment is sold for less than its cost.

C)is recorded when the fair market value of the investment is more than its cost,but it has not been sold.

D)is recorded when the fair market value of the investment is less than its cost,but it has not been sold.

A)is recorded when an investment is sold for more than its cost.

B)is recorded when an investment is sold for less than its cost.

C)is recorded when the fair market value of the investment is more than its cost,but it has not been sold.

D)is recorded when the fair market value of the investment is less than its cost,but it has not been sold.

C

3

Marathon Corporation owns 500 shares of Mini Company's common stock.Mini Company has 100,000 shares of common stock outstanding.Marathon Corporation is the ________ and Mini Company is the ________.

A)investee;investor

B)investor;investee

C)parent company;subsidiary company

D)controlling company;noncontrolling company

A)investee;investor

B)investor;investee

C)parent company;subsidiary company

D)controlling company;noncontrolling company

B

4

To be classified as a current asset,an investment must either be liquid or the investor must intend to use it to pay a current liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

5

Investments in equity securities with insignificant influence were purchased for $400,000,and had a fair value of $410,000 at the end of the year.The adjusting entry to record this difference includes a credit to:

A)Retained Earnings.

B)Unrealized Gain on Equity Securities.

C)Investment in Equity Securities.

D)Unrealized Loss on Equity Securities.

A)Retained Earnings.

B)Unrealized Gain on Equity Securities.

C)Investment in Equity Securities.

D)Unrealized Loss on Equity Securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

6

Cash dividends received on stock investments with less than 20% ownership of the investee should be credited to the Equity-Method Investment account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

7

Investments with insignificant influence:

A)are reported at amortized cost on the balance sheet.

B)are more liquid than cash.

C)are reported at historical cost on the balance sheet.

D)are reported using the fair value method on the balance sheet.

A)are reported at amortized cost on the balance sheet.

B)are more liquid than cash.

C)are reported at historical cost on the balance sheet.

D)are reported using the fair value method on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

8

If an investor owns less than 20% of the common stock of another company as a long-term investment:

A)the equity method of accounting should be used for the investment.

B)the investor has a controlling interest in the investee.

C)the investor usually has little or no influence on the investee.

D)the investor has significant influence on the investee.

A)the equity method of accounting should be used for the investment.

B)the investor has a controlling interest in the investee.

C)the investor usually has little or no influence on the investee.

D)the investor has significant influence on the investee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

9

When an investment is readily convertible to cash and the investor plans to convert the investment to cash within one year,the investment is reported on the balance sheet as:

A)a current asset.

B)a long-term asset.

C)stockholders' equity.

D)a cash equivalent.

A)a current asset.

B)a long-term asset.

C)stockholders' equity.

D)a cash equivalent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

10

At the beginning of the year,an investment in equity securities with insignificant influence was purchased for $400,000,and it has a fair value of $420,000 at the end of the year.The year-end journal entry will have a credit to:

A)Retained Earnings.

B)Unrealized Gain on Equity Securities.

C)Investment in Equity Securities.

D)Gain on Sale of Equity Securities.

A)Retained Earnings.

B)Unrealized Gain on Equity Securities.

C)Investment in Equity Securities.

D)Gain on Sale of Equity Securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

11

Unrealized gains on equity securities when the investor has insignificant influence are reported on the:

A)statement of cash flows as investing activities.

B)balance sheet as an element of other comprehensive income.

C)statement of cash flows as financing activities.

D)income statement as Other Income.

A)statement of cash flows as investing activities.

B)balance sheet as an element of other comprehensive income.

C)statement of cash flows as financing activities.

D)income statement as Other Income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

12

The Investment in Equity Securities account when the investor has insignificant influence is reported on the:

A)income statement using the equity method.

B)income statement using the fair value method.

C)balance sheet using the equity method.

D)balance sheet using the fair value method.

A)income statement using the equity method.

B)income statement using the fair value method.

C)balance sheet using the equity method.

D)balance sheet using the fair value method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

13

When a company receives a cash dividend from equity securities with insignificant influence,the journal entry is:

A)debit to Investment in Equity Securities and credit Cash.

B)debit to Cash and credit to Dividend Revenue.

C)debit to Dividend Revenue and credit to Cash.

D)debit to Cash and credit to Investment in Equity Securities.

A)debit to Investment in Equity Securities and credit Cash.

B)debit to Cash and credit to Dividend Revenue.

C)debit to Dividend Revenue and credit to Cash.

D)debit to Cash and credit to Investment in Equity Securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

14

Michael Company's investment in equity securities with insignificant influence had a fair value of $31,700 at the end of the prior year.Management decided to sell the investment.The investment was purchased for $27,800.If Michael Company sold this investment for $50,200,Michael will have a(n):

A)Gain on Sale of Equity Securities for $22,400.

B)Gain on Sale of Equity Securities for $18,500.

C)Unrealized Loss on Equity Securities of $18,500.

D)Unrealized Gain on Equity Securities of $22,400.

A)Gain on Sale of Equity Securities for $22,400.

B)Gain on Sale of Equity Securities for $18,500.

C)Unrealized Loss on Equity Securities of $18,500.

D)Unrealized Gain on Equity Securities of $22,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

15

To be classified as a current asset,an investment must meet which of the following criteria:

A)the investment must be liquid.

B)the investor must intend to either convert the investment to cash within one year or current operating cycle,whichever is longer,or use it to pay a current liability.

C)the investment must be easily convertible to cash.

D)all of the above.

A)the investment must be liquid.

B)the investor must intend to either convert the investment to cash within one year or current operating cycle,whichever is longer,or use it to pay a current liability.

C)the investment must be easily convertible to cash.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

16

A company's investment with insignificant influence has a fair market value which exceeds its cost.When recording the year-end adjustment,the:

A)Investment in Equity Securities account will be credited.

B)Unrealized Gain on Equity Securities account will be credited.

C)Unrealized Loss on Equity Securities account will be debited.

D)Unrealized Loss on Equity Securities account will be credited.

A)Investment in Equity Securities account will be credited.

B)Unrealized Gain on Equity Securities account will be credited.

C)Unrealized Loss on Equity Securities account will be debited.

D)Unrealized Loss on Equity Securities account will be credited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

17

Long-term investments include:

A)stocks and bonds that are not liquid or readily convertible to cash.

B)securities that the investor expects to hold longer than one year or operating cycle,whichever is longer.

C)securities reported in the non-current asset section of the balance sheet.

D)all of the above.

A)stocks and bonds that are not liquid or readily convertible to cash.

B)securities that the investor expects to hold longer than one year or operating cycle,whichever is longer.

C)securities reported in the non-current asset section of the balance sheet.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

18

For accounting purposes,the method used to account for long-term investments in common stock is determined by:

A)the size of the investor.

B)the size of the investor when compared to the size of the investee.

C)vote by the Board of Directors of the investor.

D)the investor's percentage ownership of the investee's stock.

A)the size of the investor.

B)the size of the investor when compared to the size of the investee.

C)vote by the Board of Directors of the investor.

D)the investor's percentage ownership of the investee's stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

19

Investments with insignificant influence are reported on the:

A)income statement using fair value method.

B)balance sheet at cost.

C)balance sheet using fair value method.

D)income statement at cost.

A)income statement using fair value method.

B)balance sheet at cost.

C)balance sheet using fair value method.

D)income statement at cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

20

If 15% of the common stock of an investee company is purchased as a long-term investment,the appropriate method of accounting for the investment is:

A)the equity method.

B)the consolidation method.

C)the fair value method.

D)the lower of cost or market method.

A)the equity method.

B)the consolidation method.

C)the fair value method.

D)the lower of cost or market method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

21

An investor receives a cash dividend from an investment with 48% ownership and significant influence.Which journal entry is required?

A)a debit to Cash and a credit to Dividend Revenue

B)a debit to Cash and a credit to Equity-Method Investment

C)a debit to Equity-Method Investment and a credit to Dividend Revenue

D)a memorandum entry only

A)a debit to Cash and a credit to Dividend Revenue

B)a debit to Cash and a credit to Equity-Method Investment

C)a debit to Equity-Method Investment and a credit to Dividend Revenue

D)a memorandum entry only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

22

When an investor owns between 20% and 50% of the outstanding stock of another company,the ________ method is used to account for the stock investment.

A)fair value

B)equity

C)consolidated

D)available-for-sale

A)fair value

B)equity

C)consolidated

D)available-for-sale

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

23

Under the equity method of accounting for long-term investments in common stock,when a cash dividend is received from the investee company:

A)the investor's Equity-method Investment account is increased.

B)the Dividend Revenue account is increased.

C)the investor's Equity-method Investment account is decreased.

D)no entry is necessary.

A)the investor's Equity-method Investment account is increased.

B)the Dividend Revenue account is increased.

C)the investor's Equity-method Investment account is decreased.

D)no entry is necessary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

24

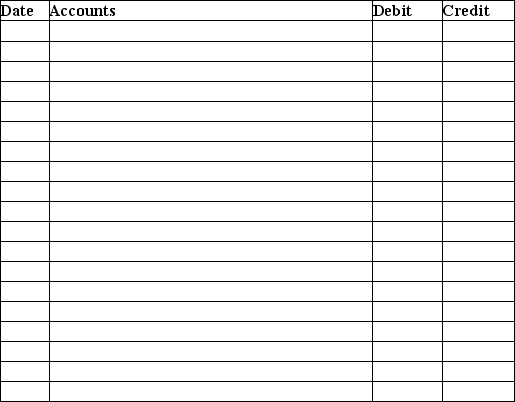

On January 1,2018,Innocente Company purchased 1,000 shares of Entel common stock at $40 per share.Innocente owns 3% of the outstanding shares with insignificant influence.On June 1,2018,Entel declares and distributes a cash dividend of $0.50 per share.On December 31,2018,the market price of Entel's stock is $44 per share.On February 1,2019,the Entel's stock is sold for $48 per share.

Prepare the journal entries on:

1.January 1,2018

2.June 1,2018

3.December 31,2018

4.February 1,2019

Explanations are not required.

Prepare the journal entries on:

1.January 1,2018

2.June 1,2018

3.December 31,2018

4.February 1,2019

Explanations are not required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

25

If an investor owns between 20% and 50% of an investee's voting stock,it is assumed that the investor has significant influence over the investee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

26

Investments accounted for by the equity method are recorded initially at cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

27

A company that owns 40% of the common stock of another business recognizes revenue from the investment when:

A)the investor sells the shares in the investee company.

B)the investee issues a cash dividend.

C)the investee recognizes net income.

D)the investee issues a stock dividend.

A)the investor sells the shares in the investee company.

B)the investee issues a cash dividend.

C)the investee recognizes net income.

D)the investee issues a stock dividend.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

28

If an investor company owns 35% of the common stock of another business,the investor:

A)receives 35% of the investee's net income in cash.

B)reports the Equity-method Investment Revenue on the balance sheet.

C)records dividends received as investment revenue.

D)increases its Equity-method Investment account for 35% of net income reported by the investee company.

A)receives 35% of the investee's net income in cash.

B)reports the Equity-method Investment Revenue on the balance sheet.

C)records dividends received as investment revenue.

D)increases its Equity-method Investment account for 35% of net income reported by the investee company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

29

The fair value method of accounting for long-term investments in stock should be used when the:

A)investor owns less than 20% of the outstanding stock of the investee.

B)investor has significant influence over the investee's operating decisions and policies.

C)investor has little or no influence on the investee.

D)A and C.

A)investor owns less than 20% of the outstanding stock of the investee.

B)investor has significant influence over the investee's operating decisions and policies.

C)investor has little or no influence on the investee.

D)A and C.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

30

An investor receives a cash dividend from an investment with 3% ownership and insignificant influence.Which journal entry is required?

A)a debit to Cash and a credit to Dividend Revenue

B)a debit to Cash and a credit to Interest Revenue

C)a debit to Cash and credit to Equity-Method Investment

D)a debit to Cash and credit to Interest Receivable

A)a debit to Cash and a credit to Dividend Revenue

B)a debit to Cash and a credit to Interest Revenue

C)a debit to Cash and credit to Equity-Method Investment

D)a debit to Cash and credit to Interest Receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

31

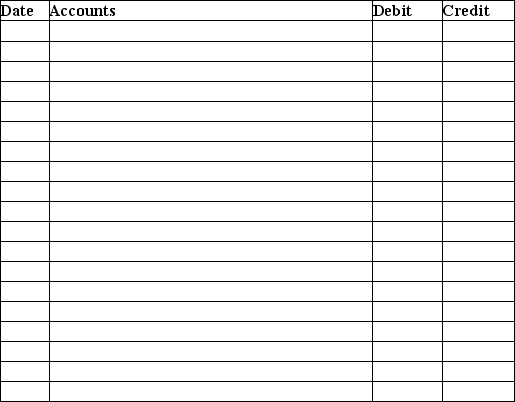

Jones Corporation purchases $500,000 of Basic Corporation's stock on October 1,2020 at cost.Jones owns less than 2% of Basic's outstanding shares,and thus has insignificant influence.On December 1,2020 Jones Corporation received a cash dividend of $15,000 on the Basic Corporation's stock.On December 31,2020,Jones Corporation's investment in Basic Corporation has a fair value of $550,000.

Required:

Prepare the necessary journal entries.Explanations are not required.

Required:

Prepare the necessary journal entries.Explanations are not required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

32

Wolverine Corporation owns 27% of Buckeye Corporation.Net income for Buckeye for the year is $300,000.The journal entry prepared by Wolverine Corporation is:

A)debit Equity-method Investment for $81,000 and credit Cash for $81,000.

B)debit Equity-method Investment for $81,000 and credit Equity-Method Investment Revenue for $81,000.

C)debit Cash for $81,000 and credit Equity-method Investment for $81,000.

D)debit Equity-method Investment for $300,000 and credit Equity-method Investment Revenue for $300,000.

A)debit Equity-method Investment for $81,000 and credit Cash for $81,000.

B)debit Equity-method Investment for $81,000 and credit Equity-Method Investment Revenue for $81,000.

C)debit Cash for $81,000 and credit Equity-method Investment for $81,000.

D)debit Equity-method Investment for $300,000 and credit Equity-method Investment Revenue for $300,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

33

When an investor owns 35% of the stock of another business,cash dividends received from the investee company are recorded by decreasing the Equity-method Investment account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

34

An investor who may significantly influence the business activities of the investee should report the investment using the:

A)fair value method.

B)consolidated method.

C)equity method.

D)available-for-sale method.

A)fair value method.

B)consolidated method.

C)equity method.

D)available-for-sale method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

35

Under the equity method,the investor applies his percentage of ownership in recording his share of the investee's net income,but not dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

36

Cash dividends received on stock investments with more than 20% ownership of the investee,but less than 50% ownership,should be credited to the Equity-method Investment Revenue account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

37

Under the equity method,the Equity-method Investment account is debited when the:

A)investee reports net income.

B)investee reports net loss.

C)investor receives a cash dividend.

D)investment is sold.

A)investee reports net income.

B)investee reports net loss.

C)investor receives a cash dividend.

D)investment is sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

38

The equity method is used to account for stock investments in which the investor company owns less than 20% of the outstanding stock of the investee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

39

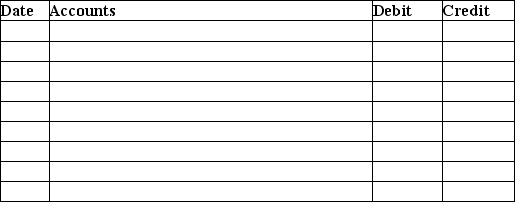

Smith Corporation purchases $620,000 of TMI Corporation's stock on October 18,2020 at cost.Smith owns less than 2% of TMI's outstanding shares,and thus has insignificant influence.On December 1,2020,Smith Corporation received a cash dividend of $12,000 on the TMI Corporation's stock.On December 31,2020,Smith Corporation's investment in TMI Corporation has a fair value of $600,000.

Required:

Prepare the necessary journal entries.Explanations are not required.

Required:

Prepare the necessary journal entries.Explanations are not required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

40

Under the equity method,when the investee reports net income,the Equity-method Investment account increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

41

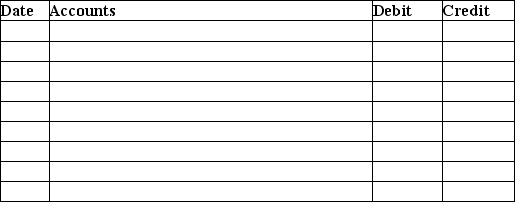

On January 1,2019,Walker Company pays $10 million for 40% of the voting stock of a supplier,Dorglass,Inc.On December 1,2019,Dorglass declared and paid cash dividends of $100,000.For the year ending December 31,2019,Dorglass also reported net income of $1,000,000.At December 31,2019,the fair value of 40% of Dorglass's stock was $9 million.On January 1,2020,all the Dorglass stock was sold for $9 million.

Required:

Prepare journal entries on the following dates:

1.January 1,2019

2.December 1,2019

3.December 31,2019

4.January 1,2020

Explanations are not required.

Required:

Prepare journal entries on the following dates:

1.January 1,2019

2.December 1,2019

3.December 31,2019

4.January 1,2020

Explanations are not required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

42

If the equity method is used to account for a long-term investment in common stock,cash dividends received from the investee are recorded by the investor as:

A)a debit to Equity-method Investment and a credit to Equity-method Investment Revenue.

B)a debit to Cash and a credit to Dividend Revenue.

C)a debit to Dividend Receivable and a credit to Dividend Revenue.

D)a debit to Cash and a credit to Equity-method Investment

A)a debit to Equity-method Investment and a credit to Equity-method Investment Revenue.

B)a debit to Cash and a credit to Dividend Revenue.

C)a debit to Dividend Receivable and a credit to Dividend Revenue.

D)a debit to Cash and a credit to Equity-method Investment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

43

The consolidation accounting method is appropriate when an investor controls an investee by ownership of more than 50% of the investee's voting stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

44

On January 1 of the current year,Conner Corporation purchased 100,000 of the 400,000 shares of outstanding stock of JJ Company for $560,000.Net income reported by JJ Company for the year was $600,000.Dividends declared and paid by JJ Company during the year were $130,000.The Equity-method Investment will be reported on Conner Corporation's December 31 balance sheet for the current year in the amount of:

A)$560,000.

B)$592,500.

C)$677,500.

D)$742,500.

A)$560,000.

B)$592,500.

C)$677,500.

D)$742,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

45

An investor owns 32% of the outstanding common stock of Leshan Company.Leshan Company reports net income of $90,000 for the current year.Which journal entry should the investor prepare?

A)debit Cash for $28,800 and credit Equity-method Investment Revenue for $28,800

B)debit Cash for $28,800 and credit Equity-method Investment for $28,800

C)debit Equity-method Investment for $28,800 and credit Equity-method Investment Revenue for $28,800

D)debit Equity-method Investment Revenue for $28,800 and credit Equity-method Investment for $28,800

A)debit Cash for $28,800 and credit Equity-method Investment Revenue for $28,800

B)debit Cash for $28,800 and credit Equity-method Investment for $28,800

C)debit Equity-method Investment for $28,800 and credit Equity-method Investment Revenue for $28,800

D)debit Equity-method Investment Revenue for $28,800 and credit Equity-method Investment for $28,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

46

On January 1 of the current year,Gardner Corporation purchased 29% of the common stock outstanding of Lance Corporation for $300,000.During the year,Lance Corporation reported net income of $80,000 and declared and paid cash dividends of $37,000.The balance of the Equity-method Investment account at December 31 for the current year,is:

A)$300,000.

B)$312,470.

C)$323,200.

D)$333,930.

A)$300,000.

B)$312,470.

C)$323,200.

D)$333,930.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

47

A controlling interest enables the investor to elect a majority of the members of the investee's board of directors and thus control the investee's policies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

48

Milton Company owns a 26% interest in the stock of Darcy Corporation.During the year,Darcy declares and pays $23,000 in dividends to Milton,and reports $110,000 in net income.Milton Company will report Equity-method Investment Revenue of:

A)$5980.

B)$22,620.

C)$28,600.

D)$34,580.

A)$5980.

B)$22,620.

C)$28,600.

D)$34,580.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

49

Consolidated financial statements are prepared for the:

A)balance sheet and income statement only.

B)statement of cash flows and statement of stockholders' equity only.

C)balance sheet,income statement and statement of cash flows only.

D)balance sheet,income statement,statement of cash flows and statement of stockholders' equity.

A)balance sheet and income statement only.

B)statement of cash flows and statement of stockholders' equity only.

C)balance sheet,income statement and statement of cash flows only.

D)balance sheet,income statement,statement of cash flows and statement of stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

50

On January 1,2019,Barry Corporation paid $750,000 for 100,000 shares of Oak Company's common stock,which represents 40% of Oak's outstanding common stock.For the year ending December 31,2019,Oak reported net income of $190,000 and declared and paid cash dividends of $60,000.Barry should report the investment in Oak Company on its balance sheet at December 31,2019 at:

A)$750,000.

B)$698,000.

C)$774,000.

D)$802,000.

A)$750,000.

B)$698,000.

C)$774,000.

D)$802,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

51

Consolidated financial statements combine the financial statements of the parent company and its subsidiaries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

52

After the work sheet is complete,the consolidated amount for each account represents the total asset,liability,and equity amounts controlled by the parent corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

53

In consolidation accounting,a year-end elimination entry is required to add the subsidiary company's stockholders' equity accounts to those of the parent company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

54

An investor owns 28% of the outstanding common stock of Stokes Corporation.Stokes Corporation declares and pays a $60,000 dividend.Which journal entry should the investor prepare?

A)debit Equity-method Investment for $16,800 and credit Cash for $16,800

B)debit Cash for $16,800 and credit Equity-method Investment for $16,800

C)debit Cash for $16,800 and credit Dividend Revenue for $16,800

D)debit Dividend Receivable for $16,800 and credit Dividend Revenue for $16,800

A)debit Equity-method Investment for $16,800 and credit Cash for $16,800

B)debit Cash for $16,800 and credit Equity-method Investment for $16,800

C)debit Cash for $16,800 and credit Dividend Revenue for $16,800

D)debit Dividend Receivable for $16,800 and credit Dividend Revenue for $16,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

55

Acme Company owns 35% of Superior Company.Superior Company declared and paid $33,000 cash dividends for the year.Acme Company's journal entry to record the dividends includes a:

A)credit to Equity-method Investment for $11,550.

B)credit to Equity-method Investment for $33,000.

C)credit to Dividend Revenue for $11,550.

D)credit to Dividend Revenue for $33,000.

A)credit to Equity-method Investment for $11,550.

B)credit to Equity-method Investment for $33,000.

C)credit to Dividend Revenue for $11,550.

D)credit to Dividend Revenue for $33,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

56

Under the equity method,if the investee company has a net loss,the investor company will ________ for its share of the net loss.

A)debit the Equity-method Investment account

B)credit the Unrealized Loss on Equity-method Investment account

C)credit the Equity-method Investment account

D)debit the Unrealized Loss on Equity-method Investment account

A)debit the Equity-method Investment account

B)credit the Unrealized Loss on Equity-method Investment account

C)credit the Equity-method Investment account

D)debit the Unrealized Loss on Equity-method Investment account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

57

A noncontrolling interest arises in all consolidations,regardless of the parent's level of ownership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

58

Daniel Company purchased 34% of the outstanding shares of Clooney Corporation on January 1 at a cost of $620,000.Clooney Corporation reported net income of $93,000 and declared and paid total dividends of $20,000 for the year.At the end of the year,Clooney shares had a current fair value of $614,000.After all necessary adjusting entries are made for the year,the balance in Daniel Company's Equity-method Investment account will be:

A)$614,000.

B)$644,820.

C)$693,000.

D)$687,000.

A)$614,000.

B)$644,820.

C)$693,000.

D)$687,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

59

On January 1,of the current year,Rod Corporation purchased 40% of the outstanding stock of Alamo Corporation for $480,000.Net income reported by Alamo for the year was $210,000.Dividends declared and paid by Alamo during the year were $40,000.The amount of investment revenue that Rod should recognize for the current year is:

A)$16,000.

B)$68,000.

C)$84,000.

D)$100,000.

A)$16,000.

B)$68,000.

C)$84,000.

D)$100,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

60

Consolidated financial statements are prepared when a company owns ________ of the common stock of another company.

A)between 20% and 50%

B)50% or more

C)more than 50%

D)more than 90%

A)between 20% and 50%

B)50% or more

C)more than 50%

D)more than 90%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

61

At maturity,the carrying amount of a bond should be equal to its face value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

62

On January 1,2019,Corbin Company purchases $176,000,4% bonds at a price of 96 and a maturity date of January 1,2029.Corbin Company intends to hold the bonds until their maturity date and has the ability to do so.Interest is paid semiannually,on January 1 and July 1.Corbin Company has a calendar year end and uses the straight-line amortization method for discounts and premiums.The entry to amortize the bond discount or premium on July 1,2019 is:

A)debit Held-to-Maturity Investment in Bonds for $352 and credit Interest Receivable for $352.

B)debit Cash for $704 and credit Interest Revenue for $704.

C)debit Held-to-Maturity Investment in Bonds for $352 and credit Interest Revenue for $352.

D)debit Held-to-Maturity Investment in Bonds for $704 and credit Interest Revenue for $704.

A)debit Held-to-Maturity Investment in Bonds for $352 and credit Interest Receivable for $352.

B)debit Cash for $704 and credit Interest Revenue for $704.

C)debit Held-to-Maturity Investment in Bonds for $352 and credit Interest Revenue for $352.

D)debit Held-to-Maturity Investment in Bonds for $704 and credit Interest Revenue for $704.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

63

An investment in bonds is categorized as a held-to-maturity investment if management intends to sell the investment before its maturity date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

64

On January 1,2018,Winston Company purchased 4% bonds with a face value of $80,000 for par.Winston Company intends to hold the bonds until maturity and has the ability to do so.Interest is payable semiannually on July 1 and January 1.The company's fiscal year ends on December 31.The company uses the straight-line amortization method for discounts and premiums.The journal entry on December 31,2018 is:

A)debit Interest Receivable for $3,200 and credit Held-to-Maturity Investment in Bonds $3,200.

B)debit Cash for $1,600 and credit Interest Revenue for $1,600.

C)debit Interest Receivable for $1,600 and credit Interest Revenue for $1,600.

D)debit Interest Receivable for $1,600 and credit Held-to-Maturity Investment in Bonds $1,600.

A)debit Interest Receivable for $3,200 and credit Held-to-Maturity Investment in Bonds $3,200.

B)debit Cash for $1,600 and credit Interest Revenue for $1,600.

C)debit Interest Receivable for $1,600 and credit Interest Revenue for $1,600.

D)debit Interest Receivable for $1,600 and credit Held-to-Maturity Investment in Bonds $1,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

65

Investments in debt securities may be divided into held-to-maturity securities,trading securities,and available-for-sale securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

66

On January 1,2018,Winston Company purchased 6% bonds with a face value of $62,000 for par.Winston Company intends to hold the bonds until maturity and has the ability to do so.Interest is payable semiannually on July 1 and January 1.The company's fiscal year ends on December 31.The journal entry on July 1,2018 is:

A)debit Cash $3,720 and credit Interest Revenue $3,720.

B)debit Cash $1,860 and credit Interest Revenue for $1,860.

C)debit Cash $1,860 and credit Interest Receivable for $1,860.

D)debit Cash $3,720 and credit Interest Receivable for $3,720.

A)debit Cash $3,720 and credit Interest Revenue $3,720.

B)debit Cash $1,860 and credit Interest Revenue for $1,860.

C)debit Cash $1,860 and credit Interest Receivable for $1,860.

D)debit Cash $3,720 and credit Interest Receivable for $3,720.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

67

On January 1,2019,Dooley Company purchases $92,000,6% bonds at a price of 90.8 and a maturity date of January 1,2029.Dooley Company intends to hold the bonds until their maturity date and has the ability to do so.Interest is paid semiannually,on January 1 and July 1.Dooley Company has a calendar year end.The entry for the receipt of interest on July 1,2019 is:

A)debit Cash for $2,760 and credit Interest Revenue for $2,760.

B)debit Cash for $5,520 and credit Interest Revenue for $5,520.

C)debit Investment in Bonds for $2,760 and credit Interest Revenue for 2,760.

D)debit Investment in Bonds for $5,520 and credit Interest Revenue for $5,520.

A)debit Cash for $2,760 and credit Interest Revenue for $2,760.

B)debit Cash for $5,520 and credit Interest Revenue for $5,520.

C)debit Investment in Bonds for $2,760 and credit Interest Revenue for 2,760.

D)debit Investment in Bonds for $5,520 and credit Interest Revenue for $5,520.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

68

When a company receives interest revenue from a held-to maturity bond,the journal entry includes:

A)a debit to Interest Revenue and credit to Cash.

B)a debit to Dividend Revenue and credit to Cash.

C)a debit to Cash and credit to Dividend Revenue.

D)a debit to Cash and credit to Interest Revenue.

A)a debit to Interest Revenue and credit to Cash.

B)a debit to Dividend Revenue and credit to Cash.

C)a debit to Cash and credit to Dividend Revenue.

D)a debit to Cash and credit to Interest Revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

69

The market prices of bonds fluctuate inversely with market interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

70

All investments in debt securities NOT classified as trading securities or held-to-maturity securities are classified as:

A)debt securities.

B)equity securities.

C)marketable securities.

D)available-for-sale securities.

A)debt securities.

B)equity securities.

C)marketable securities.

D)available-for-sale securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

71

On January 1,2019,Dodge Company purchases $106,000,4% bonds at a price of 90.5 and a maturity date of January 1,2029.Dodge Company intends to hold the bonds until their maturity date and has the ability to do so.Interest is paid semiannually,on January 1 and July 1.Dodge Company has a calendar year end.The entry to record the purchase of the bond investment on January 1,2019,is:

A)debit Held-to-Maturity Investment in Bonds for $106,000 and credit Cash for $106,000.

B)debit Held-to-Maturity Investment in Bonds for $95,930 and credit Cash for $95,930.

C)debit Cash for $106,000 and credit Bonds Payable for $106,000.

D)debit Cash for $95,930 and credit Investment in Bonds for $95,930.

A)debit Held-to-Maturity Investment in Bonds for $106,000 and credit Cash for $106,000.

B)debit Held-to-Maturity Investment in Bonds for $95,930 and credit Cash for $95,930.

C)debit Cash for $106,000 and credit Bonds Payable for $106,000.

D)debit Cash for $95,930 and credit Investment in Bonds for $95,930.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

72

On January 1,2019,Benson Company purchases $120,000,8% bonds at a price of 90 and a maturity date of January 1,2024.Benson Company plans to hold the bonds until their maturity date and has the ability to do so.Interest is paid semiannually,on January 1 and July 1.Benson Company has a calendar year and uses the straight-line amortization method for discounts and premiums.The adjusting entry to amortize the discount and record interest revenue on December 31,2019 is:

A)debit Cash $1,200 and credit Interest Revenue $1,200.

B)debit Cash $9,600 and credit Interest Revenue $9,600.

C)debit to Interest Receivable $4,800,debit Held-to-Maturity Investment in Bonds for $1,200 and credit Interest Revenue $6,000.

D)debit to Interest Receivable $9,600 and credit Interest Revenue $9,600.

A)debit Cash $1,200 and credit Interest Revenue $1,200.

B)debit Cash $9,600 and credit Interest Revenue $9,600.

C)debit to Interest Receivable $4,800,debit Held-to-Maturity Investment in Bonds for $1,200 and credit Interest Revenue $6,000.

D)debit to Interest Receivable $9,600 and credit Interest Revenue $9,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

73

The amortized cost method determines the carrying value of held-to-maturity debt investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

74

A quoted bond price of 103 means that the bonds were sold at a discount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

75

The face interest rate of a bond determines the cash amount of interest the debtor company is expected to pay annually or semiannually.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

76

On January 1,2019,Brooklyn Company purchases $82,000,8% bonds at a price of 90 and a maturity date of January 1,2029.Brooklyn Company intends to hold the bonds until maturity and has the ability to do so.Interest is paid semiannually,on January 1 and July 1.Brooklyn Company has a calendar year and uses the straight-line amortization method for discounts and premiums.The adjusting entry to amortize the bond discount or premium on December 31,2019 is:

A)debit Interest Receivable $3,280 and credit Interest Revenue $3,280.

B)debit Interest Receivable $6,560 and credit Interest Revenue $6,560.

C)debit Held-to-Maturity Investment in Bonds $410 and credit Interest Revenue $410.

D)debit Held-to-Maturity Investment in Bonds $820 and credit Interest Revenue $820.

A)debit Interest Receivable $3,280 and credit Interest Revenue $3,280.

B)debit Interest Receivable $6,560 and credit Interest Revenue $6,560.

C)debit Held-to-Maturity Investment in Bonds $410 and credit Interest Revenue $410.

D)debit Held-to-Maturity Investment in Bonds $820 and credit Interest Revenue $820.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

77

Matthew Company purchases held-to-maturity bonds for $12,000 cash.The journal entry to record this transaction will include a:

A)debit to the Held-to Maturity Investment in Bonds account and a credit to Cash.

B)debit to Cash and a credit to the Held-to Maturity Investment in Bonds account.

C)debit to the Long-term Investment account and a credit to Cash.

D)debit to the Unrealized Loss on Held-to Maturity Investment in Bonds account and a credit to Cash.

A)debit to the Held-to Maturity Investment in Bonds account and a credit to Cash.

B)debit to Cash and a credit to the Held-to Maturity Investment in Bonds account.

C)debit to the Long-term Investment account and a credit to Cash.

D)debit to the Unrealized Loss on Held-to Maturity Investment in Bonds account and a credit to Cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

78

Debt investments that are expected to be sold within the near term,with the intent of generating profits on the sale,are called:

A)held-to-maturity debt investments.

B)trading debt securities.

C)available-for-sale debt securities.

D)equity-method investments.

A)held-to-maturity debt investments.

B)trading debt securities.

C)available-for-sale debt securities.

D)equity-method investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

79

Consolidated financial statements:

A)are prepared if the parent owns more than 20% of the investee's voting stock.

B)do not include a consolidated statement of cash flows because investors need to understand the separate cash flows of the parent and each individual subsidiary.

C)allow investors to gain a better perspective on total operations than they could by examining the reports of the parent and each individual subsidiary.

D)do not identify the amount of noncontrolling interest in subsidiaries' stock because investors do not focus on that information.

A)are prepared if the parent owns more than 20% of the investee's voting stock.

B)do not include a consolidated statement of cash flows because investors need to understand the separate cash flows of the parent and each individual subsidiary.

C)allow investors to gain a better perspective on total operations than they could by examining the reports of the parent and each individual subsidiary.

D)do not identify the amount of noncontrolling interest in subsidiaries' stock because investors do not focus on that information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

80

Both trading and available-for-sale investments in debt securities are accounted for using the fair value method in a way that is similar to how investments in equity securities with insignificant influence are accounted for.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck