Deck 4: Activity-Based Costing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

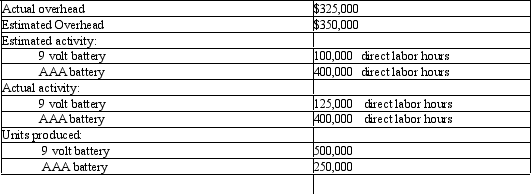

سؤال

سؤال

سؤال

سؤال

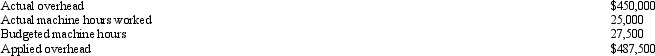

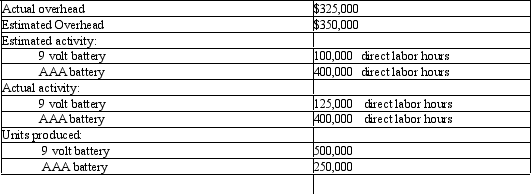

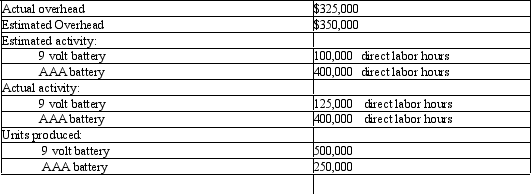

سؤال

سؤال

سؤال

سؤال

سؤال

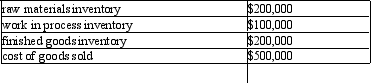

سؤال

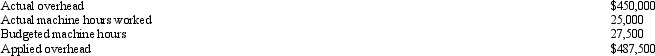

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/201

العب

ملء الشاشة (f)

Deck 4: Activity-Based Costing

1

The justification for not using a departmental rate for overhead cost assignment is that it increases accuracy.

False

2

An activity-based costing system traces costs to activities and then to products and other cost objects.

True

3

A list of the activities identified in the design of an activity-based system is called an activity inventory.

True

4

Product classification attributes define and describe activities and are the basis for product classification.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

5

The difference between actual overhead and applied overhead is an underapplied overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

6

Overhead assignments should reflect the amount of overhead demanded by each product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

7

Activity-based costing uses only unit-level drivers for costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

8

The first step in designing an activity-based costing system is to identify activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

9

The activity-based cost assignment is the most accurate method of costing because it follows a cause-and-effect pattern of overhead consumption.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

10

Unit-based product costing assigns manufacturing and selling costs to products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

11

Classifying activities into four general categories facilitates product costing by associating the response to different types of activity drivers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

12

After identifying and describing activities, the next step is to determine the cost of the performance of each activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

13

Unit based costing first assigns overhead costs to departmental pools and then assigns these costs to products using predetermined overhead rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

14

Activity attributes are nonfinancial and financial information items that describe individual activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

15

Unit-level drivers are factors that measure the demands placed on unit-level activities by products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

16

If applied overhead is greater than actual overhead it is called overapplied overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

17

If overhead is a significant proportion of the unit manufacturing costs, the distortion caused by using multi-level drivers can be serious.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

18

Management information systems can be divided into a unit-based type and activity-based type.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

19

Non-unit-based drivers are factors that measure the demands that cost objects place on activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

20

Predetermined overhead rates are calculated at the end of each year using the formula: overhead rate = budgeted annual driver level/budgeted annual driver level.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

21

There are many two-driver combinations that may be used to reduce the ABC system without sacrificing accuracy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

22

The formula Budgeted annual overhead/Budgeted annual driver level is used to calculate a __________ rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

23

An __________costing database is the collected data sets that are organized and interrelated for use in a company's ABC information system.

or

or

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

24

Efforts to simplify activity-based costing systems (ABC) involve either before-the-fact simplification or after-the-fact simplification.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

25

After-the-fact simplification includes two approaches: the approximately relevant reduced ABC system and the equally accurate enhanced ABC system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

26

For labor-intensive operations, the most appropriate activity driver would be the __________ hours.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

27

The use of __________ activity drivers to assign costs tends to __________ high-volume products.

or

or

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

28

Using the before-the-fact simplification method TDABC eliminates the need for detailed interviewing and surveying to determine resource drivers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

29

A(n) __________ method first traces costs to a department and then to products.

or

or

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

30

In the __________ ABC systems, managers directly estimate the resource demands imposed by each product.

or

or

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

31

The proportion of an overhead activity consumed by a product is the __________ ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

32

A(n) __________ costing system first traces costs to activities and then to products.

or

or

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

33

Activity __________ are nonfinancial and financial data that describe individual activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

34

A(n) __________ is a grouping of logically related information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

35

Materials handling would be classified as a __________ activity when using activity-level costing.

or

or

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

36

Offering greater product accuracy than an activity-based costing system is not a characteristic of a __________ costing system.

or

or

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

37

__________ drivers create distortions when different products utilize resources differently.

or

or

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

38

The activity __________ is a simple list of activities identified in an ABC system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

39

Time driven activity-based costing (TDABC) requires the need to identify resource drivers to assign costs to activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

40

Activity __________ helps management achieve objectives such as product or customer costing and continuous improvement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

41

All of the following are non-unit-based activity drivers EXCEPT

A) number of direct labor hours.

B) number of inspections.

C) number of setups.

D) number of material moves.

A) number of direct labor hours.

B) number of inspections.

C) number of setups.

D) number of material moves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

42

A predetermined overhead rate is calculated using which of the following formulas?

A) Actual annual overhead / budgeted annual driver level

B) Budgeted annual overhead / budgeted annual driver level

C) Budgeted annual overhead / actual annual driver level

D) Actual annual overhead / actual annual driver level

A) Actual annual overhead / budgeted annual driver level

B) Budgeted annual overhead / budgeted annual driver level

C) Budgeted annual overhead / actual annual driver level

D) Actual annual overhead / actual annual driver level

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

43

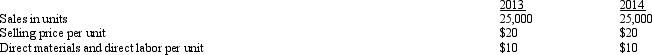

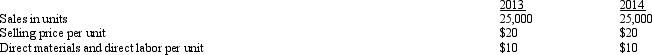

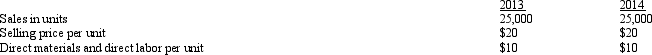

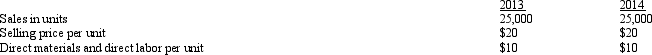

Figure 4-1 The Foremost Company predicted factory overhead for 2013 and 2014 would be $120,000 for each year. The predicted activity for 2013 and 2014 were 30,000 and 20,000 direct labor hours, respectively. Additional data are as follows:

The company assumes that the long-run normal production level is 20,000 direct labor hours per year. The actual factory overhead cost for the end of 2013 and 2014 was $120,000. Assume that it takes one direct labor hour to make one finished unit.

The company assumes that the long-run normal production level is 20,000 direct labor hours per year. The actual factory overhead cost for the end of 2013 and 2014 was $120,000. Assume that it takes one direct labor hour to make one finished unit.

Refer to Figure 4-1. When the annual estimated factory overhead rate is used, the gross profits for 2013 and 2014, respectively, are

A) $150,000 and $150,000.

B) $150,000 and $100,000.

C) $250,000 and $250,000.

D) $100,000 and $150,000.

The company assumes that the long-run normal production level is 20,000 direct labor hours per year. The actual factory overhead cost for the end of 2013 and 2014 was $120,000. Assume that it takes one direct labor hour to make one finished unit.

The company assumes that the long-run normal production level is 20,000 direct labor hours per year. The actual factory overhead cost for the end of 2013 and 2014 was $120,000. Assume that it takes one direct labor hour to make one finished unit.Refer to Figure 4-1. When the annual estimated factory overhead rate is used, the gross profits for 2013 and 2014, respectively, are

A) $150,000 and $150,000.

B) $150,000 and $100,000.

C) $250,000 and $250,000.

D) $100,000 and $150,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

44

A department that is capital-intensive most likely would use a predetermined departmental overhead rate based on which of the following activity bases?

A) units of direct material used

B) direct labor hours

C) direct labor cost

D) machine hours

A) units of direct material used

B) direct labor hours

C) direct labor cost

D) machine hours

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

45

In a department that is drilling holes in materials, which activity base is likely to be most appropriate for assigning overhead costs?

A) units produced

B) direct labor hours

C) machine hours

D) number of batches

A) units produced

B) direct labor hours

C) machine hours

D) number of batches

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

46

The overhead rates of the traditional functional-based product costing use

A) non-unit-based activity drivers.

B) unit-based activity drivers.

C) process costing.

D) job order costing.

A) non-unit-based activity drivers.

B) unit-based activity drivers.

C) process costing.

D) job order costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which is NOT a characteristic of a unit-based costing system?

A) It uses traditional product costing definitions.

B) It uses unit-based activity drivers to assign overhead to products.

C) It offers greater product costing accuracy than an activity-based costing system.

D) It is cheaper than an activity-based costing system.

A) It uses traditional product costing definitions.

B) It uses unit-based activity drivers to assign overhead to products.

C) It offers greater product costing accuracy than an activity-based costing system.

D) It is cheaper than an activity-based costing system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

48

For a labor-intensive manufacturing operation, which of the following would be the most appropriate activity driver?

A) machine hours

B) direct labor hours

C) number of employees

D) units of output

A) machine hours

B) direct labor hours

C) number of employees

D) units of output

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

49

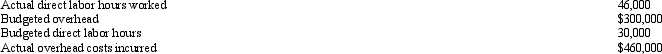

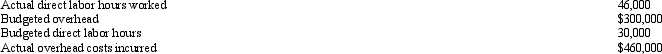

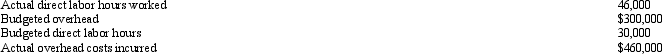

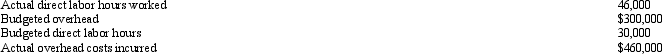

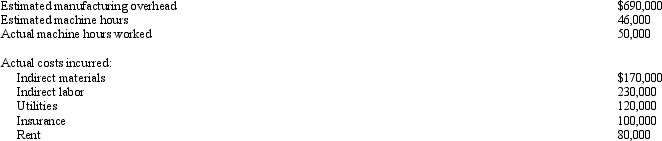

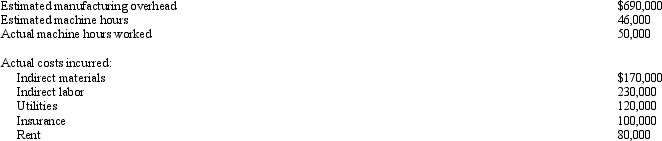

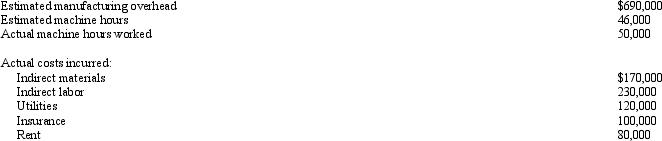

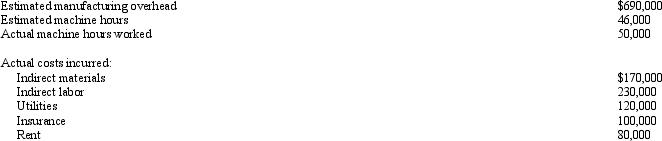

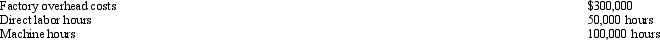

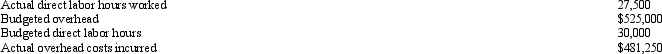

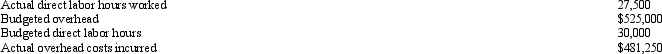

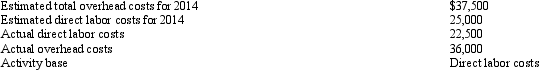

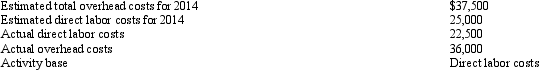

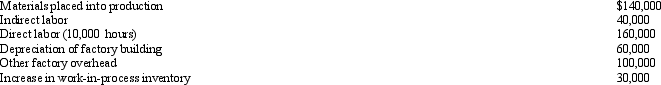

Figure 4-2 The following information is provided by the Sandman Corporation for the year:

Refer to Figure 4-2. The actual overhead rate for applying manufacturing overhead is

Refer to Figure 4-2. The actual overhead rate for applying manufacturing overhead is

A) $ 7.14.

B) $ 7.50.

C) $10.00.

D) $10.50.

Refer to Figure 4-2. The actual overhead rate for applying manufacturing overhead is

Refer to Figure 4-2. The actual overhead rate for applying manufacturing overhead isA) $ 7.14.

B) $ 7.50.

C) $10.00.

D) $10.50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

50

Unit-level product costing assigns

A) direct materials and direct labor directly to products and assigns overhead to departmental pools which are assigned to products using predetermined overhead rates based on unit-level drivers.

B) direct materials, direct labor and overhead to departmental cost pools which are assigned to products using predetermined overhead rates based on unit-level drivers.

C) direct materials and direct labor directly to products and assigns overhead to departmental pools which are assigned to products using predetermined overhead rates based on non-unit level drivers.

D) direct materials, direct labor and overhead to departmental cost pools which are assigned to products using predetermined overhead rates based on non-unit level drivers.

A) direct materials and direct labor directly to products and assigns overhead to departmental pools which are assigned to products using predetermined overhead rates based on unit-level drivers.

B) direct materials, direct labor and overhead to departmental cost pools which are assigned to products using predetermined overhead rates based on unit-level drivers.

C) direct materials and direct labor directly to products and assigns overhead to departmental pools which are assigned to products using predetermined overhead rates based on non-unit level drivers.

D) direct materials, direct labor and overhead to departmental cost pools which are assigned to products using predetermined overhead rates based on non-unit level drivers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

51

If unit-based product costing is used, which of the following would be traced directly to the product?

A) setup costs

B) direct labor

C) maintenance of machinery

D) inspection costs

A) setup costs

B) direct labor

C) maintenance of machinery

D) inspection costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

52

Common measures of production activity include

A) units produced.

B) direct labor hours.

C) machine hours.

D) all of these.

A) units produced.

B) direct labor hours.

C) machine hours.

D) all of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

53

The method that first traces costs to a department and then to products is called:

A) direct costing

B) absorption costing

C) unit-based costing

D) indirect costing

A) direct costing

B) absorption costing

C) unit-based costing

D) indirect costing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

54

A costing system that uses actual costs for direct materials and labor and predetermined overhead rates to apply overhead is called a(n)

A) actual costing system.

B) standard costing system.

C) normal costing system.

D) activity-based costing system.

A) actual costing system.

B) standard costing system.

C) normal costing system.

D) activity-based costing system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

55

Figure 4-1 The Foremost Company predicted factory overhead for 2013 and 2014 would be $120,000 for each year. The predicted activity for 2013 and 2014 were 30,000 and 20,000 direct labor hours, respectively. Additional data are as follows:

The company assumes that the long-run normal production level is 20,000 direct labor hours per year. The actual factory overhead cost for the end of 2013 and 2014 was $120,000. Assume that it takes one direct labor hour to make one finished unit.

The company assumes that the long-run normal production level is 20,000 direct labor hours per year. The actual factory overhead cost for the end of 2013 and 2014 was $120,000. Assume that it takes one direct labor hour to make one finished unit.

Refer to Figure 4-1. When the normal factory overhead rate is used, the gross profits for 2013 and 2014, respectively, are

A) $80,000 and $80,000.

B) $200,000 and $200,000.

C) $120,000 and $140,000.

D) $100,000 and $100,000.

The company assumes that the long-run normal production level is 20,000 direct labor hours per year. The actual factory overhead cost for the end of 2013 and 2014 was $120,000. Assume that it takes one direct labor hour to make one finished unit.

The company assumes that the long-run normal production level is 20,000 direct labor hours per year. The actual factory overhead cost for the end of 2013 and 2014 was $120,000. Assume that it takes one direct labor hour to make one finished unit.Refer to Figure 4-1. When the normal factory overhead rate is used, the gross profits for 2013 and 2014, respectively, are

A) $80,000 and $80,000.

B) $200,000 and $200,000.

C) $120,000 and $140,000.

D) $100,000 and $100,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

56

Product costs can be distorted if a unit-based activity driver is used and

A) non-unit-based overhead costs are a significant proportion of total overhead.

B) the consumption ratios differ between unit-based and non-unit-based input categories.

C) both a and b.

D) neither a nor b.

A) non-unit-based overhead costs are a significant proportion of total overhead.

B) the consumption ratios differ between unit-based and non-unit-based input categories.

C) both a and b.

D) neither a nor b.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

57

Unit-based product costing uses which of the following procedures?

A) All overhead costs are expensed as incurred.

B) Overhead costs are traced to departments, then costs are traced to products.

C) Overhead costs are traced directly to products.

D) Overhead costs are traced to activities, then costs are traced to products.

A) All overhead costs are expensed as incurred.

B) Overhead costs are traced to departments, then costs are traced to products.

C) Overhead costs are traced directly to products.

D) Overhead costs are traced to activities, then costs are traced to products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

58

Figure 4-2 The following information is provided by the Sandman Corporation for the year:

Refer to Figure 4-2. If normal costing is used, the amount of overhead applied for the year is

Refer to Figure 4-2. If normal costing is used, the amount of overhead applied for the year is

A) $414,000.

B) $400,000.

C) $480,000.

D) $460,000.

Refer to Figure 4-2. If normal costing is used, the amount of overhead applied for the year is

Refer to Figure 4-2. If normal costing is used, the amount of overhead applied for the year isA) $414,000.

B) $400,000.

C) $480,000.

D) $460,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

59

Avatar Corporation uses a predetermined rate to apply overhead. At the beginning of the year, Avatar estimated its overhead costs at $240,000, direct labor hours at 40,000, and machine hours at 10,000. Actual overhead costs incurred were $249,280, actual direct labor hours were 41,000, and actual machine hours were 11,000. What is the predetermined overhead rate per machine hour for Avatar?

A) $ 6.08

B) $ 5.85

C) $22.66

D) $24.00

A) $ 6.08

B) $ 5.85

C) $22.66

D) $24.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

60

All of the following are unit-based activity drivers EXCEPT

A) number of setups.

B) machine hours.

C) number of units.

D) direct labor hours.

A) number of setups.

B) machine hours.

C) number of units.

D) direct labor hours.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

61

Figure 4 - 3 The records of Family Manufacturing show the following information:

Refer to Figure 4-3. The company uses a predetermined overhead rate to apply overhead. Manufacturing overhead applied is

Refer to Figure 4-3. The company uses a predetermined overhead rate to apply overhead. Manufacturing overhead applied is

A) $750,000.

B) $700,000.

C) $690,000.

D) $648,000.

Refer to Figure 4-3. The company uses a predetermined overhead rate to apply overhead. Manufacturing overhead applied is

Refer to Figure 4-3. The company uses a predetermined overhead rate to apply overhead. Manufacturing overhead applied isA) $750,000.

B) $700,000.

C) $690,000.

D) $648,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

62

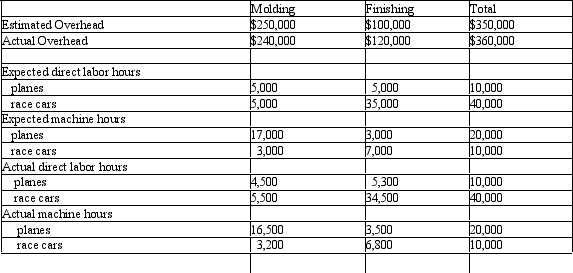

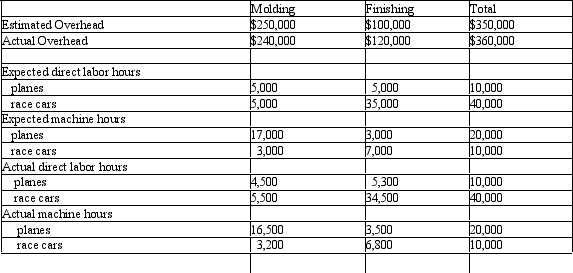

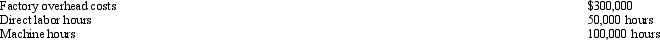

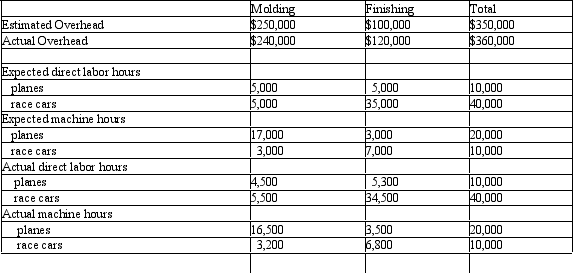

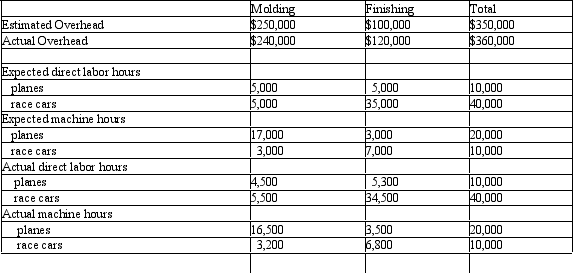

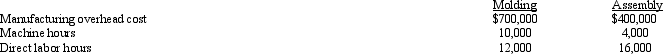

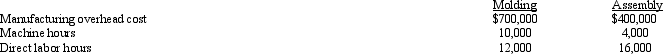

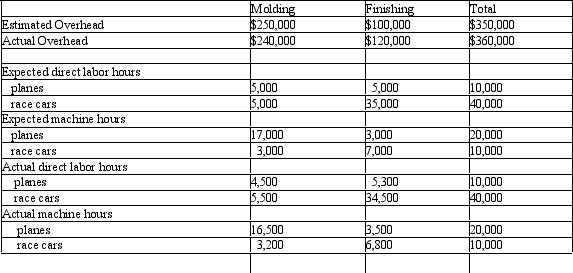

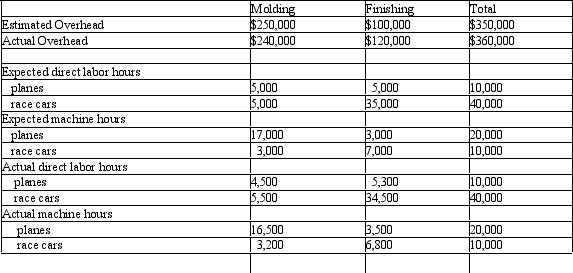

Figure 4-6 The Fast & Furious Company produces two products: toy planes and toy race cars. They use departmental overhead rates for the two production departments: molding and finishing. Molding uses machine hours to assign overhead and Finishing uses direct labor hours. 50,000 planes and 250,000 race cars are produced. Please find the following data:

Refer to Figure 4-6. How much overhead is applied to the planes?

Refer to Figure 4-6. How much overhead is applied to the planes?

A) $ 60,000

B) $250,000

C) $219,500

D) $225,000

Refer to Figure 4-6. How much overhead is applied to the planes?

Refer to Figure 4-6. How much overhead is applied to the planes?A) $ 60,000

B) $250,000

C) $219,500

D) $225,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

63

Material amounts of underapplied or overapplied overhead should be

A) treated as an adjustment to cost of goods sold.

B) treated as an adjustment to work in process.

C) allocated to direct materials, work in process, and finished goods.

D) allocated to work in process, finished goods, and cost of goods sold.

A) treated as an adjustment to cost of goods sold.

B) treated as an adjustment to work in process.

C) allocated to direct materials, work in process, and finished goods.

D) allocated to work in process, finished goods, and cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

64

Figure 4 - 3 The records of Family Manufacturing show the following information:

Refer to Figure 4-3. The amount of overapplied or underapplied overhead is

Refer to Figure 4-3. The amount of overapplied or underapplied overhead is

A) $10,000 underapplied. .

B) $50,000 overapplied.

C) $60,000 overapplied.

D) $65,200 underapplied

Refer to Figure 4-3. The amount of overapplied or underapplied overhead is

Refer to Figure 4-3. The amount of overapplied or underapplied overhead isA) $10,000 underapplied. .

B) $50,000 overapplied.

C) $60,000 overapplied.

D) $65,200 underapplied

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

65

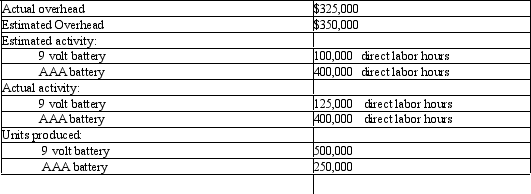

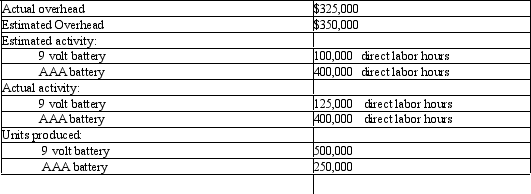

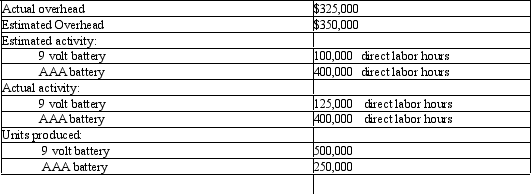

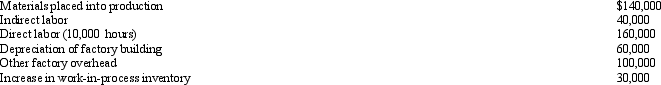

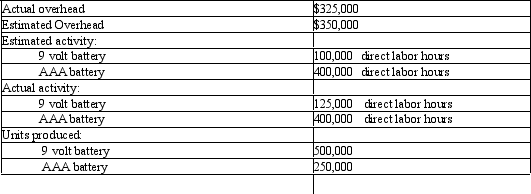

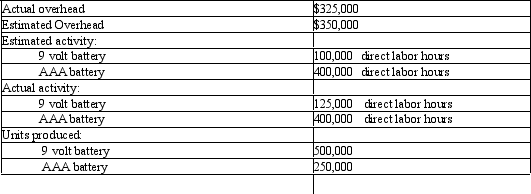

Figure 4-5 The Brookstone Company produces 9 volt batteries and AAA batteries. The Brookstone Company uses a plantwide rate to apply overhead based on direct labor hours. The following data is given:

Refer to Figure 4-5. What is the predetermined overhead rate? (round to 2 decimal places)

Refer to Figure 4-5. What is the predetermined overhead rate? (round to 2 decimal places)

A) $0.62

B) $0.65

C) $0.67

D) $0.70

Refer to Figure 4-5. What is the predetermined overhead rate? (round to 2 decimal places)

Refer to Figure 4-5. What is the predetermined overhead rate? (round to 2 decimal places)A) $0.62

B) $0.65

C) $0.67

D) $0.70

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

66

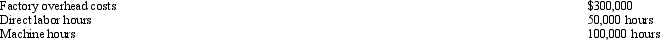

Figure 4-4 Mannitou Company made the following predictions for 2014:

Job A2 (which was started and completed in June) used 3,000 direct labor hours, 2,000 machine hours, and $57,000 of prime costs.

Job A2 (which was started and completed in June) used 3,000 direct labor hours, 2,000 machine hours, and $57,000 of prime costs.

Refer to Figure 4-4. If factory overhead is applied based on machine hours, the cost of Job A2 for the Mannitou Company is

A) $69,000.

B) $75,000.

C) $63,000.

D) $66,000.

Job A2 (which was started and completed in June) used 3,000 direct labor hours, 2,000 machine hours, and $57,000 of prime costs.

Job A2 (which was started and completed in June) used 3,000 direct labor hours, 2,000 machine hours, and $57,000 of prime costs.Refer to Figure 4-4. If factory overhead is applied based on machine hours, the cost of Job A2 for the Mannitou Company is

A) $69,000.

B) $75,000.

C) $63,000.

D) $66,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

67

Figure 4-6 The Fast & Furious Company produces two products: toy planes and toy race cars. They use departmental overhead rates for the two production departments: molding and finishing. Molding uses machine hours to assign overhead and Finishing uses direct labor hours. 50,000 planes and 250,000 race cars are produced. Please find the following data:

Refer to Figure 4-6. What is the overhead per unit for race cars? (round to 3 decimal places)

Refer to Figure 4-6. What is the overhead per unit for race cars? (round to 3 decimal places)

A) $0.50

B) $0.505

C) $0.32

D) $1.40

Refer to Figure 4-6. What is the overhead per unit for race cars? (round to 3 decimal places)

Refer to Figure 4-6. What is the overhead per unit for race cars? (round to 3 decimal places)A) $0.50

B) $0.505

C) $0.32

D) $1.40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

68

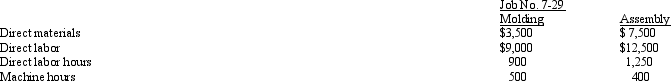

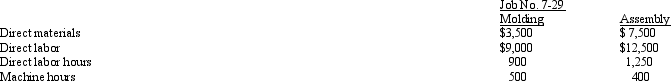

Bear Claw Industries uses a job-order costing system. The Molding Department applies overhead based on machine hours, while the Assembly Department applies overhead based on direct labor hours. The company made the following estimates at the beginning of the current year:  The following information was available for Job No. 7-29, which was started and completed during August:

The following information was available for Job No. 7-29, which was started and completed during August:

The predetermined overhead rate for the molding department is

The predetermined overhead rate for the molding department is

A) $100.

B) $83.

C) $70.

D) $50.

The following information was available for Job No. 7-29, which was started and completed during August:

The following information was available for Job No. 7-29, which was started and completed during August: The predetermined overhead rate for the molding department is

The predetermined overhead rate for the molding department isA) $100.

B) $83.

C) $70.

D) $50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

69

The following information is provided for the year:  If normal costing is used, the amount of overhead applied for the year is

If normal costing is used, the amount of overhead applied for the year is

A) $568,750.00.

B) $441,031.25.

C) $481,250.00.

D) $525,000.00.

If normal costing is used, the amount of overhead applied for the year is

If normal costing is used, the amount of overhead applied for the year isA) $568,750.00.

B) $441,031.25.

C) $481,250.00.

D) $525,000.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

70

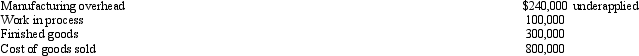

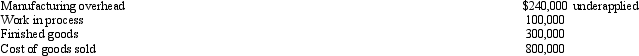

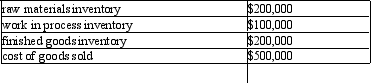

Account balances from the Boilermakers Company are as follows:  If underapplied or overapplied overhead is material and is allocated to Work in Process, Finished Goods, and Cost of Goods Sold (based on ending account balances), Cost of Goods Sold after adjustment would have a balance of

If underapplied or overapplied overhead is material and is allocated to Work in Process, Finished Goods, and Cost of Goods Sold (based on ending account balances), Cost of Goods Sold after adjustment would have a balance of

A) $ 960,000.

B) $ 640,000.

C) $1,040,000.

D) $1,440,000.

If underapplied or overapplied overhead is material and is allocated to Work in Process, Finished Goods, and Cost of Goods Sold (based on ending account balances), Cost of Goods Sold after adjustment would have a balance of

If underapplied or overapplied overhead is material and is allocated to Work in Process, Finished Goods, and Cost of Goods Sold (based on ending account balances), Cost of Goods Sold after adjustment would have a balance ofA) $ 960,000.

B) $ 640,000.

C) $1,040,000.

D) $1,440,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

71

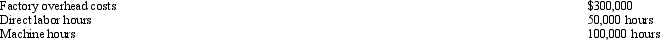

The following information is provided by the Sutton Corporation for the year:  If normal costing is used, budgeted overhead used to calculate the predetermined rate would be

If normal costing is used, budgeted overhead used to calculate the predetermined rate would be

A) $443,250.

B) $450,000.

C) $487,500.

D) $536,250.

If normal costing is used, budgeted overhead used to calculate the predetermined rate would be

If normal costing is used, budgeted overhead used to calculate the predetermined rate would beA) $443,250.

B) $450,000.

C) $487,500.

D) $536,250.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

72

Figure 4-5 The Brookstone Company produces 9 volt batteries and AAA batteries. The Brookstone Company uses a plantwide rate to apply overhead based on direct labor hours. The following data is given:

Refer to Figure 4-5. If the accounts had the following balances, how much will cost of goods sold be adjusted?

Refer to Figure 4-5. If the accounts had the following balances, how much will cost of goods sold be adjusted?

A) debit $12,500

B) debit $21,250

C) credit $26,562.50

D) none of these

Refer to Figure 4-5. If the accounts had the following balances, how much will cost of goods sold be adjusted?

Refer to Figure 4-5. If the accounts had the following balances, how much will cost of goods sold be adjusted?

A) debit $12,500

B) debit $21,250

C) credit $26,562.50

D) none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

73

The Magnanimous Company uses a predetermined overhead rate of $12 per direct labor hour to apply overhead. During the year, 30,000 direct labor hours were worked. Actual overhead costs for the year were $320,000. The overhead variance is

A) $40,000 underapplied.

B) $35,560 underapplied.

C) $36,000 overapplied.

D) none of the above.

A) $40,000 underapplied.

B) $35,560 underapplied.

C) $36,000 overapplied.

D) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

74

Figure 4-4 Mannitou Company made the following predictions for 2014:

Job A2 (which was started and completed in June) used 3,000 direct labor hours, 2,000 machine hours, and $57,000 of prime costs.

Job A2 (which was started and completed in June) used 3,000 direct labor hours, 2,000 machine hours, and $57,000 of prime costs.

Refer to Figure 4-4. If factory overhead is applied based on direct labor hours, the cost of Job A2 for the Mannitou Company is

A) $60,000.

B) $75,000.

C) $63,000.

D) $66,000.

Job A2 (which was started and completed in June) used 3,000 direct labor hours, 2,000 machine hours, and $57,000 of prime costs.

Job A2 (which was started and completed in June) used 3,000 direct labor hours, 2,000 machine hours, and $57,000 of prime costs.Refer to Figure 4-4. If factory overhead is applied based on direct labor hours, the cost of Job A2 for the Mannitou Company is

A) $60,000.

B) $75,000.

C) $63,000.

D) $66,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

75

Assume the following: Actual overhead costs equaled estimated overhead. Actual direct labor hours exceeded estimated direct labor hours used to calculate the predetermined overhead rate. If overhead is applied using the predetermined overhead rate, then overhead is

A) $-0-.

B) underapplied.

C) overapplied.

D) indeterminable from the information given.

A) $-0-.

B) underapplied.

C) overapplied.

D) indeterminable from the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

76

The following information pertains to Whitestone Industries for 2014:  What is the predetermined overhead rate for Whitestone Industries for 2014?

What is the predetermined overhead rate for Whitestone Industries for 2014?

A) 66.7%

B) 150%

C) 160%

D) 62.5%

What is the predetermined overhead rate for Whitestone Industries for 2014?

What is the predetermined overhead rate for Whitestone Industries for 2014?A) 66.7%

B) 150%

C) 160%

D) 62.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

77

Figure 4-6 The Fast & Furious Company produces two products: toy planes and toy race cars. They use departmental overhead rates for the two production departments: molding and finishing. Molding uses machine hours to assign overhead and Finishing uses direct labor hours. 50,000 planes and 250,000 race cars are produced. Please find the following data:

Refer to Figure 4-6. What are the departmental overhead rates for the molding and finishing department respectively?

Refer to Figure 4-6. What are the departmental overhead rates for the molding and finishing department respectively?

A) $25; $2.50

B) $8.33; $2

C) $25; $10

D) $12.50; $2.50

Refer to Figure 4-6. What are the departmental overhead rates for the molding and finishing department respectively?

Refer to Figure 4-6. What are the departmental overhead rates for the molding and finishing department respectively?A) $25; $2.50

B) $8.33; $2

C) $25; $10

D) $12.50; $2.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

78

Lonestar Corporation uses a job-order costing system to account for product costs. The following information pertains to 2014:  Factory overhead rate is $18 per direct labor hour.

Factory overhead rate is $18 per direct labor hour.

What is the amount of under- or overapplied overhead for Lonestar Corporation in 2014?

A) $40,000 overapplied

B) $20,000 overapplied

C) $40,000 underapplied

D) $20,000 underapplied

Factory overhead rate is $18 per direct labor hour.

Factory overhead rate is $18 per direct labor hour.What is the amount of under- or overapplied overhead for Lonestar Corporation in 2014?

A) $40,000 overapplied

B) $20,000 overapplied

C) $40,000 underapplied

D) $20,000 underapplied

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

79

Figure 4-5 The Brookstone Company produces 9 volt batteries and AAA batteries. The Brookstone Company uses a plantwide rate to apply overhead based on direct labor hours. The following data is given:

Refer to Figure 4-5. How much overhead is applied to each 9 volt batteries and AAA batteries respectively? (round to 2 decimal places)

Refer to Figure 4-5. How much overhead is applied to each 9 volt batteries and AAA batteries respectively? (round to 2 decimal places)

A) $87,500; $280,000

B) $70,000; $280,00

C) $81,250; $260,000

D) none of these

Refer to Figure 4-5. How much overhead is applied to each 9 volt batteries and AAA batteries respectively? (round to 2 decimal places)

Refer to Figure 4-5. How much overhead is applied to each 9 volt batteries and AAA batteries respectively? (round to 2 decimal places)A) $87,500; $280,000

B) $70,000; $280,00

C) $81,250; $260,000

D) none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck

80

Figure 4-5 The Brookstone Company produces 9 volt batteries and AAA batteries. The Brookstone Company uses a plantwide rate to apply overhead based on direct labor hours. The following data is given:

Refer to Figure 4-5. How much was overhead over/underapplied?

Refer to Figure 4-5. How much was overhead over/underapplied?

A) $25,000

B) $17,500

C) $42,500

D) none of these

Refer to Figure 4-5. How much was overhead over/underapplied?

Refer to Figure 4-5. How much was overhead over/underapplied?A) $25,000

B) $17,500

C) $42,500

D) none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 201 في هذه المجموعة.

فتح الحزمة

k this deck