Deck 4: Internal Control and Cash

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

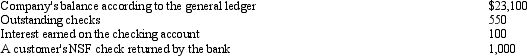

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/162

العب

ملء الشاشة (f)

Deck 4: Internal Control and Cash

1

The stronger the system of internal control,the higher the accuracy of the company's accounting records and financial reports.

True

2

When a bank collects a note on behalf of a company,the bank is likely to issue a debit memo.

False

3

On a bank reconciliation,bank service charges for the month are added to the cash balance per the company records.

False

4

When a bank pays interest on a company's checking account balance,the bank will likely issue a credit memo.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

5

Cash equivalents typically appear in the long-term investments section of a balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

6

Money market accounts with original maturities of less than 90 days are cash equivalents.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

7

Collections of accounts receivable are considered to be cash equivalents.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

8

In a sound system of internal control,cash receipts should be deposited daily.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

9

When reconciling a bank account,the company must prepare an adjusting entry for deposits in transit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

10

A check written by a company but not yet presented to the bank for payment is called a check in transit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

11

On a bank reconciliation,interest earned for the month is added to the cash balance per the company records.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

12

The establishment of a petty cash fund has no effect on the company's total cash balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

13

On a bank reconciliation,outstanding checks are added to the cash balance per the bank statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

14

When reconciling a bank account,the company has to prepare an adjusting entry for outstanding checks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

15

As a result of the bank reconciliation process,a company will prepare an adjusting entry for a debit memo but not for a credit memo.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

16

Petty Cash is NOT considered to be a cash equivalent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

17

A debit memo may be issued in the monthly bank statement in order for the bank to notify a company that a service charge has been assessed on the company's account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

18

An accounting system must be computerized in order to ensure the company has proper internal control.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

19

The key to being classified as a cash equivalent is that the amount must be available to pay debts within a year's time or less.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

20

No special internal control procedures are necessary with a petty cash fund because the amount is so small.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

21

As part of a sound system of internal controls,all disbursements (with the exception of petty cash)should be made by check.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

22

A check written by a company but not yet presented to the bank for payment is called a(n)____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

23

Items that are included on a bank statement and increase the bank account balance are called ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

24

____________________ are those investments and deposits with financial institutions that are readily convertible into known amounts of cash and that have original maturities of three months or less.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

25

Items that are included on a bank statement and decrease the bank account balance are called ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

26

If a company hires honest employees and its top management acts with integrity,no internal control procedures will be necessary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

27

Internal control over financial reporting is concerned with ensuring the reliability of the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

28

The accountant must make journal entries for all items in the book section of the bank reconciliation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

29

A good system of internal control requires that the physical custody of assets be separated from the accounting for those assets.This concept is known as safeguarding of assets and records.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

30

If a company has an internal audit function,it does not need to have external auditors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

31

If the bank credits a customer's account,then that customer's cash account balance increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

32

The best response to an employee caught stealing from the company is to say,"Don't ever let me catch you doing that again!"

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

33

A check that "bounced" or was returned by the bank due to lack of funds is called a(n)____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

34

The sole purpose for creating an internal control system is to deter embezzlement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

35

A company's internal control system must be designed and maintained by its external auditors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

36

If a company records a $450 receipt as $540,this type of mistake is called a(n)____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

37

An amount recorded as an increase in the company's cash account at the end of the period,but which has not yet been reflected on the bank statement is called a(n)____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

38

A(n)____________________ is the process used by an accountant to ensure consistency between the balance shown on the bank statement for a particular account and the balance shown on the accounting records.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

39

If the bank debits its customer's checking account,then the customer's cash balance increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

40

The accountant must make journal entries for all items in the bank section of the bank reconciliation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following is not considered to be a Cash Equivalent?

A)Corporate commercial paper due in 60 days after purchase

B)U.S.Treasury bills with an original maturity of six months

C)A money market account with a stock brokerage firm

D)A certificate of deposit with a term of 75 days when acquired

A)Corporate commercial paper due in 60 days after purchase

B)U.S.Treasury bills with an original maturity of six months

C)A money market account with a stock brokerage firm

D)A certificate of deposit with a term of 75 days when acquired

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

42

The account used to record the discrepancies that will occasionally occur between the amounts deposited and amounts shown on cash register tapes is called ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

43

Each of the following items is considered a cash equivalent except:

A)a 30-day certificate of deposit

B)60-day corporate commercial paper

C)a 75-day U.S.Treasury bill

D)a 180-day note issued by a local government

A)a 30-day certificate of deposit

B)60-day corporate commercial paper

C)a 75-day U.S.Treasury bill

D)a 180-day note issued by a local government

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

44

Strategic risk assessment is designed to identify,analyze,and manage possible threats to the organization's success concerning ____________________ forces such as competitors,customers,suppliers,and PEST factors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

45

An internal control activity that separates responsibilities so that no one person handles all the tasks for a particular activity is referred to as ____________________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

46

Checks presented for payment and paid by the bank are known as

A)Certified checks

B)NSF checks

C)Outstanding checks

D)canceled checks

A)Certified checks

B)NSF checks

C)Outstanding checks

D)canceled checks

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

47

The foundation of the internal control system is the control _____________ - the collection of environmental factors that influence the effectiveness of control procedures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

48

A cost-cutting measure used in many business organization is the use of a(n)____________________ fund,whereby a custodian handles disbursements and documentation for small expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

49

When there is proper segregation of duties,the likelihood of fraud is reduced so that an employee attempting to carry out a fraudulent scheme would have to work in ____________________ with another employee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

50

Under the ____________________ Act,management of publicly-traded corporations has increased responsibility for a system of internal controls that ensures reliability of financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

51

Cash collected and recorded by a company but not yet reflected in a bank statement are known as

A)Debit memos

B)Credit memos

C)Outstanding checks

D)Deposits in transit

A)Debit memos

B)Credit memos

C)Outstanding checks

D)Deposits in transit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

52

Whenever feasible,cash handling activities and cash record-keeping activities should be assigned to different employees,according to the internal control activity called ____________________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

53

How are cash equivalents reported or disclosed in the financial statements?

A)They are included with cash as a current asset on the balance sheet.

B)They are only reported on the statement of cash flows.

C)They are only disclosed in the notes to the financial statements.

D)They are included with short-term investments as a current asset on the balance sheet.

A)They are included with cash as a current asset on the balance sheet.

B)They are only reported on the statement of cash flows.

C)They are only disclosed in the notes to the financial statements.

D)They are included with short-term investments as a current asset on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

54

Business process risk assessment is designed to identify,analyze,and manage possible threats to the organization's success concerning ____________________ forces such as resource allocations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following is not included in Cash and Cash Equivalents on a company's balance sheet?

A)A savings account at the bank

B)A checking account at the bank

C)A bank certificate of deposit for one year

D)Petty cash

A)A savings account at the bank

B)A checking account at the bank

C)A bank certificate of deposit for one year

D)Petty cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

56

Effective cash management and control for a company's operating cycle includes all of the following except:

A)the use of a petty cash fund

B)the preparation of monthly bank reconciliations

C)the practice of using surplus cash for the purchase of bonds or other long-term investments

D)the practice of keeping inventory levels low

A)the use of a petty cash fund

B)the preparation of monthly bank reconciliations

C)the practice of using surplus cash for the purchase of bonds or other long-term investments

D)the practice of keeping inventory levels low

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the assets listed below is considered the most liquid?

A)Accounts receivable

B)Cash

C)Inventory

D)Prepaid insurance

A)Accounts receivable

B)Cash

C)Inventory

D)Prepaid insurance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

58

The elapsed time between the purchase of goods for resale and the collection of cash from customers is referred to as the ____________________ cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

59

The practices of delaying payments to suppliers,speeding up collection from customers,and earning the greatest possible return on any excess cash are known as ____________________ principles.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which one of the following would never be considered a cash equivalent?

A)U.S.Treasury bills

B)Corporate commercial paper

C)Money market funds

D)Common stock issued by a corporation

A)U.S.Treasury bills

B)Corporate commercial paper

C)Money market funds

D)Common stock issued by a corporation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following items would be added to the company's cash balance on a bank reconciliation?

A)Outstanding checks

B)Deposits in transit

C)Bank service charges

D)Interest earned on the bank account

A)Outstanding checks

B)Deposits in transit

C)Bank service charges

D)Interest earned on the bank account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

62

Dance Town Academy The items listed below were identified while preparing a bank reconciliation for the company's checking account as of March 31,2013.

-Refer to Dance Town Academy.Determine the amount of the company's adjusted cash balance.

A)$16,800

B)$20,200

C)$ 1,700

D)Cannot be determined

-Refer to Dance Town Academy.Determine the amount of the company's adjusted cash balance.

A)$16,800

B)$20,200

C)$ 1,700

D)Cannot be determined

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of the following procedures is not part of the preparation of a bank reconciliation for a checking account?

A)Comparing deposits listed on the bank statement to the cash account to identify deposits in transit

B)Comparing canceled checks returned with the bank statement to the cash account to identify outstanding checks

C)Looking for bank services charges and other items on the bank statement that have not yet been included in the cash account.

D)Reversing all the transactions recorded on the company's records that do not yet appear on the bank statement.

A)Comparing deposits listed on the bank statement to the cash account to identify deposits in transit

B)Comparing canceled checks returned with the bank statement to the cash account to identify outstanding checks

C)Looking for bank services charges and other items on the bank statement that have not yet been included in the cash account.

D)Reversing all the transactions recorded on the company's records that do not yet appear on the bank statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following items would not be a reconciling item on a bank reconciliation?

A)canceled checks

B)NSF checks

C)Outstanding checks

D)Bounced checks

A)canceled checks

B)NSF checks

C)Outstanding checks

D)Bounced checks

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

65

Dance Town Academy The items listed below were identified while preparing a bank reconciliation for the company's checking account as of March 31,2013.

-Refer to Dance Town Academy.How will the deposits in transit be handled on a bank reconciliation?

A)add to the balance from the company records

B)subtract from the balance from the company records

C)add to the bank statement balance

D)subtract from the bank statement balance

-Refer to Dance Town Academy.How will the deposits in transit be handled on a bank reconciliation?

A)add to the balance from the company records

B)subtract from the balance from the company records

C)add to the bank statement balance

D)subtract from the bank statement balance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

66

While preparing the February 28th bank reconciliation,the accountant identified the following items:  In the process of preparing the reconciliation,the accountant discovered an error in recording a customer's check;the amount was incorrectly recorded on the books as a cash receipt of $600,while the bank correctly recorded the amount as $650.What is the company's adjusted cash balance on February 28th?

In the process of preparing the reconciliation,the accountant discovered an error in recording a customer's check;the amount was incorrectly recorded on the books as a cash receipt of $600,while the bank correctly recorded the amount as $650.What is the company's adjusted cash balance on February 28th?

A)$22,250

B)$21,700

C)$22,200

D)$22,150

In the process of preparing the reconciliation,the accountant discovered an error in recording a customer's check;the amount was incorrectly recorded on the books as a cash receipt of $600,while the bank correctly recorded the amount as $650.What is the company's adjusted cash balance on February 28th?

In the process of preparing the reconciliation,the accountant discovered an error in recording a customer's check;the amount was incorrectly recorded on the books as a cash receipt of $600,while the bank correctly recorded the amount as $650.What is the company's adjusted cash balance on February 28th?A)$22,250

B)$21,700

C)$22,200

D)$22,150

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following statements best describes the term "outstanding check" from a company's point of view?

A)A check written by the company and presented to the bank for payment.

B)A check written by the company but not yet presented to the bank for payment.

C)A check written by a customer to the company,and the check has been presented to the bank for payment.

D)A check written by a customer to the company,but it has not yet been presented to the bank for payment.

A)A check written by the company and presented to the bank for payment.

B)A check written by the company but not yet presented to the bank for payment.

C)A check written by a customer to the company,and the check has been presented to the bank for payment.

D)A check written by a customer to the company,but it has not yet been presented to the bank for payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

68

While preparing a bank reconciliation,which of the following items would be subtracted from the balance per the company records?

A)Outstanding checks

B)Deposits in transit

C)Bank service charges

D)Interest earned on the bank account

A)Outstanding checks

B)Deposits in transit

C)Bank service charges

D)Interest earned on the bank account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

69

Dance Town Academy The items listed below were identified while preparing a bank reconciliation for the company's checking account as of March 31,2013.

-Refer to Dance Town Academy.How will the customer's bounced checks be handled on a bank reconciliation?

A)add to the balance from the company records

B)subtract from the balance from the company records

C)add to the bank statement balance

D)subtract from the bank statement balance

-Refer to Dance Town Academy.How will the customer's bounced checks be handled on a bank reconciliation?

A)add to the balance from the company records

B)subtract from the balance from the company records

C)add to the bank statement balance

D)subtract from the bank statement balance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

70

While preparing a bank reconciliation,which of the following items would be added to the bank statement balance?

A)Outstanding checks

B)Deposits in transit

C)Bank service charges

D)Interest earned on the bank account

A)Outstanding checks

B)Deposits in transit

C)Bank service charges

D)Interest earned on the bank account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which one of the following statements is true?

A)Sound internal control practice dictates that disbursements should be made by check.

B)Good cash management practice dictates that large cash balances should be maintained.

C)The person handling cash should also prepare the bank reconciliation.

D)Petty cash can be substituted for a checking account to expedite the payment of all disbursements.

A)Sound internal control practice dictates that disbursements should be made by check.

B)Good cash management practice dictates that large cash balances should be maintained.

C)The person handling cash should also prepare the bank reconciliation.

D)Petty cash can be substituted for a checking account to expedite the payment of all disbursements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

72

Dance Town Academy The items listed below were identified while preparing a bank reconciliation for the company's checking account as of March 31,2013.

-Refer to Dance Town Academy.How will the interest earned on the checking account be handled on a bank reconciliation?

A)add to the balance from the company records

B)subtract from the balance from the company records

C)add to the bank statement balance

D)subtract from the bank statement balance

-Refer to Dance Town Academy.How will the interest earned on the checking account be handled on a bank reconciliation?

A)add to the balance from the company records

B)subtract from the balance from the company records

C)add to the bank statement balance

D)subtract from the bank statement balance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

73

A check returned by a bank because the issuer's cash account balance could not cover the check is called a(n)

A)Outstanding check.

B)canceled check

C)Certified check

D)NSF check

A)Outstanding check.

B)canceled check

C)Certified check

D)NSF check

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

74

Dance Town Academy The items listed below were identified while preparing a bank reconciliation for the company's checking account as of March 31,2013.

-Refer to Dance Town Academy.Determine the company's cash balance before adjustment.

A)$16,410

B)$16,900

C)$17,190

D)$17,310

-Refer to Dance Town Academy.Determine the company's cash balance before adjustment.

A)$16,410

B)$16,900

C)$17,190

D)$17,310

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

75

Dance Town Academy The items listed below were identified while preparing a bank reconciliation for the company's checking account as of March 31,2013.

-Refer to Dance Town Academy.How will the outstanding checks be handled on a bank reconciliation?

A)add to the balance from the company records

B)subtract from the balance from the company records

C)add to the bank statement balance

D)subtract from the bank statement balance

-Refer to Dance Town Academy.How will the outstanding checks be handled on a bank reconciliation?

A)add to the balance from the company records

B)subtract from the balance from the company records

C)add to the bank statement balance

D)subtract from the bank statement balance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

76

Each of the following represents an effective cash management practice except:

A)Short-term investments should be purchased with excess cash in order to maximize the interest-earning potential.

B)Payments should be delayed as long as possible (without compromising the relationship with the payee)in order to maximize the interest-earning potential.

C)Payments should be expedited in order to simplify record keeping.

D)Receivable collections should be expedited or receivables should be sold in order to minimize the costs associated with accounting for customer accounts and servicing delinquent accounts.

A)Short-term investments should be purchased with excess cash in order to maximize the interest-earning potential.

B)Payments should be delayed as long as possible (without compromising the relationship with the payee)in order to maximize the interest-earning potential.

C)Payments should be expedited in order to simplify record keeping.

D)Receivable collections should be expedited or receivables should be sold in order to minimize the costs associated with accounting for customer accounts and servicing delinquent accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

77

While preparing a bank reconciliation,which of the following items would be subtracted from the balance per the bank statement?

A)Outstanding checks

B)Deposits in transit

C)Bank service charges

D)Interest earned on the bank account

A)Outstanding checks

B)Deposits in transit

C)Bank service charges

D)Interest earned on the bank account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

78

Dance Town Academy The items listed below were identified while preparing a bank reconciliation for the company's checking account as of March 31,2013.

-Refer to Dance Town Academy.How will the bank services charges be handled on a bank reconciliation?

A)add to the balance from the company records

B)subtract from the balance from the company records

C)add to the bank statement balance

D)subtract from the bank statement balance

-Refer to Dance Town Academy.How will the bank services charges be handled on a bank reconciliation?

A)add to the balance from the company records

B)subtract from the balance from the company records

C)add to the bank statement balance

D)subtract from the bank statement balance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following would not appear on a bank statement for a checking account?

A)Service charges

B)Outstanding checks

C)Credit memos

D)Interest earned

A)Service charges

B)Outstanding checks

C)Credit memos

D)Interest earned

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

80

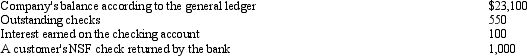

While preparing the April 30th bank reconciliation,the accountant identified the following items:  What is the company's adjusted cash balance at April 30th?

What is the company's adjusted cash balance at April 30th?

A)$12,385

B)$12,500

C)$14,885

D)$17,385

What is the company's adjusted cash balance at April 30th?

What is the company's adjusted cash balance at April 30th?A)$12,385

B)$12,500

C)$14,885

D)$17,385

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck