Deck 5: Sales and Receivables

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/134

العب

ملء الشاشة (f)

Deck 5: Sales and Receivables

1

The terms "realized" and "realizable" mean that the selling price is fixed and determinable and collectibility is reasonably assured.

True

2

The account,"Allowance for Doubtful Accounts" is an expense account (the cost of making bad credit sales)that is reported on the income statement.

False

3

If a company estimates its bad debt expense on the basis of a receivables aging,the balance in the Allowance for Doubtful Accounts account will not affect the amount of the end-of-period adjusting entry for bad debts.

False

4

A primary advantage of the allowance method to account for bad debts is that it supports the matching principle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

5

The longer a customer's account balance remains outstanding,the greater the likelihood that it will be collected in the near future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

6

A sale and its associated receivable are recorded only when the order,shipping,and billing documents are all present.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

7

Net Sales = Total credit sales - Sales Discounts - Sales Returns and Allowances

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

8

The use of the allowance method is an attempt by accountants to match bad debts as an expense with the revenue of the period in which a sale on credit takes place.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

9

A balance sheet approach to estimating bad debt expense is not permitted under GAAP (Generally Accepted Accounting Principles).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

10

The amount of interest paid is a function of three variables,the amount borrowed,the interest rate,and the length of the loan period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

11

The lender of a note recognizes a note receivable on the balance sheet and interest revenue on its income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

12

Accounts receivable are shown on the balance sheet at their net realizable value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

13

The accounts receivable turnover ratio is used to evaluate how well a company does in collecting its accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

14

If a company accepts a major credit card such as VISA from a customer,then the company is responsible for the amount of the sale in a case of nonpayment from a cardholder.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

15

Selling on credit protects a company from the risk that some of its receivables will never be collected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

16

The higher the accounts receivable turnover the better because it indicates that the company is more quickly collecting cash (through sales).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

17

The lender (issuer)of a note recognizes a note payable on the balance sheet and interest expense on its income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

18

Under the allowance method of accounting for bad debts,the company estimates the amount of bad debts before those debts actually occur.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

19

Trade receivables represent a stronger legal claim against the debtor than do non-trade receivables.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

20

Because the allowance method results in better matching,accounting standards require its use rather than the direct write-off method,unless bad debts are immaterial.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

21

Special forms of factoring are called ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

22

What is the distinguishing characteristic between accounts receivable and notes receivable?

A)Accounts receivable are usually current assets while notes receivable are usually long-term assets.

B)Accounts receivable require payment of interest while notes receivable does not have payment of interest.

C)Notes receivable result from credit sale transactions for merchandising companies,while accounts receivable result from credit sale transactions for service companies.

D)Notes receivable generally specify an interest rate and a maturity date at which any interest and principle must be repaid.

A)Accounts receivable are usually current assets while notes receivable are usually long-term assets.

B)Accounts receivable require payment of interest while notes receivable does not have payment of interest.

C)Notes receivable result from credit sale transactions for merchandising companies,while accounts receivable result from credit sale transactions for service companies.

D)Notes receivable generally specify an interest rate and a maturity date at which any interest and principle must be repaid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

23

The amount of money borrowed when a promissory note is issued is called the ____________________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

24

Action Signs recorded credit sales of $10,000 on the gross method.Terms are 2/20,n/30.Select the correct statement about the entry to record this sale.

A)Accounts receivable increases $10,000.

B)Sales increase $9,800

C)Sales discounts increase $200

D)All of the above are correct

A)Accounts receivable increases $10,000.

B)Sales increase $9,800

C)Sales discounts increase $200

D)All of the above are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

25

The difference between the principal amount of a note and its maturity value is called ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

26

How efficiently a company is using the resources at its disposal is called ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

27

The ____________________ order is necessary for the buyer to be obligated to accept and pay for the ordered goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

28

A(n)____________________ categorizes the various accounts receivable amounts by the length of time outstanding

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

29

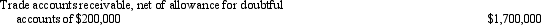

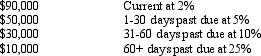

The following information was presented in the balance sheet of Acworth Pools as of December 31,2012:  Select the incorrect statement from the following.

Select the incorrect statement from the following.

A)The company expects to actually collect $1,700,000 of its receivables.

B)The balance in the Accounts Receivable account in the company's general ledger is $1,700,000.

C)The net realizable value of the company's receivables is $1,700,000.

D)The company expects uncollectibles to total $200,000.

Select the incorrect statement from the following.

Select the incorrect statement from the following.A)The company expects to actually collect $1,700,000 of its receivables.

B)The balance in the Accounts Receivable account in the company's general ledger is $1,700,000.

C)The net realizable value of the company's receivables is $1,700,000.

D)The company expects uncollectibles to total $200,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

30

____________________ are receivables that generally specify an interest rate and a maturity date at which any interest and principal must be repaid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

31

A company receiving payment of a $20,000 accounts receivable within 10 days with terms of 2/10,n/30,would record a sales discount of:

A)10% of $20,000

B)2% of $20,000

C)(100% - 10%)x $20,000

D)(100% - 2%)x $20,000

A)10% of $20,000

B)2% of $20,000

C)(100% - 10%)x $20,000

D)(100% - 2%)x $20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

32

Gross profit divided by net sales is called the ____________________ ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

33

According to the ____________________ principle,bad debt expense must be recorded in the period in which the sale was made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

34

A(n)____________________ is the buyer of receivables,who acquires the right to collect the receivables and assumes the risk of uncollectibility.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

35

The method of recording bad debts that results in a bad debt expense before the actual default is the ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

36

A sales invoice that bears the notation 2/10 means ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

37

A company had sales of $40,000,sales discounts of $800,sales returns of $1,600 and commissions owed to sales people of $600.Compute net sales.

A)$37,600

B)$37,000

C)$38,400

D)$39,000

A)$37,600

B)$37,000

C)$38,400

D)$39,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

38

To encourage prompt payment,sellers offer a(n)____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

39

Net sales is total sales less sales discounts and ________________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

40

The basis of accounting that recognizes revenue when it is realizable and earned is called the ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which one of the approaches for the allowance procedure emphasizes the net realizable value of accounts receivable on the balance sheet?

A)The aging of accounts receivable method

B)The percentage of net credit sales method

C)The percentage of accounts written off method

D)The direct write-off method

A)The aging of accounts receivable method

B)The percentage of net credit sales method

C)The percentage of accounts written off method

D)The direct write-off method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

42

A company's accounts receivable balance after posting net collections from customers for 2012 is $150,000.Management feels that uncollected accounts should be based on the following aging of accounts receivable and uncollected percentages.There are $100,000 that are 1-30 past due at 2% and $50,000 that are 31 to 60 days past due at 10%.The net realizable value of the accounts receivable is

A)$147,500

B)$148,000

C)$150,000

D)$143,000

A)$147,500

B)$148,000

C)$150,000

D)$143,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

43

A company uses the direct write-off method to account for bad debts.What are the effects on the accounting equation of the entry to record the write-off of a customer's account balance?

A)Assets and liabilities decrease

B)Assets and Stockholders' equity decrease

C)Stockholders' equity and liabilities decrease

D)Assets increase and Stockholders' equity decrease

A)Assets and liabilities decrease

B)Assets and Stockholders' equity decrease

C)Stockholders' equity and liabilities decrease

D)Assets increase and Stockholders' equity decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

44

AT&U Company Data for the year ended December 31,2012,are presented below:

-Refer to AT&U Company.If the company uses the aging of accounts receivable approach to estimate its bad debts,what will be the net realizable value of its accounts receivable after the adjustment for bad debt expense?

A)$640,000

B)$595,000

C)$620,000

D)$615,000

-Refer to AT&U Company.If the company uses the aging of accounts receivable approach to estimate its bad debts,what will be the net realizable value of its accounts receivable after the adjustment for bad debt expense?

A)$640,000

B)$595,000

C)$620,000

D)$615,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

45

If a company uses the allowance method to account for doubtful accounts,when will the company's Stockholders' equity decrease?

A)At the date a customer's account is written off

B)At the end of the accounting period when an adjusting entry for bad debts is recorded

C)At the date a customer's account is determined to be uncollected

D)When the accounts receivable amount becomes past due

A)At the date a customer's account is written off

B)At the end of the accounting period when an adjusting entry for bad debts is recorded

C)At the date a customer's account is determined to be uncollected

D)When the accounts receivable amount becomes past due

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

46

The Allowance for Doubtful Accounts represents:

A)Bad debt losses incurred in the current period

B)The amount of uncollected accounts written off to date

C)The difference between total sales made on credit and the amount collected from those credit sales

D)The difference between the recorded value of accounts receivable and the net realizable value of accounts receivable

A)Bad debt losses incurred in the current period

B)The amount of uncollected accounts written off to date

C)The difference between total sales made on credit and the amount collected from those credit sales

D)The difference between the recorded value of accounts receivable and the net realizable value of accounts receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which allowance method approach is considered to be an income statement approach to estimating bad debts?

A)The percentage of accounts receivable approach

B)The percentage of accounts written off approach

C)The percentage of net credit sales approach

D)The direct write off method

A)The percentage of accounts receivable approach

B)The percentage of accounts written off approach

C)The percentage of net credit sales approach

D)The direct write off method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

48

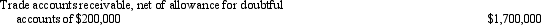

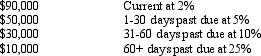

All Star Auto has an accounts receivable balance after posting net collections from customers for 2012 of $180,000.The customers took advantage of sales discounts of $15,000.Management aged the accounts receivable and estimate for uncollected account percentages as follows:  The net realizable value of the accounts receivable is

The net realizable value of the accounts receivable is

A)$173,200

B)$170,200

C)$172,700

D)$180,000

The net realizable value of the accounts receivable is

The net realizable value of the accounts receivable isA)$173,200

B)$170,200

C)$172,700

D)$180,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

49

AT&U Company Data for the year ended December 31,2012,are presented below:

-Refer to AT&U Company.If the company uses the aging of accounts receivable approach to estimate its bad debts,what amount will be reported as bad debt expense for 2012?

A)$25,000

B)$45,000

C)$20,000

D)$49,000

-Refer to AT&U Company.If the company uses the aging of accounts receivable approach to estimate its bad debts,what amount will be reported as bad debt expense for 2012?

A)$25,000

B)$45,000

C)$20,000

D)$49,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which one of the following statements is true if a company's collection period for accounts receivable is unacceptably long?

A)The collection cost would be reduced.

B)The company may offer sales discounts to shorten the collection period.

C)Cash flows from operations may be higher than expected for the company's sales.

D)The company should expand operations with its excess cash.

A)The collection cost would be reduced.

B)The company may offer sales discounts to shorten the collection period.

C)Cash flows from operations may be higher than expected for the company's sales.

D)The company should expand operations with its excess cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

51

A company had beginning accounts receivable of $175,000.All sales were on account and totaled $550,000.Cash collected from customers totaled $650,000.Calculate the ending accounts receivable balance.

A)$725,000

B)$275,000

C)$ 75,000

D)$175,000

A)$725,000

B)$275,000

C)$ 75,000

D)$175,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

52

AT&U Company Data for the year ended December 31,2012,are presented below:

-Refer to AT&U Company.If the company estimates its bad debts at 1% of net credit sales,what amount will be reported as bad debt expense for 2012?

A)$44,500

B)$25,000

C)$24,500

D)$4,500

-Refer to AT&U Company.If the company estimates its bad debts at 1% of net credit sales,what amount will be reported as bad debt expense for 2012?

A)$44,500

B)$25,000

C)$24,500

D)$4,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

53

Allatoona Landing reported net credit sales of $1,250,000 and cost of goods sold of $900,000 for 2012.Its beginning balance of Accounts Receivable was $175,000.The accounts receivable balance decreased by $25,000 during 2012.Rounded to two decimal places,what is the company's accounts receivable turnover rate for 2012?

A)7.14

B)7.69

C)8.33

D)11.03

A)7.14

B)7.69

C)8.33

D)11.03

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

54

If a company uses the direct write-off method of accounting for bad debts,

A)It establishes an estimate for the allowance for doubtful accounts.

B)It will record bad debt expense only when an account is determined to be uncollected.

C)It will reduce the accounts receivable account at the end of the accounting period for estimated uncollected accounts.

D)When an account is written off,total assets will stay the same.

A)It establishes an estimate for the allowance for doubtful accounts.

B)It will record bad debt expense only when an account is determined to be uncollected.

C)It will reduce the accounts receivable account at the end of the accounting period for estimated uncollected accounts.

D)When an account is written off,total assets will stay the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

55

AT&U Company Data for the year ended December 31,2012,are presented below:

-Refer to AT&U Company.If the company estimates its bad debt to be 2% of net credit sales,what will be the balance in the Allowance for Doubtful Accounts account after the adjustment for bad debts?

A)$20,000

B)$19,000

C)$49,000

D)$69,000

-Refer to AT&U Company.If the company estimates its bad debt to be 2% of net credit sales,what will be the balance in the Allowance for Doubtful Accounts account after the adjustment for bad debts?

A)$20,000

B)$19,000

C)$49,000

D)$69,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

56

All of the following are true for a company that uses the allowance method of accounting for bad debts,EXCEPT:

A)It uses a contra-asset account called the allowance for doubtful accounts.

B)It records bad debt expense each time an account is determined to be uncollectible.

C)It reduces its accounts receivable balance when the account is written off.

D)It reports accounts receivable in the balance sheet at their net realizable value.

A)It uses a contra-asset account called the allowance for doubtful accounts.

B)It records bad debt expense each time an account is determined to be uncollectible.

C)It reduces its accounts receivable balance when the account is written off.

D)It reports accounts receivable in the balance sheet at their net realizable value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

57

On December 15,2012,the accounts receivable balance was $50,000 and the balance in the allowance for doubtful accounts was $5,000.That morning,a $1,000 uncollected account was written-off.The net realizable value of accounts receivable immediately after the write-off is:

A)$49,000

B)$46,000

C)$45,000

D)$44,000

A)$49,000

B)$46,000

C)$45,000

D)$44,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

58

Alco Roofing Company's beginning accounts receivable were $200,000 and ending accounts receivable were $270,000.During the period,credit sales totaled $570,000,How much cash was collected from customers?

A)$470,000

B)$500,000

C)$570,000

D)$640,000

A)$470,000

B)$500,000

C)$570,000

D)$640,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which one of the following is an accurate description of the Allowance for Doubtful Accounts?

A)Contra Account

B)Liability Account

C)Revenue Account

D)Expense Account

A)Contra Account

B)Liability Account

C)Revenue Account

D)Expense Account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

60

Beginning accounts receivable were $200,000 and ending accounts receivable were $300,000.Assuming cash collections totaled $1,100,000,what were credit sales?

A)$1,200,000

B)$1,100,000

C)$1,300,000

D)$1,500,000

A)$1,200,000

B)$1,100,000

C)$1,300,000

D)$1,500,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

61

Ace Computing Company On January 1,2012,the Accounts Receivable and the Allowance for Doubtful Accounts carried balances of $40,000 and $1,500 respectively.During the year,the company reported $80,000 of credit sales.There were $500 of receivables written off as uncollected in 2012.Cash collections of receivables amounted to $78,200.The company estimates that it will be unable to collect 4% of the year-end accounts receivable balance.

-Refer to the Ace Computing Company.The net realizable value of receivables appearing on the 2012 balance sheet will amount to:

A)$40,648

B)$39,648

C)$41,300

D)$39,800

-Refer to the Ace Computing Company.The net realizable value of receivables appearing on the 2012 balance sheet will amount to:

A)$40,648

B)$39,648

C)$41,300

D)$39,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

62

A-One Construction The following data are from the company's records for 2012:

-Refer to A-One Construction.If the aging approach is used to estimate bad debts,what should the balance in the Allowance for Doubtful Accounts be after the bad debts adjustment?

A)$ 2,100

B)$31,100

C)$29,200

D)$27,100

-Refer to A-One Construction.If the aging approach is used to estimate bad debts,what should the balance in the Allowance for Doubtful Accounts be after the bad debts adjustment?

A)$ 2,100

B)$31,100

C)$29,200

D)$27,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

63

A-One Construction The following data are from the company's records for 2012:

-Refer to A-One Construction.If the aging approach is used to estimate bad debts,what amount should be recorded as bad debt expense for 2012?

A)$ 2,100

B)$27,100

C)$29,200

D)$31,300

-Refer to A-One Construction.If the aging approach is used to estimate bad debts,what amount should be recorded as bad debt expense for 2012?

A)$ 2,100

B)$27,100

C)$29,200

D)$31,300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

64

Accelerated Solutions The following data are from the company's records for 2012:

-Refer to Accelerated Solutions.If the aging method is used to estimate bad debts,what amount should be recorded as bad debt expense for 2012?

A)$50,000

B)$ 5,000

C)$15,000

D)$25,000

-Refer to Accelerated Solutions.If the aging method is used to estimate bad debts,what amount should be recorded as bad debt expense for 2012?

A)$50,000

B)$ 5,000

C)$15,000

D)$25,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

65

On December 1,2012,Anson's Drug Store concluded that a customer's $325 account receivable was uncollected and that the account should be written off.What effect will this write-off have on the company's 2012 net income and balance sheet totals assuming the direct write-off method is used to account for bad debts?

A)Decrease in net income;decrease in total assets

B)Increase in net income;no effect on total assets

C)No effect on net income;decrease in total assets

D)No effect on net income;no effect on total assets

A)Decrease in net income;decrease in total assets

B)Increase in net income;no effect on total assets

C)No effect on net income;decrease in total assets

D)No effect on net income;no effect on total assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

66

A&B Foods Data for the year ended December 31,2012,are presented below.

-Refer to A&B Foods.If the company uses the aging of accounts receivable method to estimate its bad debts,what amount will be reported as bad debt expense for 2012?

A)$50,000

B)$75,000

C)$78,000

D)$53,000

-Refer to A&B Foods.If the company uses the aging of accounts receivable method to estimate its bad debts,what amount will be reported as bad debt expense for 2012?

A)$50,000

B)$75,000

C)$78,000

D)$53,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

67

A&B Foods Data for the year ended December 31,2012,are presented below.

-Refer to A&B Foods.If the company uses the aging of accounts receivable method to estimate its bad debts,what will be the net realizable value of its accounts receivable after the adjustment for bad debt expense?

A)$343,000

B)$345,000

C)$420,000

D)$395,000

-Refer to A&B Foods.If the company uses the aging of accounts receivable method to estimate its bad debts,what will be the net realizable value of its accounts receivable after the adjustment for bad debt expense?

A)$343,000

B)$345,000

C)$420,000

D)$395,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

68

Accelerated Solutions The following data are from the company's records for 2012:

-Refer to Accelerated Solutions.If the aging approach is used to estimate bad debts,find the balance in the Allowance for Doubtful Accounts after the bad debt expense adjustment.

A)$ 5,000

B)$15,000

C)$25,000

D)$50,000

-Refer to Accelerated Solutions.If the aging approach is used to estimate bad debts,find the balance in the Allowance for Doubtful Accounts after the bad debt expense adjustment.

A)$ 5,000

B)$15,000

C)$25,000

D)$50,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

69

A-One Construction The following data are from the company's records for 2012:

-Refer to A-One Construction.What is the balance of Accounts Receivable at December 31,2012?

A)$545,000

B)$440,000

C)$515,000

D)$530,000

-Refer to A-One Construction.What is the balance of Accounts Receivable at December 31,2012?

A)$545,000

B)$440,000

C)$515,000

D)$530,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

70

During 2012,the accounts receivable turnover rate for Adaptive Equipment increased from 10 to 15 times per year.Which one of the following statements is the most likely explanation for the change?

A)The company's credit department has followed up with customers whose account balances are past due in order to generate quicker collections.

B)The company has decreased sales to its most credit worthy customers.

C)The company has increased the amount of time customers have to pay their accounts before they are past due.

D)The company has extended credit to more risky customers in order to increase sales.

A)The company's credit department has followed up with customers whose account balances are past due in order to generate quicker collections.

B)The company has decreased sales to its most credit worthy customers.

C)The company has increased the amount of time customers have to pay their accounts before they are past due.

D)The company has extended credit to more risky customers in order to increase sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

71

A2Z Events The following data are from the company's records for 2012:

-Refer to A2Z Events.What amount will the company show on its year-end balance sheet for the net realizable value of its accounts receivable?

A)$410,000

B)$285,000

C)$340,000

D)$355,000

-Refer to A2Z Events.What amount will the company show on its year-end balance sheet for the net realizable value of its accounts receivable?

A)$410,000

B)$285,000

C)$340,000

D)$355,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following statements is true regarding the two allowance procedures used to estimate bad debts?

A)The percentage of net credit sales method takes into account the existing balance in the Allowance for Doubtful Accounts account.

B)The direct write-off method takes into account the existing balance in the Allowance for Doubtful Accounts account.

C)The aging of accounts receivable method takes into account the existing balance in the Allowance for Doubtful Accounts account.

D)The direct write-off method does a better job of matching revenues and expenses.

A)The percentage of net credit sales method takes into account the existing balance in the Allowance for Doubtful Accounts account.

B)The direct write-off method takes into account the existing balance in the Allowance for Doubtful Accounts account.

C)The aging of accounts receivable method takes into account the existing balance in the Allowance for Doubtful Accounts account.

D)The direct write-off method does a better job of matching revenues and expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

73

A&B Foods Data for the year ended December 31,2012,are presented below.

-Refer to A&B Foods.If the company estimates its bad debts at 4% of net credit sales,what amount will be reported as bad debt expense for 2012?

A)$50,000

B)$75,000

C)$78,000

D)$84,000

-Refer to A&B Foods.If the company estimates its bad debts at 4% of net credit sales,what amount will be reported as bad debt expense for 2012?

A)$50,000

B)$75,000

C)$78,000

D)$84,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

74

Ace Computing Company On January 1,2012,the Accounts Receivable and the Allowance for Doubtful Accounts carried balances of $40,000 and $1,500 respectively.During the year,the company reported $80,000 of credit sales.There were $500 of receivables written off as uncollected in 2012.Cash collections of receivables amounted to $78,200.The company estimates that it will be unable to collect 4% of the year-end accounts receivable balance.

-Refer to the Ace Computing Company.The amount of bad debts expense recognized in the 2012 income statement will be:

A)$1,652

B)$ 652

C)$ 142

D)$1,450

-Refer to the Ace Computing Company.The amount of bad debts expense recognized in the 2012 income statement will be:

A)$1,652

B)$ 652

C)$ 142

D)$1,450

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

75

Ace Computing Company On January 1,2012,the Accounts Receivable and the Allowance for Doubtful Accounts carried balances of $40,000 and $1,500 respectively.During the year,the company reported $80,000 of credit sales.There were $500 of receivables written off as uncollected in 2012.Cash collections of receivables amounted to $78,200.The company estimates that it will be unable to collect 4% of the year-end accounts receivable balance.

-Refer to the Ace Computing Company.The entry to recognize the write-off of the specific uncollected accounts will act to:

A)Increase total assets and stockholders' equity

B)Increase total assets and decrease stockholders' equity

C)Decrease total assets and stockholders' equity

D)Not affect total assets or stockholders' equity

-Refer to the Ace Computing Company.The entry to recognize the write-off of the specific uncollected accounts will act to:

A)Increase total assets and stockholders' equity

B)Increase total assets and decrease stockholders' equity

C)Decrease total assets and stockholders' equity

D)Not affect total assets or stockholders' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

76

A2Z Events The following data are from the company's records for 2012:

-Refer to A2Z Events.What are the effects on the accounting equation when the company writes off a bad debt under the allowance method?

A)Assets decrease and stockholders' equity increase

B)Assets and stockholders' equity decrease

C)Assets increase and stockholders' equity decreases

D)No effect on overall assets or stockholders' equity

-Refer to A2Z Events.What are the effects on the accounting equation when the company writes off a bad debt under the allowance method?

A)Assets decrease and stockholders' equity increase

B)Assets and stockholders' equity decrease

C)Assets increase and stockholders' equity decreases

D)No effect on overall assets or stockholders' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

77

A&B Foods Data for the year ended December 31,2012,are presented below.

-Refer to A&B Foods.If the company uses 4% of net credit sales to estimate its bad debts,what will be the balance in the Allowance for Doubtful Accounts account after the adjustment for bad debts?

A)$ 50,000

B)$103,000

C)$ 78,000

D)$ 75,000

-Refer to A&B Foods.If the company uses 4% of net credit sales to estimate its bad debts,what will be the balance in the Allowance for Doubtful Accounts account after the adjustment for bad debts?

A)$ 50,000

B)$103,000

C)$ 78,000

D)$ 75,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

78

Ace Computing Company On January 1,2012,the Accounts Receivable and the Allowance for Doubtful Accounts carried balances of $40,000 and $1,500 respectively.During the year,the company reported $80,000 of credit sales.There were $500 of receivables written off as uncollected in 2012.Cash collections of receivables amounted to $78,200.The company estimates that it will be unable to collect 4% of the year-end accounts receivable balance.

-Refer to the Ace Computing Company.The entry required to recognize the bad debts expense for 2012 will act to:

A)Increase total assets and retained earnings

B)Decrease total assets and retained earnings

C)Decrease total assets and increase net income

D)Increase total assets and decrease net income

-Refer to the Ace Computing Company.The entry required to recognize the bad debts expense for 2012 will act to:

A)Increase total assets and retained earnings

B)Decrease total assets and retained earnings

C)Decrease total assets and increase net income

D)Increase total assets and decrease net income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

79

Accelerated Solutions The following data are from the company's records for 2012:

-Refer to Accelerated Solutions.What is the balance of Accounts Receivable at December 31,2012?

A)$700,000

B)$340,000

C)$690,000

D)$710,000

-Refer to Accelerated Solutions.What is the balance of Accounts Receivable at December 31,2012?

A)$700,000

B)$340,000

C)$690,000

D)$710,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

80

A2Z Events The following data are from the company's records for 2012:

-Refer to A2Z Events.What are the effects on the accounting equation when the company makes the adjustment to record bad debt expense using the allowance method?

A)Assets increase and liabilities decrease

B)Assets and stockholders' equity decrease

C)Assets increase and stockholders' equity decreases

D)Assets decrease and stockholders' equity increases

-Refer to A2Z Events.What are the effects on the accounting equation when the company makes the adjustment to record bad debt expense using the allowance method?

A)Assets increase and liabilities decrease

B)Assets and stockholders' equity decrease

C)Assets increase and stockholders' equity decreases

D)Assets decrease and stockholders' equity increases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck