Deck 28: Accounting for Investments

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/112

العب

ملء الشاشة (f)

Deck 28: Accounting for Investments

1

A controlling investment is defined as ownership of more than 50 percent of the stock of another company.

True

2

Unrealized gains and losses on trading securities appear on the income statement.

True

3

It is not possible for one company to influence the operating policies of another company unless it owns more than a 50 percent interest in that company.

False

4

Detailed information about a company's investments is never disclosed in the notes to the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

5

Investments with a maturity of less than ninety days are generally classified as cash equivalents.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

6

Another term for short-term investments is marketable securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

7

An ownership interest of greater than 50 percent is required for an investor to have accounting control over an investee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

8

For available-for-sale securities,an unrealized loss on long-term investments appears as part of other comprehensive income (loss)in the company's financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

9

Insider trading is considered unethical,but it is not illegal in the United States.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

10

Held-to-maturity securities are always debt securities,and never equity securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

11

Available-for-sale securities may only be classified as short-term investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

12

A noninfluential and noncontrolling investment is defined as ownership of less than 25 percent of the stock of another company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

13

Investments are valued on the balance sheet at the original purchase price,even if the price has changed since the date of purchase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

14

An influential but noncontrolling investment is defined as ownership of between 20 to 50 percent of the stock of another company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

15

Unless there is evidence to the contrary,an investor owning 35 percent of the stock of an investee is assumed to have significant influence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

16

An individual can be prosecuted by the SEC for insider trading whether or not that individual is employed by the company involved.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

17

As long as an investment can be sold within a short period of time,it must be classified as a current asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

18

Gains and losses on the sale of investments appear as adjustments within the financing activities section of the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

19

Trading securities are valued on the balance sheet at market value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

20

Unrealized gains and losses on available-for-sale securities are reported on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

21

With few exceptions,all subsidiaries in which the parent company owns a controlling interest (more than 50 percent)must be consolidated with the parent company for financial reporting purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

22

Under the equity method of accounting for a stock investment,a proportionate share of the investee's income is recorded on the investor's records.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

23

When the equity method is used to account for an investment in stock,the investor will report its share of the investee's annual earnings as income in proportion to how much the investee distributes in the form of dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

24

Using the cost-adjusted-to-market method of accounting for a long-term investment in stock,the journal entry to record the receipt of dividends involves a debit to Dividend Income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

25

It is possible that an investor with less than a 50 percent ownership interest may qualify for accounting recognition of control and appropriately prepare consolidated financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

26

When the cost-adjusted-to-market method is used to account for an investment in stock,dividends received are accounted for as an increase to dividend income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

27

When the equity method is used to account for an investment in stock,dividends received by the investor decrease the investment account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

28

The Allowance to Adjust Long-Term Investments to Market and the Unrealized Loss on Long-Term Investments are reciprocal accounts,each with the same dollar balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

29

Unrealized Loss (Gain)on Short-Term Investments is a contra-asset account that will appear on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

30

The equity method usually is the most appropriate method for accounting for investments of more than a 20 percent interest of another company's stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

31

The Allowance to Adjust Long-Term Investments to Market account appears in the assets section of the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

32

Dividends received on investments are accounted for in the same way under the cost-adjusted-to-market and the equity methods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

33

When a company holds U.S.Treasury bills,it debits Interest Income and credits Short-Term Investments at the end of the accounting period (assuming it is prior to the T-bills' maturity).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

34

When the market value of available-for-sale securities exceeds cost,an unrealized loss appears in stockholders' equity as an addition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

35

The account Allowance to Adjust Short-Term Investments to Market appears as a contra-asset on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

36

An increase or decrease in the fair value of a company's total trading portfolio is included in net income in the period in which the increase or decrease occurs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

37

Trading securities appear as current assets on the balance sheet at their historical cost regardless of subsequent increases or decreases in market value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

38

The cost-adjusted-to-market method of accounting for investments allows for a departure from cost when the market value of the investment falls below or rises above cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

39

Trading securities are always short-term investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

40

If a long-term investment suffers a permanent decline in value,a loss only has to be recorded if the investment is sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

41

All of the following are conditions that could affect the valuation of investments on the balance sheet except

A)changes in the general purchasing power of the dollar.

B)changes in the operations of investee companies.

C)changes in the market value or fair value of the investments.

D)changes caused by the passage of time.

A)changes in the general purchasing power of the dollar.

B)changes in the operations of investee companies.

C)changes in the market value or fair value of the investments.

D)changes caused by the passage of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following categories of investments can be both debt and equity securities?

A)Available-for-sale securities

B)Trading securities

C)Held-to-maturity securities

D)Both available-for-sale and trading securities

A)Available-for-sale securities

B)Trading securities

C)Held-to-maturity securities

D)Both available-for-sale and trading securities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which is the only type of investment that is always classified as short-term?

A)Trading securities

B)Held-to-maturity securities

C)Available-for-sale securities

D)Equity securities

A)Trading securities

B)Held-to-maturity securities

C)Available-for-sale securities

D)Equity securities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

44

When bonds are purchased between interest dates,the buyer must pay (in addition to the bonds' cost)the amount of interest that has accrued since the last interest payment date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which type of investment,if any,could be classified as short- or long-term,as well as debt or equity?

A)Available-for-sale securities

B)Trading securities

C)Held-to-maturity securities

D)None of these are correct.

A)Available-for-sale securities

B)Trading securities

C)Held-to-maturity securities

D)None of these are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

46

All of the following are indications of significant influence over another company except

A)exchange of managerial personnel.

B)representation on the board of directors.

C)technological dependency between the two companies.

D)ownership of all of the other company's debt securities.

A)exchange of managerial personnel.

B)representation on the board of directors.

C)technological dependency between the two companies.

D)ownership of all of the other company's debt securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

47

All the interest income on U.S.Treasury bills is recorded at maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

48

The purchase and sale of debt and equity securities would appear in which section of the statement of cash flows?

A)Operating activities

B)Investing activities

C)Financing activities

D)Noncash investing and financing activities

A)Operating activities

B)Investing activities

C)Financing activities

D)Noncash investing and financing activities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

49

Short-term available-for-sale securities are valued on the balance sheet at

A)market value.

B)cost,adjusted for the effects of interest.

C)cost.

D)lower of cost or market.

A)market value.

B)cost,adjusted for the effects of interest.

C)cost.

D)lower of cost or market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

50

The ability of an investing company to affect the operating and financial policies of another company,even though the investor holds less than 50 percent of the voting stock,is known as

A)significant influence.

B)control.

C)minority interest.

D)noninfluential control.

A)significant influence.

B)control.

C)minority interest.

D)noninfluential control.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

51

In the United States,insider trading is considered

A)unethical,but not illegal.

B)neither unethical nor illegal.

C)both unethical and illegal.

D)illegal,but not unethical.

A)unethical,but not illegal.

B)neither unethical nor illegal.

C)both unethical and illegal.

D)illegal,but not unethical.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following is not a category of investments?

A)Held-to-maturity securities

B)Trading securities

C)Collateral securities

D)Available-for-sale securities

A)Held-to-maturity securities

B)Trading securities

C)Collateral securities

D)Available-for-sale securities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

53

Held-to-maturity securities that will mature within one year are classified as short-term investments and valued on the balance sheet at fair value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

54

Most long-term bond investments are classified as held-to-maturity securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

55

A controlling investment is defined as owning what percent of the stock of another company?

A)More than 50 percent

B)100 percent

C)More than 75 percent

D)75 percent

A)More than 50 percent

B)100 percent

C)More than 75 percent

D)75 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

56

U.S.Treasury bills are considered equity securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

57

Held-to-maturity securities are valued on the balance sheet at cost adjusted for the effects of interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

58

Long-term bond investments that are classified as available-for-sale must be valued on the balance sheet at fair value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following categories of investments can be debt but not equity securities?

A)Trading securities

B)Held-to-maturity securities

C)Available-for-sale securities

D)Both trading and available-for-sale securities

A)Trading securities

B)Held-to-maturity securities

C)Available-for-sale securities

D)Both trading and available-for-sale securities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

60

Significant influence is defined as owning what percent of the stock of another company?

A)15 to 60 percent

B)More than 50 percent

C)20 to 50 percent

D)75 percent

A)15 to 60 percent

B)More than 50 percent

C)20 to 50 percent

D)75 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

61

Under the cost-adjusted-to-market method of accounting for an investment,

A)Dividend Income is credited when dividends are received.

B)the investment account is credited when dividends are received.

C)the investment account is credited when the investee reports a net income.

D)Investment Income is credited when the invested reports a net income.

A)Dividend Income is credited when dividends are received.

B)the investment account is credited when dividends are received.

C)the investment account is credited when the investee reports a net income.

D)Investment Income is credited when the invested reports a net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

62

Kirk Corporation owns 25 percent of the voting stock of Allen Corporation and accounts for the investment using the equity method.Allen reports a net loss of $40,000.Kirk Corporation's entry to record its share of loss is:

A)Cash 10,000 Investment in Allen Corporation 10,000

B)Loss on Investments 40,000 Investment in Allen Corporation 40,000

C)Loss,Allen Corporation Investment 10,000 Investment in Allen Corporation 10,000

D)Cash 10,000 Loss,Allen Corporation Investment 10,000

A)Cash 10,000 Investment in Allen Corporation 10,000

B)Loss on Investments 40,000 Investment in Allen Corporation 40,000

C)Loss,Allen Corporation Investment 10,000 Investment in Allen Corporation 10,000

D)Cash 10,000 Loss,Allen Corporation Investment 10,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

63

For available-for-sale equity securities,the Allowance to Adjust Long-Term Investments to Market account should be reported as a(n)

A)realized loss item on the income statement.

B)prior period adjustment.

C)contra-asset on the balance sheet.

D)other comprehensive income (loss)

A)realized loss item on the income statement.

B)prior period adjustment.

C)contra-asset on the balance sheet.

D)other comprehensive income (loss)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

64

When the equity method is used to account for a long-term investment in the stock of another company,the carrying value of the investment is affected by

A)declines in the market value of the stock.

B)the earnings and dividends of the investee.

C)an excess of market price over cost.

D)neither the earnings nor the dividends of the investee.

A)declines in the market value of the stock.

B)the earnings and dividends of the investee.

C)an excess of market price over cost.

D)neither the earnings nor the dividends of the investee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

65

Singletary Corporation owns a 40 percent interest in the stock of Fleming Corporation.During 2014,Fleming pays $50,000 in dividends to Singletary and reports $214,000 in net income.Singletary Corporation's investment in Fleming will increase Singletary's income before income taxes by

A)$35,600.

B)$65,600.

C)$85,600.

D)$105,600.

A)$35,600.

B)$65,600.

C)$85,600.

D)$105,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

66

The year-end adjusting entry to reflect an increase in the value of trading securities includes a

A)credit to Unrealized Gain on Short-Term Investments.

B)credit to Short-Term Investments.

C)credit to Allowance to Adjust Short-Term Investments to Market.

D)credit to Realized Gain on Investments.

A)credit to Unrealized Gain on Short-Term Investments.

B)credit to Short-Term Investments.

C)credit to Allowance to Adjust Short-Term Investments to Market.

D)credit to Realized Gain on Investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

67

All of the following are ways one corporation could affect the operating and financial policies of another corporation except

A)analysis of data regarding profitability.

B)material transactions between the companies.

C)representation on the board of directors.

D)exchange of managerial personnel.

A)analysis of data regarding profitability.

B)material transactions between the companies.

C)representation on the board of directors.

D)exchange of managerial personnel.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

68

Stock categorized as trading securities is purchased for $52,000.At year end,when the market value of the stock is $61,000,the adjusting entry that would be recorded is:

A)Allowance to Adjust Short-Term Investments to Market 9,000 Unrealized Gain on Short-Term Investments 9,000

B)Unrealized Loss on Short-Term Investments 9,000 Allowance to Adjust Short-Term Investments to Market 9,000

C)Allowance to Adjust Short-Term Investments to Market 9,000 Short-Term Investments 9,000

D)Realized Gain on Investments 9,000 Short-Term Investments 9,000

A)Allowance to Adjust Short-Term Investments to Market 9,000 Unrealized Gain on Short-Term Investments 9,000

B)Unrealized Loss on Short-Term Investments 9,000 Allowance to Adjust Short-Term Investments to Market 9,000

C)Allowance to Adjust Short-Term Investments to Market 9,000 Short-Term Investments 9,000

D)Realized Gain on Investments 9,000 Short-Term Investments 9,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

69

The cost-adjusted-to-market method of accounting for investments is used when the investment is

A)controlling.

B)influential and noncontrolling.

C)noninfluential and controlling.

D)noninfluential and noncontrolling.

A)controlling.

B)influential and noncontrolling.

C)noninfluential and controlling.

D)noninfluential and noncontrolling.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

70

A credit balance in the account Allowance to Adjust Long-Term Investments to Market is disclosed in the financial statements as a

A)regular account in the stockholders' equity section of the balance sheet.

B)contra account to Long-Term Investments.

C)note to the financial statements.

D)current asset.

A)regular account in the stockholders' equity section of the balance sheet.

B)contra account to Long-Term Investments.

C)note to the financial statements.

D)current asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

71

Tomlin Enterprises has a credit balance of $80,000 in its Allowance to Adjust Long-Term Investments to Market account before adjustment.Its investment portfolio has a total cost of $500,000 and a market value of $450,000.The year-end adjustment entry that would be recorded in the books of Tomlin Enterprises is:

A)Long-Term Investments 30,000 Allowance to Adjust Long-Term Investments to Market 30,000

B)Allowance to Adjust Long-Term Investments to Market 30,000 Unrealized Loss on Long-Term Investments 30,000

C)Allowance to Adjust Long-Term Investments to Market 50,000 Long-Term Investments 50,000

D)Unrealized Loss on Long-Term Investments 50,000 Long-Term Investments 50,000

A)Long-Term Investments 30,000 Allowance to Adjust Long-Term Investments to Market 30,000

B)Allowance to Adjust Long-Term Investments to Market 30,000 Unrealized Loss on Long-Term Investments 30,000

C)Allowance to Adjust Long-Term Investments to Market 50,000 Long-Term Investments 50,000

D)Unrealized Loss on Long-Term Investments 50,000 Long-Term Investments 50,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following statements is true about investments categorized as trading securities?

A)They are valued on the balance sheet at cost.

B)They can consist of debt,but not equity,securities.

C)They are purchased to be held to maturity.

D)Changes in market value are reflected in net income.

A)They are valued on the balance sheet at cost.

B)They can consist of debt,but not equity,securities.

C)They are purchased to be held to maturity.

D)Changes in market value are reflected in net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

73

When the cost-adjusted-to-market method is used to account for a long-term investment in the stock of another company,the carrying value of the investment is directly affected by

A)the dividend distributions of the investee.

B)the earnings and dividend distributions of the investee.

C)the earnings of the investee.

D)neither the earnings nor the dividends of the investee.

A)the dividend distributions of the investee.

B)the earnings and dividend distributions of the investee.

C)the earnings of the investee.

D)neither the earnings nor the dividends of the investee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

74

For available-for-sale equity securities,the Unrealized Loss on Long-Term Investments account should be reported as a(n)

A)realized loss item on the income statement.

B)prior period adjustment.

C)contra-asset on the balance sheet.

D)other comprehensive income (loss).

A)realized loss item on the income statement.

B)prior period adjustment.

C)contra-asset on the balance sheet.

D)other comprehensive income (loss).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

75

Stock categorized as trading securities is purchased for $52,000.At year end,when the market value of the stock is $61,000,the balance of the Short-Term Investments account appearing on the balance sheet will be

A)$9,000

B)$52,000

C)$61,000

D)none of these

A)$9,000

B)$52,000

C)$61,000

D)none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

76

Stock categorized as trading securities is purchased for $72,000.At year end,when the market value of the stock is $63,000,the adjusting entry that would be recorded is:

A)Allowance to Adjust Short-Term Investments to Market 9,000 Unrealized Loss on Investments 9,000

B)Unrealized Loss on Short-Term Investments 9,000 Allowance to Adjust Short-Term Investments to Market 9,000

C)Allowance to Adjust Short-Term Investments to Market 9,000 Short-Term Investments 9,000

D)Realized Loss on Investments 9,000 Short-Term Investments 9,000

A)Allowance to Adjust Short-Term Investments to Market 9,000 Unrealized Loss on Investments 9,000

B)Unrealized Loss on Short-Term Investments 9,000 Allowance to Adjust Short-Term Investments to Market 9,000

C)Allowance to Adjust Short-Term Investments to Market 9,000 Short-Term Investments 9,000

D)Realized Loss on Investments 9,000 Short-Term Investments 9,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

77

Trading securities are valued on the balance sheet at

A)lower of cost or market.

B)cost.

C)market value.

D)cost,adjusted for the effects of interest.

A)lower of cost or market.

B)cost.

C)market value.

D)cost,adjusted for the effects of interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

78

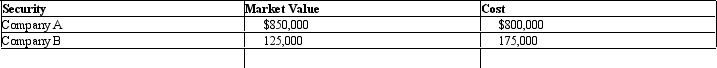

At year-end,a company's trading portfolio appears as follows:  The adjusting entry will include

The adjusting entry will include

A)a debit to Allowance to Adjust Short-Term Investments to Market of $50.

B)a credit to Allowance to Adjust Short-Term Investments to Market of $50.

C)a debit to Unrealized Loss on Short-Term Investments of $100.

D)none of these,since no adjusting entry is necessary.

The adjusting entry will include

The adjusting entry will includeA)a debit to Allowance to Adjust Short-Term Investments to Market of $50.

B)a credit to Allowance to Adjust Short-Term Investments to Market of $50.

C)a debit to Unrealized Loss on Short-Term Investments of $100.

D)none of these,since no adjusting entry is necessary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

79

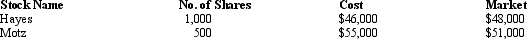

Barkely Corporation has invested in the stock of two other corporations,Hayes Corporation and Motz Corporation.Barkely does not own a controlling interest or exercise significant influence over either corporation.Barkely's accountant is preparing financial statements and has compiled the following information:  What should be the balance in the Allowance to Adjust Long-Term Investments to Market account,based on the above information?

What should be the balance in the Allowance to Adjust Long-Term Investments to Market account,based on the above information?

A)$2,000 credit

B)$4,000 debit

C)$4,000 credit

D)$2,000 debit

What should be the balance in the Allowance to Adjust Long-Term Investments to Market account,based on the above information?

What should be the balance in the Allowance to Adjust Long-Term Investments to Market account,based on the above information?A)$2,000 credit

B)$4,000 debit

C)$4,000 credit

D)$2,000 debit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

80

The equity method generally should be used to account for an investment in stock when the level of ownership is

A)between 20 and 50 percent.

B)10 percent or more.

C)less than 20 percent.

D)between 10 and 40 percent.

A)between 20 and 50 percent.

B)10 percent or more.

C)less than 20 percent.

D)between 10 and 40 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck