Deck 24: Standard Costing and Variance Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

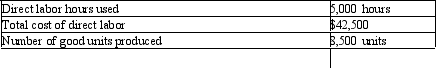

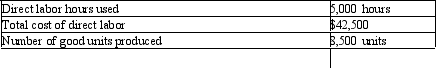

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/123

العب

ملء الشاشة (f)

Deck 24: Standard Costing and Variance Analysis

1

Variance analysis involves computing the difference between standard and actual costs.

True

2

The standard overhead cost is the sum of the estimates of variable and fixed overhead costs in the next accounting period.

True

3

A standard unit cost can be determined after developing standard costs for direct materials,direct labor,and variable and fixed overhead.

True

4

Comparing "what did happen" with "what should have happened" aids in the performance evaluation of a company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

5

The purchasing agent is responsible for developing the direct materials quantity standard.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

6

The standard fixed overhead rate is usually based on the expected number of standard labor hours.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

7

Standard costing is typically an inexpensive component to add to a company's existing cost accounting system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

8

Cost centers have well-defined links between the cost of the resources and the resulting products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

9

Standard costs are realistically predetermined costs of direct materials,direct labor,and overhead that usually are expressed as a cost per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

10

Standard costing can be used only with a process costing system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

11

A variance is the difference between standard costs and actual costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

12

The flexible budget formula is an equation that determines budgeted costs for any level of output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

13

If standard costing is not economically feasible for a company,predetermined overhead rates should not be used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

14

Corrective action is necessary even if a variance is insignificant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

15

Although expensive to install and maintain,a standard cost accounting system can save a company considerable amounts of money by reducing resource waste.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

16

Standard costs are based solely on actual costs incurred in past.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

17

Flexible budgets are also called static budgets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

18

When a manufacturing company employs standard costs,all costs affecting the three inventory accounts and the Cost of Goods Sold account are stated in terms of actual costs rather than in terms of standard costs incurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

19

Predetermined overhead costs are the same as actual costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

20

The final step in variance analysis is taking appropriate corrective action.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

21

The variable overhead efficiency variance is the difference between actual total overhead costs incurred and the total overhead costs applied using the standard overhead rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

22

A flexible budget is a summary of expected costs for a range of activity levels and is geared to changes in the level of productive output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

23

Direct labor time standards express the hourly labor cost per function or job classification that exists during the current accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

24

The direct labor rate variance is the difference between the standard hours allowed and the actual hours multiplied by the actual labor rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

25

Another name for a flexible budget is a variable budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

26

The direct materials price variance is the difference between the standard price and the actual price,multiplied by the actual quantity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

27

In a service company,standard unit cost related of a service will typically include direct materials,direct labor,and overhead standard costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

28

A standard costing system

A)is used by management for cost planning,but not for cost control purposes.

B)is a system in which all costs affecting the three inventory accounts and the Cost of Goods Sold account are stated in terms of actual costs incurred.

C)depends on actual costs rather than planned costs.

D)is employed with an existing job order costing or process costing system and is not a full cost accounting system in itself.

A)is used by management for cost planning,but not for cost control purposes.

B)is a system in which all costs affecting the three inventory accounts and the Cost of Goods Sold account are stated in terms of actual costs incurred.

C)depends on actual costs rather than planned costs.

D)is employed with an existing job order costing or process costing system and is not a full cost accounting system in itself.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

29

The total overhead cost variance is the difference between what actual overhead cost is and what it should have cost according to the flexible budget for the good units produced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

30

The direct materials price standard is a carefully derived estimate of what a particular type of direct material will cost when purchased during the next accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

31

If a company is operating at a capacity below its normal capacity in units,the fixed overhead volume variance will be favorable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

32

The static budget can be adjusted automatically for changes in the level of output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

33

The direct materials price standard for a period is determined by averaging that period's cost of direct material purchases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

34

The fixed overhead volume variance measures the use of existing facilities and capacity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

35

A performance report should contain cost or revenue items that the manager receiving the report can control.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

36

It is not necessary to provide an area on the performance report for a manager's reasons for variances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

37

The variable overhead spending variance is also called the variable overhead rate variance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

38

The direct labor efficiency variance is the difference between standard hours allowed and actual hours worked for good units produced,multiplied by the standard labor rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

39

The direct materials quantity variance is the difference between the actual quantity used and the standard quantity times the actual price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

40

The responsibility of a production manager is limited to direct materials used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

41

In standard costing,

A)the standards are developed only for overhead costs.

B)the standards are developed primarily from past costs.

C)comparisons with actual costs usually are not performed.

D)debit and credit entries to inventory accounts are made at standard costs.

A)the standards are developed only for overhead costs.

B)the standards are developed primarily from past costs.

C)comparisons with actual costs usually are not performed.

D)debit and credit entries to inventory accounts are made at standard costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

42

Standard costs are not used for

A)determining actual costs.

B)preparing budgets and forecasts.

C)evaluating the performance of workers and management.

D)developing appropriate selling prices.

A)determining actual costs.

B)preparing budgets and forecasts.

C)evaluating the performance of workers and management.

D)developing appropriate selling prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

43

In a fully integrated standard costing system,standard costs eventually flow into the

A)Cost of Goods Sold account.

B)Standard Cost account.

C)Selling and Administrative Expenses account.

D)Sales account.

A)Cost of Goods Sold account.

B)Standard Cost account.

C)Selling and Administrative Expenses account.

D)Sales account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

44

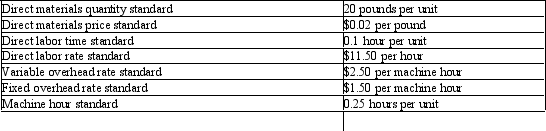

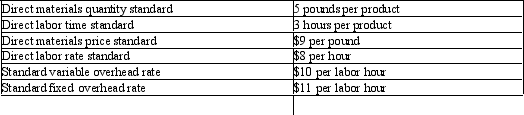

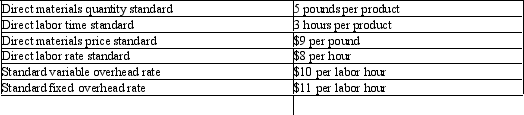

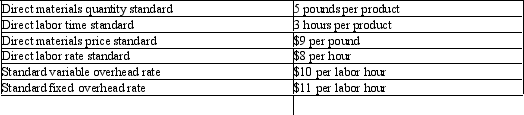

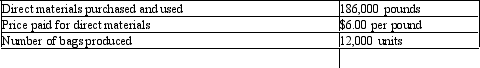

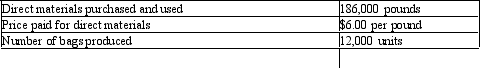

Gunnie Inc.produces and sells dog food.Each bag contains 20 pounds of dog food. Following additional information is provided by the company:

Compute the standard unit cost for each bag.

Compute the standard unit cost for each bag.

A)$2.55

B)$2.21

C)$2.15

D)$2.80

Compute the standard unit cost for each bag.

Compute the standard unit cost for each bag.A)$2.55

B)$2.21

C)$2.15

D)$2.80

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

45

An expression of the hourly labor pay cost per function or job classification that is expected to exist during the next accounting period is the definition of a

A)direct labor time standard.

B)direct materials quantity standard.

C)direct labor rate standard.

D)variable overhead rate.

A)direct labor time standard.

B)direct materials quantity standard.

C)direct labor rate standard.

D)variable overhead rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following is a drawback of using standard costing system?

A)It can be expensive and time-consuming to implement.

B)It distorts actual cost information.

C)It is often inaccurate.

D)It is applicable only to manufacturing businesses,not service businesses.

A)It can be expensive and time-consuming to implement.

B)It distorts actual cost information.

C)It is often inaccurate.

D)It is applicable only to manufacturing businesses,not service businesses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following provides an explanation of why the variable overhead rate is separated from the fixed overhead rate in standard costing?

A)There is no justifiable reason;their separation is merely to simplify entries.

B)Both calculations divide by the same direct labor hours,but the numerator is different for each calculation.

C)The variable overhead rate is calculated using actual direct labor hours,whereas the fixed overhead rate is calculated using normal capacity direct labor hours.

D)The behavior of costs,used for computing variable overhead rate and fixed overhead rate,differs.

A)There is no justifiable reason;their separation is merely to simplify entries.

B)Both calculations divide by the same direct labor hours,but the numerator is different for each calculation.

C)The variable overhead rate is calculated using actual direct labor hours,whereas the fixed overhead rate is calculated using normal capacity direct labor hours.

D)The behavior of costs,used for computing variable overhead rate and fixed overhead rate,differs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

48

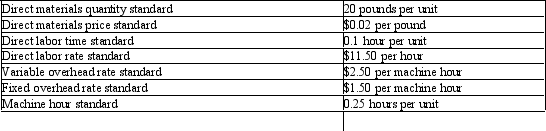

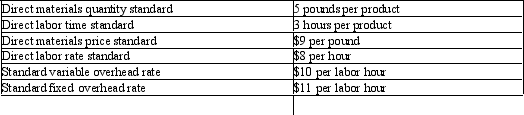

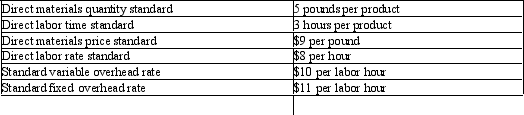

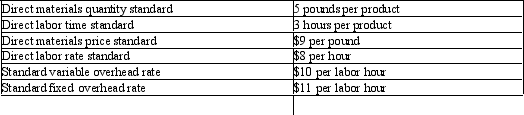

James Corporation's controller has developed the cost and usage data listed below in preparation of standard unit cost information for the coming year.  Using the above information provided for James Corporation,the standard overhead cost for each unit is

Using the above information provided for James Corporation,the standard overhead cost for each unit is

A)$45.

B)$33.

C)$30.

D)$63.

Using the above information provided for James Corporation,the standard overhead cost for each unit is

Using the above information provided for James Corporation,the standard overhead cost for each unit isA)$45.

B)$33.

C)$30.

D)$63.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

49

Blue Bull Inc.uses direct labor hours to allocate variable and fixed overhead costs.Under which of the following circumstances would the base used to calculate the variable overhead rate be the same as that used for the fixed overhead rate?

A)When actual labor hours are the same as budgeted labor hours

B)When standard indirect labor hours agree with standard direct labor hours

C)In all circumstances the base used for each calculation is the same

D)When the number of labor hours expected to be incurred for the period is the same as normal capacity direct labor hours

A)When actual labor hours are the same as budgeted labor hours

B)When standard indirect labor hours agree with standard direct labor hours

C)In all circumstances the base used for each calculation is the same

D)When the number of labor hours expected to be incurred for the period is the same as normal capacity direct labor hours

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

50

For which of the following can a standard cost accounting system be used?

A)Direct materials

B)Overhead

C)Direct labor

D)All of these

A)Direct materials

B)Overhead

C)Direct labor

D)All of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following yields the standard direct material cost?

A)Multiplying the standard price of direct materials by the standard quantity for direct materials

B)Adding the standard price of direct materials to the standard quantity for direct materials

C)Multiplying the actual price of direct materials by the actual quantity for direct materials

D)Adding the actual price of direct materials to the actual quantity for direct materials

A)Multiplying the standard price of direct materials by the standard quantity for direct materials

B)Adding the standard price of direct materials to the standard quantity for direct materials

C)Multiplying the actual price of direct materials by the actual quantity for direct materials

D)Adding the actual price of direct materials to the actual quantity for direct materials

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

52

A purpose of standard costing is to

A)control costs.

B)allocate costs more accurately.

C)replace subjective decision making.

D)compute the breakeven point.

A)control costs.

B)allocate costs more accurately.

C)replace subjective decision making.

D)compute the breakeven point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following is true of standard costing?

A)It uses estimates that are based only on past costs.

B)It is the same as normal costing.

C)It cannot be used to manage cost centers.

D)It can be used in any type of business.

A)It uses estimates that are based only on past costs.

B)It is the same as normal costing.

C)It cannot be used to manage cost centers.

D)It can be used in any type of business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

54

Standard costs for company products are typically used for all except

A)variance analysis and cost control.

B)computing production costs in operating budgets.

C)determining the actual cost of direct materials and direct labor used in production.

D)comparing the production costs for performance measurement purposes.

A)variance analysis and cost control.

B)computing production costs in operating budgets.

C)determining the actual cost of direct materials and direct labor used in production.

D)comparing the production costs for performance measurement purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

55

James Corporation's controller has developed the cost and usage data listed below in preparation of standard unit cost information for the coming year.  Using the above information provided for James Corporation,the standard unit cost for direct labor is

Using the above information provided for James Corporation,the standard unit cost for direct labor is

A)$24.

B)$45.

C)$20.

D)$63.

Using the above information provided for James Corporation,the standard unit cost for direct labor is

Using the above information provided for James Corporation,the standard unit cost for direct labor isA)$24.

B)$45.

C)$20.

D)$63.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

56

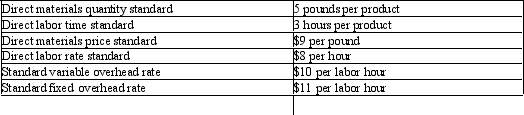

James Corporation's controller has developed the cost and usage data listed below in preparation of standard unit cost information for the coming year.  Using the above information provided for James Corporation,the total standard unit cost is

Using the above information provided for James Corporation,the total standard unit cost is

A)$99.

B)$132.

C)$102.

D)$46.

Using the above information provided for James Corporation,the total standard unit cost is

Using the above information provided for James Corporation,the total standard unit cost isA)$99.

B)$132.

C)$102.

D)$46.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

57

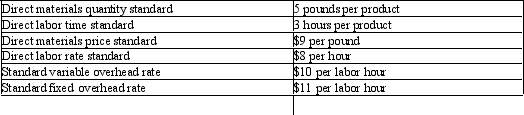

James Corporation's controller has developed the cost and usage data listed below in preparation of standard unit cost information for the coming year.  Using the above information provided for James Corporation,the standard unit cost for direct materials is

Using the above information provided for James Corporation,the standard unit cost for direct materials is

A)$45.

B)$10.

C)$24.

D)$33.

Using the above information provided for James Corporation,the standard unit cost for direct materials is

Using the above information provided for James Corporation,the standard unit cost for direct materials isA)$45.

B)$10.

C)$24.

D)$33.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

58

Service organizations do not develop standard rates for which of the following?

A)Any service costs

B)Overhead

C)Direct materials

D)Labor

A)Any service costs

B)Overhead

C)Direct materials

D)Labor

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following costs generally do not include standard unit costs?

A)Direct materials costs

B)Indirect materials costs

C)Board of directors' salary

D)Depreciation on factory machine

A)Direct materials costs

B)Indirect materials costs

C)Board of directors' salary

D)Depreciation on factory machine

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

60

The use of realistic predetermined unit costs to facilitate product costing,cost control,cost flow,and inventory valuation is a description of the

A)flexible budget concept.

B)budgetary control concept.

C)capacity level concept.

D)standard cost accounting concept.

A)flexible budget concept.

B)budgetary control concept.

C)capacity level concept.

D)standard cost accounting concept.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

61

A summary of expected costs for a range of activity levels that is geared to changes in the level of productive output is the definition of a

A)continuous budget.

B)flexible budget.

C)master budget.

D)period budget.

A)continuous budget.

B)flexible budget.

C)master budget.

D)period budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

62

The direct materials standards for the main product of Duchess Company are 8 grams of direct materials per product at a cost of $3 per gram.During April,969 grams of direct materials were used to produce 120 products at a direct materials cost of $2,900.The direct materials quantity variance for April was

A)$57 (U).

B)$77 (U).

C)$27 (U).

D)$97 (F).

A)$57 (U).

B)$77 (U).

C)$27 (U).

D)$97 (F).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

63

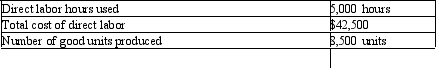

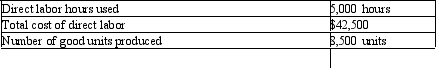

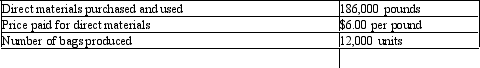

Choco Sweet Inc.gives you the following information: The standard labor time of 0.75 labor hour is required to produce one unit.The standard labor cost for a 10 pound bag of chocolate is $8 per labor hour.The following is data relating to the actual cost and usage data.

Using the above information provided for Choco Sweet,compute the direct labor rate variance for Choco Sweet Inc.

Using the above information provided for Choco Sweet,compute the direct labor rate variance for Choco Sweet Inc.

A)$8,500 (F)

B)$11,688 (U)

C)$6,000 (F)

D)$2,500 (U)

Using the above information provided for Choco Sweet,compute the direct labor rate variance for Choco Sweet Inc.

Using the above information provided for Choco Sweet,compute the direct labor rate variance for Choco Sweet Inc.A)$8,500 (F)

B)$11,688 (U)

C)$6,000 (F)

D)$2,500 (U)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

64

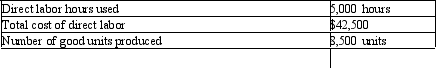

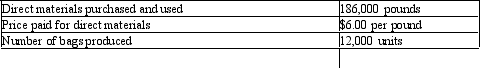

Candy Stores Inc.gives you the following information: The standard material cost is $7 per pound for a 15 pound bag of chocolate.The following is the actual cost and usage data:

Using the above information provided for Candy Stores,compute the direct materials price variance for Candy Stores.

Using the above information provided for Candy Stores,compute the direct materials price variance for Candy Stores.

A)$186,000 (F)

B)$186,000 (U)

C)$42,000 (F)

D)$42,000 (F)

Using the above information provided for Candy Stores,compute the direct materials price variance for Candy Stores.

Using the above information provided for Candy Stores,compute the direct materials price variance for Candy Stores.A)$186,000 (F)

B)$186,000 (U)

C)$42,000 (F)

D)$42,000 (F)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

65

Harrison Inc.has computed direct labor standards for the manufacture of its product to be 4 hours of labor per product at a cost of $15 per hour.During March,Harrison produced 45 products in 190 hours and incurred direct labor costs of $2,720.Harrison's direct labor efficiency variance was

A)$150 (F).

B)$130 (U).

C)$150 (U).

D)$130 (F).

A)$150 (F).

B)$130 (U).

C)$150 (U).

D)$130 (F).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

66

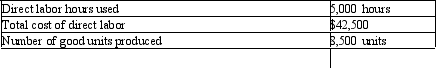

Choco Sweet Inc.gives you the following information: The standard labor time of 0.75 labor hour is required to produce one unit.The standard labor cost for a 10 pound bag of chocolate is $8 per labor hour.The following is data relating to the actual cost and usage data.

Using the above information provided for Choco Sweet,compute the direct labor efficiency variance for Choco Sweet.

Using the above information provided for Choco Sweet,compute the direct labor efficiency variance for Choco Sweet.

A)$8,500 (U)

B)$2,500 (F)

C)$11,000 (F)

D)$1,375 (U)

Using the above information provided for Choco Sweet,compute the direct labor efficiency variance for Choco Sweet.

Using the above information provided for Choco Sweet,compute the direct labor efficiency variance for Choco Sweet.A)$8,500 (U)

B)$2,500 (F)

C)$11,000 (F)

D)$1,375 (U)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

67

The direct materials price variance is best measured and reported to appropriate management personnel at the time

A)purchased quantities exceed standard order size.

B)quarterly financial statements are prepared.

C)shipments are received and recorded as purchases.

D)direct materials are issued to production areas.

A)purchased quantities exceed standard order size.

B)quarterly financial statements are prepared.

C)shipments are received and recorded as purchases.

D)direct materials are issued to production areas.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

68

The formula used to compute budgeted total cost at any level of activity is presented in the

A)flexible budget.

B)performance report.

C)static budget.

D)cash flow forecast.

A)flexible budget.

B)performance report.

C)static budget.

D)cash flow forecast.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

69

A flexible budget is most useful

A)when company has only fixed costs.

B)when actual output equals budgeted output.

C)as a cost control tool to help evaluate performance.

D)when a product's cost structure includes variable costs only.

A)when company has only fixed costs.

B)when actual output equals budgeted output.

C)as a cost control tool to help evaluate performance.

D)when a product's cost structure includes variable costs only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

70

Lucas Company has set standards for the manufacturing of clay pots to be 2 pounds of direct materials,per pot,at a cost of $3 per pound.During the current period,600 pounds of direct materials were purchased for $1,872.All of the direct materials were used to manufacture 295 pots.Lucas' direct materials price variance was

A)$102 (U).

B)$72 (U).

C)$102 (F).

D)$70 (U).

A)$102 (U).

B)$72 (U).

C)$102 (F).

D)$70 (U).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

71

If a company's flexible budget formula is $11.25 per unit plus $72,100,what would be the total budget for evaluating operating performance if 28,650 units were sold and 38,500 units were produced?

A)$433,125

B)$505,225

C)$811,125

D)$72,100

A)$433,125

B)$505,225

C)$811,125

D)$72,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

72

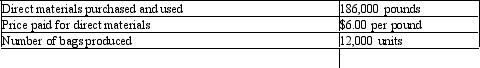

Candy Stores Inc.gives you the following information: The standard material cost is $7 per pound for a 15 pound bag of chocolate.The following is the actual cost and usage data:

Using the above information provided for Candy Stores,compute the direct materials variance for Candy Stores.

Using the above information provided for Candy Stores,compute the direct materials variance for Candy Stores.

A)$186,000 (U)

B)$144,000 (F)

C)$186,000 (F)

D)$42,000 (U)

Using the above information provided for Candy Stores,compute the direct materials variance for Candy Stores.

Using the above information provided for Candy Stores,compute the direct materials variance for Candy Stores.A)$186,000 (U)

B)$144,000 (F)

C)$186,000 (F)

D)$42,000 (U)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

73

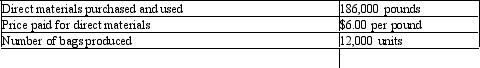

Candy Stores Inc.gives you the following information: The standard material cost is $7 per pound for a 15 pound bag of chocolate.The following is the actual cost and usage data:

Using the above information provided for Candy Stores,compute the direct materials quantity variance for Candy Stores.

Using the above information provided for Candy Stores,compute the direct materials quantity variance for Candy Stores.

A)$42,000 (F)

B)$42,000 (U)

C)$186,000 (F)

D)$186,000 (F)

Using the above information provided for Candy Stores,compute the direct materials quantity variance for Candy Stores.

Using the above information provided for Candy Stores,compute the direct materials quantity variance for Candy Stores.A)$42,000 (F)

B)$42,000 (U)

C)$186,000 (F)

D)$186,000 (F)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

74

Variance analysis includes all of the following except

A)taking corrective action.

B)investigating all significant and insignificant variances.

C)developing performance measures to track activities causing the variance.

D)computing variances.

A)taking corrective action.

B)investigating all significant and insignificant variances.

C)developing performance measures to track activities causing the variance.

D)computing variances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

75

The Lennon Company uses a standard costing system and a flexible budget.At a normal level of activity of 15,000 units and 45,000 standard direct labor hours,the standard direct labor cost would be $270,000.During June,44,950 hours were worked to produce 14,000 units at an actual direct labor cost of $352,000.The direct labor efficiency variance in June was

A)$25,700 (U).

B)$17,700 (U).

C)$17,700 (F).

D)$25,700 (U).

A)$25,700 (U).

B)$17,700 (U).

C)$17,700 (F).

D)$25,700 (U).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

76

Which of the following measures the difference between the quantity of materials actually used to make the product and what the design standard called for?

A)Direct labor efficiency variance.

B)Direct materials price variance.

C)Direct labor rate variance.

D)Direct materials usage variance.

A)Direct labor efficiency variance.

B)Direct materials price variance.

C)Direct labor rate variance.

D)Direct materials usage variance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

77

The primary difference between a fixed (static)budget and a flexible budget is that a fixed budget

A)cannot be changed after the period begins,whereas a flexible budget can be changed after the period begins.

B)is concerned only with future acquisitions of fixed assets,whereas a flexible budget is concerned with expenses that vary with sales.

C)is a plan for a single level of production,whereas a flexible budget is several plans (one for each of several production levels).

D)includes only fixed costs,whereas a flexible budget includes only variable costs.

A)cannot be changed after the period begins,whereas a flexible budget can be changed after the period begins.

B)is concerned only with future acquisitions of fixed assets,whereas a flexible budget is concerned with expenses that vary with sales.

C)is a plan for a single level of production,whereas a flexible budget is several plans (one for each of several production levels).

D)includes only fixed costs,whereas a flexible budget includes only variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

78

If the actual amount of direct materials used equals the standard amount of direct materials that should have been used,the difference between the standard cost and actual cost of direct materials is called the

A)price variance.

B)rate variance.

C)quantity variance.

D)efficiency variance.

A)price variance.

B)rate variance.

C)quantity variance.

D)efficiency variance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

79

Suppose the standard for a given cost during a period was $80,000.The actual cost for the period was $72,000.Under what circumstances would you consider the variance from budget to be a positive performance indication?

A)The cost is fixed,and actual production was 90 percent of the standard level of budgeted production.

B)The cost is variable,and the standard cost noted above is the cost at a production level lower than the actual production level.

C)The cost is variable,and actual production was 90 percent of the standard level of production.

D)The cost is variable,and actual production was 75 percent of the standard level of production.

A)The cost is fixed,and actual production was 90 percent of the standard level of budgeted production.

B)The cost is variable,and the standard cost noted above is the cost at a production level lower than the actual production level.

C)The cost is variable,and actual production was 90 percent of the standard level of production.

D)The cost is variable,and actual production was 75 percent of the standard level of production.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

80

Choco Sweet Inc.gives you the following information: The standard labor time of 0.75 labor hour is required to produce one unit.The standard labor cost for a 10 pound bag of chocolate is $8 per labor hour.The following is data relating to the actual cost and usage data.

Using the above information provided for Choco Sweet,compute the direct labor variance for Choco Sweet Inc.

Using the above information provided for Choco Sweet,compute the direct labor variance for Choco Sweet Inc.

A)$11,688 (U)

B)$8,500 (F)

C)$2,500 (F)

D)$11,688 (F)

Using the above information provided for Choco Sweet,compute the direct labor variance for Choco Sweet Inc.

Using the above information provided for Choco Sweet,compute the direct labor variance for Choco Sweet Inc.A)$11,688 (U)

B)$8,500 (F)

C)$2,500 (F)

D)$11,688 (F)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck