Deck 6: Process Costing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

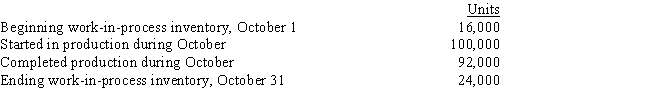

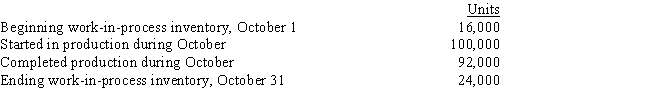

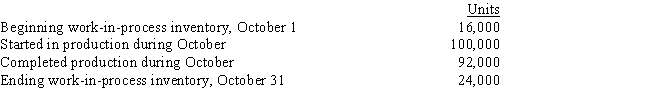

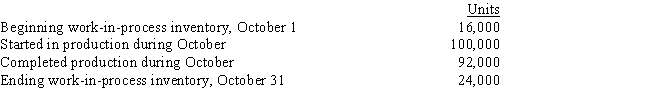

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/157

العب

ملء الشاشة (f)

Deck 6: Process Costing

1

Which statement is a characteristic of process accounting?

A)It is used on unique products that are produced on a continuous basis.

B)It accumulates costs by individual job.

C)It works best with a small number of unique products.

D)It utilizes equivalent units computed by the weighted average method or the FIFO method.

A)It is used on unique products that are produced on a continuous basis.

B)It accumulates costs by individual job.

C)It works best with a small number of unique products.

D)It utilizes equivalent units computed by the weighted average method or the FIFO method.

D

2

Which costing system is most likely to be used by manufacturer that produces unique products?

A)job-order costing

B)process costing

C)sequential costing

D)parallel costing

A)job-order costing

B)process costing

C)sequential costing

D)parallel costing

A

3

Which account do the costs of completed products move to after work-in-process?

A)sales

B)finished goods

C)completed goods

D)cost of goods sold

A)sales

B)finished goods

C)completed goods

D)cost of goods sold

B

4

For which of the following businesses is process costing is most appropriate?

A)a vitamin manufacturer

B)a headhunting firm

C)a custom bike builder

D)a print shop

A)a vitamin manufacturer

B)a headhunting firm

C)a custom bike builder

D)a print shop

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which type of costing system works best with a large number of homogeneous products?

A)job-order costing

B)process costing

C)sequential costing

D)parallel costing

A)job-order costing

B)process costing

C)sequential costing

D)parallel costing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following best describes sequential processing?

A)A large number of similar products pass through an identical set of processes.

B)Units typically pass through a series of manufacturing or producing departments at the same time.

C)Partially completed units can be worked on simultaneously in different processes and then brought together in a final process for completion.

D)Units must pass through one process before they can be worked on in later processes.

A)A large number of similar products pass through an identical set of processes.

B)Units typically pass through a series of manufacturing or producing departments at the same time.

C)Partially completed units can be worked on simultaneously in different processes and then brought together in a final process for completion.

D)Units must pass through one process before they can be worked on in later processes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following is the cost of partially completed goods from a prior period?

A)a work-in-process transfer cost

B)beginning work-in-process cost

C)a transferred-in cost

D)an added-in cost

A)a work-in-process transfer cost

B)beginning work-in-process cost

C)a transferred-in cost

D)an added-in cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following is a cost transferred from a prior process to a subsequent process?

A)a work-in-process transfer cost

B)the beginning work-in-process cost

C)a transferred-in cost

D)an added-in cost

A)a work-in-process transfer cost

B)the beginning work-in-process cost

C)a transferred-in cost

D)an added-in cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

9

What type of business would likely use process costing?

A)a paper cup manufacturer

B)a cruise ship manufacturer

C)a modular home builder

D)a custom snowboard company

A)a paper cup manufacturer

B)a cruise ship manufacturer

C)a modular home builder

D)a custom snowboard company

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following companies would be least likely to use a process-costing system?

A)a disposable diaper manufacturer

B)a print shop

C)a chemical producer

D)a paint manufacturer

A)a disposable diaper manufacturer

B)a print shop

C)a chemical producer

D)a paint manufacturer

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

11

Suppose that finished units are now in the last (final)department.To which account will the cost of the finished units flow from the work-in-process account?

A)sales

B)finished goods

C)inventory

D)cost of goods sold

A)sales

B)finished goods

C)inventory

D)cost of goods sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

12

When should process costing techniques be used in assigning costs to products?

A)any time production is only partially completed during the accounting period

B)when the product is composed of mass-produced homogeneous products

C)when the product is manufactured according to customer specifications

D)when the product is unique and made to order

A)any time production is only partially completed during the accounting period

B)when the product is composed of mass-produced homogeneous products

C)when the product is manufactured according to customer specifications

D)when the product is unique and made to order

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following businesses is most likely to use process costing?

A)a paint manufacturer

B)a law firm

C)an orthodontist

D)a custom home builder

A)a paint manufacturer

B)a law firm

C)an orthodontist

D)a custom home builder

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following best describes parallel processing?

A)A large number of similar products pass through an identical set of processes.

B)Units typically pass through a series of manufacturing or producing departments.

C)Partially completed units can be worked on simultaneously in different processes and then brought together in a final process for completion.

D)Units must pass through one process before they can be worked on in later processes.

A)A large number of similar products pass through an identical set of processes.

B)Units typically pass through a series of manufacturing or producing departments.

C)Partially completed units can be worked on simultaneously in different processes and then brought together in a final process for completion.

D)Units must pass through one process before they can be worked on in later processes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which goods are moved from a prior department to subsequent department?

A)transferred-in goods

B)finished goods

C)work in process

D)beginning goods

A)transferred-in goods

B)finished goods

C)work in process

D)beginning goods

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

16

What types of inputs are normally found in a process-costing accounting system?

A)selling costs

B)marketing costs

C)administrative costs

D)overhead costs

A)selling costs

B)marketing costs

C)administrative costs

D)overhead costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following businesses is most likely to use process costing?

A)a dentist

B)an accounting firm

C)a tire manufacturer

D)a custom machine manufacturer

A)a dentist

B)an accounting firm

C)a tire manufacturer

D)a custom machine manufacturer

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

18

What type of service firm would not likely use process costing?

A)sorting of mail

B)filling printing orders

C)processing cheques

D)laundering of shirts

A)sorting of mail

B)filling printing orders

C)processing cheques

D)laundering of shirts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following best describes sequential processing?

A)Units must pass through one process before they can be worked on in later processes.

B)Several sequences of production are applied to a product in the department.

C)Only one process can be applied to a product in each department.

D)Subcomponents can be worked on simultaneously in different processes and then brought together in a final process for completion.

A)Units must pass through one process before they can be worked on in later processes.

B)Several sequences of production are applied to a product in the department.

C)Only one process can be applied to a product in each department.

D)Subcomponents can be worked on simultaneously in different processes and then brought together in a final process for completion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following best describes parallel processing?

A)Units must pass sequentially through a process.

B)Units must pass through one process before they can be worked on in later processes.

C)Units that are not processed in the correct sequence are discarded.

D)Subcomponents can be worked on simultaneously in different processes and then brought together in a final process for completion.

A)Units must pass sequentially through a process.

B)Units must pass through one process before they can be worked on in later processes.

C)Units that are not processed in the correct sequence are discarded.

D)Subcomponents can be worked on simultaneously in different processes and then brought together in a final process for completion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

21

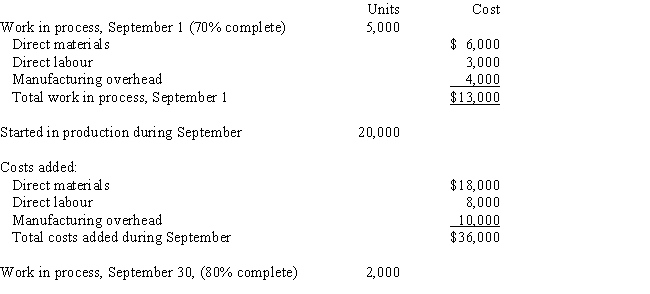

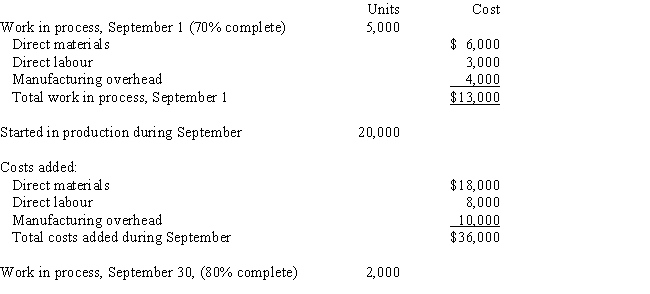

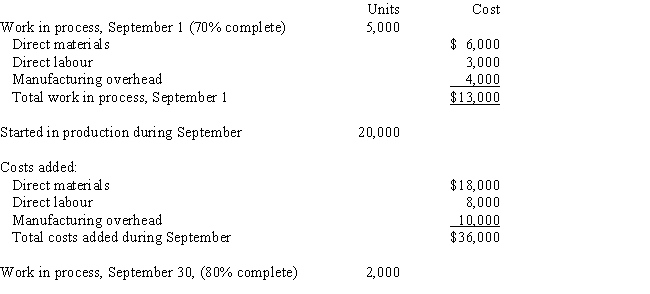

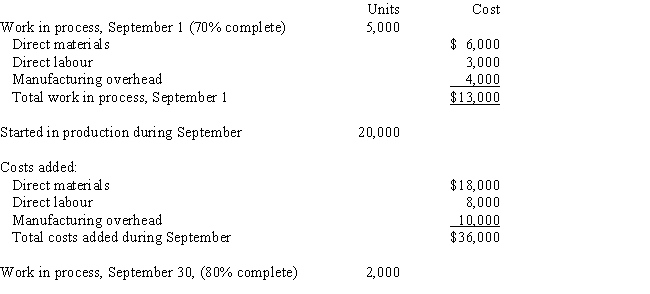

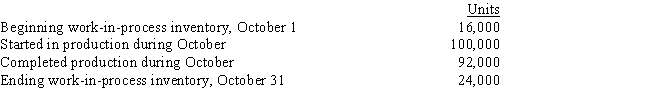

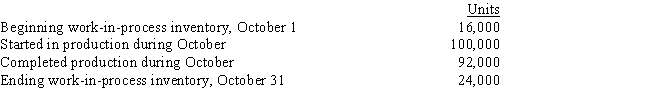

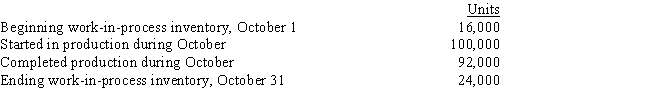

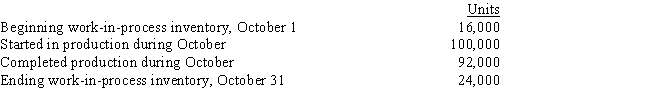

The following information is provided: Materials are added at the beginning of the process.

What would be the equivalent units of production for conversion costs when using the weighted average method?

A)27,600

B)34,800

C)35,600

D)37,600

What would be the equivalent units of production for conversion costs when using the weighted average method?

A)27,600

B)34,800

C)35,600

D)37,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

22

In process costing,which account will the cost of finished goods be transferred to when the goods are sold?

A)cost of goods sold

B)completed processes

C)finished goods

D)sales

A)cost of goods sold

B)completed processes

C)finished goods

D)sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

23

The following information is provided: Materials and conversion are incurred uniformly throughout the process.

What would be the equivalent units of production for conversion when using the weighted average method?

A)17,400

B)18,600

C)21,000

D)22,000

What would be the equivalent units of production for conversion when using the weighted average method?

A)17,400

B)18,600

C)21,000

D)22,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

24

Beginning inventory for the month contained 4,000 units that were 65% complete with respect to materials.During the month,60,000 units were completed and transferred out.Ending inventory contained 6,000 units that were 40% complete with respect to materials.What would be the weighted average equivalent units of production for materials for the month?

A)56,000

B)57,600

C)60,000

D)62,400

A)56,000

B)57,600

C)60,000

D)62,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

25

Beginning inventory for the month contained 12,000 units that were 60% complete with respect to materials.During the month,80,000 units were completed and transferred out.Ending inventory contained 6,000 units,30% complete with respect to materials.What would be the weighted average equivalent units of production for materials for the month?

A)92,000

B)81,800

C)80,000

D)12,000

A)92,000

B)81,800

C)80,000

D)12,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

26

The Glove Company uses the weighted average method.The beginning work in process consists of 25,000 units (100% completed as to materials and 50% complete as to conversion costs).The number of units completed was 100,000.The ending work in process consists of 15,000 units (100% complete as to materials and 25% complete as to conversion costs).What would be the equivalent units of production for conversion costs?

A)40,000

B)103,750

C)112,500

D)116,250

A)40,000

B)103,750

C)112,500

D)116,250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

27

Beginning inventory for the month contained 3,000 units that were 60% complete with respect to materials.During the month,50,000 units were completed and transferred out.Ending inventory contained 5,000 units that were 30% complete with respect to materials.What would be the weighted average equivalent units of production for materials for the month?

A)49,500

B)50,000

C)50,300

D)51,500

A)49,500

B)50,000

C)50,300

D)51,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following methods combines partially completed units in beginning inventory with current period production when computing equivalent units of production?

A)FIFO method

B)LIFO method

C)weighted average method

D)actual cost method

A)FIFO method

B)LIFO method

C)weighted average method

D)actual cost method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which is the best description of the cost of production report?

A)The production report provides information about the manufacturing costs incurred by the department.

B)The production report provides information about the physical units processed by the department.

C)The production report summarizes the manufacturing activity that takes place in a process department for a given period of time.

D)The production report includes the costs related to a specific job.

A)The production report provides information about the manufacturing costs incurred by the department.

B)The production report provides information about the physical units processed by the department.

C)The production report summarizes the manufacturing activity that takes place in a process department for a given period of time.

D)The production report includes the costs related to a specific job.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which statement best defines the concept of equivalent units of production?

A)Equivalent units are the measure of a period's output.

B)Equivalent units are the units completed in a department.

C)Equivalent units are the total of the units produced by all departments.

D)Equivalent units are the number of units completed at the end of the last process.

A)Equivalent units are the measure of a period's output.

B)Equivalent units are the units completed in a department.

C)Equivalent units are the total of the units produced by all departments.

D)Equivalent units are the number of units completed at the end of the last process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

31

For which process costing method is simplicity the main advantage?

A)LIFO

B)FIFO

C)weighted average

D)exact cost method

A)LIFO

B)FIFO

C)weighted average

D)exact cost method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

32

Habitat Company uses the weighted average method in its costing system.In the assembly department,the equivalent units for conversion costs amounted to 35,000 for the month of May.In beginning work in process,5,000 units were 50% complete.During the month,33,000 units were started and 31,400 were completed and transferred.How many units were in the ending work in process?

A)3,600 units

B)5,000 units

C)6,600 units

D)7,000 units

A)3,600 units

B)5,000 units

C)6,600 units

D)7,000 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following methods can be used to account for the costs and work of beginning work in process?

A)weighted average method and LIFO

B)FIFO method and sequential processing method

C)sequential processing method and LIFO

D)weighted average method and FIFO method

A)weighted average method and LIFO

B)FIFO method and sequential processing method

C)sequential processing method and LIFO

D)weighted average method and FIFO method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following is included in the cost of a department's transferred-in goods?

A)its materials, labour, and overhead

B)the goods transferred out as computed in the prior department

C)its materials and conversion costs

D)its materials and overhead

A)its materials, labour, and overhead

B)the goods transferred out as computed in the prior department

C)its materials and conversion costs

D)its materials and overhead

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

35

What is the major advantage of the weighted average cost method?

A)It is simple.

B)It is accurate.

C)It is the required method.

D)It is the preferred method.

A)It is simple.

B)It is accurate.

C)It is the required method.

D)It is the preferred method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

36

The following information concerns Transformation Inc.'s equivalent units in June: What are Transformation's equivalent units for May when using the weighted average method?

A)10,000

B)12,030

C)12,900

D)22,900

A)10,000

B)12,030

C)12,900

D)22,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following methods considers the percentage of completion of ending work in process?

A)FIFO and LIFO

B)LIFO and CVP

C)weighted average and CVP

D)weighted average and FIFO

A)FIFO and LIFO

B)LIFO and CVP

C)weighted average and CVP

D)weighted average and FIFO

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

38

Suppose a one-to-one relationship exists between the output measures.What would the units started in a subsequent department be equal to?

A)the equivalent units plus the materials added

B)the equivalent units of that department

C)the materials added plus conversion costs

D)the units transferred out from the prior department

A)the equivalent units plus the materials added

B)the equivalent units of that department

C)the materials added plus conversion costs

D)the units transferred out from the prior department

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following is used to record raw materials,direct labour,and applied overhead costs at the time they are used?

A)raw materials inventory

B)finished goods

C)work in process

D)cost of goods sold

A)raw materials inventory

B)finished goods

C)work in process

D)cost of goods sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

40

What does equivalent production use to express all activity of the period?

A)work in process

B)materials labour and overhead

C)fully completed units

D)partially completed units

A)work in process

B)materials labour and overhead

C)fully completed units

D)partially completed units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

41

LuLu, Inc. manufactures a product that passes through two processes: mixing and moulding. All manufacturing costs are added uniformly in the mixing department.

Information for the mixing department for May follows:

During May, 25,000 units were completed and transferred to the moulding department. The following costs were incurred by the mixing department during May:

Work in process, May 1:

By May 31, 2,500 units that were 80% complete remained in the mixing department. LuLu uses the weighted average method.

-Refer to the Figure.What would be LuLu's total cost per equivalent unit of production?

A)$6.52

B)$9.76

C)$11.26

D)$12.16

Information for the mixing department for May follows:

During May, 25,000 units were completed and transferred to the moulding department. The following costs were incurred by the mixing department during May:

Work in process, May 1:

By May 31, 2,500 units that were 80% complete remained in the mixing department. LuLu uses the weighted average method.

-Refer to the Figure.What would be LuLu's total cost per equivalent unit of production?

A)$6.52

B)$9.76

C)$11.26

D)$12.16

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

42

LuLu, Inc. manufactures a product that passes through two processes: mixing and moulding. All manufacturing costs are added uniformly in the mixing department.

Information for the mixing department for May follows:

During May, 25,000 units were completed and transferred to the moulding department. The following costs were incurred by the mixing department during May:

Work in process, May 1:

By May 31, 2,500 units that were 80% complete remained in the mixing department. LuLu uses the weighted average method.

-Refer to the Figure.What would be LuLu's cost of goods transferred to the moulding department during May?

A)$210,000

B)$261,050

C)$281,500

D)$294,000

Information for the mixing department for May follows:

During May, 25,000 units were completed and transferred to the moulding department. The following costs were incurred by the mixing department during May:

Work in process, May 1:

By May 31, 2,500 units that were 80% complete remained in the mixing department. LuLu uses the weighted average method.

-Refer to the Figure.What would be LuLu's cost of goods transferred to the moulding department during May?

A)$210,000

B)$261,050

C)$281,500

D)$294,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

43

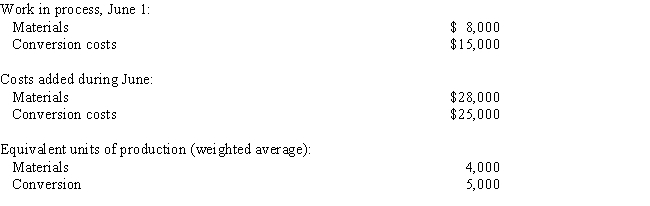

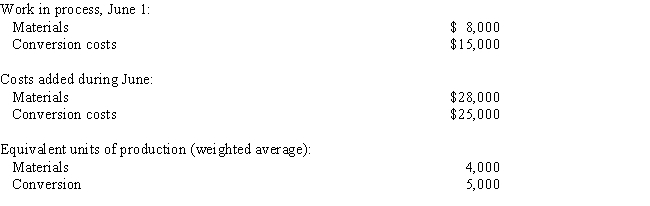

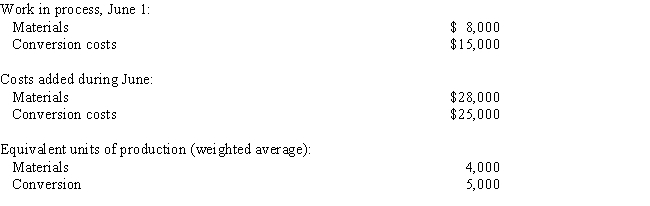

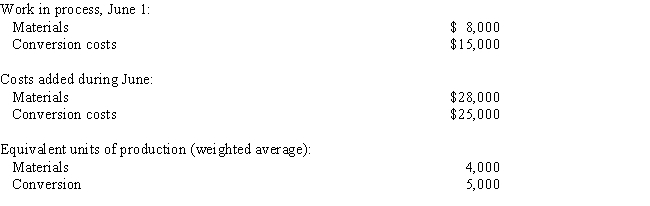

The following information is available for Painting Department for June:

Refer to the Figure.What would be Painting Department's cost per equivalent unit for conversion when using the weighted average method?

A)$3.00

B)$5.00

C)$8.00

D)$9.00

Refer to the Figure.What would be Painting Department's cost per equivalent unit for conversion when using the weighted average method?

A)$3.00

B)$5.00

C)$8.00

D)$9.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

44

Door Specialists make a product that passes through two processes. During March, the first department transferred 50,000 units to the second department. The cost of the units transferred was $75,000. Materials are added uniformly in the second process. The following information was provided about the second department's operations during March:

-Refer to the Figure.How many units were started in Door Specialists second department during March?

A)37,000

B)40,000

C)50,000

D)63,000

-Refer to the Figure.How many units were started in Door Specialists second department during March?

A)37,000

B)40,000

C)50,000

D)63,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

45

Door Specialists make a product that passes through two processes. During March, the first department transferred 50,000 units to the second department. The cost of the units transferred was $75,000. Materials are added uniformly in the second process. The following information was provided about the second department's operations during March:

-Refer to the Figure.How many units were started and completed in Door Specialists second department during March?

A)37,000

B)50,000

C)60,000

D)61,000

-Refer to the Figure.How many units were started and completed in Door Specialists second department during March?

A)37,000

B)50,000

C)60,000

D)61,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

46

Door Specialists make a product that passes through two processes. During March, the first department transferred 50,000 units to the second department. The cost of the units transferred was $75,000. Materials are added uniformly in the second process. The following information was provided about the second department's operations during March:

-Refer to the Figure.How many units were completed in Door Specialists second department during March?

A)40,000

B)47,000

C)63,000

D)73,000

-Refer to the Figure.How many units were completed in Door Specialists second department during March?

A)40,000

B)47,000

C)63,000

D)73,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

47

The following amounts were selected from the production report of Doggie Donuts Corporation: Doggie Donuts uses the weighted average method in preparing its production reports.What must Doggie Donuts' total production cost to be accounted for have been?

A)$49,500

B)$82,500

C)$132,000

D)$150,000

A)$49,500

B)$82,500

C)$132,000

D)$150,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

48

What is total cost divided by units produced?

A)process costs

B)unit driver

C)unit cost

D)total costs incurred

A)process costs

B)unit driver

C)unit cost

D)total costs incurred

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

49

LuLu, Inc. manufactures a product that passes through two processes: mixing and moulding. All manufacturing costs are added uniformly in the mixing department.

Information for the mixing department for May follows:

During May, 25,000 units were completed and transferred to the moulding department. The following costs were incurred by the mixing department during May:

Work in process, May 1:

By May 31, 2,500 units that were 80% complete remained in the mixing department. LuLu uses the weighted average method.

-Refer to the Figure.What would be LuLu's total costs to account for?

A)$176,000

B)$240,000

C)$264,000

D)$304,000

Information for the mixing department for May follows:

During May, 25,000 units were completed and transferred to the moulding department. The following costs were incurred by the mixing department during May:

Work in process, May 1:

By May 31, 2,500 units that were 80% complete remained in the mixing department. LuLu uses the weighted average method.

-Refer to the Figure.What would be LuLu's total costs to account for?

A)$176,000

B)$240,000

C)$264,000

D)$304,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which two methods determine the equivalent units of production in process costing?

A)weighted average and FIFO

B)FIFO and LIFO

C)actual costing and LIFO

D)weighted average and actual costing

A)weighted average and FIFO

B)FIFO and LIFO

C)actual costing and LIFO

D)weighted average and actual costing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

51

The following information is available for Painting Department for June:

Refer to the Figure.What would be Painting Department's cost per equivalent unit for materials when using the weighted average method?

A)$2.00

B)$7.00

C)$8.00

D)$9.00

Refer to the Figure.What would be Painting Department's cost per equivalent unit for materials when using the weighted average method?

A)$2.00

B)$7.00

C)$8.00

D)$9.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

52

LuLu, Inc. manufactures a product that passes through two processes: mixing and moulding. All manufacturing costs are added uniformly in the mixing department.

Information for the mixing department for May follows:

During May, 25,000 units were completed and transferred to the moulding department. The following costs were incurred by the mixing department during May:

Work in process, May 1:

By May 31, 2,500 units that were 80% complete remained in the mixing department. LuLu uses the weighted average method.

-Refer to the Figure.What would be LuLu's cost of May's ending work in process for the mixing department?

A)$17,500

B)$19,200

C)$21,400

D)$22,520

Information for the mixing department for May follows:

During May, 25,000 units were completed and transferred to the moulding department. The following costs were incurred by the mixing department during May:

Work in process, May 1:

By May 31, 2,500 units that were 80% complete remained in the mixing department. LuLu uses the weighted average method.

-Refer to the Figure.What would be LuLu's cost of May's ending work in process for the mixing department?

A)$17,500

B)$19,200

C)$21,400

D)$22,520

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

53

LuLu, Inc. manufactures a product that passes through two processes: mixing and moulding. All manufacturing costs are added uniformly in the mixing department.

Information for the mixing department for May follows:

During May, 25,000 units were completed and transferred to the moulding department. The following costs were incurred by the mixing department during May:

Work in process, May 1:

By May 31, 2,500 units that were 80% complete remained in the mixing department. LuLu uses the weighted average method.

-Refer to the Figure.What would be LuLu's equivalent units of production when using the weighted average method?

A)20,000

B)23,000

C)27,000

D)28,750

Information for the mixing department for May follows:

During May, 25,000 units were completed and transferred to the moulding department. The following costs were incurred by the mixing department during May:

Work in process, May 1:

By May 31, 2,500 units that were 80% complete remained in the mixing department. LuLu uses the weighted average method.

-Refer to the Figure.What would be LuLu's equivalent units of production when using the weighted average method?

A)20,000

B)23,000

C)27,000

D)28,750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

54

CandyMan Manufacturing uses a process-cost system and computes cost using the weighted average method.During the current period,the beginning work-in-process inventory cost was $15,000.Manufacturing cost added was $65,000.Suppose CandyMan's ending work-in-process inventory was valued at $22,000.What must have been the cost of goods transferred?

A)$43,000

B)$58,000

C)$65,000

D)$80,000

A)$43,000

B)$58,000

C)$65,000

D)$80,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which step is cost reconciliation in the general pattern of a process-costing production report?

A)part of the physical flow analysis

B)the step before calculation of equivalent units

C)the step before the computation of unit cost

D)the last step

A)part of the physical flow analysis

B)the step before calculation of equivalent units

C)the step before the computation of unit cost

D)the last step

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which step is physical flow analysis in the general pattern of a process-costing production report?

A)the first step

B)the step after calculation of equivalent units

C)the step after the computation of unit cost

D)the last step

A)the first step

B)the step after calculation of equivalent units

C)the step after the computation of unit cost

D)the last step

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

57

For the current period, SmartCo. started 20,000 units and completed 20,000 units, leaving 7,000 units in process 40% complete.

Refer to the Figure.Suppose SmartCo.incurred $102,600 in production costs.What would be SmartCo's cost per equivalent unit for the period?

A)$1.84

B)$4.50

C)$5.13

D)$36.64

Refer to the Figure.Suppose SmartCo.incurred $102,600 in production costs.What would be SmartCo's cost per equivalent unit for the period?

A)$1.84

B)$4.50

C)$5.13

D)$36.64

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which two methods are used to determine equivalent units of production in process costing?

A)weighted average and FIFO

B)FIFO and LIFO

C)exact costing and LIFO

D)weighted average and exact costing

A)weighted average and FIFO

B)FIFO and LIFO

C)exact costing and LIFO

D)weighted average and exact costing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following are included in conversion costs?

A)direct labour and manufacturing overhead

B)direct materials and administrative costs

C)direct materials and manufacturing overhead

D)direct labour and administrative costs

A)direct labour and manufacturing overhead

B)direct materials and administrative costs

C)direct materials and manufacturing overhead

D)direct labour and administrative costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

60

For the current period, SmartCo. started 20,000 units and completed 20,000 units, leaving 7,000 units in process 40% complete.

Refer to the Figure.How many equivalent units of production did SmartCo.have for the period?

A)10,000

B)11,500

C)13,500

D)22,800

Refer to the Figure.How many equivalent units of production did SmartCo.have for the period?

A)10,000

B)11,500

C)13,500

D)22,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

61

Red Manufacturing uses a process cost system to manufacture sensors for the security industry. The following information pertains to operations for the month of October.

The beginning inventory was 60% complete for materials and 20% complete for conversion costs. The ending inventory was 90% complete for materials and 40% complete for conversion costs.

Costs pertaining to the month of October area as follows:

Beginning inventory costs: materials, $54,560; conversion cost, $35,560.

Costs incurred during October: materials used, $468,000; conversion cost, $574,040.

Refer to the Figure.What would be the unit cost of materials for October when using the weighted average method?

A)$4.50

B)$4.60

C)$5.03

D)$5.46

The beginning inventory was 60% complete for materials and 20% complete for conversion costs. The ending inventory was 90% complete for materials and 40% complete for conversion costs.

Costs pertaining to the month of October area as follows:

Beginning inventory costs: materials, $54,560; conversion cost, $35,560.

Costs incurred during October: materials used, $468,000; conversion cost, $574,040.

Refer to the Figure.What would be the unit cost of materials for October when using the weighted average method?

A)$4.50

B)$4.60

C)$5.03

D)$5.46

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

62

Assume conversion costs represent a single category.How many input categories would be typical for a department receiving transferred-in goods?

A)2

B)3

C)4

D)5

A)2

B)3

C)4

D)5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

63

Red Manufacturing uses a process cost system to manufacture sensors for the security industry. The following information pertains to operations for the month of October.

The beginning inventory was 60% complete for materials and 20% complete for conversion costs. The ending inventory was 90% complete for materials and 40% complete for conversion costs.

Costs pertaining to the month of October area as follows:

Beginning inventory costs: materials, $54,560; conversion cost, $35,560.

Costs incurred during October: materials used, $468,000; conversion cost, $574,040.

Refer to the Figure.What would be the equivalent unit conversion cost for October when using the weighted average method?

A)$5.65

B)$5.83

C)$6.00

D)$6.41

The beginning inventory was 60% complete for materials and 20% complete for conversion costs. The ending inventory was 90% complete for materials and 40% complete for conversion costs.

Costs pertaining to the month of October area as follows:

Beginning inventory costs: materials, $54,560; conversion cost, $35,560.

Costs incurred during October: materials used, $468,000; conversion cost, $574,040.

Refer to the Figure.What would be the equivalent unit conversion cost for October when using the weighted average method?

A)$5.65

B)$5.83

C)$6.00

D)$6.41

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

64

Information concerning Department C of Boot and Shoe Company for the month of March is as follows:

All materials are added at the beginning of the process.

-Refer to the Figure.What would be the equivalent units for materials when using the first-in,first-out method?

A)85,000

B)90,000

C)105,000

D)110,000

All materials are added at the beginning of the process.

-Refer to the Figure.What would be the equivalent units for materials when using the first-in,first-out method?

A)85,000

B)90,000

C)105,000

D)110,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

65

What are the two sections of a production report?

A)work in process and completed goods

B)a unit information section and a cost information section

C)finished goods and cost of goods sold

D)goods produced and goods in process

A)work in process and completed goods

B)a unit information section and a cost information section

C)finished goods and cost of goods sold

D)goods produced and goods in process

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

66

What does an accountant need to know to calculate unit cost?

A)materials cost plus overhead

B)the output for a period and the manufacturing costs for the department for that period

C)conversion costs and prime costs

D)total units produced by all departments

A)materials cost plus overhead

B)the output for a period and the manufacturing costs for the department for that period

C)conversion costs and prime costs

D)total units produced by all departments

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

67

What two categories of completed units are needed in the FIFO method so that each category can be costed correctly?

A)beginning work-in-process units and units started

B)units started and completed and ending work-in-process units

C)beginning work-in-process units and units started and completed

D)units started and completed and ending work in process

A)beginning work-in-process units and units started

B)units started and completed and ending work-in-process units

C)beginning work-in-process units and units started and completed

D)units started and completed and ending work in process

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following method considers the percentage of completion of beginning work in process?

A)FIFO

B)CVP

C)weighted average

D)LIFO

A)FIFO

B)CVP

C)weighted average

D)LIFO

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

69

The following information is available for Department ABC for the month of September:

Materials are added at the beginning of the process. (Round unit costs to two decimal places.)

Refer to the Figure.What would be Department ABC's cost per equivalent unit of production for conversion costs when using the FIFO method?

A)$0.73

B)$0.85

C)$1.02

D)$1.18

Materials are added at the beginning of the process. (Round unit costs to two decimal places.)

Refer to the Figure.What would be Department ABC's cost per equivalent unit of production for conversion costs when using the FIFO method?

A)$0.73

B)$0.85

C)$1.02

D)$1.18

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following is affected by nonuniform manufacturing inputs?

A)the calculation of equivalent units, unit cost, and valuation of ending work in process

B)only the calculation of equivalent units, and valuation of ending work in process

C)only the valuation of ending work in process

D)only the manufacturing outputs

A)the calculation of equivalent units, unit cost, and valuation of ending work in process

B)only the calculation of equivalent units, and valuation of ending work in process

C)only the valuation of ending work in process

D)only the manufacturing outputs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

71

The following information is available for Department ABC for the month of September:

Materials are added at the beginning of the process. (Round unit costs to two decimal places.)

Refer to the Figure.What would be Department ABC's cost per equivalent unit of production for materials when using the FIFO method?

A)$0.90

B)$0.96

C)$1.04

D)$1.20

Materials are added at the beginning of the process. (Round unit costs to two decimal places.)

Refer to the Figure.What would be Department ABC's cost per equivalent unit of production for materials when using the FIFO method?

A)$0.90

B)$0.96

C)$1.04

D)$1.20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

72

What information is found in the cost of production report?

A)the physical units processed and the manufacturing costs incurred by the department

B)the manufacturing costs incurred by the department and the variable costs

C)the fixed costs and the physical units processed by the department

D)the units planned to be produced by a department

A)the physical units processed and the manufacturing costs incurred by the department

B)the manufacturing costs incurred by the department and the variable costs

C)the fixed costs and the physical units processed by the department

D)the units planned to be produced by a department

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

73

Red Manufacturing uses a process cost system to manufacture sensors for the security industry. The following information pertains to operations for the month of October.

The beginning inventory was 60% complete for materials and 20% complete for conversion costs. The ending inventory was 90% complete for materials and 40% complete for conversion costs.

Costs pertaining to the month of October area as follows:

Beginning inventory costs: materials, $54,560; conversion cost, $35,560.

Costs incurred during October: materials used, $468,000; conversion cost, $574,040.

Refer to the Figure.What would be the total cost of the units in the ending work-in-process inventory at October 31 when using the weighted average method?

A)$153,960

B)$154,800

C)$155,328

D)$156,960

The beginning inventory was 60% complete for materials and 20% complete for conversion costs. The ending inventory was 90% complete for materials and 40% complete for conversion costs.

Costs pertaining to the month of October area as follows:

Beginning inventory costs: materials, $54,560; conversion cost, $35,560.

Costs incurred during October: materials used, $468,000; conversion cost, $574,040.

Refer to the Figure.What would be the total cost of the units in the ending work-in-process inventory at October 31 when using the weighted average method?

A)$153,960

B)$154,800

C)$155,328

D)$156,960

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

74

The M & M Manufacturing Company uses the weighted average method. The beginning work in process consists of 10,000 units (100% completed as to materials and 50% complete as to conversion costs). The number of units completed was 100,000. The ending work in process consists of 15,000 units (100% complete as to materials and 20% complete as to conversion costs).

Refer to the Figure.How many units were started during the period?

A)95,000

B)100,000

C)105,000

D)115,000

Refer to the Figure.How many units were started during the period?

A)95,000

B)100,000

C)105,000

D)115,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following does NOT appear in the production report?

A)costs transferred from prior departments

B)costs added in the department

C)physical units passing through the department

D)retail value of the units produced

A)costs transferred from prior departments

B)costs added in the department

C)physical units passing through the department

D)retail value of the units produced

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

76

For which of the following are the total associated manufacturing costs under the FIFO method the sum of the prior-period costs plus the costs incurred in the current period to finish the units?

A)beginning work-in-process units

B)ending work-in-process units

C)units started and completed

D)conversion costs

A)beginning work-in-process units

B)ending work-in-process units

C)units started and completed

D)conversion costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

77

What is process accounting's solution for nonuniform manufacturing inputs?

A)the calculation of equivalent units for each category of manufacturing input

B)the calculation of total unit cost as if there were uniform manufacturing inputs

C)the use of the weighted average method

D)the use of FIFO method or the weighted average method

A)the calculation of equivalent units for each category of manufacturing input

B)the calculation of total unit cost as if there were uniform manufacturing inputs

C)the use of the weighted average method

D)the use of FIFO method or the weighted average method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

78

The M & M Manufacturing Company uses the weighted average method. The beginning work in process consists of 10,000 units (100% completed as to materials and 50% complete as to conversion costs). The number of units completed was 100,000. The ending work in process consists of 15,000 units (100% complete as to materials and 20% complete as to conversion costs).

Refer to the Figure.What were the equivalent units of production for conversion costs?

A)103,000

B)108,000

C)110,000

D)150,000

Refer to the Figure.What were the equivalent units of production for conversion costs?

A)103,000

B)108,000

C)110,000

D)150,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

79

Information concerning Department C of Boot and Shoe Company for the month of March is as follows:

All materials are added at the beginning of the process.

-Refer to the Figure.What would be the cost (rounded to two decimal places)per equivalent unit for materials when using the first-in,first-out method?

A)$0.74

B)$0.77

C)$0.78

D)$0.90

All materials are added at the beginning of the process.

-Refer to the Figure.What would be the cost (rounded to two decimal places)per equivalent unit for materials when using the first-in,first-out method?

A)$0.74

B)$0.77

C)$0.78

D)$0.90

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

80

Red Manufacturing uses a process cost system to manufacture sensors for the security industry. The following information pertains to operations for the month of October.

The beginning inventory was 60% complete for materials and 20% complete for conversion costs. The ending inventory was 90% complete for materials and 40% complete for conversion costs.

Costs pertaining to the month of October area as follows:

Beginning inventory costs: materials, $54,560; conversion cost, $35,560.

Costs incurred during October: materials used, $468,000; conversion cost, $574,040.

Refer to the Figure.What would be the total equivalent units of production for direct materials when using the weighted average method?

A)92,000

B)101,600

C)113,600

D)116,000

The beginning inventory was 60% complete for materials and 20% complete for conversion costs. The ending inventory was 90% complete for materials and 40% complete for conversion costs.

Costs pertaining to the month of October area as follows:

Beginning inventory costs: materials, $54,560; conversion cost, $35,560.

Costs incurred during October: materials used, $468,000; conversion cost, $574,040.

Refer to the Figure.What would be the total equivalent units of production for direct materials when using the weighted average method?

A)92,000

B)101,600

C)113,600

D)116,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck