Deck 17: Issues in Macroeconomic Theory and Policy

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/74

العب

ملء الشاشة (f)

Deck 17: Issues in Macroeconomic Theory and Policy

1

The loans that ended up in the hands of low-risk borrowers were called subprime loans.

False

2

Indexing protects parties against unanticipated price increases by writing contracts that automatically change the prices of goods or services.

True

3

The Taylor rule is a complete discretionary policy.

False

4

Assuming wages are indexed to inflation, if prices rose by 1.4 percent this month and your last month's wage was $1,000, your wage this month would be $1,014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

5

Automatic stabilizers are not regarded as important fiscal policies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

6

Inflation targeting may lead to a liquidity trap.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

7

If policy makers' ability to forecast the future is limited, their ability to stabilize the economy with fiscal and monetary policy is compromised.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

8

When expansionary policy is anticipated, it leads to a short-run expansion in output and employment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

9

When the economy operates at levels significantly lower than the full-employment level, input prices are flexible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

10

Critics of inflation targeting argue that central banks need flexibility.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

11

If people respond quickly to policy changes that imply future inflation will increase, the short run aggregate supply curve will shift upward due to their changed expectations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

12

The crowding-out effect occurs when household consumption and investment spending increase as a result of a decrease in the demand for money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

13

Critics of targeting a zero inflation rate believe that achieving zero inflation is almost impossible and the costs are too high.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

14

It is easier to adopt an economic policy when a recession is caused by a supply shock rather than a demand shock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

15

Before the global economic crisis, the United States had discouraged the mortgage industry by raising lending standards for low-income families.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

16

The rational expectations theory suggests that government or central bank policies designed to change aggregate demand will be effective.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

17

A positive supply shock causes a leftward shift in the short-run aggregate supply curve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

18

The problem of time lags in making policy changes is less acute for monetary policy than it is for fiscal policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

19

The financial crisis of 2008-2009 led to a decline in confidence and a credit crunch in the U.S. economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

20

Because of lag problems, policies intended to stabilize the economy may actually destabilize the economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

21

A decrease in government purchases, other things being equal, will tend to _____.

A)increase interest rates and consequently decrease private investment

B)increase interest rates and consequently increase private consumption

C)decrease interest rates and consequently decrease private investment

D)decrease interest rates and consequently increase private investment

E)decrease interest rates and consequently decrease private consumption

A)increase interest rates and consequently decrease private investment

B)increase interest rates and consequently increase private consumption

C)decrease interest rates and consequently decrease private investment

D)decrease interest rates and consequently increase private investment

E)decrease interest rates and consequently decrease private consumption

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

22

Monetary policy is more effective at closing an expansionary gap than a recessionary gap because:

A)banks may be unwilling to lend and seeking more liquidity, thereby offsetting any expansionary policy.

B)households and firms make situations worse by borrowing too much from the excess reserves.

C)the implementation lag for an expansionary policy is longer than that for a contractionary policy.

D)most expansionary monetary policies get delayed due to several governmental regulations.

E)expansionary monetary policies aggravate the crowding-out effect that might render them ineffective.

A)banks may be unwilling to lend and seeking more liquidity, thereby offsetting any expansionary policy.

B)households and firms make situations worse by borrowing too much from the excess reserves.

C)the implementation lag for an expansionary policy is longer than that for a contractionary policy.

D)most expansionary monetary policies get delayed due to several governmental regulations.

E)expansionary monetary policies aggravate the crowding-out effect that might render them ineffective.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

23

If commercial banks increase their borrowing from the Fed at a time when the Fed is selling government securities, the borrowing of the commercial banks from the Fed will tend to:

A)reinforce the Fed's contractionary policy.

B)increase the unemployment rate in the country.

C)counteract the Fed's contractionary policy.

D)counteract the Fed's expansionary policy.

E)increase the credibility of the Fed.

A)reinforce the Fed's contractionary policy.

B)increase the unemployment rate in the country.

C)counteract the Fed's contractionary policy.

D)counteract the Fed's expansionary policy.

E)increase the credibility of the Fed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

24

The crowding-out effect:

A)increases the demand for money and increases private investment.

B)increases the demand for money and increases consumption expenditure.

C)increases the demand for money and decreases consumption expenditure.

D)decreases the demand for money and increases private investment.

E)decreases the demand for money and increases consumption expenditure.

A)increases the demand for money and increases private investment.

B)increases the demand for money and increases consumption expenditure.

C)increases the demand for money and decreases consumption expenditure.

D)decreases the demand for money and increases private investment.

E)decreases the demand for money and increases consumption expenditure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following is an expansionary monetary policy?

A)The Federal Reserve increasing the discount rate for commercial banks

B)The Federal Reserve increasing commercial bank's reserve requirements

C)An increase in taxes imposed by the government

D)The Federal Reserve buying government bonds from commercial banks

E)A decrease in government's expenditures

A)The Federal Reserve increasing the discount rate for commercial banks

B)The Federal Reserve increasing commercial bank's reserve requirements

C)An increase in taxes imposed by the government

D)The Federal Reserve buying government bonds from commercial banks

E)A decrease in government's expenditures

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

26

The time span between the beginning of a downturn and the time taken to gather enough data to indicate a downturn is called _____.

A)the display lag

B)the implementation lag

C)the impact lag

D)the recognition lag

E)the decision lag

A)the display lag

B)the implementation lag

C)the impact lag

D)the recognition lag

E)the decision lag

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

27

From early 2007 to mid-2008, the short-run aggregate supply curve of the United States shifted to the left.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following is a problem associated with monetary policy?

A)The Fed cannot control deposit expansion at member banks.

B)The Fed is not able to predict the impact of its monetary policies on the loans issued by member banks.

C)The Fed is not able to predict the impact of its policies on the loans issued by global banks.

D)Monetary policies are subject to excessive implementation lags.

E)Monetary policies are subject to several governmental regulations.

A)The Fed cannot control deposit expansion at member banks.

B)The Fed is not able to predict the impact of its monetary policies on the loans issued by member banks.

C)The Fed is not able to predict the impact of its policies on the loans issued by global banks.

D)Monetary policies are subject to excessive implementation lags.

E)Monetary policies are subject to several governmental regulations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following would cause the U.S. money supply to expand?

A)A commercial bank using excess reserves to extend a loan to a customer

B)A commercial bank purchasing U.S. securities from the Fed as an investment

C)An increase in reserve requirements by the Fed

D)An increase in the discount rate by the Fed

E)An increase in the tax rate by the government

A)A commercial bank using excess reserves to extend a loan to a customer

B)A commercial bank purchasing U.S. securities from the Fed as an investment

C)An increase in reserve requirements by the Fed

D)An increase in the discount rate by the Fed

E)An increase in the tax rate by the government

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

30

A cut in taxes, other things being equal, will:

A)increase interest rates and consequently decrease private investment.

B)increase interest rates and consequently increase private investment.

C)decrease interest rates and consequently decrease private investment.

D)decrease interest rates and consequently increase private investment.

E)decrease interest rates and consequently increase consumer spending.

A)increase interest rates and consequently decrease private investment.

B)increase interest rates and consequently increase private investment.

C)decrease interest rates and consequently decrease private investment.

D)decrease interest rates and consequently increase private investment.

E)decrease interest rates and consequently increase consumer spending.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

31

When a commercial bank purchases government securities from the Fed, _____.

A)aggregate supply in the economy decreases

B)aggregate demand in the economy increases

C)both aggregate demand and aggregate supply increase

D)both aggregate demand and aggregate supply decrease

E)aggregate demand in the economy decreases

A)aggregate supply in the economy decreases

B)aggregate demand in the economy increases

C)both aggregate demand and aggregate supply increase

D)both aggregate demand and aggregate supply decrease

E)aggregate demand in the economy decreases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

32

Starting from a position of macroeconomic equilibrium at the full-employment level of real GDP, in the short run, an unanticipated decrease in the money supply will:

A)raise real interest rates, lower the price level, and reduce real GDP.

B)raise real interest rates, lower the price level, and increase real GDP.

C)raise nominal interest rates, raise the price level, and leave real GDP unchanged.

D)lower real interest rates, raise the price level, and increase real GDP.

E)lower real interest rate, lower the price level, and increase real GDP.

A)raise real interest rates, lower the price level, and reduce real GDP.

B)raise real interest rates, lower the price level, and increase real GDP.

C)raise nominal interest rates, raise the price level, and leave real GDP unchanged.

D)lower real interest rates, raise the price level, and increase real GDP.

E)lower real interest rate, lower the price level, and increase real GDP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

33

The time required to identify an appropriate policy and get it approved by Congress is known as _____.

A)the signal lag

B)the implementation lag

C)the impact lag

D)the recognition lag

E)the decision lag

A)the signal lag

B)the implementation lag

C)the impact lag

D)the recognition lag

E)the decision lag

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

34

Expansionary fiscal policy, other things being equal, will tend to:

A)increase interest rates.

B)increase private investment.

C)increase net exports.

D)increase consumer spending.

E)increase the marginal propensity to consume.

A)increase interest rates.

B)increase private investment.

C)increase net exports.

D)increase consumer spending.

E)increase the marginal propensity to consume.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

35

When the crowding-out effect of an increase in government purchases is included when analyzing the impact of the increase in government purchases, _____.

A)the AD curve shifts to the left, but by more than the simple multiplier analysis would imply

B)the AD curve remains unchanged

C)the AD curve shifts to the right, but by more than the simple multiplier analysis would imply

D)the AD curve shifts to the right, but by less than the simple multiplier analysis would imply

E)the AD curve shifts to the left, but by less than the simple multiplier analysis would imply

A)the AD curve shifts to the left, but by more than the simple multiplier analysis would imply

B)the AD curve remains unchanged

C)the AD curve shifts to the right, but by more than the simple multiplier analysis would imply

D)the AD curve shifts to the right, but by less than the simple multiplier analysis would imply

E)the AD curve shifts to the left, but by less than the simple multiplier analysis would imply

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

36

The belief that workers and consumers incorporate the likely consequences of government policy changes into their expectations by quickly adjusting wages and prices is known as _____.

A)the theory of supply and demand

B)the rational choice theory

C)the prospect theory

D)the new trade theory

E)the theory of rational expectations

A)the theory of supply and demand

B)the rational choice theory

C)the prospect theory

D)the new trade theory

E)the theory of rational expectations

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

37

The crowding-out effect implies that an increase in government borrowing to finance deficit financing results in _____.

A)an increase in the demand for money that causes interest rate to rise

B)a decrease in the demand for money that causes interest rate to rise

C)an increase in private investments by businesses

D)an increase in the demand for money that causes interest rate to fall

E)an increase in consumption spending by households.

A)an increase in the demand for money that causes interest rate to rise

B)a decrease in the demand for money that causes interest rate to rise

C)an increase in private investments by businesses

D)an increase in the demand for money that causes interest rate to fall

E)an increase in consumption spending by households.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

38

The crowding-out effect:

A)increases interest rates and decreases private investment.

B)decreases both interest rates and decreases private investment.

C)increases both interest rates and private investment.

D)increases both interest rates and consumption expenditure.

E)decreases interest rates and increases consumption expenditure.

A)increases interest rates and decreases private investment.

B)decreases both interest rates and decreases private investment.

C)increases both interest rates and private investment.

D)increases both interest rates and consumption expenditure.

E)decreases interest rates and increases consumption expenditure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following is true?

A)When increased government purchases or expansionary monetary policy does give the economy a boost, no one knows precisely how long it will take to do so.

B)Given the difficulties of timing stabilization policy, a contractionary monetary policy intended to reduce the severity of a recession may instead add inflationary pressures to an economy that is already overheating.

C)If velocity changes but moves in a fairly predictable pattern, the connection between the money supply and GDP is still unpredictable.

D)When the economy is operating at levels significantly lower than the full-employment output, input prices are flexible.

E)Government estimates of the real GDP and the value of the multiplier are always correct.

A)When increased government purchases or expansionary monetary policy does give the economy a boost, no one knows precisely how long it will take to do so.

B)Given the difficulties of timing stabilization policy, a contractionary monetary policy intended to reduce the severity of a recession may instead add inflationary pressures to an economy that is already overheating.

C)If velocity changes but moves in a fairly predictable pattern, the connection between the money supply and GDP is still unpredictable.

D)When the economy is operating at levels significantly lower than the full-employment output, input prices are flexible.

E)Government estimates of the real GDP and the value of the multiplier are always correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

40

An impact lag refers to the time required to:

A)gather enough data to indicate the beginning of an economic downturn.

B)bring about an actual fiscal stimulus desired.

C)analyze the importance of a stable policy tool.

D)identify an appropriate policy and get it approved by Congress.

E)determine an appropriate policy during an economic downturn.

A)gather enough data to indicate the beginning of an economic downturn.

B)bring about an actual fiscal stimulus desired.

C)analyze the importance of a stable policy tool.

D)identify an appropriate policy and get it approved by Congress.

E)determine an appropriate policy during an economic downturn.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

41

Critics of inflation targeting argue that _____.

A)it can lead to lower aggregate supply in the long run

B)forecasting future inflation may be inaccurate, leading to inefficiency

C)governments are too flexible with inflation target rates and need to be more tight

D)targeting inflation may cause net exports to fall in the long run

E)the government can run into a deficit as a result of targeting inflation

A)it can lead to lower aggregate supply in the long run

B)forecasting future inflation may be inaccurate, leading to inefficiency

C)governments are too flexible with inflation target rates and need to be more tight

D)targeting inflation may cause net exports to fall in the long run

E)the government can run into a deficit as a result of targeting inflation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

42

The rational expectations theory implies that an accurately anticipated change in aggregate demand:

A)will increase real GDP in the long run.

B)will affect real GDP and inflation only in the long run.

C)will affect real GDP in the short run but not nominal GDP.

D)will affect nominal GDP in the short run but not real GDP.

E)will affect real GDP in the long run but not nominal GDP.

A)will increase real GDP in the long run.

B)will affect real GDP and inflation only in the long run.

C)will affect real GDP in the short run but not nominal GDP.

D)will affect nominal GDP in the short run but not real GDP.

E)will affect real GDP in the long run but not nominal GDP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

43

Believers in the hypothesis of rational expectations argue that:

A)expansionary fiscal and monetary policy can reduce unemployment without creating inflation.

B)a trade-off exists between unemployment and inflation even in the long run.

C)the only long-run impact of a change in monetary policy is a higher price level.

D)the long run aggregate supply curve is upward sloping.

E)when a change is correctly anticipated, expansionary fiscal policy changes real output.

A)expansionary fiscal and monetary policy can reduce unemployment without creating inflation.

B)a trade-off exists between unemployment and inflation even in the long run.

C)the only long-run impact of a change in monetary policy is a higher price level.

D)the long run aggregate supply curve is upward sloping.

E)when a change is correctly anticipated, expansionary fiscal policy changes real output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

44

With rational expectations, a correctly anticipated policy that would increase AD would lead to:

A)higher inflation and lower unemployment in the long run.

B)higher inflation and higher unemployment in the short run.

C)higher inflation and no change in unemployment in the short run.

D)lower inflation and lower unemployment in the short run.

E)higher inflation and higher unemployment in the long run.

A)higher inflation and lower unemployment in the long run.

B)higher inflation and higher unemployment in the short run.

C)higher inflation and no change in unemployment in the short run.

D)lower inflation and lower unemployment in the short run.

E)higher inflation and higher unemployment in the long run.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

45

According to the Taylor rule, the Fed should raise the federal funds rate by 0.5% relative to the inflation rate _____.

A)if nominal GDP rises 1.0% above its target of 1.0%

B)if real GDP rises 1.0% above its target of 1.0%

C)if inflation falls 1.0% below its target of 2.0%

D)if inflation rises 1.0% above its target of 2.0%

E)if nominal GDP falls 1.0% below its target of 1.0%

A)if nominal GDP rises 1.0% above its target of 1.0%

B)if real GDP rises 1.0% above its target of 1.0%

C)if inflation falls 1.0% below its target of 2.0%

D)if inflation rises 1.0% above its target of 2.0%

E)if nominal GDP falls 1.0% below its target of 1.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

46

Critics of the rational expectations theory believe that:

A)most people are well informed about the effects of a policy change.

B)most people adjust their behavior very rapidly to changes in government policies even if they are not informed about the effects of policy changes.

C)wages and prices are not as flexible as the rational expectations theory assumes.

D)expected changes affect real output and employment in the long run.

E)unexpected changes in policies do not affect real output and employment in the short run as the rational expectations theory assumes.

A)most people are well informed about the effects of a policy change.

B)most people adjust their behavior very rapidly to changes in government policies even if they are not informed about the effects of policy changes.

C)wages and prices are not as flexible as the rational expectations theory assumes.

D)expected changes affect real output and employment in the long run.

E)unexpected changes in policies do not affect real output and employment in the short run as the rational expectations theory assumes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

47

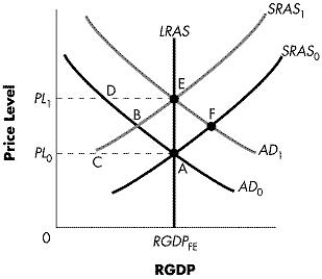

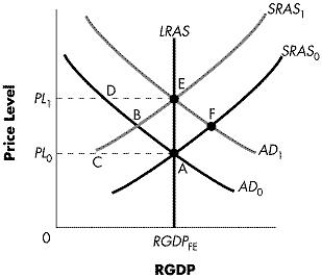

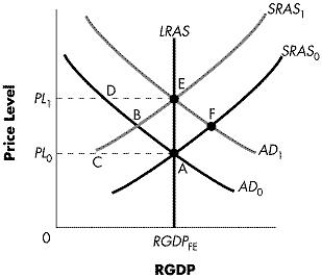

The figure below shows the aggregate demand curve, the long-run aggregate supply curve, and the short-run aggregate supply curve in an economy. Based on the figure, if an increase in aggregate demand from AD0 to AD1 is unanticipated, the economy will move from point A to point _____in the short run.Figure-1

A)A

B)B

C)E

D)F

E)D

A)A

B)B

C)E

D)F

E)D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

48

According to the Taylor rule, if real GDP rises 1.0 % over potential GDP, the Fed should, _____.

A)raise the federal funds rate by 5% relative to the inflation rate

B)raise the federal funds rate by 1% relative to the inflation rate

C)raise the federal funds rate by 2% relative to the inflation rate

D)raise the federal funds rate by 0.5% relative to the inflation rate

E)keep the federal funds rate at 4 percent

A)raise the federal funds rate by 5% relative to the inflation rate

B)raise the federal funds rate by 1% relative to the inflation rate

C)raise the federal funds rate by 2% relative to the inflation rate

D)raise the federal funds rate by 0.5% relative to the inflation rate

E)keep the federal funds rate at 4 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

49

According to the rational expectations view, the government can change real output by:

A)making appropriate and well-publicized fiscal and monetary policy changes in the long run.

B)making appropriate and well-publicized fiscal and monetary policy changes in the short run.

C)making unexpected changes in aggregate demand.

D)keeping the economy away from inflation.

E)making unexpected changes in aggregate supply.

A)making appropriate and well-publicized fiscal and monetary policy changes in the long run.

B)making appropriate and well-publicized fiscal and monetary policy changes in the short run.

C)making unexpected changes in aggregate demand.

D)keeping the economy away from inflation.

E)making unexpected changes in aggregate supply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

50

It is difficult for policy makers to adopt an expansionary policy as a response to a recession caused by a negative supply shock because an:

A)expansionary policy leads to an increase in aggregate demand, which causes aggregate output to increase, causing inflation to rise.

B)expansionary policy results in a shift of the aggregate demand curve to the left, as a result of which real output decreases.

C)expansionary policy leads to an increase in aggregate demand, as a result of which the price level decreases.

D)expansionary policy results in a shift of the long-run aggregate supply curve to the left, as a result of which the price level decreases.

E)expansionary policy results in a shift of the long-run aggregate supply curve to the right, as a result of which the price level decreases.

A)expansionary policy leads to an increase in aggregate demand, which causes aggregate output to increase, causing inflation to rise.

B)expansionary policy results in a shift of the aggregate demand curve to the left, as a result of which real output decreases.

C)expansionary policy leads to an increase in aggregate demand, as a result of which the price level decreases.

D)expansionary policy results in a shift of the long-run aggregate supply curve to the left, as a result of which the price level decreases.

E)expansionary policy results in a shift of the long-run aggregate supply curve to the right, as a result of which the price level decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

51

A negative supply shock may lead to:

A)an increase in real aggregate output and an increase in the price level.

B)a reduction in real aggregate output and an increase in the price level.

C)a reduction in real aggregate output and a decrease in the price level.

D)an increase in real aggregate output and a decrease in price level.

E)a reduction in the price level and no change in real aggregate output.

A)an increase in real aggregate output and an increase in the price level.

B)a reduction in real aggregate output and an increase in the price level.

C)a reduction in real aggregate output and a decrease in the price level.

D)an increase in real aggregate output and a decrease in price level.

E)a reduction in the price level and no change in real aggregate output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following is true?

A)Rational expectation theorists believe that an anticipated change in policies can alter real GDP in the short run.

B)Rational expectation theorists believe that an unanticipated change in policies can alter real GDP in the long run.

C)Rational expectation theorists believe that government economic policies designed to alter aggregate demand are effective at changing real output.

D)Activists believe that appropriate economic policies can alter aggregate demand.

E)Activists believe that economic policies cannot keep the rate of unemployment below the natural rate.

A)Rational expectation theorists believe that an anticipated change in policies can alter real GDP in the short run.

B)Rational expectation theorists believe that an unanticipated change in policies can alter real GDP in the long run.

C)Rational expectation theorists believe that government economic policies designed to alter aggregate demand are effective at changing real output.

D)Activists believe that appropriate economic policies can alter aggregate demand.

E)Activists believe that economic policies cannot keep the rate of unemployment below the natural rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

53

According to the rational expectations view, the government has the ability to control the level of real output and unemployment:

A)only in the short run if it makes unexpected changes in aggregate demand

B)only in the short run if it announces policies well in advance so that expectations are affected

C)only in the long run if it shifts aggregate supply instead of aggregate demand

D)only in the long run if it uses monetary policy instead of fiscal policy

E)only in the long run when the aggregate supply curve is vertical

A)only in the short run if it makes unexpected changes in aggregate demand

B)only in the short run if it announces policies well in advance so that expectations are affected

C)only in the long run if it shifts aggregate supply instead of aggregate demand

D)only in the long run if it uses monetary policy instead of fiscal policy

E)only in the long run when the aggregate supply curve is vertical

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

54

According to the Taylor rule, the Fed should keep the federal fund rate at 4 percent if:

A)real GDP is 2 percent above potential GDP and inflation is 1 percent above target inflation of 2 percent.

B)real GDP is 1 percent above potential GDP and inflation is equal to its target of 2 percent.

C)real GDP is 4 percent above potential GDP and inflation is 4 percent above target inflation of 2 percent.

D)real GDP is equal to potential GDP and inflation is 1 percent above target inflation of 2 percent.

E)real GDP is equal to potential GDP and inflation is equal to its target of 2 percent.

A)real GDP is 2 percent above potential GDP and inflation is 1 percent above target inflation of 2 percent.

B)real GDP is 1 percent above potential GDP and inflation is equal to its target of 2 percent.

C)real GDP is 4 percent above potential GDP and inflation is 4 percent above target inflation of 2 percent.

D)real GDP is equal to potential GDP and inflation is 1 percent above target inflation of 2 percent.

E)real GDP is equal to potential GDP and inflation is equal to its target of 2 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

55

A conclusion of the theory of rational expectations is that, in the short run, the impact of discretionary fiscal policies designed to shift the AD curve to the right will:

A)result in an increase in the demand for money once people's expectations have been accounted for.

B)shift the AD curve in the opposite direction intended once people's expectations have been accounted for.

C)result in no significant change in real or nominal GDP or employment once the change is anticipated.

D)result in a change in real output in the intended direction if the policy is anticipated.

E)result in a change in real output in the long run if the policy is unanticipated.

A)result in an increase in the demand for money once people's expectations have been accounted for.

B)shift the AD curve in the opposite direction intended once people's expectations have been accounted for.

C)result in no significant change in real or nominal GDP or employment once the change is anticipated.

D)result in a change in real output in the intended direction if the policy is anticipated.

E)result in a change in real output in the long run if the policy is unanticipated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

56

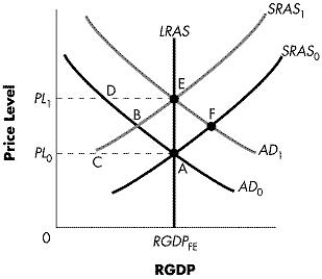

The figure below shows the aggregate demand curve, the long-run aggregate supply curve, and the short-run aggregate supply curve in an economy. Based on the figure, if an increase in aggregate demand from AD0 to AD1 is fully anticipated, the economy will move from point A to point _____ in the short run.Figure-1

A)B

B)C

C)D

D)E

E)F

A)B

B)C

C)D

D)E

E)F

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

57

A problem associated with targeting inflation at zero is that:

A)it could lead to hyperinflation in the long run.

B)it could lead to deflation.

C)it could lead to a deficit in the government budget.

D)it could reduce aggregate demand.

E)it could reduce net exports.

A)it could lead to hyperinflation in the long run.

B)it could lead to deflation.

C)it could lead to a deficit in the government budget.

D)it could reduce aggregate demand.

E)it could reduce net exports.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

58

If policy makers choose to use a contractionary fiscal policy as a response to the recession caused by a negative supply shock, _____.

A)both aggregate output and inflation will increase

B)both aggregate output and unemployment level will increase

C)aggregate output will and unemployment will increase

D)aggregate output will increase and unemployment will decrease

E)both unemployment and prices will decrease

A)both aggregate output and inflation will increase

B)both aggregate output and unemployment level will increase

C)aggregate output will and unemployment will increase

D)aggregate output will increase and unemployment will decrease

E)both unemployment and prices will decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

59

With rational expectations, a policy that would increase AD would lead to:

A)higher inflation and a higher real output in the long run if people's expectations were incorrect.

B)higher inflation and a lower real output in the long run if people's expectations were incorrect.

C)higher inflation and a higher real output in the short run if people's expectations were correct.

D)higher inflation and no change in real output in the short run if people's expectations were correct in the short run.

E)higher inflation and a lower real output in the short run if people's expectations were incorrect.

A)higher inflation and a higher real output in the long run if people's expectations were incorrect.

B)higher inflation and a lower real output in the long run if people's expectations were incorrect.

C)higher inflation and a higher real output in the short run if people's expectations were correct.

D)higher inflation and no change in real output in the short run if people's expectations were correct in the short run.

E)higher inflation and a lower real output in the short run if people's expectations were incorrect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

60

If the public has rational expectations and the Fed reduces both reserve requirements and the discount rate, this would result in:

A)a higher level of real output and a lower price level in the long run.

B)a lower price level but no change in real output in the long run.

C)a higher price level and a reduced level of real output in the short run.

D)a higher price level but no change in real output in the short run.

E)a higher level of real output and a lower price level in the short run.

A)a higher level of real output and a lower price level in the long run.

B)a lower price level but no change in real output in the long run.

C)a higher price level and a reduced level of real output in the short run.

D)a higher price level but no change in real output in the short run.

E)a higher level of real output and a lower price level in the short run.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following is true?

A)The recession of 2008-2009 was a result of a few large banks with many branches.

B)During the recession of 2008-2009, consumption and investment spending reduced substantially.

C)The recession of 2008-09 was a result of the customers' fear that depositor withdrawals could force a bank to close.

D)During the recession of 2008-09, aggregate demand declined because of a sudden increase in the demand for imported goods.

E)The recession of 2008-09 was a result of imprudent management or even criminal activity on the part of bank officers.

A)The recession of 2008-2009 was a result of a few large banks with many branches.

B)During the recession of 2008-2009, consumption and investment spending reduced substantially.

C)The recession of 2008-09 was a result of the customers' fear that depositor withdrawals could force a bank to close.

D)During the recession of 2008-09, aggregate demand declined because of a sudden increase in the demand for imported goods.

E)The recession of 2008-09 was a result of imprudent management or even criminal activity on the part of bank officers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

62

Is it possible for monetary policy to be more effective during an expansion than during a recession? If yes, why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

63

Why is the time lag for making fiscal policy changes longer than that for making monetary policy changes?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

64

What do rational expectations theorists believe? What is their critics' point of view?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which of the following was believed to have started the global economic crisis of 2008?

A)The absence of depositor insurance

B)Excessive transfer payments made by the government

C)A sudden and sharp increase in oil prices

D)Lack of financial aids to banks

E)A sudden fall in housing prices

A)The absence of depositor insurance

B)Excessive transfer payments made by the government

C)A sudden and sharp increase in oil prices

D)Lack of financial aids to banks

E)A sudden fall in housing prices

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

66

Why is a stagflation caused by a negative supply shock worse than a recession caused by a negative demand shock?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

67

During the recession of 2008-09, _____.

A)the long-run aggregate supply curve shifted to the right

B)the long-run aggregate supply curve shifted to the left

C)the short-run aggregate supply curve shifted to the right

D)the aggregate demand curve shifted to the right

E)the aggregate demand curve shifted to the left

A)the long-run aggregate supply curve shifted to the right

B)the long-run aggregate supply curve shifted to the left

C)the short-run aggregate supply curve shifted to the right

D)the aggregate demand curve shifted to the right

E)the aggregate demand curve shifted to the left

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

68

One main argument against indexing is that:

A)it can worsen inflation.

B)it can reduce asset prices.

C)it can reduce net exports.

D)it can lead to deflation.

E)it can lead to hyperinflation.

A)it can worsen inflation.

B)it can reduce asset prices.

C)it can reduce net exports.

D)it can lead to deflation.

E)it can lead to hyperinflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

69

What is quantitative easing?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following contributed to the global economic crisis of 2008?

A)Low interest rates encouraging less qualified buyers to purchase houses

B)An excessive outflow of foreign capital

C)A large amount of subsidies being offered by the government

D)Low ratings of mortgage-backed subprime securities

E)A sharp increase in personal savings

A)Low interest rates encouraging less qualified buyers to purchase houses

B)An excessive outflow of foreign capital

C)A large amount of subsidies being offered by the government

D)Low ratings of mortgage-backed subprime securities

E)A sharp increase in personal savings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

71

Why does a larger government budget deficit increase the magnitude of the crowding-out effect?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

72

Why is indexing not commonly adopted in spite of the fact that it eliminates most of the wealth transfers associated with unexpected inflation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

73

Can monetary policy be used to successfully fine-tune the economy?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

74

How do you think each of the following would affect the unemployment rate?

a. The Fed increases the money supply and engineers an unexpected increase in the rate of inflation from 2 percent to 5 percent.

b. As expected, the rate of inflation remains stable at 2 percent over a five-year period.

c. There is an unexpected decrease in the rate of inflation from 10 percent to 3 percent.

a. The Fed increases the money supply and engineers an unexpected increase in the rate of inflation from 2 percent to 5 percent.

b. As expected, the rate of inflation remains stable at 2 percent over a five-year period.

c. There is an unexpected decrease in the rate of inflation from 10 percent to 3 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck