Deck 1: Introduction to Business Combinations and the Conceptual Framework

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/35

العب

ملء الشاشة (f)

Deck 1: Introduction to Business Combinations and the Conceptual Framework

1

The excess of the amount offered in an acquisition over the prior stock price of the acquired firm is the:

A)bonus.

B)goodwill.

C)implied offering price.

D)takeover premium.

A)bonus.

B)goodwill.

C)implied offering price.

D)takeover premium.

D

2

When a new corporation is formed to acquire two or more other corporations and the acquired corporations cease to exist as separate legal entities,the result is a statutory:

A)acquisition.

B)combination.

C)consolidation.

D)merger.

A)acquisition.

B)combination.

C)consolidation.

D)merger.

C

3

The defense tactic that involves purchasing shares held by the would-be acquiring company at a price substantially in excess of their fair value is called:

A)poison pill.

B)pac-man defense.

C)greenmail.

D)white knight.

A)poison pill.

B)pac-man defense.

C)greenmail.

D)white knight.

C

4

The impairment standard as it relates to goodwill is an example of a:

A)consumption of benefit approach.

B)loss or lack of benefit approach.

C)component of other comprehensive income.

D)direct matching of expenses to revenues.

A)consumption of benefit approach.

B)loss or lack of benefit approach.

C)component of other comprehensive income.

D)direct matching of expenses to revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

5

The difference between normal earnings and expected future earnings is:

A)average earnings.

B)excess earnings.

C)ordinary earnings.

D)target earnings.

A)average earnings.

B)excess earnings.

C)ordinary earnings.

D)target earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

6

Estimated goodwill is determined by computing the present value of the:

A)average earnings.

B)excess earnings.

C)expected future earnings.

D)normal earnings.

A)average earnings.

B)excess earnings.

C)expected future earnings.

D)normal earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

7

A business combination in which the boards of directors of the potential combining companies negotiate mutually agreeable terms is a(n):

A)agreeable combination.

B)friendly combination.

C)hostile combination.

D)unfriendly combination.

A)agreeable combination.

B)friendly combination.

C)hostile combination.

D)unfriendly combination.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

8

The third period of business combinations started after World War II and is called:

A)horizontal integration.

B)merger mania.

C)operating integration.

D)vertical integration.

A)horizontal integration.

B)merger mania.

C)operating integration.

D)vertical integration.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

9

Under the parent company concept,consolidated net income __________ the consolidated net income under the economic unit concept.

A)is the same as

B)is higher than

C)is lower than

D)can be higher or lower than

A)is the same as

B)is higher than

C)is lower than

D)can be higher or lower than

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

10

A merger between a supplier and a customer is a(n):

A)friendly combination.

B)horizontal combination.

C)unfriendly combination.

D)vertical combination.

A)friendly combination.

B)horizontal combination.

C)unfriendly combination.

D)vertical combination.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

11

The objectives of FASB 141R (Business Combinations)and FASB 160 (Noncontrolling Interests in Consolidated Financial Statements)are as follows:

A)to improve the relevance,comparability,and transparency of financial information related to business combinations.

B)to eliminate the amortization of Goodwill.

C)to facilitate the convergence project of the FASB and the International Accounting Standards Board.

D)to improve the relevance,comparability,and transparency of financial information related to business combinations and to eliminate the amortization of Goodwill.

A)to improve the relevance,comparability,and transparency of financial information related to business combinations.

B)to eliminate the amortization of Goodwill.

C)to facilitate the convergence project of the FASB and the International Accounting Standards Board.

D)to improve the relevance,comparability,and transparency of financial information related to business combinations and to eliminate the amortization of Goodwill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

12

Stock given as consideration for a business combination is valued at:

A)fair market value

B)par value

C)historical cost

D)None of these

A)fair market value

B)par value

C)historical cost

D)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following situations best describes a business combination to be accounted for as a statutory merger?

A)Both companies in a combination continue to operate as separate,but related,legal entities.

B)Only one of the combining companies survives and the other loses its separate identity.

C)Two companies combine to form a new third company,and the original two companies are dissolved.

D)One company transfers assets to another company it has created.

A)Both companies in a combination continue to operate as separate,but related,legal entities.

B)Only one of the combining companies survives and the other loses its separate identity.

C)Two companies combine to form a new third company,and the original two companies are dissolved.

D)One company transfers assets to another company it has created.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

14

A firm can use which method of financing for an acquisition structured as either an asset or stock acquisition?

A)Cash

B)Issuing Debt

C)Issuing Stock

D)All of these

A)Cash

B)Issuing Debt

C)Issuing Stock

D)All of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following statements is correct?

A)Total elimination is consistent with the parent company concept.

B)Partial elimination is consistent with the economic unit concept.

C)Past accounting standards required the total elimination of unrealized intercompany profit in assets acquired from affiliated companies.

D)none of these.

A)Total elimination is consistent with the parent company concept.

B)Partial elimination is consistent with the economic unit concept.

C)Past accounting standards required the total elimination of unrealized intercompany profit in assets acquired from affiliated companies.

D)none of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

16

The first step in estimating goodwill in the excess earnings approach is to:

A)determine normal earnings.

B)identify a normal rate of return for similar firms.

C)compute excess earnings.

D)estimate expected future earnings.

A)determine normal earnings.

B)identify a normal rate of return for similar firms.

C)compute excess earnings.

D)estimate expected future earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following statements would not be a valid or logical reason for entering into a business combination?

A)to increase market share.

B)to avoid becoming a takeover target.

C)to reduce risk by acquiring established product lines.

D)the operating costs of the combined entity would be more than the sum of the separate entities.

A)to increase market share.

B)to avoid becoming a takeover target.

C)to reduce risk by acquiring established product lines.

D)the operating costs of the combined entity would be more than the sum of the separate entities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

18

The parent company concept of consolidation represents the view that the primary purpose of consolidated financial statements is:

A)to provide information relevant to the controlling stockholders.

B)to represent the view that the affiliated companies are a separate,identifiable economic entity.

C)to emphasis control of the whole by a single management.

D)to include only a portion of the subsidiary's assets,liabilities,revenues,expenses,gains,and losses.

A)to provide information relevant to the controlling stockholders.

B)to represent the view that the affiliated companies are a separate,identifiable economic entity.

C)to emphasis control of the whole by a single management.

D)to include only a portion of the subsidiary's assets,liabilities,revenues,expenses,gains,and losses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following is not a component of other comprehensive income under GAAP?

A)earnings.

B)gains and losses that bypass earnings.

C)impairment losses.

D)accumulated other comprehensive income.

A)earnings.

B)gains and losses that bypass earnings.

C)impairment losses.

D)accumulated other comprehensive income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

20

Many of FASB's recent pronouncements indicate a shift away from historical cost accounting toward:

A)an elevated status for the Statements of Financial Accounting Concepts.

B)convergence of standards.

C)fair value accounting.

D)representationally faithful reporting.

A)an elevated status for the Statements of Financial Accounting Concepts.

B)convergence of standards.

C)fair value accounting.

D)representationally faithful reporting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

21

When following the economic unit concept in the preparation of consolidated financial statements,the basis for valuing the noncontrolling interest in net assets is the:

A)book values of subsidiary assets and liabilities.

B)fair values of subsidiary assets and liabilities.

C)general price level adjusted values of subsidiary assets and liabilities.

D)fair values of parent company assets and liabilities.

A)book values of subsidiary assets and liabilities.

B)fair values of subsidiary assets and liabilities.

C)general price level adjusted values of subsidiary assets and liabilities.

D)fair values of parent company assets and liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

22

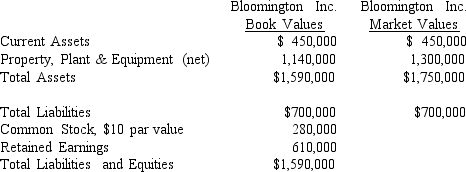

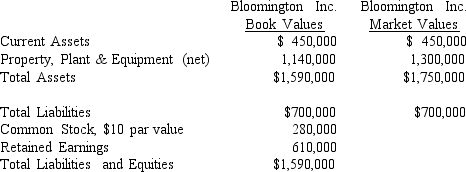

Eden Company is trying to decide whether to acquire Bloomington Inc.The following balance sheet for Bloomington Inc.provides information about book values.Estimated market values are also listed,based upon Eden Company's appraisals.

Eden Company expects that Bloomington will earn approximately $290,000 per year in net income over the next five years.This income is higher than the 14% annual return on tangible assets considered to be the industry "norm."

Eden Company expects that Bloomington will earn approximately $290,000 per year in net income over the next five years.This income is higher than the 14% annual return on tangible assets considered to be the industry "norm."

Required:

A.Compute an estimation of goodwill based on the information above that Eden might be willing to pay (include in its purchase price),under each of the following additional assumptions:

(1)Eden is willing to pay for excess earnings for an expected life of 4 years (undiscounted).

(2)Eden is willing to pay for excess earnings for an expected life of 4 years,which should be

capitalized at the industry normal rate of return.

(3)Excess earnings are expected to last indefinitely,but Eden demands a higher rate of return of

20% because of the risk involved.

B.Determine the amount of goodwill to be recorded on the books if Eden pays $1,300,000 cash and assumes Bloomington's liabilities.

Eden Company expects that Bloomington will earn approximately $290,000 per year in net income over the next five years.This income is higher than the 14% annual return on tangible assets considered to be the industry "norm."

Eden Company expects that Bloomington will earn approximately $290,000 per year in net income over the next five years.This income is higher than the 14% annual return on tangible assets considered to be the industry "norm."Required:

A.Compute an estimation of goodwill based on the information above that Eden might be willing to pay (include in its purchase price),under each of the following additional assumptions:

(1)Eden is willing to pay for excess earnings for an expected life of 4 years (undiscounted).

(2)Eden is willing to pay for excess earnings for an expected life of 4 years,which should be

capitalized at the industry normal rate of return.

(3)Excess earnings are expected to last indefinitely,but Eden demands a higher rate of return of

20% because of the risk involved.

B.Determine the amount of goodwill to be recorded on the books if Eden pays $1,300,000 cash and assumes Bloomington's liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

23

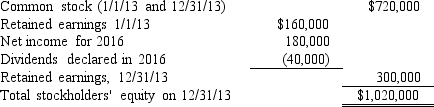

Park Company acquired an 80% interest in the common stock of Southdale Company for $1,540,000 on July 1,2016.Southdale Company's stockholders' equity on that date consisted of:

Required:

Required:

Compute the total noncontrolling interest to be reported in the consolidated balance sheet assuming the:

(1)parent company concept.

(2)economic unit concept.

Required:

Required:Compute the total noncontrolling interest to be reported in the consolidated balance sheet assuming the:

(1)parent company concept.

(2)economic unit concept.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

24

According to the economic unit concept,the primary purpose of consolidated financial statements is to provide information that is relevant to:

A)majority stockholders.

B)minority stockholders.

C)creditors.

D)both majority and minority stockholders.

A)majority stockholders.

B)minority stockholders.

C)creditors.

D)both majority and minority stockholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

25

The view that only the parent company's share of the unrealized intercompany profit recognized by the selling affiliate that remains in assets should be eliminated in the preparation of consolidated financial statements is consistent with the:

A)economic unit concept.

B)current practice concept.

C)parent company concept.

D)historical cost company concept.

A)economic unit concept.

B)current practice concept.

C)parent company concept.

D)historical cost company concept.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

26

Estimating the value of goodwill to be included in an offering price can be done under several alternative methods.The excess earnings approach is frequently used.Identify the steps used in this approach to estimate goodwill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

27

The two alternative views of consolidated financial statements are the parent company concept and the economic entity concept.Briefly explain the differences between the concepts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

28

The parent company concept adjusts subsidiary net asset values for the:

A)differences between cost and fair value.

B)differences between cost and book value.

C)total fair value implied by the price paid by the parent.

D)total cost implied by the price paid by the parent.

A)differences between cost and fair value.

B)differences between cost and book value.

C)total fair value implied by the price paid by the parent.

D)total cost implied by the price paid by the parent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following statements is correct?

A)The economic unit concept suggests partial elimination of unrealized intercompany profits.

B)The parent company concept suggests partial elimination of unrealized intercompany profits.

C)The economic unit concept suggests no elimination of unrealized intercompany profits.

D)The parent company concept suggests total elimination of unrealized intercompany profits.

A)The economic unit concept suggests partial elimination of unrealized intercompany profits.

B)The parent company concept suggests partial elimination of unrealized intercompany profits.

C)The economic unit concept suggests no elimination of unrealized intercompany profits.

D)The parent company concept suggests total elimination of unrealized intercompany profits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

30

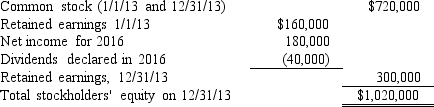

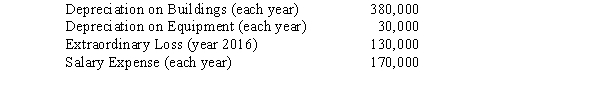

The following balances were taken from the records of S Company:

P Company purchased 75% of S Company's common stock on January 1,2014 for $900,000.The difference between implied value and book value is attributable to assets with a remaining useful life on January 1,2016 of ten years.

P Company purchased 75% of S Company's common stock on January 1,2014 for $900,000.The difference between implied value and book value is attributable to assets with a remaining useful life on January 1,2016 of ten years.

Required:

A.Compute the difference between cost/(implied)and book value applying:

1.Parent company theory.

2.Economic unit theory.

B.Assuming the economic unit theory:

1.Compute noncontrolling interest in consolidated income for 2016.

2.Compute noncontrolling interest in net assets on December 31,2016.

P Company purchased 75% of S Company's common stock on January 1,2014 for $900,000.The difference between implied value and book value is attributable to assets with a remaining useful life on January 1,2016 of ten years.

P Company purchased 75% of S Company's common stock on January 1,2014 for $900,000.The difference between implied value and book value is attributable to assets with a remaining useful life on January 1,2016 of ten years.Required:

A.Compute the difference between cost/(implied)and book value applying:

1.Parent company theory.

2.Economic unit theory.

B.Assuming the economic unit theory:

1.Compute noncontrolling interest in consolidated income for 2016.

2.Compute noncontrolling interest in net assets on December 31,2016.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

31

The view that consolidated financial statements represent those of a single economic entity with several classes of stockholder interest is consistent with the:

A)parent company concept.

B)current practice concept.

C)historical cost company concept.

D)economic unit concept.

A)parent company concept.

B)current practice concept.

C)historical cost company concept.

D)economic unit concept.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

32

The view that the noncontrolling interest in income reflects the noncontrolling stockholders' allocated share of consolidated income is consistent with the:

A)economic unit concept.

B)parent company concept.

C)current practice concept.

D)historical cost company concept.

A)economic unit concept.

B)parent company concept.

C)current practice concept.

D)historical cost company concept.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

33

When following the parent company concept in the preparation of consolidated financial statements,noncontrolling interest in combined income is considered a(n):

A)prorated share of the combined income.

B)addition to combined income to arrive at consolidated net income.

C)expense deducted from combined income to arrive at consolidated net income.

D)deduction from current assets in the balance sheet.

A)prorated share of the combined income.

B)addition to combined income to arrive at consolidated net income.

C)expense deducted from combined income to arrive at consolidated net income.

D)deduction from current assets in the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

34

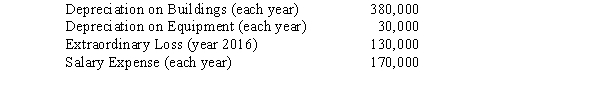

Hopkins Company is considering the acquisition of Richfield,Inc.To assess the amount it might be willing to pay,Hopkins makes the following computations and assumptions.

A.Richfield,Inc.has identifiable assets with a total fair value of $6,000,000 and liabilities of $3,700,000.The assets include office equipment with a fair value approximating book value,buildings with a fair value 25% higher than book value,and land with a fair value 50% higher than book value.The remaining lives of the assets are deemed to be approximately equal to those used by Richfield,Inc.

B.Richfield,Inc.'s pretax incomes for the years 2014 through 2016 were $470,000,$570,000,and $370,000,respectively.Hopkins believes that an average of these earnings represents a fair estimate of annual earnings for the indefinite future.However,it may need to consider adjustments for the following items included in pretax earnings:

C.The normal rate of return on net assets for the industry is 15%.

C.The normal rate of return on net assets for the industry is 15%.

Required:

A.Assume that Hopkins feels that it must earn a 20% return on its investment,and that goodwill is determined by capitalizing excess earnings.Based on these assumptions,calculate a reasonable offering price for Richfield,Inc.Indicate how much of the price consists of goodwill.

B.Assume that Hopkins feels that it must earn a 15% return on its investment,but that average excess earnings are to be capitalized for five years only.Based on these assumptions,calculate a reasonable offering price for Richfield,Inc.Indicate how much of the price consists of goodwill.

A.Richfield,Inc.has identifiable assets with a total fair value of $6,000,000 and liabilities of $3,700,000.The assets include office equipment with a fair value approximating book value,buildings with a fair value 25% higher than book value,and land with a fair value 50% higher than book value.The remaining lives of the assets are deemed to be approximately equal to those used by Richfield,Inc.

B.Richfield,Inc.'s pretax incomes for the years 2014 through 2016 were $470,000,$570,000,and $370,000,respectively.Hopkins believes that an average of these earnings represents a fair estimate of annual earnings for the indefinite future.However,it may need to consider adjustments for the following items included in pretax earnings:

C.The normal rate of return on net assets for the industry is 15%.

C.The normal rate of return on net assets for the industry is 15%.Required:

A.Assume that Hopkins feels that it must earn a 20% return on its investment,and that goodwill is determined by capitalizing excess earnings.Based on these assumptions,calculate a reasonable offering price for Richfield,Inc.Indicate how much of the price consists of goodwill.

B.Assume that Hopkins feels that it must earn a 15% return on its investment,but that average excess earnings are to be capitalized for five years only.Based on these assumptions,calculate a reasonable offering price for Richfield,Inc.Indicate how much of the price consists of goodwill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

35

Under the economic unit concept,noncontrolling interest in net assets is treated as:

A)a liability.

B)an asset.

C)stockholders' equity.

D)an expense.

A)a liability.

B)an asset.

C)stockholders' equity.

D)an expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck