Deck 18: Investment

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/103

العب

ملء الشاشة (f)

Deck 18: Investment

1

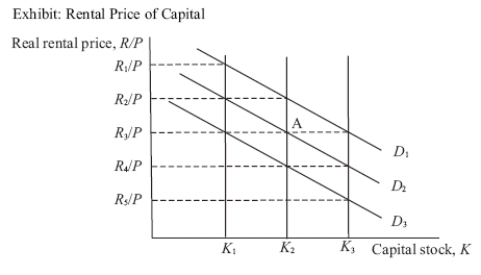

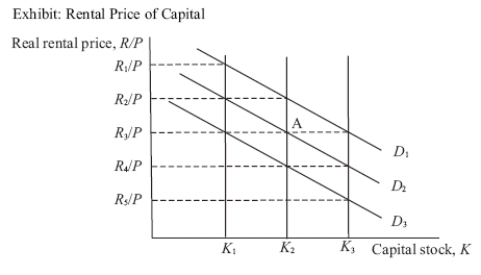

Use the following to answer questions :

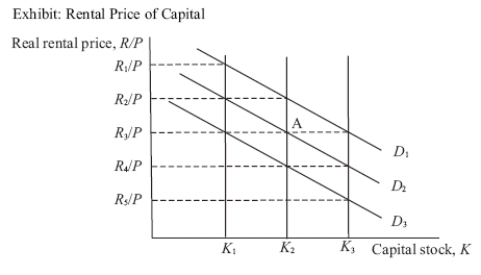

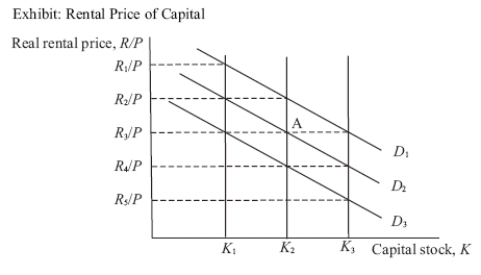

(Exhibit: Rental Price of Capital)Based on the graph,if the capital market is initially in equilibrium at A with real rental price R3/P and capital stock K2,then holding other factors constant,an improvement in technology that increases the marginal productivity of capital will move:

A) the demand curve from D2 to D1.

B) the demand curve from D2 to D3.

C) the supply of capital from K2 to K1.

D) the supply of capital from K2 to K3.

(Exhibit: Rental Price of Capital)Based on the graph,if the capital market is initially in equilibrium at A with real rental price R3/P and capital stock K2,then holding other factors constant,an improvement in technology that increases the marginal productivity of capital will move:

A) the demand curve from D2 to D1.

B) the demand curve from D2 to D3.

C) the supply of capital from K2 to K1.

D) the supply of capital from K2 to K3.

the demand curve from D2 to D1.

2

Investment spending is:

A) generally countercyclical.

B) generally procyclical.

C) unrelated to the business cycle.

D) generally procyclical for some components and generally countercyclical for others.

A) generally countercyclical.

B) generally procyclical.

C) unrelated to the business cycle.

D) generally procyclical for some components and generally countercyclical for others.

generally procyclical.

3

The investment spending component of GDP includes all of the following except:

A) business fixed investment.

B) net foreign investment.

C) residential investment.

D) inventory investment.

A) business fixed investment.

B) net foreign investment.

C) residential investment.

D) inventory investment.

net foreign investment.

4

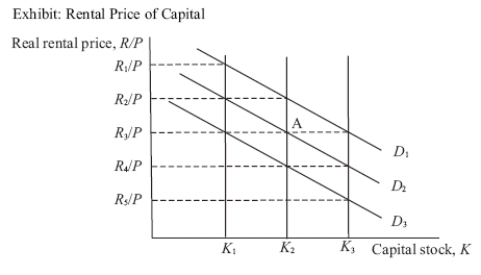

Use the following to answer questions :

(Exhibit: Rental Price of Capital)Based on the graph,if the capital market is initially in equilibrium at A with real rental price R3/P and capital stock K2,then holding other factors constant,an increase in the capital stock to K3 will change the real rental price of capital to:

A) R1/P.

B) R2/P.

C) R4/P.

D) R5/P.

(Exhibit: Rental Price of Capital)Based on the graph,if the capital market is initially in equilibrium at A with real rental price R3/P and capital stock K2,then holding other factors constant,an increase in the capital stock to K3 will change the real rental price of capital to:

A) R1/P.

B) R2/P.

C) R4/P.

D) R5/P.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

5

The rate of depreciation is the:

A) nominal interest rate times the purchase price of capital.

B) capital losses resulting from decreases in the price of capital.

C) fraction of the value of capital lost per period because of wear and tear.

D) change in the q value of the firm.

A) nominal interest rate times the purchase price of capital.

B) capital losses resulting from decreases in the price of capital.

C) fraction of the value of capital lost per period because of wear and tear.

D) change in the q value of the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

6

If the price index for capital goods is the same as the price index for other goods,an index of the real cost of capital for investment,in the absence of taxes,may be summarized as the:

A) nominal interest rate plus the depreciation rate.

B) real interest rate plus the depreciation rate.

C) purchase price of a capital good multiplied by the sum of the nominal interest rate plus the depreciation rate.

D) purchase price of a capital good multiplied by the sum of the real interest rate plus the depreciation rate.

A) nominal interest rate plus the depreciation rate.

B) real interest rate plus the depreciation rate.

C) purchase price of a capital good multiplied by the sum of the nominal interest rate plus the depreciation rate.

D) purchase price of a capital good multiplied by the sum of the real interest rate plus the depreciation rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

7

A firm renting out capital does not bear as cost the:

A) lost interest it could have earned by depositing the purchase price of the capital in a bank.

B) wear and tear on the capital.

C) wages of the labour that works with the capital.

D) capital loss or gain in the asset's value.

A) lost interest it could have earned by depositing the purchase price of the capital in a bank.

B) wear and tear on the capital.

C) wages of the labour that works with the capital.

D) capital loss or gain in the asset's value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

8

The most volatile component of real GDP is:

A) consumption spending.

B) government spending.

C) investment spending.

D) net exports.

A) consumption spending.

B) government spending.

C) investment spending.

D) net exports.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

9

In equilibrium,other things being equal,all of the following changes will increase the real rental price of capital except:

A) a lower quantity of labour employed.

B) a lower stock of capital.

C) better technology.

D) a higher labour-capital ratio.

A) a lower quantity of labour employed.

B) a lower stock of capital.

C) better technology.

D) a higher labour-capital ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

10

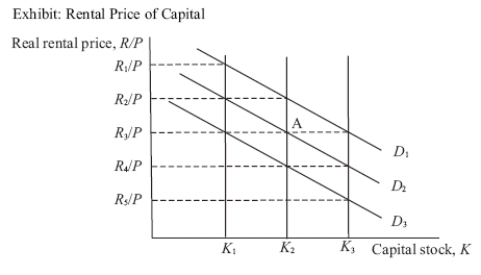

Use the following to answer questions :

(Exhibit: Rental Price of Capital)Based on the graph,if the capital market is initially in equilibrium at A with real rental price R3/P and capital stock K2,then holding other factors constant,an increase in the quantity of labour employed will move the real rental price of capital to:

A) R1/P.

B) R2/P.

C) R4/P.

D) R5/P.

(Exhibit: Rental Price of Capital)Based on the graph,if the capital market is initially in equilibrium at A with real rental price R3/P and capital stock K2,then holding other factors constant,an increase in the quantity of labour employed will move the real rental price of capital to:

A) R1/P.

B) R2/P.

C) R4/P.

D) R5/P.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

11

If a great wave of immigration increased employment in Canada,this wave would:

A) increase the marginal productivity of capital in Canada.

B) decrease the marginal productivity of capital in Canada.

C) leave the marginal productivity of capital in Canada unchanged.

D) increase the marginal productivity of capital in the country from which the immigrants came.

A) increase the marginal productivity of capital in Canada.

B) decrease the marginal productivity of capital in Canada.

C) leave the marginal productivity of capital in Canada unchanged.

D) increase the marginal productivity of capital in the country from which the immigrants came.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

12

According to the neoclassical model of investment,business fixed investment does not depend on:

A) the realized profits of firms.

B) the marginal product of capital.

C) the interest rate.

D) tax rules affecting firms.

A) the realized profits of firms.

B) the marginal product of capital.

C) the interest rate.

D) tax rules affecting firms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

13

If the capital stock is fixed and something happens to raise the marginal product of capital (MPK)for any given quantity of capital,then the real rental price of capital will:

A) remain the same.

B) rise.

C) fall.

D) fall and then rise.

A) remain the same.

B) rise.

C) fall.

D) fall and then rise.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

14

The standard model of business fixed investment is called the ______ of investment.

A) new classical model

B) neoclassical model

C) classical model

D) Keynesian model

A) new classical model

B) neoclassical model

C) classical model

D) Keynesian model

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

15

If the real rental price of capital is $10,000 per unit and the real cost of capital is $9,000 per unit,to maximize profits a firm should:

A) add to its capital stock.

B) let its capital stock shrink.

C) keep its capital stock unchanged.

D) reduce the real rental price of capital.

A) add to its capital stock.

B) let its capital stock shrink.

C) keep its capital stock unchanged.

D) reduce the real rental price of capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

16

The profit rate of a firm that rents capital is equal to:

A) the marginal product of capital minus the cost of capital.

B) the cost of capital minus the marginal product of capital.

C) zero.

D) a negative number,if it is adding to its capital stock.

A) the marginal product of capital minus the cost of capital.

B) the cost of capital minus the marginal product of capital.

C) zero.

D) a negative number,if it is adding to its capital stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

17

Assuming that the purchase price of capital goods is the same as the price of other goods,and that there are no taxes,the rental cost of capital for investment may be summarized as the:

A) nominal interest rate plus the depreciation rate.

B) real interest rate plus the depreciation rate.

C) purchase price of a capital good multiplied by the sum of the nominal interest rate plus the depreciation rate.

D) purchase price of a capital good multiplied by the sum of the real interest rate plus the depreciation rate.

A) nominal interest rate plus the depreciation rate.

B) real interest rate plus the depreciation rate.

C) purchase price of a capital good multiplied by the sum of the nominal interest rate plus the depreciation rate.

D) purchase price of a capital good multiplied by the sum of the real interest rate plus the depreciation rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

18

Business fixed investment includes:

A) rental housing that landlords buy to rent out.

B) goods businesses put aside in fixed storage facilities,including materials and supplies.

C) the fixed cost of borrowing that businesses pay for new equipment.

D) equipment and structures that businesses buy to use in production.

A) rental housing that landlords buy to rent out.

B) goods businesses put aside in fixed storage facilities,including materials and supplies.

C) the fixed cost of borrowing that businesses pay for new equipment.

D) equipment and structures that businesses buy to use in production.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

19

The real cost of capital is the:

A) purchase price of a unit of capital divided by the price level.

B) purchase price of a unit of capital minus the rate of inflation.

C) cost of a unit of capital less the marginal product of capital.

D) cost of buying and renting out a unit of capital measured in units of the economy's output.

A) purchase price of a unit of capital divided by the price level.

B) purchase price of a unit of capital minus the rate of inflation.

C) cost of a unit of capital less the marginal product of capital.

D) cost of buying and renting out a unit of capital measured in units of the economy's output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

20

Net investment is the:

A) business fixed investment minus inventory investment.

B) change in the stock of capital.

C) gross investment minus the rate of inflation.

D) gross investment plus the replacement of depreciated capital.

A) business fixed investment minus inventory investment.

B) change in the stock of capital.

C) gross investment minus the rate of inflation.

D) gross investment plus the replacement of depreciated capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

21

Interest rates affect investment spending and,as a result,the steady-state capital stock.I: An increase in interest rates lowers the steady-state capital stock.II: With a Cobb-Douglas production function,the higher is the capital-share parameter,the bigger is the change in the steady-state capital stock.

A) I is true; II is not.

B) II is true; I is not.

C) Both I and II are true.

D) Neither I nor II is true.

A) I is true; II is not.

B) II is true; I is not.

C) Both I and II are true.

D) Neither I nor II is true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

22

If the replacement cost of installed capital equals $20 trillion and the market value of installed capital equals $25 trillion,then according to q theory,businesses should:

A) add to capital stock.

B) let capital stock shrink.

C) keep capital stock unchanged.

D) reduce product prices to increase profits.

A) add to capital stock.

B) let capital stock shrink.

C) keep capital stock unchanged.

D) reduce product prices to increase profits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

23

The corporate tax system affects investment spending.I: More generous depreciation allowances lower the rental cost of capital.II: More generous depreciation allowances increase the effectiveness of a corporate tax rate cut as a mechanism for stimulating investment spending.

A) I is true; II is not.

B) II is true; I is not.

C) Both I and II are true.

D) Neither I nor II is true.

A) I is true; II is not.

B) II is true; I is not.

C) Both I and II are true.

D) Neither I nor II is true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

24

If firms are earning a profit,then this raises the ______ value of installed capital and implies a ______ value of Tobin's q.

A) market; low

B) market; high

C) replacement; low

D) replacement; high

A) market; low

B) market; high

C) replacement; low

D) replacement; high

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

25

If Tobin's q is greater than 1,then managers should:

A) increase the capital stock of the firm.

B) maintain the existing capital stock of the firm.

C) allow inventories to run down.

D) decrease the capital stock of the firm.

A) increase the capital stock of the firm.

B) maintain the existing capital stock of the firm.

C) allow inventories to run down.

D) decrease the capital stock of the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

26

A capital rental firm makes a profit if the ______ is ______ the cost of capital.

A) real rental price of capital; less than

B) equilibrium marginal product of capital; less than

C) equilibrium marginal product of capital; equal to

D) equilibrium marginal product of capital; greater than

A) real rental price of capital; less than

B) equilibrium marginal product of capital; less than

C) equilibrium marginal product of capital; equal to

D) equilibrium marginal product of capital; greater than

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

27

The corporate profit tax is a tax on the:

A) earnings of employees of a corporation.

B) dividends paid to the shareholders of a corporation.

C) earnings of the managers of a corporation.

D) profits of a corporation.

A) earnings of employees of a corporation.

B) dividends paid to the shareholders of a corporation.

C) earnings of the managers of a corporation.

D) profits of a corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

28

If corporate profit were defined as the real price of capital minus the properly defined cost of capital,then:

A) having a tax on corporate profits would be more favourable to investment than having no tax at all.

B) having a tax on corporate profits would be less favourable to investment than having no tax at all.

C) having a tax on corporate profits would leave investment incentives the same as having no tax at all.

D) whether a corporate profits tax was more or less favourable for investment than no tax at all would depend on the rate of tax.

A) having a tax on corporate profits would be more favourable to investment than having no tax at all.

B) having a tax on corporate profits would be less favourable to investment than having no tax at all.

C) having a tax on corporate profits would leave investment incentives the same as having no tax at all.

D) whether a corporate profits tax was more or less favourable for investment than no tax at all would depend on the rate of tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

29

The neoclassical model of investment says investment depends negatively on the real interest rate because an increase in the real interest rate:

A) raises the cost of capital.

B) lowers the marginal product of capital.

C) lowers the real rental price of capital.

D) slows down the speed at which net investment responds to the incentive to invest.

A) raises the cost of capital.

B) lowers the marginal product of capital.

C) lowers the real rental price of capital.

D) slows down the speed at which net investment responds to the incentive to invest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

30

The investment tax credit:

A) enables a firm to deduct a certain proportion of each dollar spent on capital goods from its profits.

B) enables a firm to deduct a certain proportion of each dollar spent on capital goods from its tax bill.

C) reduces the corporate tax rate in proportion to each dollar spent on capital goods.

D) allows a firm to count a certain proportion of each dollar spent on capital goods as depreciation expense.

A) enables a firm to deduct a certain proportion of each dollar spent on capital goods from its profits.

B) enables a firm to deduct a certain proportion of each dollar spent on capital goods from its tax bill.

C) reduces the corporate tax rate in proportion to each dollar spent on capital goods.

D) allows a firm to count a certain proportion of each dollar spent on capital goods as depreciation expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

31

One possible disadvantage of a cyclical investment subsidy such as the former Swedish Investment Funds System is that:

A) it is believed that investment does not respond to changes in the cost of capital.

B) if the economy begins to slow down,firms may anticipate a future subsidy and delay investment.

C) consumption should be encouraged,not investment.

D) most economists believe that the government should not try to control the business cycle.

A) it is believed that investment does not respond to changes in the cost of capital.

B) if the economy begins to slow down,firms may anticipate a future subsidy and delay investment.

C) consumption should be encouraged,not investment.

D) most economists believe that the government should not try to control the business cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

32

______ is a share of ownership in a corporation,and the ______ market is the market where these shares are traded.

A) Capital; capital

B) A dividend; stock

C) A bond; capital

D) Stock; stock

A) Capital; capital

B) A dividend; stock

C) A bond; capital

D) Stock; stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

33

According to the neoclassical model of investment,when the real interest rate increases,business fixed investment ______ because the ______ of capital increases.

A) increases; marginal product

B) increases; cost of

C) decreases; marginal product

D) decreases; cost of

A) increases; marginal product

B) increases; cost of

C) decreases; marginal product

D) decreases; cost of

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

34

Other things being equal,Tobin's stock market valuation ratio q will rise if:

A) stock prices fall.

B) the replacement cost of capital rises.

C) more capital is installed.

D) stock prices rise.

A) stock prices fall.

B) the replacement cost of capital rises.

C) more capital is installed.

D) stock prices rise.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

35

Because corporate profit tax laws do not define profit to be the same as economic profit,many economists believe that the corporate profit tax ______ investment.

A) encourages

B) discourages

C) does not affect

D) promotes excessive

A) encourages

B) discourages

C) does not affect

D) promotes excessive

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

36

When the capital stock reaches a steady state,the:

A) marginal product of capital must exceed the real cost of capital.

B) marginal product of capital must equal the real cost of capital.

C) real cost of capital must exceed the marginal product of capital.

D) real cost of capital must exceed the real rental price of capital.

A) marginal product of capital must exceed the real cost of capital.

B) marginal product of capital must equal the real cost of capital.

C) real cost of capital must exceed the marginal product of capital.

D) real cost of capital must exceed the real rental price of capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

37

Other things being equal,the neoclassical model of investment predicts that net investment will increase when the:

A) marginal product of capital falls.

B) price of new capital goods rises.

C) real interest rate falls.

D) depreciation rate rises.

A) marginal product of capital falls.

B) price of new capital goods rises.

C) real interest rate falls.

D) depreciation rate rises.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

38

The function showing total spending on investment would be shifted inward and to the left by:

A) a technological innovation that increases the production function parameter A.

B) any event that raises the marginal product of capital.

C) any event that raises the purchase price of capital.

D) an accident that destroyed one-quarter of the Canadian capital stock while leaving the labour supply intact.

A) a technological innovation that increases the production function parameter A.

B) any event that raises the marginal product of capital.

C) any event that raises the purchase price of capital.

D) an accident that destroyed one-quarter of the Canadian capital stock while leaving the labour supply intact.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

39

Because of the way that Canadian tax law defines depreciation,depreciation for tax purposes is:

A) always less than true economic depreciation.

B) always greater than true economic depreciation.

C) always equal to true economic depreciation.

D) sometimes greater than true economic depreciation and sometimes less.

A) always less than true economic depreciation.

B) always greater than true economic depreciation.

C) always equal to true economic depreciation.

D) sometimes greater than true economic depreciation and sometimes less.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

40

Tobin's q equals the:

A) cost of buying and renting out one unit of capital measured in units of the economy's output.

B) marginal product of capital minus the cost of capital.

C) ratio of the replacement value of installed capital to the market value of installed capital.

D) ratio of the market value of installed capital to the replacement cost of installed capital.

A) cost of buying and renting out one unit of capital measured in units of the economy's output.

B) marginal product of capital minus the cost of capital.

C) ratio of the replacement value of installed capital to the market value of installed capital.

D) ratio of the market value of installed capital to the replacement cost of installed capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

41

The existence of financing constraints makes investment:

A) more sensitive to current conditions.

B) less sensitive to current conditions.

C) spending follow a random walk.

D) spending increase during recessions.

A) more sensitive to current conditions.

B) less sensitive to current conditions.

C) spending follow a random walk.

D) spending increase during recessions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

42

According to Keynes,movements in stock prices:

A) follow a random walk.

B) reflect rational valuations of underlying economic fundamentals.

C) result when new information becomes available.

D) are often driven by irrational waves of optimism and pessimism.

A) follow a random walk.

B) reflect rational valuations of underlying economic fundamentals.

C) result when new information becomes available.

D) are often driven by irrational waves of optimism and pessimism.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

43

According to the efficient-market hypothesis,changes in stock prices are:

A) driven by irrational waves of optimism.

B) driven by irrational waves of pessimism.

C) rational reflections of underlying economic fundamentals.

D) possible to predict from available information.

A) driven by irrational waves of optimism.

B) driven by irrational waves of pessimism.

C) rational reflections of underlying economic fundamentals.

D) possible to predict from available information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

44

According to the efficient-market hypothesis,stock price changes reflect ______,but according to Keynes,stock price changes often reflect ______.

A) the inventory accelerator; changes in Tobin's q

B) changes in the real cost of capital; financing constraints

C) changes in the underlying economic fundamentals; irrational waves of optimism or pessimism

D) reductions in investment tax credits; the use of historical cost rather than replacement cost in computing depreciation costs

A) the inventory accelerator; changes in Tobin's q

B) changes in the real cost of capital; financing constraints

C) changes in the underlying economic fundamentals; irrational waves of optimism or pessimism

D) reductions in investment tax credits; the use of historical cost rather than replacement cost in computing depreciation costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

45

The demand for housing is brought into equilibrium with the existing stock of housing by changes in the:

A) real interest rate.

B) nominal interest rate.

C) relative price of housing.

D) overall price level.

A) real interest rate.

B) nominal interest rate.

C) relative price of housing.

D) overall price level.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

46

Holding other factors constant,a decline in the real interest rate will ______ the price of housing and ______ the flow of residential housing investment.

A) increase; increase

B) increase; decrease

C) decrease; increase

D) decrease; decrease

A) increase; increase

B) increase; decrease

C) decrease; increase

D) decrease; decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

47

In the long run,credit crunches:

A) have no lasting economic effects.

B) are offset by periods of credit ease.

C) improve the allocation of national saving,improving potential output.

D) misallocate national saving,reducing potential output.

A) have no lasting economic effects.

B) are offset by periods of credit ease.

C) improve the allocation of national saving,improving potential output.

D) misallocate national saving,reducing potential output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

48

The price of housing relative to the price of other goods is determined in the short run by the:

A) cost of construction.

B) demand for the services of homes.

C) supply of existing homes.

D) supply and demand for the existing stock of homes.

A) cost of construction.

B) demand for the services of homes.

C) supply of existing homes.

D) supply and demand for the existing stock of homes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

49

For a firm facing financing constraints on its investment spending,the most important determinant of how much it invests is the:

A) firm's expected future profitability.

B) firm's current profitability.

C) interest rate.

D) firm's cost of capital.

A) firm's expected future profitability.

B) firm's current profitability.

C) interest rate.

D) firm's cost of capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

50

James Tobin reasoned that:

A) the stock market is a random walk.

B) if the stock market values capital at less than its replacement cost,the stock market will go up.

C) if the stock market values capital at less than its replacement cost,the stock market will go down.

D) if the stock market values capital at less than its replacement cost,the firm's managers will not replace capital as it wears out.

A) the stock market is a random walk.

B) if the stock market values capital at less than its replacement cost,the stock market will go up.

C) if the stock market values capital at less than its replacement cost,the stock market will go down.

D) if the stock market values capital at less than its replacement cost,the firm's managers will not replace capital as it wears out.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

51

Holding other factors constant,the decline in aggregate income during a recession will ______ the price of housing and ______ the flow of residential housing investment.

A) increase; increase

B) increase; decrease

C) decrease; increase

D) decrease; decrease

A) increase; increase

B) increase; decrease

C) decrease; increase

D) decrease; decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

52

The theory behind Tobin's q indicates that:

A) the stock market may be expected to predict every turning point in real GDP.

B) the stock market may be expected to be closely tied to fluctuations in output and employment.

C) every time investment goes up we would expect the stock market to go down.

D) the stock market and the economy are basically independent of each other.

A) the stock market may be expected to predict every turning point in real GDP.

B) the stock market may be expected to be closely tied to fluctuations in output and employment.

C) every time investment goes up we would expect the stock market to go down.

D) the stock market and the economy are basically independent of each other.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

53

If stock prices follow a random walk,then:

A) changes in stock prices cannot be predicted from available information.

B) managed mutual funds should outperform index funds.

C) it would be easy to beat the market by buying undervalued stocks and selling overvalued stocks.

D) stock prices fluctuate for no good reason.

A) changes in stock prices cannot be predicted from available information.

B) managed mutual funds should outperform index funds.

C) it would be easy to beat the market by buying undervalued stocks and selling overvalued stocks.

D) stock prices fluctuate for no good reason.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

54

During a credit crunch,financing constraints become ______ prevalent and investment spending ______.

A) more; increases

B) more; decreases

C) less; increases

D) less; decreases

A) more; increases

B) more; decreases

C) less; increases

D) less; decreases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

55

Holding other factors constant,an increase in population due to a large increase in immigrants will ______ the price of housing and ______ the flow of residential housing investment.

A) increase; increase

B) increase; decrease

C) decrease; increase

D) decrease; decrease

A) increase; increase

B) increase; decrease

C) decrease; increase

D) decrease; decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

56

In the mortgage market,a rise in the real interest rate:

A) lowers housing demand,housing prices,and residential investment.

B) raises housing demand,housing prices,and residential investment.

C) lowers housing demand and residential investment but raises housing prices.

D) raises housing demand but lowers housing prices and residential investment.

A) lowers housing demand,housing prices,and residential investment.

B) raises housing demand,housing prices,and residential investment.

C) lowers housing demand and residential investment but raises housing prices.

D) raises housing demand but lowers housing prices and residential investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

57

According to the efficient-market hypothesis,changes in stock prices:

A) follow a random walk.

B) can be predicted from available information.

C) are driven by irrational waves of optimism and pessimism.

D) are based on what investors expect other investors to pay.

A) follow a random walk.

B) can be predicted from available information.

C) are driven by irrational waves of optimism and pessimism.

D) are based on what investors expect other investors to pay.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

58

Residential investment equals the:

A) stock of existing housing.

B) flow of new housing.

C) demand for housing.

D) imputed rent from housing.

A) stock of existing housing.

B) flow of new housing.

C) demand for housing.

D) imputed rent from housing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

59

Residential investment spending includes spending on:

A) new housing that people buy to live in and that landlords buy to rent out.

B) new and existing housing.

C) all houses purchased less the value of mortgages used to finance the houses.

D) only those houses that landlords buy to rent out.

A) new housing that people buy to live in and that landlords buy to rent out.

B) new and existing housing.

C) all houses purchased less the value of mortgages used to finance the houses.

D) only those houses that landlords buy to rent out.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

60

During a banking crisis and credit crunch,the ______ curve shifts leftward,resulting in a(n)______ in aggregate demand,production,and employment.

A) IS; increase

B) IS; decrease

C) LM; increase

D) LM; decrease

A) IS; increase

B) IS; decrease

C) LM; increase

D) LM; decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

61

Inventory investment is the ______ component of aggregate spending and very ______.

A) largest; volatile

B) largest; stable

C) smallest; volatile

D) smallest; stable

A) largest; volatile

B) largest; stable

C) smallest; volatile

D) smallest; stable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

62

The opportunity cost of holding inventories is the:

A) real interest rate.

B) nominal interest rate.

C) raw materials used up in the production of inventories.

D) labour used in the production of inventories.

A) real interest rate.

B) nominal interest rate.

C) raw materials used up in the production of inventories.

D) labour used in the production of inventories.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

63

In the accelerator model of inventory investment,when there is no change in output,inventory investment is:

A) positive.

B) zero.

C) negative.

D) declining.

A) positive.

B) zero.

C) negative.

D) declining.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

64

According to the accelerator model of inventory investment,if firms desire to hold 25 percent of output as inventories,and output increases by $1 trillion,then inventory investment will increase by:

A) $0.25 trillion.

B) $1 trillion.

C) $1.25 trillion.

D) $4 trillion.

A) $0.25 trillion.

B) $1 trillion.

C) $1.25 trillion.

D) $4 trillion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

65

The inventories as a factor of production motive for holding inventories suggests that:

A) firms hold inventories in order to produce more output.

B) when sales are low,firms produce more than they sell and put the extra goods in inventories.

C) firms hold inventories to avoid losing sales.

D) when a product is only partly completed,its components are counted as part of the firm's inventory.

A) firms hold inventories in order to produce more output.

B) when sales are low,firms produce more than they sell and put the extra goods in inventories.

C) firms hold inventories to avoid losing sales.

D) when a product is only partly completed,its components are counted as part of the firm's inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

66

Inventory investment,at least in theory,should:

A) rise when the real interest rate rises,other things being equal.

B) not depend on the real interest rate,other things being equal.

C) fall when the real interest rate rises,other things being equal.

D) depend only on the change in real GDP.

A) rise when the real interest rate rises,other things being equal.

B) not depend on the real interest rate,other things being equal.

C) fall when the real interest rate rises,other things being equal.

D) depend only on the change in real GDP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

67

When banks make rules on maximum permissible mortgage payments for borrowers,they use:

A) nominal interest rates,and economists feel that this practice is appropriate.

B) real interest rates,and economists feel that this practice is appropriate.

C) real interest rates,but economists feel that this practice is inappropriate.

D) nominal interest rates,but economists feel that this practice is inappropriate.

A) nominal interest rates,and economists feel that this practice is appropriate.

B) real interest rates,and economists feel that this practice is appropriate.

C) real interest rates,but economists feel that this practice is inappropriate.

D) nominal interest rates,but economists feel that this practice is inappropriate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

68

The stock-out avoidance motive for holding inventories suggests that:

A) firms hold inventories in order to produce more output.

B) when sales are low,firms produce more than they sell and put the extra goods in inventories.

C) firms hold inventories to avoid losing sales.

D) when a product is only partly completed,its components are counted as part of the firm's inventory.

A) firms hold inventories in order to produce more output.

B) when sales are low,firms produce more than they sell and put the extra goods in inventories.

C) firms hold inventories to avoid losing sales.

D) when a product is only partly completed,its components are counted as part of the firm's inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

69

According to the accelerator model of inventory investment,inventory investment is ______ when the economy falls into a recession.

A) positive

B) negative

C) zero

D) declining

A) positive

B) negative

C) zero

D) declining

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

70

Economic booms should stimulate investment spending because during booms:

A) the real interest rate increases.

B) corporate tax rates usually increase.

C) the purchase price of capital increases.

D) higher levels of employment increase the marginal product of capital.

A) the real interest rate increases.

B) corporate tax rates usually increase.

C) the purchase price of capital increases.

D) higher levels of employment increase the marginal product of capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

71

A toy manufacturer accumulates inventories because of the uncertainty of the demand for their product at Christmas and the desire not to lose any potential sales.This is an example of the ______ motive for holding inventories.

A) production-smoothing

B) inventories as a factor of production

C) stock-out avoidance

D) work in progress

A) production-smoothing

B) inventories as a factor of production

C) stock-out avoidance

D) work in progress

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

72

The work in process motive for holding inventories suggests that:

A) firms hold inventories in order to produce more output.

B) when sales are low,firms produce more than they sell and put the extra goods in inventories.

C) firms hold inventories to avoid losing sales.

D) when a product is only partly completed,its components are counted as part of the firm's inventory.

A) firms hold inventories in order to produce more output.

B) when sales are low,firms produce more than they sell and put the extra goods in inventories.

C) firms hold inventories to avoid losing sales.

D) when a product is only partly completed,its components are counted as part of the firm's inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

73

The production-smoothing motive for holding inventories suggests that:

A) firms hold inventories in order to produce more output.

B) when sales are low,firms produce more than they sell and put the extra goods in inventories.

C) firms hold inventories to avoid losing sales.

D) when a product is only partly completed,its components are counted as part of the firm's inventory.

A) firms hold inventories in order to produce more output.

B) when sales are low,firms produce more than they sell and put the extra goods in inventories.

C) firms hold inventories to avoid losing sales.

D) when a product is only partly completed,its components are counted as part of the firm's inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

74

Inventory investment includes spending on:

A) equipment and structures that businesses buy to use in production.

B) goods that businesses put aside in storage,including materials and supplies,work in progress,and finished goods.

C) goods that businesses produce to sell to other businesses.

D) capital equipment less depreciation expense.

A) equipment and structures that businesses buy to use in production.

B) goods that businesses put aside in storage,including materials and supplies,work in progress,and finished goods.

C) goods that businesses produce to sell to other businesses.

D) capital equipment less depreciation expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

75

In the accelerator model of inventory investment,it is assumed that the stock of inventories firms want to hold is:

A) constant.

B) a constant proportion of output.

C) a proportion of output that decreases as output increases.

D) a proportion of output that increases as output increases.

A) constant.

B) a constant proportion of output.

C) a proportion of output that decreases as output increases.

D) a proportion of output that increases as output increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

76

Holding other factors constant,a fall in the interest rate will ______ inventory investment.

A) increase

B) decrease

C) have no impact on

D) sometimes increase and sometimes decrease

A) increase

B) decrease

C) have no impact on

D) sometimes increase and sometimes decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

77

The inventories of a company that manufactures snow blowers increase in the summer and decline in the winter.This example is most consistent with which of the following explanations for holding inventories?

A) production smoothing

B) inventories as factors of production

C) stock-out avoidance

D) work in progress

A) production smoothing

B) inventories as factors of production

C) stock-out avoidance

D) work in progress

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

78

The corporate income tax ______ business fixed investment,and the personal income tax ______ residential investment.

A) encourages; encourages

B) encourages; discourages

C) discourages; encourages

D) discourages; discourages

A) encourages; encourages

B) encourages; discourages

C) discourages; encourages

D) discourages; discourages

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

79

The investment demand function would shift for all of the following reasons except:

A) an improvement in technology raises the marginal product of capital.

B) an increase in population raises the demand for housing.

C) an increase in government spending raises the real interest rate.

D) the investment tax credit is reinstated.

A) an improvement in technology raises the marginal product of capital.

B) an increase in population raises the demand for housing.

C) an increase in government spending raises the real interest rate.

D) the investment tax credit is reinstated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

80

The real interest rate should be inversely related to investment in:

A) plant and equipment,home building,and inventories.

B) plant and equipment and home building,but not inventories.

C) plant and equipment and inventories,but not home building.

D) inventories and home building,but not plant and equipment.

A) plant and equipment,home building,and inventories.

B) plant and equipment and home building,but not inventories.

C) plant and equipment and inventories,but not home building.

D) inventories and home building,but not plant and equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck