Deck 13: Risk and Capital Budgeting

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/90

العب

ملء الشاشة (f)

Deck 13: Risk and Capital Budgeting

1

A basic assumption in financial theory is that most investors and managers are risk seekers.

False

2

In order to reduce risk, one should diversify into areas that are positively correlated with current areas of involvement.

False

3

The coefficient of correlation represents the standard deviation divided by the expected value.

False

4

If we are risk-averse, a risky investment with an 8% return will be preferred over a 10% risk-free investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

5

A firm might be willing to accept high risk in a given investment if the portfolio effect (for the whole firm) were beneficial.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

6

Regardless of risk, no projects should be accepted unless they earn more than the firm's weighted average cost of capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

7

Decision trees present a tabular or graphical comparison of projected decision outcomes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

8

Projects that are totally uncorrelated provide some overall reduction in portfolio risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

9

Simulation models allow the analyst to test possible changes in the variables used in the model.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

10

The expected value is a weighted average of the outcomes multiplied by their probabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

11

As the time horizon increases, the standard deviation for each forecast of cash flow normally increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

12

Expected value is defined as DP where the outcomes are D and probabilities are P.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

13

Risk is not only measured in terms of losses, but also in terms of variability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

14

As the time horizon becomes shorter, more uncertainty enters the forecast.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

15

A common stock with a beta of 1.0 is said to be of equal risk with the market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

16

The cost of capital is assumed to contain no risk for the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

17

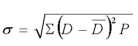

If possible outcomes are D and probabilities are P, the standard deviation is defined as

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

18

Computers are helpful for "what if" simulations, but so far they are not able to assess project risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

19

Generally, the higher the coefficient of variation a project has, the higher the discount rate it should be assigned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

20

Investment A may have a higher standard deviation than investment B and still have less risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

21

The higher the possible outcomes fall from the expected outcome of an investment, the higher the risk and lower the required rate of return by investors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

22

Assume that Widget Repair Corporation provides services to 100 customers whose decision to change suppliers is uncorrelated. The portfolio effect suggests that the entrepreneur/owner of Widget, who is compensated on the basis of the firm's profits, may have lower cash-flow risk than a clerk who works full-time for Widget on a fixed salary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

23

The capital budgeting decisions of a firm will have no effect on the share price of the common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

24

Projects which are totally uncorrelated provide more overall risk reduction than negatively correlated projects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

25

In considering the share price effect on risk-return trade-offs, our goal should always be to earn the highest return possible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

26

The highest possible value for positive correlation is +1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

27

Combining assets with highly correlated returns will greatly reduce portfolio risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

28

Choosing projects with returns equal to the company norm but having a higher level of risk will most likely lower the company's stock price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

29

Generally, because of the unpredictability of earnings, cyclical stocks are given higher price-earnings multiples than growth stocks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

30

When choosing portfolios of assets, management should try to achieve the highest possible return at a given level of risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

31

Sensitivity analysis helps the financial planner to determine how sensitive shareholders will be to changes in investment strategy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

32

The investor's portfolio should always be on the efficient frontier.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

33

Cyclical businesses are likely to have higher costs of capital than firms with less variability in earnings. Therefore, more cyclical firms should typically use a higher discount rate in project evaluation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

34

The efficient frontier is always along the left-most portion of the risk-return tradeoff diagram.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

35

Coefficient of variation considers how an investment impacts the total risk of the firm while coefficient of correlation considers the specific risk of an investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

36

An investment with a $500 standard deviation and a $5,000 expected value has higher risk than an investment with a $4,000 standard deviation and a $50,000 expected value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

37

Insurance companies take advantage of the portfolio effect by insuring many different homeowners against loss. However, the risks of loss for individual homes in hurricane-prone or earthquake-prone areas such as Florida and California are highly correlated. This suggests that insurance companies should avoid writing (or consider canceling) some customers' policies in Florida and California, even when the policies are both needed by homeowners and expected to be highly profitable to the insurer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

38

Projects with high positive correlation are sometimes valuable because they allow us to smooth out the overall performance of the firm during a business cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

39

Selection of portfolio combinations from the efficient frontier will depend upon our willingness to assume risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

40

The coefficient of variation calculates the percentage of return relative to the risk of a project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

41

A project's cash flows have a beta of 1.2, a standard deviation of $340, and a coefficient of variation of 0.40. What is the expected cash flow?

A) $850

B) $167

C) $2,400

D) $500

A) $850

B) $167

C) $2,400

D) $500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

42

Risk is usually measured as the

A) potential loss.

B) variability of outcomes around some expected value.

C) probability of expected values.

D) potential expected loss.

A) potential loss.

B) variability of outcomes around some expected value.

C) probability of expected values.

D) potential expected loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following is a characteristic of beta?

A) Beta measures only the volatility of returns on an individual bond relative to a bond market index.

B) A beta of 1.0 is of equal risk with the market.

C) A beta of greater than 1.0 has less risk than the market.

D) Two of the above are true.

A) Beta measures only the volatility of returns on an individual bond relative to a bond market index.

B) A beta of 1.0 is of equal risk with the market.

C) A beta of greater than 1.0 has less risk than the market.

D) Two of the above are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

44

The coefficient of variation (V) can be defined as the

A) expected value multiplied by the standard deviation.

B) standard deviation divided by the mean (expected value).

C) mean (expected value) divided by the standard deviation.

D) standard deviation squared, divided by the expected value.

A) expected value multiplied by the standard deviation.

B) standard deviation divided by the mean (expected value).

C) mean (expected value) divided by the standard deviation.

D) standard deviation squared, divided by the expected value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

45

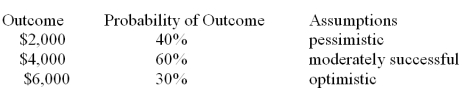

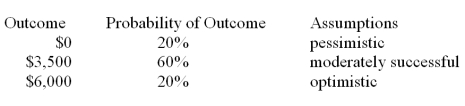

Buchanan Corp. forecasts the following payoffs from a project:  What is the expected value of the outcomes?

What is the expected value of the outcomes?

A) $5,000

B) $4,000

C) $5,300

D) The forecast is incorrect and must be modified before finding the expected value.

What is the expected value of the outcomes?

What is the expected value of the outcomes?A) $5,000

B) $4,000

C) $5,300

D) The forecast is incorrect and must be modified before finding the expected value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

46

If three investment alternatives all have some degree of risk and different expected returns, which of the following measures could best be used to rank the risk levels of the projects?

A) Coefficient of correlation

B) Coefficient of variation

C) Standard deviation of returns

D) Net present value

A) Coefficient of correlation

B) Coefficient of variation

C) Standard deviation of returns

D) Net present value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

47

If one project has a higher standard deviation than another

A) it has a greater risk.

B) it has a higher expected value.

C) it has more possible outcomes.

D) it may be riskier, but this can only be determined by the coefficient of variation.

A) it has a greater risk.

B) it has a higher expected value.

C) it has more possible outcomes.

D) it may be riskier, but this can only be determined by the coefficient of variation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

48

The concept of being risk averse-means

A) for a given situation investors would prefer relative certainty to uncertainty.

B) investors would usually prefer investments with high standard deviations and greater opportunity for gain.

C) that the greater the risk the higher the expected return must be.

D) a and c are both true.

A) for a given situation investors would prefer relative certainty to uncertainty.

B) investors would usually prefer investments with high standard deviations and greater opportunity for gain.

C) that the greater the risk the higher the expected return must be.

D) a and c are both true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

49

The firm's highest risk-adjusted discount should be applied to

A) the repair of old machinery.

B) a new product in a related field.

C) a new product in a foreign market.

D) the purchase of new equipment.

A) the repair of old machinery.

B) a new product in a related field.

C) a new product in a foreign market.

D) the purchase of new equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

50

The term "risk averse" means that

A) an individual refuses to take risks.

B) most investors and businessmen seek risk.

C) an individual will seek to avoid risk or be compensated with a higher return.

D) only investment proposals with no risk should be accepted.

A) an individual refuses to take risks.

B) most investors and businessmen seek risk.

C) an individual will seek to avoid risk or be compensated with a higher return.

D) only investment proposals with no risk should be accepted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

51

Risk may be integrated into capital budgeting decisions by

A) adjusting the standard deviation of possible outcomes.

B) determining the expected value.

C) adjusting the discount rate.

D) adjusting the time horizon.

A) adjusting the standard deviation of possible outcomes.

B) determining the expected value.

C) adjusting the discount rate.

D) adjusting the time horizon.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

52

A project has the following projected outcomes in dollars: $250, $350, and $500. The probabilities of their outcomes are 25%, 50%, and 25% respectively. What is the expected value of these outcomes?

A) $362.5

B) $89.4

C) $94.5

D) $178.3

A) $362.5

B) $89.4

C) $94.5

D) $178.3

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following is a false statement?

A) Risky investments may produce large losses.

B) Risky investments may produce large gains.

C) The coefficient of variation is a risk measure.

D) Risk-averse investors cannot be induced to invest in risky assets.

A) Risky investments may produce large losses.

B) Risky investments may produce large gains.

C) The coefficient of variation is a risk measure.

D) Risk-averse investors cannot be induced to invest in risky assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

54

In determining the appropriate discount rate for an individual project, the financial manager will be most influenced by the

A) expected value.

B) internal rate of return.

C) standard deviation.

D) coefficient of variation.

A) expected value.

B) internal rate of return.

C) standard deviation.

D) coefficient of variation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which investment has the least amount of risk?

A) Standard deviation = $450, expected return = $4,500

B) Standard deviation = $600, expected return = $400

C) Standard deviation = $500, expected return = $800

D) Standard deviation = $400, expected return = $5,000

A) Standard deviation = $450, expected return = $4,500

B) Standard deviation = $600, expected return = $400

C) Standard deviation = $500, expected return = $800

D) Standard deviation = $400, expected return = $5,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

56

Investors tend to decrease required rates of return over time for projects with longer lives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which investment has the least amount of risk?

A) Coefficient of variation = 8%, expected return = $800

B) Coefficient of variation = 8%, Standard deviation = $200

C) Standard deviation = $300, expected return = $5,000

D) Standard deviation = $100, expected return = $80

A) Coefficient of variation = 8%, expected return = $800

B) Coefficient of variation = 8%, Standard deviation = $200

C) Standard deviation = $300, expected return = $5,000

D) Standard deviation = $100, expected return = $80

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

58

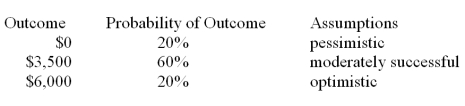

Modigliani and Associates has forecasted the following payoffs from a project:  What is the expected value of the outcomes?

What is the expected value of the outcomes?

A) $4,000

B) $3,300

C) $3,700

D) Cannot be determined/depends upon which prediction is correct.

What is the expected value of the outcomes?

What is the expected value of the outcomes?A) $4,000

B) $3,300

C) $3,700

D) Cannot be determined/depends upon which prediction is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

59

Firm X is considering a project and its analysts have projected the following outcomes and their probabilities. HYPERLINK "" Error! Hyperlink reference not valid. HYPERLINK "" Error! Hyperlink reference not valid.

A) $3,123

B) $8,633

C) $8,265

D) Cannot be determined/depends upon which prediction is correct.

A) $3,123

B) $8,633

C) $8,265

D) Cannot be determined/depends upon which prediction is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

60

A project's coefficient of variation is 0.55. The project has a positive coefficient of correlation of 0.20. The expected value is $1,200. What is one standard deviation?

A) $400.00

B) $220.00

C) $660.00

D) $1,200.00

A) $400.00

B) $220.00

C) $660.00

D) $1,200.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

61

The lower the coefficient of correlation the greater the

A) risk when projects are combined.

B) risk reduction when projects are combined.

C) return when projects are combined.

D) standard deviation when projects are combined.

A) risk when projects are combined.

B) risk reduction when projects are combined.

C) return when projects are combined.

D) standard deviation when projects are combined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

62

Projects that are negatively correlated

A) reduce the standard deviation of returns for the firm.

B) increase the possible losses of the firm.

C) are generally in the same industry.

D) none of these.

A) reduce the standard deviation of returns for the firm.

B) increase the possible losses of the firm.

C) are generally in the same industry.

D) none of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

63

In order to evaluate risk, management may also set qualitative risk classes. Rank these four projects from the least to the most risky.

Completely new market in United States.

Completely new market in South America.

Addition to normal product line.

Repair to old machinery.

A) 4, 3, 1, 2

B) 1, 2, 3, 4

C) 3, 4, 1, 2

D) 4, 3, 2, 1

Completely new market in United States.

Completely new market in South America.

Addition to normal product line.

Repair to old machinery.

A) 4, 3, 1, 2

B) 1, 2, 3, 4

C) 3, 4, 1, 2

D) 4, 3, 2, 1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

64

Simulation models allow the planner to:

A) reduce the standard deviations of projects.

B) test possible changes in each variable.

C) deal with the uncertainty in forecasting outcomes.

D) b and c.

A) reduce the standard deviations of projects.

B) test possible changes in each variable.

C) deal with the uncertainty in forecasting outcomes.

D) b and c.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

65

An al tool which helps to organize the decision process by presenting a graphical comparison of investment choices is called a

A) module hierarchy diagram.

B) "what if" simulation.

C) decision tree.

D) none of these.

A) module hierarchy diagram.

B) "what if" simulation.

C) decision tree.

D) none of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

66

Using the risk-adjusted discount rate approach, projects with high coefficients of variation will have ______ net present values than projects with low coefficients of variation and similar cash flows.

A) somewhat higher

B) substantially higher

C) lower

D) either a or b

A) somewhat higher

B) substantially higher

C) lower

D) either a or b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

67

The coefficient of correlation

A) takes on values anywhere from 0 to +1.

B) takes on values anywhere from -1 to 0.

C) takes on values anywhere from -1 to +1.

D) takes on values of 0 or larger.

A) takes on values anywhere from 0 to +1.

B) takes on values anywhere from -1 to 0.

C) takes on values anywhere from -1 to +1.

D) takes on values of 0 or larger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

68

Projects that are totally uncorrelated provide:

A) no risk reduction.

B) some risk reduction.

C) extreme risk reduction.

D) need more information.

A) no risk reduction.

B) some risk reduction.

C) extreme risk reduction.

D) need more information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

69

In order to reduce risk in a firm, the firm would seek to enter a business that

A) has high positive correlation with its present business.

B) has zero correlation with its present business.

C) has high negative correlation with its present business.

D) has high negative variation with its present business.

A) has high positive correlation with its present business.

B) has zero correlation with its present business.

C) has high negative correlation with its present business.

D) has high negative variation with its present business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

70

Using the risk-adjusted discount rate approach, the firm's weighted average cost of capital is applied to projects with:

A) no risk.

B) low risk.

C) normal risk.

D) high risk.

A) no risk.

B) low risk.

C) normal risk.

D) high risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

71

In a portfolio, risk is evaluated in a different way than with an individual project. In evaluating portfolio risk we

A) need to consider the impact of a given project on the overall risk of the firm.

B) recognize that a risky investment may create a portfolio with less risk.

C) need to consider how the returns of the projects in the portfolio are correlated.

D) all of these are true.

A) need to consider the impact of a given project on the overall risk of the firm.

B) recognize that a risky investment may create a portfolio with less risk.

C) need to consider how the returns of the projects in the portfolio are correlated.

D) all of these are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

72

A Monte Carlo simulation model uses:

A) random variables as inputs.

B) a point estimate.

C) the cost of capital.

D) portfolio risk.

A) random variables as inputs.

B) a point estimate.

C) the cost of capital.

D) portfolio risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

73

An example of negative correlation may exist between the

A) forest products and housing industries.

B) jewelry and discount furniture industries.

C) steel and aluminum industries.

D) oil and auto industries.

A) forest products and housing industries.

B) jewelry and discount furniture industries.

C) steel and aluminum industries.

D) oil and auto industries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following is a common approach in dealing with uncertainty?

A) Monte Carlo simulation

B) Internal rate of return

C) Net present value

D) Payback period

A) Monte Carlo simulation

B) Internal rate of return

C) Net present value

D) Payback period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

75

A correlation coefficient of _____ provides no risk reduction.

A) 0

B) -1

C) +1

D) +.5

A) 0

B) -1

C) +1

D) +.5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

76

Using the risk-adjusted discount rate approach, the cost of capital is applied to projects with:

A) normal risk.

B) high risk.

C) no risk.

D) low risk.

A) normal risk.

B) high risk.

C) no risk.

D) low risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

77

The portfolio effect in capital budgeting refers to

A) the relationship of stocks to bonds.

B) the degree of correlation between various investments.

C) the coefficient of variation.

D) the risk-adjusted discount rate.

A) the relationship of stocks to bonds.

B) the degree of correlation between various investments.

C) the coefficient of variation.

D) the risk-adjusted discount rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

78

A "what if" simulation using a computer helps to:

A) reduce the risk associated with a particular investment.

B) determine the effects of changes in certain variables.

C) increase the accuracy of the inputs.

D) more than one of the above are true.

A) reduce the risk associated with a particular investment.

B) determine the effects of changes in certain variables.

C) increase the accuracy of the inputs.

D) more than one of the above are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

79

A correlation coefficient of _____ provides the greatest risk reduction.

A) 0

B) -1

C) +1

D) +.5

A) 0

B) -1

C) +1

D) +.5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

80

A correlation coefficient of zero indicates

A) the projects have the same expected value.

B) there is no correlation and no risk reduction when the projects are combined.

C) there is no correlation, but some risk reduction when the projects are combined.

D) the projects have the same standard deviation.

A) the projects have the same expected value.

B) there is no correlation and no risk reduction when the projects are combined.

C) there is no correlation, but some risk reduction when the projects are combined.

D) the projects have the same standard deviation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck