Deck 2: Review of Accounting

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/130

العب

ملء الشاشة (f)

Deck 2: Review of Accounting

1

The P/E ratio provides no indication of investors' expectations about the future of a company.

False

2

The income statement is the major device for measuring the profitability of a firm over a period of time.

True

3

The investments account includes marketable securities.

False

4

Sales minus cost of goods sold is equal to earnings before taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

5

Accumulated depreciation shows up in the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

6

The real value of a firm is the same from an economic and accounting perspective.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

7

Operating profit is essentially a measure of how efficient management is in generating revenues and controlling expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

8

Sales minus cost of goods sold is equal to gross profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

9

Marketable securities are temporary investments of excess cash and are valued at their original purchase price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

10

Total assets of a firm are financed with liabilities and stockholders equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

11

The P/E ratio is strongly related to the past performance of the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

12

Accounting income is based on verifiably completed transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

13

When a firm has a sharp drop off in earnings, its P/E ratio may be artificially high.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

14

The investments account represents a commitment of funds of at least one year or more.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

15

It is not possible for a company with a high profit margin to have a low operating profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

16

A balance sheet represents the assets, liabilities, and owner's equity of a company at a given point in time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

17

Dividing Operating Profit by Shares Outstanding produces Earnings per Share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

18

Accumulated depreciation should always be equal to the depreciation expense charged in the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

19

The income statement measures the increase in the assets of a firm over a period of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

20

Asset accounts are listed in order of their liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

21

Equity is a measure of the monetary contributions that have been made directly or indirectly on behalf of the owners of the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

22

An increase in accounts receivable represents a reduction in cash flows from operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

23

An increase in a liability account represents a source of funds on the cash flow statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

24

An increase in an asset represents a source of funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

25

Stockholders' equity is equal to liabilities plus assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

26

An increase in inventory represents a source of funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

27

Cash flow is equal to earnings before taxes minus depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

28

The statement of cash flows helps measure how the changes in a balance sheet were financed between two time periods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

29

Book value is equal to net worth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

30

Cash flow consists of illiquid cash equivalents which are difficult to convert to cash within 90 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

31

Preferred stock is excluded from stockholders equity because it does not have full voting rights.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

32

An increase in accounts payable represents a reduction in cash flows from operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

33

Retained earnings represent the firm's cumulative earnings since inception, minus dividends and other adjustments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

34

Book value per share is of greater concern to the financial manager than market value per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

35

Stockholders' equity is equal to assets minus liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

36

Stockholders' equity minus preferred stock is the same thing as what is sometimes called net worth or book value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

37

Retained earnings shown on the balance sheet represents available cash on hand generated from prior year's earnings but not paid out in dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

38

Book value per share and market value per share are usually the same dollar amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

39

Balance sheet items are usually adjusted for inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

40

Assume that two companies both have Net Income of $100,000. The firm with the highest depreciation expense will have the highest cash flow, assuming all other adjustments are equal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

41

A $125,000 credit sale could be a part of a firm's cash flow from operations if paid off within the firm's fiscal year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

42

An increase in accounts receivable results in a cash inflow on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

43

Depreciation is an accounting entry and does not involve a cash expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

44

An increase in accrued expenses results in a cash outflow on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

45

A cash flow statement is correct if the net cash flow ties to the ending cash balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

46

Federal corporate tax rates have changed four times since 1980.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

47

Preferred stock dividends are paid out before income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

48

The sale of a firm's securities is a source of funds, whereas the payment of dividends is a use of funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

49

The sale of corporate bonds held by the firm as a long-term investment would increase cash flows from investing activities on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

50

Interest expense is deductible before taxes and therefore has an after-tax cost equal to the interest paid times (1

tax rate).

tax rate).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

51

The purchase of a new factory would reduce the cash flows from investing activities on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

52

Paying dividends to common shareholders will not affect cash flows from financing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

53

A decrease in bonds payable results in a cash outflow on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

54

Free cash flow is equal to cash flow from operating activities plus depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

55

Unlike sole proprietorships, corporations do not need to be concerned about individual tax rates in corporate decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

56

Free cash flow is equal to cash flow from operating activities minus necessary capital expenditures and normal dividend payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

57

The use of depreciation is an attempt to allocate the past and future costs of an asset over its useful life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

58

For corporations with low taxable income (less than $100,000), the effective tax rate can be as much as 40%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

59

Book value per share is the most important measure of value for a stockholder.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

60

Net working capital is the difference between current assets and current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following would not be classified as a current asset?

A) Marketable securities

B) Investments

C) Prepaid expenses

D) Inventory

A) Marketable securities

B) Investments

C) Prepaid expenses

D) Inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

62

Earnings per share is

A) operating profit divided by number of shares outstanding.

B) net income divided by number of shares outstanding.

C) net income divided by stockholders' equity.

D) net income minus preferred dividends divided by number of shares outstanding.

A) operating profit divided by number of shares outstanding.

B) net income divided by number of shares outstanding.

C) net income divided by stockholders' equity.

D) net income minus preferred dividends divided by number of shares outstanding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

63

Allen Lumber Company had earnings after taxes of $750,000 in the year 2009 with 300,000 shares outstanding on December 31, 2009. On January 1, 2010, the firm issued 50,000 new shares. Because of the proceeds from these new shares and other operating improvements, 2010 earnings after taxes were 25 percent higher than in 2009. Earnings per share for the year 2010 were

A) $2.14

B) $2.68

C) $3.13

D) None of these

A) $2.14

B) $2.68

C) $3.13

D) None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

64

The residual income of the firm belongs to

A) creditors.

B) preferred stockholders.

C) common stockholders.

D) bondholders.

A) creditors.

B) preferred stockholders.

C) common stockholders.

D) bondholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which of the following is not one of the three basic financial statements?

A) Income Statement

B) Statement of Retained Earnings

C) Statement of Cash Flows

D) Balance Sheet

A) Income Statement

B) Statement of Retained Earnings

C) Statement of Cash Flows

D) Balance Sheet

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

66

A firm has $1,500,000 in its common stock account and $1,000,000 in its paid-in capital account. The firm issued 100,000 shares of common stock. What was the original issue price if only one stock issue has ever been sold?

A) $35 per share

B) $25 per share

C) $15 per share

D) Not enough information to tell

A) $35 per share

B) $25 per share

C) $15 per share

D) Not enough information to tell

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

67

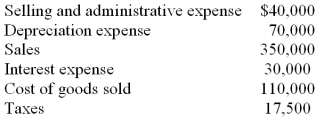

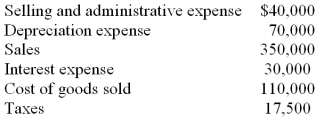

Consider the following information for Ball Corp.  What is the Operating Profit for Ball Corp?

What is the Operating Profit for Ball Corp?

A) $71,450

B) $90,000

C) $130,000

D) None of these

What is the Operating Profit for Ball Corp?

What is the Operating Profit for Ball Corp?A) $71,450

B) $90,000

C) $130,000

D) None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

68

A firm with earnings per share of $3 and a price-earnings ratio of 20 will have a stock price of

A) $60.00

B) $15.00

C) $6.67

D) the market assigns a stock price independent of EPS and the P/E ratio.

A) $60.00

B) $15.00

C) $6.67

D) the market assigns a stock price independent of EPS and the P/E ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

69

The firm's price-earnings (P/E) ratio is influenced by its

A) capital structure.

B) earnings volatility.

C) sales, profit margins, and earnings.

D) all of these.

A) capital structure.

B) earnings volatility.

C) sales, profit margins, and earnings.

D) all of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

70

When a firm's earnings are falling more rapidly than its stock price, its P/E ratio will:

A) remain the same

B) go up

C) go down

D) go either up or down

A) remain the same

B) go up

C) go down

D) go either up or down

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following factors do not influence the firm's P/E ratio?

A) Past earnings.

B) Shares outstanding.

C) Volatility in performance.

D) None of these.

A) Past earnings.

B) Shares outstanding.

C) Volatility in performance.

D) None of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

72

Increasing interest expense will have what effect on EBIT?

A) Increase it

B) Decrease it

C) No effect

D) Not enough information to tell

A) Increase it

B) Decrease it

C) No effect

D) Not enough information to tell

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

73

Gross profit is equal to

A) sales minus cost of goods sold.

B) sales minus (selling and administrative expenses).

C) sales minus (cost of goods sold and selling and administrative expenses).

D) sales minus (cost of goods sold and depreciation expense).

A) sales minus cost of goods sold.

B) sales minus (selling and administrative expenses).

C) sales minus (cost of goods sold and selling and administrative expenses).

D) sales minus (cost of goods sold and depreciation expense).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

74

Density Farms, Inc. had sales of $750,000, cost of goods sold of $200,000, selling and administrative expense of $70,000, and operating profit of $150,000. What was the value of depreciation expense?

A) $150,000

B) $230,000

C) $330,000

D) None of these

A) $150,000

B) $230,000

C) $330,000

D) None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

75

An item which may be converted to cash within one year or one operating cycle of the firm is classified as a

A) current liability.

B) long-term asset.

C) current asset.

D) long-term liability.

A) current liability.

B) long-term asset.

C) current asset.

D) long-term liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

76

Candy Company had sales of $320,000 and cost of goods sold of $112,000. What is the gross profit margin (ratio of gross profit to sales)?

A) 55%

B) 65%

C) 73.3%

D) None of these

A) 55%

B) 65%

C) 73.3%

D) None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

77

Elgin Battery Manufacturers had sales of $1,000,000 in 2009 and their cost of goods sold represented 70 percent of sales. Selling and administrative expenses were 10 percent of sales. Depreciation expense was $100,000 and interest expense for the year was $10,000. The firm's tax rate is 30 percent. What is the dollar amount of taxes paid?

A) $30,000

B) $117,800

C) $27,000

D) None of these

A) $30,000

B) $117,800

C) $27,000

D) None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

78

Reinvested funds from retained earnings theoretically belong to:

A) bond holders.

B) common stockholders.

C) employees.

D) all of these.

A) bond holders.

B) common stockholders.

C) employees.

D) all of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

79

A firm has $4,000,000 in its common stock account and $10,000,000 in its paid-in capital account. The firm issued 1,000,000 shares of common stock. What is the par value of the common stock?

A) $40 per share

B) $10 per share

C) $4 per share

D) $14 per share

A) $40 per share

B) $10 per share

C) $4 per share

D) $14 per share

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following is not subtracted out in arriving at operating income?

A) Interest expense

B) Cost of goods sold

C) Depreciation

D) Selling and administrative expense

A) Interest expense

B) Cost of goods sold

C) Depreciation

D) Selling and administrative expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck