Deck 9: Differential Analysis and Product Pricing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/163

العب

ملء الشاشة (f)

Deck 9: Differential Analysis and Product Pricing

1

Manufacturers must conform to the Robinson-Patman Act which prohibits price discrimination within the United States unless differences in prices can be justified by different costs of serving different customers.

True

2

In deciding whether to accept business at a special price, the short-run price should be set high enough to cover all variable costs and expenses.

True

3

A cost that will not be affected by later decisions is termed an opportunity cost.

False

4

Hill Co. can further process Product O to produce Product P. Product O is currently selling for $60 per pound and costs $42 per pound to produce. Product P would sell for $82 per pound and would require an additional cost of $13 per pound to produce.

The differential revenue of producing Product P is $82 per pound.

The differential revenue of producing Product P is $82 per pound.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

5

Differential revenue is the amount of income that would result from the best available alternative proposed use of cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

6

If the total unit cost of manufacturing Product Y is currently $36 and the total unit cost after modifying the style is estimated to be $48, the differential cost for this situation is $48.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

7

The costs of initially producing an intermediate product should be considered in deciding whether to further process a product, even though the costs will not change, regardless of the decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

8

Hill Co. can further process Product O to produce Product P. Product O is currently selling for $60 per pound and costs $42 per pound to produce. Product P would sell for $82 per pound and would require an additional cost of $13 per pound to produce.

The differential cost of producing Product P is $13 per pound.

The differential cost of producing Product P is $13 per pound.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

9

In addition to the differential costs in an equipment replacement decision, the remaining useful life of the old equipment and the estimated life of the new equipment are important considerations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

10

Differential analysis can aid management in making decisions on a variety of alternatives, including whether to discontinue an unprofitable segment and whether to replace usable plant assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

11

The amount of income that would result from an alternative use of cash is called opportunity cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

12

A cost that will not be affected by later decisions is termed a sunk cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

13

Hill Co. can further process Product O to produce Product P. Product O is currently selling for $60 per pound and costs $42 per pound to produce. Product P would sell for $82 per pound and would require an additional cost of $13 per pound to produce.

The differential cost of producing Product P is $55 per pound.

The differential cost of producing Product P is $55 per pound.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

14

Opportunity cost is the amount of increase or decrease in cost that would result from the best available alternative to the proposed use of cash or its equivalent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

15

Since the costs of producing an intermediate product do not change regardless of whether the intermediate product is sold or processed further, these costs are not considered in deciding whether to further process a product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

16

Differential revenue is the amount of increase or decrease in revenue expected from a particular course of action as compared with an alternative.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

17

If the total unit cost of manufacturing Product Y is currently $36 and the total unit cost after modifying the style is estimated to be $48, the differential cost for this situation is $12.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

18

Hill Co. can further process Product O to produce Product P. Product O is currently selling for $60 per pound and costs $42 per pound to produce. Product P would sell for $82 per pound and would require an additional cost of $13 per pound to produce.

The differential revenue of producing Product P is $22 per pound.

The differential revenue of producing Product P is $22 per pound.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

19

Make or buy options often arise when a manufacturer has excess productive capacity in the form of unused equipment, space, and labor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

20

Eliminating a product or segment may have the long-term effect of reducing fixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

21

When a company is showing a net loss, it is always best to discontinue the segment in order not to continue with losses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

22

When a bottleneck occurs between two products, the company must determine the contribution margin for each product and manufacture the product that has the highest contribution margin per bottleneck hour.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

23

In using the variable cost concept of applying the cost-plus approach to product pricing, fixed manufacturing costs and both fixed and variable selling and administrative expenses must be covered by the markup.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

24

Discontinuing a segment or product may not be the best choice when the segment is contributing to fixed expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

25

A bottleneck happens when a key piece of manufacturing machinery can produce 1000 units per hour and demand for the product supports a production rate of 1200 units per hour.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

26

In using the total cost concept of applying the cost-plus approach to product pricing, selling expenses, administrative expenses, and profit are covered in the markup.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

27

When estimated costs are used in applying the cost-plus approach to product pricing, the estimates should be based upon normal levels of performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

28

Activity-based costing provides more accurate and useful cost data than traditional systems.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

29

The product cost concept includes all manufacturing costs in the cost amount to which the markup is added to determine product price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

30

A practical approach which is frequently used by managers when setting normal long-run prices is the cost-plus approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

31

When estimated costs are used in applying the cost-plus approach to product pricing, the estimates should be based upon ideal levels of performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

32

Depending on the capacity of the plant, a company may best be served by further processing some of the product and leaving the rest as is, with no further processing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

33

In using the product cost concept of applying the cost-plus approach to product pricing, selling expenses, administrative expenses, and profit are covered in the markup.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

34

The lowest contribution margin per scarce resource is the most profitable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

35

The product cost concept includes all manufacturing costs plus selling and administrative expenses in the cost amount to which the markup is added to determine product price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

36

A bottleneck begins when demand for the company's product exceeds the ability to produce the product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

37

The total cost concept includes all manufacturing costs plus selling and administrative expenses in the cost amount to which the markup is added to determine product price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

38

Make or buy decisions should be made only with related parties.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

39

In using the variable cost concept of applying the cost-plus approach to product pricing, fixed manufacturing costs and fixed selling and administrative expenses must be covered by the markup.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

40

The theory of constraints is a manufacturing strategy that focuses on reducing the influence of bottlenecks on a process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

41

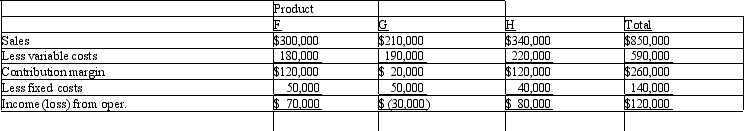

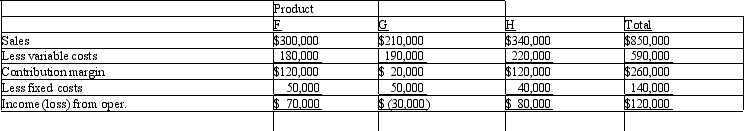

The condensed income statement for a business for the past year is presented as follows:  Management is considering the discontinuance of the manufacture and sale of Product G at the beginning of the current year. The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Products F and H. What is the amount of change in net income for the current year that will result from the discontinuance of Product G?

Management is considering the discontinuance of the manufacture and sale of Product G at the beginning of the current year. The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Products F and H. What is the amount of change in net income for the current year that will result from the discontinuance of Product G?

A) $20,000 increase

B) $30,000 increase

C) $20,000 decrease

D) $30,000 decrease

Management is considering the discontinuance of the manufacture and sale of Product G at the beginning of the current year. The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Products F and H. What is the amount of change in net income for the current year that will result from the discontinuance of Product G?

Management is considering the discontinuance of the manufacture and sale of Product G at the beginning of the current year. The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Products F and H. What is the amount of change in net income for the current year that will result from the discontinuance of Product G?A) $20,000 increase

B) $30,000 increase

C) $20,000 decrease

D) $30,000 decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

42

Cost plus methods determine the normal selling price by estimating a cost amount per unit and adding a markup.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

43

Raven Company is considering replacing equipment which originally cost $500,000 and which has $420,000 accumulated depreciation to date. A new machine will cost $790,000. What is the sunk cost in this situation?

A) $370,000

B) $790,000

C) $80,000

D) $290,000

A) $370,000

B) $790,000

C) $80,000

D) $290,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

44

The amount of increase or decrease in cost that is expected from a particular course of action as compared with an alternative is termed:

A) period cost

B) product cost

C) differential cost

D) discretionary cost

A) period cost

B) product cost

C) differential cost

D) discretionary cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

45

Under the variable cost concept, only variable costs are included in the cost amount per unit to which the markup is added.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

46

A business is considering a cash outlay of $250,000 for the purchase of land, which it could lease for $35,000 per year. If alternative investments are available which yield an 18% return, the opportunity cost of the purchase of the land is:

A) $35,000

B) $45,000

C) $10,000

D) $6,300

A) $35,000

B) $45,000

C) $10,000

D) $6,300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

47

Pheasant Co. can further process Product B to produce Product

A) $30 per pound

B) $24 per pound

C) $28 per pound

C) Product B is currently selling for $30 per pound and costs $28 per pound to produce. Product C would sell for $60 per pound and would require an additional cost of $24 per pound to produce. What is the differential cost of producing Product C?

D) $60 per pound

A) $30 per pound

B) $24 per pound

C) $28 per pound

C) Product B is currently selling for $30 per pound and costs $28 per pound to produce. Product C would sell for $60 per pound and would require an additional cost of $24 per pound to produce. What is the differential cost of producing Product C?

D) $60 per pound

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

48

Quail Co. can further process Product B to produce Product

A) $32 per pound

B) $42 per pound

C) $50 per pound

C) Product B is currently selling for $60 per pound and costs $42 per pound to produce. Product C would sell for $92 per pound and would require an additional cost of $13 per pound to produce. What is the differential revenue of producing and selling Product C?

D) $18 per pound

A) $32 per pound

B) $42 per pound

C) $50 per pound

C) Product B is currently selling for $60 per pound and costs $42 per pound to produce. Product C would sell for $92 per pound and would require an additional cost of $13 per pound to produce. What is the differential revenue of producing and selling Product C?

D) $18 per pound

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

49

A business is operating at 70% of capacity and is currently purchasing a part used in its manufacturing operations for $24 per unit. The unit cost for the business to make the part is $36, including fixed costs, and $28, not including fixed costs. If 15,000 units of the part are normally purchased during the year but could be manufactured using unused capacity, what would be the amount of differential cost increase or decrease from making the part rather than purchasing it?

A) $60,000 cost decrease

B) $180,000 cost increase

C) $60,000 cost increase

D) $180,000 cost decrease

A) $60,000 cost decrease

B) $180,000 cost increase

C) $60,000 cost increase

D) $180,000 cost decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

50

Under the total cost concept, manufacturing cost plus desired profit is included in the total cost per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

51

A cost that will not be affected by later decisions is termed a(n):

A) period cost

B) differential cost

C) sunk cost

D) replacement cost

A) period cost

B) differential cost

C) sunk cost

D) replacement cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

52

Partridge Co. can further process Product J to produce Product

A) $6.50 per pound

B) $9.25 per pound

C) $17 per pound

D) $5.25 per pound

D) Product J is currently selling for $21 per pound and costs $15.75 per pound to produce. Product D would sell for $38 per pound and would require an additional cost of $9.25 per pound to produce.

What is the differential cost of producing Product D?

A) $6.50 per pound

B) $9.25 per pound

C) $17 per pound

D) $5.25 per pound

D) Product J is currently selling for $21 per pound and costs $15.75 per pound to produce. Product D would sell for $38 per pound and would require an additional cost of $9.25 per pound to produce.

What is the differential cost of producing Product D?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

53

The amount of income that would result from an alternative use of cash is called:

A) differential income

B) sunk cost

C) differential revenue

D) opportunity cost

A) differential income

B) sunk cost

C) differential revenue

D) opportunity cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

54

Partridge Co. can further process Product J to produce Product

A) $6.75 per pound

B) $9.25 per pound

C) $17 per pound

D) $5.25 per pound

D) Product J is currently selling for $21 per pound and costs $15.75 per pound to produce. Product D would sell for $38 per pound and would require an additional cost of $9.25 per pound to produce.

What is the differential revenue of producing Product D?

A) $6.75 per pound

B) $9.25 per pound

C) $17 per pound

D) $5.25 per pound

D) Product J is currently selling for $21 per pound and costs $15.75 per pound to produce. Product D would sell for $38 per pound and would require an additional cost of $9.25 per pound to produce.

What is the differential revenue of producing Product D?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

55

Activity-based costing is determined by charging products for only the services (activities) they used during production.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

56

Raptor Company is considering replacing equipment which originally cost $500,000 and which has $420,000 accumulated depreciation to date. A new machine will cost $790,000 and the old equipment can be sold for $8,000. What is the sunk cost in this situation?

A) $72,000

B) $80,000

C) $88,000

D) $290,000

A) $72,000

B) $80,000

C) $88,000

D) $290,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

57

A business is operating at 90% of capacity and is currently purchasing a part used in its manufacturing operations for $15 per unit. The unit cost for the business to make the part is $20, including fixed costs, and $12, not including fixed costs. If 30,000 units of the part are normally purchased during the year but could be manufactured using unused capacity, what would be the amount of differential cost increase or decrease from making the part rather than purchasing it?

A) $150,000 cost increase

B) $ 90,000 cost decrease

C) $150,000 cost increase

D) $ 90,000 cost increase

A) $150,000 cost increase

B) $ 90,000 cost decrease

C) $150,000 cost increase

D) $ 90,000 cost increase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

58

The desired selling price for a product will be the same under both variable and total cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

59

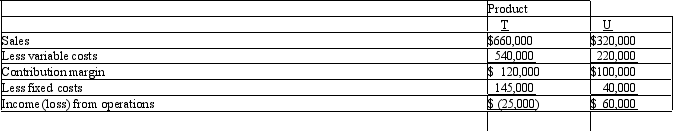

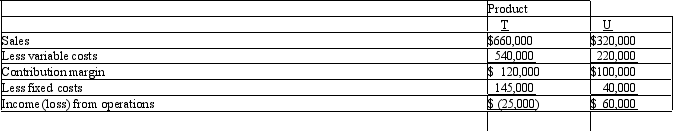

The condensed income statement for a business for the past year is as follows:  Management is considering the discontinuance of the manufacture and sale of Product T at the beginning of the current year. The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Product U. What is the amount of change in net income for the current year that will result from the discontinuance of Product T?

Management is considering the discontinuance of the manufacture and sale of Product T at the beginning of the current year. The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Product U. What is the amount of change in net income for the current year that will result from the discontinuance of Product T?

A) $120,000 increase

B) $250,000 increase

C) $25,000 decrease

D) $120,000 decrease

Management is considering the discontinuance of the manufacture and sale of Product T at the beginning of the current year. The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Product U. What is the amount of change in net income for the current year that will result from the discontinuance of Product T?

Management is considering the discontinuance of the manufacture and sale of Product T at the beginning of the current year. The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Product U. What is the amount of change in net income for the current year that will result from the discontinuance of Product T?A) $120,000 increase

B) $250,000 increase

C) $25,000 decrease

D) $120,000 decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

60

The amount of increase or decrease in revenue that is expected from a particular course of action as compared with an alternative is termed:

A) manufacturing margin

B) contribution margin

C) differential cost

D) differential revenue

A) manufacturing margin

B) contribution margin

C) differential cost

D) differential revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

61

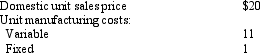

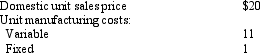

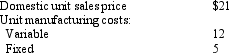

A business received an offer from an exporter for 10,000 units of product at $17.50 per unit. The acceptance of the offer will not affect normal production or domestic sales prices. The following data is available:  What is the differential revenue from the acceptance of the offer?

What is the differential revenue from the acceptance of the offer?

A) $200,000

B) $175,000

C) $130,000

D) $140,000

What is the differential revenue from the acceptance of the offer?

What is the differential revenue from the acceptance of the offer?A) $200,000

B) $175,000

C) $130,000

D) $140,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

62

Heston and Burton, CPAs, currently work a five-day week. They estimate that net income for the firm would increase by $75,000 annually if they worked an additional day each month. The cost associated with the decision to continue the practice of a five-day work week is an example of:

A) differential revenue

B) sunk cost

C) differential income

D) opportunity cost

A) differential revenue

B) sunk cost

C) differential income

D) opportunity cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

63

Discontinuing a product or segment is a huge decision that must be carefully analyzed. Which of the following would be a valid reason not to discontinue an operation?

A) The losses are minimal.

B) The variable costs are less than revenues.

C) The variable costs are more than revenues.

D) The allocated fixed costs are more than revenues.

A) The losses are minimal.

B) The variable costs are less than revenues.

C) The variable costs are more than revenues.

D) The allocated fixed costs are more than revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

64

Starling Co. is considering disposing of a machine with a book value of $12,500 and estimated remaining life of five years. The old machine can be sold for $1,500. A new high-speed machine can be purchased at a cost of $25,000. It will have a useful life of five years and no residual value. It is estimated that the annual variable manufacturing costs will be reduced from $26,000 to $23,500 if the new machine is purchased. The total net differential increase or decrease in cost for the new equipment for the entire five years is:

A) decrease of $11,000

B) decrease of $15,000

C) increase of $11,000

D) increase of $15,000

A) decrease of $11,000

B) decrease of $15,000

C) increase of $11,000

D) increase of $15,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

65

Assume that Penguin Co. is considering disposing of equipment that cost $50,000 and has $40,000 of accumulated depreciation to date. Penguin Co. can sell the equipment through a broker for $25,000 less 5% commission. Alternatively, Teal Co. has offered to lease the equipment for five years for a total of $48,750. Penguin will incur repair, insurance, and property tax expenses estimated at $10,000. At lease-end, the equipment is expected to have no residual value. The net differential income from the lease alternative is:

A) $15,000

B) $ 5,000

C) $25,000

D) $12,500

A) $15,000

B) $ 5,000

C) $25,000

D) $12,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

66

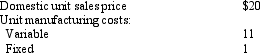

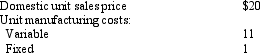

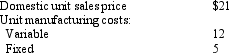

A business received an offer from an exporter for 30,000 units of product at $16 per unit. The acceptance of the offer will not affect normal production or domestic sales prices. The following data are available:  What is the differential cost from the acceptance of the offer?

What is the differential cost from the acceptance of the offer?

A) $120,000

B) $330,000

C) $300,000

D) $510,000

What is the differential cost from the acceptance of the offer?

What is the differential cost from the acceptance of the offer?A) $120,000

B) $330,000

C) $300,000

D) $510,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

67

Sparrow Co. is currently operating at 80% of capacity and is currently purchasing a part used in its manufacturing operations for $8.00 a unit. The unit cost for Sparrow Co. to make the part is $9.00, which includes $.60 of fixed costs. If 4,000 units of the part are normally purchased each year but could be manufactured using unused capacity, what would be the amount of differential cost increase or decrease for making the part rather than purchasing it?

A) $12,000 cost decrease

B) $4,000 cost increase

C) $20,000 cost decrease

D) $1,600 cost increase

A) $12,000 cost decrease

B) $4,000 cost increase

C) $20,000 cost decrease

D) $1,600 cost increase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

68

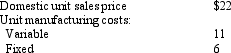

A business received an offer from an exporter for 10,000 units of product at $17.50 per unit. The acceptance of the offer will not affect normal production or domestic sales prices. The following data is available:  What is the differential cost from the acceptance of the offer?

What is the differential cost from the acceptance of the offer?

A) $200,000

B) $175,000

C) $140,000

D) $110,000

What is the differential cost from the acceptance of the offer?

What is the differential cost from the acceptance of the offer?A) $200,000

B) $175,000

C) $140,000

D) $110,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

69

Relevant revenues and costs refer to:

A) activities that occurred in the past

B) monies already earned and/or spent

C) last year's net income

D) differences between the alternatives being considered

A) activities that occurred in the past

B) monies already earned and/or spent

C) last year's net income

D) differences between the alternatives being considered

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

70

Mighty Safe Fire Alarm is currently buying 50,000 motherboard from MotherBoard, Inc. at a price of $65 per board. Mighty Safe is considering making its own boards. The costs to make the board are as follows: Direct Materials $32 per unit, Direct labor $10 per unit, Variable Factory Overhead $16.00, Fixed Costs for the plant would increase by $75,000. Which option should be selected and why?

A) Buy - $75,000 more in profits

B) Make - $275,000 increase in profits

C) Buy - $275,000 more in profits

D) Make - $350,000 increase in profits

A) Buy - $75,000 more in profits

B) Make - $275,000 increase in profits

C) Buy - $275,000 more in profits

D) Make - $350,000 increase in profits

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

71

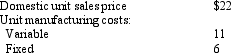

A business received an offer from an exporter for 30,000 units of product at $16 per unit. The acceptance of the offer will not affect normal production or domestic sales prices. The following data are available:  What is the amount of the gain or loss from acceptance of the offer?

What is the amount of the gain or loss from acceptance of the offer?

A) $30,000 loss

B) $40,000 gain

C) $150,000 gain

D) $50,000 gain

What is the amount of the gain or loss from acceptance of the offer?

What is the amount of the gain or loss from acceptance of the offer?A) $30,000 loss

B) $40,000 gain

C) $150,000 gain

D) $50,000 gain

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

72

Falcon Co. produces a single product. Its normal selling price is $30.00 per unit. The variable costs are $19.00 per unit. Fixed costs are $25,000 for a normal production run of 5,000 units per month. Falcon received a request for a special order that would not interfere with normal sales. The order was for 1,500 units and a special price of $20.00 per unit. Falcon Co. has the capacity to handle the special order and, for this order, a variable selling cost of $1.00 per unit would be eliminated. Should the special order be accepted?

A) Cannot determine from the data given

B) Yes

C) No

D) There would be no difference in accepting or rejecting the special order

A) Cannot determine from the data given

B) Yes

C) No

D) There would be no difference in accepting or rejecting the special order

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

73

A business is considering a cash outlay of $300,000 for the purchase of land, which it could lease for $36,000 per year. If alternative investments are available which yield an 18% return, the opportunity cost of the purchase of the land is:

A) $54,000

B) $36,000

C) $18,000

D) $72,000

A) $54,000

B) $36,000

C) $18,000

D) $72,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following would be considered a sunk cost?

A) Purchase price of new equipment

B) Equipment rental for the production area

C) Net book value of equipment that has no market value

D) Warehouse lease expense

A) Purchase price of new equipment

B) Equipment rental for the production area

C) Net book value of equipment that has no market value

D) Warehouse lease expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

75

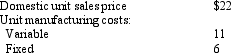

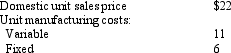

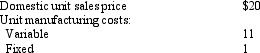

A business received an offer from an exporter for 20,000 units of product at $15 per unit. The acceptance of the offer will not affect normal production or domestic sales prices. The following data are available:  What is the differential revenue from the acceptance of the offer?

What is the differential revenue from the acceptance of the offer?

A) $300,000

B) $420,000

C) $120,000

D) $240,000

What is the differential revenue from the acceptance of the offer?

What is the differential revenue from the acceptance of the offer?A) $300,000

B) $420,000

C) $120,000

D) $240,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

76

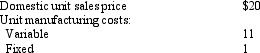

A business received an offer from an exporter for 10,000 units of product at $17.50 per unit. The acceptance of the offer will not affect normal production or domestic sales prices. The following data is available:  What is the amount of gain or loss from acceptance of the offer?

What is the amount of gain or loss from acceptance of the offer?

A) $65,000 gain

B) $50,000 loss

C) $30,000 loss

D) $20,000 loss

What is the amount of gain or loss from acceptance of the offer?

What is the amount of gain or loss from acceptance of the offer?A) $65,000 gain

B) $50,000 loss

C) $30,000 loss

D) $20,000 loss

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

77

A business is considering a cash outlay of $400,000 for the purchase of land, which it could lease for $40,000 per year. If alternative investments are available which yield a 21% return, the opportunity cost of the purchase of the land is:

A) $84,000

B) $40,000

C) $44,000

D) $ 8,400

A) $84,000

B) $40,000

C) $44,000

D) $ 8,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

78

Nighthawk Inc. is considering disposing of a machine with a book value of $22,500 and an estimated remaining life of three years. The old machine can be sold for $6,250. A new machine with a purchase price of $68,750 is being considered as a replacement. It will have a useful life of three years and no residual value. It is estimated that the annual variable manufacturing costs will be reduced from $43,750 to $20,000 if the new machine is purchased. The net differential increase or decrease in cost for the entire three years for the new equipment is:

A) $8,750 increase

B) $31,250 decrease

C) $8,750 decrease

D) $2,925 decrease

A) $8,750 increase

B) $31,250 decrease

C) $8,750 decrease

D) $2,925 decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

79

Falcon Co. produces a single product. Its normal selling price is $30.00 per unit. The variable costs are $19.00 per unit. Fixed costs are $25,000 for a normal production run of 5,000 units per month. Falcon received a request for a special order that would not interfere with normal sales. The order was for 1,500 units and a special price of $20.00 per unit. Falcon Co. has the capacity to handle the special order and, for this order, a variable selling cost of $1.00 per unit would be eliminated. If the order is accepted, what would be the impact on net income?

A) decrease of $750

B) decrease of $4,500

C) increase of $3,000

D) increase of $1,500

A) decrease of $750

B) decrease of $4,500

C) increase of $3,000

D) increase of $1,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

80

Super Security Company manufacturers home alarms. Currently it is manufacturing one of its components at a variable cost of $45 and fixed costs of $15 per unit. An outside provider of this component has offered to sell Safe Security the component for $50. Determine the best plan and calculate the savings.

A) $5 savings per unit - Manufacture

B) $5 savings per unit - Purchase

C) $10 savings per unit - Manufacture

D) $15 savings per unit - Purchase

A) $5 savings per unit - Manufacture

B) $5 savings per unit - Purchase

C) $10 savings per unit - Manufacture

D) $15 savings per unit - Purchase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck