Deck 11: Cost Allocation and Activity-Based Costing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/110

العب

ملء الشاشة (f)

Deck 11: Cost Allocation and Activity-Based Costing

1

Zorn Co. budgeted $600,000 of factory overhead cost for the coming year. Its plantwide allocation base, machine hours, is budgeted at 100,000 hours. Budgeted units to be produced are 200,000 units. Zorn's plantwide factory overhead rate is $6.00 per unit.

False

2

If the budgeted factory overhead cost is $460,000, the budgeted direct labor hours is 80,000, and the actual direct labor hours is 6,700 for the month, the factory overhead rate for the month is $68.65 (if the allocation is based on direct labor hours).

False

3

Managers depend on accurate factory overhead allocation to make decisions regarding product mix and product price.

True

4

A plantwide factory overhead rate is computed by dividing total budgeted factory overhead costs by the plantwide allocation base.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

5

Zorn Co. budgeted $300,000 of factory overhead cost for the coming year. Its plantwide allocation base, machine hours, is budgeted at 50,000 hours. Budgeted units to be produced are 100,000 units. Zorn's plantwide factory overhead rate is $6.00 per machine hour.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

6

If the activities causing overhead costs are different across different departments and products, use of a plantwide factory overhead rate will cause distorted product costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

7

Use of a plantwide factory overhead rate assumes that the activities causing overhead costs are the same across all departments and products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

8

A single plantwide overhead rate method is very expensive to apply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

9

If the budgeted factory overhead cost is $460,000, the budgeted direct labor hours is 80,000, and the actual direct labor hours is 6,700 for the month, the amount of factory overhead to be allocated is $38,525 (if the allocation is based on direct labor hours).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

10

Multiple production department factory overhead rates are more accurate and more costly than are plantwide factory overhead rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

11

When a plantwide factory overhead rate is used, overhead costs are applied to all products by a single rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

12

The selection of the factory overhead allocation method is important because the method selected determines the accuracy of the product cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

13

Use of a plantwide factory overhead rate assumes that the activities causing overhead costs are different across different departments and products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

14

When a plantwide factory overhead rate is used, the total overhead costs allocated to all products is the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

15

Multiple production department factory overhead rates are less accurate and less costly than are plantwide factory overhead rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

16

Multiple production department factory overhead rates are most useful when production departments are very similar in their manufacturing processes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

17

Multiple production department factory overhead rates are most useful when production departments differ in their manufacturing processes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

18

Managers depend on product costing to make decisions regarding continuing operations, advertising, and product mix.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

19

A plantwide factory overhead rate assumes that all overhead is directly related to one activity representing the entire plant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

20

Product costing consists of only direct materials and direct labor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

21

Service companies can effectively use multiple department overhead rate costing to compute product (service) costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

22

Use of a plantwide factory overhead rate distorts product costs when there are differences in the factory overhead rates across different production departments and when products require different ratios of allocation-base usage in each production department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

23

Use of a plantwide factory overhead rate does not distort product costs when there are differences in the factory overhead rates across different production departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

24

Activity cost pools are cost accumulations associated with a given activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following is not a factory overhead allocation method?

A) single plantwide rate

B) multiple departmental rates

C) factory costing

D) activity-based costing

A) single plantwide rate

B) multiple departmental rates

C) factory costing

D) activity-based costing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

26

Service organizations can use activity-based costing to allocate selling and administrative costs to services provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

27

Activity-based costing is much easier to apply than single plantwide factory overhead allocation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

28

Service companies can effectively use single facility-wide overhead costing to compute product (service) costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

29

Activity-based costing can only be used to allocate manufacturing factory overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

30

When production departments differ significantly in their manufacturing process, it is recommended that the single plantwide factory overhead rate be used for allocating factory overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

31

ABC is used to allocate selling and administrative expenses to each product based on the product's individual differences in consuming these activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

32

In a service organization, the multiple department overhead rate method is the most effective in providing information about the cost of services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

33

Activity-based costing can be used to allocate period costs to various products that the company sells.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

34

Activity cost pools are assigned to products, using factory overhead rates for each activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

35

Use of a plantwide factory overhead rate does not distort product costs only when products require different ratios of allocation-base usage in each production department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

36

Activity rates are computed by dividing the cost budgeted for each activity pool by the estimated activity base for that pool.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

37

Estimated activity-base usage quantities are the total activity-base quantities related to each product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

38

Direct labor hours is not a cost pool that is regularly used in the activity-based costing method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

39

Service companies can effectively use activity-based costing to compute product (service) costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

40

In an effort to simplify the multiple production department factory overhead rate method, the same rate can be used for all departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

41

Blackwelder Factory produces two similar products - small lamps and desk lamps. The total plant overhead budget is $640,000 with 400,000 estimated direct labor hours. It is further estimated that small lamp production will require 275,000 direct labor hours and desk lamp production will need 125,000 direct labor hours. Using the single plantwide factory overhead rate with an allocation base of direct labor hours, how much factory overhead will be allocated to the small lamp production if the actual direct hours for the period is 285,000?

A) $275,000

B) $285,000

C) $440,000

D) $456,000

A) $275,000

B) $285,000

C) $440,000

D) $456,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

42

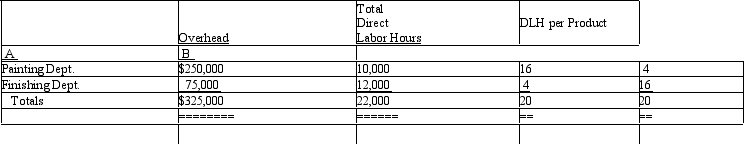

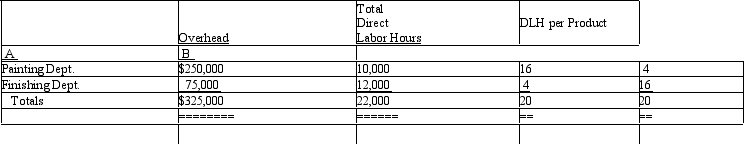

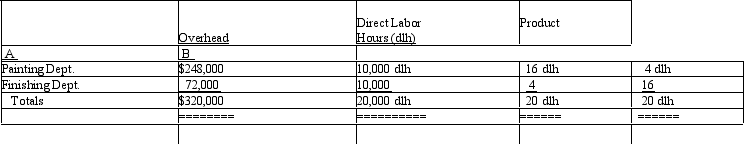

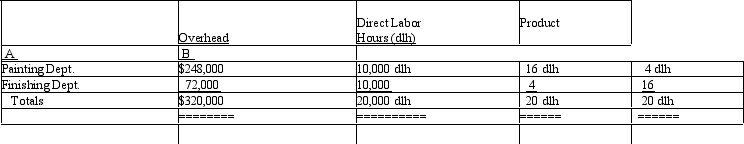

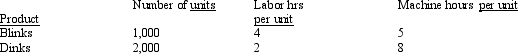

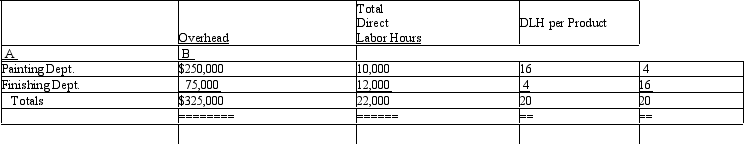

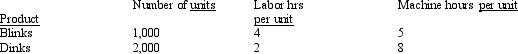

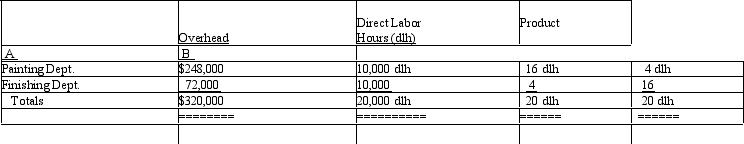

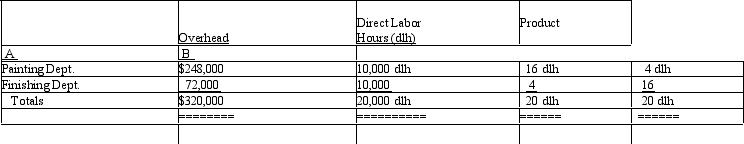

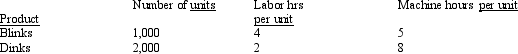

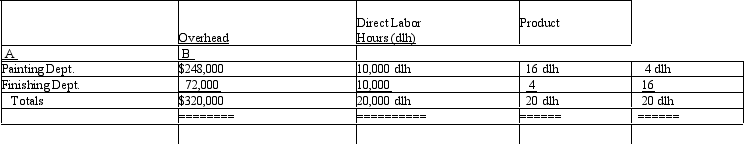

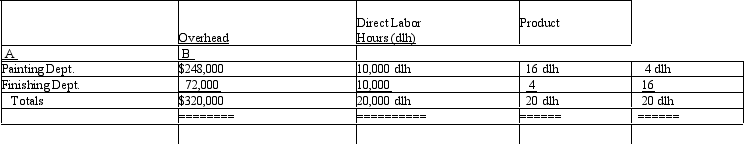

Adirondak Marketing Inc. manufactures two products, A and B. Presently, the company uses a single plantwide factory overhead rate for allocating overhead to products. However, management is considering moving to a multiple department rate system for allocating overhead.  Calculate the overhead rate per unit for Product A in painting department:

Calculate the overhead rate per unit for Product A in painting department:

A) $236.32 per unit

B) $325.00 per unit

C) $147.70 per unit

D) $161.00 per unit

Calculate the overhead rate per unit for Product A in painting department:

Calculate the overhead rate per unit for Product A in painting department:A) $236.32 per unit

B) $325.00 per unit

C) $147.70 per unit

D) $161.00 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

43

Challenger Factory produces two similar products - regular widgets and deluxe widgets. The total plant overhead budget is $675,000 with 300,000 estimated direct labor hours. It is further estimated that deluxe widget production will need 3 direct labor hours for each unit and regular widget production will require 2 direct labor hours for each unit. Using the single plantwide factory overhead rate with an allocation base of direct labor hours, how much factory overhead will be allocated to the deluxe widget production if the budgeted production for the period is 50,000 units and actual production for the period is 58,000 units?

A) $391,500

B) $225,000

C) $261,000

D) $337,500

A) $391,500

B) $225,000

C) $261,000

D) $337,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

44

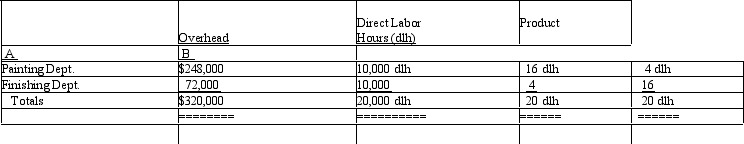

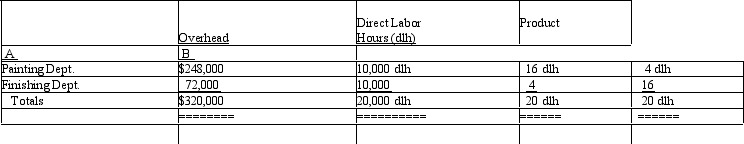

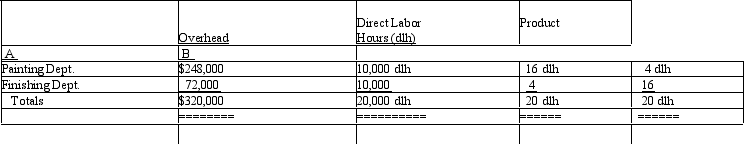

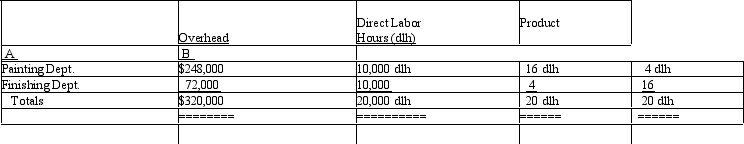

Blue Ridge Marketing Inc. manufactures two products, A and B. Presently, the company uses a single plantwide factory overhead rate for allocating overhead to products. However, management is considering moving to a multiple department rate system for allocating overhead. The following table presents information about estimated overhead and direct labor hours.  Determine the overhead rate in the Painting Department for each unit of Product B if the company uses a multiple department rate system.

Determine the overhead rate in the Painting Department for each unit of Product B if the company uses a multiple department rate system.

A) $12.40 per dlh

B) $24.80 per dlh

C) $7.20 per dlh

D) $16.00 per dlh

Determine the overhead rate in the Painting Department for each unit of Product B if the company uses a multiple department rate system.

Determine the overhead rate in the Painting Department for each unit of Product B if the company uses a multiple department rate system.A) $12.40 per dlh

B) $24.80 per dlh

C) $7.20 per dlh

D) $16.00 per dlh

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

45

Challenger Factory produces two similar products - regular widgets and deluxe widgets. The total plant overhead budget is $675,000 with 300,000 estimated direct labor hours. It is further estimated that deluxe widget production will need 3 direct labor hours for each unit and regular widget production will require 2 direct labor hours for each unit. Using the single plantwide factory overhead rate with an allocation base of direct labor hours, how much factory overhead will be allocated to the regular widget production if budgeted production for the period is 75,000 units and actual production for the period is 72,000 units?

A) $168,750

B) $324,000

C) $162,000

D) $337,500

A) $168,750

B) $324,000

C) $162,000

D) $337,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

46

Everest Co. uses a plantwide factory overhead rate based on direct labor hours. Overhead costs would be overcharged to which of the following departments?

A) A labor-intensive department

B) A capital-intensive department

C) A materials-intensive department

D) All of the above

A) A labor-intensive department

B) A capital-intensive department

C) A materials-intensive department

D) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

47

Common allocation bases are

A) direct labor dollars, direct labor hours, direct material dollars

B) direct labor dollars, direct labor hours, machine hours

C) direct labor dollars, direct labor hours, machine dollars

D) machine dollars, direct labor dollars, machine hours

A) direct labor dollars, direct labor hours, direct material dollars

B) direct labor dollars, direct labor hours, machine hours

C) direct labor dollars, direct labor hours, machine dollars

D) machine dollars, direct labor dollars, machine hours

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

48

Blue Ridge Marketing Inc. manufactures two products, A and B. Presently, the company uses a single plantwide factory overhead rate for allocating overhead to products. However, management is considering moving to a multiple department rate system for allocating overhead. The following table presents information about estimated overhead and direct labor hours.  Using a single plantwide rate, determine the overhead rate per unit for Product B:

Using a single plantwide rate, determine the overhead rate per unit for Product B:

A) $496.00

B) $144.00

C) $640.00

D) $320.00

Using a single plantwide rate, determine the overhead rate per unit for Product B:

Using a single plantwide rate, determine the overhead rate per unit for Product B:A) $496.00

B) $144.00

C) $640.00

D) $320.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

49

Blue Ridge Marketing Inc. manufactures two products, A and B. Presently, the company uses a single plantwide factory overhead rate for allocating overhead to products. However, management is considering moving to a multiple department rate system for allocating overhead. The following table presents information about estimated overhead and direct labor hours.  Determine the overhead rate in the Finishing Department for each unit of Product A if the company uses a multiple department rate system.

Determine the overhead rate in the Finishing Department for each unit of Product A if the company uses a multiple department rate system.

A) $24.80 per dlh

B) $12.40 per dlh

C) $16.00 per dlh

D) $7.20 per dlh

Determine the overhead rate in the Finishing Department for each unit of Product A if the company uses a multiple department rate system.

Determine the overhead rate in the Finishing Department for each unit of Product A if the company uses a multiple department rate system.A) $24.80 per dlh

B) $12.40 per dlh

C) $16.00 per dlh

D) $7.20 per dlh

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

50

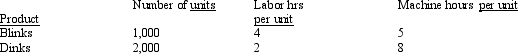

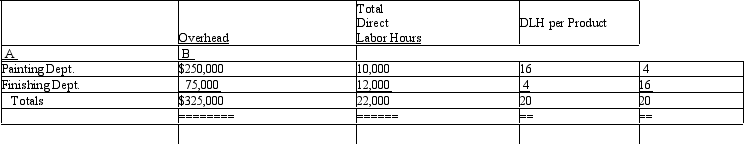

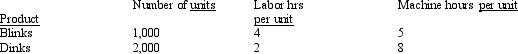

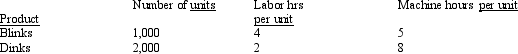

The Ramapo Company produces two products, Blinks and Dinks. They are manufactured in two departments, Fabrication and Assembly. Data for the products and departments are listed below.  All of the machine hours take place in the Fabrication department, which has an estimated overhead of $84,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $72,000.

All of the machine hours take place in the Fabrication department, which has an estimated overhead of $84,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $72,000.

The Ramapo Company uses a single overhead rate to apply all overhead costs. What would the single plantwide rate be if it was based on machine hours instead of labor hours?

A) $9.00 per MH

B) $19.50 per MH

C) $7.43 per MH

D) $4.00 per MH

All of the machine hours take place in the Fabrication department, which has an estimated overhead of $84,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $72,000.

All of the machine hours take place in the Fabrication department, which has an estimated overhead of $84,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $72,000.The Ramapo Company uses a single overhead rate to apply all overhead costs. What would the single plantwide rate be if it was based on machine hours instead of labor hours?

A) $9.00 per MH

B) $19.50 per MH

C) $7.43 per MH

D) $4.00 per MH

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

51

Adirondak Marketing Inc. manufactures two products, A and B. Presently, the company uses a single plantwide factory overhead rate for allocating overhead to products. However, management is considering moving to a multiple department rate system for allocating overhead.  Calculate the plantwide factory overhead rate:

Calculate the plantwide factory overhead rate:

A) $25.00 per dlh

B) $0.07 per dlh

C) $14.77 per dlh

D) $ 6.25 per dlh

Calculate the plantwide factory overhead rate:

Calculate the plantwide factory overhead rate:A) $25.00 per dlh

B) $0.07 per dlh

C) $14.77 per dlh

D) $ 6.25 per dlh

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following does not support managerial decisions involving accurate product costing?

A) product constraints

B) emphasis of a product line

C) product mix

D) product price

A) product constraints

B) emphasis of a product line

C) product mix

D) product price

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

53

The Ramapo Company produces two products, Blinks and Dinks. They are manufactured in two departments, Fabrication and Assembly. Data for the products and departments are listed below.  All of the machine hours take place in the Fabrication department, which has an estimated overhead of $84,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $72,000.

All of the machine hours take place in the Fabrication department, which has an estimated overhead of $84,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $72,000.

The Ramapo Company uses a single overhead rate to apply all overhead costs based on labor hours. What is the overhead cost per unit for Blinks?

A) $78.00

B) $19.50

C) $37.45

D) $56.00

All of the machine hours take place in the Fabrication department, which has an estimated overhead of $84,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $72,000.

All of the machine hours take place in the Fabrication department, which has an estimated overhead of $84,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $72,000.The Ramapo Company uses a single overhead rate to apply all overhead costs based on labor hours. What is the overhead cost per unit for Blinks?

A) $78.00

B) $19.50

C) $37.45

D) $56.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

54

Blue Ridge Marketing Inc. manufactures two products, A and B. Presently, the company uses a single plantwide factory overhead rate for allocating overhead to products. However, management is considering moving to a multiple department rate system for allocating overhead. The following table presents information about estimated overhead and direct labor hours.  Determine the overhead from both production departments allocated to each unit of Product B if the company uses a multiple department rate system.

Determine the overhead from both production departments allocated to each unit of Product B if the company uses a multiple department rate system.

A) $425.60 per unit

B) $115.20 per unit

C) $214.40 per unit

D) $320.00 per unit

Determine the overhead from both production departments allocated to each unit of Product B if the company uses a multiple department rate system.

Determine the overhead from both production departments allocated to each unit of Product B if the company uses a multiple department rate system.A) $425.60 per unit

B) $115.20 per unit

C) $214.40 per unit

D) $320.00 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

55

The Ramapo Company produces two products, Blinks and Dinks. They are manufactured in two departments, Fabrication and Assembly. Data for the products and departments are listed below.  All of the machine hours take place in the Fabrication department, which has an estimated overhead of $84,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $72,000.

All of the machine hours take place in the Fabrication department, which has an estimated overhead of $84,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $72,000.

The Ramapo Company uses a single overhead rate to apply all overhead costs based on labor hours. What is the overhead cost per unit for Dinks?

A) $77.00

B) $39.00

C) $19.50

D) $59.92

All of the machine hours take place in the Fabrication department, which has an estimated overhead of $84,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $72,000.

All of the machine hours take place in the Fabrication department, which has an estimated overhead of $84,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $72,000.The Ramapo Company uses a single overhead rate to apply all overhead costs based on labor hours. What is the overhead cost per unit for Dinks?

A) $77.00

B) $39.00

C) $19.50

D) $59.92

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

56

Pinacle Corp. budgeted $350,000 of overhead cost for 2012. Actual overhead costs for the year were $325,000. Pinacle's plantwide allocation base, machine hours, was budgeted at 50,000 hours. Actual machine hours were 40,000. A total of 100,000 units was budgeted to be produced and 98,000 units were actually produced. Pinacle's plantwide factory overhead rate for 2012 is:

A) $8.13 per machine hour

B) $7.00 per machine hour

C) $6.50 per machine hour

D) $8.75 per machine hour

A) $8.13 per machine hour

B) $7.00 per machine hour

C) $6.50 per machine hour

D) $8.75 per machine hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

57

Blackwelder Factory produces two similar products - small lamps and desk lamps. The total plant overhead budget is $640,000 with 400,000 estimated direct labor hours. It is further estimated that small lamp production will require 275,000 direct labor hours and desk lamp production will need 125,000 direct labor hours. Using the single plantwide factory overhead rate with an allocation base of direct labor hours, how much factory overhead will be allocated to the desk lamp production if the actual direct hours for the period is 118,000?

A) $118,000

B) $200,000

C) $188,800

D) $125,000

A) $118,000

B) $200,000

C) $188,800

D) $125,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

58

Blue Ridge Marketing Inc. manufactures two products, A and B. Presently, the company uses a single plantwide factory overhead rate for allocating overhead to products. However, management is considering moving to a multiple department rate system for allocating overhead. The following table presents information about estimated overhead and direct labor hours.  Determine the overhead from both production departments allocated to each unit of Product A if the company uses a multiple department rate system.

Determine the overhead from both production departments allocated to each unit of Product A if the company uses a multiple department rate system.

A) $396.80 per unit

B) $425.60 per unit

C) $320.00 per unit

D) $214.40 per unit

Determine the overhead from both production departments allocated to each unit of Product A if the company uses a multiple department rate system.

Determine the overhead from both production departments allocated to each unit of Product A if the company uses a multiple department rate system.A) $396.80 per unit

B) $425.60 per unit

C) $320.00 per unit

D) $214.40 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

59

The Cunningham Factory has determined that its budgeted factory overhead budget for the year is $6,750,000 and budgeted direct labor hours are 5,000,000. If the actual direct labors for the period are 175,000 how much overhead would be allocated to the period?

A) $675,000

B) $129,630

C) $236,250

D) $175,000

A) $675,000

B) $129,630

C) $236,250

D) $175,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

60

The Baffin Factory has determined that its budgeted factory overhead budget for the year is $7,750,000. They plan to produce 1,000,000 units. Budgeted direct labor hours are 525,000 and budgeted machine hours are 375,000. Using the single plantwide factory overhead rate based on direct labor hours, calculate the factory overhead rate for the year.

A) $14.76

B) $20.67

C) $7.75

D) $77.50

A) $14.76

B) $20.67

C) $7.75

D) $77.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

61

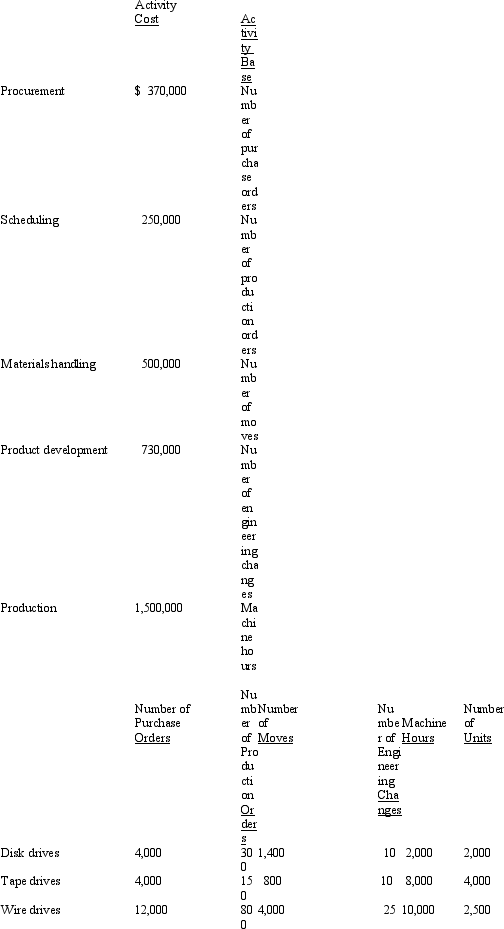

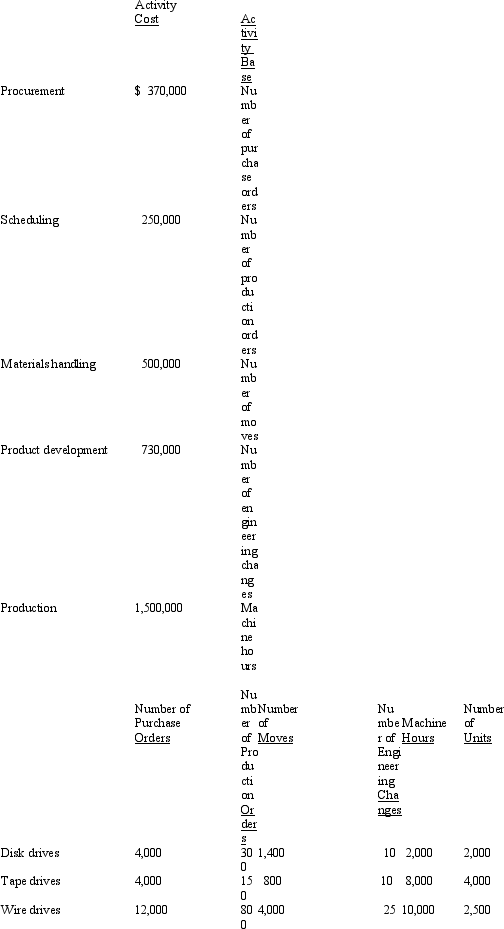

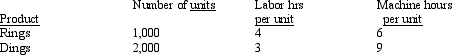

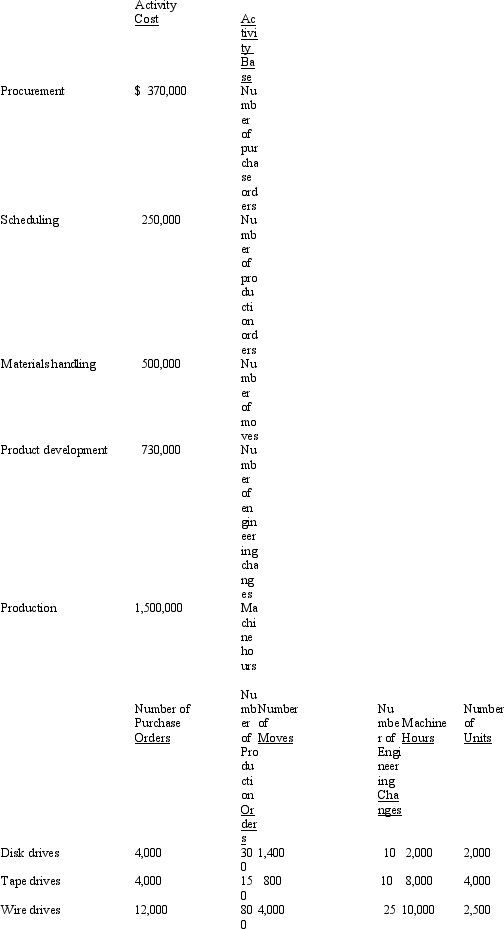

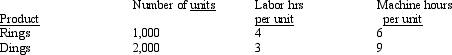

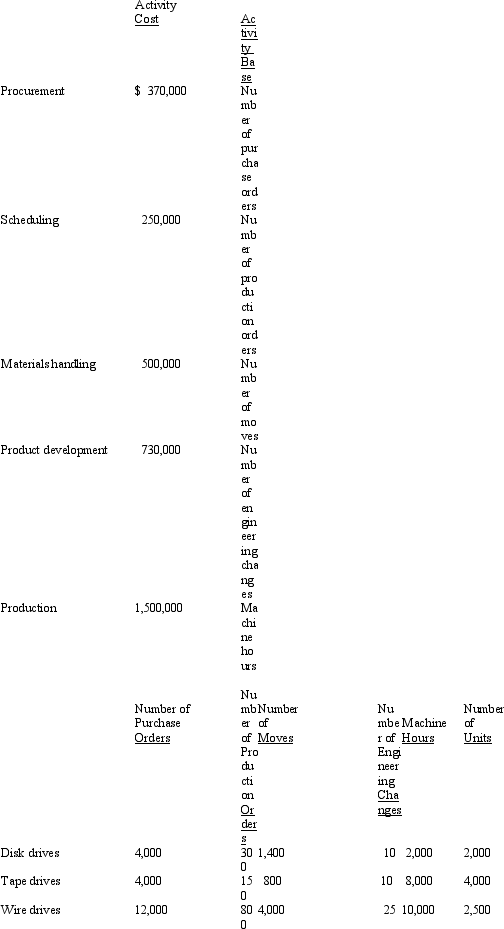

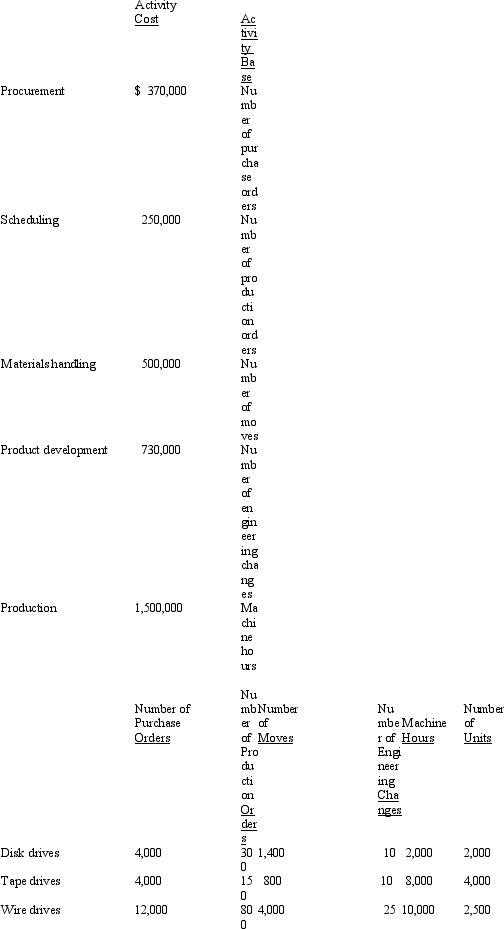

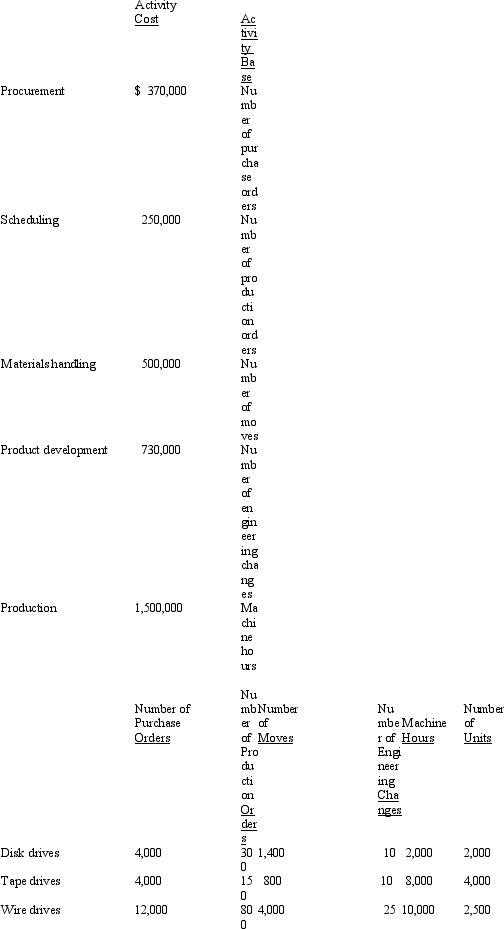

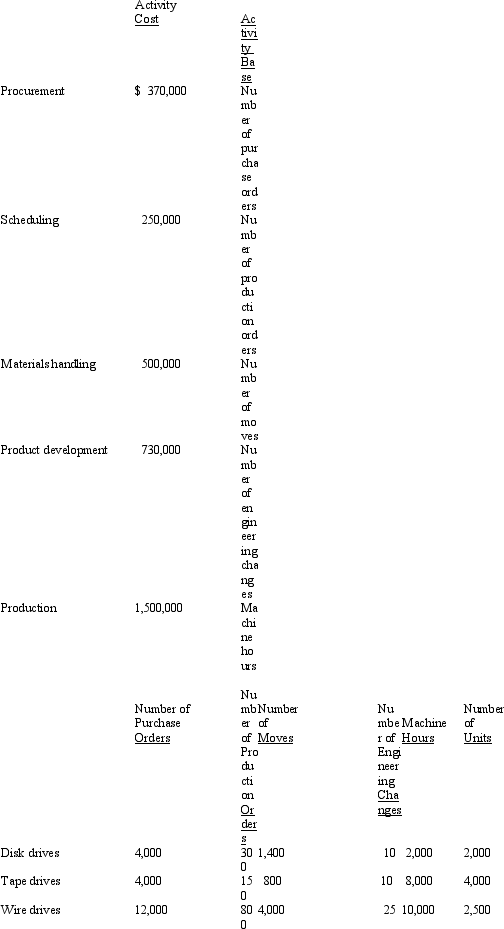

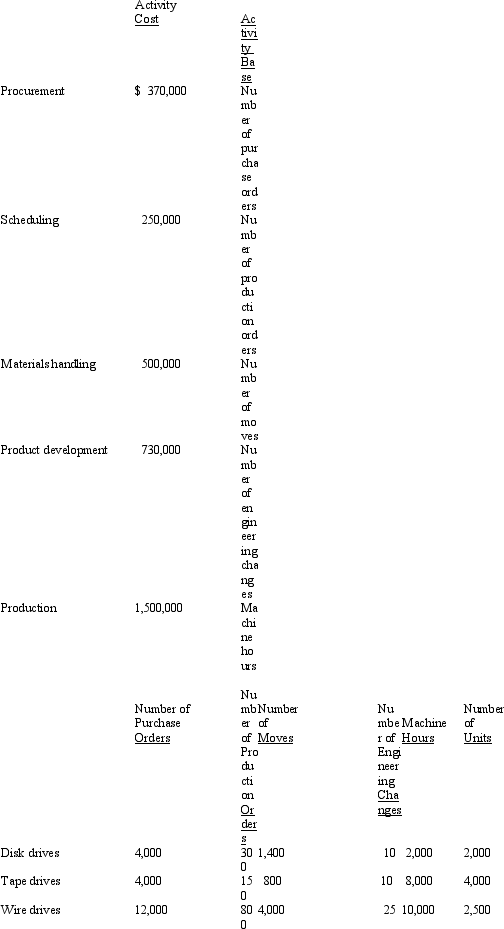

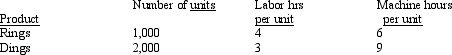

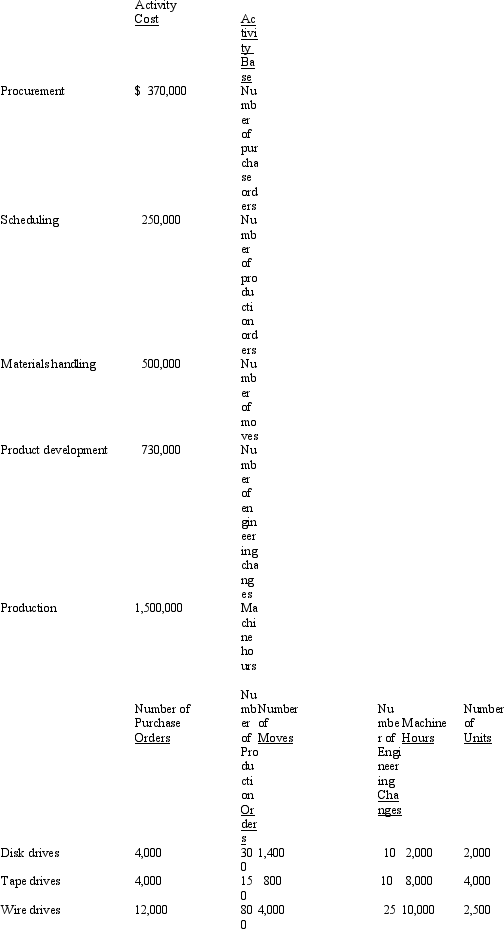

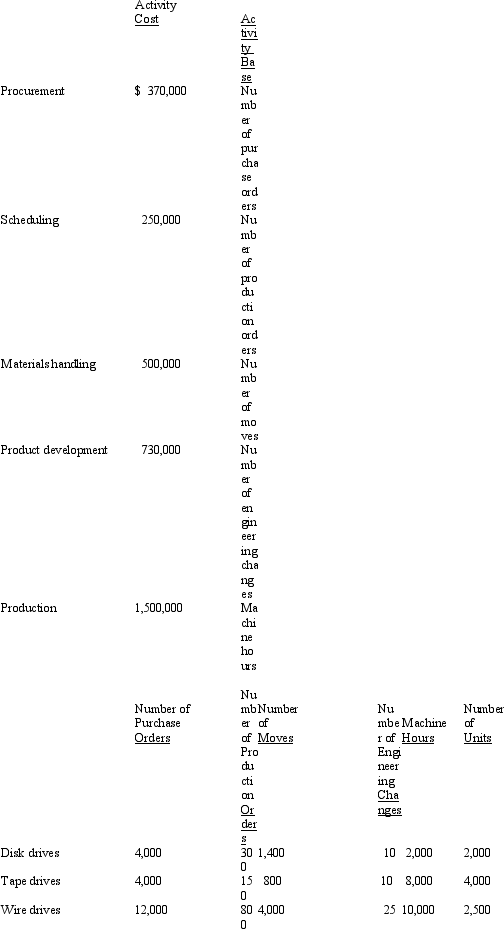

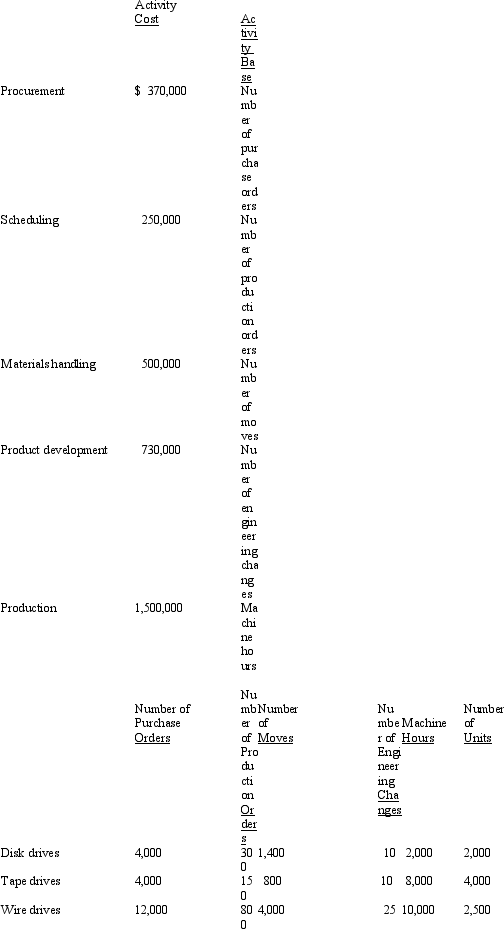

Panamint Systems Corporation is estimating activity costs associated with producing disk drives, tapes drives, and wire drives. The indirect labor can be traced to four separate activity pools. The budgeted activity cost and activity base data by product are provided below.  Determine the activity rate for procurement per purchase order.

Determine the activity rate for procurement per purchase order.

A) $43.53

B) $18.50

C) $15.42

D) $37.00

Determine the activity rate for procurement per purchase order.

Determine the activity rate for procurement per purchase order.A) $43.53

B) $18.50

C) $15.42

D) $37.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

62

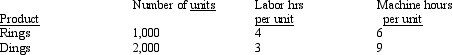

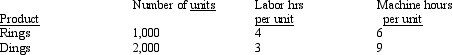

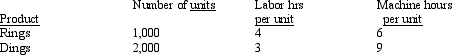

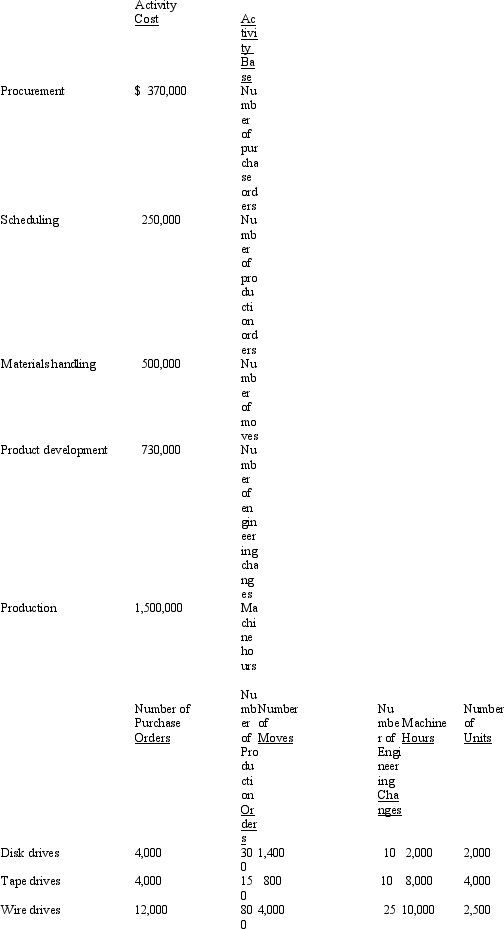

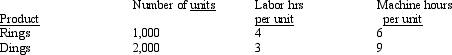

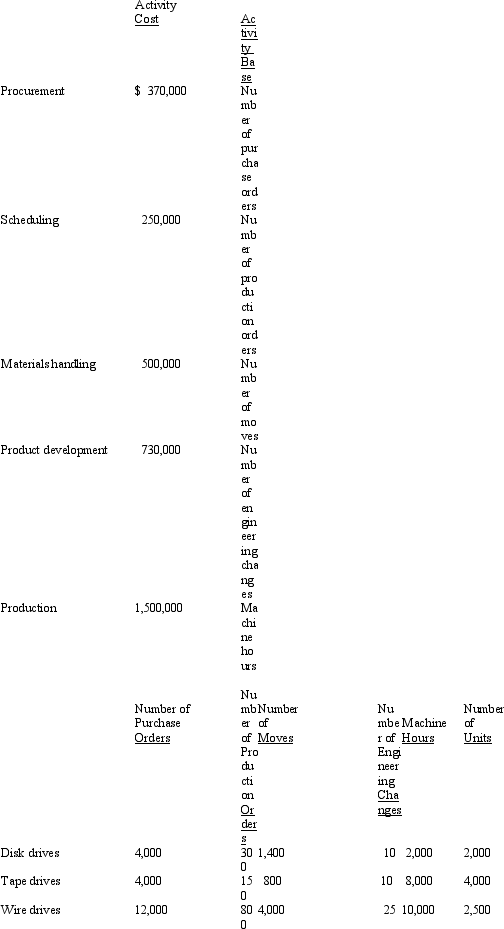

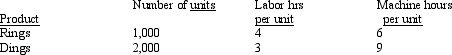

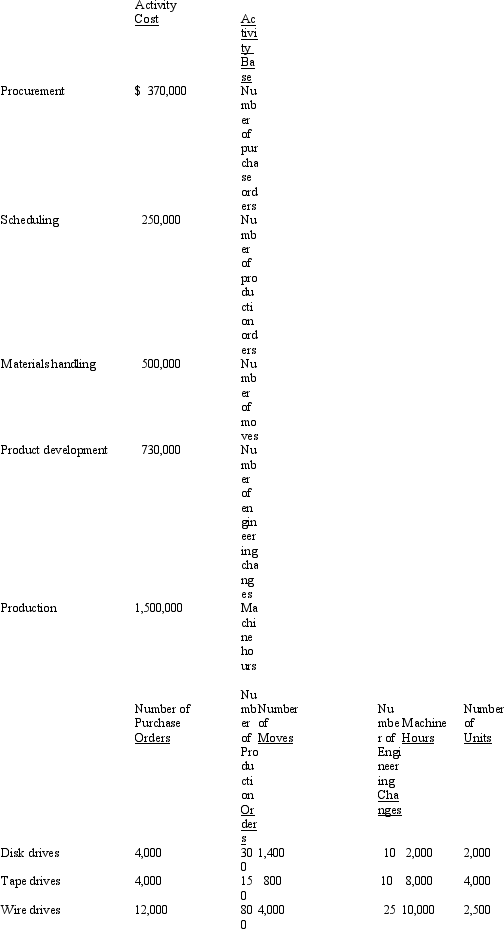

The Aleutian Company produces two products, Rings and Dings. They are manufactured in two departments-fabrication and assembly. Data for the products and departments are listed below.  All of the machine hours take place in the Fabrication department, which has an estimated overhead of $90,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $105,000.

All of the machine hours take place in the Fabrication department, which has an estimated overhead of $90,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $105,000.

The Aleutian Company uses a departmental overhead rates. The fabrication department uses machine hours for an allocation base, and the assembly department uses labor hours.

What is the overhead cost per unit for Dings?

A) $65.25

B) $56.75

C) $23.25

D) $64.50

All of the machine hours take place in the Fabrication department, which has an estimated overhead of $90,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $105,000.

All of the machine hours take place in the Fabrication department, which has an estimated overhead of $90,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $105,000.The Aleutian Company uses a departmental overhead rates. The fabrication department uses machine hours for an allocation base, and the assembly department uses labor hours.

What is the overhead cost per unit for Dings?

A) $65.25

B) $56.75

C) $23.25

D) $64.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

63

The Aleutian Company produces two products, Rings and Dings. They are manufactured in two departments-fabrication and assembly. Data for the products and departments are listed below.  All of the machine hours take place in the Fabrication department, which has an estimated overhead of $90,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $105,000.

All of the machine hours take place in the Fabrication department, which has an estimated overhead of $90,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $105,000.

The Aleutian Company uses a departmental overhead rates. The fabrication department uses machine hours for an allocation base, and the assembly department uses labor hours.

What is the fabrication department overhead rate per machine hour?

A) $10.50

B) $9.00

C) $8.12

D) $3.75

All of the machine hours take place in the Fabrication department, which has an estimated overhead of $90,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $105,000.

All of the machine hours take place in the Fabrication department, which has an estimated overhead of $90,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $105,000.The Aleutian Company uses a departmental overhead rates. The fabrication department uses machine hours for an allocation base, and the assembly department uses labor hours.

What is the fabrication department overhead rate per machine hour?

A) $10.50

B) $9.00

C) $8.12

D) $3.75

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

64

Panamint Systems Corporation is estimating activity costs associated with producing disk drives, tapes drives, and wire drives. The indirect labor can be traced to four separate activity pools. The budgeted activity cost and activity base data by product are provided below.  Determine the activity rate for product development per change.

Determine the activity rate for product development per change.

A) $73,000

B) $8,588

C) $30,417

D) $16,222

Determine the activity rate for product development per change.

Determine the activity rate for product development per change.A) $73,000

B) $8,588

C) $30,417

D) $16,222

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

65

The Kaumajet Factory produces two products - table lamps and desk lamps. It has two separate departments - finishing and production. The overhead budget for the finishing department is $550,000, using 500,000 direct labor hours. The overhead budget for the production department is $400,000 using 80,000 direct labor hours. If the budget estimates that a desk lamp will require 1 hours of finishing and 2 hours of production, how much factory overhead will be allocated to each unit of desk lamps using the multiple production department factory overhead rate method with an allocation base of direct labor hours?

A) $11.10

B) $4.91

C) $5.00

D) $7.20

A) $11.10

B) $4.91

C) $5.00

D) $7.20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

66

The Aleutian Company produces two products, Rings and Dings. They are manufactured in two departments-fabrication and assembly. Data for the products and departments are listed below.  All of the machine hours take place in the Fabrication department, which has an estimated overhead of $90,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $105,000.

All of the machine hours take place in the Fabrication department, which has an estimated overhead of $90,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $105,000.

The Aleutian Company uses a departmental overhead rates. The fabrication department uses machine hours for an allocation base, and the assembly department uses labor hours.

What is the assembly department overhead rate per labor hour?

A) $10.50

B) $19.50

C) $3.75

D) $4.38

All of the machine hours take place in the Fabrication department, which has an estimated overhead of $90,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $105,000.

All of the machine hours take place in the Fabrication department, which has an estimated overhead of $90,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $105,000.The Aleutian Company uses a departmental overhead rates. The fabrication department uses machine hours for an allocation base, and the assembly department uses labor hours.

What is the assembly department overhead rate per labor hour?

A) $10.50

B) $19.50

C) $3.75

D) $4.38

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

67

Panamint Systems Corporation is estimating activity costs associated with producing disk drives, tapes drives, and wire drives. The indirect labor can be traced to four separate activity pools. The budgeted activity cost and activity base data by product are provided below.  Determine the activity-based cost for each wire drive unit.

Determine the activity-based cost for each wire drive unit.

A) $204.13

B) $173.51

C) $744.06

D) $394.12

Determine the activity-based cost for each wire drive unit.

Determine the activity-based cost for each wire drive unit.A) $204.13

B) $173.51

C) $744.06

D) $394.12

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

68

The Kaumajet Factory produces two products - table lamps and desk lamps. It has two separate departments - finishing and production. The overhead budget for the finishing department is $550,000, using 500,000 direct labor hours. The overhead budget for the production department is $400,000 using 80,000 direct labor hours. If the budget estimates that a table lamp will require 2 hours of finishing and 1 hours of production, how much factory overhead will be allocated to each unit of table lamp using the multiple production department factory overhead rate method with an allocation base of direct labor hours?

A) $6.33

B) $4.91

C) $5.00

D) $7.20

A) $6.33

B) $4.91

C) $5.00

D) $7.20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following are the two most common allocation bases for factory overhead?

A) Total overhead dollars and machine hours

B) Direct labor hours and machine hours

C) Direct labor hours and factory expenses

D) Machine hours and factory expenses

A) Total overhead dollars and machine hours

B) Direct labor hours and machine hours

C) Direct labor hours and factory expenses

D) Machine hours and factory expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

70

Panamint Systems Corporation is estimating activity costs associated with producing disk drives, tapes drives, and wire drives. The indirect labor can be traced to four separate activity pools. The budgeted activity cost and activity base data by product are provided below.  Determine the activity rate for materials handling per move.

Determine the activity rate for materials handling per move.

A) $58.82

B) $50.00

C) $20.83

D) $80.65

Determine the activity rate for materials handling per move.

Determine the activity rate for materials handling per move.A) $58.82

B) $50.00

C) $20.83

D) $80.65

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

71

The Kaumajet Factory produces two products - table lamps and desk lamps. It has two separate departments - finishing and production. The overhead budget for the finishing department is $550,000, using 500,000 direct labor hours. The overhead budget for the production department is $400,000 using 80,000 direct labor hours. If the budget estimates that a table lamp will require 2 hours of finishing and 1 hours of production, what is the total amount of factory overhead to be allocated to table lamps using the multiple production department factory overhead rate method with an allocation base of direct labor hours, if 75,000 units are produced?

A) $368,250

B) $540,000

C) $832,500

D) $475,000

A) $368,250

B) $540,000

C) $832,500

D) $475,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

72

All of the following can be used as an allocation base for calculating factory overhead rates except:

A) direct labor dollars

B) direct labor hours

C) machine hours

D) total overhead costs

A) direct labor dollars

B) direct labor hours

C) machine hours

D) total overhead costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

73

Using multiple department factory overhead rates instead of a single plantwide factory overhead rate:

A) results in more accurate product costs

B) results in distorted product costs

C) is simpler and less expensive than a plantwide rate

D) applies overhead costs to all departments equally

A) results in more accurate product costs

B) results in distorted product costs

C) is simpler and less expensive than a plantwide rate

D) applies overhead costs to all departments equally

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

74

The Kaumajet Factory produces two products - table lamps and desk lamps. It has two separate departments - finishing and production. The overhead budget for the finishing department is $550,000, using 500,000 direct labor hours. The overhead budget for the production department is $400,000 using 80,000 direct labor hours. If the budget estimates that a desk lamp will require 1 hours of finishing and 2 hours of production, what is the total amount of factory overhead to be allocated to desk lamps using the multiple production department factory overhead rate method with an allocation base of direct labor hours, if 26,000 units are produced?

A) $540,000

B) $187,200

C) $475,000

D) $288,600

A) $540,000

B) $187,200

C) $475,000

D) $288,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

75

Using a plantwide factory overhead rate distorts product costs when:

A) products require different ratios of allocation-base usage in each production department

B) significant differences exist in the factory overhead rates used across different production departments

C) both A and B are true

D) neither A nor B are true

A) products require different ratios of allocation-base usage in each production department

B) significant differences exist in the factory overhead rates used across different production departments

C) both A and B are true

D) neither A nor B are true

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

76

Panamint Systems Corporation is estimating activity costs associated with producing disk drives, tapes drives, and wire drives. The indirect labor can be traced to four separate activity pools. The budgeted activity cost and activity base data by product are provided below.  Determine the activity rate for production per machine hour.

Determine the activity rate for production per machine hour.

A) $62.50

B) $150.00

C) $75.00

D) $176.47

Determine the activity rate for production per machine hour.

Determine the activity rate for production per machine hour.A) $62.50

B) $150.00

C) $75.00

D) $176.47

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

77

Scoresby Co. uses 3 machine hours and 1 direct labor hour to produce Product X. It uses 4 machine hours and 8 direct labor hours to produce Product Y. Scoresby's Assembly and Finishing Departments have factory overhead rates of $240 per machine hour and $160 per direct labor hour, respectively. How much overhead cost will be charged to the two products?

A) Product X = $1,600; Product Y = $4,800

B) Product X = $400; Product Y = $400

C) Product X = $880; Product Y = $2,240

D) Product X = $720; Product Y = $1,280

A) Product X = $1,600; Product Y = $4,800

B) Product X = $400; Product Y = $400

C) Product X = $880; Product Y = $2,240

D) Product X = $720; Product Y = $1,280

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

78

The Aleutian Company produces two products, Rings and Dings. They are manufactured in two departments-fabrication and assembly. Data for the products and departments are listed below.  All of the machine hours take place in the Fabrication department, which has an estimated overhead of $90,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $105,000.

All of the machine hours take place in the Fabrication department, which has an estimated overhead of $90,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $105,000.

The Aleutian Company uses a departmental overhead rates. The fabrication department uses machine hours for an allocation base, and the assembly department uses labor hours.

What is the overhead cost per unit for Rings?

A) $65.25

B) $23.25

C) $44.10

D) $64.50

All of the machine hours take place in the Fabrication department, which has an estimated overhead of $90,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $105,000.

All of the machine hours take place in the Fabrication department, which has an estimated overhead of $90,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $105,000.The Aleutian Company uses a departmental overhead rates. The fabrication department uses machine hours for an allocation base, and the assembly department uses labor hours.

What is the overhead cost per unit for Rings?

A) $65.25

B) $23.25

C) $44.10

D) $64.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

79

Panamint Systems Corporation is estimating activity costs associated with producing disk drives, tapes drives, and wire drives. The indirect labor can be traced to four separate activity pools. The budgeted activity cost and activity base data by product are provided below.  Determine the activity rate per production order for scheduling.

Determine the activity rate per production order for scheduling.

A) $200.00

B) $20.00

C) $29.41

D) $10.42

Determine the activity rate per production order for scheduling.

Determine the activity rate per production order for scheduling.A) $200.00

B) $20.00

C) $29.41

D) $10.42

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

80

Panamint Systems Corporation is estimating activity costs associated with producing disk drives, tapes drives, and wire drives. The indirect labor can be traced to four separate activity pools. The budgeted activity cost and activity base data by product are provided below.  Determine the activity-based cost for each disk drive unit.

Determine the activity-based cost for each disk drive unit.

A) $92.25

B) $130.69

C) $394.12

D) $279.57

Determine the activity-based cost for each disk drive unit.

Determine the activity-based cost for each disk drive unit.A) $92.25

B) $130.69

C) $394.12

D) $279.57

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck