Deck 14: Financial Statement Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

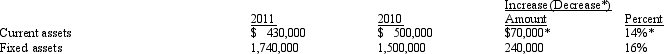

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

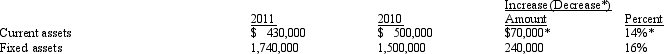

سؤال

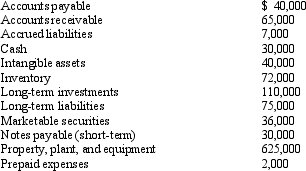

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

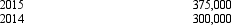

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/186

العب

ملء الشاشة (f)

Deck 14: Financial Statement Analysis

1

Vertical analysis refers to comparing the financial statements of a single company for several years.

False

2

Current position analysis indicates a company's ability to liquidate current liabilities.

True

3

The relationship of each asset item as a percent of total assets is an example of vertical analysis.

True

4

The ratio of the sum of cash, receivables, and marketable securities to current liabilities is referred to as the current ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

5

In the vertical analysis of a balance sheet, the base for current liabilities is total liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

6

If two companies have the same current ratio, their ability to pay short-term debt is the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

7

Dollar amounts of working capital are difficult to assess when comparing companies of different sizes or in comparing such amounts with industry figures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

8

In a common-sized income statement, each item is expressed as a percentage of net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

9

In the vertical analysis of an income statement, each item is generally stated as a percentage of total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

10

In horizontal analysis, the current year is the base year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

11

On a common-sized income statement, all items are stated as a percent of total assets or equities at year-end.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

12

Comparable financial statements are designed to compare the financial statements of two or more corporations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

13

Factors which reflect the ability of a business to pay its debts and earn a reasonable amount of income are referred to as solvency and profitability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

14

Using vertical analysis of the income statement, a company's net income as a percentage of net sales is 15%; therefore, the cost of goods sold as a percentage of sales must be 85%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

15

A 15% change in sales will result in a 15% change in net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

16

The excess of current assets over current liabilities is referred to as working capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

17

A financial statement showing each item on the statement as a percentage of one key item on the statement is called common-sized financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

18

The percentage analysis of increases and decreases in corresponding items in comparative financial statements is referred to as horizontal analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

19

An advantage of the current ratio is that it considers the makeup of the current assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

20

Using measures to assess a business's ability to pay its current liabilities is called current position analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

21

If a company has issued only one class of stock, the earnings per share are determined by dividing net income plus interest expense by the number of shares outstanding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

22

In computing the rate earned on total assets, interest expense is subtracted from net income before dividing by average total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

23

Assuming that the quantities of inventory on hand during the current year were sufficient to meet all demands for sales, a decrease in the inventory turnover for the current year when compared with the turnover for the preceding year indicates an improvement in inventory management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

24

A decrease in the ratio of liabilities to stockholders' equity indicates an improvement in the margin of safety for creditors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

25

If the accounts receivable turnover for the current year has decreased when compared with the ratio for the preceding year, there has been an acceleration in the collection of receivables.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

26

Solvency analysis focuses on the ability of a business to pay its current and noncurrent liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

27

If a firm has a quick ratio of 1, the subsequent payment of an account payable will cause the ratio to increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

28

The rate earned on total assets measures the profitability of total assets, without considering how the assets are financed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

29

When computing the rate earned on total common stockholders' equity, preferred stock dividends are subtracted from net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

30

When the rate of return on total assets ratio is greater than the rate of return on common stockholders' equity ratio, the management of the company has effectively used leverage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

31

The number of days' sales in inventory is one means of expressing the relationship between the cost of goods sold and inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

32

The ratio of fixed assets to long-term liabilities provides a measure of a firm's ability to pay dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

33

The denominator of the rate of return on total assets ratio is the average total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

34

The ratio of the market price per share of common stock on a specific date to the annual earnings per share is referred to as the price-earnings ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

35

If a firm has a current ratio of 2, the subsequent receipt of a 60-day note receivable on account will cause the ratio to decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

36

The number of days' sales in receivables is one means of expressing the relationship between average daily sales and accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

37

An increase in the accounts receivable turnover may be due to an improvement in the collection of receivables or to a change in the granting of credit and/or in collection practices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

38

In computing the ratio of net sales to assets, long-term investments are excluded from average total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

39

A firm selling food should have higher inventory turnover rate than a firm selling office furniture.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

40

A balance sheet shows cash, $75,000; marketable securities, $115,000; receivables, $150,000 and $222,500 of inventories. Current liabilities are $225,000. The current ratio is 2.5 to 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

41

An extraordinary loss of $300,000 that results in income tax savings of $90,000 should be reported as an extraordinary loss (net of tax) of $210,000 on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

42

A company can use comparisons of its financial data to the data of other companies and industry values to evaluate its position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

43

A clean audit opinion is the same as a qualified audit opinion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

44

Earnings per share amounts are only required to be presented for income from continuing operations and net income on the face of the statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

45

When a corporation discontinues a segment of its operations at a loss, the loss should be reported as a separate item after income from continuing operations on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

46

The auditor's report is where the auditor certifies that the financial statements are correct and accurate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

47

The effects of differences in accounting methods are of little importance when analyzing comparable data from competing businesses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

48

In a company's annual report, the section called management discussion and analysis provides critical information in interpreting the financial statements and assessing the future of the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

49

Comparing dividends per share to earnings per share indicates the extent to which the corporation is retaining its earnings for use in operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

50

Unusual items affecting the prior period's income statement consist of errors and change in accounting principles.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

51

The report on internal control required by the Sarbanes-Oxley Act of 2002 may be prepared by either management or the company's auditors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

52

An extraordinary item must be either unusual in nature or infrequent in occurrence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

53

When a corporation discontinues a segment of its operations at a loss, the loss should be reported as a separate item before income from continuing operations on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

54

Interpreting financial analysis should be considered in light of conditions peculiar to the industry and the general economic conditions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

55

Reporting unusual items separately on the income statement allows investors to isolate the effects of these items on income and cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

56

The dividend yield rate is equal to the dividends per share divided by the par value per share of common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

57

Those unusual items reported as deductions from income from continuing operations should be listed net of the related income tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

58

Unusual items affecting the current period's income statement consist of changes in accounting principles and discontinued operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

59

When you are interpreting financial ratios, it is useful to compare a company's ratios to some form of standard.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

60

Ratios and various other analytical measures are a substitute for sound judgment, nor do they provide definitive guides for action.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

61

What type of analysis is indicated by the following?

A) vertical analysis

B) horizontal analysis

C) liquidity analysis

D) common-size analysis

A) vertical analysis

B) horizontal analysis

C) liquidity analysis

D) common-size analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

62

One reason that a common-size statement is a useful tool in financial analysis is that it enables the user to

A) judge the relative potential of two companies of similar size in different industries.

B) determine which companies in a single industry are of the same value.

C) determine which companies in a single industry are of the same size.

D) make a better comparison of two companies of different sizes in the same industry.

A) judge the relative potential of two companies of similar size in different industries.

B) determine which companies in a single industry are of the same value.

C) determine which companies in a single industry are of the same size.

D) make a better comparison of two companies of different sizes in the same industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

63

Under which of the following cases may a percentage change be computed?

A) There is no amount in the base year.

B) There is a negative amount in the base year and a negative amount in the subsequent year.

C) The trend of the amounts is decreasing but all amounts are positive.

D) There is a negative amount in the base year and a positive amount in the subsequent year.

A) There is no amount in the base year.

B) There is a negative amount in the base year and a negative amount in the subsequent year.

C) The trend of the amounts is decreasing but all amounts are positive.

D) There is a negative amount in the base year and a positive amount in the subsequent year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

64

Horizontal analysis is a technique for evaluating financial statement data

A) for one period of time.

B) over a period of time.

C) on a certain date.

D) as it may appear in the future.

A) for one period of time.

B) over a period of time.

C) on a certain date.

D) as it may appear in the future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

65

In a common size balance sheet, the 100% figure is:

A) total property, plant and equipment.

B) total current assets.

C) total liabilities.

D) total assets.

A) total property, plant and equipment.

B) total current assets.

C) total liabilities.

D) total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

66

The percent of fixed assets to total assets is an example of

A) vertical analysis

B) solvency analysis

C) profitability analysis

D) horizontal analysis

A) vertical analysis

B) solvency analysis

C) profitability analysis

D) horizontal analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

67

In horizontal analysis, each item is expressed as a percentage of the

A) base year figure.

B) retained earnings figure.

C) total assets figure.

D) net income figure.

A) base year figure.

B) retained earnings figure.

C) total assets figure.

D) net income figure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

68

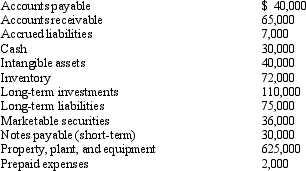

Based on the above data, what is the amount of working capital?

Based on the above data, what is the amount of working capital?A) $238,000

B) $128,000

C) $168,000

D) $203,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

69

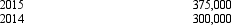

Assume the following sales data for a company:  What is the percentage increase in sales from 2014 to 2015?

What is the percentage increase in sales from 2014 to 2015?

A) 75%

B) 66.7%

C) 25%

D) 150%

What is the percentage increase in sales from 2014 to 2015?

What is the percentage increase in sales from 2014 to 2015?A) 75%

B) 66.7%

C) 25%

D) 150%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following below generally is the most useful in analyzing companies of different sizes

A) comparative statements

B) common-sized financial statements

C) price-level accounting

D) audit report

A) comparative statements

B) common-sized financial statements

C) price-level accounting

D) audit report

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

71

In performing a vertical analysis, the base for cost of goods sold is

A) total selling expenses.

B) net sales.

C) total expenses.

D) gross profit.

A) total selling expenses.

B) net sales.

C) total expenses.

D) gross profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

72

In a common size income statement, the 100% figure is:

A) net cost of goods sold.

B) net income.

C) gross profit.

D) net sales.

A) net cost of goods sold.

B) net income.

C) gross profit.

D) net sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

73

The relationship of $325,000 to $125,000, expressed as a ratio, is

A) 2.0 to 1

B) 2.6 to 1

C) 2.5 to 1

D) 0.45 to 1

A) 2.0 to 1

B) 2.6 to 1

C) 2.5 to 1

D) 0.45 to 1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

74

Based on the above data, what is the amount of quick assets?

Based on the above data, what is the amount of quick assets?A) $205,000

B) $203,000

C) $131,000

D) $66,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

75

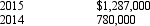

Assume the following sales data for a company:  What is the percentage increase in sales from 2014 to 2015?

What is the percentage increase in sales from 2014 to 2015?

A) 100%

B) 65%

C) 165%

D) 60.1%

What is the percentage increase in sales from 2014 to 2015?

What is the percentage increase in sales from 2014 to 2015?A) 100%

B) 65%

C) 165%

D) 60.1%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

76

A balance sheet that displays only component percentages is called

A) trend balance sheet

B) comparative balance sheet

C) condensed balance sheet

D) common-sized balance sheet

A) trend balance sheet

B) comparative balance sheet

C) condensed balance sheet

D) common-sized balance sheet

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

77

An analysis in which all the components of an income statement are expressed as a percentage of net sales is called

A) vertical analysis

B) horizontal analysis

C) liquidity analysis

D) solvency analysis

A) vertical analysis

B) horizontal analysis

C) liquidity analysis

D) solvency analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

78

The ability of a business to pay its debts as they come due and to earn a reasonable amount of income is referred to as

A) solvency and leverage

B) solvency and profitability

C) solvency and liquidity

D) solvency and equity

A) solvency and leverage

B) solvency and profitability

C) solvency and liquidity

D) solvency and equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

79

The percentage analysis of increases and decreases in individual items in comparative financial statements is called

A) vertical analysis

B) solvency analysis

C) profitability analysis

D) horizontal analysis

A) vertical analysis

B) solvency analysis

C) profitability analysis

D) horizontal analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck

80

Horizontal analysis of comparative financial statements includes the

A) development of common size statements.

B) calculation of liquidity ratios.

C) calculation of dollar amount changes and percentage changes from the previous to the current year.

D) the evaluation of each component in a financial statement to a total within the statement.

A) development of common size statements.

B) calculation of liquidity ratios.

C) calculation of dollar amount changes and percentage changes from the previous to the current year.

D) the evaluation of each component in a financial statement to a total within the statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 186 في هذه المجموعة.

فتح الحزمة

k this deck