Deck 3: Cost Behavior

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/132

العب

ملء الشاشة (f)

Deck 3: Cost Behavior

1

Which of the following statements is TRUE about relevant range?

A) When costs reach a level above the relevant range, they are considered appropriate for analysis.

B) Linear estimates of an economist's curvilinear cost function is only valid within the relevant range.

C) When costs reach a level below the relevant range, they are considered appropriate for analysis.

D) The nonlinear relevant range is ignored, and only those costs outside of this range may be considered.

A) When costs reach a level above the relevant range, they are considered appropriate for analysis.

B) Linear estimates of an economist's curvilinear cost function is only valid within the relevant range.

C) When costs reach a level below the relevant range, they are considered appropriate for analysis.

D) The nonlinear relevant range is ignored, and only those costs outside of this range may be considered.

B

2

A manufacturing company pays an assembly line worker $10 per hour.What is the proper classification of this labor cost?

A) fixed cost

B) semivariable cost

C) variable cost

D) mixed cost

A) fixed cost

B) semivariable cost

C) variable cost

D) mixed cost

C

3

The range of activity within which a linear cost function is valid is called the

A) normal range.

B) relevant range.

C) activity range.

D) none of these.

A) normal range.

B) relevant range.

C) activity range.

D) none of these.

B

4

Cost behavior analysis focuses on how costs

A) react to changes in profit.

B) change over time.

C) react to changes in activity level.

D) both a and c.

A) react to changes in profit.

B) change over time.

C) react to changes in activity level.

D) both a and c.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

5

As the volume of activity increases within the relevant range, the variable cost per unit

A) decreases.

B) decreases at first, then increases.

C) remains the same.

D) increases.

A) decreases.

B) decreases at first, then increases.

C) remains the same.

D) increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

6

Direct materials are an example of a

A) fixed cost.

B) variable cost.

C) step cost.

D) mixed cost.

A) fixed cost.

B) variable cost.

C) step cost.

D) mixed cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

7

__________ explain changes in costs as units produced change.

A) Non-unit-level drivers

B) Activity based cost drivers

C) Unit-level drivers

D) All of these

A) Non-unit-level drivers

B) Activity based cost drivers

C) Unit-level drivers

D) All of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

8

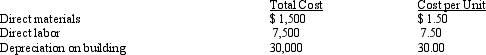

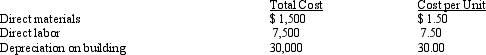

Holly Corporation has the following costs for 1,000 units:  What is the total amount of direct materials for 100 units?

What is the total amount of direct materials for 100 units?

A) $ 1.50

B) $ 3.00

C) $150.00

D) $225.00

What is the total amount of direct materials for 100 units?

What is the total amount of direct materials for 100 units?A) $ 1.50

B) $ 3.00

C) $150.00

D) $225.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

9

When the volume of activity increases within the relevant range, the fixed cost per unit

A) decreases.

B) decreases at first, then increases.

C) remains the same.

D) increases.

A) decreases.

B) decreases at first, then increases.

C) remains the same.

D) increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

10

Fixed cost per unit is $9 when 20,000 units are produced and $6 when 30,000 units are produced.What is the total fixed cost when nothing is produced?

A) $120,000

B) $270,000

C) $15

D) $180,000

A) $120,000

B) $270,000

C) $15

D) $180,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

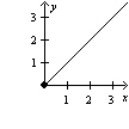

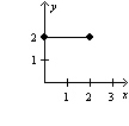

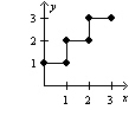

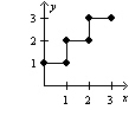

11

Given the following graphs, which graph represents fixed costs?

A) II

B) I

C) III

D) none of these

A) II

B) I

C) III

D) none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following would be an example of a unit-based cost driver?

A) engineering orders

B) direct labor hours

C) inspection hours

D) material moves

A) engineering orders

B) direct labor hours

C) inspection hours

D) material moves

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

13

__________ explain changes in costs as factors other than changes in units produced.

A) Functional based cost drivers

B) Non-unit-based cost drivers

C) Unit-based cost drivers

D) None of these

A) Functional based cost drivers

B) Non-unit-based cost drivers

C) Unit-based cost drivers

D) None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following costs is a variable cost?

A) supervisors' salaries

B) research and development

C) materials used in production

D) rent

A) supervisors' salaries

B) research and development

C) materials used in production

D) rent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following statements is TRUE about fixed and variable costs?

A) Both costs are constant when considered on a per-unit basis.

B) Both costs are constant when considered on a total basis.

C) Fixed costs are constant in total and variable costs are constant per unit.

D) Variable costs are constant in total and fixed costs are constant per unit.

A) Both costs are constant when considered on a per-unit basis.

B) Both costs are constant when considered on a total basis.

C) Fixed costs are constant in total and variable costs are constant per unit.

D) Variable costs are constant in total and fixed costs are constant per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

16

In a traditional cost management system, cost behavior is assumed to be driven only by

A) unit based cost drivers.

B) non-unit level cost drivers.

C) activity-based cost drivers.

D) none of these.

A) unit based cost drivers.

B) non-unit level cost drivers.

C) activity-based cost drivers.

D) none of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

17

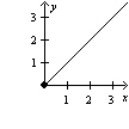

A steep slope in the variable cost line indicates a

A) low variable cost per unit.

B) high influence of activity on total variable costs.

C) low influence of activity on total variable costs.

D) large amount of fixed costs.

A) low variable cost per unit.

B) high influence of activity on total variable costs.

C) low influence of activity on total variable costs.

D) large amount of fixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

18

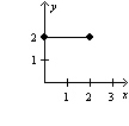

Assuming costs are represented on the vertical axis and volume of activity on the horizontal axis, which of the following costs would be represented by a line that is parallel to the horizontal axis?

A) total direct material costs

B) a consultant paid $75 per hour with a maximum fee of $1,200

C) employees who are paid $10 per hour and guaranteed a minimum weekly wage of $200

D) rent on exhibit space at a convention

A) total direct material costs

B) a consultant paid $75 per hour with a maximum fee of $1,200

C) employees who are paid $10 per hour and guaranteed a minimum weekly wage of $200

D) rent on exhibit space at a convention

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

19

A supervisor's salary of $2,000 per month is an example of a

A) fixed cost.

B) variable cost.

C) step cost.

D) mixed cost.

A) fixed cost.

B) variable cost.

C) step cost.

D) mixed cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

20

The direct material cost is $10,000 when 2,000 units are produced.What is the direct material cost for 2,500 units produced?

A) $10,000

B) $ 8,000

C) $15,000

D) $12,500

A) $10,000

B) $ 8,000

C) $15,000

D) $12,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

21

If production volume increases from 8,000 to 10,000 units,

A) total costs will increase by 20 percent.

B) total costs will increase by 25 percent.

C) total variable costs will increase by 25 percent.

D) mixed and variable costs will increase by 25 percent.

A) total costs will increase by 20 percent.

B) total costs will increase by 25 percent.

C) total variable costs will increase by 25 percent.

D) mixed and variable costs will increase by 25 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

22

Committed resources

A) are supplied as needed.

B) are acquired by a contract for the exact amount of their usage.

C) may exceed the demand for their usage.

D) all of these.

A) are supplied as needed.

B) are acquired by a contract for the exact amount of their usage.

C) may exceed the demand for their usage.

D) all of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

23

_______________ are those that are acquired from outside sources, where the terms of acquisition do NOT require any long-term commitment for any given amount of the resource.

A) Flexible resources

B) Committed resources

C) Discretionary fixed expenses

D) Committed fixed expenses

A) Flexible resources

B) Committed resources

C) Discretionary fixed expenses

D) Committed fixed expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

24

Mixed costs, by definition, contain both

A) product and period costs.

B) fixed and variable costs.

C) direct and indirect costs.

D) controllable and noncontrollable costs.

A) product and period costs.

B) fixed and variable costs.

C) direct and indirect costs.

D) controllable and noncontrollable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following is an example of a committed fixed expense?

A) depreciation on a factory building

B) supervisor's salary

C) direct labor

D) insurance on a building

A) depreciation on a factory building

B) supervisor's salary

C) direct labor

D) insurance on a building

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

26

Boss Company currently leases a delivery van from Check Enterprises for a fee of $250 per month plus $0.40 per mile.Management is evaluating the desirability of switching to a modern, fuel-efficient van, which can be leased from David, Inc., for a fee of $600 per month plus $0.05 per mile.All operating costs and fuel are included in the rental fees.In general, a lease from

A) David, Inc., is economically preferable to a lease from Check Enterprises regardless of the monthly use.

B) Check Enterprises is economically preferable below 1,000 miles per month.

C) Check Enterprises is economically preferable to a lease from David, Inc., regardless of the monthly use.

D) Check Enterprises is economically preferable above 1,000 miles per month.

A) David, Inc., is economically preferable to a lease from Check Enterprises regardless of the monthly use.

B) Check Enterprises is economically preferable below 1,000 miles per month.

C) Check Enterprises is economically preferable to a lease from David, Inc., regardless of the monthly use.

D) Check Enterprises is economically preferable above 1,000 miles per month.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

27

Flexible resources

A) are supplied as needed.

B) are acquired from outside sources, not requiring a long-term commitment.

C) have no unused capacity.

D) all of these.

A) are supplied as needed.

B) are acquired from outside sources, not requiring a long-term commitment.

C) have no unused capacity.

D) all of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

28

Figure 3-1 ALF Systems undertakes its own machine maintenance.The depreciation on the equipment is $20,000 per year and operating cost is $2 per machine hour.Last year 275,000 machine hours were used to produce 100,000 units.

-

Refer to Figure 3-1.Compute the total variable machine maintenance cost last year.

A) $275,000

B) $240,000

C) $220,000

D) $550,000

-

Refer to Figure 3-1.Compute the total variable machine maintenance cost last year.

A) $275,000

B) $240,000

C) $220,000

D) $550,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

29

_______________ result when organizations acquire many multiperiod service capacities by paying cash up front or by entering into an explicit contract that requires periodic cash payments.

A) Managed fixed expenses

B) Committed fixed expenses

C) Discretionary fixed expenses

D) Period expenses

A) Managed fixed expenses

B) Committed fixed expenses

C) Discretionary fixed expenses

D) Period expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

30

Figure 3-1 ALF Systems undertakes its own machine maintenance.The depreciation on the equipment is $20,000 per year and operating cost is $2 per machine hour.Last year 275,000 machine hours were used to produce 100,000 units.

-

See Figure 3-1.Develop a cost equation for the total machine maintenance cost.

A) Y= $275,000

B) Y = $20,000

C) Y = $20,000 + $2 MHR

D) Y = $2 MHR

-

See Figure 3-1.Develop a cost equation for the total machine maintenance cost.

A) Y= $275,000

B) Y = $20,000

C) Y = $20,000 + $2 MHR

D) Y = $2 MHR

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

31

Figure 3-1 ALF Systems undertakes its own machine maintenance.The depreciation on the equipment is $20,000 per year and operating cost is $2 per machine hour.Last year 275,000 machine hours were used to produce 100,000 units.

-

See Figure 3-1.If 300,000 machine hours had been worked last year, what would be the total machine maintenance cost?

A) $600,000

B) $620,000

C) $420,000

D) $220,000

-

See Figure 3-1.If 300,000 machine hours had been worked last year, what would be the total machine maintenance cost?

A) $600,000

B) $620,000

C) $420,000

D) $220,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

32

The linearity assumption is most likely to be a close approximation for an underlying nonlinear cost function

A) within a relevant range of activity.

B) over the long run.

C) for short-run periods.

D) both a and c.

A) within a relevant range of activity.

B) over the long run.

C) for short-run periods.

D) both a and c.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

33

Figure 3-1 ALF Systems undertakes its own machine maintenance.The depreciation on the equipment is $20,000 per year and operating cost is $2 per machine hour.Last year 275,000 machine hours were used to produce 100,000 units.

-

See Figure 3-1.Compute the total machine maintenance cost for last year.

A) $570,000

B) $550,000

C) $420,000

D) $20,000

-

See Figure 3-1.Compute the total machine maintenance cost for last year.

A) $570,000

B) $550,000

C) $420,000

D) $20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

34

Adams Corporation rents a truck for a flat fee plus an additional charge per mile.What type of cost is the rent?

A) fixed cost

B) mixed cost

C) variable cost

D) step cost

A) fixed cost

B) mixed cost

C) variable cost

D) step cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

35

Figure 3-1 ALF Systems undertakes its own machine maintenance.The depreciation on the equipment is $20,000 per year and operating cost is $2 per machine hour.Last year 275,000 machine hours were used to produce 100,000 units.

-

See Figure 3-1.What is the total maintenance cost per unit produced?

A) $0.55

B) $4.20

C) $5.50

D) $5.70

-

See Figure 3-1.What is the total maintenance cost per unit produced?

A) $0.55

B) $4.20

C) $5.50

D) $5.70

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

36

The efficient level of activity performance is called

A) activity capacity.

B) practical capacity.

C) unused capacity.

D) acquired capacity.

A) activity capacity.

B) practical capacity.

C) unused capacity.

D) acquired capacity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

37

Assuming costs are represented on the vertical axis and volume of activity on the horizontal axis, which of the following costs would be represented by a line that starts at the origin and reaches a maximum value beyond which the line is parallel to the horizontal axis?

A) total direct material costs

B) a consultant paid $100 per hour with a maximum fee of $2,000

C) employees who are paid $15 per hour and guaranteed a minimum weekly wage of $300

D) rent on exhibit space at a convention.

A) total direct material costs

B) a consultant paid $100 per hour with a maximum fee of $2,000

C) employees who are paid $15 per hour and guaranteed a minimum weekly wage of $300

D) rent on exhibit space at a convention.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

38

If all the activity capacity acquired is not used, this is an example of

A) practical capacity.

B) activity capacity.

C) unused capacity.

D) ideal capacity.

A) practical capacity.

B) activity capacity.

C) unused capacity.

D) ideal capacity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

39

An equipment lease that specifies a payment of $5,000 per month plus $8 per machine hour used is an example of a

A) fixed cost.

B) variable cost.

C) step cost.

D) mixed cost.

A) fixed cost.

B) variable cost.

C) step cost.

D) mixed cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following is NOT a correct statement concerning cost behavior?

A) In the long run, all costs are variable.

B) Variable costs increase in total in relation to the activity driver.

C) Unit fixed costs increase or decrease inversely in relation to the activity driver.

D) All of these

A) In the long run, all costs are variable.

B) Variable costs increase in total in relation to the activity driver.

C) Unit fixed costs increase or decrease inversely in relation to the activity driver.

D) All of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

41

_______________ are costs incurred for the acquisition of short-run activity capacity, usually as the result of yearly planning.

A) Discretionary fixed expenses

B) Committed fixed expenses

C) Mixed costs

D) Step-variable costs

A) Discretionary fixed expenses

B) Committed fixed expenses

C) Mixed costs

D) Step-variable costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

42

A hospital requires one nurse for each eight patients.This is an example of a

A) fixed cost.

B) variable cost.

C) step cost.

D) mixed cost.

A) fixed cost.

B) variable cost.

C) step cost.

D) mixed cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

43

The method for analyzing cost behavior that generally classifies general ledger accounts is

A) account analysis method.

B) multiple regression method.

C) industrial engineering method.

D) learning curve method.

A) account analysis method.

B) multiple regression method.

C) industrial engineering method.

D) learning curve method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

44

When a firm acquires the resources needed to perform an activity, it is obtaining

A) practical capacity.

B) resource usage.

C) activity capacity.

D) unused capacity.

A) practical capacity.

B) resource usage.

C) activity capacity.

D) unused capacity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following is an example of a step-fixed cost?

A) cost of disposable surgical scissors, which are purchased in increments of 100

B) cost of soaking solution to clean jewelry (Each jar can soak 50 rings before losing effectiveness.)

C) cost of tuition at $300 per credit hour up to 15 credit hours (Hours taken in excess of 15 hours are free.)

D) cost of disposable gowns used by patients in a hospital

A) cost of disposable surgical scissors, which are purchased in increments of 100

B) cost of soaking solution to clean jewelry (Each jar can soak 50 rings before losing effectiveness.)

C) cost of tuition at $300 per credit hour up to 15 credit hours (Hours taken in excess of 15 hours are free.)

D) cost of disposable gowns used by patients in a hospital

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following is an example of a discretionary fixed expense?

A) direct labor

B) depreciation on a factory building

C) insurance on a building

D) property taxes on a factory building

A) direct labor

B) depreciation on a factory building

C) insurance on a building

D) property taxes on a factory building

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following decision-making tools would NOT be useful in determining the slope and intercept of a mixed cost?

A) linear programming

B) least-squares method

C) high-low method

D) scattergraphs

A) linear programming

B) least-squares method

C) high-low method

D) scattergraphs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following is NOT a method of determining cost behavior?

A) industrial engineering method

B) account analysis method

C) statistical and quantitative methods

D) confidence interval model

A) industrial engineering method

B) account analysis method

C) statistical and quantitative methods

D) confidence interval model

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

49

The cost behavior method that may use time and motion studies to determine the activities and amounts for cost behavior analysis is

A) account analysis method.

B) industrial engineering method.

C) regression analysis.

D) high-low method.

A) account analysis method.

B) industrial engineering method.

C) regression analysis.

D) high-low method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

50

In the formula Y = F + VX, Y refers to the

A) slope.

B) intercept.

C) dependent variable.

D) independent variable.

A) slope.

B) intercept.

C) dependent variable.

D) independent variable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

51

In the formula Y = F + VX, V refers to the

A) slope.

B) intercept.

C) dependent variable.

D) total variable costs.

A) slope.

B) intercept.

C) dependent variable.

D) total variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

52

In the formula Y = F + VX, VX refers to the

A) total variable costs.

B) intercept.

C) dependent variable.

D) independent variable.

A) total variable costs.

B) intercept.

C) dependent variable.

D) independent variable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

53

_______________ are costs incurred that provide long-term activity capacity, usually as the result of strategic planning.

A) Discretionary fixed expenses

B) Committed fixed expenses

C) Mixed costs

D) Step-variable costs

A) Discretionary fixed expenses

B) Committed fixed expenses

C) Mixed costs

D) Step-variable costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

54

Figure 3-2 A company usually processes 20,000 orders at a total cost of $300,000.During the year, only 16,000 orders were processed.

-

Refer to Figure 3-2.What is the cost of resource usage?

A) $300,000

B) $240,000

C) $30

D) $60,000

-

Refer to Figure 3-2.What is the cost of resource usage?

A) $300,000

B) $240,000

C) $30

D) $60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

55

Figure 3-3 Mork Company has four process engineers that are each able to process 1,500 design changes.Last year 5,250 design changes were produced by the four engineers.Each engineer is paid $60,000 per year.

-

Refer to Figure 3-3.What is the unused capacity in dollars?

A) $60,000

B) $30,000

C) $240,000

D) $15,000

-

Refer to Figure 3-3.What is the unused capacity in dollars?

A) $60,000

B) $30,000

C) $240,000

D) $15,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

56

Figure 3-3 Mork Company has four process engineers that are each able to process 1,500 design changes.Last year 5,250 design changes were produced by the four engineers.Each engineer is paid $60,000 per year.

-

Refer to Figure 3-3.Calculate the activity rate per change order.

A) $4 per change order

B) $10 per change order

C) $40 per change order

D) $15 per change order

-

Refer to Figure 3-3.Calculate the activity rate per change order.

A) $4 per change order

B) $10 per change order

C) $40 per change order

D) $15 per change order

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

57

Figure 3-3 Mork Company has four process engineers that are each able to process 1,500 design changes.Last year 5,250 design changes were produced by the four engineers.Each engineer is paid $60,000 per year.

-

Refer to Figure 3-3.Calculate the unused capacity.

A) 750 change orders

B) 1,375 change orders

C) 4,000 change orders

D) 2,000 change orders

-

Refer to Figure 3-3.Calculate the unused capacity.

A) 750 change orders

B) 1,375 change orders

C) 4,000 change orders

D) 2,000 change orders

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

58

The activity-based resource usage model improves managerial control and decision making such as

A) the best way to use excess activity capacity in the system.

B) maximization of individual unit performance.

C) increasing the allocation of costs.

D) focusing on managing costs rather than activities.

A) the best way to use excess activity capacity in the system.

B) maximization of individual unit performance.

C) increasing the allocation of costs.

D) focusing on managing costs rather than activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

59

Salaries paid to shift supervisors are an example of a

A) step-variable cost.

B) step-fixed cost.

C) variable cost.

D) mixed cost.

A) step-variable cost.

B) step-fixed cost.

C) variable cost.

D) mixed cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

60

Figure 3-2 A company usually processes 20,000 orders at a total cost of $300,000.During the year, only 16,000 orders were processed.

-

Refer to Figure 3-2.What is the cost of unused activity?

A) $300,000

B) $240,000

C) $30

D) $60,000

-

Refer to Figure 3-2.What is the cost of unused activity?

A) $300,000

B) $240,000

C) $30

D) $60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

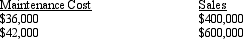

61

Kane Corporation found its maintenance cost and sales dollars to be somewhat correlated.Last year's high and low observations were as follows:  What is the fixed portion of the maintenance cost?

What is the fixed portion of the maintenance cost?

A) $24,000

B) $42,000

C) $30,000

D) $12,000

What is the fixed portion of the maintenance cost?

What is the fixed portion of the maintenance cost?A) $24,000

B) $42,000

C) $30,000

D) $12,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

62

Weaknesses of the high-low method include all of the following EXCEPT

A) only two observations are used to develop the cost function.

B) the high and low activity levels may not be representative.

C) the method does not detect if the cost behavior is nonlinear.

D) the method is relatively complex and difficult to apply.

A) only two observations are used to develop the cost function.

B) the high and low activity levels may not be representative.

C) the method does not detect if the cost behavior is nonlinear.

D) the method is relatively complex and difficult to apply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

63

In the formula Y = F + VX, X refers to the

A) slope.

B) intercept.

C) dependent variable.

D) independent variable.

A) slope.

B) intercept.

C) dependent variable.

D) independent variable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

64

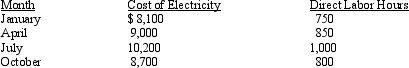

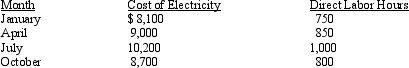

Hook Company wants to develop a cost estimating equation for its monthly cost of electricity.It has the following data:  Using the high-low method, which of the following is the best equation?

Using the high-low method, which of the following is the best equation?

A) Y = $900 + $12.00X

B) Y = $900 + $8.40X

C) Y = $1,800 + $8.40X

D) Y = $2,400 + $8.40X

Using the high-low method, which of the following is the best equation?

Using the high-low method, which of the following is the best equation?A) Y = $900 + $12.00X

B) Y = $900 + $8.40X

C) Y = $1,800 + $8.40X

D) Y = $2,400 + $8.40X

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

65

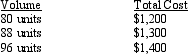

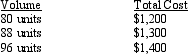

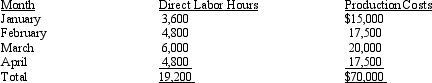

Assume the following information:  What is the variable cost per unit?

What is the variable cost per unit?

A) $15.00

B) $14.78

C) $13.75

D) $12.50

What is the variable cost per unit?

What is the variable cost per unit?A) $15.00

B) $14.78

C) $13.75

D) $12.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

66

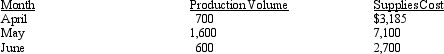

The following information was available about supplies cost for the second quarter of the year:  Using the high-low method, the estimate of supplies cost at 1,000 units of production is

Using the high-low method, the estimate of supplies cost at 1,000 units of production is

A) $2,700.

B) $4,460.

C) $4,900.

D) $7,100.

Using the high-low method, the estimate of supplies cost at 1,000 units of production is

Using the high-low method, the estimate of supplies cost at 1,000 units of production isA) $2,700.

B) $4,460.

C) $4,900.

D) $7,100.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

67

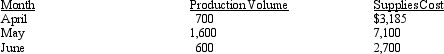

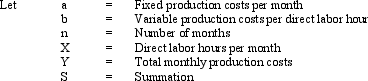

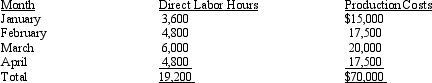

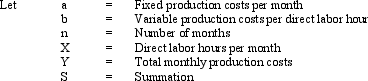

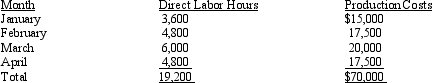

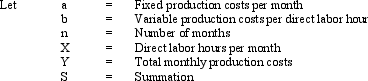

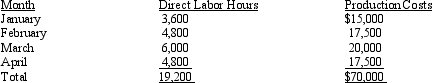

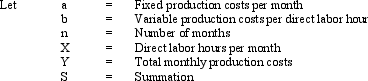

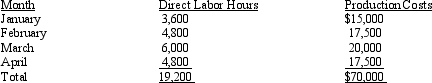

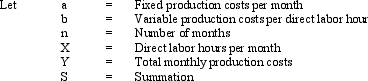

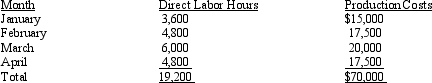

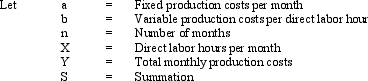

Figure 3-5 Lee Corporation manufactures and sells party items.The following representative direct labor hours and production costs are provided for a four-month period:

- Refer to Figure 3-5.Predict a cost for 5,000 labor hours.

A) $17,900

B) $17,700

C) $16,667

D) $30,400

- Refer to Figure 3-5.Predict a cost for 5,000 labor hours.

A) $17,900

B) $17,700

C) $16,667

D) $30,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

68

Advantages of the method of least squares over the high-low method include all of the following EXCEPT

A) a statistical method is used to mathematically derive the cost function.

B) only two points are used to develop the cost function.

C) the squared differences between actual observations and the line (cost function) are minimized.

D) all the observations have an effect on the cost function.

A) a statistical method is used to mathematically derive the cost function.

B) only two points are used to develop the cost function.

C) the squared differences between actual observations and the line (cost function) are minimized.

D) all the observations have an effect on the cost function.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

69

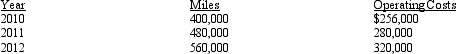

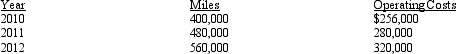

Greene Enterprises has the following information about its truck fleet miles and operating costs:  What is the best estimate of total costs using the high-low method if the expected fleet mileage for 2008 is 500,000 miles?

What is the best estimate of total costs using the high-low method if the expected fleet mileage for 2008 is 500,000 miles?

A) $288,000

B) $296,000

C) $256,000

D) $320,000

What is the best estimate of total costs using the high-low method if the expected fleet mileage for 2008 is 500,000 miles?

What is the best estimate of total costs using the high-low method if the expected fleet mileage for 2008 is 500,000 miles?A) $288,000

B) $296,000

C) $256,000

D) $320,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

70

Total costs may be computed as follows:

A) Fixed costs + (Variable costs per unit ´ Unit volume)

B) (Fixed costs per unit ´ Unit volume) + Variable costs

C) Fixed costs per unit + (Variable costs per unit ´ Unit volume)

D) (Fixed costs per unit ´ Unit volume) + Variable costs per unit

A) Fixed costs + (Variable costs per unit ´ Unit volume)

B) (Fixed costs per unit ´ Unit volume) + Variable costs

C) Fixed costs per unit + (Variable costs per unit ´ Unit volume)

D) (Fixed costs per unit ´ Unit volume) + Variable costs per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

71

If at a given volume total costs and fixed costs are known, the variable costs per unit may be computed as follows:

A) (Total costs - Fixed costs)/Unit volume

B) (Total costs/Unit volume) - Fixed costs

C) (Total costs ´ Unit volume) - (Fixed costs/Unit volume)

D) Total costs - (Fixed costs/Unit volume)

A) (Total costs - Fixed costs)/Unit volume

B) (Total costs/Unit volume) - Fixed costs

C) (Total costs ´ Unit volume) - (Fixed costs/Unit volume)

D) Total costs - (Fixed costs/Unit volume)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

72

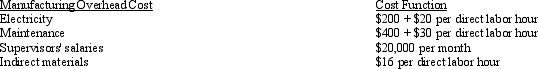

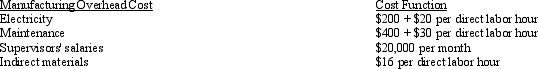

The following cost functions were developed for manufacturing overhead costs:  If June production is expected to be 2,000 units requiring 3,000 direct labor hours, estimated manufacturing overhead costs would be

If June production is expected to be 2,000 units requiring 3,000 direct labor hours, estimated manufacturing overhead costs would be

A) $218,600.

B) $198,000.

C) $152,600.

D) $20,733.

If June production is expected to be 2,000 units requiring 3,000 direct labor hours, estimated manufacturing overhead costs would be

If June production is expected to be 2,000 units requiring 3,000 direct labor hours, estimated manufacturing overhead costs would beA) $218,600.

B) $198,000.

C) $152,600.

D) $20,733.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

73

The high-low method may give unsatisfactory results if

A) the data points all fall on a line.

B) volume of activity is heavy.

C) volume of activity is light.

D) the points are unrepresentative.

A) the data points all fall on a line.

B) volume of activity is heavy.

C) volume of activity is light.

D) the points are unrepresentative.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

74

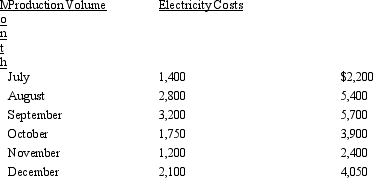

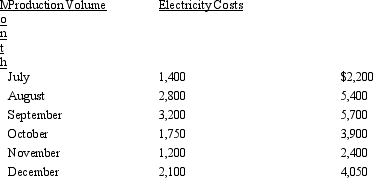

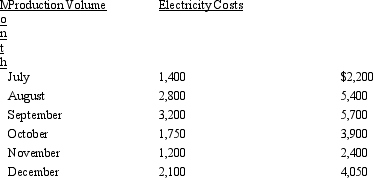

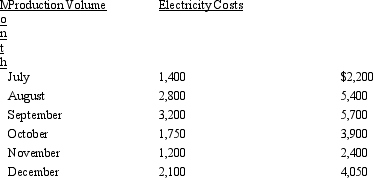

Figure 3-4 The following information is available for electricity costs for the last six months of the year:

-Refer to Figure 3-4.What are the fixed costs?

A) $420

B) $100

C) $200

D) none of these

-Refer to Figure 3-4.What are the fixed costs?

A) $420

B) $100

C) $200

D) none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

75

Figure 3-4 The following information is available for electricity costs for the last six months of the year:

- Refer to Figure 3-4.Using the high-low method, estimated variable cost per unit of production is

A) $1.26.

B) $1.53.

C) $1.65.

D) $1.75.

- Refer to Figure 3-4.Using the high-low method, estimated variable cost per unit of production is

A) $1.26.

B) $1.53.

C) $1.65.

D) $1.75.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

76

Figure 3-5 Lee Corporation manufactures and sells party items.The following representative direct labor hours and production costs are provided for a four-month period:

-Refer to Figure 3-5.The monthly production cost can be expressed as

A) X = aY + b

B) Y = a + bX

C) X = a + bY

D) Y = b + aX

-Refer to Figure 3-5.The monthly production cost can be expressed as

A) X = aY + b

B) Y = a + bX

C) X = a + bY

D) Y = b + aX

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

77

In the formula Y = F + VX, F refers to the

A) slope.

B) intercept.

C) dependent variable.

D) independent variable.

A) slope.

B) intercept.

C) dependent variable.

D) independent variable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

78

Figure 3-5 Lee Corporation manufactures and sells party items.The following representative direct labor hours and production costs are provided for a four-month period:

-Refer to Figure 3-5.Using the high-low method, what is the cost formula for estimating costs?

A) Total cost = $20,000 + $2.08X

B) Total cost = $2.08X

C) Total cost = $5,000 + 2.08X

D) Total cost = $7,500 + $2.08X

-Refer to Figure 3-5.Using the high-low method, what is the cost formula for estimating costs?

A) Total cost = $20,000 + $2.08X

B) Total cost = $2.08X

C) Total cost = $5,000 + 2.08X

D) Total cost = $7,500 + $2.08X

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

79

Baker Enterprises developed a cost function for manufacturing overhead costs of Y = $8,000 + $1.60X.Estimated manufacturing overhead costs at 10,000 units of production are

A) $16,000.

B) $17,600.

C) $24,000.

D) $26,000.

A) $16,000.

B) $17,600.

C) $24,000.

D) $26,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

80

English Corporation analyzed the relationship between total factory overhead and changes in direct labor hours.It found the following:

Y = $6,000 + $6X

The Y in the equation is an estimate of

A) total variable costs.

B) total direct labor hours.

C) total factory overhead.

D) total fixed costs.

Y = $6,000 + $6X

The Y in the equation is an estimate of

A) total variable costs.

B) total direct labor hours.

C) total factory overhead.

D) total fixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck