Deck 10: Decentralization: Responsibility Accounting, Performance Evaluation, and Transfer Pricing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/110

العب

ملء الشاشة (f)

Deck 10: Decentralization: Responsibility Accounting, Performance Evaluation, and Transfer Pricing

1

Both revenue center and profit center managers are responsible for achieving

A) budgeted revenues.

B) budgeted net income.

C) budgeted costs.

D) budgeted contribution margin.

A) budgeted revenues.

B) budgeted net income.

C) budgeted costs.

D) budgeted contribution margin.

A

2

A manufacturing division of a company would most likely be evaluated as a(n)

A) cost center.

B) investment center.

C) revenue center.

D) asset center.

A) cost center.

B) investment center.

C) revenue center.

D) asset center.

A

3

One of the reasons for decentralization is more timely response.This means

A) lower-level managers being more in contact with immediate operating conditions.

B) central management can be free to focus on strategic planning.

C) allowing an organization to determine each division's contribution to profit and expose each division to market forces.

D) local management both makes and implements decisions.

A) lower-level managers being more in contact with immediate operating conditions.

B) central management can be free to focus on strategic planning.

C) allowing an organization to determine each division's contribution to profit and expose each division to market forces.

D) local management both makes and implements decisions.

D

4

Responsibility accounting is defined as a system that

A) measures the results of each responsibility center and compares those results with some measure of expected or budgeted outcome.

B) defines responsibility by function only.

C) measures the results of a manager responsible for revenues and costs.

D) measures actual results against a flexible budget.

A) measures the results of each responsibility center and compares those results with some measure of expected or budgeted outcome.

B) defines responsibility by function only.

C) measures the results of a manager responsible for revenues and costs.

D) measures actual results against a flexible budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

5

An example of an investment center is a

A) production department.

B) company.

C) marketing department.

D) credit department.

A) production department.

B) company.

C) marketing department.

D) credit department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following departments would NOT be classified as a profit center?

A) hardware department

B) men's shoes department

C) accounting department

D) automotive department

A) hardware department

B) men's shoes department

C) accounting department

D) automotive department

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

7

___________________ is the delegation of decision-making authority to successively lower management levels in an organization.

A) Decentralization

B) Centralization

C) Optimization

D) An unfavorable overhead variance

A) Decentralization

B) Centralization

C) Optimization

D) An unfavorable overhead variance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

8

The manager of a cost center is responsible for

A) decisions regarding costs.

B) decisions regarding revenues.

C) decisions to invest in assets.

D) both a and b.

A) decisions regarding costs.

B) decisions regarding revenues.

C) decisions to invest in assets.

D) both a and b.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following departments would NOT be a cost center?

A) advertising department

B) city police department

C) building and grounds department

D) sales department

A) advertising department

B) city police department

C) building and grounds department

D) sales department

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following changes would increase return on investment (ROI)?

A) Decrease sales and expenses by the same percentage.

B) Increase total assets.

C) Increase sales and expenses by the same percentage.

D) Decrease sales and expenses by the same dollar amount.

A) Decrease sales and expenses by the same percentage.

B) Increase total assets.

C) Increase sales and expenses by the same percentage.

D) Decrease sales and expenses by the same dollar amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following responsibility centers would have a manager responsible for revenues, costs, and investments?

A) cost center

B) investment center

C) profit center

D) expense center

A) cost center

B) investment center

C) profit center

D) expense center

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

12

Responsibility accounting is a system that does NOT consider

A) responsibility.

B) accountability.

C) performance evaluation.

D) static budgeting.

A) responsibility.

B) accountability.

C) performance evaluation.

D) static budgeting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

13

The manager of an investment center is responsible for

A) decisions regarding costs.

B) decisions regarding revenues.

C) decisions to invest in assets.

D) all of these.

A) decisions regarding costs.

B) decisions regarding revenues.

C) decisions to invest in assets.

D) all of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following would NOT be a reason for decentralization?

A) Managers will make decisions for their own benefit, rather than the organization's benefit.

B) Lower level managers have better access to information.

C) Upper management can spend more time focusing on strategic planning and decision making.

D) Lower level managers with decision-making ability are more motivated.

A) Managers will make decisions for their own benefit, rather than the organization's benefit.

B) Lower level managers have better access to information.

C) Upper management can spend more time focusing on strategic planning and decision making.

D) Lower level managers with decision-making ability are more motivated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following changes would NOT change return on investment (ROI)?

A) Decrease sales and expenses by the same percentage.

B) Increase total assets.

C) Increase sales dollars by the same amount as total assets.

D) Decrease sales and expenses by the same dollar amount.

A) Decrease sales and expenses by the same percentage.

B) Increase total assets.

C) Increase sales dollars by the same amount as total assets.

D) Decrease sales and expenses by the same dollar amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

16

___________________ exists when the major functions of an organization are controlled by top management.

A) Decentralization

B) Centralization

C) Optimization

D) An unfavorable overhead variance

A) Decentralization

B) Centralization

C) Optimization

D) An unfavorable overhead variance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

17

_______________ are NOT controlled by a manager of a profit center.

A) Revenues

B) Costs

C) Investments

D) Profits

A) Revenues

B) Costs

C) Investments

D) Profits

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

18

The manager of a profit center is responsible for

A) delivering a quality product or service at reasonable but minimal cost.

B) decisions to invest in capital equipment.

C) decisions regarding revenue generation.

D) both a and c.

A) delivering a quality product or service at reasonable but minimal cost.

B) decisions to invest in capital equipment.

C) decisions regarding revenue generation.

D) both a and c.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

19

The return on investment is computed as

A) operating income divided by sales.

B) operating income divided by average operating assets.

C) sales divided by average operating assets.

D) operating asset turnover divided by the operating income margin.

A) operating income divided by sales.

B) operating income divided by average operating assets.

C) sales divided by average operating assets.

D) operating asset turnover divided by the operating income margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following departments is likely to be an investment center?

A) machining department

B) food products division

C) personnel department

D) accounting department

A) machining department

B) food products division

C) personnel department

D) accounting department

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

21

If the margin of 0.3 stayed the same and the turnover ratio of 5.0 increased by 10 percent, the ROI would

A) increase by 10 percent.

B) decrease by 10 percent.

C) increase by 15 percent.

D) remain the same.

A) increase by 10 percent.

B) decrease by 10 percent.

C) increase by 15 percent.

D) remain the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

22

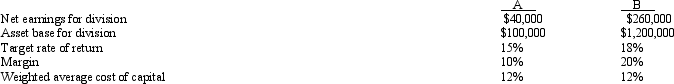

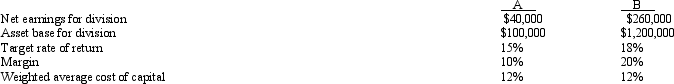

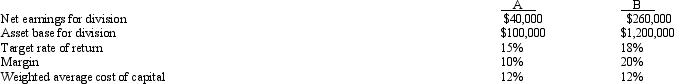

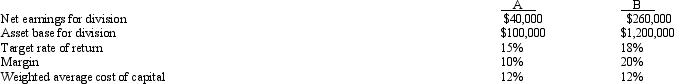

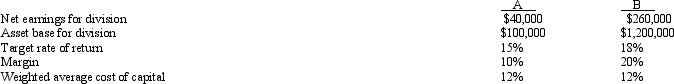

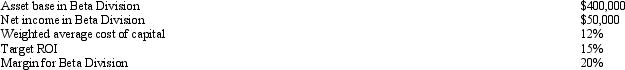

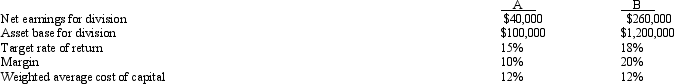

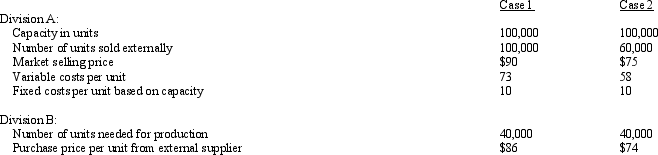

Correll Company has two divisions, A and B.Information for each division is as follows:

-What is the operating asset turnover for A?

A) 4.00

B) 0.10

C) 0.15

D) 2.50

-What is the operating asset turnover for A?

A) 4.00

B) 0.10

C) 0.15

D) 2.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

23

If the turnover increased by 30 percent and the margin decreased by 30 percent, the ROI would

A) decrease by 9 percent.

B) increase by 69 percent.

C) increase by 91 percent.

D) stay the same.

A) decrease by 9 percent.

B) increase by 69 percent.

C) increase by 91 percent.

D) stay the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

24

If the National Division of American Products Company had a turnover ratio of 4.2 and a margin of 0.10, the return on investment would be

A) 23.8%.

B) 420.0%.

C) 42.0%.

D) 238.0%.

A) 23.8%.

B) 420.0%.

C) 42.0%.

D) 238.0%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

25

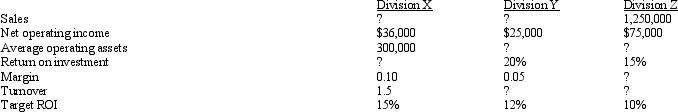

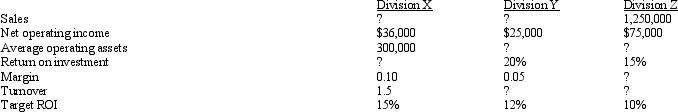

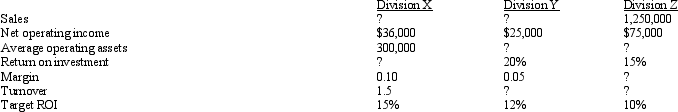

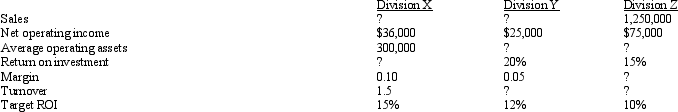

The following information pertains to the three divisions of Marlow Company:  What is the margin for Division Z?

What is the margin for Division Z?

A) 1.5%

B) 100.0%

C) 15.0%

D) 6.0%

What is the margin for Division Z?

What is the margin for Division Z?A) 1.5%

B) 100.0%

C) 15.0%

D) 6.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

26

If the operating asset turnover ratio increased by 30 percent and the margin increased by 20 percent, the divisional ROI

A) would increase by 56 percent.

B) would decrease by 60 percent.

C) would increase by 20 percent.

D) cannot be determined.

A) would increase by 56 percent.

B) would decrease by 60 percent.

C) would increase by 20 percent.

D) cannot be determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

27

Patterson Company had sales of $200,000, net income of $10,000, and an asset base of $300,000.Its margin is

A) 66.7%.

B) 150.0%.

C) 3.3%.

D) 5.0%.

A) 66.7%.

B) 150.0%.

C) 3.3%.

D) 5.0%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following is NOT an advantage of ROI?

A) It encourages managers of departments with high ROIs to invest in average ROI projects.

B) It encourages managers to pay careful attention to the relationships among sales, expenses, and investment.

C) It encourages cost efficiency.

D) It discourages excessive investment in operating assets.

A) It encourages managers of departments with high ROIs to invest in average ROI projects.

B) It encourages managers to pay careful attention to the relationships among sales, expenses, and investment.

C) It encourages cost efficiency.

D) It discourages excessive investment in operating assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

29

If a company has sales of $2,500,000, net income of $250,000, and an asset base of $1,250,000, its return on investment is

A) 20%.

B) 10%.

C) 500%.

D) 200%.

A) 20%.

B) 10%.

C) 500%.

D) 200%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

30

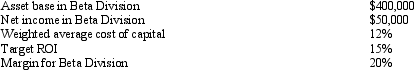

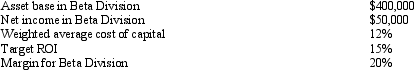

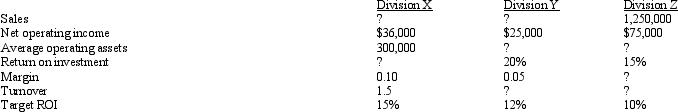

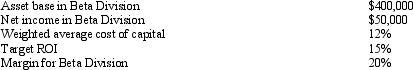

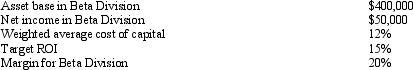

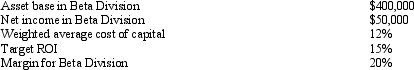

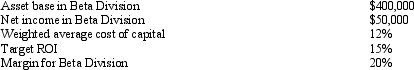

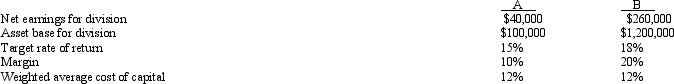

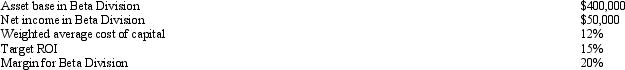

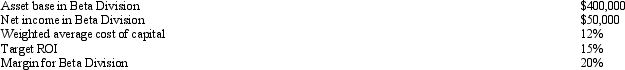

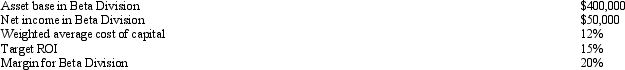

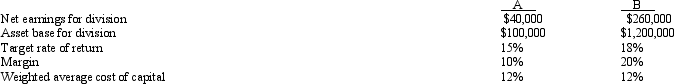

Beta Division had the following information:  If the asset base is decreased by $100,000, with no other changes, the return on investment of Beta Division will be

If the asset base is decreased by $100,000, with no other changes, the return on investment of Beta Division will be

A) 100.0%.

B) 16.7%.

C) 600.0%.

D) 62.5%.

If the asset base is decreased by $100,000, with no other changes, the return on investment of Beta Division will be

If the asset base is decreased by $100,000, with no other changes, the return on investment of Beta Division will beA) 100.0%.

B) 16.7%.

C) 600.0%.

D) 62.5%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

31

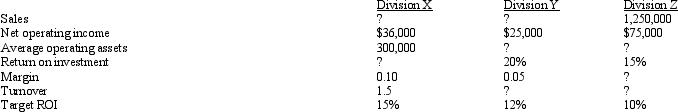

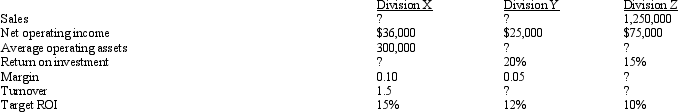

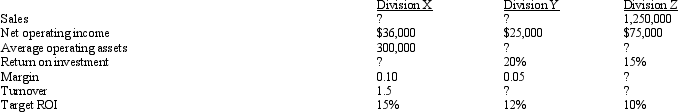

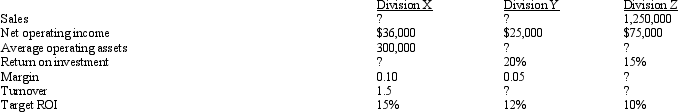

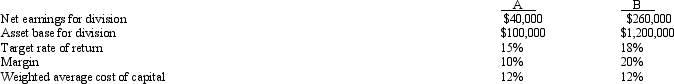

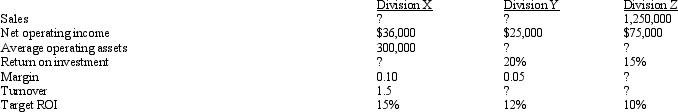

The following information pertains to the three divisions of Marlow Company:

- What are the average operating assets for Division Y?

A) $25,000

B) $125,000

C) $5,000

D) $208,333

- What are the average operating assets for Division Y?

A) $25,000

B) $125,000

C) $5,000

D) $208,333

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

32

The following information pertains to the three divisions of Marlow Company:

-What are the average operating assets for Division Z?

A) $75,000

B) $500,000

C) $1,250,000

D) $187,500

-What are the average operating assets for Division Z?

A) $75,000

B) $500,000

C) $1,250,000

D) $187,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

33

If the operating asset turnover increased by 50 percent and the margin increased by 50 percent, the ROI would increase by

A) 50 percent.

B) 25 percent.

C) 100 percent.

D) 125 percent.

A) 50 percent.

B) 25 percent.

C) 100 percent.

D) 125 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

34

Beta Division had the following information:

-What is the turnover ratio for Beta Division?

A) 0.200

B) 0.125

C) 0.625

D) 8.000

-What is the turnover ratio for Beta Division?

A) 0.200

B) 0.125

C) 0.625

D) 8.000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

35

Beta Division had the following information:

- What is the return on investment of Beta Division?

A) 20.0%

B) 12.5%

C) 62.5%

D) 800.0%

- What is the return on investment of Beta Division?

A) 20.0%

B) 12.5%

C) 62.5%

D) 800.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

36

The following information pertains to the three divisions of Marlow Company:

-What is the turnover for Division Z?

A) 2.500

B) 0.150

C) 6.670

D) 1.500

-What is the turnover for Division Z?

A) 2.500

B) 0.150

C) 6.670

D) 1.500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

37

The following information pertains to the three divisions of Marlow Company:

-What are the sales for Division Y?

A) $25,000

B) $125,000

C) $500,000

D) $208,333

-What are the sales for Division Y?

A) $25,000

B) $125,000

C) $500,000

D) $208,333

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

38

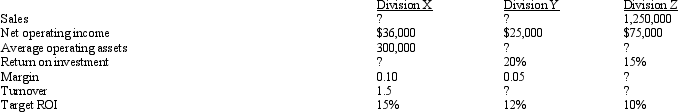

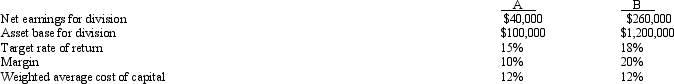

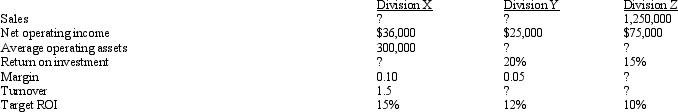

Correll Company has two divisions, A and B.Information for each division is as follows:

- What is the return on investment for A?

A) 18%

B) 15%

C) 20%

D) 40%

- What is the return on investment for A?

A) 18%

B) 15%

C) 20%

D) 40%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

39

Parker Corporation had sales of $250,000, income of $10,000, and an asset base of $100,000.The turnover is

A) 0.04.

B) 2.50.

C) 4.00.

D) 0.25.

A) 0.04.

B) 2.50.

C) 4.00.

D) 0.25.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

40

Correll Company has two divisions, A and B.Information for each division is as follows:

-What is the total sales amount for B?

A) $666,667

B) $800,000

C) $1,200,000

D) $1,300,000

-What is the total sales amount for B?

A) $666,667

B) $800,000

C) $1,200,000

D) $1,300,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

41

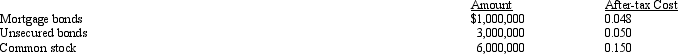

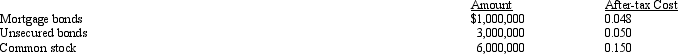

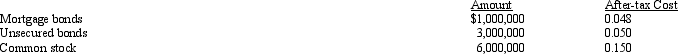

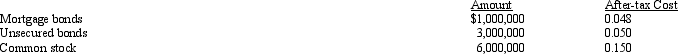

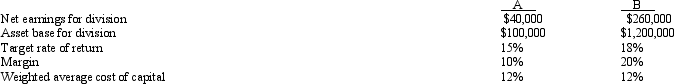

Young Company has a tax rate of 40 percent.Information for the company is as follows:

- What is the EVA if the before-tax operating income is $1,500,000?

A) $1,134,000

B) $402,000

C) $534,000

D) $(198,000)

- What is the EVA if the before-tax operating income is $1,500,000?

A) $1,134,000

B) $402,000

C) $534,000

D) $(198,000)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

42

Correll Company has two divisions, A and B.Information for each division is as follows:

- What is EVA for Division A?

A) $40,000

B) $25,000

C) $15,000

D) $28,000

- What is EVA for Division A?

A) $40,000

B) $25,000

C) $15,000

D) $28,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

43

Beta Division had the following information:  What is EVA for Beta Division?

What is EVA for Beta Division?

A) $60,000

B) $48,000

C) $7,500

D) $2,000

What is EVA for Beta Division?

What is EVA for Beta Division?A) $60,000

B) $48,000

C) $7,500

D) $2,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following is NOT a disadvantage of the ROI performance measure?

A) It encourages managers to focus on the long run rather than the short run.

B) It discourages managers from investing in projects that would decrease divisional ROI but increase the profitability of the company as a whole.

C) It encourages myopic behavior.

D) All are disadvantages of the ROI measure.

A) It encourages managers to focus on the long run rather than the short run.

B) It discourages managers from investing in projects that would decrease divisional ROI but increase the profitability of the company as a whole.

C) It encourages myopic behavior.

D) All are disadvantages of the ROI measure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

45

Return on investment can be divided into two separate components

A) margin and profit.

B) margin and turnover.

C) value and turnover.

D) liquidity and margin.

A) margin and profit.

B) margin and turnover.

C) value and turnover.

D) liquidity and margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

46

Young Company has a tax rate of 40 percent.Information for the company is as follows:

-What is the weighted cost of capital?

A) 0.1098

B) 0.2480

C) 0.0827

D) 0.0366

-What is the weighted cost of capital?

A) 0.1098

B) 0.2480

C) 0.0827

D) 0.0366

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following is a disadvantage of both residual income and ROI?

A) They are both absolute measures of return.

B) They are both difficult to calculate.

C) They both do not discourage myopic behavior.

D) All of these are disadvantages of both ROI and residual income.

A) They are both absolute measures of return.

B) They are both difficult to calculate.

C) They both do not discourage myopic behavior.

D) All of these are disadvantages of both ROI and residual income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

48

Beta Division had the following information:  What is the residual income for Beta Division?

What is the residual income for Beta Division?

A) $60,000

B) $48,000

C) $7,500

D) $(10,000)

What is the residual income for Beta Division?

What is the residual income for Beta Division?A) $60,000

B) $48,000

C) $7,500

D) $(10,000)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

49

EVA encourages the right kind of behavior from divisions because of its emphasis on

A) after-tax net income.

B) total capital employed.

C) true cost of capital.

D) before-tax operating income.

A) after-tax net income.

B) total capital employed.

C) true cost of capital.

D) before-tax operating income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

50

_______________ is(are) a type of fringe benefit received over and above salary.

A) Perquisites

B) Cash compensation

C) Bonus based on net income

D) EVA

A) Perquisites

B) Cash compensation

C) Bonus based on net income

D) EVA

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

51

The Auto Division of Big Department Store had a net income of $560,000, a net asset base of $4,000,000, and a required rate of return of 12 percent.Sales for the period totaled $3,000,000.The residual income for the period is

A) $480,000.

B) $360,000.

C) $120,000.

D) $80,000.

A) $480,000.

B) $360,000.

C) $120,000.

D) $80,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following would be a reason why managers would NOT provide good service?

A) They may have low ability.

B) They may not prefer to work hard.

C) They may prefer to spend company resources on perquisites.

D) All of these are reasons.

A) They may have low ability.

B) They may not prefer to work hard.

C) They may prefer to spend company resources on perquisites.

D) All of these are reasons.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

53

The emphasis on short-run results at the expense of the long run is

A) efficient behavior.

B) effective behavior.

C) optimal behavior.

D) myopic behavior.

A) efficient behavior.

B) effective behavior.

C) optimal behavior.

D) myopic behavior.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

54

Multiple measures of performance are beneficial if they

A) are all financial measures.

B) include nonfinancial operating measures.

C) focus only on short-run factors.

D) all of these statements are true.

A) are all financial measures.

B) include nonfinancial operating measures.

C) focus only on short-run factors.

D) all of these statements are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

55

The following information pertains to the three divisions of Marlow Company:  What is the residual income for Division X?

What is the residual income for Division X?

A) $36,000

B) $45,000

C) $(9,000)

D) $(36,000)

What is the residual income for Division X?

What is the residual income for Division X?A) $36,000

B) $45,000

C) $(9,000)

D) $(36,000)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

56

Economic value added is calculated by which of the following formulas?

A) EVA = After-tax operating income + (Weighted average cost of capital ´ Total capital employed)

B) EVA = After-tax operating income * Weighted average cost of capital

C) EVA = After-tax operating income - (Weighted average cost of capital ´ Total capital employed)

D) EVA = Total capital employed - (Weighted average cost of capital ´ After-tax operating income)

A) EVA = After-tax operating income + (Weighted average cost of capital ´ Total capital employed)

B) EVA = After-tax operating income * Weighted average cost of capital

C) EVA = After-tax operating income - (Weighted average cost of capital ´ Total capital employed)

D) EVA = Total capital employed - (Weighted average cost of capital ´ After-tax operating income)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

57

Correll Company has two divisions, A and B.Information for each division is as follows:

- What is EVA for Division B?

A) $144,000

B) $116,000

C) $216,000

D) $44,000

- What is EVA for Division B?

A) $144,000

B) $116,000

C) $216,000

D) $44,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

58

_______________ is(are) the right to buy a certain number shares of a company's stock at a particular price.

A) Stock options

B) Cash compensation

C) Stock-based compensation

D) Perquisites

A) Stock options

B) Cash compensation

C) Stock-based compensation

D) Perquisites

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

59

Correll Company has two divisions, A and B.Information for each division is as follows:  What is the residual income for A?

What is the residual income for A?

A) $40,000

B) $25,000

C) $15,000

D) $28,000

What is the residual income for A?

What is the residual income for A?A) $40,000

B) $25,000

C) $15,000

D) $28,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

60

_______________ is after-tax operating profit minus the total annual cost of capital.

A) ROI

B) Residual income

C) EVA

D) Net income

A) ROI

B) Residual income

C) EVA

D) Net income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

61

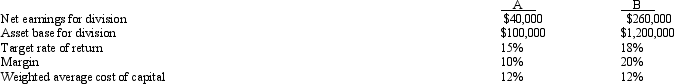

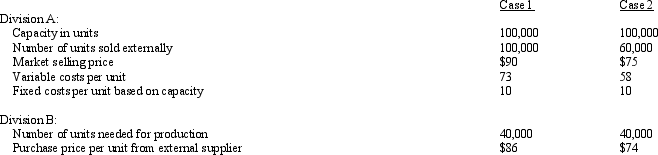

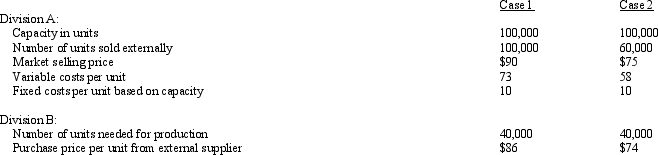

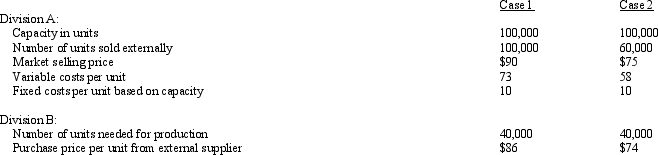

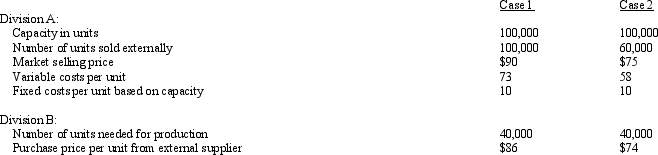

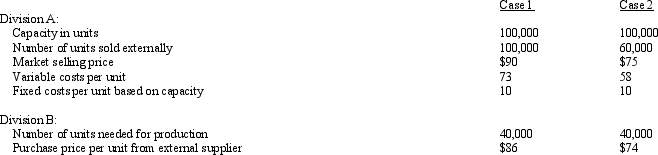

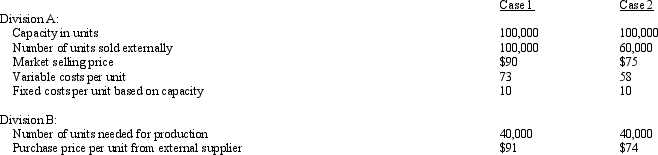

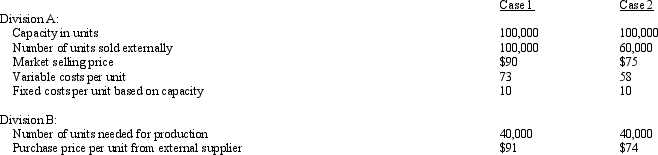

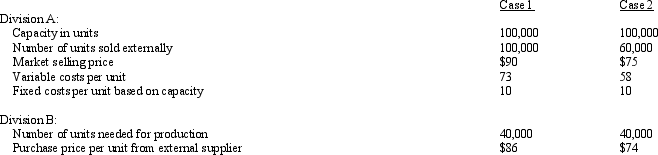

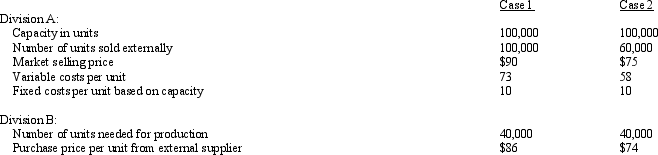

In the Ambros Company, Division A has a product that can be sold either to outside customers or to Division B.Information about these divisions is given below:

-The company uses the opportunity cost approach to transfer pricing.Which case should not be transferred internally?

A) Case 1

B) Case 2

C) Neither should be transferred internally.

D) Both should be transferred internally.

-The company uses the opportunity cost approach to transfer pricing.Which case should not be transferred internally?

A) Case 1

B) Case 2

C) Neither should be transferred internally.

D) Both should be transferred internally.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

62

Transfer prices are the prices charged

A) for distributing goods from one warehouse to another.

B) for the goods produced by one division to another division that needs these goods.

C) when delivering goods to the customer.

D) when transferring goods to international divisions.

A) for distributing goods from one warehouse to another.

B) for the goods produced by one division to another division that needs these goods.

C) when delivering goods to the customer.

D) when transferring goods to international divisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of the following managerial rewards is NOT a short-term reward?

A) stock ownership

B) cash bonuses

C) stock options

D) both a and b

A) stock ownership

B) cash bonuses

C) stock options

D) both a and b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

64

As a managerial reward, _______________ encourage(s) a short-term orientation.

A) cash bonuses

B) stock options

C) stock ownership

D) both a and b

A) cash bonuses

B) stock options

C) stock ownership

D) both a and b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which of the following is a political or legal factor affecting performance evaluation in the multinational firm?

A) social attitude toward industry and business

B) literacy rate

C) effect of defense policy

D) currency restrictions

A) social attitude toward industry and business

B) literacy rate

C) effect of defense policy

D) currency restrictions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

66

_______________ is(are) the transfer price that would leave the buying division no worse off if an input is purchased from an internal division.

A) The negotiated transfer price

B) The minimum transfer price

C) The maximum transfer price

D) Both a and c

A) The negotiated transfer price

B) The minimum transfer price

C) The maximum transfer price

D) Both a and c

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following is an economic factor affecting performance evaluation in the multinational firm?

A) currency restrictions

B) economic stability

C) impact of foreign policy

D) both a and b

A) currency restrictions

B) economic stability

C) impact of foreign policy

D) both a and b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

68

In the Ambros Company, Division A has a product that can be sold either to outside customers or to Division B.Information about these divisions is given below:

-The company uses the opportunity cost approach to transfer pricing.What is the maximum transfer price in Case 2?

A) $75

B) $74

C) $68

D) $58

-The company uses the opportunity cost approach to transfer pricing.What is the maximum transfer price in Case 2?

A) $75

B) $74

C) $68

D) $58

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

69

In the Ambros Company, Division A has a product that can be sold either to outside customers or to Division B.Information about these divisions is given below:

- The company uses the opportunity cost approach to transfer pricing.What is the minimum transfer price in Case 1?

A) $90

B) $86

C) $83

D) $73

- The company uses the opportunity cost approach to transfer pricing.What is the minimum transfer price in Case 1?

A) $90

B) $86

C) $83

D) $73

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

70

_______________ is(are) the transfer price that would leave the selling division no worse off if the good is sold to an internal division.

A) The negotiated transfer price

B) The minimum transfer price

C) The maximum transfer price

D) Both a and c

A) The negotiated transfer price

B) The minimum transfer price

C) The maximum transfer price

D) Both a and c

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

71

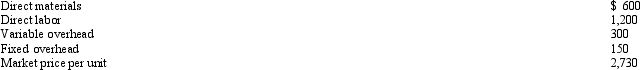

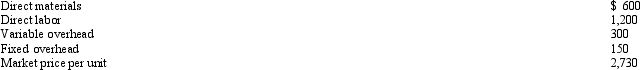

The Engine Division provides engines for the Tractor Division of a company.The standard unit costs for Engine Division are as follows:  What is the best transfer price to avoid transfer price problems?

What is the best transfer price to avoid transfer price problems?

A) $2,730

B) $600

C) $1,800

D) $2,100

What is the best transfer price to avoid transfer price problems?

What is the best transfer price to avoid transfer price problems?A) $2,730

B) $600

C) $1,800

D) $2,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

72

Division 'A' produces a component and wants to sell it to Division 'B'.The transfer price is

A) revenue to Division 'A' and a cost to Division 'B'

B) revenue to Division 'B' and a cost to Division 'A'

C) revenue to Division 'A' and no effect on Division 'B'

D) a cost to Division 'B' and no effect on Division 'A'

A) revenue to Division 'A' and a cost to Division 'B'

B) revenue to Division 'B' and a cost to Division 'A'

C) revenue to Division 'A' and no effect on Division 'B'

D) a cost to Division 'B' and no effect on Division 'A'

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

73

It is important to separate the evaluation of the manager from the evaluation of the division in a multinational firm.A manager's evaluation should NOT include

A) revenues.

B) income taxes.

C) operating costs.

D) cost of goods sold.

A) revenues.

B) income taxes.

C) operating costs.

D) cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

74

Comparison of an international division's ROI can potentially be misleading because of

A) the absence of activity-based management.

B) differing production technologies.

C) the lack of good information.

D) differing environmental factors.

A) the absence of activity-based management.

B) differing production technologies.

C) the lack of good information.

D) differing environmental factors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

75

In the Ambros Company, Division A has a product that can be sold either to outside customers or to Division B.Information about these divisions is given below:

-The company uses the opportunity cost approach to transfer pricing.What is the maximum transfer price in Case 1?

A) $91

B) $90

C) $83

D) $73

-The company uses the opportunity cost approach to transfer pricing.What is the maximum transfer price in Case 1?

A) $91

B) $90

C) $83

D) $73

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

76

When there is an outside market for an intermediate product that is perfectly competitive, the most equitable method of transfer pricing is

A) market price.

B) production cost pricing.

C) variable cost pricing.

D) cost plus markup pricing.

A) market price.

B) production cost pricing.

C) variable cost pricing.

D) cost plus markup pricing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

77

Goal congruence can be defined as

A) an incentive plan arranged so the managers' goals are allied with the shareholders' goals.

B) managers operating the business in the best interest of the shareholders.

C) tying management rewards to shareholder results.

D) all of these are correct.

A) an incentive plan arranged so the managers' goals are allied with the shareholders' goals.

B) managers operating the business in the best interest of the shareholders.

C) tying management rewards to shareholder results.

D) all of these are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

78

Negotiated prices are transfer prices

A) determined between a division and corporate headquarters.

B) negotiated with external customers.

C) used when supplying and buying divisions independently agree on a price.

D) agreed to by division management and employees.

A) determined between a division and corporate headquarters.

B) negotiated with external customers.

C) used when supplying and buying divisions independently agree on a price.

D) agreed to by division management and employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

79

In the Ambros Company, Division A has a product that can be sold either to outside customers or to Division B.Information about these divisions is given below:

- The company uses the opportunity cost approach to transfer pricing.What is the minimum transfer price in Case 2?

A) $75

B) $74

C) $68

D) $58

- The company uses the opportunity cost approach to transfer pricing.What is the minimum transfer price in Case 2?

A) $75

B) $74

C) $68

D) $58

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following is NOT an environmental factor affecting performance evaluation in the multinational firm?

A) sociological factors

B) economic factors

C) political or legal factors

D) All of these are environmental factors affecting performance evaluation in the multinational firm.

A) sociological factors

B) economic factors

C) political or legal factors

D) All of these are environmental factors affecting performance evaluation in the multinational firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck