Deck 1: A Survey of International Accounting

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/38

العب

ملء الشاشة (f)

Deck 1: A Survey of International Accounting

1

What are factors that can influence a country's accountings standards?

A)The level of development of capital markets.

B)Government policy.

C)Market practice.

D)Educational standards set for professional accountants.

A)The level of development of capital markets.

B)Government policy.

C)Market practice.

D)Educational standards set for professional accountants.

A

2

Financial Statements prepared under different accounting principles would adversely affected by which of the following?

A)Reduced comparability.

B)Reduced reliability.

C)Increased complexity.

D)Inaccurate asset valuations.

A)Reduced comparability.

B)Reduced reliability.

C)Increased complexity.

D)Inaccurate asset valuations.

A

3

Which of the following statements is correct with respect to Canadian and American standards of accounting disclosure?

A)In general,pronouncements in the United States are more detailed,while those in Canada tend to rely more on professional judgement.

B)In general,pronouncements in the United States are less detailed,while those in Canada tend to rely more on professional judgement.

C)In general,pronouncements in the United States are more detailed,while those in Canada tend to rely less on professional judgement.

D)In general,pronouncements in the United States are less detailed,while those in Canada tend to rely less on professional judgement.

A)In general,pronouncements in the United States are more detailed,while those in Canada tend to rely more on professional judgement.

B)In general,pronouncements in the United States are less detailed,while those in Canada tend to rely more on professional judgement.

C)In general,pronouncements in the United States are more detailed,while those in Canada tend to rely less on professional judgement.

D)In general,pronouncements in the United States are less detailed,while those in Canada tend to rely less on professional judgement.

A

4

Which of the following bodies is responsible for the harmonization of international accounting standards?

A)The European Union.(EU)

B)The Federal Accounting Standards Board (FASB)

C)The International Accounting Standards Board (IASB)

D)The Canadian Institute of Chartered Accountants (CICA).

A)The European Union.(EU)

B)The Federal Accounting Standards Board (FASB)

C)The International Accounting Standards Board (IASB)

D)The Canadian Institute of Chartered Accountants (CICA).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

5

The SEC made a monumental decision to change the requirements for foreign registrants and their reporting in the US under certain circumstances in 2007:

A)Foreign registrants could use IFRSs in preparing their financial statements

B)Foreign registrants must report under US GAAAP.

C)Foreign registrants may report under IFRS as long as they provide a reconciliation to US GAAP.

D)The SEC has no jurisdiction under foreign registrants..

A)Foreign registrants could use IFRSs in preparing their financial statements

B)Foreign registrants must report under US GAAAP.

C)Foreign registrants may report under IFRS as long as they provide a reconciliation to US GAAP.

D)The SEC has no jurisdiction under foreign registrants..

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

6

The degree of accounting disclosure required tends to be greater in countries with well-developed capital markets.This is because:

A)countries with well developed capital markets also have well developed legal systems.

B)the disclosure requirements were designed to prevent fraud.

C)these markets tend to have more sophisticated investors who demand more information.

D)companies are required to comply with GAAP.

A)countries with well developed capital markets also have well developed legal systems.

B)the disclosure requirements were designed to prevent fraud.

C)these markets tend to have more sophisticated investors who demand more information.

D)companies are required to comply with GAAP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

7

IMVAR INC is US-based Company with Subsidiaries in both the United States and in Canada.The Company's Consolidated Financial Statements show a significantly higher net-income amount when prepared under Canadian GAAP than under U.S.GAAP.This difference can be largely explained by

A)different corporate tax rates in each country.

B)timing differences which will reverse out in the future.

C)differing reporting requirements in each country.

D)currency fluctuations.

A)different corporate tax rates in each country.

B)timing differences which will reverse out in the future.

C)differing reporting requirements in each country.

D)currency fluctuations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following is/are LEAST likely to influence a country's accounting standards?

A)Taxation Policies.

B)Differing Legal Systems.

C)The currency used.

D)Ties between countries.

A)Taxation Policies.

B)Differing Legal Systems.

C)The currency used.

D)Ties between countries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

9

Accounting policies created in countries governed by code law tend to

A)have greater disclosure requirements on Financial Statements.

B)offer more favourable tax incentives to foreign countries.

C)offer greater protection to creditors and suppliers.

D)favour illicit activity.

A)have greater disclosure requirements on Financial Statements.

B)offer more favourable tax incentives to foreign countries.

C)offer greater protection to creditors and suppliers.

D)favour illicit activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following nations is NOT governed by code (statute)law?

A)Germany.

B)Japan.

C)France.

D)Canada.

A)Germany.

B)Japan.

C)France.

D)Canada.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

11

If a country's accounting income does not differ significantly from its taxable income,one would reasonably expect:

A)extreme conservatism on the part of accountants.

B)a significant amount of Deferred Taxes on the Balance Sheet.

C)that the use of LIFO would be more prevalent.

D)extreme conservatism on the part of accountants as well as increased use of LIFO.

A)extreme conservatism on the part of accountants.

B)a significant amount of Deferred Taxes on the Balance Sheet.

C)that the use of LIFO would be more prevalent.

D)extreme conservatism on the part of accountants as well as increased use of LIFO.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

12

Income-smoothing has been applied to a German subsidiary of Company Inc,as it had an abnormally high operating income last year.The accountants working for the subsidiary would likely have:

A)debited an expense account and credited an equity account.

B)credited an expense account and debited an equity account.

C)credited an expense account and debited a Provision account appearing under the Liabilities section.

D)debited an expense account and credited a Provision account appearing under the Liabilities section.

A)debited an expense account and credited an equity account.

B)credited an expense account and debited an equity account.

C)credited an expense account and debited a Provision account appearing under the Liabilities section.

D)debited an expense account and credited a Provision account appearing under the Liabilities section.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following is true with respect to the implementation of IASB standards for the European Union?

A)These standards have been in place since 1985.

B)These standards shall be required by 2005.

C)All members of the European Union are required to comply with these standards with the exception of the United Kingdom.

D)Compliance with these standards shall be strictly optional.

A)These standards have been in place since 1985.

B)These standards shall be required by 2005.

C)All members of the European Union are required to comply with these standards with the exception of the United Kingdom.

D)Compliance with these standards shall be strictly optional.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

14

Canadian companies whose shares trade on U.S.stock exchanges are required to:

A)provide 2 sets of Financial Statements,one under Canadian GAAP and one under U.S GAAP.

B)present reconciliations from Canadian GAAP to U.S.GAAP in the footnotes to their financial statements.

C)be consistent in their reporting practices,regardless of which accounting principles they adhere to.

D)revalue their assets under lower-of -cost-and-market principles.

A)provide 2 sets of Financial Statements,one under Canadian GAAP and one under U.S GAAP.

B)present reconciliations from Canadian GAAP to U.S.GAAP in the footnotes to their financial statements.

C)be consistent in their reporting practices,regardless of which accounting principles they adhere to.

D)revalue their assets under lower-of -cost-and-market principles.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which decision has Canada made with respect to financial reporting for small and medium sized enterprises?

A)To adopt the IFRS standards for small and medium sized enterprises.

B)To retain the current standards.

C)To look to US GAAP for standards.

D)To maintain and develop its own standards for private enterprises.

A)To adopt the IFRS standards for small and medium sized enterprises.

B)To retain the current standards.

C)To look to US GAAP for standards.

D)To maintain and develop its own standards for private enterprises.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

16

Countries are MOST likely to have similar accounting policies when:

A)they have greater political and economic ties.

B)they share a common language.

C)they are close to each other geographically.

D)their economies are of a similar size.

A)they have greater political and economic ties.

B)they share a common language.

C)they are close to each other geographically.

D)their economies are of a similar size.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following would not be a reason to obtain a greater understanding of accounting practices in other nations?

A)Financial Results are disclosed in different currencies.

B)One needs to be aware of differing disclosure requirements from nation to nation,as this impacts the preparation of Financial Statements.

C)Income-smoothing may have affected a Foreign Subsidiary's results;such smoothing practices are not permitted in North America.

D)Departures from the Historical Cost Principle may be possible in other nations.

A)Financial Results are disclosed in different currencies.

B)One needs to be aware of differing disclosure requirements from nation to nation,as this impacts the preparation of Financial Statements.

C)Income-smoothing may have affected a Foreign Subsidiary's results;such smoothing practices are not permitted in North America.

D)Departures from the Historical Cost Principle may be possible in other nations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

18

Tax Law has the greatest effect on the accounting policies of which of the following countries?

A)Canada

B)The United Kingdom

C)Japan

D)The United States

A)Canada

B)The United Kingdom

C)Japan

D)The United States

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following statements is correct?

A)IFRS rules are broader based than U.S or Canadian GAAP.

B)Canadian accounting rules will be closer to those of the FASB in the next few years than to IFRS.

C)FASB standards are clearly superior to IFRS.

D)IFRS expressly prohibits the use of fair values and optional accounting treatments.

A)IFRS rules are broader based than U.S or Canadian GAAP.

B)Canadian accounting rules will be closer to those of the FASB in the next few years than to IFRS.

C)FASB standards are clearly superior to IFRS.

D)IFRS expressly prohibits the use of fair values and optional accounting treatments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

20

Starting in 2011,what is the definition of a private enterprise (PE)under Canadian GAAP:

A)A corporation that has no public shareholders.

B)A corporation that has less than 500 shareholders and is not listed on a stock exchange..

C)No distinction is made between private and publically accountable private enterprises for the purposes of IFRSs..

D)A profit oriented enterprise that has none of its issued and outstanding financial instruments traded in a public market and does not hold assets in a fiduciary capacity for a broad group of outsiders as one of its primary businesses.

A)A corporation that has no public shareholders.

B)A corporation that has less than 500 shareholders and is not listed on a stock exchange..

C)No distinction is made between private and publically accountable private enterprises for the purposes of IFRSs..

D)A profit oriented enterprise that has none of its issued and outstanding financial instruments traded in a public market and does not hold assets in a fiduciary capacity for a broad group of outsiders as one of its primary businesses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

21

What choices will private enterprises have in their financial reporting in Canada:

A)no choice at all.They will need to adapt to using IFRSs.

B)continue on with differential reporting..

C)adopt accounting principles that are appropriate to the circumstances..

D)report under IFRSs or GAAP for private enterprises..

A)no choice at all.They will need to adapt to using IFRSs.

B)continue on with differential reporting..

C)adopt accounting principles that are appropriate to the circumstances..

D)report under IFRSs or GAAP for private enterprises..

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

22

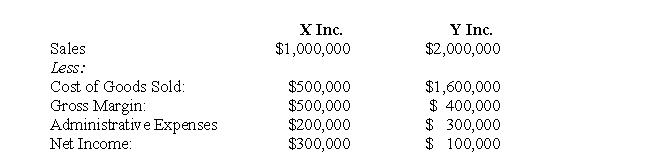

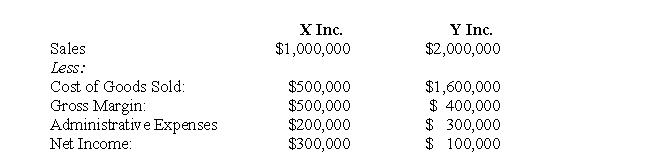

X Inc and Y Inc.are virtually identical companies with identical cost structures and very similar business practices operating in the same lines of business.X Inc is based in Canada while Y Inc.is based in Japan.The following are the condensed Income Statements for both companies for the past fiscal year.For the sake of simplicity,Y Inc's results have been translated into Canadian Dollars.

Required:

Given the information provided,what are some possible causes for the differing results of these companies?

Required:

Given the information provided,what are some possible causes for the differing results of these companies?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

23

One of the underlying assumptions of the Historical Cost Principle is that a stable unit measure (currency)can be used for Financial Reporting.Is this always the case? How have some countries attempted to adjust for any limitations associated with the Historical Cost Principle?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

24

Many large corporations have operation in many countries around the world.As a result,they need to raise debt and equity in order to finance their operations in many different countries.Will the movement towards converging reporting standards around the world make it easier for corporations to raise capital in many different capital markets around the world?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following is a major restructuring objective of the IASB?

A)To ensure compliance to a single set of accounting standards.

B)To progressively phase out divergent accounting practices.

C)To promote a greater understanding of the accounting practices of different nations.

D)To cooperate with various national accounting standard-setters in order to achieve convergence in accounting standards around the world.

A)To ensure compliance to a single set of accounting standards.

B)To progressively phase out divergent accounting practices.

C)To promote a greater understanding of the accounting practices of different nations.

D)To cooperate with various national accounting standard-setters in order to achieve convergence in accounting standards around the world.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following accounting standards have been revised by the FASB to be fully consistent with IFRS?

A)Deferred taxes.

B)Pension costs.

C)Contingencies.

D)Financial instruments.

A)Deferred taxes.

B)Pension costs.

C)Contingencies.

D)Financial instruments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

27

Canada and the U.S both experimented with price level accounting in the 1970s.This practice was quickly abandoned largely because

A)inflation rates declined after the 1970s.

B)the cost of providing this information was quite high.

C)it was a clear violation of the Historical Cost Principle.

D)it provided disclosure figure which were not verifiable.

A)inflation rates declined after the 1970s.

B)the cost of providing this information was quite high.

C)it was a clear violation of the Historical Cost Principle.

D)it provided disclosure figure which were not verifiable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which enterprises will need to report under IFRSs in Canada:

A)All corporations,government agencies and private companies..

B)Public companies and private companies whose shareholders' equity is in excess of $500,000,000 at any particular year end.

C)Public companies,private companies and not-for-profit organizations.

D)Publically accountable enterprises.

A)All corporations,government agencies and private companies..

B)Public companies and private companies whose shareholders' equity is in excess of $500,000,000 at any particular year end.

C)Public companies,private companies and not-for-profit organizations.

D)Publically accountable enterprises.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

29

The CICA Handbook is the handbook of Canadian accounting standards.Why do companies in Canada ensure that there financial reporting is consistent with Canadian GAAP?

A)because their bank requires them to.

B)because their auditors require that they report.

C)because reporting under the CICA Handbook is required by public companies boards' of directors.

D)because the CICA Handbook pronouncements constitute the accounting standards required by the provincial and federal Companies Acts and the Ontario Securities Commission.

A)because their bank requires them to.

B)because their auditors require that they report.

C)because reporting under the CICA Handbook is required by public companies boards' of directors.

D)because the CICA Handbook pronouncements constitute the accounting standards required by the provincial and federal Companies Acts and the Ontario Securities Commission.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

30

Asset revaluations,unlike in Canada,have been acceptable in many countries for accounting purposes.Under what circumstances have these adjustments been allowed?

A)Price level adjusted historical costs.

B)Periodic adjustment of asset valuations to current replacement cost.

C)Immediate write off of purchased goodwill to equities.

D)All of the above.

A)Price level adjusted historical costs.

B)Periodic adjustment of asset valuations to current replacement cost.

C)Immediate write off of purchased goodwill to equities.

D)All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

31

Briefly list the two types of legal systems in existence today and discuss how they would affect the accounting standards of a nation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

32

At present,Canada's accounting policies most resemble those of which nation?

A)The United Kingdom.

B)The United States.

C)The European Union (EU)

D)Australia

A)The United Kingdom.

B)The United States.

C)The European Union (EU)

D)Australia

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

33

The FASB in the U.S and the International Accounting Standards Board published an updated Memorandum of Understanding ("MOU")in September 2008 that set out priorities and milestones to be achieved on major projects by 2011.What major projects are on the agenda?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

34

Your company has an important subsidiary in Germany.You have been given an Income Statement that was prepared by the subsidiary's Frankfurt offices.As there were no notes to the Financial Statements,you should be MOST concerned about:

A)the fact that it was not prepared under GAAP,and may therefore be unreliable.

B)amortization periods differ from those of its American parent company.

C)smoothing practices may have been applied,masking the subsidiary's real operating results.

D)the lack of verifiability attached to the Income Statement.

A)the fact that it was not prepared under GAAP,and may therefore be unreliable.

B)amortization periods differ from those of its American parent company.

C)smoothing practices may have been applied,masking the subsidiary's real operating results.

D)the lack of verifiability attached to the Income Statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

35

What approach did Canada decide to take with respect to convergence with IFRSs:

A)harmonization with IFRS .

B)Substituting IFRSs for Canadian GAAP when approved by the IASB..

C)Adopting some but not necessarily all IFRSs by reviewing them on a case by case basis.

D)Reviewing them with all publically accountable entities to see which ones would be acceptable.

A)harmonization with IFRS .

B)Substituting IFRSs for Canadian GAAP when approved by the IASB..

C)Adopting some but not necessarily all IFRSs by reviewing them on a case by case basis.

D)Reviewing them with all publically accountable entities to see which ones would be acceptable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

36

Your company has an important subsidiary operating in the United Kingdom.The Canadian equivalent to the "Profit and Loss" section appearing on the Equity section of the subsidiary's balance sheet would be

A)Contributed Surplus.

B)Special Reserve.

C)Retained Earnings.

D)Common Shares.

A)Contributed Surplus.

B)Special Reserve.

C)Retained Earnings.

D)Common Shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

37

The European Union has attempted to harmonize accounting principles amongst its member nations by issuing:

A)statutes.

B)standards.

C)bylaws.

D)directives.

A)statutes.

B)standards.

C)bylaws.

D)directives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

38

The predecessor to the International Accounting Standards Board (IASB)was:

A)the Federal Accounting Standards Board (FASB).

B)the Canadian Institute of Chartered Accountants (CICA).

C)the European Economic Community (EEC).

D)the International Accounting Standards Committee (IASC).

A)the Federal Accounting Standards Board (FASB).

B)the Canadian Institute of Chartered Accountants (CICA).

C)the European Economic Community (EEC).

D)the International Accounting Standards Committee (IASC).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck