Deck 4: Consolidated Statements on Date of Acquisition

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/52

العب

ملء الشاشة (f)

Deck 4: Consolidated Statements on Date of Acquisition

1

The purchase price of an entity includes:

A)the book value of the subsidiary's shareholder equity and the acquisition differential.

B)the book value of the subsidiary's shareholder equity and goodwill.

C)the fair market value of the subsidiary's shareholder equity and the purchase price discrepancy.

D)the fair market value of the subsidiary's net assets.

A)the book value of the subsidiary's shareholder equity and the acquisition differential.

B)the book value of the subsidiary's shareholder equity and goodwill.

C)the fair market value of the subsidiary's shareholder equity and the purchase price discrepancy.

D)the fair market value of the subsidiary's net assets.

A

2

On the date of acquisition,the parent's investment (in subsidiary account)is:

A)revalued to fair market value

B)replaced with 100% of the assets and liabilities of the subsidiary at fair market value.

C)replaced with 100% of the assets and liabilities of the subsidiary at book value.

D)replaced with the parent's pro rata share of the assets and liabilities of the subsidiary at fair market value

A)revalued to fair market value

B)replaced with 100% of the assets and liabilities of the subsidiary at fair market value.

C)replaced with 100% of the assets and liabilities of the subsidiary at book value.

D)replaced with the parent's pro rata share of the assets and liabilities of the subsidiary at fair market value

B

3

Any negative goodwill arising on the date of acquisition

A)is recognized as a gain on the date of acquisition.

B)is prorated among the parent company's identifiable net assets.

C)should be amortized over a predetermined period)

D)is recognized as a loss on the date of acquisition.

A)is recognized as a gain on the date of acquisition.

B)is prorated among the parent company's identifiable net assets.

C)should be amortized over a predetermined period)

D)is recognized as a loss on the date of acquisition.

A

4

Consolidated financial statements consist of

A)a balance sheet,a statement of comprehensive income,a statement of changes in equity,a cash flow statement and accompanying notes.

B)a balance sheet,a statement of income,a statement of changes in financial position,and a statement of retained earnings.

C)a balance sheet,income statements and a statement of retained earnings.

D)a balance sheet,a statement of comprehensive and non-comprehensive income and any other statements that will provide useful information to the users of the financial statements.

A)a balance sheet,a statement of comprehensive income,a statement of changes in equity,a cash flow statement and accompanying notes.

B)a balance sheet,a statement of income,a statement of changes in financial position,and a statement of retained earnings.

C)a balance sheet,income statements and a statement of retained earnings.

D)a balance sheet,a statement of comprehensive and non-comprehensive income and any other statements that will provide useful information to the users of the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

5

On the date of formation of a 100% owned subsidiary by the parent:

A)it is possible to prepare consolidated financial statements that include all the assets and liabilities of the subsidiary..

B)consolidated financial statements are difficult to prepare because the assets and liabilities of the subsidiary have yet to be determined)

C)consolidation requires the elimination of the parent's investment account against the subsidiaries share capital..

D)none of the above is applicable.

A)it is possible to prepare consolidated financial statements that include all the assets and liabilities of the subsidiary..

B)consolidated financial statements are difficult to prepare because the assets and liabilities of the subsidiary have yet to be determined)

C)consolidation requires the elimination of the parent's investment account against the subsidiaries share capital..

D)none of the above is applicable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

6

One weakness associated with the Entity Theory is that

A)it is inconsistent with the Historical Cost Principle.

B)Non-Controlling Interest is computed using the fair market values of the subsidiary's net assets.

C)Non-Controlling interest is computed using the book values of the subsidiary's net assets.

D)the presumed acquisition cost may be unrealistic when the parent purchases significantly less than 100% of the subsidiary's voting shares,or voting control is achieved incrementally.

A)it is inconsistent with the Historical Cost Principle.

B)Non-Controlling Interest is computed using the fair market values of the subsidiary's net assets.

C)Non-Controlling interest is computed using the book values of the subsidiary's net assets.

D)the presumed acquisition cost may be unrealistic when the parent purchases significantly less than 100% of the subsidiary's voting shares,or voting control is achieved incrementally.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

7

The calculation of Goodwill and Non-Controlling Interest under the Entity Theory is derived :

A)by using an imputed acquisition cost,which would be the presumed cost of acquiring 100% of the outstanding voting shares of the subsidiary.

B)by using the actual acquisition cost.

C)by using the actual acquisition cost less any uncontrolled portion of the subsidiary's net assets at fair market value.

D)by using the actual acquisition cost less any uncontrolled portion of the subsidiary's net assets at book value.

A)by using an imputed acquisition cost,which would be the presumed cost of acquiring 100% of the outstanding voting shares of the subsidiary.

B)by using the actual acquisition cost.

C)by using the actual acquisition cost less any uncontrolled portion of the subsidiary's net assets at fair market value.

D)by using the actual acquisition cost less any uncontrolled portion of the subsidiary's net assets at book value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

8

The following data pertains to questions

Parent and Sub Inc had the following balance sheets on July 31,2007: The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

Assume that Parent Inc.decides to prepare an Income Statement for the combined entity on the date of acquisition.Assuming that Parent acquires 100% of Sub Inc.on that date,what would be the net income reported for the combined entity?

A)$180,000

B)$120,000

C)$ 60,000

D)Nil

Parent and Sub Inc had the following balance sheets on July 31,2007:

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.Assume that Parent Inc.decides to prepare an Income Statement for the combined entity on the date of acquisition.Assuming that Parent acquires 100% of Sub Inc.on that date,what would be the net income reported for the combined entity?

A)$180,000

B)$120,000

C)$ 60,000

D)Nil

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

9

A negative acquisition differential

A)is always equal to negative goodwill.

B)is equal to negative goodwill when the fair values of the subsidiary's identifiable net assets are equal to their book values.

C)implies that the parent company may have overpaid for its acquisition.

D)cannot occur under the acquisition method)

A)is always equal to negative goodwill.

B)is equal to negative goodwill when the fair values of the subsidiary's identifiable net assets are equal to their book values.

C)implies that the parent company may have overpaid for its acquisition.

D)cannot occur under the acquisition method)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

10

The following data pertains to questions

Parent and Sub Inc had the following balance sheets on July 31,2007: The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

Assume that Parent Inc.decides to prepare an Income Statement for the combined entity on the date of acquisition.Assuming that Parent acquires 80% of Sub Inc.on that date,what would be the net income reported for the combined entity?

A)$130,000

B)$120,000

C)$104,000

D)Nil

Parent and Sub Inc had the following balance sheets on July 31,2007:

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.Assume that Parent Inc.decides to prepare an Income Statement for the combined entity on the date of acquisition.Assuming that Parent acquires 80% of Sub Inc.on that date,what would be the net income reported for the combined entity?

A)$130,000

B)$120,000

C)$104,000

D)Nil

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

11

HRN Enterprises Inc purchases 80% of the outstanding voting shares of NHR Inc on January 1,2009.On that date,

A)HRN's Non-Controlling Interest account will include 20% of the fair value of NHR's net assets.

B)HRN's Non-Controlling Interest account will include 20% of the book value of NHR's net assets.

C)HRN's Non-Controlling Interest account will include 20% of the acquisition differential on the Date of Acquisition.

D)HRN's Non-Controlling Interest account will include 20% of any unallocated portion of the acquisition differential on the Date of Acquisition.

A)HRN's Non-Controlling Interest account will include 20% of the fair value of NHR's net assets.

B)HRN's Non-Controlling Interest account will include 20% of the book value of NHR's net assets.

C)HRN's Non-Controlling Interest account will include 20% of the acquisition differential on the Date of Acquisition.

D)HRN's Non-Controlling Interest account will include 20% of any unallocated portion of the acquisition differential on the Date of Acquisition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

12

Under the Proprietary theory,Non-Controlling Interest is

A)non-existent.Goodwill is established based on the Parent's pro-rata share of any acquisition differential.

B)non-existent.Goodwill is established based on the Parent's acquisition cost.

C)based on the fair market values of the subsidiary's net assets.Goodwill is established based on the Parent's acquisition cost.

D)based on the book values of the subsidiary's net assets.Goodwill is established based on the Parent's acquisition cost.

A)non-existent.Goodwill is established based on the Parent's pro-rata share of any acquisition differential.

B)non-existent.Goodwill is established based on the Parent's acquisition cost.

C)based on the fair market values of the subsidiary's net assets.Goodwill is established based on the Parent's acquisition cost.

D)based on the book values of the subsidiary's net assets.Goodwill is established based on the Parent's acquisition cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

13

Contingent consideration should be valued at

A)the fair value of the consideration on the date of acquisition.

B)the book value of the consideration at the date of acquisition.

C)the acquirer's pro-rata share of the subsidiary's net assets at book value at the date of acquisition.

D)the acquirer's pro-rata share of the subsidiary's net assets at fair value at the date of acquisition.

A)the fair value of the consideration on the date of acquisition.

B)the book value of the consideration at the date of acquisition.

C)the acquirer's pro-rata share of the subsidiary's net assets at book value at the date of acquisition.

D)the acquirer's pro-rata share of the subsidiary's net assets at fair value at the date of acquisition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

14

Under the Parent Company Theory,which of the following pertaining to Consolidated Financial Statements is correct?

A)The Consolidated Balance Sheet is prepared by adding the book values of both the Parent and its subsidiary.

B)The Consolidated Balance Sheet is prepared by adding the book values of both the Parent and its subsidiary as well as the Parent's share of any acquisition differentials.

C)The Consolidated Balance Sheet is prepared by adding the fair market values of both the Parent and its subsidiary as well as the parent's share of any acquisition differentials.

D)The Consolidated Balance Sheet is prepared by adding together the fair market values of both the parent and its subsidiary.

A)The Consolidated Balance Sheet is prepared by adding the book values of both the Parent and its subsidiary.

B)The Consolidated Balance Sheet is prepared by adding the book values of both the Parent and its subsidiary as well as the Parent's share of any acquisition differentials.

C)The Consolidated Balance Sheet is prepared by adding the fair market values of both the Parent and its subsidiary as well as the parent's share of any acquisition differentials.

D)The Consolidated Balance Sheet is prepared by adding together the fair market values of both the parent and its subsidiary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

15

On the date of acquisition,consolidated shareholder equity is equal to:

A)the sum of the parent and subsidiary's shareholder equities.

B)the sum of the parent's shareholder equity plus its pro rata share of the subsidiary's shareholder equity on the date of acquisition.

C)the parent's shareholder equity.

D)the subsidiary's shareholder equity.

A)the sum of the parent and subsidiary's shareholder equities.

B)the sum of the parent's shareholder equity plus its pro rata share of the subsidiary's shareholder equity on the date of acquisition.

C)the parent's shareholder equity.

D)the subsidiary's shareholder equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

16

When the parent forms a new subsidiary,

A)there should be no acquisition differential.

B)a gain or loss will usually arise.

C)push down accounting rules must be followed)

D)it should not be included in the company's consolidated financial statements as this would effectively be double-counting.

A)there should be no acquisition differential.

B)a gain or loss will usually arise.

C)push down accounting rules must be followed)

D)it should not be included in the company's consolidated financial statements as this would effectively be double-counting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

17

Contingent consideration will be classified as a liability when

A)it will be paid in the form of additional equity.

B)it will be paid in the form of cash or another asset.

C)the form of payment will be determined at a future date.

D)the acquirer decides the appropriate time to make a payment.

A)it will be paid in the form of additional equity.

B)it will be paid in the form of cash or another asset.

C)the form of payment will be determined at a future date.

D)the acquirer decides the appropriate time to make a payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

18

A company owning a majority (but less than 100%)of another's voting shares on the date of acquisition should account for its subsidiary

A)by including only its share of the fair market values of the subsidiary's net assets.

B)by including only its share of the book values of the subsidiary's net assets.

C)by including 100% of the fair market values of the subsidiary's net assets.

D)by including 100% of the fair market values of the subsidiary's net assets and accounting for any unowned portion of the subsidiary's voting shares using the Non-Controlling Interest account.

A)by including only its share of the fair market values of the subsidiary's net assets.

B)by including only its share of the book values of the subsidiary's net assets.

C)by including 100% of the fair market values of the subsidiary's net assets.

D)by including 100% of the fair market values of the subsidiary's net assets and accounting for any unowned portion of the subsidiary's voting shares using the Non-Controlling Interest account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

19

If a subsidiary's goodwill is reasonably measurable on the date of acquisition,which consolidation theory should the parent company apply after January 1,2009?

A)Proprietary Theory.

B)Parent Company Theory.

C)Parent Company Extension.

D)Entity Theory.

A)Proprietary Theory.

B)Parent Company Theory.

C)Parent Company Extension.

D)Entity Theory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

20

Under "push-down" accounting,a subsidiary's assets and liabilities are revalued using:

A)fair market values.

B)Lower of Cost and Market principles.

C)the parent's acquisition cost.

D)the net asset values (NAV).

A)fair market values.

B)Lower of Cost and Market principles.

C)the parent's acquisition cost.

D)the net asset values (NAV).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

21

One commonly cited weakness of Consolidated Financial Statements is that:

A)they lack completeness.

B)they are of little use to end-users.

C)divergent accounting practices between Parent and its Subsidiary may often yield misleading results.

D)a poor performance by one or more subsidiaries can be masked through the aggregation process.

A)they lack completeness.

B)they are of little use to end-users.

C)divergent accounting practices between Parent and its Subsidiary may often yield misleading results.

D)a poor performance by one or more subsidiaries can be masked through the aggregation process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

22

The following data pertains to questions

Parent and Sub Inc had the following balance sheets on July 31,2007: The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

Assuming that Parent Inc acquires 80% of Sub Inc,what amount would appear in the Non-Controlling Interest Account on the Consolidated Balance Sheet on the date of acquisition if the Proprietary Method were used?

A)$200,000

B)Nil

C)$120,000

D)$100,000

Parent and Sub Inc had the following balance sheets on July 31,2007:

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.Assuming that Parent Inc acquires 80% of Sub Inc,what amount would appear in the Non-Controlling Interest Account on the Consolidated Balance Sheet on the date of acquisition if the Proprietary Method were used?

A)$200,000

B)Nil

C)$120,000

D)$100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

23

The following data pertains to questions

Parent and Sub Inc had the following balance sheets on July 31,2007: The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

Assuming once again that the Proprietary Theory was applied,what would be the amount of Goodwill appearing on the Consolidated Balance Sheet on the Date of acquisition,assuming once again that Parent purchased 80% of Sub Inc.for $180,000?

A)$26,000

B)$130,000

C)Nil

D)Cannot be determined from the information given.

Parent and Sub Inc had the following balance sheets on July 31,2007:

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.Assuming once again that the Proprietary Theory was applied,what would be the amount of Goodwill appearing on the Consolidated Balance Sheet on the Date of acquisition,assuming once again that Parent purchased 80% of Sub Inc.for $180,000?

A)$26,000

B)$130,000

C)Nil

D)Cannot be determined from the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

24

Non-Controlling Interest is presented under the Liabilities section of the Consolidated Balance Sheet using the:

A)the Entity Theory.

B)the Proprietary Theory.

C)the Parent Company Theory.

D)both the Parent Company Theory and the Proprietary Theory.

A)the Entity Theory.

B)the Proprietary Theory.

C)the Parent Company Theory.

D)both the Parent Company Theory and the Proprietary Theory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

25

The following data pertains to questions

Parent and Sub Inc had the following balance sheets on July 31,2007: The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

Assuming the Entity Theory was applied,what would be the amount of Goodwill appearing on the Consolidated Balance Sheet on the Date of acquisition,assuming once again that Parent purchased 80% of Sub Inc.for $180,000?

A)$137,000

B)$130,000

C)$138,000

D)$88,000

Parent and Sub Inc had the following balance sheets on July 31,2007:

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.Assuming the Entity Theory was applied,what would be the amount of Goodwill appearing on the Consolidated Balance Sheet on the Date of acquisition,assuming once again that Parent purchased 80% of Sub Inc.for $180,000?

A)$137,000

B)$130,000

C)$138,000

D)$88,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

26

Any goodwill on the subsidiary's company's books on the date of acquisition:

A)must be revalued)

B)must be eliminated)

C)must be recorded as a loss on acquisition.

D)must be subject to an impairment test.

A)must be revalued)

B)must be eliminated)

C)must be recorded as a loss on acquisition.

D)must be subject to an impairment test.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

27

In many countries,exceptions to the general rule that all subsidiaries must be consolidated are allowed)These exclusions could include any of the following except:

A)any subsidiaries that are under temporary control.

B)any subsidiaries that are immaterial in size.

C)any holding companies that are not actively engaged in any business activity.

D)any subsidiaries that are under reorganization or are bankrupt.

A)any subsidiaries that are under temporary control.

B)any subsidiaries that are immaterial in size.

C)any holding companies that are not actively engaged in any business activity.

D)any subsidiaries that are under reorganization or are bankrupt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

28

Non-Controlling Interest is presented in the Shareholders' Equity section of the Balance Sheet under:

A)the Entity Theory.

B)the Proprietary Theory.

C)the Parent Company Theory.

D)both the Parent Company Theory and the Proprietary Theory.

A)the Entity Theory.

B)the Proprietary Theory.

C)the Parent Company Theory.

D)both the Parent Company Theory and the Proprietary Theory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

29

Goodwill is:

A)the amount paid for the customer lists,patents and other intangibles in excess of book value.

B)never recognized for accounting purposes.

C)the differential between the amount paid and the book value of the net assets acquired)

D)the difference between the total value of the subsidiary and the amounts assigned to identifiable assets and liabilities.

A)the amount paid for the customer lists,patents and other intangibles in excess of book value.

B)never recognized for accounting purposes.

C)the differential between the amount paid and the book value of the net assets acquired)

D)the difference between the total value of the subsidiary and the amounts assigned to identifiable assets and liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

30

The following data pertains to Questions

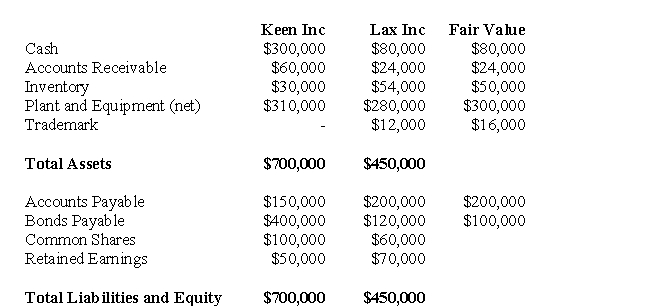

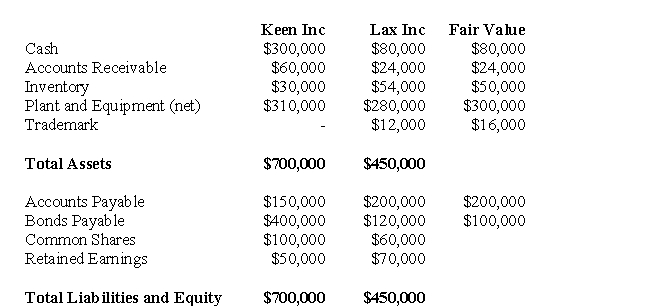

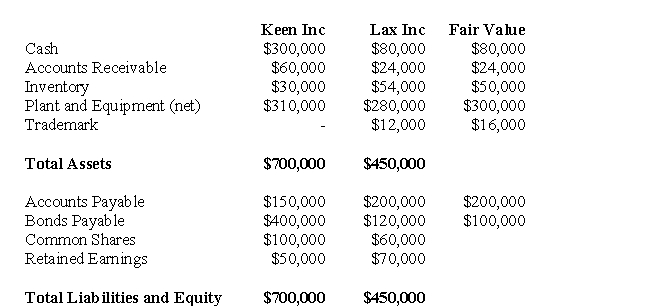

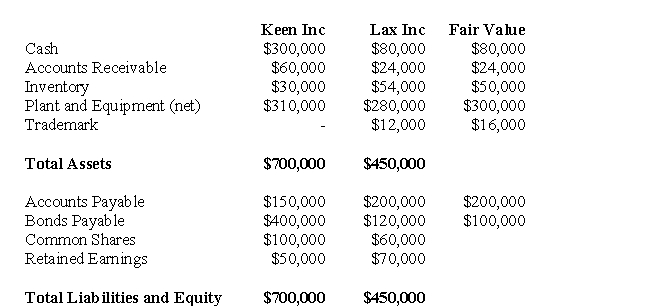

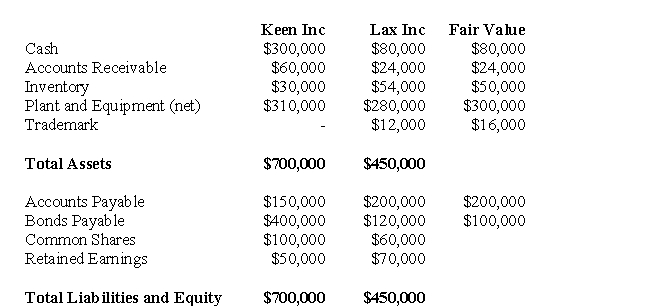

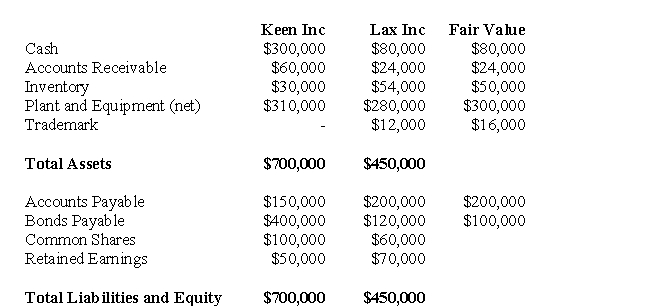

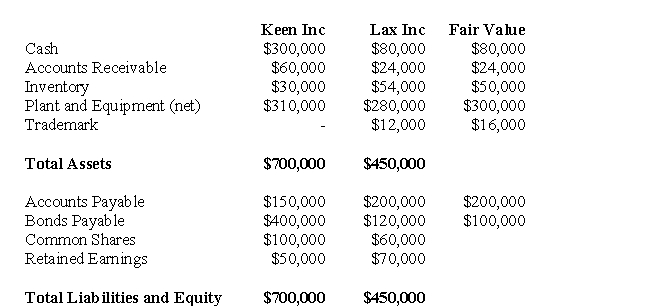

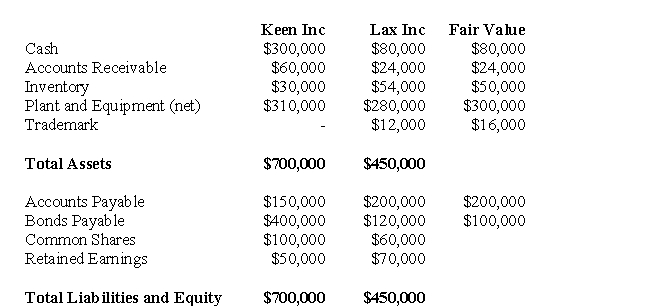

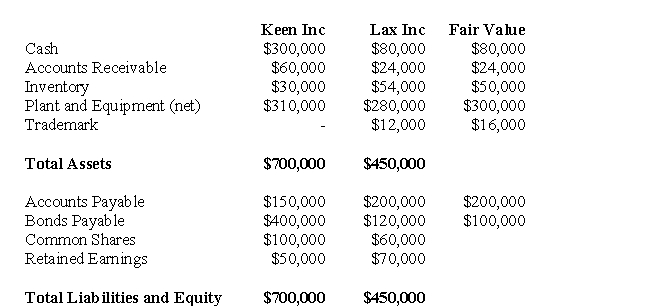

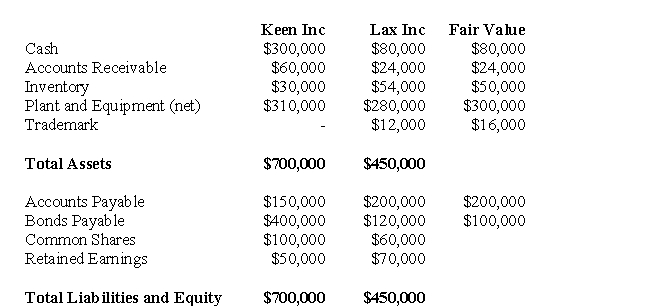

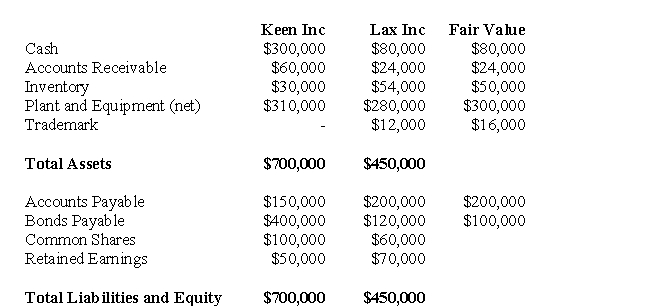

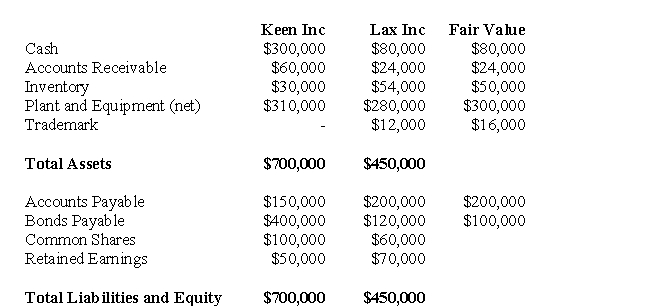

Keen and Lax Inc had the following balance sheets on October 31,2007:

Assuming that Keen Inc.purchases 100% of Lax Inc.for $200,000,prepare any journal entries you feel are necessary on the date of acquisition prior to the preparation of Consolidated Financial Statements.

Keen and Lax Inc had the following balance sheets on October 31,2007:

Assuming that Keen Inc.purchases 100% of Lax Inc.for $200,000,prepare any journal entries you feel are necessary on the date of acquisition prior to the preparation of Consolidated Financial Statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

31

Section 1625 of the CICA Handbook states that a Parent can only require Push-Down accounting when it owns at least what percentage of the Subsidiary?

A)80%

B)75%

C)90%

D)95%

A)80%

B)75%

C)90%

D)95%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

32

Using Push Down accounting is:

A)permissible under IFRSs.

B)is likely permissible under Canadian GAAP.

C)required for SEC registration in some cases.

D)will be presented in the financial statements when the information is meaningful.

A)permissible under IFRSs.

B)is likely permissible under Canadian GAAP.

C)required for SEC registration in some cases.

D)will be presented in the financial statements when the information is meaningful.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

33

The following data pertains to questions

Parent and Sub Inc had the following balance sheets on July 31,2007: The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

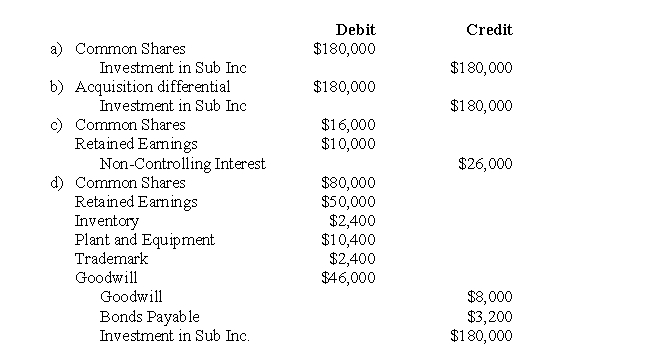

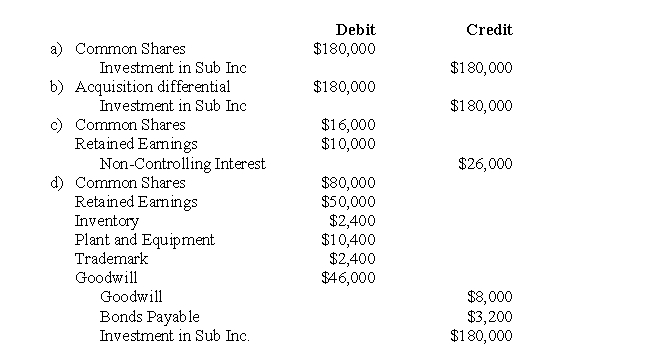

Assuming that Parent Inc.purchased 80% of Sub's voting shares on the date of acquisition for $180,000,what would be the journal entry to clear out the Investment in Sub Inc.account assuming any Acquisition differential is to be allocated to the identifiable assets and liabilities of Sub Inc if the Proprietary Method were used?

Parent and Sub Inc had the following balance sheets on July 31,2007:

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.Assuming that Parent Inc.purchased 80% of Sub's voting shares on the date of acquisition for $180,000,what would be the journal entry to clear out the Investment in Sub Inc.account assuming any Acquisition differential is to be allocated to the identifiable assets and liabilities of Sub Inc if the Proprietary Method were used?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

34

The following data pertains to questions

Parent and Sub Inc had the following balance sheets on July 31,2007: The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

The Shareholder Equity section of Parent's Consolidated Balance Sheet on the date of acquisition would total what amount under the Entity Method?

A)$270,000

B)$140,000

C)$185,000

D)$244,000

Parent and Sub Inc had the following balance sheets on July 31,2007:

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.The Shareholder Equity section of Parent's Consolidated Balance Sheet on the date of acquisition would total what amount under the Entity Method?

A)$270,000

B)$140,000

C)$185,000

D)$244,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

35

The following data pertains to questions

Parent and Sub Inc had the following balance sheets on July 31,2007: The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

Assuming that Parent Company purchased 80% of Sub Inc.for $180,000,the Liabilities section (including Non-Controlling Interest)of Parent's Consolidated Balance Sheet on the date of acquisition would total what amount under current GAAP?

A)$400,000

B)$473,200

C)$499,200

D)$477,200

Parent and Sub Inc had the following balance sheets on July 31,2007:

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.Assuming that Parent Company purchased 80% of Sub Inc.for $180,000,the Liabilities section (including Non-Controlling Interest)of Parent's Consolidated Balance Sheet on the date of acquisition would total what amount under current GAAP?

A)$400,000

B)$473,200

C)$499,200

D)$477,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

36

When the Non-Controlling Interest's share of the subsidiary's goodwill is not reliably determined the method used to prepare consolidated financial statements is:

A)the Entity Theory.

B)the Proprietary Theory.

C)the Non-Controlling Interest Revaluation Theory.

D)the Parent Company Extension Theory..

A)the Entity Theory.

B)the Proprietary Theory.

C)the Non-Controlling Interest Revaluation Theory.

D)the Parent Company Extension Theory..

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

37

The following data pertains to questions

Parent and Sub Inc had the following balance sheets on July 31,2007: The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

Assuming that Parent Inc.purchased 80% of Sub's voting shares on the date of acquisition for $180,000,what would be the amount of the Non-Controlling Interest on the date of acquisition if the Entity Method were used?

A)$104,000

B)$26,000

C)$ 45,000

D)$38,000

Parent and Sub Inc had the following balance sheets on July 31,2007:

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.Assuming that Parent Inc.purchased 80% of Sub's voting shares on the date of acquisition for $180,000,what would be the amount of the Non-Controlling Interest on the date of acquisition if the Entity Method were used?

A)$104,000

B)$26,000

C)$ 45,000

D)$38,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

38

The following data pertains to questions

Parent and Sub Inc had the following balance sheets on July 31,2007: The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

What would be the amount of Non-Controlling Interest appearing on the Consolidated Balance Sheet on the date of acquisition,assuming once again that Parent purchased 80% of Sub Inc.for $180,000 under current GAAP?

B)$26,000

C)$86,000

D)$72,000

E)The answer cannot be determined from the information given.

Parent and Sub Inc had the following balance sheets on July 31,2007:

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.What would be the amount of Non-Controlling Interest appearing on the Consolidated Balance Sheet on the date of acquisition,assuming once again that Parent purchased 80% of Sub Inc.for $180,000 under current GAAP?

B)$26,000

C)$86,000

D)$72,000

E)The answer cannot be determined from the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

39

The focus of the Consolidated Financial Statements on the shareholders of the parent company is characteristic of:

A)the Entity Theory.

B)the Proprietary Theory.

C)the Parent Company Theory.

D)both the Parent Company Theory and the Proprietary Theory.

A)the Entity Theory.

B)the Proprietary Theory.

C)the Parent Company Theory.

D)both the Parent Company Theory and the Proprietary Theory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

40

The following data pertains to questions

Parent and Sub Inc had the following balance sheets on July 31,2007: The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

Assuming Parent purchased 80% of Sub Inc.for $180,000;the Assets section of Parent's Consolidated Balance Sheet on the date of acquisition would total what amount under current GAAP?

A)$637,600

B)$639,200

C)$637,200

D)$571,000

Parent and Sub Inc had the following balance sheets on July 31,2007:

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.Assuming Parent purchased 80% of Sub Inc.for $180,000;the Assets section of Parent's Consolidated Balance Sheet on the date of acquisition would total what amount under current GAAP?

A)$637,600

B)$639,200

C)$637,200

D)$571,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

41

The following data pertains to Questions

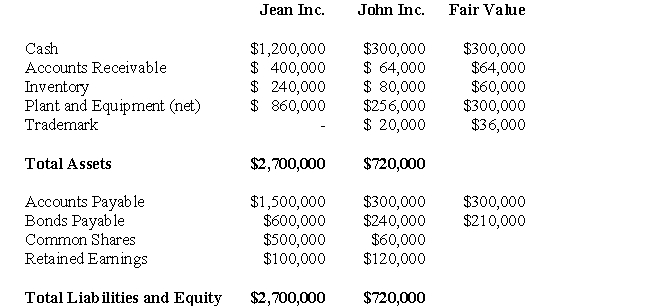

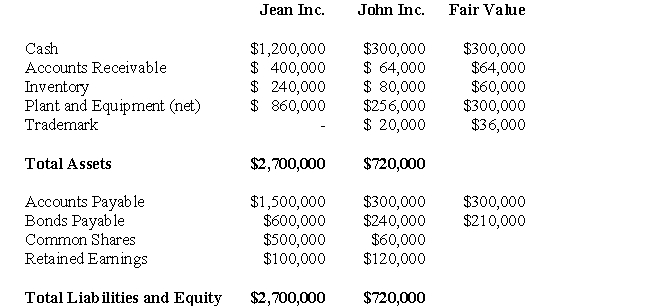

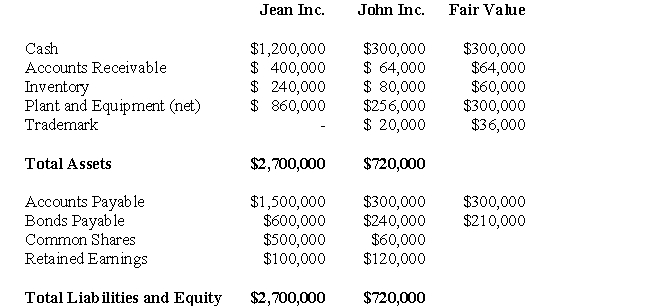

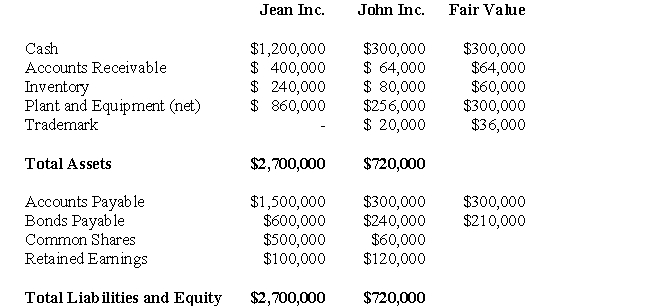

Jean and John Inc had the following balance sheets on August 31,2007: On August 31,2007,Jean's date of acquisition,Jean Inc.purchased 90% of John Inc for $400,000.

On August 31,2007,Jean's date of acquisition,Jean Inc.purchased 90% of John Inc for $400,000.

-Prepare Jean Inc's consolidated Balance Sheet on the date of acquisition using the Entity Theory.

Jean and John Inc had the following balance sheets on August 31,2007:

On August 31,2007,Jean's date of acquisition,Jean Inc.purchased 90% of John Inc for $400,000.

On August 31,2007,Jean's date of acquisition,Jean Inc.purchased 90% of John Inc for $400,000.-Prepare Jean Inc's consolidated Balance Sheet on the date of acquisition using the Entity Theory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

42

Company A owns all of the outstanding common voting shares of Company B,which is said to have 500,000 shares.However,Company B's bondholders have a conversion option,which,if exercised would be convertible to 600,000 voting shares.50% of Company B's current Board Members are Company A Executives.How should Company A account for its investment in Company B?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

43

Company A Inc.owns a controlling interest in Company B.which is located overseas.Company A and B are in entirely different lines of business.Company A wishes to file a request allowing it to not consolidate its financial statements with those of Company B.Assuming that Company A is based in Canada,is this allowed? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

44

The following data pertains to Questions

Keen and Lax Inc had the following balance sheets on October 31,2007:

Assume once again that Keen Purchases 100% of Lax.However,in this instance,Keen acquired Lax for only $100,000.Prepare any journal entries you feel are necessary on the date of acquisition prior to the preparation of Consolidated Financial Statements.

Keen and Lax Inc had the following balance sheets on October 31,2007:

Assume once again that Keen Purchases 100% of Lax.However,in this instance,Keen acquired Lax for only $100,000.Prepare any journal entries you feel are necessary on the date of acquisition prior to the preparation of Consolidated Financial Statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

45

The following data pertains to Questions

Keen and Lax Inc had the following balance sheets on October 31,2007:

Assuming that Keen Inc.purchases 80% of Lax Inc.for $240,000,prepare the Consolidated Balance Sheet on the Date of Acquisition.

Keen and Lax Inc had the following balance sheets on October 31,2007:

Assuming that Keen Inc.purchases 80% of Lax Inc.for $240,000,prepare the Consolidated Balance Sheet on the Date of Acquisition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

46

The following data pertains to Questions

Keen and Lax Inc had the following balance sheets on October 31,2007:

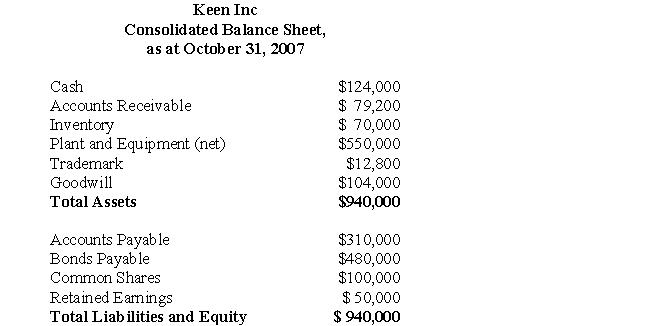

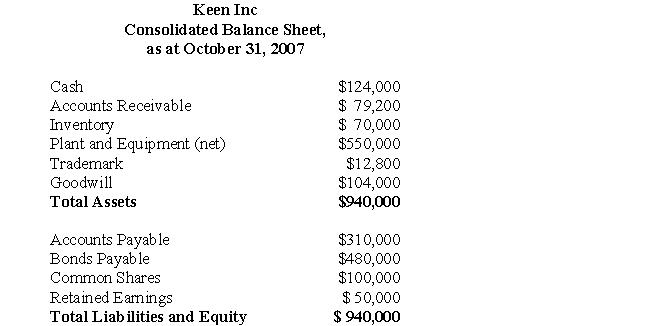

Assuming that Keen Inc.purchases 100% of Lax Inc.for $200,000,prepare the Consolidated Balance Sheet on the Date of Acquisition.

Keen and Lax Inc had the following balance sheets on October 31,2007:

Assuming that Keen Inc.purchases 100% of Lax Inc.for $200,000,prepare the Consolidated Balance Sheet on the Date of Acquisition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

47

There are a number of theories of how financial statements should be prepared for non-wholly owned subsidiaries.Briefly discuss each theory and provide your reasoning to support the theory that is being adopted under IFRSs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

48

Discuss the disclosure requirements for long term investments including accounting policies and NCI.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

49

The following data pertains to Questions

Keen and Lax Inc had the following balance sheets on October 31,2007:

Assuming that Keen Inc.purchases 80% of Lax Inc.for $240,000,prepare any journal entries you feel are necessary on the date of acquisition prior to the preparation of Consolidated Financial Statements.Assume that the Entity Method applies.

Keen and Lax Inc had the following balance sheets on October 31,2007:

Assuming that Keen Inc.purchases 80% of Lax Inc.for $240,000,prepare any journal entries you feel are necessary on the date of acquisition prior to the preparation of Consolidated Financial Statements.Assume that the Entity Method applies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

50

The following data pertains to Questions

Jean and John Inc had the following balance sheets on August 31,2007: On August 31,2007,Jean's date of acquisition,Jean Inc.purchased 90% of John Inc for $400,000.

On August 31,2007,Jean's date of acquisition,Jean Inc.purchased 90% of John Inc for $400,000.

Prepare Jean Inc's consolidated Balance Sheet on the date of acquisition using the Proprietary Theory.

Jean and John Inc had the following balance sheets on August 31,2007:

On August 31,2007,Jean's date of acquisition,Jean Inc.purchased 90% of John Inc for $400,000.

On August 31,2007,Jean's date of acquisition,Jean Inc.purchased 90% of John Inc for $400,000.Prepare Jean Inc's consolidated Balance Sheet on the date of acquisition using the Proprietary Theory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

51

Assume the same facts as Question 62 except that Company B's Bondholders had a conversion option which,if exercised,would be convertible to 2,000,000 common voting shares.Would this change your response? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

52

The following data pertains to Questions

Keen and Lax Inc had the following balance sheets on October 31,2007:

Assume that the following draft balance sheet was prepared by a co-worker subsequent to Keen's 80% purchase of Lax Inc for $240,000.Assuming this balance sheet is devoid of technical errors,what can be concluded about the balance sheet below?

Keen and Lax Inc had the following balance sheets on October 31,2007:

Assume that the following draft balance sheet was prepared by a co-worker subsequent to Keen's 80% purchase of Lax Inc for $240,000.Assuming this balance sheet is devoid of technical errors,what can be concluded about the balance sheet below?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck