Deck 7: Advanced Option Strategies

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/50

العب

ملء الشاشة (f)

Deck 7: Advanced Option Strategies

1

Answer questions about a long straddle constructed using the June 50 options.

What is the profit if the stock price at expiration is at $64.75?

A)-$971

B)$1,475

C)-$3,525

D)$500

E)none of the above

What is the profit if the stock price at expiration is at $64.75?

A)-$971

B)$1,475

C)-$3,525

D)$500

E)none of the above

E

2

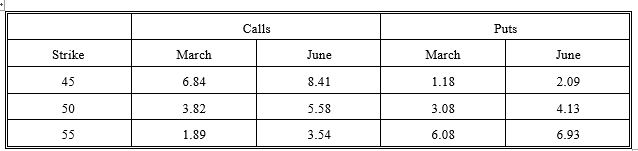

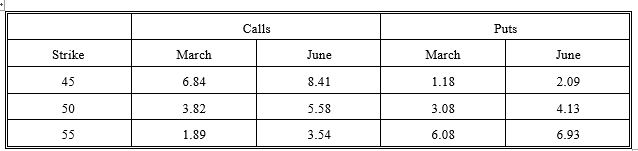

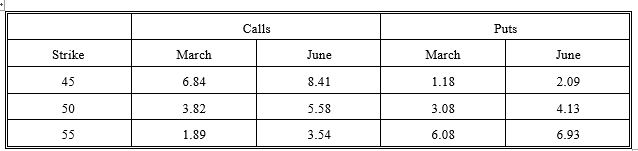

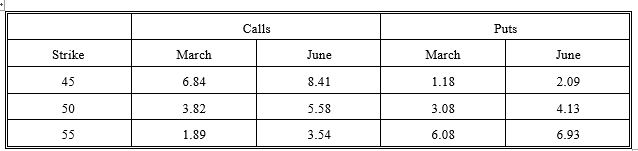

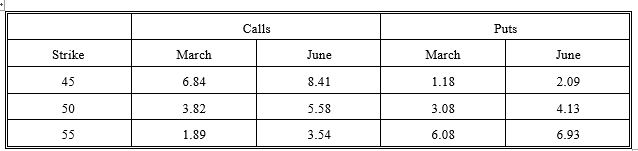

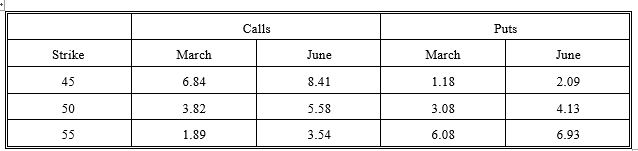

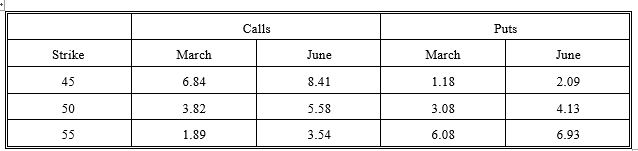

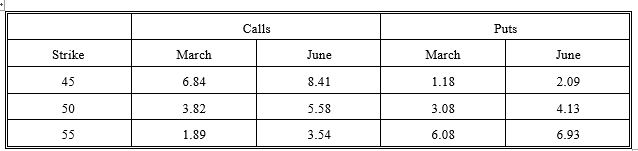

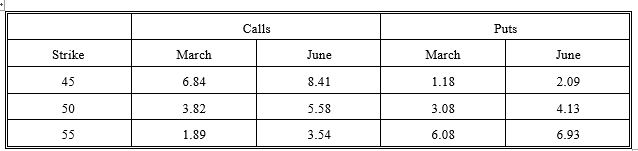

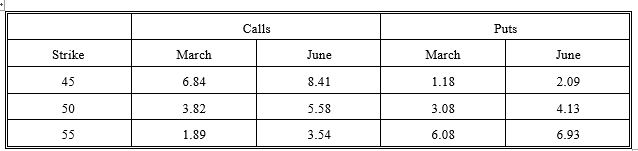

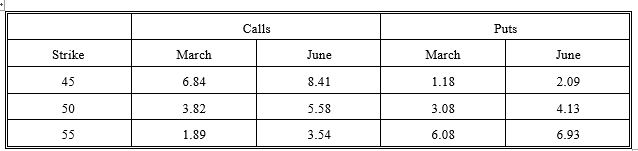

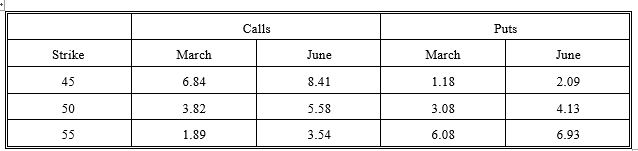

The following prices are available for call and put options on a stock priced at $50. The risk-free rate is 6 percent and the volatility is 0.35. The March options have 90 days remaining and the June options have 180 days remaining. The Black-Scholes model was used to obtain the prices.

Use this information to answer questions 1 through 20. Assume that each transaction consists of one contract (100 options) unless otherwise indicated.

Use this information to answer questions 1 through 20. Assume that each transaction consists of one contract (100 options) unless otherwise indicated.

For questions 1 through 6, consider a bull money spread using the March 45/50 calls.

What is the maximum profit on the spread?

A)$500

B)$802

C)$198

D)$302

E)none of the above

Use this information to answer questions 1 through 20. Assume that each transaction consists of one contract (100 options) unless otherwise indicated.

Use this information to answer questions 1 through 20. Assume that each transaction consists of one contract (100 options) unless otherwise indicated.For questions 1 through 6, consider a bull money spread using the March 45/50 calls.

What is the maximum profit on the spread?

A)$500

B)$802

C)$198

D)$302

E)none of the above

C

3

Suppose you wish to construct a ratio spread using the March and June 50 calls.You want to buy 100 June 50 call contracts.How many March 50 calls would you sell?

A)105

B)95

C)100

D)57

E)none of the above

Answer questions 10 and 11 about a calendar spread based on the assumption that stock prices are expected to remain fairly constant.Use the June/March 50 call spread.Assume one contract of each.

A)105

B)95

C)100

D)57

E)none of the above

Answer questions 10 and 11 about a calendar spread based on the assumption that stock prices are expected to remain fairly constant.Use the June/March 50 call spread.Assume one contract of each.

A

4

Answer questions about a long straddle constructed using the June 50 options.

What is the profit if the position is held for 90 days and the stock price is $55?

A)-$971

B)-$58

C)-$109

D)-$471

E)none of the above

What is the profit if the position is held for 90 days and the stock price is $55?

A)-$971

B)-$58

C)-$109

D)-$471

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

5

suppose an investor expects the stock price to remain at about $50 and decides to execute a butterfly spread using the June calls.

What will be the profit if the stock price at expiration is $52.50?

A)$171

B)$1,421

C)$1.037

D)$421

E)none of the above

What will be the profit if the stock price at expiration is $52.50?

A)$171

B)$1,421

C)$1.037

D)$421

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

6

Answer questions about a long box spread using the June 50 and 55 options.

What is the cost of the box spread?

A)$500

B)$2,018

C)$76

D)$484

E)none of the above

What is the cost of the box spread?

A)$500

B)$2,018

C)$76

D)$484

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

7

Answer questions about a long straddle constructed using the June 50 options.

Suppose the investor adds a call to the long straddle,a transaction known as a strap.What will this do to the breakeven stock prices?

A)lower both the upside and downside breakevens

B)raise both the upside and downside breakevens

C)raise the upside and lower the downside breakevens

D)lower the upside and raise the downside breakevens

E)none of the above

Suppose the investor adds a call to the long straddle,a transaction known as a strap.What will this do to the breakeven stock prices?

A)lower both the upside and downside breakevens

B)raise both the upside and downside breakevens

C)raise the upside and lower the downside breakevens

D)lower the upside and raise the downside breakevens

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

8

Answer questions about a long straddle constructed using the June 50 options.

Suppose a put is added to a straddle.This overall transaction is called a strip.Determine the profit at expiration on a strip if the stock price at expiration is $36.

A)-$129

B)$1,416

C)$429

D)$1,384

E)none of the above

Answer questions 18 through 20 about a long box spread using the June 50 and 55 options.

Suppose a put is added to a straddle.This overall transaction is called a strip.Determine the profit at expiration on a strip if the stock price at expiration is $36.

A)-$129

B)$1,416

C)$429

D)$1,384

E)none of the above

Answer questions 18 through 20 about a long box spread using the June 50 and 55 options.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

9

Answer questions about a long straddle constructed using the June 50 options.

What are the two breakeven stock prices at expiration?

A)$55.58 and $45.87

B)$54.13 and $45.87

C)$55.58 and $44.42

D)$59.71 and $40.29

E)none of the above

What are the two breakeven stock prices at expiration?

A)$55.58 and $45.87

B)$54.13 and $45.87

C)$55.58 and $44.42

D)$59.71 and $40.29

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

10

Answer questions about a long straddle constructed using the June 50 options.

What will the straddle cost?

A)$145

B)$690

C)$971

D)$413

E)none of the above

What will the straddle cost?

A)$145

B)$690

C)$971

D)$413

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

11

The following prices are available for call and put options on a stock priced at $50. The risk-free rate is 6 percent and the volatility is 0.35. The March options have 90 days remaining and the June options have 180 days remaining. The Black-Scholes model was used to obtain the prices.

Use this information to answer questions 1 through 20. Assume that each transaction consists of one contract (100 options) unless otherwise indicated.

Use this information to answer questions 1 through 20. Assume that each transaction consists of one contract (100 options) unless otherwise indicated.

For questions 1 through 6, consider a bull money spread using the March 45/50 calls.

What is the breakeven point?

A)$48.02

A)none of the above

B)$41.98

C)$55.66

D)$50.00

Use this information to answer questions 1 through 20. Assume that each transaction consists of one contract (100 options) unless otherwise indicated.

Use this information to answer questions 1 through 20. Assume that each transaction consists of one contract (100 options) unless otherwise indicated.For questions 1 through 6, consider a bull money spread using the March 45/50 calls.

What is the breakeven point?

A)$48.02

A)none of the above

B)$41.98

C)$55.66

D)$50.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

12

Answer questions about a calendar spread based on the assumption that stock prices are expected to remain fairly constant. Use the June/March 50 call spread. Assume one contract of each.

What will the spread cost?

A)-$176

B)$176

C)$558

D)$105

E)none of the above

What will the spread cost?

A)-$176

B)$176

C)$558

D)$105

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

13

Answer questions about a calendar spread based on the assumption that stock prices are expected to remain fairly constant. Use the June/March 50 call spread. Assume one contract of each.

What will be the profit if the spread is held 90 days and the stock price is $45?

A)$36

B)$20

C)$558

D)-$20

E)none of the above

Answer questions 12 through 17 about a long straddle constructed using the June 50 options.

What will be the profit if the spread is held 90 days and the stock price is $45?

A)$36

B)$20

C)$558

D)-$20

E)none of the above

Answer questions 12 through 17 about a long straddle constructed using the June 50 options.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

14

The following prices are available for call and put options on a stock priced at $50. The risk-free rate is 6 percent and the volatility is 0.35. The March options have 90 days remaining and the June options have 180 days remaining. The Black-Scholes model was used to obtain the prices.

Use this information to answer questions 1 through 20. Assume that each transaction consists of one contract (100 options) unless otherwise indicated.

Use this information to answer questions 1 through 20. Assume that each transaction consists of one contract (100 options) unless otherwise indicated.

For questions 1 through 6, consider a bull money spread using the March 45/50 calls.

What is the profit if the stock price at expiration is $47?

A)-$102

B)$398

C)-$302

D)$500

E)none of the above

Use this information to answer questions 1 through 20. Assume that each transaction consists of one contract (100 options) unless otherwise indicated.

Use this information to answer questions 1 through 20. Assume that each transaction consists of one contract (100 options) unless otherwise indicated.For questions 1 through 6, consider a bull money spread using the March 45/50 calls.

What is the profit if the stock price at expiration is $47?

A)-$102

B)$398

C)-$302

D)$500

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

15

The following prices are available for call and put options on a stock priced at $50. The risk-free rate is 6 percent and the volatility is 0.35. The March options have 90 days remaining and the June options have 180 days remaining. The Black-Scholes model was used to obtain the prices.

Use this information to answer questions 1 through 20. Assume that each transaction consists of one contract (100 options) unless otherwise indicated.

Use this information to answer questions 1 through 20. Assume that each transaction consists of one contract (100 options) unless otherwise indicated.

For questions 1 through 6, consider a bull money spread using the March 45/50 calls.

Suppose you closed the spread 60 days later.What will be the profit if the stock price is still at $50?

A)$41

B)$198

C)$302

D)$102

E)none of the above

For questions 7 and 8,suppose an investor expects the stock price to remain at about $50 and decides to execute a butterfly spread using the June calls.

Use this information to answer questions 1 through 20. Assume that each transaction consists of one contract (100 options) unless otherwise indicated.

Use this information to answer questions 1 through 20. Assume that each transaction consists of one contract (100 options) unless otherwise indicated.For questions 1 through 6, consider a bull money spread using the March 45/50 calls.

Suppose you closed the spread 60 days later.What will be the profit if the stock price is still at $50?

A)$41

B)$198

C)$302

D)$102

E)none of the above

For questions 7 and 8,suppose an investor expects the stock price to remain at about $50 and decides to execute a butterfly spread using the June calls.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

16

The following prices are available for call and put options on a stock priced at $50. The risk-free rate is 6 percent and the volatility is 0.35. The March options have 90 days remaining and the June options have 180 days remaining. The Black-Scholes model was used to obtain the prices.

Use this information to answer questions 1 through 20. Assume that each transaction consists of one contract (100 options) unless otherwise indicated.

Use this information to answer questions 1 through 20. Assume that each transaction consists of one contract (100 options) unless otherwise indicated.

For questions 1 through 6, consider a bull money spread using the March 45/50 calls.

How much will the spread cost?

A)$986

B)$302

C)$283

D)$193

E)none of the above

Use this information to answer questions 1 through 20. Assume that each transaction consists of one contract (100 options) unless otherwise indicated.

Use this information to answer questions 1 through 20. Assume that each transaction consists of one contract (100 options) unless otherwise indicated.For questions 1 through 6, consider a bull money spread using the March 45/50 calls.

How much will the spread cost?

A)$986

B)$302

C)$283

D)$193

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

17

Answer questions about a long box spread using the June 50 and 55 options.

What is the net present value of the box spread?

A)$9.84

B)$5.00

C)$16.00

D)$1.84

E)none of the above

What is the net present value of the box spread?

A)$9.84

B)$5.00

C)$16.00

D)$1.84

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

18

The following prices are available for call and put options on a stock priced at $50. The risk-free rate is 6 percent and the volatility is 0.35. The March options have 90 days remaining and the June options have 180 days remaining. The Black-Scholes model was used to obtain the prices.

Use this information to answer questions 1 through 20. Assume that each transaction consists of one contract (100 options) unless otherwise indicated.

Use this information to answer questions 1 through 20. Assume that each transaction consists of one contract (100 options) unless otherwise indicated.

For questions 1 through 6, consider a bull money spread using the March 45/50 calls.

What is the maximum loss on the spread?

A)$500

B)$698

C)$198

D)$802

E)none of the above

Use this information to answer questions 1 through 20. Assume that each transaction consists of one contract (100 options) unless otherwise indicated.

Use this information to answer questions 1 through 20. Assume that each transaction consists of one contract (100 options) unless otherwise indicated.For questions 1 through 6, consider a bull money spread using the March 45/50 calls.

What is the maximum loss on the spread?

A)$500

B)$698

C)$198

D)$802

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

19

Answer questions about a long box spread using the June 50 and 55 options.

What is the profit if the stock price at expiration is $52.50?

A)$16

B)$500

C)-$234

D)$250

E)none of the above

What is the profit if the stock price at expiration is $52.50?

A)$16

B)$500

C)-$234

D)$250

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

20

suppose an investor expects the stock price to remain at about $50 and decides to execute a butterfly spread using the June calls.

What will be the cost of the butterfly spread?

A)$1,195

B)$637

C)$79

D)$1,045

E)none of the above

What will be the cost of the butterfly spread?

A)$1,195

B)$637

C)$79

D)$1,045

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

21

The holder of a straddle does not care which way the market moves as long as it makes a significant move.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

22

There are three breakeven stock prices in a butterfly spread.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

23

A spread that is profitable if the options are in-the-money is called a money spread.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

24

One of the risks of a calendar spread is that the intrinsic values may be different.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

25

If a straddle is closed prior to expiration,the investor can recover some of the time value of either the call or the put but not both.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following have similar profit graphs?

A)call bull spread and long box spread

B)put bear spread and short box spread

C)butterfly spread and ratio spread

D)calendar spread and call bear spread

E)none of the above

A)call bull spread and long box spread

B)put bear spread and short box spread

C)butterfly spread and ratio spread

D)calendar spread and call bear spread

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

27

Buying a put money spread is a bearish strategy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

28

Early exercise is a disadvantage in which of the following transactions?

A)short box spread

B)put bear spread

C)long strip (2 puts and 1 call)

D)long strap (2 calls and 1 put)

E)none of the above

A)short box spread

B)put bear spread

C)long strip (2 puts and 1 call)

D)long strap (2 calls and 1 put)

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following is the best strategy for an expected fall in the market?

A)long strip (2 puts and 1 call)

B)put bull spread

C)calendar spread

D)butterfly spread

E)none of the above

A)long strip (2 puts and 1 call)

B)put bull spread

C)calendar spread

D)butterfly spread

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following transactions can have an unlimited loss?

A)long straddle

B)calendar spread

C)butterfly spread

D)reverse box spread

E)none of the above

A)long straddle

B)calendar spread

C)butterfly spread

D)reverse box spread

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

31

An investor who holds a strap (2 calls and 1 put)believes the market is more likely to go up than down.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

32

A reverse calendar spread is used to take advantage of unexpected high volatility.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following strategies does not profit in a rising market?

A)put bull spread

B)long straddle

C)collar

D)call bull spread

E)none of the above

A)put bull spread

B)long straddle

C)collar

D)call bull spread

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

34

A call money spread that is closed prior to expiration has lower losses but higher profits for each stock price than if held to expiration.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

35

In a calendar spread the time value of the nearby option will decay more rapidly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

36

A call butterfly spread combines a call bull spread with a call bear spread.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

37

Early exercise is an important risk when call bear spreads and put bull spreads are used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

38

A call butterfly spread is a bullish strategy that is profitable if stock prices increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

39

A call bear spread is a strategy for investors who expect stock prices to increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

40

A strip (2 puts and one call)would cost more than a straddle but would pay off more if the stock falls.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

41

The risk of early exercise is of no concern to the holder of a long straddle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

42

The payoffs form a straddle are more like the payoffs from a money spread than a calendar spread.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

43

A ratio spread can be conducted with money spreads or time spreads.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

44

At the expiration of a box spread,at most there will be only one option exercised.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

45

A box spread is a combination of a call bull spread and a put bear spread.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

46

A collar gives downside protection,leaving the upside open.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

47

A strap is a less expensive bullish strategy than a straddle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

48

To truly gain from a straddle,an investor must have a better estimate of volatility than everyone else.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

49

A box spread is a good strategy to use if high volatility is expected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

50

The delta of a straddle would be the call delta plus the put delta.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck