Deck 3: Principles of Option Pricing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/50

العب

ملء الشاشة (f)

Deck 3: Principles of Option Pricing

1

If there are no dividends on a stock,which of the following statements is correct?

A)An American call will sell for more than a European call

B)A European call will sell for more than an American call

C)An American call will be immediately exercised

D)An American call and an American put will sell for the same price

E)none of the above

A)An American call will sell for more than a European call

B)A European call will sell for more than an American call

C)An American call will be immediately exercised

D)An American call and an American put will sell for the same price

E)none of the above

E

2

Suppose you use put-call parity to compute a European call price from the European put price,the stock price,and the risk-free rate.You find the market price of the call to be less than the price given by put-call parity.Ignoring transaction costs,what trades should you do?

A)buy the call and the risk-free bonds and sell the put and the stock

B)buy the stock and the risk-free bonds and sell the put and the call

C)buy the put and the stock and sell the risk-free bonds and the call

D)buy the put and the call and sell the risk-free bonds and the stock

E)none of the above

A)buy the call and the risk-free bonds and sell the put and the stock

B)buy the stock and the risk-free bonds and sell the put and the call

C)buy the put and the stock and sell the risk-free bonds and the call

D)buy the put and the call and sell the risk-free bonds and the stock

E)none of the above

A

3

What is the lowest possible value of a European put?

A)Max(0,X - S0)

B)X(1 + r)-T

C)Max[0,S0 - X(1 + r)-T]

D)Max[0,X(1 + r)-T - S0)]

E)none of the above

A)Max(0,X - S0)

B)X(1 + r)-T

C)Max[0,S0 - X(1 + r)-T]

D)Max[0,X(1 + r)-T - S0)]

E)none of the above

D

4

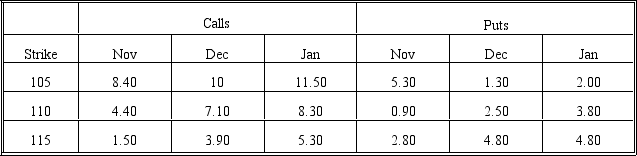

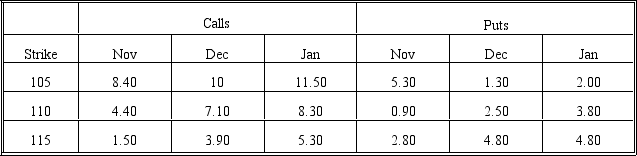

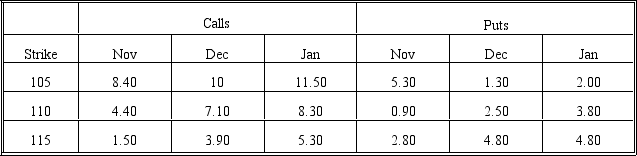

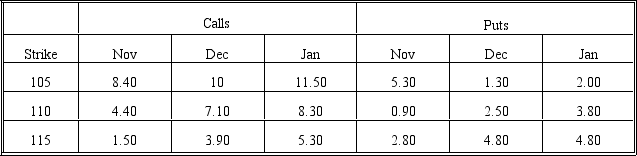

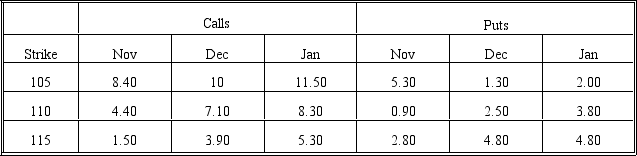

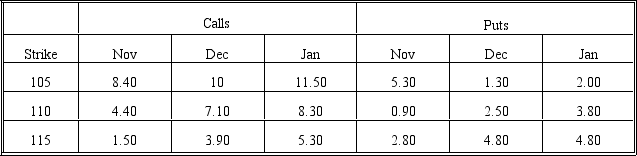

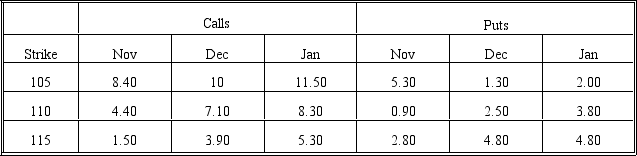

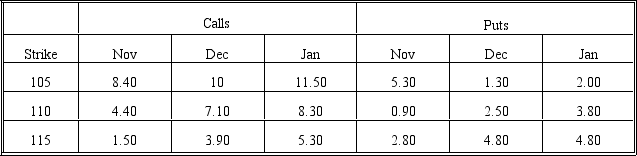

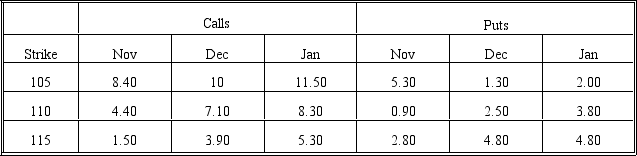

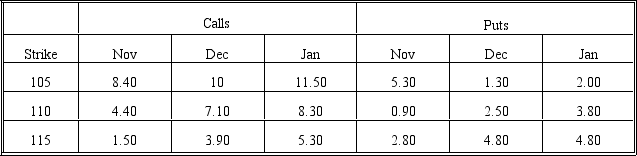

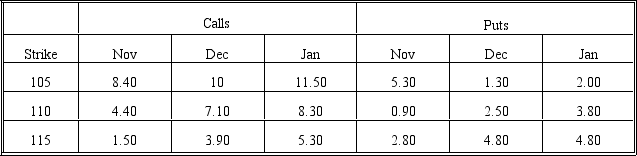

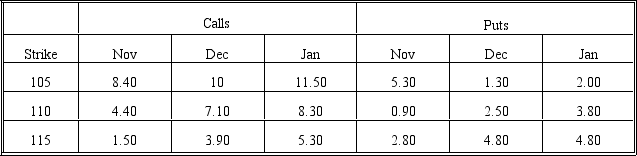

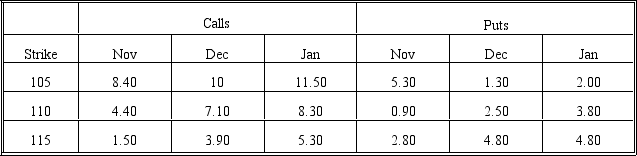

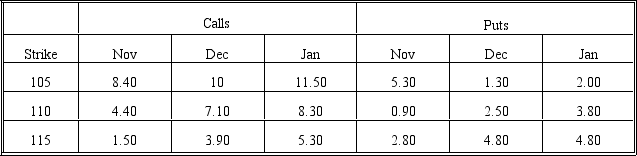

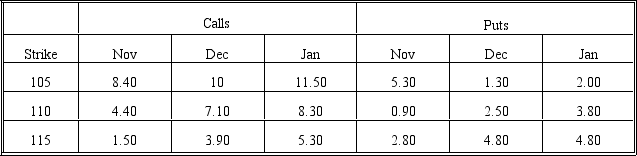

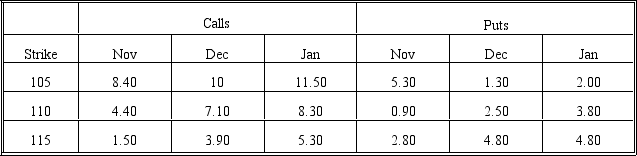

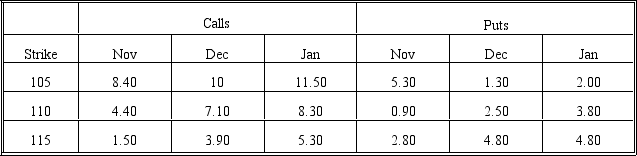

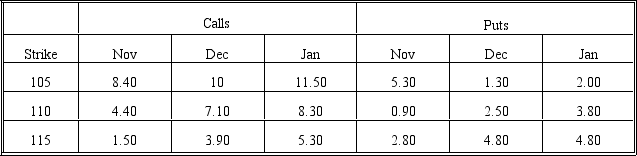

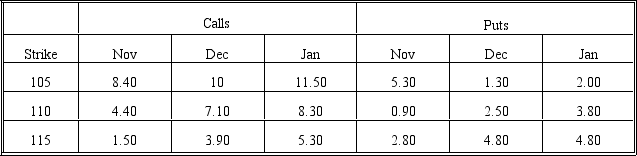

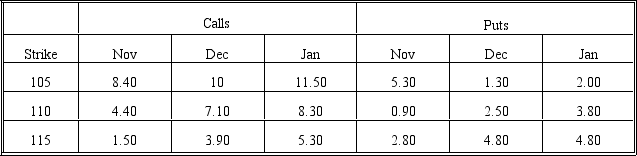

The following quotes were observed for options on a given stock on November 1 of a given year.These are American calls except where indicated.Use the information to answer questions 7 through 20.

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.

What is the time value of the December 105 put?

A)1.30

B)8.30

C)0.00

D)7.00

E)none of the above

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.What is the time value of the December 105 put?

A)1.30

B)8.30

C)0.00

D)7.00

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

5

Suppose the stock is about to go ex-dividend in one day.The dividend will be $4.00.Which of the following calls will you consider for exercise?

A)November 115

B)November 110

C)December 115

D)all of the above

E)none of the above

A)November 115

B)November 110

C)December 115

D)all of the above

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

6

The following quotes were observed for options on a given stock on November 1 of a given year.These are American calls except where indicated.Use the information to answer questions 7 through 20.

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.

What is the European lower bound of the December 105 call?

A)9.86

B)0.00

C)8.25

D)9.26

E)none of the above

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.What is the European lower bound of the December 105 call?

A)9.86

B)0.00

C)8.25

D)9.26

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

7

The following quotes were observed for options on a given stock on November 1 of a given year.These are American calls except where indicated.Use the information to answer questions 7 through 20.

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.

What is the intrinsic value of the January 110 call?

A)0.00

B)8.30

C)3.75

D)5.00

E)none of the above

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.What is the intrinsic value of the January 110 call?

A)0.00

B)8.30

C)3.75

D)5.00

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

8

The following quotes were observed for options on a given stock on November 1 of a given year.These are American calls except where indicated.Use the information to answer questions 7 through 20.

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.

What is the intrinsic value of the December 115 put?

A)1.75

B)0.00

C)3.90

D)3.00

E)none of the above

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.What is the intrinsic value of the December 115 put?

A)1.75

B)0.00

C)3.90

D)3.00

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

9

The following quotes were observed for options on a given stock on November 1 of a given year.These are American calls except where indicated.Use the information to answer questions 7 through 20.

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.

What is the time value of the November 115 put?

A)1.75

B)2.80

C)1.10

D)0.00

E)none of the above

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.What is the time value of the November 115 put?

A)1.75

B)2.80

C)1.10

D)0.00

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

10

The following quotes were observed for options on a given stock on November 1 of a given year.These are American calls except where indicated.Use the information to answer questions 7 through 20.

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.

What is the European lower bound of the November 115 call?

A)1.44

B)0.00

C)1.75

D)2.06

E)none of the above

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.What is the European lower bound of the November 115 call?

A)1.44

B)0.00

C)1.75

D)2.06

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

11

The following quotes were observed for options on a given stock on November 1 of a given year.These are American calls except where indicated.Use the information to answer questions 7 through 20.

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.

What is the intrinsic value of the November 105 put?

A)0.30

B)8.25

C)8.50

D)0.00

E)none of the above

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.What is the intrinsic value of the November 105 put?

A)0.30

B)8.25

C)8.50

D)0.00

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

12

Consider a portfolio consisting of a long call with an exercise price of X,a short position in a non-dividend paying stock at an initial price of S0,and the purchase of riskless bonds with a face value of X and maturing when the call expires.What should such a portfolio be worth?

A)C + P - X(1 + r)-T

B)C - S0

C)P - X

D)P + S0 - X(1 + r)-T

E)none of the above

A)C + P - X(1 + r)-T

B)C - S0

C)P - X

D)P + S0 - X(1 + r)-T

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

13

The following quotes were observed for options on a given stock on November 1 of a given year.These are American calls except where indicated.Use the information to answer questions 7 through 20.

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.

What is the time value of the November 110 call?

A)0.00

B)4.40

C)1.15

D)3.25

E)none of the above

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.What is the time value of the November 110 call?

A)0.00

B)4.40

C)1.15

D)3.25

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

14

The following quotes were observed for options on a given stock on November 1 of a given year.These are American calls except where indicated.Use the information to answer questions 7 through 20.

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.

What is the intrinsic value of the November 115 call?

A)1.50

B)0.00

C)2.80

D)1.75

E)none of the above

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.What is the intrinsic value of the November 115 call?

A)1.50

B)0.00

C)2.80

D)1.75

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

15

Another expression for intrinsic value is

A)parity

B)parity value

C)exercise value

D)all of the above

E)none of the above

A)parity

B)parity value

C)exercise value

D)all of the above

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

16

Suppose you knew that the January 115 options were correctly priced but suspected that the stock was mispriced.Using put-call parity,what would you expect the stock price to be? For this problem,treat the options as if they were European.

A)113.73

B)123.23

C)121.23

D)112.77

E)none of the above

A)113.73

B)123.23

C)121.23

D)112.77

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

17

The maximum difference between the January 105 and 110 calls is which of the following?

A)11.50

B)4.92

C)5.00

D)4.0

E)none of the above

A)11.50

B)4.92

C)5.00

D)4.0

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

18

From American put-call parity,what are the minimum and maximum values that the sum of the stock price and December 110 put price can be?

A)101.81 and 102.87

B)2.50 and 113.25

C)116.038 and 117.10

D)7.125 and 110

E)none of the above

A)101.81 and 102.87

B)2.50 and 113.25

C)116.038 and 117.10

D)7.125 and 110

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

19

On March 2,a Treasury bill expiring on April 20 had a bid discount of 5.80,and an ask discount of 5.86.What is the best estimate of the risk-free rate as given in the text?

A)5.86 %

B)5.83 %

C)6.11 %

D)6.14 %

E)none of the above

A)5.86 %

B)5.83 %

C)6.11 %

D)6.14 %

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

20

The following quotes were observed for options on a given stock on November 1 of a given year.These are American calls except where indicated.Use the information to answer questions 7 through 20.

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.

What is the time value of the January 115 call?

A)5.30

B)0.00

C)3.50

D)1.70

E)none of the above

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.

The stock price was 113.25.The risk-free rates were 7.30 percent (November),7.50 percent (December)and 7.62 percent (January).The times to expiration were 0.0384 (November),0.1342 (December),and 0.211 (January).Assume no dividends unless indicated.What is the time value of the January 115 call?

A)5.30

B)0.00

C)3.50

D)1.70

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

21

The lower bound of a European call on a non-dividend paying stock is lower than the intrinsic value of an American call.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

22

The lower the exercise price,the more valuable the call option.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

23

If one portfolio always provides a return at least as high as another portfolio,then that portfolio will have a price no less than that of the other portfolio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

24

Holding everything else constant,call options are more expensive in periods of high interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

25

The maximum value of a call is the stock price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

26

An American put might be exercised early even when there are no dividends on the underlying stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following is the lowest possible value of an American put on a stock with no dividends?

A)X(1 + r)-T

B)X

C)Max(0,X(1 + r)-T - S0)

D)Max(0,X - S0)

E)none of the above

A)X(1 + r)-T

B)X

C)Max(0,X(1 + r)-T - S0)

D)Max(0,X - S0)

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

28

Holding everything else constant,put options are more expensive in periods of high interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

29

Holding everything else constant,a longer-term European put is always worth more than a shorter-term European put.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

30

The difference between a Treasury bill's face value and its price is called the

A)time value

B)discount

C)coupon rate

D)bid

E)none of the above

A)time value

B)discount

C)coupon rate

D)bid

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following is the lowest possible value of an American call on a stock with no dividends?

A)Max(0,S0 - X(1 + r)-T)

B)S0

C)Max(0,S0 - X)

D)Max(0,S0 (1 + r)-T - X)

E)none of the above

A)Max(0,S0 - X(1 + r)-T)

B)S0

C)Max(0,S0 - X)

D)Max(0,S0 (1 + r)-T - X)

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

32

An option can be priced at less than zero because it can potentially generate a large profit for its owner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

33

High volatility is bad for option holders because it increases the probability that the option will expire out-of-the-money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

34

The time value of an option is also referred to as the

A)synthetic value

B)strike value

C)speculative value

D)parity value

E)none of the above

A)synthetic value

B)strike value

C)speculative value

D)parity value

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

35

The difference between an American call's price and its intrinsic value is called the time value because the call can be exercised at any time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following statements about an American call is not true?

A)Its time value decreases as expiration approaches

B)Its maximum value is the stock price

C)It can be exercised prior to expiration

D)It pays dividends

E)none of the above

A)Its time value decreases as expiration approaches

B)Its maximum value is the stock price

C)It can be exercised prior to expiration

D)It pays dividends

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

37

Put-call parity is a relationship that can be used to provide the price of both a European put and call simultaneously.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

38

The lower bound of a European put on a non-dividend paying stock is lower than the intrinsic value of an American put.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

39

An American call should be exercised early when the stock price is extremely high and is expected to fall.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

40

The concept of the intrinsic value does not apply to European calls prior to expiration because they cannot be exercised immediately.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

41

The time value of a call is greatest when the stock price is very high.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

42

The spread between the prices of two European puts,alike in all respects except exercise price,cannot exceed the difference in their exercise prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

43

A stock is equivalent to a long call,short put and long risk-free bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

44

At expiration the call price must converge to the stock price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

45

An American call on a non-dividend paying stock will be worth more than a European call on that same stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

46

The gain from the early exercise of an American put is X(1 + r)-T - S0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

47

Selling short a risk-free bond is equivalent to borrowing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

48

If an option portfolio generates a zero cash flow at expiration and a positive cash flow today,an arbitrage opportunity is available.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

49

Even if there are no dividends on the stock,American put-call parity will not be the same as European put-call parity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

50

Transactions to exploit pricing errors in the put-call parity relationship are called conversions and reversals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck