Deck 6: Accounting for Merchandising Businesses

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

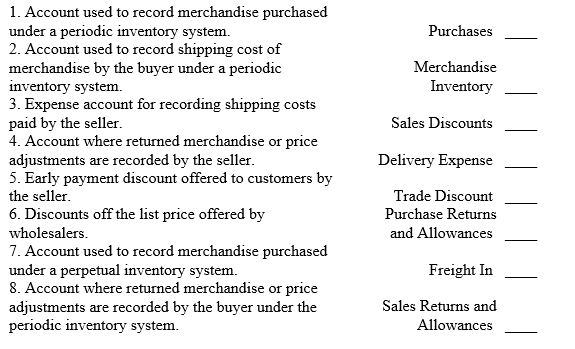

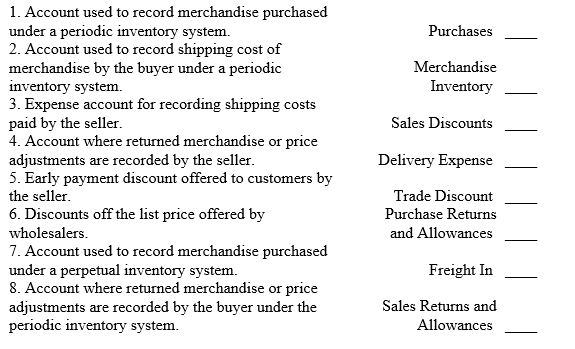

Match between columns

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/215

العب

ملء الشاشة (f)

Deck 6: Accounting for Merchandising Businesses

1

Under a periodic inventory system, the merchandise on hand at the end of the year is determined by a physical count of the inventory.

True

2

One of the most important differences between a service business and a retail business is in what is sold.

True

3

On the income statement in the single-step form, the total of all expenses is deducted from the total of all revenues.

True

4

The single-step income statement is easier to prepare, but a criticism of this format is that gross profit and income from operations are readily available.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

5

In a multiple-step income statement the dollar amount for income from operations is always the same as net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

6

Net sales is equal to sales minus cost of merchandise sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

7

When a merchandising business is compared to a service business, the financial statement that is affected by that change is the Statement of Owner's Equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

8

In a merchandise business, sales minus operating expenses equals net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

9

In the periodic inventory system, purchases of merchandise for resale are debited to the Purchases account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

10

Under the periodic inventory system, the cost of merchandise sold is equal to the beginning merchandise inventory plus the cost of merchandise purchased plus the ending merchandise inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

11

The ending merchandise inventory for 2010 is the same as the beginning merchandise inventory for 2011.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

12

Cost of merchandise sold is the amount that the merchandising company pays for the merchandise it intends to sell.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

13

In a perpetual inventory system, the Merchandise Inventory account is only used to reflect the beginning inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

14

Service businesses provide services for income, while a merchandising business sells merchandise.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

15

In many retail businesses, inventory is the largest current asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

16

Income that be associated definitely with operations, such as a gain from the sale of a fixed asset, is listed as Other Income on the multiple-step income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

17

As we compare a merchandise business to a service business, the financial statement that changes the most is the Balance Sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

18

The form of the balance sheet in which assets, liabilities, and owner's equity are presented in a downward sequence is called the report form.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

19

In a periodic inventory system, the cost of merchandise purchased includes the cost of freight-in.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

20

Gross profit minus selling expenses equals net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

21

Other income and expenses are items that are related to the primary operating activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

22

Freight-in is considered a cost of purchasing inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

23

The effect of a sales return and allowance is a reduction in sales revenue and a decrease in cash or accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

24

Sales Discounts is a revenue account with a credit balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

25

Sales to customers who use bank credit cards, such as MasterCard and VISA, are generally treated as credit sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

26

In a perpetual inventory system, when merchandise is returned to the seller, Cost of Merchandise Sold is debited as part of the transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

27

Sales Returns and Allowances is a contra-revenue account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

28

When merchandise that was sold is returned, a credit to sales returns and allowances is made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

29

Sales to customers who use nonbank credit cards, such as American Express, are generally treated as credit sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

30

Freight in is the amount paid by the company to deliver merchandise sold to a customer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

31

The service fee that credit card companies charge retailers varies and is the primary reason why some businesses do accept all credit cards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

32

If payment is due by the end of the month in which the sale is made, the invoice terms are expressed as n/30.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

33

Under the periodic inventory system, the cost of merchandise sold is recorded when sales are made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

34

In the merchandising income statement, sales will be reduced by sales discounts and sales returns and allowances to arrive at net sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

35

The cost of merchandise inventory is limited to the purchase price less any purchase discounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

36

Under the perpetual inventory system, when a sale is made, both the sale and cost of merchandise sold are recorded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

37

Cost of Merchandise Sold is often the largest expense on a merchandising company income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

38

A seller may grant a buyer a reduction in selling price and this is called a sales allowance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

39

Retailers record all credit card sales as credit sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

40

Merchandise Inventory normally has a debit balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

41

If merchandise costing $3,500, terms FOB destination, 2/10, n/30, with prepaid freight costs of $125, is paid within 10 days, the amount of the purchases discount is $70.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

42

When a large quantity of merchandise is purchased, a reduction allowed on the sale price is called a trade discount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

43

If the ownership of merchandise passes to the buyer when the seller delivers the merchandise for shipment, the terms are stated as FOB destination.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

44

When merchandise is sold for $600 plus 6% sales tax, the Sales account should be credited for $636.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

45

A deduction allowed to wholesalers and retailers from the price of merchandise listed in catalogs is called cash discounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

46

When the terms of sale are FOB shipping point, the buyer should pay the freight charges.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

47

Merchandise is sold for $3,600, terms FOB destination, 2/10, n/30, with prepaid freight costs of $150. If $500 of the merchandise is returned prior to payment and the invoice is paid within the discount period, the amount of the sales discount is $65.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

48

There is no difference between the recording of cash sales and the recording of MasterCard or VISA sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

49

Discounts taken by the buyer for early payment of an invoice are credited to Sales Discounts by the buyer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

50

A buyer who acquires merchandise under credit terms of 1/10, n/30 has 30days after the invoice date to take advantage of the cash discount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

51

When companies use a perpetual inventory system, the recording of the purchase of inventory will include a debit to purchases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

52

In a perpetual inventory system, merchandise returned to vendors reduces the merchandise inventory account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

53

The chart of accounts for a merchandise business would include an account called Delivery Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

54

Sellers and buyers are required to record trade discounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

55

The abbreviation FOB stands for Free On Board.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

56

When the seller offers a sales discount, even if borrowing has to be done, it is generally advantageous for the buyer to pay within the discount period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

57

Purchases of merchandise are typically credited to the merchandise inventory account under the perpetual inventory system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

58

A sale of $750 on account, subject to a sales tax of 6%, would be recorded as an account receivable of $750.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

59

If the buyer bears the freight costs related to a purchase, the terms are said to be FOB destination.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

60

Under the perpetual inventory system, a company purchases merchandise on terms 2/10, n/30. If payment is made within 10 days of the purchase, the entry to record the payment will include a credit to Cash and a credit to Purchase Discounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

61

The adjusting entry to record inventory shrinkage would generally include a debit to Cost of Merchandise Sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

62

The buyer will include the sales tax as part of the cost of items purchased for use.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

63

Match each of the following terms with the appropriate definition below.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

64

Because many companies use computerized accounting systems, periodic inventory is widely used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

65

If the perpetual inventory system is used, an account entitled Cost of Merchandise Sold is included in the general ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

66

Purchased goods in transit, shipped FOB destination, should be excluded from ending inventory of the buyer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

67

The seller may prepay the freight costs even though the terms are FOB shipping point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

68

Title to merchandise shipped FOB shipping point passes to the buyer upon delivery of the merchandise to the buyer's place of business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which one of the following is not a difference between a retail business and a service business?

A) in what is sold

B) the inclusion of gross profit in the income statement

C) accounting equation

D) merchandise inventory included in the balance sheet

A) in what is sold

B) the inclusion of gross profit in the income statement

C) accounting equation

D) merchandise inventory included in the balance sheet

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

70

The seller records the sales tax as part of the sales amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

71

Purchased goods in transit should be included in the ending inventory of the buyer if the goods were shipped FOB shipping point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

72

Computerized systems can be used to capture accounting information such as accounts receivable, inventory items, accounts payable, and sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

73

Most companies will take a purchases discount, because 1% or 2% discounts are insignificant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

74

A business using the perpetual inventory system, with its detailed subsidiary records, does need to take a physical inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

75

The accounts Purchases, Purchases Returns and Allowances, Purchases Discounts, and Freight In are found on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

76

Generally, the revenue account for a merchandising business is entitled

A) Sales

B) Fees Earned

C) Gross Sales

D) Gross Profit

A) Sales

B) Fees Earned

C) Gross Sales

D) Gross Profit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

77

Match between columns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

78

Net income plus operating expenses is equal to

A) cost of merchandise sold

B) cost of merchandise available for sale

C) net sales

D) gross profit

A) cost of merchandise sold

B) cost of merchandise available for sale

C) net sales

D) gross profit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

79

Closing entries for a merchandising business are similar to those for a service business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck

80

The ratio of net sales to assets measures how effectively a business is using its assets to generate sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 215 في هذه المجموعة.

فتح الحزمة

k this deck