Deck 8: Capital Expenditure Decisions

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/126

العب

ملء الشاشة (f)

Deck 8: Capital Expenditure Decisions

1

The appropriate discount rate that analysts use in computing the present value of future cash flows is composed of a pure interest rate increased to reflect expected inflation.What is this pure rate called?

A)risk-free rate.

B)real interest rate.

C)nominal interest rate.

D)none of the above.

A)risk-free rate.

B)real interest rate.

C)nominal interest rate.

D)none of the above.

A

2

In making long-term decisions about investing and financing,a firm should do which of the following?

A)decide whether to make the investment,then decide how to raise the funds required for the investment.

B)decide how to raise the funds required for the investment,then decide whether to make the investment.

C)decide how to raise the funds required for the investment at the same time as deciding whether to make the investment.

D)None of the above.

A)decide whether to make the investment,then decide how to raise the funds required for the investment.

B)decide how to raise the funds required for the investment,then decide whether to make the investment.

C)decide how to raise the funds required for the investment at the same time as deciding whether to make the investment.

D)None of the above.

A

3

When is the discount rate used?

A)When determining the applicable treasury rate.

B)When computing the present value of future cash flows.

C)To reduce the price of an investment.

D)When determining the future value of the firm's cash inflows and outflows.

A)When determining the applicable treasury rate.

B)When computing the present value of future cash flows.

C)To reduce the price of an investment.

D)When determining the future value of the firm's cash inflows and outflows.

B

4

The appropriate discount rate that analysts use in computing the present value of future cash flows is composed of a risk factor reflecting the riskiness of the project.Thus,

A)the greater a projects risk,the higher the discount rate.

B)the Federal government has the lowest probability of default,so government bodies usually have the lowest risk premiums.

C)a different discount rate would be used to invest a company's funds in a high-risk research and development project rather than low-risk bonds.

D)all of the above.

A)the greater a projects risk,the higher the discount rate.

B)the Federal government has the lowest probability of default,so government bodies usually have the lowest risk premiums.

C)a different discount rate would be used to invest a company's funds in a high-risk research and development project rather than low-risk bonds.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following involves deciding which long-term investments to undertake and how to finance them?

A)Operational planning.

B)Capital budgeting.

C)Investment planning.

D)Continuous budgeting.

A)Operational planning.

B)Capital budgeting.

C)Investment planning.

D)Continuous budgeting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

6

What does the term capitalmean in the context of making capital expenditure decisions?

A)long-term assets.

B)the funds with which a firm acquires assets.

C)the source of funds typically reported as long-term liabilities and owners' equity.

D)None of the above.

A)long-term assets.

B)the funds with which a firm acquires assets.

C)the source of funds typically reported as long-term liabilities and owners' equity.

D)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following is an assumption of capital budgeting?

A)The firm can raise new funds at the same opportunity costs as the opportunity cost of the funds it already has on hand.

B)The firm can raise new funds at the 30-year Federal funds rate.

C)The firm can raise new funds at the prime interest rate.

D)The firm can raise new funds at the same interest rate as the mean of the interest rates of the funds it already has on hand.

A)The firm can raise new funds at the same opportunity costs as the opportunity cost of the funds it already has on hand.

B)The firm can raise new funds at the 30-year Federal funds rate.

C)The firm can raise new funds at the prime interest rate.

D)The firm can raise new funds at the same interest rate as the mean of the interest rates of the funds it already has on hand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which interest rate is used by analysts when computing the present value of future cash flows?

A)prime interest rate

B)Federal funds rate

C)discount rate

D)real rate

A)prime interest rate

B)Federal funds rate

C)discount rate

D)real rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following best identifies the reason for using probabilities in the capital-budget decision?

A)Uncertainty.

B)Cost of capital.

C)Time value of money.

D)Projects with unequal lives.

A)Uncertainty.

B)Cost of capital.

C)Time value of money.

D)Projects with unequal lives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

10

What does the term capital budgetingmean in the context of making capital expenditure decisions?

A)the process of choosing assets.

B)the process of allocating the funds among assets.

C)the process of acquiring the funds to finance the business.

D)None of the above.

A)the process of choosing assets.

B)the process of allocating the funds among assets.

C)the process of acquiring the funds to finance the business.

D)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

11

The appropriate discount rate that analysts use in computing the present value of future cash flows is composed of an increase reflecting the inflation expected to occur over the life of the project.Thus,

A)the higher the expected inflation,the higher should be the discount rate.

B)the higher the expected inflation,the lower should be the discount rate.

C)the lower the expected inflation,the higher should be the discount rate.

D)all of the above.

A)the higher the expected inflation,the higher should be the discount rate.

B)the higher the expected inflation,the lower should be the discount rate.

C)the lower the expected inflation,the higher should be the discount rate.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

12

Organizational policies,procedures,and performance measures should support accurate estimations,and should consider the effect these factors have on planners when evaluating which of the following?

A)capital investment projects.

B)raw material purchases.

C)hiring temporary labor.

D)indirect material purchases.

A)capital investment projects.

B)raw material purchases.

C)hiring temporary labor.

D)indirect material purchases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

13

Competing investment projects where accepting one project eliminates the possibility of taking the remaining projects is referred to as

A)common projects.

B)mutually exclusive projects.

C)joint projects.

D)opportunity costs.

A)common projects.

B)mutually exclusive projects.

C)joint projects.

D)opportunity costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

14

In making capital budgeting decisions,the discounted cash flow method aids in evaluating investments involving cash flows over time where there is a significant time difference between cash payment and receipt.Analysts use which two discounted cash flow methods?

A)the future value method and the internal rate of return method.

B)the net present value method and the external rate of return method.

C)the net present value method and the internal rate of return method.

D)the future value method and the external rate of return method.

A)the future value method and the internal rate of return method.

B)the net present value method and the external rate of return method.

C)the net present value method and the internal rate of return method.

D)the future value method and the external rate of return method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

15

What is the process by which a firm considering acquiring a new plant or new equipment must decide whether to make the investment,then decide how to raise the funds required for the investment?

A)zero-based budgeting.

B)capital budgeting.

C)annual budgeting.

D)management by objectives.

A)zero-based budgeting.

B)capital budgeting.

C)annual budgeting.

D)management by objectives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following is a capital investment decision method that in evaluating investments involving cash flows over time where there is a significant time difference between cash payment and receipt?

A)zero-based budgeting

B)linear programming.

C)discounted cash flow.

D)program planning and review.

A)zero-based budgeting

B)linear programming.

C)discounted cash flow.

D)program planning and review.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

17

What is the process by which an organization decides on its major programs and the approximate resources to devote to them?

A)capital budgeting.

B)strategic planning.

C)program planning and budgeting.

D)zero-based budgeting.

A)capital budgeting.

B)strategic planning.

C)program planning and budgeting.

D)zero-based budgeting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which term describes the interest rate used in computing the present value of future cash flows?

A)applicable treasury rate

B)discount rate

C)income tax rate

D)borrowing rate.

A)applicable treasury rate

B)discount rate

C)income tax rate

D)borrowing rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which statement is true concerning environmental investments such as installing pollution control devices?

A)These investments may provide many social benefits,not leading to quantifiable cash flows for the company.

B)These investments may provide cash flow benefits by eliminating fines,legal costs,and cleanups.

C)These investments are never undertaken unless required by Federal regulations.

D)Both "a" and "b".

A)These investments may provide many social benefits,not leading to quantifiable cash flows for the company.

B)These investments may provide cash flow benefits by eliminating fines,legal costs,and cleanups.

C)These investments are never undertaken unless required by Federal regulations.

D)Both "a" and "b".

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

20

The appropriate discount rate that analysts use in computing the present value of future cash flows is comprised of which of the following?

A)an increase reflecting the inflation expected to occur over the life of the project.

B)a risk factor reflecting the riskiness of the project

C)a pure rate of interest reflecting the productive capability of capital assets

D)all of the above.

A)an increase reflecting the inflation expected to occur over the life of the project.

B)a risk factor reflecting the riskiness of the project

C)a pure rate of interest reflecting the productive capability of capital assets

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

21

The terminal cash flows associated with an investment project include which of the following?

A)income tax effects resulting from periodic cash flows.

B)loss in tax savings from lost depreciation.

C)tax loss on disposal of equipment.

D)all of the above.

A)income tax effects resulting from periodic cash flows.

B)loss in tax savings from lost depreciation.

C)tax loss on disposal of equipment.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

22

Because the cost of capital includes a premium reflecting inflation expected to occur over the life of the asset,what should decision-makers do?

A)Ignore anticipated inflation on cash flows.

B)Consider inflation-adjusted receipts but not expenditures.

C)Consider inflation adjusted expenditures but not receipts.

D)Consider inflation-adjusted receipts and expenditures.

A)Ignore anticipated inflation on cash flows.

B)Consider inflation-adjusted receipts but not expenditures.

C)Consider inflation adjusted expenditures but not receipts.

D)Consider inflation-adjusted receipts and expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following is used to compute the present value of future cash flows when evaluating investments involving cash flows over time where time elapses between cash payment and receipt?

A)prime rate plus 1 point.

B)United States Federal Reserve Interest Rate.

C)firm's cost of capital.

D)short-term United States Treasury Bill rate.

A)prime rate plus 1 point.

B)United States Federal Reserve Interest Rate.

C)firm's cost of capital.

D)short-term United States Treasury Bill rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

24

What would the periodic cash flows associated with an investment project include?

A)savings for fixed and variable production costs

B)selling,general,and administrative expenditures and savings in selling,general,and administrative expenditures

C)income tax effects resulting from other periodic cash flows

D)all of the above.

A)savings for fixed and variable production costs

B)selling,general,and administrative expenditures and savings in selling,general,and administrative expenditures

C)income tax effects resulting from other periodic cash flows

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

25

The appropriate discount rate that analysts use in computing the present value of future cash flows is composed of a pure interest rate and a premium for the risk of the investment,but no increase to reflect expected inflation.What is this rate called?

A)risk-free rate.

B)real interest rate.

C)nominal interest rate.

D)none of the above.

A)risk-free rate.

B)real interest rate.

C)nominal interest rate.

D)none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

26

Project A has an expected cash flow of $500,000 at the end of year 5.Project B has an expected cash flow of $100,000 to be received at the end of each year for the next five years.What can be said of the net present value of project A compared to project B?

A)They are the same because both cash flows total $500,000 over the lives of the projects.

B)Project A is preferred because of the largest lump-sum payment in year 5.

C)Project B is preferred because of the periodic payments made consistently throughout the years and are made earlier.

D)The both have the same internal rate of return and either should be accepted.

A)They are the same because both cash flows total $500,000 over the lives of the projects.

B)Project A is preferred because of the largest lump-sum payment in year 5.

C)Project B is preferred because of the periodic payments made consistently throughout the years and are made earlier.

D)The both have the same internal rate of return and either should be accepted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

27

If the firm must choose one from a set of mutually exclusive alternatives with the same life span,which alternative should be selected?

A)Select the alternative with the largest net present value of cash flows.

B)Select the alternative with the smallest net present value of cash flows.

C)Select the alternative with the largest net present value of cash inflows.

D)Select the alternative with the smallest net present value of cash outflows.

A)Select the alternative with the largest net present value of cash flows.

B)Select the alternative with the smallest net present value of cash flows.

C)Select the alternative with the largest net present value of cash inflows.

D)Select the alternative with the smallest net present value of cash outflows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

28

What is the appropriate decision to make it the present value of the future cash inflows exceeds the present value of the future cash outflows for a proposal?

A)accept the alternative.

B)reject the alternative.

C)find a better alternative.

D)decrease the firm's cost of capital.

A)accept the alternative.

B)reject the alternative.

C)find a better alternative.

D)decrease the firm's cost of capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following would not be considered a periodic cash flow?

A)Receipts from sales.

B)Expenditures for heat,light,and electricity.

C)Income taxes paid on taxable income.

D)Initial lump-sum investment in a project.

A)Receipts from sales.

B)Expenditures for heat,light,and electricity.

C)Income taxes paid on taxable income.

D)Initial lump-sum investment in a project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

30

If the net present value of a proposed project is positive,then the actual rate of return

A)is higher than the cost of capital.

B)is lower than the cost of capital.

C)is equal to the cost of capital.

D)is negative.

A)is higher than the cost of capital.

B)is lower than the cost of capital.

C)is equal to the cost of capital.

D)is negative.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

31

What would the initial cash flows associated with an investment project include?

A)asset,freight and installation costs.

B)cash proceeds from disposing of existing assets made redundant or unnecessary by the new project.

C)income tax effect of gain(loss)on disposal of existing assets.

D)all of the above.

A)asset,freight and installation costs.

B)cash proceeds from disposing of existing assets made redundant or unnecessary by the new project.

C)income tax effect of gain(loss)on disposal of existing assets.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following are steps needed for using the net present value method for making long-term decisions using discounted cash flows?

A)estimate the amounts of future cash inflows and future cash outflows in each period for each alternative under consideration.

B)discount the future cash flows to the present using the project's discount rate.

C)accept or reject the proposed project,or select one from a set of mutually exclusive projects.

D)all of the above.

A)estimate the amounts of future cash inflows and future cash outflows in each period for each alternative under consideration.

B)discount the future cash flows to the present using the project's discount rate.

C)accept or reject the proposed project,or select one from a set of mutually exclusive projects.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

33

The appropriate discount rate that analysts use in computing the present value of future cash flows is composed of a pure interest rate,a premium for the risk of the investment,an increase to reflect expected inflation.What is this rate is called?

A)risk-free rate.

B)real interest rate.

C)nominal interest rate.

D)none of the above.

A)risk-free rate.

B)real interest rate.

C)nominal interest rate.

D)none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following would not be included as part of the periodic cash inflows associated with an investment project?

A)savings for fixed and variable production costs

B)savings in selling,general,and administrative expenditures

C)receipts from sales

D)opportunity costs of undertaking this particular project.

A)savings for fixed and variable production costs

B)savings in selling,general,and administrative expenditures

C)receipts from sales

D)opportunity costs of undertaking this particular project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

35

The periodic cash flows associated with an investment project include which of the following?

A)savings in taxes caused by deductibility of depreciation on tax return.

B)income tax effect of gain(loss)on disposal of existing assets.

C)asset and freight costs.

D)all of the above.

A)savings in taxes caused by deductibility of depreciation on tax return.

B)income tax effect of gain(loss)on disposal of existing assets.

C)asset and freight costs.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following would not be included as part of the periodic cash outflows associated with an investment project?

A)savings for fixed and variable production costs

B)selling,general,and administrative expenditures

C)opportunity costs of undertaking this particular project.

D)expenditures for fixed and variable production costs.

A)savings for fixed and variable production costs

B)selling,general,and administrative expenditures

C)opportunity costs of undertaking this particular project.

D)expenditures for fixed and variable production costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

37

What would the periodic cash flows associated with an investment project include?

A)receipts from sales.

B)opportunity costs of undertaking this particular project.

C)expenditures for fixed and variable production costs.

D)all of the above.

A)receipts from sales.

B)opportunity costs of undertaking this particular project.

C)expenditures for fixed and variable production costs.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

38

The cash flows associated with an investment project include which of the following?

A)initial cash flows

B)periodic cash flows

C)terminal cash flows.

D)all of the above.

A)initial cash flows

B)periodic cash flows

C)terminal cash flows.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

39

The periodic cash outflows associated with an investment project do not include which of the following?

A)savings in taxes caused by deductibility of depreciation on tax return.

B)expenditures for fixed production costs.

C)expenditures for variable production costs.

D)selling,general,and administrative expenditures.

A)savings in taxes caused by deductibility of depreciation on tax return.

B)expenditures for fixed production costs.

C)expenditures for variable production costs.

D)selling,general,and administrative expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

40

A company purchased an asset at a cost of $80,000.Annual operating cash flows are expected to be $30,000 each year for 4 years.At the end of the asset life,there will be no residual (salvage)value.What is the net present value if the cost of capital is 12 percent? (Ignore income taxes. )

A)$40,000.

B)$24,400.

C)$11,120.

D)$5,650.

A)$40,000.

B)$24,400.

C)$11,120.

D)$5,650.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which statement is true concerning depreciation?

A)Depreciation is not a cash flow and does not affect the tax cash flow.

B)Depreciation is not a cash flow and does affect the tax cash flow.

C)Depreciation is a cash flow and does not affect the tax cash flow.

D)Depreciation is a cash flow and does affect the tax cash flow.

A)Depreciation is not a cash flow and does not affect the tax cash flow.

B)Depreciation is not a cash flow and does affect the tax cash flow.

C)Depreciation is a cash flow and does not affect the tax cash flow.

D)Depreciation is a cash flow and does affect the tax cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

42

For the internal rate of return to rank projects the same way as the net present value rule,which condition must exist?

A)The cutoff rate used for the internal rate equals the cost of capital.

B)Projects are mutually exclusive.

C)Projects have different lives.

D)There must be more than one internal rate of return.

A)The cutoff rate used for the internal rate equals the cost of capital.

B)Projects are mutually exclusive.

C)Projects have different lives.

D)There must be more than one internal rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

43

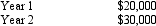

A firm will depreciate a computer costing $10,000 over five years using the straight-line methods for financial reporting.For tax purposes,the company will use an accelerated method as follows:

Assuming a tax rate of 40 percent,what is the relevant cash flow for present value analysis associated with the tax savings related to depreciation for Year 2?

A)$1,280.

B)$1,667.

C)$1,920.

D)$3,200.

Assuming a tax rate of 40 percent,what is the relevant cash flow for present value analysis associated with the tax savings related to depreciation for Year 2?

A)$1,280.

B)$1,667.

C)$1,920.

D)$3,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

44

How would income tax laws affect investment decisions?

A)Through their effect on the discount rate allowed.

B)Through their effect on the type of investments allowed.

C)Through their effect on the internal rate of return allowed.

D)Through their effect on the type of depreciation method allowed.

A)Through their effect on the discount rate allowed.

B)Through their effect on the type of investments allowed.

C)Through their effect on the internal rate of return allowed.

D)Through their effect on the type of depreciation method allowed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which statement is true concerning depreciation?

A)Depreciation does not affect taxable income.

B)Depreciation should be considered in the cash flow analysis.

C)Depreciation is never relevant for decision making.

D)Depreciation is never affected by income tax laws.

A)Depreciation does not affect taxable income.

B)Depreciation should be considered in the cash flow analysis.

C)Depreciation is never relevant for decision making.

D)Depreciation is never affected by income tax laws.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

46

When is the only time an investment analysis needs working capital?

A)when the firm must let cash sit idle as a condition of undertaking an investment.

B)whenever a capital expenditure decision is made.

C)when a firm makes cash payments

D)when a firm must show cash received from sales when it collects the cash.

A)when the firm must let cash sit idle as a condition of undertaking an investment.

B)whenever a capital expenditure decision is made.

C)when a firm makes cash payments

D)when a firm must show cash received from sales when it collects the cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which errors will likely have the largest effect on the net present value of changes in assumptions and estimates?

A)Errors in predicting the amounts of future cash flows.

B)Errors in predicting the timing of future cash flows.

C)Errors in predicting the discount rate.

D)Errors in sensitivity analysis.

A)Errors in predicting the amounts of future cash flows.

B)Errors in predicting the timing of future cash flows.

C)Errors in predicting the discount rate.

D)Errors in sensitivity analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following statements is correct regarding capital investments?

A)Capital investments should be funded out of excess cash reserves.

B)Capital investments should have a positive internal rate of return.

C)Capital investments should achieve short-term objectives.

D)Capital investments should implement a company's strategy.

A)Capital investments should be funded out of excess cash reserves.

B)Capital investments should have a positive internal rate of return.

C)Capital investments should achieve short-term objectives.

D)Capital investments should implement a company's strategy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following is a likely errors in the calculation of net present value?

A)the amount of cash flows

B)the timing of cash flows

C)the discount rate.

D)all of the above

A)the amount of cash flows

B)the timing of cash flows

C)the discount rate.

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

50

A planned factory expansion project has an estimated initial cost of $500,000.Using a discount rate of 20 percent,the present value of the future cost savings from the expansion is $520,000.To yield exactly the 20 percent time-adjusted rate of return,the actual investment expenditure should not exceed the $500,000 estimate by more than

A)$160,000.

B)$20,000.

C)$1,075.

D)$43,000.

A)$160,000.

B)$20,000.

C)$1,075.

D)$43,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

51

At the end of a five-year life,a company will dispose of an asset and recognize a gain of $6,000.If the company's cost of capital is 15 percent and its tax rate is 30 percent,what is the present value of the future cash flow?

A)$14,078.

B)$6,000.

C)$2,087.

D)$895.

A)$14,078.

B)$6,000.

C)$2,087.

D)$895.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

52

The steps of the net present value method for making long-term decisions include

A)estimate the amounts of future cash inflows and future cash outflows in each period for each alternative under consideration.

B)requiring the use of the applicable treasury rate as the discount rate in computing the present value of future cash flows.

C)if the present value of the future cash inflows exceeds the present value of the future cash outflows for a proposal,reject the alternative.

D)ignore depreciation because it is not a cash flow and does not affects the after-tax cash flow.

A)estimate the amounts of future cash inflows and future cash outflows in each period for each alternative under consideration.

B)requiring the use of the applicable treasury rate as the discount rate in computing the present value of future cash flows.

C)if the present value of the future cash inflows exceeds the present value of the future cash outflows for a proposal,reject the alternative.

D)ignore depreciation because it is not a cash flow and does not affects the after-tax cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

53

The calculation of the net present value of a proposed project does not require estimates of which of the following?

A)the amount of future cash flows.

B)the timing of future cash flows.

C)the cost of capital rate.

D)the amount of sunk costs already incurred.

A)the amount of future cash flows.

B)the timing of future cash flows.

C)the cost of capital rate.

D)the amount of sunk costs already incurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

54

A not-for-profit company purchased an asset at a cost of $60,000.Annual operating cash flows are expected to be $20,000 each year for 4 years.At the end of the asset life,there will be no residual (salvage)value.Ignore income taxes.What is the net present value if the cost of capital is 10 percent?

A)$(1,960. )

B)$3,397.

C)$12,400.

D)$23,400.

A)$(1,960. )

B)$3,397.

C)$12,400.

D)$23,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which statement is true concerning depreciation?

A)Depreciation does not affect after-tax cash flow.

B)Depreciation should be considered in the cash flow analysis.

C)Depreciation is not affected by income tax laws which specify the allowable methods.

D)Depreciation is a method used in financial accounting to allocate the cost of an asset over its useful life,but has no application for managerial accounting purposes.

A)Depreciation does not affect after-tax cash flow.

B)Depreciation should be considered in the cash flow analysis.

C)Depreciation is not affected by income tax laws which specify the allowable methods.

D)Depreciation is a method used in financial accounting to allocate the cost of an asset over its useful life,but has no application for managerial accounting purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which statement is true concerning depreciation?

A)Depreciation affects the tax cash flow because it is a deductible expense that affects taxable income.

B)Depreciation should be considered in the cash flow analysis.

C)Depreciation is affected by income tax laws which specify the allowable methods.

D)all of the above.

A)Depreciation affects the tax cash flow because it is a deductible expense that affects taxable income.

B)Depreciation should be considered in the cash flow analysis.

C)Depreciation is affected by income tax laws which specify the allowable methods.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following is a useful feature of spreadsheet programs?

A)Spreadsheet programs reduce the errors in predicting the amounts of future cash flows.

B)Spreadsheet programs reduce the errors in predicting the timing of future cash flows.

C)Spreadsheet programs reduce the errors in predicting the discount rate.

D)Spreadsheet programs help the user see the effect on the net present value of changes in assumptions and estimates.

A)Spreadsheet programs reduce the errors in predicting the amounts of future cash flows.

B)Spreadsheet programs reduce the errors in predicting the timing of future cash flows.

C)Spreadsheet programs reduce the errors in predicting the discount rate.

D)Spreadsheet programs help the user see the effect on the net present value of changes in assumptions and estimates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

58

In which area will analysts likely err when making capital investment decisions?

A)predicting or estimating amounts.

B)the timing of cash flows

C)the discount rate.

D)all of the above.

A)predicting or estimating amounts.

B)the timing of cash flows

C)the discount rate.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

59

In which area will analysts will likely err when making capital investment decisions?

A)the amount of future cash flows

B)the timing of cash flows

C)the discount rate.

D)all of the above.

A)the amount of future cash flows

B)the timing of cash flows

C)the discount rate.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which statement is true concerning depreciation charges?

A)Depreciation charges directly affects cash flows.

B)Depreciation charges directly affect the after-tax cash flow.

C)Depreciation charges can be deducted from a firm's tax return.

D)all of the above.

A)Depreciation charges directly affects cash flows.

B)Depreciation charges directly affect the after-tax cash flow.

C)Depreciation charges can be deducted from a firm's tax return.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following is the discount rate that discounts the future cash flows to a present value just equal to the initial investment?

A)investment rate of return.

B)external rate of return.

C)internal rate of return.

D)international rate of return.

A)investment rate of return.

B)external rate of return.

C)internal rate of return.

D)international rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

62

What is true concerning the internal rate of return (IRR)method?

A)The IRR method determines the discount rate that equates the net present value of the series to the initial investment.

B)The IRR method determines the discount rate that equates the net present value of the series to hurdle rate.

C)The IRR method determines the discount rate that equates the net present value of the series to cut-off rate.

D)The IRR method determines the discount rate that equates the net present value of the series to zero.

A)The IRR method determines the discount rate that equates the net present value of the series to the initial investment.

B)The IRR method determines the discount rate that equates the net present value of the series to hurdle rate.

C)The IRR method determines the discount rate that equates the net present value of the series to cut-off rate.

D)The IRR method determines the discount rate that equates the net present value of the series to zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

63

What should a firm do to justify or reject investments in advanced manufacturing systems?

A)only uses discounted cash flow analysis.

B)only use perfect estimates of tangible costs and benefits.

C)establish a high discount or cut-off rate

D)make a judgement that recognizes both quantifiable and nonquantifiable benefits.

A)only uses discounted cash flow analysis.

B)only use perfect estimates of tangible costs and benefits.

C)establish a high discount or cut-off rate

D)make a judgement that recognizes both quantifiable and nonquantifiable benefits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

64

The Information Technology Club,Inc.is considering an investment that requires $20,000 and promises to return $28,090 in 3 years.The company's income tax rate is 40 percent.What is the approximate internal rate of return?

A)8 percent.

B)10 percent.

C)12 percent.

D)15 percent.

A)8 percent.

B)10 percent.

C)12 percent.

D)15 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

65

Justification of investments in advanced manufacturing systems by using discounted cash flow analysis results in rejection of the proposal because the present value of future cash flows are negative.What is/are possible reason(s)for adopting the proposal,anyway?

A)to inject new technology into the company's manufacturing operations

B)improved quality,greater flexibility,and lower inventories that lead to long-term cash flows.

C)intangible benefits in addition to quantifiable benefits should be considered.

D)all of the above.

A)to inject new technology into the company's manufacturing operations

B)improved quality,greater flexibility,and lower inventories that lead to long-term cash flows.

C)intangible benefits in addition to quantifiable benefits should be considered.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

66

What is a general type of long-term capital investment that companies make?

A)replacement and minor improvements

B)training and development of employees

C)advertising campaigns

D)all of the above

A)replacement and minor improvements

B)training and development of employees

C)advertising campaigns

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

67

The decision to accept or reject an investment proposal can be made using either the internal rate of return method or the net present value method under most circumstances.The following is/are circumstance(s)that may arise where the two methods need not give the same answer and the net present value method's answer is always the correct one.

A)mutually exclusive projects.

B)projects with different lifetimes.

C)projects with intermixing of inflows and outflows.

D)all of the above are possible circumstances.

A)mutually exclusive projects.

B)projects with different lifetimes.

C)projects with intermixing of inflows and outflows.

D)all of the above are possible circumstances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following is a behavioral issue that influences capital investment project planners objectivity when making estimates?

A)desire to implement a project.

B)performance evaluation measures.

C)organizational policies and procedures.

D)all of the above.

A)desire to implement a project.

B)performance evaluation measures.

C)organizational policies and procedures.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

69

Managers are often correct that the company would benefit from advanced manufacturing technology.However,the present value of future cash flows analysis usually results in a negative net present value for the investment because of the exclusion of benefits that are difficult to quantify such as

A)greater flexibility in the production process.

B)shorter cycle times and lead times.

C)reduction of non-value-added costs.

D)all of the above.

A)greater flexibility in the production process.

B)shorter cycle times and lead times.

C)reduction of non-value-added costs.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

70

When using the internal rate of return to evaluate investment alternatives,which rate would analysts specify?

A)hurdle rate.

B)Federal funds rate.

C)prime interest rate.

D)time-adjusted rate.

A)hurdle rate.

B)Federal funds rate.

C)prime interest rate.

D)time-adjusted rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

71

Justification of investments in advanced manufacturing systems is a(n)

A)easy problem.

B)moderately-easy problem.

C)moderately-difficult problem.

D)difficult problem.

A)easy problem.

B)moderately-easy problem.

C)moderately-difficult problem.

D)difficult problem.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

72

Systematic feedback to planners based on audits creates an environment in which planners will find less temptation to

A)deflate their estimates of the benefits associated with their pet projects.

B)inflate their estimates of the benefits associated with their pet projects.

C)inflate their estimates of the costs associated with their pet projects.

D)inflate their estimates of the prestige associated with their pet projects.

A)deflate their estimates of the benefits associated with their pet projects.

B)inflate their estimates of the benefits associated with their pet projects.

C)inflate their estimates of the costs associated with their pet projects.

D)inflate their estimates of the prestige associated with their pet projects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

73

Managers are often correct that the company would benefit from advanced manufacturing technology.However,the present value of future cash flows analysis usually results in a negative net present value for the investment because of the

A)hurdle rate being set too high and there is a bias toward incremental projects.

B)uncertainty about operating cash flows.

C)exclusion of benefits that are difficult to quantify.

D)all of the above.

A)hurdle rate being set too high and there is a bias toward incremental projects.

B)uncertainty about operating cash flows.

C)exclusion of benefits that are difficult to quantify.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

74

When using the internal rate of return to evaluate investment alternatives,what rate would an analyst need to specify?

A)cutoff rate.

B)Federal funds rate.

C)prime interest rate.

D)time-adjusted rate.

A)cutoff rate.

B)Federal funds rate.

C)prime interest rate.

D)time-adjusted rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

75

When using the internal rate of return to evaluate investment alternatives,analysts specify which of the following?

A)applicable federal rate.

B)cut-off rate.

C)risk-free rate.

D)prime rate.

A)applicable federal rate.

B)cut-off rate.

C)risk-free rate.

D)prime rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

76

The decision to accept or reject an investment proposal that computes the investment's net present value,using the organization's adjusted cost of capital as the discount rate and undertakes the investment if its net present value is positive,or rejects the investment if its net present value is negative is called the

A)net present value method.

B)future value method.

C)internal rate of return method.

D)external rate of return method.

A)net present value method.

B)future value method.

C)internal rate of return method.

D)external rate of return method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following can be calculated using built-in functions in spreadsheet programs?

A)external rate of return.

B)internal rate of return.

C)investment rate of return.

D)international rate of return.

A)external rate of return.

B)internal rate of return.

C)investment rate of return.

D)international rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

78

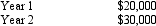

A project requires an initial investment of $43,000 and has the following expected stream of cash flows:

The internal rate of return for the project is closest to

A)0 percent.

B)10 percent.

C)15 percent.

D)20 percent.

The internal rate of return for the project is closest to

A)0 percent.

B)10 percent.

C)15 percent.

D)20 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following is the discount rate that equates the net present value of a series of cash flows to zero?

A)investment rate of return.

B)external rate of return.

C)internal rate of return.

D)international rate of return.

A)investment rate of return.

B)external rate of return.

C)internal rate of return.

D)international rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

80

Justification of investments in advanced manufacturing systems by using discounted cash flow analysis is

A)required by generally accepted accounting principles.

B)easy.

C)a difficult problem.

D)based on quantifiable benefits,only.

A)required by generally accepted accounting principles.

B)easy.

C)a difficult problem.

D)based on quantifiable benefits,only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck