Deck 3: Activity-Based Management

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/139

العب

ملء الشاشة (f)

Deck 3: Activity-Based Management

1

What is the firststep in the activity analysis process used to implement Activity Based Management?

A)Chart,from start to finish,the activities used to complete the product or service

B)Classify activities as value-added or non-value-added

C)Eliminate non-value-added activities

D)Continuously improve and reevaluate the efficiency of value-added activities or replace them with more efficient activities

A)Chart,from start to finish,the activities used to complete the product or service

B)Classify activities as value-added or non-value-added

C)Eliminate non-value-added activities

D)Continuously improve and reevaluate the efficiency of value-added activities or replace them with more efficient activities

A

2

Which of the following is a non-value added cost?

A)Running machines.

B)Performing surgeries.

C)Waiting for work.

D)Speaking to customers.

A)Running machines.

B)Performing surgeries.

C)Waiting for work.

D)Speaking to customers.

C

3

Activity-based costing assigns more costs to items produced in __________ than traditional methods do.

A)small runs

B)medium runs

C)large runs

D)extra large runs

A)small runs

B)medium runs

C)large runs

D)extra large runs

A

4

Activity-based management starts with which of the following?

A)activity benefit analysis.

B)activity cost cutting.

C)activity-based costing.

D)activity analysis.

A)activity benefit analysis.

B)activity cost cutting.

C)activity-based costing.

D)activity analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

5

The value chain begins with which of the following?

A)supplier.

B)research and development.

C)design.

D)production.

A)supplier.

B)research and development.

C)design.

D)production.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

6

What is the final step in the activity analysis process used to implement Activity Based Management?

A)Chart,from start to finish,the activities used to complete the product or service.

B)Classify activities as value-added or non-value-added.

C)Eliminate non-value-added activities.

D)Continuously improve and reevaluate the efficiency of value-added activities or replace them with more efficient activities.

A)Chart,from start to finish,the activities used to complete the product or service.

B)Classify activities as value-added or non-value-added.

C)Eliminate non-value-added activities.

D)Continuously improve and reevaluate the efficiency of value-added activities or replace them with more efficient activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

7

What do managers use to analyze the cost-generating and revenue-generating components of a company's activities?

A)Low cost solution

B)Critical path

C)Value chain

D)Optimal solution

A)Low cost solution

B)Critical path

C)Value chain

D)Optimal solution

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

8

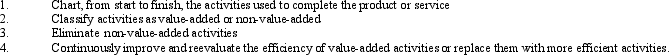

Activity-based management starts with activity analysis.The four steps in activity analysis are:

The value-added activities identified in Step 2 make up the

A)low cost solution.

B)critical path.

C)value chain.

D)optimal solution.

The value-added activities identified in Step 2 make up the

A)low cost solution.

B)critical path.

C)value chain.

D)optimal solution.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following is an example of non-value added activities?

A)Storage.

B)Moving items.

C)Waiting for work.

D)All of the answers are correct.

A)Storage.

B)Moving items.

C)Waiting for work.

D)All of the answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following are not examples of non-value-added costs?

A)Storage

B)Moving items

C)Waiting for work

D)Production

A)Storage

B)Moving items

C)Waiting for work

D)Production

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

11

The value chain is a linked set of value-creating activities leading from

A)supplier to marketing.

B)research and development to distribution.

C)design to customer service.

D)raw material sources to the ultimate end use of the goods or services produced.

A)supplier to marketing.

B)research and development to distribution.

C)design to customer service.

D)raw material sources to the ultimate end use of the goods or services produced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following is an example of a non-value-added cost?

A)Storage

B)Moving items

C)Waiting for work

D)All of the above are non-value-added costs.

A)Storage

B)Moving items

C)Waiting for work

D)All of the above are non-value-added costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

13

The value chain ends with which of the following?

A)production.

B)marketing.

C)distribution.

D)customer service.

A)production.

B)marketing.

C)distribution.

D)customer service.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

14

What is the thirdstep in the activity analysis process used to implement Activity Based Management?

A)Chart,from start to finish,the activities used to complete the product or service.

B)Classify activities as value-added or non-value-added.

C)Eliminate non-value-added activities.

D)Continuously improve and reevaluate the efficiency of value-added activities or replace them with more efficient activities.

A)Chart,from start to finish,the activities used to complete the product or service.

B)Classify activities as value-added or non-value-added.

C)Eliminate non-value-added activities.

D)Continuously improve and reevaluate the efficiency of value-added activities or replace them with more efficient activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

15

For which one of the following activities is it more difficult to obtain reasonable measures to allocate the costs?

A)Indirect labor

B)Machine setups

C)Plant administration

D)Quality control inspections

A)Indirect labor

B)Machine setups

C)Plant administration

D)Quality control inspections

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

16

What provides a systematic way for organizations to evaluate the processes that they use to produce goods and services for their customers?

A)Cost-benefit analysis

B)Activity analysis

C)Process evaluation and review technique

D)Flow charting

A)Cost-benefit analysis

B)Activity analysis

C)Process evaluation and review technique

D)Flow charting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following is a systematic way for organizations to identify and eliminate activities that add costs but not value to the product?

A)customer profitability analysis.

B)activity analysis.

C)systems analysis.

D)cost-based analysis.

A)customer profitability analysis.

B)activity analysis.

C)systems analysis.

D)cost-based analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

18

Bush Enterprises adopts Strategic activity-based costing and management techniques which would most likely shift the mix of activities and products away from

A)less profitable to more profitable applications.

B)less complex to more complex applications.

C)high volume to low volume applications.

D)less prestigious to more prestigious applications.

A)less profitable to more profitable applications.

B)less complex to more complex applications.

C)high volume to low volume applications.

D)less prestigious to more prestigious applications.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

19

What is the secondstep in the activity analysis process used to implement Activity Based Management?

A)Chart,from start to finish,the activities used to complete the product or service.

B)Classify activities as value-added or non-value-added.

C)Eliminate non-value-added activities.

D)Continuously improve and reevaluate the efficiency of value-added activities or replace them with more efficient activities.

A)Chart,from start to finish,the activities used to complete the product or service.

B)Classify activities as value-added or non-value-added.

C)Eliminate non-value-added activities.

D)Continuously improve and reevaluate the efficiency of value-added activities or replace them with more efficient activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which term describes the costs of activities that the company can eliminate without reducing product quality,performance,or value?

A)non-value-performance-quality-added costs.

B)non-value-added costs.

C)non-performance-added costs.

D)non-quality-added costs.

A)non-value-performance-quality-added costs.

B)non-value-added costs.

C)non-performance-added costs.

D)non-quality-added costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

21

The major cost pool(s)for activity-based costing is/are

A)the "plant."

B)the department.

C)the activity center.

D)the "plant" and the department.

A)the "plant."

B)the department.

C)the activity center.

D)the "plant" and the department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which is not an example of a cost driver?

A)General and administrative expenses.

B)Machine hours.

C)Number of inspections.

D)Number of different customers.

A)General and administrative expenses.

B)Machine hours.

C)Number of inspections.

D)Number of different customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following statements is true concerning activity-based costing (ABC)?

A)ABC can distort product costs.

B)ABC fails to recognize that the demand for overhead activities is driven by product-sustaining activities.

C)ABC permits management to focus on the increased efficiencies and better resource utilization.

D)ABC first assigns costs to products,then to cost pools.

A)ABC can distort product costs.

B)ABC fails to recognize that the demand for overhead activities is driven by product-sustaining activities.

C)ABC permits management to focus on the increased efficiencies and better resource utilization.

D)ABC first assigns costs to products,then to cost pools.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

24

How does activity-based management treats fixed costs?

A)As costs which vary directly with volume.

B)As costs which cannot be controlled over the long-run.

C)As costs which may vary for reasons other than volume.

D)As sunk costs which have no future economic benefit.

A)As costs which vary directly with volume.

B)As costs which cannot be controlled over the long-run.

C)As costs which may vary for reasons other than volume.

D)As sunk costs which have no future economic benefit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following does not represent how managers make cost-benefit decisions as to the use of activity analysis or traditional costing methods?

A)They reject activity analysis and stay with the simpler traditional method.

B)They use activity-based costing because they want information that will help them be competitive.

C)They use traditional costing as a special analysis,but not as an ongoing information system.

D)They use activity-based costing as a special analysis,but not as an ongoing information system.

A)They reject activity analysis and stay with the simpler traditional method.

B)They use activity-based costing because they want information that will help them be competitive.

C)They use traditional costing as a special analysis,but not as an ongoing information system.

D)They use activity-based costing as a special analysis,but not as an ongoing information system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

26

Activity-based costing first assigns costs to

A)activities.

B)products.

C)departments.

D)plants

A)activities.

B)products.

C)departments.

D)plants

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following statements is true concerning how companies benefit from using an activity-based accounting system?

A)They have had few changes in activities over time and few corresponding changes have been made in the accounting system.

B)They have low overhead costs.

C)They have a narrow range of products.

D)They have wide variations in the volume of individual production runs and setups are costly (i.e. ,complex production methods).

A)They have had few changes in activities over time and few corresponding changes have been made in the accounting system.

B)They have low overhead costs.

C)They have a narrow range of products.

D)They have wide variations in the volume of individual production runs and setups are costly (i.e. ,complex production methods).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

28

How are overhead costs accumulated in an activity-based costing system?

A)in a single,plant-wide pool.

B)by departments.

C)in pools established by identified cost drivers.

D)in facility-level activities.

A)in a single,plant-wide pool.

B)by departments.

C)in pools established by identified cost drivers.

D)in facility-level activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

29

Bush Enterprises adopts Strategic activity-based costing and management techniques which would most likely result in

A)adding surcharges for particular customers

B)"firing" some customers

C)seeking to serve more profitable customers

D)All of the answers are correct.

A)adding surcharges for particular customers

B)"firing" some customers

C)seeking to serve more profitable customers

D)All of the answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

30

The major cost pool(s)for traditional methods is/are

A)the "plant."

B)the employees.

C)the activity center.

D)the management team.

A)the "plant."

B)the employees.

C)the activity center.

D)the management team.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

31

Thefirst step in activity-based costing (ABC)is to

A)identify the activities that consume resources,and assign costs to those activities.

B)identify the cost driver(s)associated with each activity.

C)compute a cost rate per cost driver unit.

D)assign costs to products by multiplying the cost driver rate by the volume of cost drivers consumed by the product.

A)identify the activities that consume resources,and assign costs to those activities.

B)identify the cost driver(s)associated with each activity.

C)compute a cost rate per cost driver unit.

D)assign costs to products by multiplying the cost driver rate by the volume of cost drivers consumed by the product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following statement accurately describes activity-based costing (ABC)?

A)ABC considers the entire plant to be one cost pool.

B)ABC uses a separate cost pool for each department.

C)ABC uses a cost pool for each activity center.

D)ABC uses a cost pool for each industry.

A)ABC considers the entire plant to be one cost pool.

B)ABC uses a separate cost pool for each department.

C)ABC uses a cost pool for each activity center.

D)ABC uses a cost pool for each industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following represents the thirdstep in activity based costing?

A)Identify the activities that consume resources and assign costs to those activities.

B)Identify the cost drivers associated with each activity.

C)Compute a cost rate per cost driver unit.

D)Assign cost to products by multiplying the cost driver rate times the volume of cost driver consumed by the product.

A)Identify the activities that consume resources and assign costs to those activities.

B)Identify the cost drivers associated with each activity.

C)Compute a cost rate per cost driver unit.

D)Assign cost to products by multiplying the cost driver rate times the volume of cost driver consumed by the product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

34

Activity-based costing first assigns costs to activities,then to

A)the products based on each product's use of activities.

B)the plant based on each plant's use of activities.

C)the departments based on each department's use of activities.

D)the industry based on each industry's use of activities.

A)the products based on each product's use of activities.

B)the plant based on each plant's use of activities.

C)the departments based on each department's use of activities.

D)the industry based on each industry's use of activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

35

Traditional cost allocation methods include which of the following?

A)plantwide allocation,only.

B)department allocation,only.

C)activity-based costing.

D)plantwide and department allocation.

A)plantwide allocation,only.

B)department allocation,only.

C)activity-based costing.

D)plantwide and department allocation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which statement is true in an activity-based costing environment?

A)Managers do not need to know product costs.

B)Companies use departmental overhead rates.

C)Companies compute the rate for each cost driver in each activity center.

D)Companies compute the rate for up to three cost drivers in each activity center.

A)Managers do not need to know product costs.

B)Companies use departmental overhead rates.

C)Companies compute the rate for each cost driver in each activity center.

D)Companies compute the rate for up to three cost drivers in each activity center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following is the secondstep in activity based costing?

A)Identify the activities that consume resources and assign costs to those activities.

B)Identify the cost drivers associated with each activity.

C)Compute a cost rate per cost driver unit.

D)Assign cost to products by multiplying the cost driver rate times the volume of cost driver consumed by the product.

A)Identify the activities that consume resources and assign costs to those activities.

B)Identify the cost drivers associated with each activity.

C)Compute a cost rate per cost driver unit.

D)Assign cost to products by multiplying the cost driver rate times the volume of cost driver consumed by the product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

38

The second step in Activity-based costing (ABC)is to identify the cost driver(s)associated with each activity.Cost drivers usually relate to

A)volume of production.

B)hours used in production.

C)marketing process.

D)All of the answers are correct.

A)volume of production.

B)hours used in production.

C)marketing process.

D)All of the answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

39

In what way(s)do managers make cost-benefit decisions as to the use of activity analysis or traditional costing methods?

A)They reject activity analysis and stay with the simpler traditional method.

B)They use activity-based costing because they want information that will help them be competitive.

C)They use activity-based costing as a special analysis,but not as an ongoing information system.

D)All of the answers are correct.

A)They reject activity analysis and stay with the simpler traditional method.

B)They use activity-based costing because they want information that will help them be competitive.

C)They use activity-based costing as a special analysis,but not as an ongoing information system.

D)All of the answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following reflects the simplest allocation method for a factory?

A)The department allocation method.

B)The unit cost allocation method.

C)The plantwide allocation method.

D)The use of activity-based costing.

A)The department allocation method.

B)The unit cost allocation method.

C)The plantwide allocation method.

D)The use of activity-based costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following is not a step accountants must follow in activity-based costing?

A)Identify the activities that consume resources and assign costs to them.

B)Identify the cost drivers associated with each activity.

C)Compute a cost rate per cost driver.

D)Compute the variance between the estimated cost driver and the actual cost driver.

A)Identify the activities that consume resources and assign costs to them.

B)Identify the cost drivers associated with each activity.

C)Compute a cost rate per cost driver.

D)Compute the variance between the estimated cost driver and the actual cost driver.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

42

Managers usually decide which cost driver to use based upon which of the following factors?

A)Causal relation.

B)Cost considerations.

C)Generally accepted costing techniques.

D)Uniform cost driver standards.

A)Causal relation.

B)Cost considerations.

C)Generally accepted costing techniques.

D)Uniform cost driver standards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following is not a step in activity based costing?

A)Identify the departments that consume resources and assign costs to those departments.

B)Identify the cost drivers associated with each activity.

C)Compute a cost rate per cost driver unit.

D)Assign cost to products by multiplying the cost driver rate times the volume of cost driver consumed by the product.

A)Identify the departments that consume resources and assign costs to those departments.

B)Identify the cost drivers associated with each activity.

C)Compute a cost rate per cost driver unit.

D)Assign cost to products by multiplying the cost driver rate times the volume of cost driver consumed by the product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

44

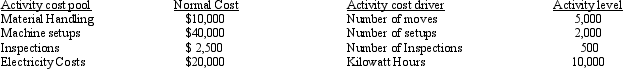

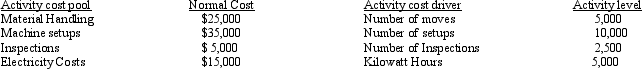

Marshall Manufacturing Co.

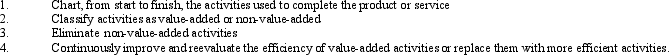

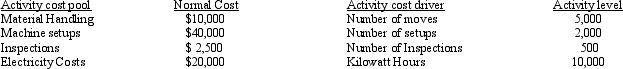

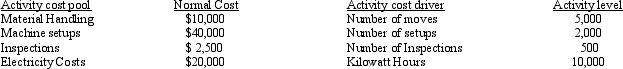

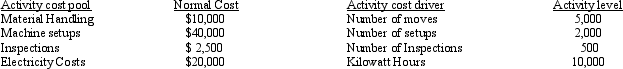

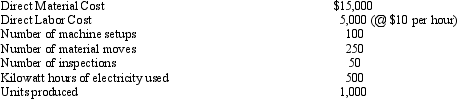

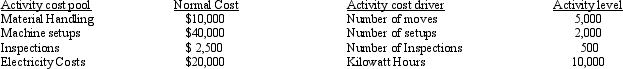

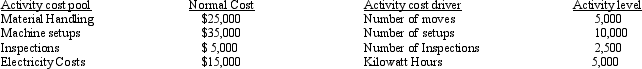

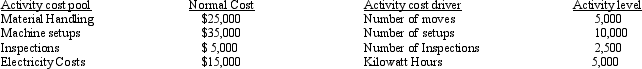

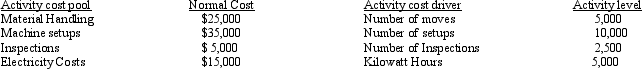

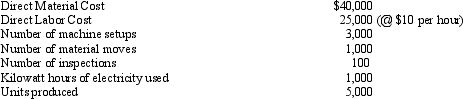

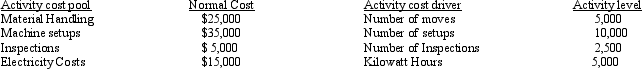

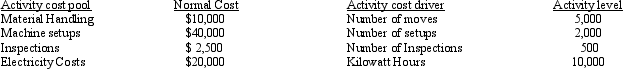

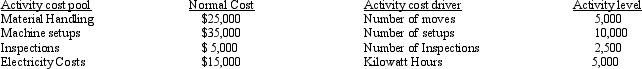

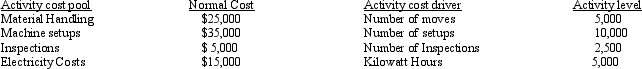

Marshall Manufacturing Co.uses an activity-based costing system.The company has gathered the following information concerning various cost pools and activity drivers;

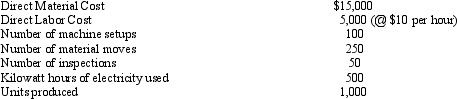

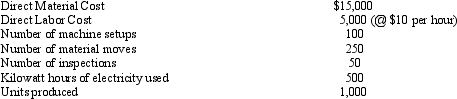

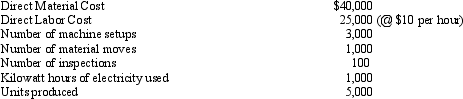

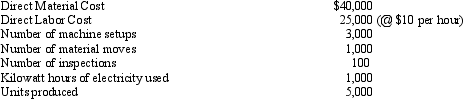

The following data was collected and is specific to Item No.824.

Refer to Marshall Manufacturing Co.What would be the amount of quality inspection cost allocated to Item No.824?

A)$2,500

B)$ 125

C)$1,000

D)$ 250

Marshall Manufacturing Co.uses an activity-based costing system.The company has gathered the following information concerning various cost pools and activity drivers;

The following data was collected and is specific to Item No.824.

Refer to Marshall Manufacturing Co.What would be the amount of quality inspection cost allocated to Item No.824?

A)$2,500

B)$ 125

C)$1,000

D)$ 250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which statement best describes an activity center?

A)An organizational command post from which management controls activity.

B)A unit of the organization that performs a set of tasks.

C)A think-tank where managers select value-added activities.

D)A part of the organization that has been designated for in depth study of specific activities.

A)An organizational command post from which management controls activity.

B)A unit of the organization that performs a set of tasks.

C)A think-tank where managers select value-added activities.

D)A part of the organization that has been designated for in depth study of specific activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

46

Resources used for an activity are measured by the

A)cost driver rate times the cost driver volume.

B)resources supplied to an activity.

C)expenditures for the activity.

D)unused resource capacity.

A)cost driver rate times the cost driver volume.

B)resources supplied to an activity.

C)expenditures for the activity.

D)unused resource capacity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following is the primary criterion for selecting a cost driver?

A)Causal relation.

B)Benefits received.

C)Reasonableness.

D)Fairness.

A)Causal relation.

B)Benefits received.

C)Reasonableness.

D)Fairness.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

48

Marshall Manufacturing Co.

Marshall Manufacturing Co.uses an activity-based costing system.The company has gathered the following information concerning various cost pools and activity drivers;

The following data was collected and is specific to Item No.824.

Refer to Marshall Manufacturing Co.What would be the unit cost for the materials handling activity at Marshall Manufacturing Co.?

A)$ 4.00

B)$80.00

C)$ 2.00

D)$ 1.00

Marshall Manufacturing Co.uses an activity-based costing system.The company has gathered the following information concerning various cost pools and activity drivers;

The following data was collected and is specific to Item No.824.

Refer to Marshall Manufacturing Co.What would be the unit cost for the materials handling activity at Marshall Manufacturing Co.?

A)$ 4.00

B)$80.00

C)$ 2.00

D)$ 1.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following are resources supplied to an activity in activity-based costing?

A)the expenditures for the activity.

B)actual resource usage.

C)estimated resource usage.

D)unused resource capacity.

A)the expenditures for the activity.

B)actual resource usage.

C)estimated resource usage.

D)unused resource capacity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

50

The use of activity-based costing and activity-based management have resulted in

A)less need to maintain good relationships with suppliers.

B)overhead costs being reduced substantially.

C)increased number of supervisory personnel being hired.

D)All of the answers are correct.

A)less need to maintain good relationships with suppliers.

B)overhead costs being reduced substantially.

C)increased number of supervisory personnel being hired.

D)All of the answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which formula correctly identifies the predetermined indirect cost rate in an activity-based costing system?

A)Actual indirect cost divided by the actual volume of the allocation base.

B)Estimated indirect cost divided by the actual volume of the allocation base.

C)Actual cost divided by the estimated volume of the allocation base.

D)Estimated indirect cost divided by the estimated volume of the allocation base.

A)Actual indirect cost divided by the actual volume of the allocation base.

B)Estimated indirect cost divided by the actual volume of the allocation base.

C)Actual cost divided by the estimated volume of the allocation base.

D)Estimated indirect cost divided by the estimated volume of the allocation base.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

52

Marshall Manufacturing Co.

Marshall Manufacturing Co.uses an activity-based costing system.The company has gathered the following information concerning various cost pools and activity drivers;

The following data was collected and is specific to Item No.824.

Refer to Marshall Manufacturing Co.What would be the amount of machine setup cost allocated to Item No.824?

A)$40,000

B)$ 8,000

C)$ 2,500

D)$ 2,000

Marshall Manufacturing Co.uses an activity-based costing system.The company has gathered the following information concerning various cost pools and activity drivers;

The following data was collected and is specific to Item No.824.

Refer to Marshall Manufacturing Co.What would be the amount of machine setup cost allocated to Item No.824?

A)$40,000

B)$ 8,000

C)$ 2,500

D)$ 2,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

53

Activity-based management can reduce customer response time by all of the following,except for

A)identifying those activities that consume the most resources.

B)making activities more efficient.

C)identifying non-value added activities.

D)identifying fraudulent activities.

A)identifying those activities that consume the most resources.

B)making activities more efficient.

C)identifying non-value added activities.

D)identifying fraudulent activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

54

Often the most interesting and challenging step(s)of activity-based costing (ABC)which also require(s)the manager to know the product is to

A)identify the activities that consume resources,and assign costs to those activities.

B)identify the cost driver(s)associated with each activity.

C)compute a cost rate per cost driver unit.

D)assign costs to products by multiplying the cost driver rate by the volume of cost drivers consumed by the product.

A)identify the activities that consume resources,and assign costs to those activities.

B)identify the cost driver(s)associated with each activity.

C)compute a cost rate per cost driver unit.

D)assign costs to products by multiplying the cost driver rate by the volume of cost drivers consumed by the product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

55

Marshall Manufacturing Co.

Marshall Manufacturing Co.uses an activity-based costing system.The company has gathered the following information concerning various cost pools and activity drivers;

The following data was collected and is specific to Item No.824.

Refer to Marshall Manufacturing Co.What would be the unit cost for the inspection activity on Item No.824?

A)$ 4.00

B)$80.00

C)$ 5.00

D)$ 1.00

Marshall Manufacturing Co.uses an activity-based costing system.The company has gathered the following information concerning various cost pools and activity drivers;

The following data was collected and is specific to Item No.824.

Refer to Marshall Manufacturing Co.What would be the unit cost for the inspection activity on Item No.824?

A)$ 4.00

B)$80.00

C)$ 5.00

D)$ 1.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

56

One of the lessons of activity-based costing (ABC)is that costs depend on

A)volume of the product,only.

B)complexity of the product,only.

C)volume and complexity of the product.

D)factors other than the volume or complexity of the product.

A)volume of the product,only.

B)complexity of the product,only.

C)volume and complexity of the product.

D)factors other than the volume or complexity of the product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

57

Activity-based costing (ABC)assigns costs first to

A)activities,then to the products based on each product's use of activities.

B)products,then to the activities based on each activity's use of products.

C)services,then to the activities based on each service's use of activities.

D)None of the above answers is correct.

A)activities,then to the products based on each product's use of activities.

B)products,then to the activities based on each activity's use of products.

C)services,then to the activities based on each service's use of activities.

D)None of the above answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following is not a step in activity based costing?

A)Identify the activities that consume resources and assign costs to those activities.

B)Identify the cost drivers associated with each activity.

C)Compute a cost rate per department or plant.

D)Assign cost to products by multiplying the cost driver rate times the volume of cost driver consumed by the product.

A)Identify the activities that consume resources and assign costs to those activities.

B)Identify the cost drivers associated with each activity.

C)Compute a cost rate per department or plant.

D)Assign cost to products by multiplying the cost driver rate times the volume of cost driver consumed by the product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which one of the following activities is appropriate as a cost driver for material handling costs?

A)Number of direct labor hours used

B)Number of machine hours used

C)Number of raw material moves

D)Number of units produced

A)Number of direct labor hours used

B)Number of machine hours used

C)Number of raw material moves

D)Number of units produced

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

60

The last step in activity-based costing (ABC)is to

A)identify the activities that consume resources,and assign costs to those activities.

B)identify the cost driver(s)associated with each activity.

C)compute a cost rate per cost driver unit.

D)assign costs to products by multiplying the cost driver rate by the volume of cost drivers consumed by the product.

A)identify the activities that consume resources,and assign costs to those activities.

B)identify the cost driver(s)associated with each activity.

C)compute a cost rate per cost driver unit.

D)assign costs to products by multiplying the cost driver rate by the volume of cost drivers consumed by the product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

61

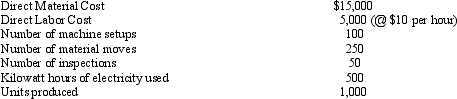

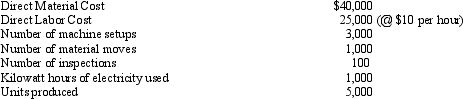

Gem Systems

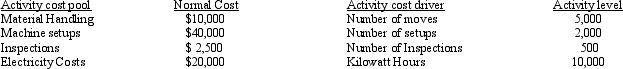

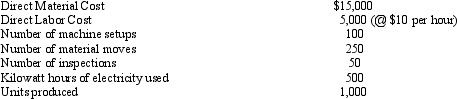

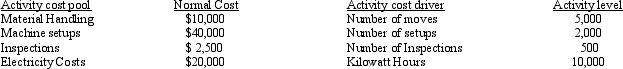

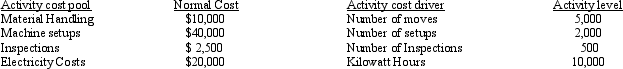

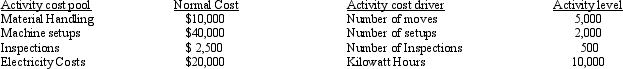

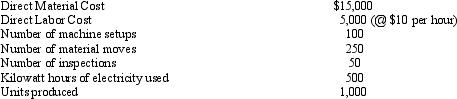

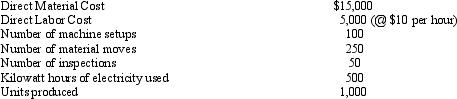

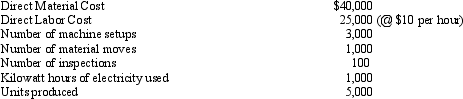

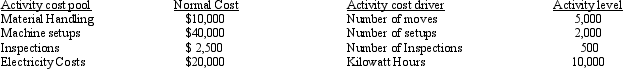

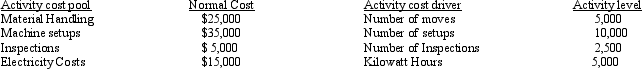

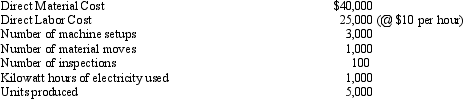

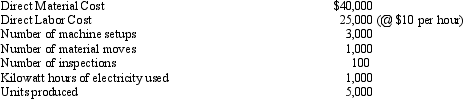

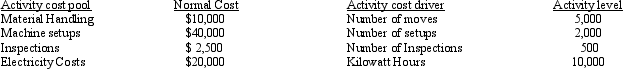

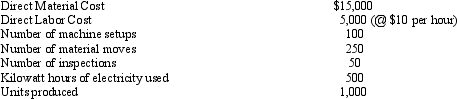

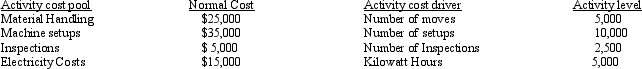

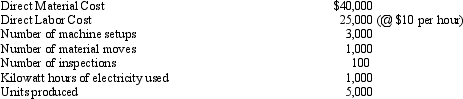

Gem Systems uses an activity-based costing system.The company has gathered the following information concerning various cost pools and activity drivers;

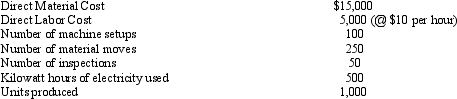

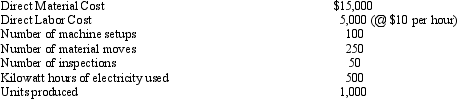

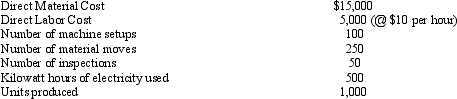

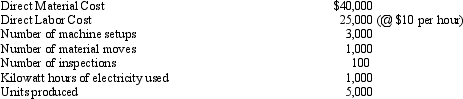

The following data was collected and is specific to Job 150.

Refer to Gem Systems.Calculate the unit cost for the Material Handling activity cost pool.

A)$5.00

B)$25.00

C)$10.00

D)$ 3.50

Gem Systems uses an activity-based costing system.The company has gathered the following information concerning various cost pools and activity drivers;

The following data was collected and is specific to Job 150.

Refer to Gem Systems.Calculate the unit cost for the Material Handling activity cost pool.

A)$5.00

B)$25.00

C)$10.00

D)$ 3.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following costs are capacity-sustaining activities in the product cost hierarchy?

A)Product testing.

B)Energy to run machines.

C)Heat and lighting.

D)Direct Materials.

A)Product testing.

B)Energy to run machines.

C)Heat and lighting.

D)Direct Materials.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

63

In traditional costing systems overhead costs are allocated on volume of production or sales,.This methodology fails to take into consideration that the demand for overhead activities is also driven by which of the following?

A)Outside contracting activities.

B)Indirect labor activities.

C)Short-term labor activities.

D)Batch-related and product-sustaining activities.

A)Outside contracting activities.

B)Indirect labor activities.

C)Short-term labor activities.

D)Batch-related and product-sustaining activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

64

The cost hierarchy can be used to organize cost information for decision-making.Which cost isnot part of the product cost hierarchy of expenses?

A)Capacity-sustaining.

B)Product-sustaining.

C)Customer-sustaining.

D)Employee-sustaining.

A)Capacity-sustaining.

B)Product-sustaining.

C)Customer-sustaining.

D)Employee-sustaining.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

65

Marshall Manufacturing Co.

Marshall Manufacturing Co.uses an activity-based costing system.The company has gathered the following information concerning various cost pools and activity drivers;

The following data was collected and is specific to Item No.824.

Refer to Marshall Manufacturing Co.What is the cost of one unit of item 824?

A)$ 3.75

B)$116.25

C)$ 23.75

D)None of the above

Marshall Manufacturing Co.uses an activity-based costing system.The company has gathered the following information concerning various cost pools and activity drivers;

The following data was collected and is specific to Item No.824.

Refer to Marshall Manufacturing Co.What is the cost of one unit of item 824?

A)$ 3.75

B)$116.25

C)$ 23.75

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

66

The cost hierarchy can be used to organize cost information for decision-making.Which cost ispart of the product cost hierarchy of expenses?

A)Capacity-sustaining.

B)Department-sustaining.

C)Plant-sustaining.

D)Employee-sustaining.

A)Capacity-sustaining.

B)Department-sustaining.

C)Plant-sustaining.

D)Employee-sustaining.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

67

Gem Systems

Gem Systems uses an activity-based costing system.The company has gathered the following information concerning various cost pools and activity drivers;

The following data was collected and is specific to Job 150.

Refer to Gem Systems.Calculate the product cost of one unit of Job 150.

A)$11.74

B)$13.00

C)$ 8.74

D)$16.74

Gem Systems uses an activity-based costing system.The company has gathered the following information concerning various cost pools and activity drivers;

The following data was collected and is specific to Job 150.

Refer to Gem Systems.Calculate the product cost of one unit of Job 150.

A)$11.74

B)$13.00

C)$ 8.74

D)$16.74

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

68

Gem Systems

Gem Systems uses an activity-based costing system.The company has gathered the following information concerning various cost pools and activity drivers;

The following data was collected and is specific to Job 150.

Refer to Gem Systems.What is the amount of machine handling cost allocated to Job 150?

A)$ 1,000

B)$ 5,000

C)$25,000

D)None of the above

Gem Systems uses an activity-based costing system.The company has gathered the following information concerning various cost pools and activity drivers;

The following data was collected and is specific to Job 150.

Refer to Gem Systems.What is the amount of machine handling cost allocated to Job 150?

A)$ 1,000

B)$ 5,000

C)$25,000

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

69

Marshall Manufacturing Co.

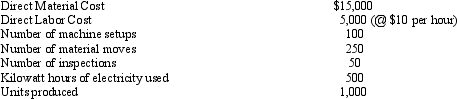

Marshall Manufacturing Co.uses an activity-based costing system.The company has gathered the following information concerning various cost pools and activity drivers;

The following data was collected and is specific to Item No.824.

Refer to Marshall Manufacturing Co.What would be the unit cost for the machine setup activity at Marshall Manufacturing Co.?

A)$ 4.00

B)$80.00

C)$ 2.00

D)$20.00

Marshall Manufacturing Co.uses an activity-based costing system.The company has gathered the following information concerning various cost pools and activity drivers;

The following data was collected and is specific to Item No.824.

Refer to Marshall Manufacturing Co.What would be the unit cost for the machine setup activity at Marshall Manufacturing Co.?

A)$ 4.00

B)$80.00

C)$ 2.00

D)$20.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

70

In comparison to an activity-based costing system,traditional allocation systems would most likely distort which of the following costs?

A)product costs.

B)activity costs.

C)department costs.

D)plant costs.

A)product costs.

B)activity costs.

C)department costs.

D)plant costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following costs are capacity-sustaining activities in the product cost hierarchy?

A)Product specification.

B)Building depreciation and rent.

C)Product testing.

D)Machine setups.

A)Product specification.

B)Building depreciation and rent.

C)Product testing.

D)Machine setups.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following costs are not capacity-sustaining activities in the product cost hierarchy?

A)Plant management.

B)Building depreciation and rent.

C)Heat and lighting.

D)Market research.

A)Plant management.

B)Building depreciation and rent.

C)Heat and lighting.

D)Market research.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

73

Activity-based management and costing cannot be applied to marketing in order to

A)identify the marketing activities needed to service each customer or order more appropriately.

B)determine the variability in marketing costs across customer types and distribution.

C)support activity-based management by encouraging the elimination of accounts with high processing costs.

D)eliminate plantwide discretionary fixed costs.

A)identify the marketing activities needed to service each customer or order more appropriately.

B)determine the variability in marketing costs across customer types and distribution.

C)support activity-based management by encouraging the elimination of accounts with high processing costs.

D)eliminate plantwide discretionary fixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

74

The cost hierarchy can be used to organize cost information for decision-making.Which cost isnot part of the product cost hierarchy of expenses?

A)Capacity-sustaining.

B)Product-sustaining.

C)Customer-sustaining.

D)Vendor-sustaining.

A)Capacity-sustaining.

B)Product-sustaining.

C)Customer-sustaining.

D)Vendor-sustaining.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

75

Gem Systems

Gem Systems uses an activity-based costing system.The company has gathered the following information concerning various cost pools and activity drivers;

The following data was collected and is specific to Job 150.

Refer to Gem Systems.Calculate the unit cost for the Electricity Costs activity cost pool.

A)$15.00

B)$ 3.50

C)$ 3.00

D)$ 5.00

Gem Systems uses an activity-based costing system.The company has gathered the following information concerning various cost pools and activity drivers;

The following data was collected and is specific to Job 150.

Refer to Gem Systems.Calculate the unit cost for the Electricity Costs activity cost pool.

A)$15.00

B)$ 3.50

C)$ 3.00

D)$ 5.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

76

Which of the following are not capacity-sustaining activities in the product cost hierarchy?

A)Plant management.

B)Building depreciation and rent.

C)Direct materials.

D)Heating and lighting.

A)Plant management.

B)Building depreciation and rent.

C)Direct materials.

D)Heating and lighting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

77

Gem Systems

Gem Systems uses an activity-based costing system.The company has gathered the following information concerning various cost pools and activity drivers;

The following data was collected and is specific to Job 150.

Refer to Gem Systems.What is the amount of electricity cost allocated to Job 150?

A)$ 1,000

B)$15,000

C)$ 3,000

D)$ 5,000

Gem Systems uses an activity-based costing system.The company has gathered the following information concerning various cost pools and activity drivers;

The following data was collected and is specific to Job 150.

Refer to Gem Systems.What is the amount of electricity cost allocated to Job 150?

A)$ 1,000

B)$15,000

C)$ 3,000

D)$ 5,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

78

Which term refers to categorizing costs according to whether they are capacity,product,customer,batch,or unit costs?

A)The cost hierarchy.

B)Activity-based costing.

C)Traditional costing.

D)None of the answers is correct.

A)The cost hierarchy.

B)Activity-based costing.

C)Traditional costing.

D)None of the answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following costs are not customer activities in the product cost hierarchy?

A)Plant management.

B)Promotion.

C)Customer records.

D)Market research.

A)Plant management.

B)Promotion.

C)Customer records.

D)Market research.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following would be considered a capacity-sustaining activityin the product cost hierarchy?

A)Plant management,building depreciation,rent,heating and lighting,market research,and customer records.

B)Market research,customer records,and promotion.

C)Machine setups and quality inspections.

D)Energy to run machines and direct materials.

A)Plant management,building depreciation,rent,heating and lighting,market research,and customer records.

B)Market research,customer records,and promotion.

C)Machine setups and quality inspections.

D)Energy to run machines and direct materials.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck