Deck 5: Lbo Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/28

العب

ملء الشاشة (f)

Deck 5: Lbo Analysis

1

Calculate the total goodwill for a pro forma balance sheet given the following details.

Details:

Equity purchase price: $2,000

Book value: $1,700

Existing goodwill: $100

A)$100

B)$300

C)$200

D)$400

Details:

Equity purchase price: $2,000

Book value: $1,700

Existing goodwill: $100

A)$100

B)$300

C)$200

D)$400

$400

2

Given the following information, calculate the cash available for debt repayment when building a post-LBO model.

Details:

Cash flow from investing activities: $30.0

EBIT: $65

Cash flow from operating activities: $120.0

D&A: $35

A)$100.0

B)$30.0

C)$90.0

D)$150.0

Details:

Cash flow from investing activities: $30.0

EBIT: $65

Cash flow from operating activities: $120.0

D&A: $35

A)$100.0

B)$30.0

C)$90.0

D)$150.0

$90.0

3

In a post-LBO model, where are the debt repayment amounts linked to?

A)Investing activities on the cash flow statement

B)Financing activities on the cash flow statement

C)Income statement

D)Long-term debt on the balance sheet

A)Investing activities on the cash flow statement

B)Financing activities on the cash flow statement

C)Income statement

D)Long-term debt on the balance sheet

B

4

Given the following information, calculate the cash available for optional debt repayment.

Details:

Cash flow from investing activities: $50.0

Cash flow from operating activities: $125.0

Total mandatory debt repayment: $30.0

Cash from balance sheet: $20.0

A)$65.0

B)$165.0

C) $45

D)$20.0

Details:

Cash flow from investing activities: $50.0

Cash flow from operating activities: $125.0

Total mandatory debt repayment: $30.0

Cash from balance sheet: $20.0

A)$65.0

B)$165.0

C) $45

D)$20.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

5

Given the following information, what is the total amount that has been drawn from the revolver?

Details:

Revolver: $100.0m

Term: 3 years

Annual commitment fee: 30 bps

Cash available for optional debt repayment:

Year 1: $40.0m

Year 2: $35.0m

Year 3: $32.0m

A)$100.0m

B)$30.0m

C)$107.0m

D)Revolver remains undrawn

Details:

Revolver: $100.0m

Term: 3 years

Annual commitment fee: 30 bps

Cash available for optional debt repayment:

Year 1: $40.0m

Year 2: $35.0m

Year 3: $32.0m

A)$100.0m

B)$30.0m

C)$107.0m

D)Revolver remains undrawn

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

6

In a pre-LBO model, what is the new line item "financing fees" under?

A)Long-term liabilities

B)Long-term assets

C)Short-term liabilities

D)Short-term assets

A)Long-term liabilities

B)Long-term assets

C)Short-term liabilities

D)Short-term assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

7

In which of these scenarios is a revolver draw necessary?

A)When cash available for optional debt repayment is positive

B)When cash available for optional debt repayment is negative

C)When cash available on the balance sheet is zero

D)When there is an increase in net working capital

A)When cash available for optional debt repayment is positive

B)When cash available for optional debt repayment is negative

C)When cash available on the balance sheet is zero

D)When there is an increase in net working capital

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

8

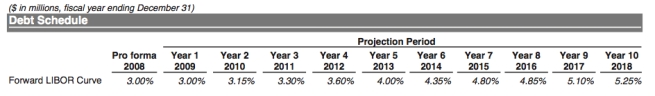

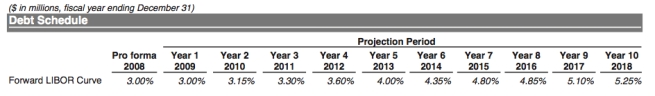

When building a debt schedule, what are interest rates typically based on for floating-rate debt instruments?

A)Federal funds rate

B)3 year treasury yields

C)Required rate of return

D)LIBOR

A)Federal funds rate

B)3 year treasury yields

C)Required rate of return

D)LIBOR

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following are sources of funds? I.Term loan

II)Repayment of term loan

III)Purchase of equity

IV)Cash on hand

A)I only

B)I and IV

C)I and II

D)All are sources of funds

II)Repayment of term loan

III)Purchase of equity

IV)Cash on hand

A)I only

B)I and IV

C)I and II

D)All are sources of funds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

10

In an LBO model, which scenario is considered the most conservative?

A)Management case

B)Base case

C)Sponsor case

D)Downside case

A)Management case

B)Base case

C)Sponsor case

D)Downside case

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following do/does not require a set amortization schedule?

A)Revolving credit facility

B)Term loan A

C)Term loan B

D)Senior notes

A)Revolving credit facility

B)Term loan A

C)Term loan B

D)Senior notes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

12

Under operating activities on a cash flow statement, amortization of financing fees is linked from the:

A)CIM

B)Balance sheet

C)Income statement

D)Management case

A)CIM

B)Balance sheet

C)Income statement

D)Management case

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

13

When preparing a pre-LBO model, the historical income statement is completed until what point?

A)Net income

B)Operating expenses

C)Interest expenses

D)EBIT

A)Net income

B)Operating expenses

C)Interest expenses

D)EBIT

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

14

Use the average interest expense approach to calculate the annual interest expense given the following details.

Details:

Beginning TLB: $300.0

Ending TLB: $250.0

Interest rate: 4%

A)$11.0m

B)$12.0m

C)$10.0m

D)$9.0m

Details:

Beginning TLB: $300.0

Ending TLB: $250.0

Interest rate: 4%

A)$11.0m

B)$12.0m

C)$10.0m

D)$9.0m

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

15

In a pre-LBO model, net income on the first line of the cash flow statement is initially:

A)Inflated

B)Understated

C)Correct

D)Deflated

A)Inflated

B)Understated

C)Correct

D)Deflated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

16

What is needed in order to complete the pro forma income statement from EBIT to net income?

A)Balance sheet

B)Debt schedule

C)CIM

D)LIBOR curve

A)Balance sheet

B)Debt schedule

C)CIM

D)LIBOR curve

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

17

Calculate the interest rate for a revolving credit facility in 2014 given the following information.

Details:

Pricing spread: 350 bps

A)7.85%

B)4.35%

C)0.85%

D)3.5%

Details:

Pricing spread: 350 bps

A)7.85%

B)4.35%

C)0.85%

D)3.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

18

Calculate implied enterprise value given the following details.

Details:

Offer price per share: $20.0

Fully diluted shares outstanding: 100

Total debt: $200.0

Cash: $100.0

A)$2,000

B)$1,900

C)$2,100

D)$1,700

Details:

Offer price per share: $20.0

Fully diluted shares outstanding: 100

Total debt: $200.0

Cash: $100.0

A)$2,000

B)$1,900

C)$2,100

D)$1,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

19

In an LBO, financing fees are an):

A)Deferred asset

B)Asset

C)Deferred expense

D)Current liability

A)Deferred asset

B)Asset

C)Deferred expense

D)Current liability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

20

The ending cash balance on the cash flow statement is linked to the:

A)Retained earnings

B)Cash and cash equivalents

C)Income statement

D)Long-term assets

A)Retained earnings

B)Cash and cash equivalents

C)Income statement

D)Long-term assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

21

What is needed to build the pro forma balance sheet once the pre-LBO model is finished?

A)CIM

B)Proxy statement

C)Sources and uses of funds

D)10-K

A)CIM

B)Proxy statement

C)Sources and uses of funds

D)10-K

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

22

In a traditional LBO analysis, it is common practice to assume an exit multiple that is:

A)Below the entry multiple

B)Above the entry multiple

C)Equal to the entry multiple

D)Both A and C

A)Below the entry multiple

B)Above the entry multiple

C)Equal to the entry multiple

D)Both A and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following provides an overview of the LBO analysis in a user-friendly format?

A)CIM

B)Transaction summary

C)Sensitivity analysis

D)Debt schedule

A)CIM

B)Transaction summary

C)Sensitivity analysis

D)Debt schedule

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

24

When building a pre-LBO model, a banker builds the cash flow statement through what point?

A)Operating activities

B)Financing activities

C)Investing activities

D)The cash flow statement is not built in the pre-LBO model

A)Operating activities

B)Financing activities

C)Investing activities

D)The cash flow statement is not built in the pre-LBO model

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

25

What is a key credit risk management concern for underwriters in an LBO?

A)Ability to pay annual interest expense

B)Ability to repay a substantial portion of bank debt

C)Optimal financing structure

D)All of the above

A)Ability to pay annual interest expense

B)Ability to repay a substantial portion of bank debt

C)Optimal financing structure

D)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

26

Calculate net interest expense given the following information.

Details:

Total interest expense: $25.0m

Interest income: $2.0m

Non-cash deferred financing fees: $3.0m

A)$23.0m

B)$20.0m

C)$26.0m

D)$30.0m

Details:

Total interest expense: $25.0m

Interest income: $2.0m

Non-cash deferred financing fees: $3.0m

A)$23.0m

B)$20.0m

C)$26.0m

D)$30.0m

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

27

Given the following information, calculate the cash that will flow to the balance sheet, assuming a 100% cash flow sweep.

Details:

Free Cash Flow: $65.0m

TLB amortization: $5.0m

Optional debt repayment: $70.0m

A)$60.0m

B)$70.0m

C)$65.0m

D)$0.0

Details:

Free Cash Flow: $65.0m

TLB amortization: $5.0m

Optional debt repayment: $70.0m

A)$60.0m

B)$70.0m

C)$65.0m

D)$0.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which part of the pro forma balance sheet is affected by the debt schedule?

A)Long-term liabilities

B)PP&E

C)Short-term assets

D)Goodwill

A)Long-term liabilities

B)PP&E

C)Short-term assets

D)Goodwill

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck