Deck 15: Contributed Capital

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

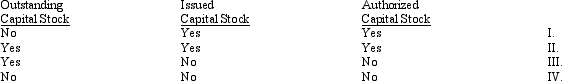

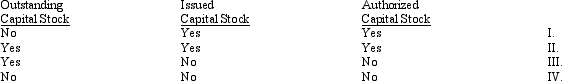

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

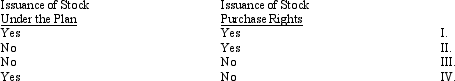

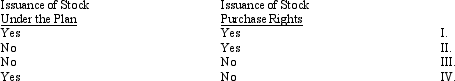

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/154

العب

ملء الشاشة (f)

Deck 15: Contributed Capital

1

Accumulated other comprehensive income is not reported with shareholder's equity.

False

2

The ratio that shows how many dollars of net income were earned for every dollar invested by the owner is return on equity.

True

3

Fully participating preferred shareholder's receive extra dividends equally with the common shareholder's.

True

4

The corporate form of organization is important to the U.S. economy because

A) there are more corporations than sole proprietorships

B) there are more corporations than partnerships

C) there are more sales of goods and services by corporations than other business forms

D) corporations provide more donations to the economy than other business forms due to the many tax incentives geared toward corporations

A) there are more corporations than sole proprietorships

B) there are more corporations than partnerships

C) there are more sales of goods and services by corporations than other business forms

D) corporations provide more donations to the economy than other business forms due to the many tax incentives geared toward corporations

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

5

All of the following are true statements about a corporation except that it

A) must pay state and federal income taxes

B) may engage in any legal activity

C) can enter into legal contracts

D) can continue in perpetuity

A) must pay state and federal income taxes

B) may engage in any legal activity

C) can enter into legal contracts

D) can continue in perpetuity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

6

Companies can reacquire their own stock to reduce the likelihood of a hostile takeover.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

7

Miscellaneous fees arising from the issuance of stock are charged to the organization expense account only if this is not the company's first issuance of stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

8

FASB requires companies to provide disclosure regarding the preferred stock characteristics.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

9

There are three criteria that must be met in order for a share purchase plan to be considered noncompensatory. If the three criteria are not met then the plan is considered compensatory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

10

Under IFRS companies are allowed to revalue their property, plant, and equipment as well as intangible assets, the revaluation is based upon market value and can be either increased up or down.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

11

Noncompensatory share purchase plans are utilized to increase employee ownership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

12

Contributed capital does not include subscribed stock because it has not been issued yet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

13

Under a restricted share plan the employees can sell the stock at their discretion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

14

Noncumulative preferred stock is entitled to all dividends, even if they are in the arrears.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

15

Treasury stock does not vote, has no preemptive rights, cannot participate in dividends, and has no liquidation rights.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

16

State laws established the concept of legal capital which is designed to protect the corporation's creditors by restricting the distribution of shareholder's equity to shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following is not a characteristic of the corporate form of business entity?

A) It is a separate legal entity.

B) Owners have unlimited liability.

C) It has an indefinite life span.

D) Owners often are not an active part of management.

A) It is a separate legal entity.

B) Owners have unlimited liability.

C) It has an indefinite life span.

D) Owners often are not an active part of management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

18

An open corporation does not allow the sale of their stock to the general public only to investment capital brokers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

19

Universities, hospitals, and churches are examples of which type of corporation?

A) stock companies

B) privately held companies

C) nonstock companies

D) publicly held companies

A) stock companies

B) privately held companies

C) nonstock companies

D) publicly held companies

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

20

The intrinsic value method of measuring options based compensation is no longer supported by FASB and the IASB.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following is not part of the stockholders' equity section of the balance sheet?

A) working capital

B) contributed capital

C) treasury stock

D) retained earnings

A) working capital

B) contributed capital

C) treasury stock

D) retained earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

22

A corporation whose stock is traded on a stock exchange is called a(n)

A) foreign corporation

B) open corporation

C) domestic corporation

D) closed corporation

A) foreign corporation

B) open corporation

C) domestic corporation

D) closed corporation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

23

A preemptive right is

A) the right to vote in the election of directors and to establish corporate policies

B) the right to share in the profits when a dividend is declared

C) the right to maintain a proportionate interest in the ownership of the corporation by purchasing a proportionate share of additional capital stock should such stock be issued

D) the right to share in the distribution of the assets of the corporation should it be liquidated

A) the right to vote in the election of directors and to establish corporate policies

B) the right to share in the profits when a dividend is declared

C) the right to maintain a proportionate interest in the ownership of the corporation by purchasing a proportionate share of additional capital stock should such stock be issued

D) the right to share in the distribution of the assets of the corporation should it be liquidated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

24

Exhibit 15-1 Hanson Co. issued 10,000 shares of its $5 par common stock for $15 a share. In addition, it incurred legal and accounting fees, stock certificate costs, and other related expenses totaling $18,500.

-Refer to Exhibit 15-1. Assume the sale occurred after the initial issuance at incorporation. The entry to record the sale and related expenses would include a

A) credit to Additional Paid-in Capital on Common Stock for $81,500

B) credit to Organization Expense for $18,500

C) credit to Common Stock for $150,000

D) debit to Cash for $150,000

-Refer to Exhibit 15-1. Assume the sale occurred after the initial issuance at incorporation. The entry to record the sale and related expenses would include a

A) credit to Additional Paid-in Capital on Common Stock for $81,500

B) credit to Organization Expense for $18,500

C) credit to Common Stock for $150,000

D) debit to Cash for $150,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

25

A corporation is a legal entity

A) held jointly by its owners and management

B) separate from its owners

C) formed by the laws of the U.S. Department of Commerce

D) under the laws established by the SEC

A) held jointly by its owners and management

B) separate from its owners

C) formed by the laws of the U.S. Department of Commerce

D) under the laws established by the SEC

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following types of corporations is owned or operated by a government unit?

A) domestic

B) private

C) closed

D) public

A) domestic

B) private

C) closed

D) public

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

27

In the United States, corporations account for

A) 10% of all companies

B) 15% of all companies

C) 11% of all companies

D) 50% of all companies

A) 10% of all companies

B) 15% of all companies

C) 11% of all companies

D) 50% of all companies

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

28

A corporation's legal capital

A) is established to protect the corporation's creditors

B) is a requirement established by the SEC to aid in enforcement of regulations

C) is the amount of cash received by the corporation from its shareholders when it originally issues stock

D) allows a corporation to declare dividends of any amount

A) is established to protect the corporation's creditors

B) is a requirement established by the SEC to aid in enforcement of regulations

C) is the amount of cash received by the corporation from its shareholders when it originally issues stock

D) allows a corporation to declare dividends of any amount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

29

Shares of capital stock issued to and held by stockholders as of a specific date are

A) I

B) II

C) III

D) IV

A) I

B) II

C) III

D) IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which one of the following equations is accurate?

A) Treasury stock = Authorized stock - Issued stock

B) Treasury stock = Outstanding stock - Subscribed stock

C) Treasury stock = Authorized stock - Outstanding stock

D) Treasury stock = Issued stock - Outstanding stock

A) Treasury stock = Authorized stock - Issued stock

B) Treasury stock = Outstanding stock - Subscribed stock

C) Treasury stock = Authorized stock - Outstanding stock

D) Treasury stock = Issued stock - Outstanding stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

31

Exhibit 15-1 Hanson Co. issued 10,000 shares of its $5 par common stock for $15 a share. In addition, it incurred legal and accounting fees, stock certificate costs, and other related expenses totaling $18,500.

-Refer to Exhibit 15-1. Assume the sale was the initial issuance of stock at incorporation for Hanson Co. The entry to record the sale would include a

A) credit to Cash for $150,000

B) credit to Common Stock for $150,000

C) debit to Organization Expense for $18,500

D) credit to Additional Paid-in Capital on Common Stock for $81,500

-Refer to Exhibit 15-1. Assume the sale was the initial issuance of stock at incorporation for Hanson Co. The entry to record the sale would include a

A) credit to Cash for $150,000

B) credit to Common Stock for $150,000

C) debit to Organization Expense for $18,500

D) credit to Additional Paid-in Capital on Common Stock for $81,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

32

The authorized shares of capital stock is the number of shares

A) outstanding

B) acquired

C) that may be issued

D) reacquired

A) outstanding

B) acquired

C) that may be issued

D) reacquired

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

33

In most states, it is illegal to sell stock

A) at a discount

B) with no par value

C) at a premium

D) in excess of par value

A) at a discount

B) with no par value

C) at a premium

D) in excess of par value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

34

The legal capital of a corporation may be any of the following except

A) the stated value of the stock

B) the par value of the stock

C) the market value of the stock at the balance sheet date (assuming the market value differs from the par or stated value)

D) the entire proceeds from the stock issuance

A) the stated value of the stock

B) the par value of the stock

C) the market value of the stock at the balance sheet date (assuming the market value differs from the par or stated value)

D) the entire proceeds from the stock issuance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

35

In the United States, corporations provide more than

A) 27% of the total revenue of all companies

B) 53% of the total revenue of all companies

C) 78% of the total revenue of all companies

D) 82% of the total revenue of all companies

A) 27% of the total revenue of all companies

B) 53% of the total revenue of all companies

C) 78% of the total revenue of all companies

D) 82% of the total revenue of all companies

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

36

If a company has 75,000 shares of treasury stock, 520,000 shares outstanding, and 1,500,000 shares authorized, how many shares are issued?

A) 500,000

B) 75,000

C) 520,000

D) 595,000

A) 500,000

B) 75,000

C) 520,000

D) 595,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which one of the following phrases is least desirable when describing an amount received from a sale of stock in excess of the par value of the stock?

A) paid-in capital in excess of par value

B) capital surplus

C) additional paid-in capital on preferred stock

D) contributed capital in excess of par value

A) paid-in capital in excess of par value

B) capital surplus

C) additional paid-in capital on preferred stock

D) contributed capital in excess of par value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

38

Smith Corp. has both Class A and Class B shares of common stock. The difference between the two classes of stock is most likely related to

A) Class A stock being worth more than Class B stock

B) Class A shareholders having greater voting rights than Class B shareholders

C) Class A shareholders receiving dividends while Class B shareholders do not

D) Class A shareholders having better preemptive rights than Class B shareholders

A) Class A stock being worth more than Class B stock

B) Class A shareholders having greater voting rights than Class B shareholders

C) Class A shareholders receiving dividends while Class B shareholders do not

D) Class A shareholders having better preemptive rights than Class B shareholders

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which one of the following statements is false?

A) When stock is issued, legal capital is usually the total amount received.

B) Par value has no direct relationship to market value.

C) The accounting for stated value, no-par stock parallels accounting for par-value stock.

D) Capital stockholders have limited liability.

A) When stock is issued, legal capital is usually the total amount received.

B) Par value has no direct relationship to market value.

C) The accounting for stated value, no-par stock parallels accounting for par-value stock.

D) Capital stockholders have limited liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following represents shares of stock that will be issued upon completion of an installment purchase contract?

A) subscribed capital stock

B) outstanding capital stock

C) treasury stock

D) contracted capital stock

A) subscribed capital stock

B) outstanding capital stock

C) treasury stock

D) contracted capital stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

41

A share option plan will be defined as compensatory if it has which one of the following characteristics?

A) The discount from market price for the stock option is greater than either what would be reasonable in an offer of stock to stockholders or others or the per-share amount of issuance costs avoided by not issuing the stock to the public.

B) Employees have 31 days or less from the date the purchase price is set to decide whether or not to enroll in the plan.

C) Almost all full-time employees are able to participate in the plan.

D) The purchase price is based solely on the market price of the stock on the purchase date.

A) The discount from market price for the stock option is greater than either what would be reasonable in an offer of stock to stockholders or others or the per-share amount of issuance costs avoided by not issuing the stock to the public.

B) Employees have 31 days or less from the date the purchase price is set to decide whether or not to enroll in the plan.

C) Almost all full-time employees are able to participate in the plan.

D) The purchase price is based solely on the market price of the stock on the purchase date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

42

A corporation issues 50 "packages" of securities for $154 per package. Each package consists of three shares of $5 par common stock and one share of $50 par preferred stock. If the market values of $40 per share for the common stock and $100 per share for preferred stock are known, the journal entry to record the sale would assign a total value to the preferred stock of

A) $3,500

B) $4,200

C) $5,775

D) $6,000

A) $3,500

B) $4,200

C) $5,775

D) $6,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

43

The Securities and Exchange Commission requires that Subscriptions Receivable be disclosed on the financial statements filed with it as a(n)

A) current asset as long as collection is to be made within one year or the normal operating cycle, whichever is longer

B) other asset if collection is to be made beyond one year from the date of the financial statements

C) contra-accounts receivable account

D) contra-stockholders' equity account

A) current asset as long as collection is to be made within one year or the normal operating cycle, whichever is longer

B) other asset if collection is to be made beyond one year from the date of the financial statements

C) contra-accounts receivable account

D) contra-stockholders' equity account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which one of the following statements is not true with regard to employee compensatory share option plans?

A) When a stock option is exercised under a compensatory stock option plan, the newly issued common stock is recorded at the exercise price and the value of the options at the grant date.

B) When stock warrants are issued under a noncompensatory stock option plan, no formal journal entry is required to record the stock warrants.

C) When a stock option is exercised under a compensatory stock option plan, the newly issued common stock is recorded at the exercise price and the previously recorded value of the warrants.

D) For federal income tax purposes, any gains resulting from stock options earned by employees are taxed at ordinary income tax rates.

A) When a stock option is exercised under a compensatory stock option plan, the newly issued common stock is recorded at the exercise price and the value of the options at the grant date.

B) When stock warrants are issued under a noncompensatory stock option plan, no formal journal entry is required to record the stock warrants.

C) When a stock option is exercised under a compensatory stock option plan, the newly issued common stock is recorded at the exercise price and the previously recorded value of the warrants.

D) For federal income tax purposes, any gains resulting from stock options earned by employees are taxed at ordinary income tax rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

45

Exhibit 15-2 Lawrence, Inc., entered into a subscription contract with several subscribers that calls for the purchase of 2,000 shares of $5 par common stock for $15 a share. The contract calls for a 20% down payment and specifies that any amounts not paid within the contract period will be forfeited in full.

-Refer to Exhibit 15-2. Lawrence received final payment (80%) on 1,800 shares and issued those shares. Subscribers defaulted on 200 shares. The entry to record the default on 200 shares would include a

A) debit to Common Stock Subscribed for $3,000

B) credit to Subscriptions Receivable: Common Stock for $3,000

C) debit to Additional Paid-in Capital on Common Stock for $2,000

D) credit to Additional Paid-in Capital from Subscribed Stock for $600

-Refer to Exhibit 15-2. Lawrence received final payment (80%) on 1,800 shares and issued those shares. Subscribers defaulted on 200 shares. The entry to record the default on 200 shares would include a

A) debit to Common Stock Subscribed for $3,000

B) credit to Subscriptions Receivable: Common Stock for $3,000

C) debit to Additional Paid-in Capital on Common Stock for $2,000

D) credit to Additional Paid-in Capital from Subscribed Stock for $600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

46

A noncompensatory share purchase plan is designed to

A) provide additional compensation to key officers and employees within the corporation

B) obtain more widespread employee ownership of the corporate stock

C) raise additional capital for the firm

D) obtain more widespread employee ownership and raise additional capital for the firm

A) provide additional compensation to key officers and employees within the corporation

B) obtain more widespread employee ownership of the corporate stock

C) raise additional capital for the firm

D) obtain more widespread employee ownership and raise additional capital for the firm

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

47

A company is exchanging its common stock for land in a nonmonetary exchange. This transaction should be valued based upon the

A) fair value of the stock

B) book value of the land

C) fair value of the stock issued and the land received

D) fair value of the stock issued and the land received, whichever is more reliable

A) fair value of the stock

B) book value of the land

C) fair value of the stock issued and the land received

D) fair value of the stock issued and the land received, whichever is more reliable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

48

In the financial statements, dividends in arrears on cumulative preferred stock should be

A) disclosed in the footnotes

B) classified as an offset to retained earnings

C) classified as a liability either current or long term

D) classified as an offset to net income

A) disclosed in the footnotes

B) classified as an offset to retained earnings

C) classified as a liability either current or long term

D) classified as an offset to net income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

49

When existing corporations issue stock, costs such as legal fees and underwriter's fees are usually accounted for as

A) organization expenses

B) reduction of Additional Paid-in Capital

C) organizational costs

D) reduction of Retained Earnings

A) organization expenses

B) reduction of Additional Paid-in Capital

C) organizational costs

D) reduction of Retained Earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

50

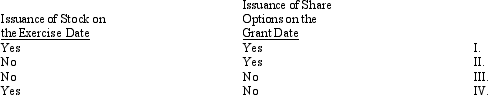

For a noncompensatory employee stock option plan, a formal journal entry or entries would be required for which of the following dates?

A) I

B) II

C) III

D) IV

A) I

B) II

C) III

D) IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

51

Common stock issued to employees through the exercise of stock purchase rights under a stock option plan that is classified as a noncompensatory share purchase plan is recorded by the corporation at the

A) market price of the stock

B) exercise price of the stock

C) market price of the stock at the first date that the stock purchase right can be exercised

D) option price of the stock plus the value assigned to the stock purchase right

A) market price of the stock

B) exercise price of the stock

C) market price of the stock at the first date that the stock purchase right can be exercised

D) option price of the stock plus the value assigned to the stock purchase right

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

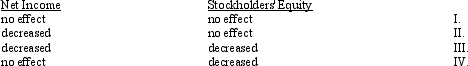

52

How will stockholders' equity and net income be affected by the issuance of stock purchase rights to employees under a noncompensatory share purchase plan?

A) I

B) II

C) III

D) IV

A) I

B) II

C) III

D) IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

53

Exhibit 15-2 Lawrence, Inc., entered into a subscription contract with several subscribers that calls for the purchase of 2,000 shares of $5 par common stock for $15 a share. The contract calls for a 20% down payment and specifies that any amounts not paid within the contract period will be forfeited in full.

-Refer to Exhibit 15-2. Lawrence received final payment (80%) on 1,800 shares and issued those shares. Subscribers defaulted on 200 shares. The entries to record receipt of final payment and issuance of 1,800 shares would include a

A) debit to Cash for $24,000

B) credit to Subscriptions Receivable: Common Stock for $24,000

C) debit to Common Stock Subscribed for $10,000

D) credit to Common Stock for $9,000

-Refer to Exhibit 15-2. Lawrence received final payment (80%) on 1,800 shares and issued those shares. Subscribers defaulted on 200 shares. The entries to record receipt of final payment and issuance of 1,800 shares would include a

A) debit to Cash for $24,000

B) credit to Subscriptions Receivable: Common Stock for $24,000

C) debit to Common Stock Subscribed for $10,000

D) credit to Common Stock for $9,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

54

Exhibit 15-2 Lawrence, Inc., entered into a subscription contract with several subscribers that calls for the purchase of 2,000 shares of $5 par common stock for $15 a share. The contract calls for a 20% down payment and specifies that any amounts not paid within the contract period will be forfeited in full.

-Refer to Exhibit 15-2. The initial entry to record this subscription and the down payment would include a

A) credit to Common Stock Subscribed for $10,000

B) credit to Additional Paid-in Capital from Subscribed Stock for $10,000

C) debit to Subscriptions Receivable: Common Stock for $30,000

D) debit to Cash for $2,000

-Refer to Exhibit 15-2. The initial entry to record this subscription and the down payment would include a

A) credit to Common Stock Subscribed for $10,000

B) credit to Additional Paid-in Capital from Subscribed Stock for $10,000

C) debit to Subscriptions Receivable: Common Stock for $30,000

D) debit to Cash for $2,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

55

A corporation acquired a copyright by issuing 1,000 shares of $5 par common stock. At the time of the exchange, the stock was selling for $40 per share. The copyright had a carrying value of $18,000 to the author. The purchasing corporation should assign to the copyright a value of

A) $18,000

B) $ 5,000

C) $32,000

D) $40,000

A) $18,000

B) $ 5,000

C) $32,000

D) $40,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

56

Assume common stock is issued to employees as a result of exercising stock purchase rights issued under a noncompensatory share purchase plan. Which of the following accurately describes the effect on the company's income, paid-in capital, and retained earnings, respectively?

A) decreased, increased, and decreased

B) no effect, increased, and increased

C) decreased, increased, and no effect

D) no effect, increased, and no effect

A) decreased, increased, and decreased

B) no effect, increased, and increased

C) decreased, increased, and no effect

D) no effect, increased, and no effect

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which one of the following entries would not be likely to be made by a corporation?

A) Land XX

Common Stock, $10 stated value XX

Additional Paid-in Capital on Common Stock XX

B) Cash XX

Common Stock, no-par XX

Additional Paid-in Capital on Common Stock XX

C) Cash XX

Subscriptions Receivable: Common Stock XX

Common Stock Subscribed XX

Additional Paid-in Capital on Common Stock XX

D) Building XX

Common Stock, no-par XX

A) Land XX

Common Stock, $10 stated value XX

Additional Paid-in Capital on Common Stock XX

B) Cash XX

Common Stock, no-par XX

Additional Paid-in Capital on Common Stock XX

C) Cash XX

Subscriptions Receivable: Common Stock XX

Common Stock Subscribed XX

Additional Paid-in Capital on Common Stock XX

D) Building XX

Common Stock, no-par XX

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

58

In accounting for a stock split, a company usually

A) receives less cash than market value

B) receives more cash than market value

C) issues more shares of stock

D) retires shares of stock

A) receives less cash than market value

B) receives more cash than market value

C) issues more shares of stock

D) retires shares of stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

59

When common stock is issued at an amount greater than par value, the difference between the par value and the proceeds from the sale is recorded by

A) crediting the common stock account

B) debiting an additional paid-in capital account

C) crediting the retained earnings account

D) crediting an additional paid-in capital account

A) crediting the common stock account

B) debiting an additional paid-in capital account

C) crediting the retained earnings account

D) crediting an additional paid-in capital account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

60

What account should be debited when stock issuance costs are associated with the initial issuance of stock at incorporation?

A) Organization Expense

B) Additional Paid-in Capital

C) Organization Costs

D) Common stock

A) Organization Expense

B) Additional Paid-in Capital

C) Organization Costs

D) Common stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

61

Under the fair value method, if an executive does not exercise a stock option and it is allowed to lapse, Paid-in Captial Share Options is debited. What is credited?

A) Additional Paid-In Capital from Expired Share Options

B) Compensation Expense

C) Gain from Expired Share Options

D) Deferred Compensation

A) Additional Paid-In Capital from Expired Share Options

B) Compensation Expense

C) Gain from Expired Share Options

D) Deferred Compensation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

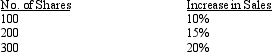

62

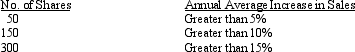

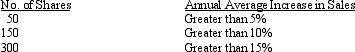

Exhibit 15-7 On January 1, 2013, 70 executives were granted a performance-based share option plan that would award them each a maximum of 300 shares of $5 par common stock for $12 a share based on the increase in sales over the next three years. The fair value per option on the grant date was $16. The award table is as follows:  The company estimates that the sales increase will be 22% and that the annual employee turnover rate will be 2%.

The company estimates that the sales increase will be 22% and that the annual employee turnover rate will be 2%.

Refer to Exhibit 15-7. The compensation expense for 2013 is (to the nearest dollar)

A) $ 82,320

B) $105,414

C) $109,760

D) $210,828

The company estimates that the sales increase will be 22% and that the annual employee turnover rate will be 2%.

The company estimates that the sales increase will be 22% and that the annual employee turnover rate will be 2%.Refer to Exhibit 15-7. The compensation expense for 2013 is (to the nearest dollar)

A) $ 82,320

B) $105,414

C) $109,760

D) $210,828

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

63

Exhibit 15-3 On January 1, 2014, Howard, Inc. granted to a key executive a fixed compensatory share option plan for 1,000 shares of $4 par common stock for $30 a share. The fair value per option on that date was $14 per option. The service period extended through December 31, 2015.

-Refer to Exhibit 15-3. What entry, if any, was required on December 31, 2014?

A) no entry was necessary

B) Compensation Expense 7,000

Paid-in Capital Share Options 7,000

C) Compensation Expense 6,000

Paid-in Capital Share Options 6,000

D) Compensation Expense 9,000

Deferred Compensation 9,000

-Refer to Exhibit 15-3. What entry, if any, was required on December 31, 2014?

A) no entry was necessary

B) Compensation Expense 7,000

Paid-in Capital Share Options 7,000

C) Compensation Expense 6,000

Paid-in Capital Share Options 6,000

D) Compensation Expense 9,000

Deferred Compensation 9,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

64

Exhibit 15-5 On January 1, 2013, Roberts Company adopts a compensatory share option plan and grants 40 executives 1,000 shares each at $30 a share. The fair value per option is $7 on the grant date. The company estimates that its annual employee turnover rate during the service period of three years will be 4%.

Refer to Exhibit 15-5. At the end of 2014, the company estimates that the employee turnover will be 5% a year for the entire service period. At the end of 2015, only 30,000 options vest as only 30 of the 40 executives actually remain. The compensation expense for 2015 will be (Round off turnover calculations to three decimal places and answer to the nearest dollar.)

A) $49,957

B) $70,000

C) $80,022

D) $82,575

Refer to Exhibit 15-5. At the end of 2014, the company estimates that the employee turnover will be 5% a year for the entire service period. At the end of 2015, only 30,000 options vest as only 30 of the 40 executives actually remain. The compensation expense for 2015 will be (Round off turnover calculations to three decimal places and answer to the nearest dollar.)

A) $49,957

B) $70,000

C) $80,022

D) $82,575

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

65

Exhibit 15-4 On January 1, 2014, Masters, Inc., grants a compensatory share option plan to 15 of its executives. The plan allows each executive to buy 1,000 shares of its $1 par common stock at $30 a share after a three-year service period. The value of each option is estimated to be $9. The company estimates it will have an annual 3% employee turnover rate during the service period.

Refer to Exhibit 15-4. By how much has contributed capital increased as of the beginning of 2017?

A) $ 0

B) $ 41,070

C) $135,000

D) $123,211

Refer to Exhibit 15-4. By how much has contributed capital increased as of the beginning of 2017?

A) $ 0

B) $ 41,070

C) $135,000

D) $123,211

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

66

Exhibit 15-5 On January 1, 2013, Roberts Company adopts a compensatory share option plan and grants 40 executives 1,000 shares each at $30 a share. The fair value per option is $7 on the grant date. The company estimates that its annual employee turnover rate during the service period of three years will be 4%.

-Refer to Exhibit 15-5. The journal entry to record compensation expense for 2013 will be (Round off any turnover calculations to three decimal places.)

A) Compensation Expense 247,726

Paid-in Capital Share Options 247,726

B) Compensation Expense 82,575

Paid-in Capital Share Options 82,575

C) Compensation Expense 91,467

Paid-in Capital Share Options 91,467

D) Compensation Expense 93,333

Common Stock Option Plan 93,333

-Refer to Exhibit 15-5. The journal entry to record compensation expense for 2013 will be (Round off any turnover calculations to three decimal places.)

A) Compensation Expense 247,726

Paid-in Capital Share Options 247,726

B) Compensation Expense 82,575

Paid-in Capital Share Options 82,575

C) Compensation Expense 91,467

Paid-in Capital Share Options 91,467

D) Compensation Expense 93,333

Common Stock Option Plan 93,333

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

67

Under the fair value method, the grant date is the date

A) of the compensation agreement

B) the options are issued

C) the options are exercised

D) the options vest

A) of the compensation agreement

B) the options are issued

C) the options are exercised

D) the options vest

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

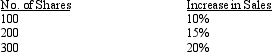

68

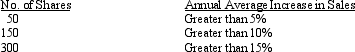

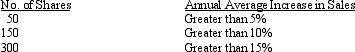

Exhibit 15-6 On January 1, 2014, 50 executives were given a performance-based share option plan that would award them with a maximum of 300 shares of $10 par common stock for $20 a share. On the grant date, the fair value of an option was $16.50. The number of options that will vest depends on the size of the annual average increase in sales over the next three years according to the following table:  On the grant date, the company estimates the annual average sales increase will be 14%.

On the grant date, the company estimates the annual average sales increase will be 14%.

Refer to Exhibit 15-6. The estimated total compensation cost will be

A) $ 55,000

B) $123,750

C) $ 27,500

D) $247,500

On the grant date, the company estimates the annual average sales increase will be 14%.

On the grant date, the company estimates the annual average sales increase will be 14%.Refer to Exhibit 15-6. The estimated total compensation cost will be

A) $ 55,000

B) $123,750

C) $ 27,500

D) $247,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

69

Exhibit 15-5 On January 1, 2013, Roberts Company adopts a compensatory share option plan and grants 40 executives 1,000 shares each at $30 a share. The fair value per option is $7 on the grant date. The company estimates that its annual employee turnover rate during the service period of three years will be 4%.

Refer to Exhibit 15-5. At the end of 2014, the company estimates that the employee turnover will be 5% a year for the entire service period. The compensation expense for 2014 will be (Round off turnover calculations to three decimal places and answer to the nearest dollar.)

A) $ 77,468

B) $ 80,022

C) $ 82,575

D) $160,043

Refer to Exhibit 15-5. At the end of 2014, the company estimates that the employee turnover will be 5% a year for the entire service period. The compensation expense for 2014 will be (Round off turnover calculations to three decimal places and answer to the nearest dollar.)

A) $ 77,468

B) $ 80,022

C) $ 82,575

D) $160,043

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

70

On January 1, 2014, Watchtower Corporation granted Emma Freegross, its president, a compensatory stock option plan to purchase 8,000 shares of Watchtower's $10 par common stock. The option price is $25 per share and the option has a fair value of $7 per option, which is exercisable on January 1, 2018, after four years of service. How much compensation expense should Watchtower recognize on December 31, 2014?

A) $ 0

B) $14,000

C) $56,000

D) $80,000

A) $ 0

B) $14,000

C) $56,000

D) $80,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

71

When accounting for a fixed compensatory share option plan, a company must make which of the following on the date of grant?

A) journal entry recognizing the common stock issued

B) journal entry recognizing the compensation expense

C) memorandum entry explaining the terms of the compensatory share option plan

D) memorandum entry of the expected annual compensation expense amount

A) journal entry recognizing the common stock issued

B) journal entry recognizing the compensation expense

C) memorandum entry explaining the terms of the compensatory share option plan

D) memorandum entry of the expected annual compensation expense amount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following share option plans would involve the creation of a liability account over the life of the plan?

A) all share option plans

B) fixed compensatory share option plans

C) performance-based compensatory share option plans

D) share option plans with stock appreciation rights

A) all share option plans

B) fixed compensatory share option plans

C) performance-based compensatory share option plans

D) share option plans with stock appreciation rights

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

73

Exhibit 15-4 On January 1, 2014, Masters, Inc., grants a compensatory share option plan to 15 of its executives. The plan allows each executive to buy 1,000 shares of its $1 par common stock at $30 a share after a three-year service period. The value of each option is estimated to be $9. The company estimates it will have an annual 3% employee turnover rate during the service period.

Refer to Exhibit 15-4. What is the compensation expense for the year ended December 31, 2015?

A) $ 0

B) $ 41,070

C) $135,000

D) $123,211

Refer to Exhibit 15-4. What is the compensation expense for the year ended December 31, 2015?

A) $ 0

B) $ 41,070

C) $135,000

D) $123,211

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following can be accounted for under the intrinsic value method?

A) share option plan with share appreciation rights

B) fixed share option plan

C) performance-based share option plan

D) all of these

A) share option plan with share appreciation rights

B) fixed share option plan

C) performance-based share option plan

D) all of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

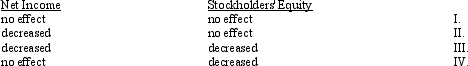

75

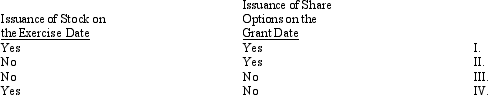

For a compensatory share option plan, a formal journal entry or entries would be required for which of the following dates?

A) I

B) II

C) III

D) IV

A) I

B) II

C) III

D) IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

76

How is Paid-in Capital from Share Options classified in the financial statements?

A) expense account

B) liability account

C) deferred expense account

D) stockholders' equity account

A) expense account

B) liability account

C) deferred expense account

D) stockholders' equity account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

77

Exhibit 15-6 On January 1, 2014, 50 executives were given a performance-based share option plan that would award them with a maximum of 300 shares of $10 par common stock for $20 a share. On the grant date, the fair value of an option was $16.50. The number of options that will vest depends on the size of the annual average increase in sales over the next three years according to the following table:  On the grant date, the company estimates the annual average sales increase will be 14%.

On the grant date, the company estimates the annual average sales increase will be 14%.

Refer to Exhibit 15-6. In 2015, the company determined that the actual annual average increase was 16%. The compensation expense for 2015 will be

A) $123,750

B) $247,500

C) $ 82,500

D) $ 55,000

On the grant date, the company estimates the annual average sales increase will be 14%.

On the grant date, the company estimates the annual average sales increase will be 14%.Refer to Exhibit 15-6. In 2015, the company determined that the actual annual average increase was 16%. The compensation expense for 2015 will be

A) $123,750

B) $247,500

C) $ 82,500

D) $ 55,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

78

Exhibit 15-3 On January 1, 2014, Howard, Inc. granted to a key executive a fixed compensatory share option plan for 1,000 shares of $4 par common stock for $30 a share. The fair value per option on that date was $14 per option. The service period extended through December 31, 2015.

-Refer to Exhibit 15-3. Which balance sheet disclosure would be correct at December 31, 2014?

A) Stockholders' equity:

Paid-in Capital Share Options $ 7,000

B) Liabilities: Employee stock option plan $ 7,000

C) Stockholders' equity:

Paid-in Capital Share Options $ 7,000

Less: Deferred compensation 7,000

$14,000

D) footnote disclosure only

-Refer to Exhibit 15-3. Which balance sheet disclosure would be correct at December 31, 2014?

A) Stockholders' equity:

Paid-in Capital Share Options $ 7,000

B) Liabilities: Employee stock option plan $ 7,000

C) Stockholders' equity:

Paid-in Capital Share Options $ 7,000

Less: Deferred compensation 7,000

$14,000

D) footnote disclosure only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

79

For a compensatory share option plan, any compensation cost related to the plan must be recognized over the service period. The underlying financial accounting concept that supports this approach is

A) revenue recognition

B) matching

C) conservatism

D) historical cost

A) revenue recognition

B) matching

C) conservatism

D) historical cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

80

When share options are exercised by an employee under a compensatory share option plan, the issuance of the common stock is recorded at the

A) amount of cash received

B) amount of cash received less the previously recorded value of the options received

C) amount of cash received plus the previously recorded value of the options received

D) market price minus the share option price

A) amount of cash received

B) amount of cash received less the previously recorded value of the options received

C) amount of cash received plus the previously recorded value of the options received

D) market price minus the share option price

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck