Deck 11: Depreciation, Depletion, Impairment, and Disposal

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/143

العب

ملء الشاشة (f)

Deck 11: Depreciation, Depletion, Impairment, and Disposal

1

Composite depreciation is applied to homogeneous assets which have similar service lives and residual values.

False

2

When a company disposes of an asset by abandonment the disclosure of the gain or loss equals the fair market value.

False

3

The use of accelerated methods are appropriate when the asset will be used more in the later periods versus earlier periods.

False

4

Assets sold on or before the 15th are not considered owned for the month based on the nearest whole month convention.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

5

Development costs incurred for the purchasing of equipment can be included as part of the cost of the natural resource.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

6

Acquisition costs, exploration costs, development costs, and reclamation costs can all be added to the cost of obtaining the rights to natural resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

7

The depreciation base is computed as follows:

Estimated Residual Value = Depreciation Base - Asset Cost

Estimated Residual Value = Depreciation Base - Asset Cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

8

GAAP allows companies to choose between time-based, activity, group, or composite cost allocation methods, but once the method is chosen it must be applied consistently over time, this ensures that financial information is comparable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

9

Group depreciation is applied to heterogeneous assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

10

A company must include impairment disclosures in the year of an impairment write-down and the subsequent three years following to ensure accurate comparability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

11

IFRS and GAAP use similar approaches when it comes to the disposal of assets and the subsequent gain or loss. The only difference is GAAP requires the use of the reevaluation method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

12

GAAP does not require companies to disclose the balances of depreciable assets by nature or function but by major classes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

13

GAAP requires the general description of the methods used in the computation of depreciation regarding major classes of assets to be disclosed in the notes of the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

14

When deciding on a depreciation method repair and maintenance costs associated with the asset should be a considering factor to ensure that the total costs are reported accurately in the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

15

The purpose of depreciation is to systematically and rationally depreciate the cost over the life of the asset to ensure appropriate capital for future replacement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

16

The service life of an asset can only be measured in units of activity or output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

17

Under the MACRS principles the residual value is eliminated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

18

A requirement of GAAP is that companies should review their assets to ensure they are not impaired, especially when a change dictates the book value may not be recoverable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

19

Under the MACRS principles the tax life winds up being shorter in most cases compared to an assets economic life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

20

If a company purchases an asset within the last 6 months of the year, it is considered owned for the entire year based upon the nearest whole year convention.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which one of the following statements is true?

A) The activity method of computing depreciation could result in zero depreciation expense in some periods of time.

B) If the activity method is in use, residual value should not be subtracted from cost to determine the depreciation base.

C) The activity method produces a constant total cost of depreciation each period.

D) The activity method should be used when the service life of the asset is affected mostly by the passage of time.

A) The activity method of computing depreciation could result in zero depreciation expense in some periods of time.

B) If the activity method is in use, residual value should not be subtracted from cost to determine the depreciation base.

C) The activity method produces a constant total cost of depreciation each period.

D) The activity method should be used when the service life of the asset is affected mostly by the passage of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

22

On January 1, 2014, Lefty, Inc. purchased a machine for $6,000. The estimated life and residual value were five years and $150, respectively. The machine will produce approximately 80,000 units over its life. In 2014 and 2015, the machine produced 10,000 and 15,000 units, respectively. In 2015, Lefty recorded $1,440 of depreciation expense. The depreciation method in use was the

A) activity method

B) sum-of-the-years'-digits method

C) double-declining-balance method

D) straight-line method

A) activity method

B) sum-of-the-years'-digits method

C) double-declining-balance method

D) straight-line method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

23

The factors involved in computing periodic depreciation charges for an asset do not include the

A) method of cost allocation

B) current value of the asset

C) service life

D) residual value of the asset

A) method of cost allocation

B) current value of the asset

C) service life

D) residual value of the asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

24

How can service life be measured?

A) units of time

B) units of activity

C) units of output

D) all of the above can measure service life

A) units of time

B) units of activity

C) units of output

D) all of the above can measure service life

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which depreciation method calculates annual depreciation expense based on the book value of an asset?

A) double-declining-balance method

B) sum-of-the-years'-digits method

C) inventory systems method

D) group method

A) double-declining-balance method

B) sum-of-the-years'-digits method

C) inventory systems method

D) group method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which one of the following is not a factor that limits the service life of an asset?

A) operational use

B) adequacy

C) deterioration as a function of time

D) obsolescence

A) operational use

B) adequacy

C) deterioration as a function of time

D) obsolescence

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following depreciation methods should be used when the expected benefits to be received from an asset will decline each period?

A) straight-line method

B) units-of-production method

C) sum-of-the-years'-digits method

D) compound-interest method

A) straight-line method

B) units-of-production method

C) sum-of-the-years'-digits method

D) compound-interest method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

28

Devon Manufacturing Company purchased a new canning machine on July 1, 2013, for $190,000. The estimated salvage value is $15,000. The company uses units-of-production depreciation and estimates the machine will produce 125,000 units during its useful life. In 2013, the company manufactured 5,000 units after acquiring the machine. Depreciation expense for 2013 will be

A) $ 7,600

B) $ 6,500

C) $ 7,000

D) $14,000

A) $ 7,600

B) $ 6,500

C) $ 7,000

D) $14,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

29

What determines residual value?

A) company policy

B) GAAP for each class of asset

C) IFRS

D) FASB

A) company policy

B) GAAP for each class of asset

C) IFRS

D) FASB

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which depreciation method ignores residual value when computing the depreciable base of an asset?

A) sum-of-the-years'-digits method

B) double-declining-balance method

C) composite method

D) group method

A) sum-of-the-years'-digits method

B) double-declining-balance method

C) composite method

D) group method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

31

Exhibit 11-1 On January 1, 2014, Hills purchased equipment for $350,000. The equipment had an estimated useful life of ten years and an estimated residual value of $50,000. Use the double-declining-balance method to answer the following question(s).

Refer to Exhibit 11-1. How much depreciation should Hills record on the asset in year 1?

A) $35,000

B) $30,600

C) $60,000

D) $70,000

Refer to Exhibit 11-1. How much depreciation should Hills record on the asset in year 1?

A) $35,000

B) $30,600

C) $60,000

D) $70,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

32

Exhibit 11-1 On January 1, 2014, Hills purchased equipment for $350,000. The equipment had an estimated useful life of ten years and an estimated residual value of $50,000. Use the double-declining-balance method to answer the following question(s).

Refer to Exhibit 11-1. How much depreciation should Hills record on the asset in year 2?

A) $16,000

B) $24,000

C) $56,000

D) $48,000

Refer to Exhibit 11-1. How much depreciation should Hills record on the asset in year 2?

A) $16,000

B) $24,000

C) $56,000

D) $48,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

33

The Sahara Company purchased equipment on January 1, 2015, for $100,000. The equipment had an estimated residual value of $10,000, an estimated useful life of five years, and estimated lifetime output of 18,000 units. In 2016, the company produced 4,400 units and recorded depreciation expense of $22,000. What depreciation method did the company use?

A) straight-line method

B) sum-of-the-years'-digits method

C) double-declining-balance method

D) units-of-output method

A) straight-line method

B) sum-of-the-years'-digits method

C) double-declining-balance method

D) units-of-output method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

34

Many companies that use the declining-balance method of depreciation switch to the straight-line method at what point in the life of a depreciable asset?

A) never, as one method must be applied consistently throughout the life of an asset

B) in the last quarter of the life of the asset

C) when the accelerated depreciation exceeds the straight-line depreciation

D) midpoint in the life of the asset

A) never, as one method must be applied consistently throughout the life of an asset

B) in the last quarter of the life of the asset

C) when the accelerated depreciation exceeds the straight-line depreciation

D) midpoint in the life of the asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

35

Exhibit 11-1 On January 1, 2014, Hills purchased equipment for $350,000. The equipment had an estimated useful life of ten years and an estimated residual value of $50,000. Use the double-declining-balance method to answer the following question(s).

Refer to Exhibit 11-1. What is the net book value of this asset that Hills should report on the company's balance sheet at December 31, year 2?

A) $142,600

B) $224,000

C) $192,000

D) $102,400

Refer to Exhibit 11-1. What is the net book value of this asset that Hills should report on the company's balance sheet at December 31, year 2?

A) $142,600

B) $224,000

C) $192,000

D) $102,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

36

The service life of an asset may be measured by all of the following except

A) units of output

B) units of activity

C) units of input

D) units of time

A) units of output

B) units of activity

C) units of input

D) units of time

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which one of the following statements is not true?

A) Depreciation is the process of allocating the purchase price of an asset minus its residual value to expense for each period benefited by the asset.

B) The cost of an asset includes all acquisition costs necessary to obtain the benefits to be derived from the asset.

C) The service life of an asset is the measure of the number of years of service expected from the asset before its disposal.

D) The residual value of an asset is the difference between the expected book value of the asset at the end of its service and the costs of disposal.

A) Depreciation is the process of allocating the purchase price of an asset minus its residual value to expense for each period benefited by the asset.

B) The cost of an asset includes all acquisition costs necessary to obtain the benefits to be derived from the asset.

C) The service life of an asset is the measure of the number of years of service expected from the asset before its disposal.

D) The residual value of an asset is the difference between the expected book value of the asset at the end of its service and the costs of disposal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following is not a factor in computing depreciation for a period?

A) method of cost allocation

B) service life

C) present value

D) residual value

A) method of cost allocation

B) service life

C) present value

D) residual value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

39

Depreciation of an asset based on the number of hours of usage is a(n)

A) time-based method

B) accelerated method

C) replacement method

D) activity-based method

A) time-based method

B) accelerated method

C) replacement method

D) activity-based method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

40

What type of cost allocation must a company use?

A) systematic

B) rational

C) systematic and rational

D) systematic, rational, and reliable

A) systematic

B) rational

C) systematic and rational

D) systematic, rational, and reliable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

41

The Cardwell Company purchased a machine on January 2, 2014, at a cost of $1,200,000. The machine had an estimated useful life of eight years and a residual value of $120,000. Cardwell computes depreciation by the sum-of-the-years'-digits method. What amount, net of accumulated depreciation, will appear on the company's December 31, 2016, balance sheet for this machine?

A) $ 570,000

B) $ 630,000

C) $ 805,094

D) $1,080,000

A) $ 570,000

B) $ 630,000

C) $ 805,094

D) $1,080,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

42

When low-cost depreciable assets with similar characteristics, service lives, and residual values are acquired, which depreciation method should be used?

A) composite depreciation

B) impairment depreciation

C) group depreciation

D) such assets should not be depreciated

A) composite depreciation

B) impairment depreciation

C) group depreciation

D) such assets should not be depreciated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

43

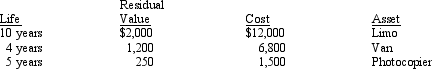

Willis Limo Service purchased three used assets with the following characteristics:

Assuming Willis uses straight-line depreciation, the composite depreciation rate is

A) 10.1%

B) 13.1%

C) 15.7%

D) 18.2%

Assuming Willis uses straight-line depreciation, the composite depreciation rate is

A) 10.1%

B) 13.1%

C) 15.7%

D) 18.2%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

44

On January 1, 2014, Flo, Inc. purchased an asset for $48,000. It was estimated that the asset life was seven years, after which it would have a residual value of $4,100. Assuming the use of the sum-of-the-years'-digits method, depreciation expense for 2014 would be

A) $12,804

B) $10,975

C) $12,000

D) $5,487.50

A) $12,804

B) $10,975

C) $12,000

D) $5,487.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

45

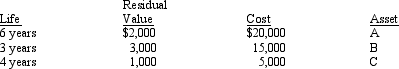

On January 1, 2014, Mullhausen Co. began using the composite depreciation method. There were three machines to consider, as follows:

At the end of the second year, Machine B was sold for $8,200. In the entry to record the sale, there should be a

A) $1,200 debit to Gain on Sale of Machine

B) $6,800 debit to Accumulated Depreciation

C) $6,800 debit to Loss on Sale of Machine

D) $8,000 debit to Accumulated Depreciation

At the end of the second year, Machine B was sold for $8,200. In the entry to record the sale, there should be a

A) $1,200 debit to Gain on Sale of Machine

B) $6,800 debit to Accumulated Depreciation

C) $6,800 debit to Loss on Sale of Machine

D) $8,000 debit to Accumulated Depreciation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

46

What effect does depreciation have on the calculation of the rate of return on total assets?

A) affects both the numerator and denominator

B) no effect

C) increases the outcome

D) decreases the outcome

A) affects both the numerator and denominator

B) no effect

C) increases the outcome

D) decreases the outcome

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which one of the following statements about group depreciation is true?

A) When assets are sold, losses will be recognized, but not gains.

B) This method is used for groups of dissimilar assets.

C) Different assets in the group will have different depreciation rates.

D) Only one accumulated depreciation account is necessary for the whole group.

A) When assets are sold, losses will be recognized, but not gains.

B) This method is used for groups of dissimilar assets.

C) Different assets in the group will have different depreciation rates.

D) Only one accumulated depreciation account is necessary for the whole group.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which one of the following statements is true?

A) One objective of depreciating an asset is to provide funds for replacement.

B) GAAP requires the use of either straight-line or declining-balance depreciation.

C) Straight-line depreciation results in a decreasing rate of return on total assets.

D) Typically, the sum-of-the-years'-digits method will result in less depreciation expense in the year of acquisition than will the double-declining-balance method.

A) One objective of depreciating an asset is to provide funds for replacement.

B) GAAP requires the use of either straight-line or declining-balance depreciation.

C) Straight-line depreciation results in a decreasing rate of return on total assets.

D) Typically, the sum-of-the-years'-digits method will result in less depreciation expense in the year of acquisition than will the double-declining-balance method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which one of the following statements is not true regarding depreciation?

A) It is a systematic, rational method of allocating the cost of an asset over its useful life.

B) It attempts to match the costs of acquiring an asset to the benefits to be derived from the asset.

C) It does not attempt to measure the value of the asset.

D) It provides funds for the replacement of the asset through tax savings over the asset's life.

A) It is a systematic, rational method of allocating the cost of an asset over its useful life.

B) It attempts to match the costs of acquiring an asset to the benefits to be derived from the asset.

C) It does not attempt to measure the value of the asset.

D) It provides funds for the replacement of the asset through tax savings over the asset's life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

50

On January 1, 2013, Morgantown Co. purchased five machines at a price of $10,000 per machine. Because the estimated life was five years and no salvage value was expected, a group depreciation rate of 20% was used. On January 1, 2015, one of the machines was sold for $5,000. The correct entry to record the sale of the machine is

A) Cash 5,000 Loss on Sale of Machine 1,000

Accumulated Depreciation 4,000

Machines 10,000

B) Cash 5,000

Machines 5,000

C) Cash 5,000

Loss on Sale of Machines 5,000

Machines 10,000

D) Cash 5,000

Accumulated Depreciation 5,000

Machines 10,000

A) Cash 5,000 Loss on Sale of Machine 1,000

Accumulated Depreciation 4,000

Machines 10,000

B) Cash 5,000

Machines 5,000

C) Cash 5,000

Loss on Sale of Machines 5,000

Machines 10,000

D) Cash 5,000

Accumulated Depreciation 5,000

Machines 10,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

51

The Chuck Company purchased a truck on January 1, 2014. The truck cost $106,000 and was expected to have a residual value of $14,000 at the end of 2018. Chuck uses the 150%-declining-balance depreciation method. What amount of depreciation should Chuck record on the truck in 2014?

A) $18,400

B) $31,800

C) $27,600

D) $21,200

A) $18,400

B) $31,800

C) $27,600

D) $21,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

52

Lucas, Inc. purchased ten air conditioning units for $5,000 each, with an average expected service life of eight years and a residual value of $700 each. The depreciation rate for the assets, assuming the group depreciation method is used, will be

A) 10%

B) 10.75%

C) 12.5%

D) 14.5%

A) 10%

B) 10.75%

C) 12.5%

D) 14.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

53

Mark Industries uses the straight-line depreciation method. One asset had been purchased for $11,000. Annual depreciation expense was $2,000 after considering residual value of $1,000. What was the approximate life of the asset?

A) 5.50 years

B) 5.00 years

C) 10.00 years

D) 11.00 years

A) 5.50 years

B) 5.00 years

C) 10.00 years

D) 11.00 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

54

A company purchased ten delivery vehicles at a cost of $20,000 each and used the group depreciation method. Which of the following entries would be correct when recording the subsequent sale of a vehicle for $8,500 (group accumulated depreciation is $88,000)?

A) Cash 8,500 Accumulated Depreciation 8,800

Vehicles 17,300

B) Cash 8,500 Accumulated Depreciation 11,500

Vehicles 20,000

C) Cash 8,500

Vehicles 8,500

D) Cash 8,500

Accumulated Depreciation 8,800

Loss on Sale 2,700

Vehicles 20,000

A) Cash 8,500 Accumulated Depreciation 8,800

Vehicles 17,300

B) Cash 8,500 Accumulated Depreciation 11,500

Vehicles 20,000

C) Cash 8,500

Vehicles 8,500

D) Cash 8,500

Accumulated Depreciation 8,800

Loss on Sale 2,700

Vehicles 20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

55

Five skid steers costing $20,000 each were purchased by the Biggs Excavating Company at the beginning of 2014. Biggs capitalized the skid steers in a single asset account and depreciates them using the group method. Each skid steer was expected to have a residual value of $6,000 in four years. At the end of 2017, Biggs sold one skid steer for $8,000. For what amount is accumulated depreciation debited in the journal entry to record the disposal of that skid steer?

A) $14,000

B) $12,000

C) $10,500

D) $20,000

A) $14,000

B) $12,000

C) $10,500

D) $20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

56

The Antarctica Co. acquired a machine on January 1, 2013, at a cost of $60,000. The machine is expected to have a ten-year life and a residual value of $5,000. The estimated lifetime output from the machine is expected to be 55,000 units. Under which of the following depreciation methods would the depreciation charge be the greatest in 2013 if 9,100 units were produced during the year?

A) activity (units-of-output) method

B) straight-line method

C) sum-of-the-years'-digits method

D) double-declining-balance method

A) activity (units-of-output) method

B) straight-line method

C) sum-of-the-years'-digits method

D) double-declining-balance method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which one of the following statements is an advantage of the group and composite methods of depreciation?

A) Faulty estimates are concealed for long periods.

B) Gains are deferred beyond the period in which they actually occurred.

C) Record keeping is simplified.

D) Losses are not recognized in the period in which they occur.

A) Faulty estimates are concealed for long periods.

B) Gains are deferred beyond the period in which they actually occurred.

C) Record keeping is simplified.

D) Losses are not recognized in the period in which they occur.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

58

On January 1, 2014, Pistachio purchased an asset that had an estimated residual value of $700 after an economic life of four years. Pistachio used sum-of-the-years'-digits depreciation and recorded $1,560 of depreciation expense in 2016. What was the cost of the asset?

A) $5,900

B) $7,100

C) $4,500

D) $8,500

A) $5,900

B) $7,100

C) $4,500

D) $8,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

59

A student is defending a certain depreciation method. She uses the argument that repairs and maintenance costs will probably increase as the asset gets older. She also argues that the asset will produce less as it gets older. What depreciation method is she probably defending?

A) straight-line method

B) sum-of-the-years'-digits method

C) sinking-fund method

D) activity method

A) straight-line method

B) sum-of-the-years'-digits method

C) sinking-fund method

D) activity method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following is not a factor in selecting a depreciation method?

A) salvage value

B) repair and maintenance costs

C) financial statement effects

D) the risk associated with the cash flows from the asset

A) salvage value

B) repair and maintenance costs

C) financial statement effects

D) the risk associated with the cash flows from the asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

61

Clementine Co. computes depreciation to the nearest whole month and uses the straight-line method. On May 2, 2013, the company purchased an asset for $18,000 with a four-year life and a $3,600 residual value. On October 6, Karen also sold an asset with a cost of $34,500 that had been purchased in 2011. The sold asset had been estimated to have a five-year life and no residual value when it was purchased. The depreciation expense on these two assets for 2013 totals

A) $ 7,575

B) $10,500

C) $ 9,300

D) $ 7,600

A) $ 7,575

B) $10,500

C) $ 9,300

D) $ 7,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

62

Karen's purchased a piece of equipment for $42,000 with a useful life of seven years and a residual value of $6,000 on January 2, 2014. If Karen's used the sum-of-the-years'-digits method with the half-year convention, depreciation expense for 2014 was

A) $9,000.00

B) $10,500.00

C) $5,250.00

D) $4,500.00

A) $9,000.00

B) $10,500.00

C) $5,250.00

D) $4,500.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

63

On January 1, 2014, Digger purchased some equipment for $29,600. The anticipated life of the equipment was five years and residual value was estimated to be $4,100. The machine was expected to produce 600,000 units. In January of 2014, 35,000 units were produced and production was doubled in February. The company uses the activity depreciation method. What is the amount of depreciation expense for the month of February?

A) $ 637.50

B) $1,487.50

C) $3,453.33

D) $2,975.00

A) $ 637.50

B) $1,487.50

C) $3,453.33

D) $2,975.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which one of the following disclosures is required by generally accepted accounting principles?

A) depreciation expense for each major class of asset

B) balances of major classes of depreciable assets by nature or function

C) accumulated depreciation on each depreciable asset

D) an explanation of why the depreciation method used was selected by management

A) depreciation expense for each major class of asset

B) balances of major classes of depreciable assets by nature or function

C) accumulated depreciation on each depreciable asset

D) an explanation of why the depreciation method used was selected by management

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

65

Exhibit 11-2 Browning purchased a business copier for $4,500 on August 3, 2014. It has an estimated residual value of $500 and an expected service life of five years. Browning uses double-declining-balance depreciation computed to the nearest whole month.

Refer to Exhibit 11-2. Depreciation expense for 2014 was

A) $ 600

B) $ 667

C) $ 750

D) $1,500

Refer to Exhibit 11-2. Depreciation expense for 2014 was

A) $ 600

B) $ 667

C) $ 750

D) $1,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

66

Property, plant, and equipment must be reviewed for impairment when which one of the following events occurs?

A) A significant change in the asset's estimated useful life occurs.

B) The costs of constructing the asset are determined to be less than the budgeted amount.

C) A current period operating loss occurs.

D) Investing activities produce a negative cash flow.

A) A significant change in the asset's estimated useful life occurs.

B) The costs of constructing the asset are determined to be less than the budgeted amount.

C) A current period operating loss occurs.

D) Investing activities produce a negative cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

67

On July 1, 2014, American Stereo purchased stereo equipment for $5,000. The estimated life of the equipment was ten years and the residual value was estimated to be $2,000. Double-declining-balance depreciation was used. If calculations are based on the nearest whole month, depreciation expense for the year 2016 was

A) $720

B) $900

C) $640

D) $800

A) $720

B) $900

C) $640

D) $800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

68

Exhibit 11-2 Browning purchased a business copier for $4,500 on August 3, 2014. It has an estimated residual value of $500 and an expected service life of five years. Browning uses double-declining-balance depreciation computed to the nearest whole month.

Refer to Exhibit 11-2. Depreciation expense for 2015 should be

A) $ 600

B) $ 667

C) $ 750

D) $1,500

Refer to Exhibit 11-2. Depreciation expense for 2015 should be

A) $ 600

B) $ 667

C) $ 750

D) $1,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

69

Hill has a fiscal year-end of December 31. Hill purchased a piece of equipment for $12,000 in February with a four-year useful life and a zero residual value. Hill used the equipment to produce finished goods in March that were sold on credit in April with cash collected in May. Hill uses straight-line depreciation. The amount of depreciation expense affecting the reported income on the first quarter income statement was

A) $250

B) $ 0

C) $500

D) $700

A) $250

B) $ 0

C) $500

D) $700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which one of the following statements is not a disclosure requirement for depreciation?

A) the balance of major classes of depreciable assets

B) a general description of the method(s) used for depreciation

C) the accumulated depreciation for each major class of depreciable asset

D) the useful lives for each major class of depreciable asset

A) the balance of major classes of depreciable assets

B) a general description of the method(s) used for depreciation

C) the accumulated depreciation for each major class of depreciable asset

D) the useful lives for each major class of depreciable asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which one of the following statements is true?

A) Financial statement readers cannot determine whether the depreciation method used by a company is appropriate.

B) Financial statement readers can determine the useful lives of assets depreciated during the reported period.

C) Financial statement readers cannot determine the depreciation expense for the reported period.

D) Financial statement readers can accurately estimate the effect an alternative depreciation method would have on income.

A) Financial statement readers cannot determine whether the depreciation method used by a company is appropriate.

B) Financial statement readers can determine the useful lives of assets depreciated during the reported period.

C) Financial statement readers cannot determine the depreciation expense for the reported period.

D) Financial statement readers can accurately estimate the effect an alternative depreciation method would have on income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

72

An impairment loss must be recognized when an asset's

A) book value is lower than its fair value

B) book value is higher than its fair value

C) present value is lower than its fair value

D) present value is higher than its fair value

A) book value is lower than its fair value

B) book value is higher than its fair value

C) present value is lower than its fair value

D) present value is higher than its fair value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

73

On July 9, 2013, March Company purchased an asset for $18,000. Marcus estimated a four-year life and no salvage value. Marcus uses sum-of-the-years'-digits depreciation to the nearest whole month. Depreciation expense for 2016 will be

A) $1,800

B) $2,700

C) $3,600

D) $4,500

A) $1,800

B) $2,700

C) $3,600

D) $4,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

74

Redeau Company has been depreciating certain assets using the straight-line method. At the beginning of the current year, the company changed to the sum-of-the-years'-digits method to depreciate these assets. Which of the following statements regarding this change is true?

A) The change should be accounted for prospectively.

B) The change should be accounted for with an adjustment of the accumulated depreciation and the retained earnings balances.

C) The change should be accounted for by including the cumulative effect of the change in the current year's income statement.

D) The accounting impact of the change is limited to the difference in current-year depreciation on the affected assets.

A) The change should be accounted for prospectively.

B) The change should be accounted for with an adjustment of the accumulated depreciation and the retained earnings balances.

C) The change should be accounted for by including the cumulative effect of the change in the current year's income statement.

D) The accounting impact of the change is limited to the difference in current-year depreciation on the affected assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

75

The Bourbon Street Ice Cream Company discovers that depreciation expense was overstated last year. How should this discovery be reported in the current year?

A) as a reduction in the current year's depreciation expense

B) as an increase to the retained earnings beginning balance

C) as a miscellaneous item in the Other Revenue/Expense section of the income statement

D) as a footnote only to the current year's financial statements

A) as a reduction in the current year's depreciation expense

B) as an increase to the retained earnings beginning balance

C) as a miscellaneous item in the Other Revenue/Expense section of the income statement

D) as a footnote only to the current year's financial statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

76

On June 15, 2015, Jupiter Corporation purchased a machine for $50,000 with an estimated useful life of six years and a residual value of $8,000. The company uses units-of-production depreciation and estimates the machine will last 300,000 units. The machine made 15,000 units in 2015 and 45,000 units in 2016. The accumulated depreciation balance on December 31, 2016, after the adjusting entries have been posted should be

A) $ 8,400

B) $10,000

C) $11,200

D) $13,333

A) $ 8,400

B) $10,000

C) $11,200

D) $13,333

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

77

Exhibit 11-2 Browning purchased a business copier for $4,500 on August 3, 2014. It has an estimated residual value of $500 and an expected service life of five years. Browning uses double-declining-balance depreciation computed to the nearest whole month.

Refer to Exhibit 11-2. The accumulated depreciation balance at December 31, 2015, should be

A) $1,750

B) $2,000

C) $2,250

D) $2,340

Refer to Exhibit 11-2. The accumulated depreciation balance at December 31, 2015, should be

A) $1,750

B) $2,000

C) $2,250

D) $2,340

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

78

When conducting an impairment test, a company must estimate

A) future cash inflows from its use of the asset and eventual sale

B) future net cash flows from its use of the asset and eventual sale

C) total net flows from its use of the asset and eventual sale

D) total cash from its use of the asset and eventual sale

A) future cash inflows from its use of the asset and eventual sale

B) future net cash flows from its use of the asset and eventual sale

C) total net flows from its use of the asset and eventual sale

D) total cash from its use of the asset and eventual sale

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

79

Wayne Co. purchased $40,000 of equipment with a salvage value of $5,000 and a useful life of nine years on August 15, 2014. If the company used sum-of-the-years'-digits depreciation computed to the nearest whole year, depreciation expense for 2015 was

A) $6,222

B) $7,000

C) $7,111

D) $8,000

A) $6,222

B) $7,000

C) $7,111

D) $8,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

80

Bagby Co. purchased a new car for $36,000 on June 1, 2014, with a useful life of eight years and a residual value of $4,800. If the company used double-declining-balance depreciation computed to the nearest whole year, depreciation expense for 2015 was

A) $6,750.00

B) $7,687.50

C) $5,250.00

D) $5,850.00

A) $6,750.00

B) $7,687.50

C) $5,250.00

D) $5,850.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck