Deck 12: Differential Analysis and Product Pricing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/99

العب

ملء الشاشة (f)

Deck 12: Differential Analysis and Product Pricing

1

If the total unit cost of manufacturing Product Y is currently $40 and the total unit cost after modifying the style is estimated to be $48, the differential cost for this situation is $8.

True

2

Hill Co. can further process Product O to produce Product P. Product O is currently selling for $65 per pound and costs $42 per pound to produce. Product P would sell for $82 per pound and would require an additional cost of $13 per pound to produce. The differential revenue of producing Product P is $82 per pound.

False

3

Eliminating a product or segment will usually eliminates all of the product's or segment's variable costs.

True

4

Hill Co. can further process Product O to produce Product P. Product O is currently selling for $65 per pound and costs $42 per pound to produce. Product P would sell for $82 per pound and would require an additional cost of $13 per pound to produce. The differential revenue of producing Product P is $17 per pound.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

5

A cost that will not be affected by later decisions is termed an opportunity cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

6

A cost that will not be affected by later decisions is termed as sunk cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

7

In addition to the differential costs in an equipment replacement decision, the difference between the remaining useful life of the old equipment and the estimated life of the new equipment is an important consideration.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

8

Hill Co. can further process Product O to produce Product P. Product O is currently selling for $60 per pound and costs $42 per pound to produce. Product P would sell for $82 per pound and would require an additional cost of $13 per pound to produce. The differential cost of producing Product P is $13 per pound.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

9

When evaluating whether to lease or sell an equipment, book value is considered to be the cost of selling the equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

10

When eliminating a product or segment of a business, the fixed costs pertaining to the product or segment will always be eliminated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

11

When deciding to make or buy a part needed for the manufacturing process, management needs to consider whether the plant has excess production capacity available to make the part or if current production will need to be interrupted to manufacture the part.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

12

Opportunity cost is the amount of increase or decrease in revenue that would result from the best available alternative to the proposed use of cash or its equivalent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

13

Hill Co. can further process Product O to produce Product P. Product O is currently selling for $65 per pound and costs $42 per pound to produce. Product P would sell for $82 per pound and would require an additional cost of $13 per pound to produce. The differential cost of producing Product P is $55 per pound.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

14

When a product or segment of a business is determined to be generating a loss, the total income from operations for the company will always increase if management eliminates the product or segment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

15

Differential revenue is the amount of income that would result from the best available alternative for the proposed use of cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

16

Differential revenue is the amount of increase or decrease in revenue expected from a particular course of action as compared to an alternative.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

17

If the total unit cost of manufacturing Product Y is currently $40 and the total unit cost after modifying the style is estimated to be $48, the differential cost for this situation is $48.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

18

When evaluating whether to lease or sell equipment, the book value of the equipment is considered to be a sunk cost and not a differential cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

19

Differential analysis can aid management in making decisions on a variety of alternatives, including whether to discontinue an unprofitable segment and whether to replace fixed assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

20

The revenue that is forgone from an alternative use of an asset, such as cash, is called an opportunity cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

21

In using the variable cost concept of applying the cost-plus approach to product pricing, variable manufacturing costs and variable selling and administrative expenses must be covered by the markup.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

22

When choosing whether or not to replace an equipment, the analysis normally focuses on the costs of continuing to use the old equipment versus replacing the equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

23

In using the product cost concept of applying the cost-plus approach to product pricing, selling expenses, administrative expenses, and profit are covered in the markup.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

24

When standard costs are used in applying the cost-plus approach to product pricing, the standards should be based upon normal levels of performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

25

In deciding whether to accept business at a special price when the company is operating below full capacity, the special price should be set high enough to cover both the fixed and variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

26

In using the variable cost concept of applying the cost-plus approach to product pricing, fixed manufacturing costs and fixed selling and administrative expenses must be covered by the markup.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

27

In deciding whether to accept business at a special price when the company is operating at full capacity, the special price should be set high enough to cover all fixed and variable costs and expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

28

Venus Co. can further process Product X to produce Product Y. Product X is currently selling for $18 per pound and costs $12.50 per pound to produce. Product Y would sell for $32 per pound and would require an additional cost of $8.75 per pound to produce. Based on the information provided for Venus Co., what is the differential revenue of producing Product Y?

A) $14 per pound

B) $8.75 per pound

C) $7 per pound

D) $5.25 per pound

A) $14 per pound

B) $8.75 per pound

C) $7 per pound

D) $5.25 per pound

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

29

Venus Co. can further process Product X to produce Product Y. Product X is currently selling for $18 per pound and costs $12.50 per pound to produce. Product Y would sell for $32 per pound and would require an additional cost of $8.75 per pound to produce. Based on the information provided for Venus Co., what is the differential cost of producing Product Y?

A) $32 per pound

B) $12.50 per pound

C) $14 per pound

D) $8.75 per pound

A) $32 per pound

B) $12.50 per pound

C) $14 per pound

D) $8.75 per pound

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

30

When choosing whether or not to replace a fixed asset, management will consider the price at which the asset can be sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

31

When standard costs are used in applying the cost-plus approach to product pricing, the standards should be based upon ideal levels of performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

32

The product cost concept includes all manufacturing costs in the cost amount to which the markup is added to determine product price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

33

In using the total cost concept of applying the cost-plus approach to product pricing, only profit is covered in the markup.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

34

A practical approach that is frequently used by managers when setting normal selling price is the cost-plus approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

35

The theory of constraints is a manufacturing strategy that focuses on reducing the influence of bottlenecks on production processes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

36

The product cost concept includes the selling and administrative expenses in the cost amount to which the markup is added to determine product price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

37

The total cost concept includes all manufacturing costs minus selling and administrative expenses in the total cost amount to which the markup is added to determine the product price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

38

The product with the highest contribution margin per scarce resource is the most profitable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

39

The amount of increase or decrease in revenue that is expected from a particular course of action as compared with an alternative is termed:

A) manufacturing margin.

B) contribution margin.

C) differential cost.

D) differential revenue.

A) manufacturing margin.

B) contribution margin.

C) differential cost.

D) differential revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

40

Manufacturers must conform to the Robinson-Patman Act, which prohibits price discrimination within the United States unless differences in prices can be justified by different costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

41

Assume that Marlow Co. is considering disposing of equipment that cost $200,000 and has $160,000 of accumulated depreciation to date. Marlow Co. can sell the equipment through a broker for $100,000 less 5% commission. Alternatively, Minton Co. has offered to lease the equipment for five years for a total of $195,000. Marlow will incur repair, insurance, and property tax expenses estimated at $40,000. At lease-end, the equipment is expected to have no residual value. The net differential income from the lease alternative is:

A) $55,000.

B) $20,000.

C) $100,000.

D) $60,000.

A) $55,000.

B) $20,000.

C) $100,000.

D) $60,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

42

Dinkins Inc. is considering disposing of a machine with a book value of $50,000 and an estimated remaining life of five years. The old machine can be sold for $15,000. A new machine with a purchase price of $150,000 is being considered as a replacement. It will have a useful life of five years and no residual value. It is estimated that variable manufacturing costs will be reduced from $70,000 to $45,000 if the new machine is purchased. The net differential increase or decrease in cost for the entire five years for the new equipment is:

A) $10,000 increase.

B) $25,000 decrease.

C) $10,000 decrease.

D) $25,000 increase.

A) $10,000 increase.

B) $25,000 decrease.

C) $10,000 decrease.

D) $25,000 increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

43

A business is considering a cash outlay of $500,000 for the purchase of land, which it intends to lease for $90,000 per year. If alternative investments are available that yield a 12% return, the opportunity cost of the purchase of the land is:

A) $60,000.

B) $49,200.

C) $90,000.

D) $30,000.

A) $60,000.

B) $49,200.

C) $90,000.

D) $30,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

44

Relevant revenues and costs focus on:

A) activities that occurred in the past.

B) monies already earned and/or spent.

C) last year's net income.

D) differences between the alternatives being considered.

A) activities that occurred in the past.

B) monies already earned and/or spent.

C) last year's net income.

D) differences between the alternatives being considered.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

45

A cost that will not be affected by later decisions is termed:

A) historical cost.

B) differential cost.

C) sunk cost.

D) replacement cost.

A) historical cost.

B) differential cost.

C) sunk cost.

D) replacement cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

46

The amount of increase or decrease in cost that is expected from a particular course of action as compared to an alternative is termed:

A) period cost.

B) product cost.

C) differential cost.

D) discretionary cost.

A) period cost.

B) product cost.

C) differential cost.

D) discretionary cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

47

Max, Inc. can sell a large piece of machinery for $90,000. The machinery originally cost $240,000 and has accumulated depreciation of $130,000. Max will have to pay a 5% sales commission on the sale. Rather than sell, Max is considering leasing the machine. It can be leased for 4 years for $24,000 per year. Max has estimated future operating expenses to be $3,000 per year, and Max will be responsible for those expenses. Which of the following options most accurately describes the analysis and decision for Max?

A) Lease - because differential revenues are $6,000 if Max leases rather than sells

B) Lease - because Max will lose $20,000 if it sells the equipment for less than its $110,000 book value

C) Sell - because differential income of selling rather than leasing is $6,000

D) Sell - because differential income is $1,500 if Max sells rather than leases

A) Lease - because differential revenues are $6,000 if Max leases rather than sells

B) Lease - because Max will lose $20,000 if it sells the equipment for less than its $110,000 book value

C) Sell - because differential income of selling rather than leasing is $6,000

D) Sell - because differential income is $1,500 if Max sells rather than leases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

48

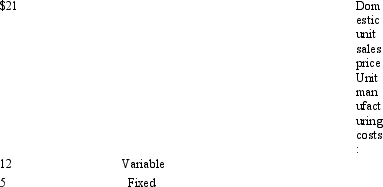

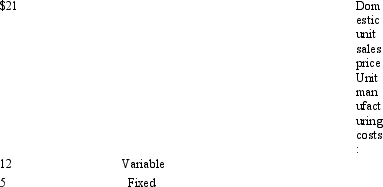

A business received an offer from an exporter for 5,000 units of product at $10 per unit. The acceptance of the offer will not affect normal production or domestic sales prices. The following data are available:

Based on the above data, what is the differential revenue from the acceptance of the offer?

A) $45,000

B) $40,000

C) $50,000

D) $60,000

Based on the above data, what is the differential revenue from the acceptance of the offer?

A) $45,000

B) $40,000

C) $50,000

D) $60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

49

A business is considering a cash outlay of $200,000 for the purchase of land, which it could lease for $35,000 per year. If alternative investments are available that yield an 18% return, the opportunity cost of the purchase of the land is:

A) $35,000.

B) $36,000.

C) $1,000.

D) $37,000.

A) $35,000.

B) $36,000.

C) $1,000.

D) $37,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

50

A business received an offer from an exporter for 5,000 units of product at $10 per unit. The acceptance of the offer will not affect normal production or domestic sales prices. The following data are available:

Based on the above data, what is the differential cost from the acceptance of the offer?

A) $10,000

B) $40,000

C) $5,000

D) $45,000

Based on the above data, what is the differential cost from the acceptance of the offer?

A) $10,000

B) $40,000

C) $5,000

D) $45,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

51

Matthews Company is considering replacing equipment that originally cost $250,000 and that has $225,000 accumulated depreciation to date. A new machine will cost $500,000, and the old equipment can be sold for $6,000. What is the sunk cost in this situation?

A) $225,000

B) $25,000

C) $250,000

D) $0

A) $225,000

B) $25,000

C) $250,000

D) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

52

A business received an offer from an exporter for 5,000 units of product at $10 per unit. The acceptance of the offer will not affect normal production or domestic sales prices. The following data are available:

Based on the above data, what is the amount of gain or loss from acceptance of the offer?

A) $5,000 gain

B) $10,000 loss

C) $5,000 loss

D) $10,000 gain

Based on the above data, what is the amount of gain or loss from acceptance of the offer?

A) $5,000 gain

B) $10,000 loss

C) $5,000 loss

D) $10,000 gain

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

53

A business is considering a cash outlay of $250,000 for the purchase of land, which it intends to lease for $40,000 per year. If alternative investments are available that yield an 15% return, the opportunity cost of the purchase of the land is

A) $45,000.

B) $37,800.

C) $47,200.

D) $37,500.

A) $45,000.

B) $37,800.

C) $47,200.

D) $37,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

54

The amount of income that would result from an alternative use of cash is called:

A) differential income.

B) sunk cost.

C) differential revenue.

D) opportunity cost.

A) differential income.

B) sunk cost.

C) differential revenue.

D) opportunity cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

55

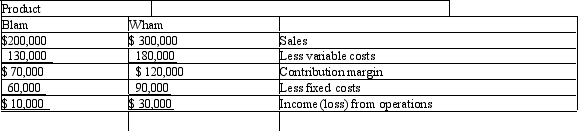

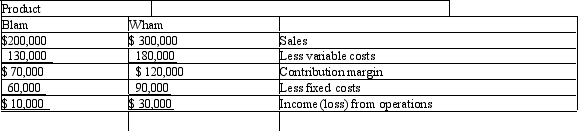

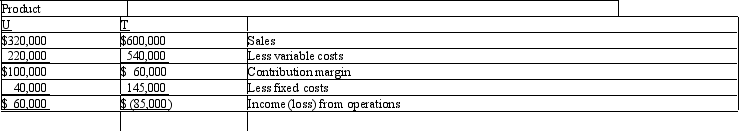

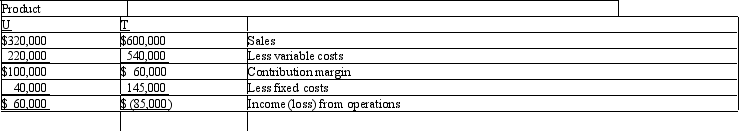

The condensed income statement for a business for the past year is as follows:  Management is considering the discontinuance of the manufacture and sale of Blam at the beginning of the current year. The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Wham. What is the amount of change in net income for the current year that will result from the discontinuance of Blam?

Management is considering the discontinuance of the manufacture and sale of Blam at the beginning of the current year. The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Wham. What is the amount of change in net income for the current year that will result from the discontinuance of Blam?

A) $10,000 decrease

B) $40,000 decrease

C) $10,000 increase

D) $70,000 decrease

Management is considering the discontinuance of the manufacture and sale of Blam at the beginning of the current year. The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Wham. What is the amount of change in net income for the current year that will result from the discontinuance of Blam?

Management is considering the discontinuance of the manufacture and sale of Blam at the beginning of the current year. The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Wham. What is the amount of change in net income for the current year that will result from the discontinuance of Blam?A) $10,000 decrease

B) $40,000 decrease

C) $10,000 increase

D) $70,000 decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

56

Whiteville Co. can further process Product B to produce Product

A) $30 per pound

B) $18 per pound

C) $17 per pound

C) Product B is currently selling for $45 per pound and costs $30 per pound to produce. Product C would sell for $80 per pound and would require an additional cost of $18 per pound to produce. What is the differential cost of producing Product C?

D) $12 per pound

A) $30 per pound

B) $18 per pound

C) $17 per pound

C) Product B is currently selling for $45 per pound and costs $30 per pound to produce. Product C would sell for $80 per pound and would require an additional cost of $18 per pound to produce. What is the differential cost of producing Product C?

D) $12 per pound

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

57

Frank Co. is currently operating at 80% of capacity and is currently purchasing a part used in its manufacturing operations for $25 unit. The unit cost for Frank Co. to make the part is $30, which includes $3 of fixed costs. If 20,000 units of the part are normally purchased each year but could be manufactured using unused capacity, what would be the amount of differential cost increase or decrease for making the part rather than purchasing it?

A) $60,000 decrease

B) $40,000 decrease

C) $40,000 increase

D) $60,000 increase

A) $60,000 decrease

B) $40,000 decrease

C) $40,000 increase

D) $60,000 increase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

58

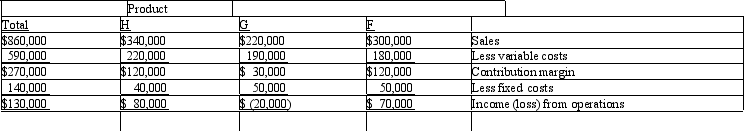

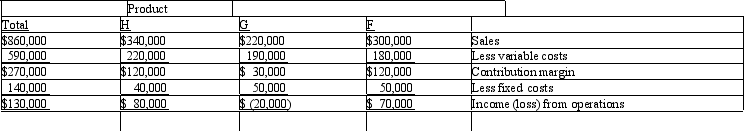

The condensed income statement for a business for the past year is presented as follows: Management is considering the discontinuance of the manufacture and sale of Product G at the beginning of the current year. The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Products F and H. What is the amount of change in net income for the current year that will result from the discontinuance of Product G?

A) $10,000 increase

B) $20,000 increase

C) $10,000 decrease

D) $20,000 decrease

A) $10,000 increase

B) $20,000 increase

C) $10,000 decrease

D) $20,000 decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

59

Paul's Delivery Service is considering selling one of its smaller trucks that is no longer needed in the business. The truck originally costed $23,000 and has accumulated depreciation of $10,000. The truck can be sold for $14,000. Another company is interested in leasing the truck. It will pay $4,800 per year for three years. Paul's Delivery Service will continue to pay the taxes and license fees for the truck, but all other expenses will be paid by the lessee. Management assumes the expenses for the taxes and license will be $300 per year. Which of the following statements is correct?

A) Paul's Delivery Service should sell the truck because the differential loss from leasing is $500.

B) Paul's Delivery Service should lease the truck because the differential income from leasing is $12,200.

C) Paul's Delivery Service should lease the truck because the differential income from leasing is $300.

D) Paul's Delivery Service is indifferent as to whether the company should lease or sell the truck because there is no differential income or loss between the alternatives.

A) Paul's Delivery Service should sell the truck because the differential loss from leasing is $500.

B) Paul's Delivery Service should lease the truck because the differential income from leasing is $12,200.

C) Paul's Delivery Service should lease the truck because the differential income from leasing is $300.

D) Paul's Delivery Service is indifferent as to whether the company should lease or sell the truck because there is no differential income or loss between the alternatives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

60

The condensed income statement for a business for the past year is presented as follows:  Management is considering the discontinuance of the manufacture and sale of Product G at the beginning of the current year. The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Products F and H. What is the amount of change in net income for the current year that will result from the discontinuance of Product G?

Management is considering the discontinuance of the manufacture and sale of Product G at the beginning of the current year. The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Products F and H. What is the amount of change in net income for the current year that will result from the discontinuance of Product G?

A) $30,000 decrease

B) $30,000 increase

C) $20,000 decrease

D) $20,000 increase

Management is considering the discontinuance of the manufacture and sale of Product G at the beginning of the current year. The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Products F and H. What is the amount of change in net income for the current year that will result from the discontinuance of Product G?

Management is considering the discontinuance of the manufacture and sale of Product G at the beginning of the current year. The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Products F and H. What is the amount of change in net income for the current year that will result from the discontinuance of Product G?A) $30,000 decrease

B) $30,000 increase

C) $20,000 decrease

D) $20,000 increase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

61

A business is considering a cash outlay of $500,000 for the purchase of land, which it could lease for $40,000 per year. If alternative investments are available that yield a 21% return, the opportunity cost of the purchase of the land is:

A) $105,000.

B) $40,000.

C) $65,000.

D) $8,400.

A) $105,000.

B) $40,000.

C) $65,000.

D) $8,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

62

In using the total cost concept of applying the cost-plus approach to product pricing, what is included in the cost amount to which the markup is added?

A) Total selling and administrative expenses plus desired profit

B) Total fixed manufacturing costs, total fixed selling and administrative expenses, and desired profit

C) Total costs of manufacturing a product plus selling and administrative expenses

D) Total variable manufacturing costs, total variable selling and administrative expenses, and desired profit

A) Total selling and administrative expenses plus desired profit

B) Total fixed manufacturing costs, total fixed selling and administrative expenses, and desired profit

C) Total costs of manufacturing a product plus selling and administrative expenses

D) Total variable manufacturing costs, total variable selling and administrative expenses, and desired profit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

63

The condensed income statement for a business for the past year is as follows:  Management is considering the discontinuance of the manufacture and sale of Product T at the beginning of the current year. The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Product U. What is the amount of change in net income for the current year that will result from the discontinuance of Product T?

Management is considering the discontinuance of the manufacture and sale of Product T at the beginning of the current year. The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Product U. What is the amount of change in net income for the current year that will result from the discontinuance of Product T?

A) $60,000 increase

B) $85,000 increase

C) $85,000 decrease

D) $60,000 decrease

Management is considering the discontinuance of the manufacture and sale of Product T at the beginning of the current year. The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Product U. What is the amount of change in net income for the current year that will result from the discontinuance of Product T?

Management is considering the discontinuance of the manufacture and sale of Product T at the beginning of the current year. The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Product U. What is the amount of change in net income for the current year that will result from the discontinuance of Product T?A) $60,000 increase

B) $85,000 increase

C) $85,000 decrease

D) $60,000 decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

64

Granger Co. can further process Product B to produce Product

A) $15 per pound

B) $42 per pound

C) $45 per pound

C) Product B is currently selling for $55 per pound and costs $42 per pound to produce. Product C would sell for $82 per pound and would require an additional cost of $13 per pound to produce. What is the differential revenue of producing and selling Product C?

D) $27 per pound

A) $15 per pound

B) $42 per pound

C) $45 per pound

C) Product B is currently selling for $55 per pound and costs $42 per pound to produce. Product C would sell for $82 per pound and would require an additional cost of $13 per pound to produce. What is the differential revenue of producing and selling Product C?

D) $27 per pound

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

65

What pricing method is most likely to be used if there are several providers in the same market and there is sufficient demand for the product?

A) Demand-based method

B) Total cost method

C) Cost-plus method

D) Competition-based method

A) Demand-based method

B) Total cost method

C) Cost-plus method

D) Competition-based method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

66

Sanchez Company is considering replacing equipment that originally cost $300,000 and has $280,000 accumulated depreciation to date. A new machine will cost $450,000. What is the sunk cost in this situation?

A) $150,000

B) $280,000

C) $20,000

D) $300,000

A) $150,000

B) $280,000

C) $20,000

D) $300,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

67

Bythel Corporation uses the product cost concept of product pricing. Below is cost information for the production and sale of 45,000 units of its sole product. Bythel desires a profit equal to a 10.8% rate of return on invested assets of $900,000.

Refer to the information provided for Bythel Corporation. The markup percentage for the company's product is:

A) 21.0%.

B) 25.4%.

C) 15.7%.

D) 24.0%.

Refer to the information provided for Bythel Corporation. The markup percentage for the company's product is:

A) 21.0%.

B) 25.4%.

C) 15.7%.

D) 24.0%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

68

In using the variable cost concept of applying the cost-plus approach to product pricing, what is included in the markup?

A) Total costs plus desired profit

B) Desired profit

C) Total selling and administrative expenses plus desired profit

D) Total fixed manufacturing costs, total fixed selling and administrative expenses, and desired profit

A) Total costs plus desired profit

B) Desired profit

C) Total selling and administrative expenses plus desired profit

D) Total fixed manufacturing costs, total fixed selling and administrative expenses, and desired profit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

69

A practical approach that is frequently used by managers when setting normal selling price is the:

A) cost-plus approach.

B) economic theory approach.

C) price graph approach.

D) market price approach.

A) cost-plus approach.

B) economic theory approach.

C) price graph approach.

D) market price approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

70

A business is operating at 90% of capacity and is currently purchasing a part used in its manufacturing operations for $15 per unit. The unit cost for the business to make the part is $20, including fixed costs, and $12, not including fixed costs. If 30,000 units of the part are normally purchased during the year but could be manufactured using unused capacity, what would be the amount of differential cost increase or decrease from making the part rather than purchasing it?

A) $150,000 increase

B) $ 90,000 decrease

C) $150,000 decrease

D) $ 90,000 increase

A) $150,000 increase

B) $ 90,000 decrease

C) $150,000 decrease

D) $ 90,000 increase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

71

What cost concept used in applying the cost-plus approach to product pricing covers selling expenses, administrative expenses, and desired profit in the "markup"?

A) Total cost concept

B) Product cost concept

C) Variable cost concept

D) Sunk cost concept

A) Total cost concept

B) Product cost concept

C) Variable cost concept

D) Sunk cost concept

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following is not a cost concept commonly used in applying the cost-plus approach to product pricing?

A) Total cost concept

B) Product cost concept

C) Variable cost concept

D) Fixed cost concept

A) Total cost concept

B) Product cost concept

C) Variable cost concept

D) Fixed cost concept

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

73

Bythel Corporation uses the product cost concept of product pricing. Below is cost information for the production and sale of 45,000 units of its sole product. Bythel desires a profit equal to a 10.8% rate of return on invested assets of $900,000.

Refer to the information provided for Bythel Corporation. The dollar amount of desired profit from the production and sale of the company's product is:

A) $97,200.

B) $67,200.

C) $73,500.

D) $96,000.

Refer to the information provided for Bythel Corporation. The dollar amount of desired profit from the production and sale of the company's product is:

A) $97,200.

B) $67,200.

C) $73,500.

D) $96,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

74

Target costing is arrived at by:

A) taking the selling price and subtracting desired profit.

B) taking the selling price and adding desired profit.

C) taking the selling price and subtracting the budget standard cost.

D) taking the budget standard cost and reducing it by 10%.

A) taking the selling price and subtracting desired profit.

B) taking the selling price and adding desired profit.

C) taking the selling price and subtracting the budget standard cost.

D) taking the budget standard cost and reducing it by 10%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

75

A business received an offer from an exporter for 10,000 units of product at $13.50 per unit. The acceptance of the offer will not affect normal production or domestic sales prices. The following data are available:  What is the amount of the gain or loss from acceptance of the offer?

What is the amount of the gain or loss from acceptance of the offer?

A) $75,000 loss

B) $40,000 gain

C) $15,000 gain

D) $85,000 gain

What is the amount of the gain or loss from acceptance of the offer?

What is the amount of the gain or loss from acceptance of the offer?A) $75,000 loss

B) $40,000 gain

C) $15,000 gain

D) $85,000 gain

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

76

Nachos Co. can further process Product J to produce Product

A) $9 per pound

B) $14 per pound

C) $5 per pound

D) $3 per pound

D) Product J is currently selling for $12 per pound and costs $9 per pound to produce. Product D would sell for $20 per pound and would require an additional cost of $5 per pound to produce. What is the differential cost of producing Product D?

A) $9 per pound

B) $14 per pound

C) $5 per pound

D) $3 per pound

D) Product J is currently selling for $12 per pound and costs $9 per pound to produce. Product D would sell for $20 per pound and would require an additional cost of $5 per pound to produce. What is the differential cost of producing Product D?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

77

Bythel Corporation uses the product cost concept of product pricing. Below is cost information for the production and sale of 45,000 units of its sole product. Bythel desires a profit equal to a 10.8% rate of return on invested assets of $900,000.

Refer to the information provided for Bythel Corporation. The unit selling price for the company's product is:

A) $17.00.

B) $13.94.

C) $20.06.

D) $20.96.

Refer to the information provided for Bythel Corporation. The unit selling price for the company's product is:

A) $17.00.

B) $13.94.

C) $20.06.

D) $20.96.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

78

In using the total cost concept of applying the cost-plus approach to product pricing, what is included in the markup?

A) Total selling and administrative expenses plus desired profit

B) Total fixed manufacturing costs, total fixed selling and administrative expenses, and desired profit

C) Total costs plus desired profit

D) Desired profit

A) Total selling and administrative expenses plus desired profit

B) Total fixed manufacturing costs, total fixed selling and administrative expenses, and desired profit

C) Total costs plus desired profit

D) Desired profit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which equation better describes target costing?

A) Selling Price - Desired Profit = Target Costs

B) Selling Price - Target Variable Costs = Profit

C) Target Variable Costs + Net operating income = Selling Price

D) Target Variable Costs + Target Fixed Costs + Contribution margin = Selling Price

A) Selling Price - Desired Profit = Target Costs

B) Selling Price - Target Variable Costs = Profit

C) Target Variable Costs + Net operating income = Selling Price

D) Target Variable Costs + Target Fixed Costs + Contribution margin = Selling Price

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

80

What pricing method is used if all costs are considered and a fair markup is added to determine the selling price?

A) Total cost method

B) Demand-based method

C) Variable cost method

D) Markup method

A) Total cost method

B) Demand-based method

C) Variable cost method

D) Markup method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck