Deck 21: Incremental Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/119

العب

ملء الشاشة (f)

Deck 21: Incremental Analysis

1

In making a decision, management will look thoroughly at both relevant and irrelevant data.

False

2

A sunk cost is an expenditure that has proven to be nonproductive.

False

3

Maple syrup and pancakes are examples of joint products.

False

4

The term "out-of-pocket cost" is often used to describe costs which have not yet been incurred and which may vary among alternative courses of action.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

5

The split-off point is the point at which joint products can be separated into two or more products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

6

In determining whether to scrap or to rebuild defective units of product, the cost already incurred in producing the defective units is not relevant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

7

Differential analysis is a tool for evaluating alternative courses of action always resulting in higher profits for the organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

8

Opportunity costs are recorded in the accounting records.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

9

Sunk costs are relevant to decisions about replacing plant assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

10

A sunk cost is the benefit that could have been obtained by pursuing an alternate course of action.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

11

A decision to discontinue a given product on the basis of contribution margin data should include consideration of the probable impact of the discontinuance on the sales of other products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

12

Joint costs are the middle costs of a product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

13

When sales of one product contribute to the sales of another product they are called contribution products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

14

Incremental analysis rarely requires the decision maker to exercise judgment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

15

Identifying information relevant to a particular business decision requires an understanding of both quantitative and qualitative considerations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

16

Joint products are similar products that serve the same exact function.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

17

An opportunity cost is a relevant cost when making a business decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

18

Sunk costs may be defined as unavoidable future costs resulting from past decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

19

All incremental revenue or incremental costs are relevant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

20

Products resulting from a shared manufacturing process are referred to as complimentary products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

21

Even though costs, revenues, and other factors do not vary among possible courses of action, they may be relevant to a decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which factor is not relevant in deciding whether or not to accept a special order?

A) Incremental revenue that will be earned.

B) Additional costs that will be incurred.

C) The effect that the order will have on the company's regular sales volume and selling prices.

D) The average cost of production if the special order is accepted.

A) Incremental revenue that will be earned.

B) Additional costs that will be incurred.

C) The effect that the order will have on the company's regular sales volume and selling prices.

D) The average cost of production if the special order is accepted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

23

Assuming that the MR Corporation has an inventory of 200 defective motors costing $450,000 to produce and $150,000 to repair, if the company receives an offer to purchase these motors for $100,000, the company's decision should be to sell the motors at the offered price.

The $450,000 production costs are sunk costs and therefore irrelevant to the decision. The relevant costs are the repair costs of $150,000 compared to the offer to purchase for $100,000. Since the offer is less than the repair costs, the decision should be not to sell the motors at the offered price.

The $450,000 production costs are sunk costs and therefore irrelevant to the decision. The relevant costs are the repair costs of $150,000 compared to the offer to purchase for $100,000. Since the offer is less than the repair costs, the decision should be not to sell the motors at the offered price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

24

Assuming that the MR Corporation has an inventory of 200 defective motors costing $450,000 to produce and $150,000 to repair, if the company receives an offer to purchase these motors for $325,000 before repairing them, the company's decision should be to sell the motors at the offered price.

The $450,000 production costs are sunk costs and therefore irrelevant to the decision. The relevant costs are the repair costs of $150,000 compared to the offer to purchase for $325,000. Since the offer is more than the repair costs, the decision should be to sell the motors at the offered price.

The $450,000 production costs are sunk costs and therefore irrelevant to the decision. The relevant costs are the repair costs of $150,000 compared to the offer to purchase for $325,000. Since the offer is more than the repair costs, the decision should be to sell the motors at the offered price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

25

A cost that has already been incurred and cannot be changed is called a(n):

A) Opportunity cost.

B) Out-of-pocket cost.

C) Joint cost.

D) Sunk cost.

A) Opportunity cost.

B) Out-of-pocket cost.

C) Joint cost.

D) Sunk cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

26

By choosing to go into business for himself, Jim Lazar foregoes the possibility of getting a highly paid job with a large company. This is called a(n):

A) Sunk cost.

B) Out-of-pocket cost.

C) Opportunity cost.

D) Joint cost.

A) Sunk cost.

B) Out-of-pocket cost.

C) Opportunity cost.

D) Joint cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

27

Opportunity costs are irrelevant in decision making.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

28

Nonfinancial considerations are relevant in decision making.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

29

Differential costs are those that are the same among alternatives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

30

Costs that have not yet been incurred and that may vary among different courses of action are called:

A) Opportunity costs.

B) Out-of-pocket costs.

C) Joint costs.

D) Sunk costs.

A) Opportunity costs.

B) Out-of-pocket costs.

C) Joint costs.

D) Sunk costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

31

Incremental revenues:

A) Always increase revenue when one course of action is selected over another.

B) Always decrease revenue when one course of action is selected over another.

C) May increase or decrease when one course of action is selected over another.

D) Cause revenues to remain steady.

A) Always increase revenue when one course of action is selected over another.

B) Always decrease revenue when one course of action is selected over another.

C) May increase or decrease when one course of action is selected over another.

D) Cause revenues to remain steady.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following types of cost are always relevant to a decision?

A) Sunk costs.

B) Average costs.

C) Incremental costs.

D) Fixed costs.

A) Sunk costs.

B) Average costs.

C) Incremental costs.

D) Fixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

33

Sunk costs have already been incurred and cannot be changed by future actions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

34

Direct material costs are always considered relevant costs in a make or buy decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

35

After January 1, 2009, in order to be consistent with IASB Standards, U.S. GAAP now requires that borrowing costs on assets that require a substantial period to bring them to a marketable condition be expensed immediately.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which is an example of joint products?

A) Sugar and beef.

B) Pens and erasers.

C) Granulated coal and methyl alcohol.

D) Iron and plastic.

A) Sugar and beef.

B) Pens and erasers.

C) Granulated coal and methyl alcohol.

D) Iron and plastic.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

37

The most common method to allocate joint costs is in proportion to the relative sales value of the products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

38

Sunk costs are relevant costs when considering a special order.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

39

Incremental revenue is relevant in decision making.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

40

In deciding whether or not to accept a special order, what is the opportunity cost of using machinery for which the firm has sufficient excess capacity to accept the order?

A) The historical cost of the machinery.

B) The undepreciated cost of the machinery.

C) The same machinery cost allocated to regular production orders.

D) Zero.

A) The historical cost of the machinery.

B) The undepreciated cost of the machinery.

C) The same machinery cost allocated to regular production orders.

D) Zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

41

In deciding whether to rework the tables or sell them as is, management should:

A) Compare the $305,000 proceeds from the sale of the tables as is, with the $355,000 cost of the tables.

B) Compare the $605,000 possible revenue from refinished tables with the total cost of $355,000 plus $315,000 to refinish.

C) Compare the $315,000 cost to refinish the tables with the incremental revenue of $300,000 if the tables are refinished.

D) Eliminate any alternative that results in a loss on the sale of the product.

A) Compare the $305,000 proceeds from the sale of the tables as is, with the $355,000 cost of the tables.

B) Compare the $605,000 possible revenue from refinished tables with the total cost of $355,000 plus $315,000 to refinish.

C) Compare the $315,000 cost to refinish the tables with the incremental revenue of $300,000 if the tables are refinished.

D) Eliminate any alternative that results in a loss on the sale of the product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following is not a relevant factor in Burns' decision concerning whether to accept the special order from Allen?

A) The opportunity cost involved in accepting Allen's order.

B) The incremental cost of manufacturing an additional 5,000 saws per month.

C) The $65 average cost per unit to manufacture a power saw.

D) Where and at what price Allen intends to sell the saws.

A) The opportunity cost involved in accepting Allen's order.

B) The incremental cost of manufacturing an additional 5,000 saws per month.

C) The $65 average cost per unit to manufacture a power saw.

D) Where and at what price Allen intends to sell the saws.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

43

Assume that Allen Distributors offers to purchase the additional 5,000 saws at a price of $47 per unit. If Burns accepts this price, Burns' monthly gross profit on sales of power saws will:

A) Increase by $35,000.

B) Increase by $185,000.

C) Decrease by $40,000.

D) Decrease by $240,000.

A) Increase by $35,000.

B) Increase by $185,000.

C) Decrease by $40,000.

D) Decrease by $240,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

44

Using an incremental analysis approach, Burns should consider accepting this special order only if the price per unit offered by Allen is at least:

A) $20.

B) $50.

C) $80.

D) $40.

A) $20.

B) $50.

C) $80.

D) $40.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

45

Products for which sales of one contribute to the sales of another are called:

A) Complementary products.

B) Competing products.

C) Contributory products.

D) Codependent products.

A) Complementary products.

B) Competing products.

C) Contributory products.

D) Codependent products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following would be an example of a sunk cost?

A) The cost of a new oil burner that replaced a destroyed one.

B) The cost of an old inefficient oil burner that will be replaced by a more modern and efficient one.

C) Depreciation expense.

D) Lost revenue from a bad debt.

A) The cost of a new oil burner that replaced a destroyed one.

B) The cost of an old inefficient oil burner that will be replaced by a more modern and efficient one.

C) Depreciation expense.

D) Lost revenue from a bad debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

47

The cost of draining sap out of a maple tree to manufacture maple syrup and maple sugar is an example of:

A) After-split-off costs.

B) Sunk costs.

C) Incremental costs.

D) Joint costs.

A) After-split-off costs.

B) Sunk costs.

C) Incremental costs.

D) Joint costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which cost is not relevant in making financial decisions?

A) Sunk costs.

B) Opportunity costs.

C) Incremental costs.

D) All three are relevant.

A) Sunk costs.

B) Opportunity costs.

C) Incremental costs.

D) All three are relevant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

49

Mell Co. manufactured 100 personal computers at a cost of $30,000. It can sell them as is for $65,000, or install hard disks in them and sell them for $105,000. The $30,000 original manufacturing cost is:

A) An out-of-pocket cost because it has already been paid.

B) A sunk cost because it is not relevant to the decision.

C) An incremental cost because it is relevant to the decision.

D) A fixed cost because it will remain the same no matter which action is taken.

A) An out-of-pocket cost because it has already been paid.

B) A sunk cost because it is not relevant to the decision.

C) An incremental cost because it is relevant to the decision.

D) A fixed cost because it will remain the same no matter which action is taken.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

50

Products which emerge from a shared manufacturing process are referred to as:

A) Complementary products.

B) Joint products.

C) Contributory products.

D) Codependent products.

A) Complementary products.

B) Joint products.

C) Contributory products.

D) Codependent products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

51

Incremental costs can be defined as:

A) Costs that are expected to increase regardless of the course of action chosen.

B) The differences between costs incurred under alternative courses of action.

C) Costs incurred in the past.

D) Costs that are irrelevant in decision making.

A) Costs that are expected to increase regardless of the course of action chosen.

B) The differences between costs incurred under alternative courses of action.

C) Costs incurred in the past.

D) Costs that are irrelevant in decision making.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

52

The Magic Microbrewery has a limited amount of vat capacity available in which it can ferment beer. In deciding which beers to brew, Magic management should consider:

A) The contribution margins of the individual beers.

B) The unit contribution margins of the individual beers.

C) The contribution margin ratios of the individual beers.

D) The contribution margin per unit of vat capacity of the individual beers.

A) The contribution margins of the individual beers.

B) The unit contribution margins of the individual beers.

C) The contribution margin ratios of the individual beers.

D) The contribution margin per unit of vat capacity of the individual beers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

53

Perfect Plumbing Corporation currently manufactures a valve for use in water pumps that it produces for sale. The company is considering purchasing the valves from an outside supplier rather than manufacturing them. Which of the following costs is not relevant to the decision?

A) The cost of direct material required to make the valve.

B) The price charged by the outside supplier for an identical valve.

C) The cost of the machinery owned by Perfect Plumbing used exclusively to manufacture this valve.

D) The salvage value of the machinery owned by Perfect Plumbing used exclusively to manufacture this valve.

A) The cost of direct material required to make the valve.

B) The price charged by the outside supplier for an identical valve.

C) The cost of the machinery owned by Perfect Plumbing used exclusively to manufacture this valve.

D) The salvage value of the machinery owned by Perfect Plumbing used exclusively to manufacture this valve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

54

If Joan Reid's order is rejected, what will be John Boyd 's average unit cost of manufacturing each motor?

A) $68.

B) $70.

C) $96.

D) Some other amount.

A) $68.

B) $70.

C) $96.

D) Some other amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

55

Burns decides to accept the special order for 5,000 units from Allen at a unit sales price that will add $100,000 per month to its operating income. The unit price Burns is charging Allen is:

A) $20.80.

B) $60.00.

C) $62.50.

D) $55.00.

A) $20.80.

B) $60.00.

C) $62.50.

D) $55.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

56

Assuming John Boyd wants to earn a pretax profit of $10,000 on this special order, what price must it charge Joan Reid?

A) $69.

B) $83.

C) $95.

D) Some other amount.

A) $69.

B) $83.

C) $95.

D) Some other amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

57

What is the incremental cost of producing each additional motor?

A) $29.

B) $69.

C) $95.

D) Some other amount.

A) $29.

B) $69.

C) $95.

D) Some other amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

58

Accepting a special order is profitable whenever the revenue from the special order exceeds:

A) The average unit cost of production multiplied by the number of units in the order.

B) The incremental cost of producing the order.

C) The materials and direct labor costs of producing the order.

D) The fixed manufacturing costs for the period.

A) The average unit cost of production multiplied by the number of units in the order.

B) The incremental cost of producing the order.

C) The materials and direct labor costs of producing the order.

D) The fixed manufacturing costs for the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

59

Sunk costs:

A) Have already been incurred as a result of past actions.

B) Vary among the alternative courses of action being considered.

C) Are benefits that could have been obtained by following another course of action.

D) Result from unfavorable cost variances.

A) Have already been incurred as a result of past actions.

B) Vary among the alternative courses of action being considered.

C) Are benefits that could have been obtained by following another course of action.

D) Result from unfavorable cost variances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following is not relevant to management's decision regarding refinishing the tables or selling them as is?

A) The additional $300,000 revenue that can be generated if the tables are refinished.

B) The $355,000 manufacturing cost of the tables already incurred.

C) The additional $315,000 cost to refinish the tables.

D) The effect of selling "seconds" on Fancy's reputation as a fine-furniture manufacturer.

A) The additional $300,000 revenue that can be generated if the tables are refinished.

B) The $355,000 manufacturing cost of the tables already incurred.

C) The additional $315,000 cost to refinish the tables.

D) The effect of selling "seconds" on Fancy's reputation as a fine-furniture manufacturer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

61

Joint costs allocated to product B1 total:

A) $8,800.

B) $13,200.

C) $13,500.

D) $22,000.

A) $8,800.

B) $13,200.

C) $13,500.

D) $22,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

62

Legendary Motors has 7,000 defective autos on hand which cost $12,880,000 to manufacture. Legendary can either sell these defective autos as scrap for $8,000 per auto, or spend an additional $18,320,000 on repairs and then sell them for $12,000 per unit. What is the net advantage to repair the autos?

A) $84,000,000.

B) $18,320,000.

C) $9,680,000.

D) $56,000,000.

A) $84,000,000.

B) $18,320,000.

C) $9,680,000.

D) $56,000,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

63

Seidman Company manufactures and sells 30,000 units of product X per month. Each unit of product X sells for $16 and has a contribution margin of $7. If product X is discontinued, $85,000 in fixed monthly overhead costs would be eliminated and there would be no effect on the sales volume of Seidman Company's other products. If product X is discontinued, Seidman Company's monthly income before taxes should:

A) Increase by $210,000.

B) Increase by $125,000.

C) Decrease by $210,000.

D) Decrease by $125,000.

A) Increase by $210,000.

B) Increase by $125,000.

C) Decrease by $210,000.

D) Decrease by $125,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

64

If Creative Corporation has a limited supply of wood available, which products should it produce?

A) Royal only.

B) Classic and royal.

C) Royal and standard.

D) Classic only.

A) Royal only.

B) Classic and royal.

C) Royal and standard.

D) Classic only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

65

Joint costs allocated to product A1 total:

A) $8,800.

B) $13,500.

C) $13,200.

D) $22,000.

A) $8,800.

B) $13,500.

C) $13,200.

D) $22,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following statements is false regarding the defective units?

A) BT&T will not recover its costs if it sells the defective units as scrap.

B) BT&T will recover its costs if it reworks the defective units.

C) BT&T will not recover its costs if it reworks the defective units.

D) BT&T will recover more of its costs if it decides to rework the defective units.

A) BT&T will not recover its costs if it sells the defective units as scrap.

B) BT&T will recover its costs if it reworks the defective units.

C) BT&T will not recover its costs if it reworks the defective units.

D) BT&T will recover more of its costs if it decides to rework the defective units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

67

On the basis of the above information only, which of the following is not true?

A) At the 5,000-unit level of production, JCN's average cost per unit is $54.20.

B) At the 6,000-unit level of production, JCN's average cost per unit is $49.33.

C) It would not be profitable for JCN to consider the special order at a price less than $49 per unit.

D) Neither the fixed manufacturing costs of $146,000 nor the variable manufacturing costs of $25 per unit is relevant to this decision regarding the special order.

A) At the 5,000-unit level of production, JCN's average cost per unit is $54.20.

B) At the 6,000-unit level of production, JCN's average cost per unit is $49.33.

C) It would not be profitable for JCN to consider the special order at a price less than $49 per unit.

D) Neither the fixed manufacturing costs of $146,000 nor the variable manufacturing costs of $25 per unit is relevant to this decision regarding the special order.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

68

The Fine Point Company currently produces all of the components for its one product; an electric pencil sharpener. The unit cost of manufacturing the motor for this pencil sharpener is: The company is considering the possibility of buying this motor from a subcontractor and has been quoted a price of $3.60 per unit. The relevant cost of manufacturing the motor to be considered in reaching the decision is:

A) $4.75.

B) $4.15.

C) $3.55.

D) $4.05.

A) $4.75.

B) $4.15.

C) $3.55.

D) $4.05.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

69

If Creative Corporation has only 250,000 square yards of wood available, what is the highest total amount of fixed cost the company can incur and still break-even?

A) $2,500,000.

B) $4,000,000.

C) $5,000,000.

D) $6,000,000.

A) $2,500,000.

B) $4,000,000.

C) $5,000,000.

D) $6,000,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

70

Aircraft Products, a manufacturer of aircraft landing gear, makes 1,000 units each year of a special valve used in assembling one of its products. The unit cost of producing this valve includes variable costs of $70 and fixed costs of $60. The valves could be purchased from an outside supplier at $77 each. If the valve were purchased from the outside supplier, 40% of the total fixed costs incurred in producing this valve could be eliminated. Buying the valves from the outside supplier instead of making them would cause the company's operating income to:

A) Increase by $26,000.

B) Increase by $17,000.

C) Decrease by $9,000.

D) Decrease by $29,000.

A) Increase by $26,000.

B) Increase by $17,000.

C) Decrease by $9,000.

D) Decrease by $29,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

71

If BT&T reworks the defective telephones, by how much will its operating income change?

A) Increase by $500.

B) Decrease by $1,600.

C) Increase by $5,500.

D) Decrease by $6,500.

A) Increase by $500.

B) Decrease by $1,600.

C) Increase by $5,500.

D) Decrease by $6,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

72

The net change in operating income resulting from a decision to manufacture product B2 is:

A) $6,000 (decrease).

B) $16,000 (decrease).

C) $48,000 (decrease).

D) $48,000 (increase).

A) $6,000 (decrease).

B) $16,000 (decrease).

C) $48,000 (decrease).

D) $48,000 (increase).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

73

Assume that Perry's fixed costs remain unchanged if the seats are purchased from an outside supplier. In order to operate more profitably by buying the seats rather than manufacturing them, Perry must negotiate a price per unit from the outside supplier that is less than:

A) $27.

B) $25.

C) $22.

D) $16.

A) $27.

B) $25.

C) $22.

D) $16.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

74

The net change in operating income resulting from a decision to manufacture product A2 is:

A) $15,000 (increase).

B) $15,000 (decrease).

C) $5,000 (increase).

D) $45,000 (increase).

A) $15,000 (increase).

B) $15,000 (decrease).

C) $5,000 (increase).

D) $45,000 (increase).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

75

If Creative Corporation has an unlimited supply of wood available, which products should it produce?

A) Royal only.

B) Classic and royal.

C) Royal and standard.

D) Classic only.

A) Royal only.

B) Classic and royal.

C) Royal and standard.

D) Classic only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

76

Assume that the price offered by the foreign company is $43 per unit. Accepting the special order will cause JCN's operating income to:

A) Increase by $18,000.

B) Decrease by $2,000.

C) Decrease by $33,000.

D) Decrease by $35,000.

A) Increase by $18,000.

B) Decrease by $2,000.

C) Decrease by $33,000.

D) Decrease by $35,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

77

Assume that seats can be purchased from the outside supplier at $25 each, and that 60% of total fixed costs incurred in producing TushSeat will be eliminated by this strategy. Buying the seats instead of manufacturing them would cause Perry's operating income to:

A) Decrease by $20,000.

B) Increase by $36,000.

C) Increase by $16,000.

D) Decrease by $24,000.

A) Decrease by $20,000.

B) Increase by $36,000.

C) Increase by $16,000.

D) Decrease by $24,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

78

What are the total relevant costs of keeping the old equipment?

A) $8,000.

B) $50,000.

C) $10,000.

D) $45,000.

A) $8,000.

B) $50,000.

C) $10,000.

D) $45,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the data above is a sunk cost?

A) The annual cost of operating the new equipment.

B) The annual cost of operating the old equipment.

C) The disposal value of the old equipment.

D) The original cost of the old equipment.

A) The annual cost of operating the new equipment.

B) The annual cost of operating the old equipment.

C) The disposal value of the old equipment.

D) The original cost of the old equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

80

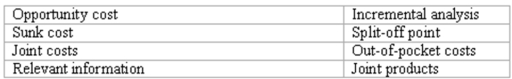

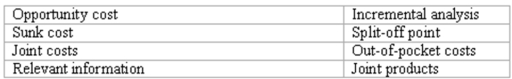

Accounting terminology

Listed below are eight technical accounting terms introduced or emphasized in this chapter:

Each of the following statements may (or may not) describe one of these technical terms. In the space provided beside each statement, indicate the accounting term described, or answer "None" if the statement does not correctly describe any of the terms. ______ (a) Data pertaining to future time periods which may vary among alternative courses of action. ______ (b) The point at which manufacturing costs are split between finished goods inventory and work in progress. ______ (c) The benefit foregone by pursuing one course of action over another. ______ (d) Products which emerge from common materials and shared production processes. ______ (e) A cost incurred in the past that will not change as a result of future actions. ______ (f) Costs yet to be incurred which are expected to vary under different courses of action. ______ (g) The examination of differences between future costs and revenue under varying courses of action.

Listed below are eight technical accounting terms introduced or emphasized in this chapter:

Each of the following statements may (or may not) describe one of these technical terms. In the space provided beside each statement, indicate the accounting term described, or answer "None" if the statement does not correctly describe any of the terms. ______ (a) Data pertaining to future time periods which may vary among alternative courses of action. ______ (b) The point at which manufacturing costs are split between finished goods inventory and work in progress. ______ (c) The benefit foregone by pursuing one course of action over another. ______ (d) Products which emerge from common materials and shared production processes. ______ (e) A cost incurred in the past that will not change as a result of future actions. ______ (f) Costs yet to be incurred which are expected to vary under different courses of action. ______ (g) The examination of differences between future costs and revenue under varying courses of action.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck