Deck 18: Process Costing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/103

العب

ملء الشاشة (f)

Deck 18: Process Costing

1

In a process costing system that uses equivalent full units of production, the per-unit cost of direct materials equals the total cost of materials used in the current month divided by the number of units completed and transferred during the current month.

False

2

Direct materials and overhead may also be referred to as conversion costs.

False

3

Manufacturing overhead is not applied to products when a process costing system is used.

False

4

Costs flow through a process costing system in the same sequence as actual products move through the assembly process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

5

Completing 3,000 units which were each 75% complete at the beginning of the period represents 2,250 equivalent full units of work during the current period.

If at the beginning of the period 3,000 units were 75% completed, then to complete these units during the current period, the equivalent units = 3,000 x (100% - 75%) = 750 equivalent full units.

If at the beginning of the period 3,000 units were 75% completed, then to complete these units during the current period, the equivalent units = 3,000 x (100% - 75%) = 750 equivalent full units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

6

As costs flow from one production department to the next in a process costing system, one Work-in-Process Inventory account shows all the changes to the units in production.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

7

The number of equivalent full units of production during a period may be greater than, equal to, or smaller than the actual number of units completed and transferred to the finished goods warehouse.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

8

As companies become more automated, overhead costs increase and direct labor costs decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

9

A process costing system is suitable for a company with a large volume of standard products produced on a relatively continuous basis, for example, golf balls or petroleum.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

10

Conversion costs include direct labor and overhead costs and direct materials associated with converting units so that they can be transferred out of Work-in-Process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

11

Process costing provides information on a total and per-unit bases as well as the per-unit cost of performing each step in the production process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

12

A process costing system is highly desirable when a company mass produces identical goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

13

In a production cost report, the units in beginning Work in Process are always expressed as equivalent units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

14

United Construction Company, which manufactures residential buildings, would most likely use a process costing system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

15

A company may choose to use process costing or job costing, but never both simultaneously.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

16

An equivalent unit measures the percentage of a completed unit's cost that is present in a partially finished unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

17

If there is no over- or underapplied overhead, equivalent units of production will equal the exact number of units actually produced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

18

In most process costing systems, the number of units "in process" at any one time is usually significant relative to the total production output of the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

19

Debiting Work in Process in Department Two and crediting Work in Process in Department One represents costs transferred from Department Two to Department One.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

20

Equivalent full units of production significantly differ from units completed and transferred during the period only when no significant differences exist between beginning and ending work in process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

21

The best cost system to use for a company producing a continuous stream of similar items would be a:

A) Job order system.

B) Process costing system.

C) Production costing system.

D) No cost system is required when jobs are similar.

A) Job order system.

B) Process costing system.

C) Production costing system.

D) No cost system is required when jobs are similar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

22

Process costing systems:

A) Are used when companies produce homogeneous units.

B) Does not have work-in-process accounts for each department.

C) Does not use equivalent units of production.

D) Track costs to individual products.

A) Are used when companies produce homogeneous units.

B) Does not have work-in-process accounts for each department.

C) Does not use equivalent units of production.

D) Track costs to individual products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

23

Process costing would be suitable for:

A) Automobile repair.

B) Production of television sets.

C) Boat building.

D) Kitchen remodeling.

A) Automobile repair.

B) Production of television sets.

C) Boat building.

D) Kitchen remodeling.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

24

In the production process described, what is the Work in Process Inventory: Packaging Department debited for?

A) Costs transferred from the Work in Process Inventory: Mixing Department only.

B) The cost of materials, direct labor, and overhead applicable to the packaging operation only.

C) Costs transferred from the Work in Process Inventory: Mixing Department, as well as materials, direct labor, and overhead applicable to the packaging operation.

D) Costs transferred to the Finished Goods Inventory.

A) Costs transferred from the Work in Process Inventory: Mixing Department only.

B) The cost of materials, direct labor, and overhead applicable to the packaging operation only.

C) Costs transferred from the Work in Process Inventory: Mixing Department, as well as materials, direct labor, and overhead applicable to the packaging operation.

D) Costs transferred to the Finished Goods Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

25

Process costing does not:

A) Trace direct costs to a specific production process.

B) Trace direct costs to a specific product.

C) Average direct and indirect costs across mass-produced identical units.

D) Apply overhead using an activity base.

A) Trace direct costs to a specific production process.

B) Trace direct costs to a specific product.

C) Average direct and indirect costs across mass-produced identical units.

D) Apply overhead using an activity base.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

26

A typical production cost report will contain all of the following except:

A) The number of equivalent units.

B) The total cost of production.

C) The costs per equivalent units.

D) The costs assigned to each job.

A) The number of equivalent units.

B) The total cost of production.

C) The costs per equivalent units.

D) The costs assigned to each job.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

27

All of the following are characteristics of the products of process costing except:

A) High volume.

B) Different amounts of direct materials.

C) Identical amounts of direct materials.

D) Repetitive operations.

A) High volume.

B) Different amounts of direct materials.

C) Identical amounts of direct materials.

D) Repetitive operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

28

The production cost report is an estimate of the equivalent units completed during the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

29

Equivalent units of production are:

A) A measure representing the percentage of a unit's cost that has been completed.

B) Not computed separately for each input added during production.

C) Not assigned to beginning work-in-process or ending work-in-process.

D) The total units completed during the period.

A) A measure representing the percentage of a unit's cost that has been completed.

B) Not computed separately for each input added during production.

C) Not assigned to beginning work-in-process or ending work-in-process.

D) The total units completed during the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

30

If 8,000 units were in beginning inventory, 26,000 units were started, and 6,000 units were in the ending inventory, how many units were transferred out?

A) 40,000.

B) 26,000.

C) 28,000.

D) 24,000.

A) 40,000.

B) 26,000.

C) 28,000.

D) 24,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

31

When either a job order costing system or a process costing system is in use, the Direct Labor account is credited:

A) When work is performed, even if not paid immediately.

B) When direct labor charges are assigned to work in process.

C) When employees are paid.

D) Instead of using a Salaries Expense account.

A) When work is performed, even if not paid immediately.

B) When direct labor charges are assigned to work in process.

C) When employees are paid.

D) Instead of using a Salaries Expense account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

32

In a production cost report, the units transferred out refer to the equivalent units completed during the period that have been moved to the next department or to Finished Goods Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

33

In either a job order or a process costing system, credits to the Materials Inventory account represent:

A) The cost of materials purchased during the period.

B) The cost of materials relating to finished goods.

C) The cost of unused materials returned to the inventory.

D) The cost of materials placed into production.

A) The cost of materials purchased during the period.

B) The cost of materials relating to finished goods.

C) The cost of unused materials returned to the inventory.

D) The cost of materials placed into production.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

34

Per-unit costs:

A) Are relevant only when a company is engaged in manufacturing activities.

B) Are determined in job order costing systems but cannot be computed when a process costing system is in use.

C) Are relevant in manufacturing, merchandising, and service industries, regardless of the type of cost accounting system in use.

D) Are determined by relating manufacturing costs to the number of units sold.

A) Are relevant only when a company is engaged in manufacturing activities.

B) Are determined in job order costing systems but cannot be computed when a process costing system is in use.

C) Are relevant in manufacturing, merchandising, and service industries, regardless of the type of cost accounting system in use.

D) Are determined by relating manufacturing costs to the number of units sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following is not a characteristic of a process costing system?

A) The costs incurred in each process are accumulated in separate Work-in-Process Inventory accounts.

B) It is suitable for mass-produced operations.

C) Costs are accumulated separately for each unit of production as it moves through the factory.

D) The cost of a finished unit is the sum of the unit costs of performing each manufacturing process.

A) The costs incurred in each process are accumulated in separate Work-in-Process Inventory accounts.

B) It is suitable for mass-produced operations.

C) Costs are accumulated separately for each unit of production as it moves through the factory.

D) The cost of a finished unit is the sum of the unit costs of performing each manufacturing process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

36

When either a job order costing system or a process costing system is in use, the Direct Labor account is debited:

A) When work is performed, even if not paid immediately.

B) When direct labor charges are assigned to work in process.

C) When employees are paid.

D) Instead of using a Salaries Expense account.

A) When work is performed, even if not paid immediately.

B) When direct labor charges are assigned to work in process.

C) When employees are paid.

D) Instead of using a Salaries Expense account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

37

A summary of work completed with related unit and total costs in a process costing system is called a(n):

A) Equivalent units production form.

B) Cost requisition form.

C) Summary of conversion costs.

D) Production cost report.

A) Equivalent units production form.

B) Cost requisition form.

C) Summary of conversion costs.

D) Production cost report.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which company would most likely use a process costing system?

A) Bic Pens.

B) Pepsi Cola.

C) Mars Candy.

D) All three.

A) Bic Pens.

B) Pepsi Cola.

C) Mars Candy.

D) All three.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

39

Equivalent units are usually computed for:

A) Only direct materials.

B) Only direct labor.

C) Only factory overhead.

D) Direct materials, direct labor, and factory overhead costs.

A) Only direct materials.

B) Only direct labor.

C) Only factory overhead.

D) Direct materials, direct labor, and factory overhead costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

40

A process costing system differs from a job order costing system in that:

A) There is no need for overhead application rates in process costing systems.

B) Process costing systems are used primarily in service industries, whereas job order costing systems are used in manufacturing operations.

C) Per-unit costs are not computed in process costing systems.

D) Process costing systems are used when production involves large volumes of standardized products, whereas job costing systems are used when each job or batch of products is uniquely different.

A) There is no need for overhead application rates in process costing systems.

B) Process costing systems are used primarily in service industries, whereas job order costing systems are used in manufacturing operations.

C) Per-unit costs are not computed in process costing systems.

D) Process costing systems are used when production involves large volumes of standardized products, whereas job costing systems are used when each job or batch of products is uniquely different.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

41

The entry to record the sale of 3,500 units in June would include:

A) A debit to Work-in-Process Inventory, of $77,000.

B) A debit to Finished Goods Inventory of $77,000.

C) A debit to Cost of Goods Sold of $77,000.

D) A credit to Cost of Goods Sold of $77,000.

A) A debit to Work-in-Process Inventory, of $77,000.

B) A debit to Finished Goods Inventory of $77,000.

C) A debit to Cost of Goods Sold of $77,000.

D) A credit to Cost of Goods Sold of $77,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

42

In a process costing system, costs flow from one Work in Process Inventory account to the next in the same sequence as:

A) Units flow through production.

B) In a LIFO periodic inventory system.

C) Shipped to customers.

D) In a job order cost system.

A) Units flow through production.

B) In a LIFO periodic inventory system.

C) Shipped to customers.

D) In a job order cost system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

43

If 80% of all inventory was sold at $32 per unit and 3,500 units were sold, what is the cost of the finished goods inventory at year-end?

A) $16,800.

B) $77,000.

C) $19,250.

D) $96,250.

A) $16,800.

B) $77,000.

C) $19,250.

D) $96,250.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

44

The journal entry to record the transfer of soup out of the Mixing and Cooking Department during March would include:

A) A debit to Work in Process Inventory, Mixing and Cooking Department of $63,000.

B) A credit to Work in Process Inventory, Canning Department of $72,000.

C) A debit to Finished Goods Inventory of $72,000.

D) A credit to Work in Process Inventory, Mixing and Cooking Department of $63,000.

A) A debit to Work in Process Inventory, Mixing and Cooking Department of $63,000.

B) A credit to Work in Process Inventory, Canning Department of $72,000.

C) A debit to Finished Goods Inventory of $72,000.

D) A credit to Work in Process Inventory, Mixing and Cooking Department of $63,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

45

In most process costing systems, per-unit costs are determined by:

A) Dividing the number of units completed during the period by the total manufacturing costs incurred during the period.

B) Dividing the total manufacturing costs incurred during the period by the number of units worked on during the period.

C) Dividing the total manufacturing costs incurred during the period by the equivalent number of units completed during the period.

D) Unit costs cannot be determined in a process costing system.

A) Dividing the number of units completed during the period by the total manufacturing costs incurred during the period.

B) Dividing the total manufacturing costs incurred during the period by the number of units worked on during the period.

C) Dividing the total manufacturing costs incurred during the period by the equivalent number of units completed during the period.

D) Unit costs cannot be determined in a process costing system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

46

Companies that compute equivalent full units of production do so to:

A) Comply with income tax regulations.

B) Compute total manufacturing costs for the period.

C) Determine a manufacturing overhead application rate.

D) Determine departmental per-unit costs.

A) Comply with income tax regulations.

B) Compute total manufacturing costs for the period.

C) Determine a manufacturing overhead application rate.

D) Determine departmental per-unit costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

47

During July, the equivalent full units of direct materials added to the product worked on by Department A amounted to a total of 90,000 applied as follows: beginning inventory, 20,000 units; units started and completed in July, 60,000 units; and ending inventory, 10,000 units. Assuming that the cost of direct materials requisitioned by the department in July was $135,000; the amount of the materials cost to be assigned to the ending inventory would be:

A) $16,875.

B) $54,000.

C) $15,000.

D) $18,000.

A) $16,875.

B) $54,000.

C) $15,000.

D) $18,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

48

For the month of June, the number of equivalent units of direct materials produced was:

A) 750.

B) 600.

C) 150.

D) Some other amount.

A) 750.

B) 600.

C) 150.

D) Some other amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

49

In a process costing system, the number of units started and completed for a period is equal to:

A) Units transferred out less units in beginning work in process.

B) Units transferred out less units in ending work in process.

C) Units transferred out plus units of beginning work in process.

D) Units transferred out plus units in ending work in process.

A) Units transferred out less units in beginning work in process.

B) Units transferred out less units in ending work in process.

C) Units transferred out plus units of beginning work in process.

D) Units transferred out plus units in ending work in process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

50

Equivalent full units of production represent units of:

A) Finished goods inventory.

B) Units of work-in-process inventory.

C) Work performed during the period.

D) Sales generated during the period.

A) Finished goods inventory.

B) Units of work-in-process inventory.

C) Work performed during the period.

D) Sales generated during the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

51

In Duffy's operation, the Finished Goods Inventory account is debited for:

A) The cost of units transferred directly from the Mixing Department.

B) The cost of units transferred directly from the Packaging Department.

C) The cost of units transferred directly from both the Mixing Department and the Packaging Department.

D) The cost of the units sold.

A) The cost of units transferred directly from the Mixing Department.

B) The cost of units transferred directly from the Packaging Department.

C) The cost of units transferred directly from both the Mixing Department and the Packaging Department.

D) The cost of the units sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

52

The computation of equivalent full units is generally not necessary when:

A) Beginning work-in-process inventories are significantly larger than ending work-in-process inventories.

B) Beginning and ending work-in-process inventories differ only slightly.

C) The number of units in ending work-in-process exceeds the number of units completed and transferred to finished goods during the period.

D) Per-unit costs become distorted as a result of not computing equivalent full units of production.

A) Beginning work-in-process inventories are significantly larger than ending work-in-process inventories.

B) Beginning and ending work-in-process inventories differ only slightly.

C) The number of units in ending work-in-process exceeds the number of units completed and transferred to finished goods during the period.

D) Per-unit costs become distorted as a result of not computing equivalent full units of production.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

53

The number of equivalent full units of production:

A) Is equal to the number of units completed by a department.

B) May not be greater than the number of units completed by a department.

C) Is used to complete the overhead application rate.

D) May be less than, equal to, or greater than the number of physical units completed during the period.

A) Is equal to the number of units completed by a department.

B) May not be greater than the number of units completed by a department.

C) Is used to complete the overhead application rate.

D) May be less than, equal to, or greater than the number of physical units completed during the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

54

The unit cost per can of soup transferred to the finished goods warehouse during March was:

A) $0.05.

B) $0.42.

C) $0.37.

D) $1.71.

A) $0.05.

B) $0.42.

C) $0.37.

D) $1.71.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

55

The unit cost per gallon of soup transferred to the Canning Department during March was:

A) $1.50.

B) $1.62.

C) $1.71.

D) $1.83.

A) $1.50.

B) $1.62.

C) $1.71.

D) $1.83.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

56

The journal entry to record the transfer of soup out of the Canning Department during March would include:

A) A credit to Work in Process Inventory, Canning Department of $9,000.

B) A credit to Work in Process Inventory, Canning Department of $63,000.

C) A debit to Finished Goods Inventory of $72,000.

D) A credit to Finished Goods Inventory, Mixing and Cooking Department of $72,000.

A) A credit to Work in Process Inventory, Canning Department of $9,000.

B) A credit to Work in Process Inventory, Canning Department of $63,000.

C) A debit to Finished Goods Inventory of $72,000.

D) A credit to Finished Goods Inventory, Mixing and Cooking Department of $72,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

57

Department X of a manufacturing company works on only one product, and all costs are incurred uniformly as the product goes along the assembly line. The 8,000 units in process on December 1 were 60% completed. An additional 50,000 units were placed in production during December. At December 31, the 10,000 units in process were 60% completed. The equivalent full units of production during December amounted to:

A) 49,200.

B) 60,800.

C) 57,200.

D) 58,800.

A) 49,200.

B) 60,800.

C) 57,200.

D) 58,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

58

The transfer of 35,000 units to the Finishing Department in June required:

A) A debit to Finished Goods Inventory of $770,000.

B) A credit to Work-in-Process Inventory, Mixing Department of $770,000.

C) A credit to Work-in-Process Inventory, Finishing Department of $140,000.

D) A debit to Work-in-Process Inventory, Finishing Department of $140,000.

A) A debit to Finished Goods Inventory of $770,000.

B) A credit to Work-in-Process Inventory, Mixing Department of $770,000.

C) A credit to Work-in-Process Inventory, Finishing Department of $140,000.

D) A debit to Work-in-Process Inventory, Finishing Department of $140,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

59

For the month of June, the number of equivalent units of labor and overhead produced was:

A) 750.

B) 600.

C) 645.

D) 595.

A) 750.

B) 600.

C) 645.

D) 595.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

60

The Finishing Department of Berle Industries works on only one product, and all costs are incurred uniformly while these units remain in the department. On March 1, 6,000 units were in process that were 45% completed. An additional 60,000 units were transferred into the Finishing Department during March. At March 31, there were 25,000 units in process that were 75% completed. Compute the equivalent full units of production for the Finishing Department during March using the FIFO method.

A) 81,450.

B) 60,000.

C) 57,050.

D) 69,550.

A) 81,450.

B) 60,000.

C) 57,050.

D) 69,550.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

61

Assuming that the cost of direct materials used by Department Q in May was $440,000, the materials cost assigned to unfinished units at May 31 would be:

A) $55,000.

B) $26,400.

C) $70,400.

D) Impossible to determine unless we know the percentage of completion for ending inventory units.

A) $55,000.

B) $26,400.

C) $70,400.

D) Impossible to determine unless we know the percentage of completion for ending inventory units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

62

On the basis of this information only:

A) The number of units transferred in May from Department Q to the next process or department was 34,000.

B) There were more units in Department Q's ending inventory than in Department Q's beginning inventory for May.

C) Department Q completed 48,000 units of product during May.

D) Department Q used enough materials during May to produce 48,000 completed units.

A) The number of units transferred in May from Department Q to the next process or department was 34,000.

B) There were more units in Department Q's ending inventory than in Department Q's beginning inventory for May.

C) Department Q completed 48,000 units of product during May.

D) Department Q used enough materials during May to produce 48,000 completed units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

63

Process costing with equivalent units and beginning inventory

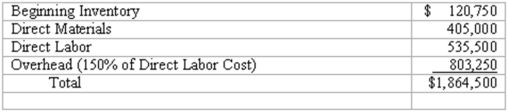

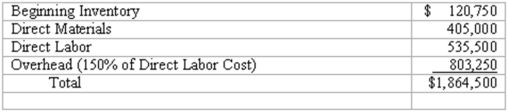

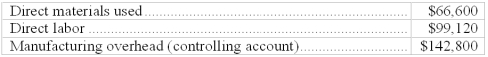

The records of Westminster Manufacturing Company for the month of May show the following costs in Department A:

The beginning inventory for May consisted of 10,000 units which were 80% complete as to direct materials and 60% complete as to labor and overhead. A total of 100,000 units were completed and transferred out during May, and 20,000 units remained in the work in process inventory. The ending inventory was 80% complete as to direct materials and 40% complete as to labor and overhead. Compute the following:

(a) Direct materials cost per equivalent unit: $________________ (b) Equivalent full units of production for direct labor and overhead: ________________ (c) Total cost of 100,000 units completed: $_________________ (d) Total cost of 20,000 units in process at the end of the month: $_________________

The records of Westminster Manufacturing Company for the month of May show the following costs in Department A:

The beginning inventory for May consisted of 10,000 units which were 80% complete as to direct materials and 60% complete as to labor and overhead. A total of 100,000 units were completed and transferred out during May, and 20,000 units remained in the work in process inventory. The ending inventory was 80% complete as to direct materials and 40% complete as to labor and overhead. Compute the following:

(a) Direct materials cost per equivalent unit: $________________ (b) Equivalent full units of production for direct labor and overhead: ________________ (c) Total cost of 100,000 units completed: $_________________ (d) Total cost of 20,000 units in process at the end of the month: $_________________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

64

Process costing system-determining unit costs

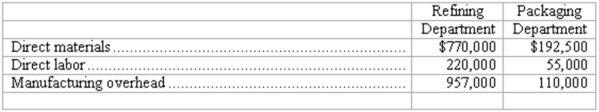

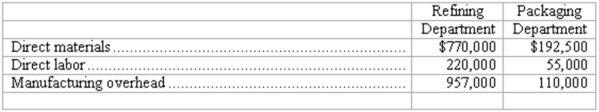

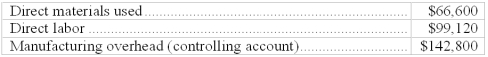

Houston Oil Company uses a process costing system with two departments: (a) a Refining Department and (b) a Packaging Department. During June, its first month of operations, the company manufactured and sold 650,000 gallons of motor oil, generating total revenue of $3,845,000. The company incurred the following manufacturing costs in June:

(a) How much was the unit cost per gallon of oil processed by the Refining Department in June?

(b) If each case of oil contains four gallons, how much was the unit cost per case incurred by the Packaging Department in June?

(c) How much was the unit cost per case transferred to finished goods in June?

(d) How much total gross profit (sales less cost of goods sold) was generated by the company in June?

Houston Oil Company uses a process costing system with two departments: (a) a Refining Department and (b) a Packaging Department. During June, its first month of operations, the company manufactured and sold 650,000 gallons of motor oil, generating total revenue of $3,845,000. The company incurred the following manufacturing costs in June:

(a) How much was the unit cost per gallon of oil processed by the Refining Department in June?

(b) If each case of oil contains four gallons, how much was the unit cost per case incurred by the Packaging Department in June?

(c) How much was the unit cost per case transferred to finished goods in June?

(d) How much total gross profit (sales less cost of goods sold) was generated by the company in June?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

65

If beginning inventory in Work in Process is zero and 2,000 units are started during the period, assuming that 1,700 units were completed and transferred out, how many units remain in ending inventory?

A) 2,000.

B) 285.

C) 300.

D) 1,700.

A) 2,000.

B) 285.

C) 300.

D) 1,700.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

66

To identify the cause of a change in a product total unit cost, management may:

A) Compute per unit product cost in total.

B) Compute per unit total cost.

C) Compute per unit product cost for each individual production department.

D) Compare prior period to current period per unit product cost in total.

A) Compute per unit product cost in total.

B) Compute per unit total cost.

C) Compute per unit product cost for each individual production department.

D) Compare prior period to current period per unit product cost in total.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

67

Refer to information above. If direct labor and overhead costs totaled $172,000, what would be the unit cost?

A) $1.23.

B) $1.08.

C) $1.56.

D) $3.44.

A) $1.23.

B) $1.08.

C) $1.56.

D) $3.44.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

68

During the month of August, $582,000 of costs were transferred from the Mixing Department to the Baking Department. The journal entry to summarize the transfer of these costs includes:

A) A debit to the Mixing department for $582,000.

B) A debit to the Baking department for $582,000.

C) A credit to the Baking department for $582,000.

D) A debit to Finished Goods Inventory.

A) A debit to the Mixing department for $582,000.

B) A debit to the Baking department for $582,000.

C) A credit to the Baking department for $582,000.

D) A debit to Finished Goods Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

69

For the month of December, its first month of operations, the Radcliffe Corporation completed and transferred 800 units of product costing $80,000 to produce to Finished Goods Inventory. If Radcliffe sold 650 units during the same month, how much was cost of goods sold for the same period?

A) $80,000.

B) $8,000.

C) $6,500.

D) $65,000.

A) $80,000.

B) $8,000.

C) $6,500.

D) $65,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

70

How many units were started in June?

A) 92,000.

B) 60,000.

C) 160,000.

D) 110,000.

A) 92,000.

B) 60,000.

C) 160,000.

D) 110,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

71

During the month of June, $352,150 of costs were transferred from Department A to Department

A) A debit to department A for $352,150.

B) A credit to department B for $352,150.

B) The journal entry to summarize the transfer of these costs includes:

C) A credit to department A for $352,150.

D) No entry is required when costs are transferred between departments.

A) A debit to department A for $352,150.

B) A credit to department B for $352,150.

B) The journal entry to summarize the transfer of these costs includes:

C) A credit to department A for $352,150.

D) No entry is required when costs are transferred between departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

72

What are the equivalent units for materials?

A) 92,000.

B) 60,000.

C) 160,000.

D) 110,000.

A) 92,000.

B) 60,000.

C) 160,000.

D) 110,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

73

For the month of July, the number of equivalent units of direct materials produced was:

A) 700.

B) 800.

C) 900.

D) 950.

A) 700.

B) 800.

C) 900.

D) 950.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

74

What are the equivalent units for direct labor and overhead?

A) 140,000.

B) 80,000.

C) 160,000.

D) 130,000.

A) 140,000.

B) 80,000.

C) 160,000.

D) 130,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

75

Selecting an appropriate cost accounting system

Listed below are seven businesses. In the spaces provided, identify whether a job order costing system or a process costing system would most likely be appropriate.

(a) _____ Nancy's Paper Plate Company

(b) _____ Two Leg Pants Manufacturers, Inc.

(c) _____ Solid Residential Contractors

(d) _____ Float's Boats

(e) _____ Big Heart Hospital

(f) _____ Fizz Soda, Inc.

(g) _____ Sugarmore Candies, Inc.

Listed below are seven businesses. In the spaces provided, identify whether a job order costing system or a process costing system would most likely be appropriate.

(a) _____ Nancy's Paper Plate Company

(b) _____ Two Leg Pants Manufacturers, Inc.

(c) _____ Solid Residential Contractors

(d) _____ Float's Boats

(e) _____ Big Heart Hospital

(f) _____ Fizz Soda, Inc.

(g) _____ Sugarmore Candies, Inc.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

76

In evaluating the efficiency of a production department, management should:

A) Consider all costs of production across departments.

B) Consider that department activities only.

C) Consider all corporate-wide period costs.

D) Compare the costs of production across departments.

A) Consider all costs of production across departments.

B) Consider that department activities only.

C) Consider all corporate-wide period costs.

D) Compare the costs of production across departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

77

During August, Department Z started and completed 90,000 units and also finished 18,000 units that were 75% completed on July 31. On August 31, Department Z's ending inventory consisted of 26,000 units that were 45% completed. All manufacturing costs are incurred at a uniform rate throughout Department Z's production process. The number of equivalent full units of production for Department Z during August is:

A) 106,200.

B) 90,000.

C) 94,500.

D) 117,800.

A) 106,200.

B) 90,000.

C) 94,500.

D) 117,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

78

If beginning inventory in Work in Process is zero and 2,000 units are started during the period, assuming that 300 units remain in ending inventory, how many equivalent units were completed and transferred out?

A) 2,000.

B) 285.

C) 300.

D) 1,700.

A) 2,000.

B) 285.

C) 300.

D) 1,700.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

79

For the month of July, the number of equivalent units of labor and overhead produced was:

A) 830.

B) 320.

C) 955.

D) Some other amount.

A) 830.

B) 320.

C) 955.

D) Some other amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

80

Equivalent units

In the first month of operations, the manufacturing costs for Blue Sun Company were as follows:

During the month 10,000 units were completed, and 5,000 units were in process at the end of the month. The 5,000 units in process were 100% completed as to materials and 80% completed as to direct labor and overhead. Compute the following:

(a) Direct materials cost per equivalent unit: $________________ (b) Equivalent full units of production for direct labor and manufacturing overhead: ________________ (c) Direct labor cost per equivalent unit: $_________________ (d) Manufacturing overhead cost per equivalent unit: $_________________ (e) Total cost of 10,000 units completed: $_________________ (f) Total cost of 5,000 units in process at the end of the month: $_________________

In the first month of operations, the manufacturing costs for Blue Sun Company were as follows:

During the month 10,000 units were completed, and 5,000 units were in process at the end of the month. The 5,000 units in process were 100% completed as to materials and 80% completed as to direct labor and overhead. Compute the following:

(a) Direct materials cost per equivalent unit: $________________ (b) Equivalent full units of production for direct labor and manufacturing overhead: ________________ (c) Direct labor cost per equivalent unit: $_________________ (d) Manufacturing overhead cost per equivalent unit: $_________________ (e) Total cost of 10,000 units completed: $_________________ (f) Total cost of 5,000 units in process at the end of the month: $_________________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck