Deck 5: Uncertainty and Information

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/16

العب

ملء الشاشة (f)

Deck 5: Uncertainty and Information

1

More risk averse people will

A)hold fewer risky assets because marginal utility is rapidly diminishing.

B)hold fewer risky assets because marginal utility is greater.

C)hold fewer risky assets because rates of return are more uncertain.

D)hold fewer risky assets because marginal utility is negative.

A)hold fewer risky assets because marginal utility is rapidly diminishing.

B)hold fewer risky assets because marginal utility is greater.

C)hold fewer risky assets because rates of return are more uncertain.

D)hold fewer risky assets because marginal utility is negative.

A

2

The option to delay the choice of portfolio allocation is valuable because

A)interest costs are positive.

B)volatility of returns is lower.

C)more can be placed into high return,risky assets.

D)the allocation can be based on new information.

A)interest costs are positive.

B)volatility of returns is lower.

C)more can be placed into high return,risky assets.

D)the allocation can be based on new information.

D

3

An individual will never buy complete insurance if

A)he or she is risk averse.

B)insurance premiums are unfair.

C)he or she is a risk taker.

D)insurance premiums are fair.

A)he or she is risk averse.

B)insurance premiums are unfair.

C)he or she is a risk taker.

D)insurance premiums are fair.

C

4

Expected value is defined as

A)the profit on a fair bet.

B)the most likely outcome of a given experiment.

C)the outcome that will occur on average for a given experiment.

D)the relative frequency with which an event will occur.

A)the profit on a fair bet.

B)the most likely outcome of a given experiment.

C)the outcome that will occur on average for a given experiment.

D)the relative frequency with which an event will occur.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

5

An option may add value to a transaction because:

A)interest charges are reduced.

B)the price of the good is reduced.

C)additional information may become available.

D)options provide buyers with monopsony power.

A)interest charges are reduced.

B)the price of the good is reduced.

C)additional information may become available.

D)options provide buyers with monopsony power.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

6

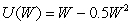

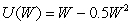

Which of the following utility functions would indicate the most (relative)risk averse behavior?

A)U(W)= W.

B)U(W)= .

.

C)U(W)= ln W.

D)U(W)= 1/W.

A)U(W)= W.

B)U(W)=

.

.C)U(W)= ln W.

D)U(W)= 1/W.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

7

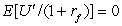

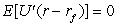

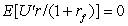

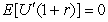

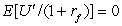

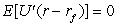

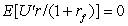

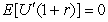

The condition for optimal portfolio choice can be represented by:

A) .

.

B) .

.

C) .

.

D) .

.

A)

.

.B)

.

.C)

.

.D)

.

.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

8

A risk averse individual is offered a gamble that promises a gain of $1000 with probability 0 .25 and a loss of $300 with probability 0.75 .Given this situation,he or she will

A)definitely take the gamble.

B)definitely not take the gamble.

C)definitely take the gamble if his or her income is high enough.

D)take an action that cannot be determined given the information available.

A)definitely take the gamble.

B)definitely not take the gamble.

C)definitely take the gamble if his or her income is high enough.

D)take an action that cannot be determined given the information available.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

9

If a fair game is played many times the monetary losses or gains will

A)approach zero.

B)be negative.

C)be positive.

D)result in an outcome that cannot be determined without more information.

A)approach zero.

B)be negative.

C)be positive.

D)result in an outcome that cannot be determined without more information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

10

Risk-averse individuals will diversify their investments because this will

A)increase their expected returns.

B)provide them with some much-needed variety.

C)reduce the variability of their returns.

D)reduce their transactions costs.

A)increase their expected returns.

B)provide them with some much-needed variety.

C)reduce the variability of their returns.

D)reduce their transactions costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following utility functions exhibits constant relative risk aversion?

A)U(W)= W.

B)

C)U(W)= ln W.

D)U(W)= .

.

A)U(W)= W.

B)

C)U(W)= ln W.

D)U(W)=

.

.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

12

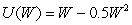

Suppose a person's utility of wealth is given by  and his or her initial wealth is 10,000.What is the maximum amount he or she would pay for insurance against a 50 percent chance of losing 3,600?

and his or her initial wealth is 10,000.What is the maximum amount he or she would pay for insurance against a 50 percent chance of losing 3,600?

A)1,800.

B)1,900.

C)2,000.

D)2,100.

and his or her initial wealth is 10,000.What is the maximum amount he or she would pay for insurance against a 50 percent chance of losing 3,600?

and his or her initial wealth is 10,000.What is the maximum amount he or she would pay for insurance against a 50 percent chance of losing 3,600?A)1,800.

B)1,900.

C)2,000.

D)2,100.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

13

Risk aversion is best explained by

A)timidness.

B)increasing marginal utility of wealth.

C)constant marginal utility of wealth.

D)decreasing marginal utility of wealth.

A)timidness.

B)increasing marginal utility of wealth.

C)constant marginal utility of wealth.

D)decreasing marginal utility of wealth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

14

People who always choose not to participate in fair games are called

A)risk takers.

B)risk averse.

C)risk neutral.

D)broke.

A)risk takers.

B)risk averse.

C)risk neutral.

D)broke.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

15

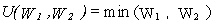

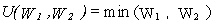

An individual whose utility function is given by  (where Wi is wealth in state i)will

(where Wi is wealth in state i)will

A)never gamble no matter how favorable the odds.

B)only gamble if the expected value of the bet is positive.

C)gamble if the bet is not too unfair.

D)always gamble,no matter how unfavorable the odds.

(where Wi is wealth in state i)will

(where Wi is wealth in state i)willA)never gamble no matter how favorable the odds.

B)only gamble if the expected value of the bet is positive.

C)gamble if the bet is not too unfair.

D)always gamble,no matter how unfavorable the odds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following utility functions exhibits constant absolute risk aversion?

A)U(W)= W.

B)

C)U(W)= ln W.

D)U(W)= .

.

A)U(W)= W.

B)

C)U(W)= ln W.

D)U(W)=

.

.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck