Deck 7: Revenue Recognition and Related Expenses

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/52

العب

ملء الشاشة (f)

Deck 7: Revenue Recognition and Related Expenses

1

An analyst can estimate the average total life of depreciable assets by

A) dividing average depreciable assets by depreciation expense for the year.

B) dividing depreciation expense for the year by average depreciable assets.

C) dividing average gross depreciable assets by accumulated depreciation.

D) Subtracting depreciation expense from accumulated depreciation.

A) dividing average depreciable assets by depreciation expense for the year.

B) dividing depreciation expense for the year by average depreciable assets.

C) dividing average gross depreciable assets by accumulated depreciation.

D) Subtracting depreciation expense from accumulated depreciation.

A

2

Which of the following is not a difficulty in determining current market values when determining the value of fixed assets?

A) There is an absence of active markets for many fixed assets.

B) It is difficult to identify comparable assets currently available in the marketplace to value assets in place

C) It is difficult to make assumptions about the effects of technology and other improvements when using the prices of new assets currently available on the market in the valuation process.

D) Our current accounting model is not equipped to handle changes in market values.

A) There is an absence of active markets for many fixed assets.

B) It is difficult to identify comparable assets currently available in the marketplace to value assets in place

C) It is difficult to make assumptions about the effects of technology and other improvements when using the prices of new assets currently available on the market in the valuation process.

D) Our current accounting model is not equipped to handle changes in market values.

D

3

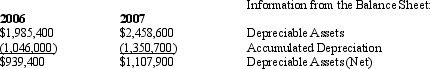

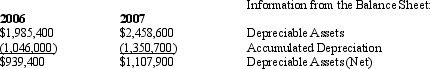

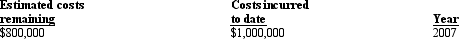

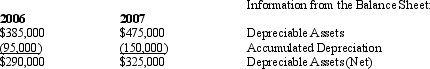

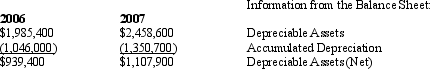

Using the information below calculate the average total depreciable life of the assets:

A) 5.8 years

B) 10 years

C) 2.9 years

D) 5.3 years

A) 5.8 years

B) 10 years

C) 2.9 years

D) 5.3 years

A

4

Firms recognize an impairment loss when the carrying amount of a tangible fixed asset is deemed "not recoverable" as specified by GAAP. GAAP defines a carrying amount as "not recoverable" if

A) it is greater than the sum of the cash flows expected from the asset's use and disposal.

B) it is greater than the sum of the undiscounted cash flows expected from the asset's use and disposal.

C) it is less valuable than its current carrying value.

D) it is less valuable than its current fair value.

A) it is greater than the sum of the cash flows expected from the asset's use and disposal.

B) it is greater than the sum of the undiscounted cash flows expected from the asset's use and disposal.

C) it is less valuable than its current carrying value.

D) it is less valuable than its current fair value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

5

Under the percentage-of-completion contract method

A) revenue and cost are recognized during the production cycle, but gross profit recognition is deferred until the contract is completed.

B) revenue, cost, and gross profit are recognized during the production cycle.

C) revenue, cost, and gross profit are recognized at the time the contract is completed.

D) none of these

A) revenue and cost are recognized during the production cycle, but gross profit recognition is deferred until the contract is completed.

B) revenue, cost, and gross profit are recognized during the production cycle.

C) revenue, cost, and gross profit are recognized at the time the contract is completed.

D) none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

6

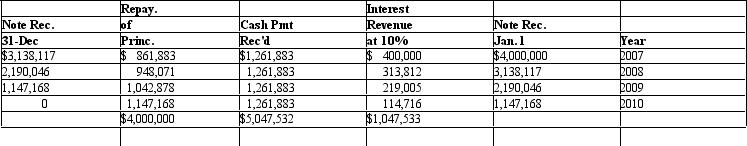

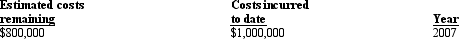

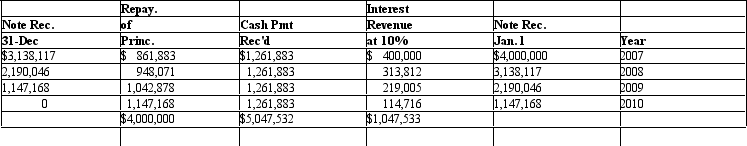

Folio Corp. Folio Corp. sold a paper machine to Library Inc. on January 1, 2007. The sale price of the machine was $4,000,000 and the machine cost $3,200,000 for Folio to manufacture. Library will make four payments at the end of each year, beginning with 2007, of $1,261,883 each. The four payments of $1,261,883 when discounted at 10% have a present value of $4,000,000. An amortization table appears below:

If Folio Corp. is uncertain that it will collect all four payments from Library Inc. and uses the installment method of accounting for revenue recognition what amount of gross profit should Folio recognize in 2007 from the sale?

If Folio Corp. is uncertain that it will collect all four payments from Library Inc. and uses the installment method of accounting for revenue recognition what amount of gross profit should Folio recognize in 2007 from the sale?

A) $0

B) $861,883

C) $172,377

D) $800,000

If Folio Corp. is uncertain that it will collect all four payments from Library Inc. and uses the installment method of accounting for revenue recognition what amount of gross profit should Folio recognize in 2007 from the sale?

If Folio Corp. is uncertain that it will collect all four payments from Library Inc. and uses the installment method of accounting for revenue recognition what amount of gross profit should Folio recognize in 2007 from the sale?A) $0

B) $861,883

C) $172,377

D) $800,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

7

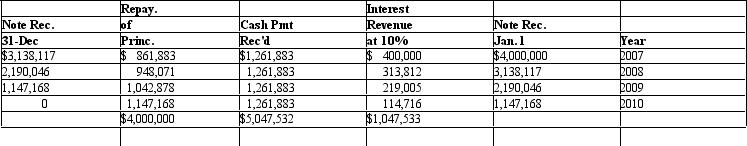

Folio Corp. Folio Corp. sold a paper machine to Library Inc. on January 1, 2007. The sale price of the machine was $4,000,000 and the machine cost $3,200,000 for Folio to manufacture. Library will make four payments at the end of each year, beginning with 2007, of $1,261,883 each. The four payments of $1,261,883 when discounted at 10% have a present value of $4,000,000. An amortization table appears below:

If Folio Corp. is uncertain that it will collect all four payments from Library Inc. and uses the cost recovery method of accounting for revenue recognition what amount of gross profit should Folio recognize in 2007 from the sale?

If Folio Corp. is uncertain that it will collect all four payments from Library Inc. and uses the cost recovery method of accounting for revenue recognition what amount of gross profit should Folio recognize in 2007 from the sale?

A) $0

B) $861,883

C) $172,377

D) $800,000

If Folio Corp. is uncertain that it will collect all four payments from Library Inc. and uses the cost recovery method of accounting for revenue recognition what amount of gross profit should Folio recognize in 2007 from the sale?

If Folio Corp. is uncertain that it will collect all four payments from Library Inc. and uses the cost recovery method of accounting for revenue recognition what amount of gross profit should Folio recognize in 2007 from the sale?A) $0

B) $861,883

C) $172,377

D) $800,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

8

A company would need to record an impairment loss for its equipment when

A) the original cost of the equipment exceeds its fair value and is deemed not recoverable.

B) management determines that the equipment will no longer be used.

C) the carrying amount of the equipment exceeds its fair value and is deemed not recoverable.

D) the cash flows from the equipment are less than its fair value.

A) the original cost of the equipment exceeds its fair value and is deemed not recoverable.

B) management determines that the equipment will no longer be used.

C) the carrying amount of the equipment exceeds its fair value and is deemed not recoverable.

D) the cash flows from the equipment are less than its fair value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

9

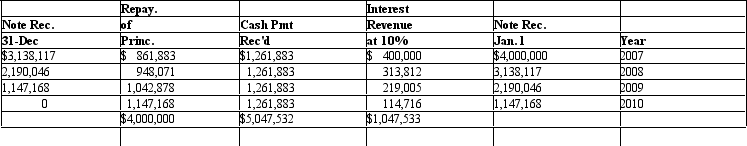

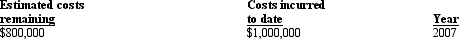

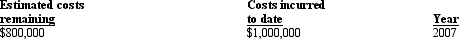

Assume that Playground Corp. has agreed to construct a new playground for Township County for $2,300,000 dollars. Construction of the new playground will begin on March 17, 2007 and is expected to be completed in August 2008. At the signing of the contract Playground Corp. estimates that the it will cost $1,600,000 dollars to build the playground. At the end of 2007 Playground provided the following information about the project:

If Playground uses the percentage of completion to recognize revenue on the long-term contract how much gross margin should Playground recognize in 2007?

If Playground uses the percentage of completion to recognize revenue on the long-term contract how much gross margin should Playground recognize in 2007?

A) $389,200

B) $278,000

C) $556,000

D) $0

If Playground uses the percentage of completion to recognize revenue on the long-term contract how much gross margin should Playground recognize in 2007?

If Playground uses the percentage of completion to recognize revenue on the long-term contract how much gross margin should Playground recognize in 2007?A) $389,200

B) $278,000

C) $556,000

D) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following would not be suggestive of a company recognizing sales too early?

A) large and volatile amounts of uncollectible accounts receivable

B) excessive warranty expenditures

C) large growth in accounts receivable

D) unusually large amount of returned goods

A) large and volatile amounts of uncollectible accounts receivable

B) excessive warranty expenditures

C) large growth in accounts receivable

D) unusually large amount of returned goods

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

11

GAAP stipulates that firms should do what with expenditures that increase the service potential of an asset beyond that originally anticipated?

A) Expense the expenditure immediately.

B) Capitalize the expenditure and depreciate it over the remaining service life of the asset.

C) Capitalize the expenditure, but do not depreciate the asset.

D) Charge it off to shareholders' equity.

A) Expense the expenditure immediately.

B) Capitalize the expenditure and depreciate it over the remaining service life of the asset.

C) Capitalize the expenditure, but do not depreciate the asset.

D) Charge it off to shareholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

12

Finale Company's accounting manager decided to start capitalizing the company's routing repairs and maintenance expense, starting in 2006. What effect will this change have on the company's 2007 income and assets respectively?

A) overstate, overstate

B) overstate, understate

C) understate, understate

D) understate, overstate

A) overstate, overstate

B) overstate, understate

C) understate, understate

D) understate, overstate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

13

A LIFO liquidation during periods when prices are increasing results in a company

A) recording a large inventory write down.

B) recording higher earnings than it would have if it had used FIFO.

C) recording lower earnings than it would have if it had used FIFO.

D) having operational problems, but no financial statement effects.

A) recording a large inventory write down.

B) recording higher earnings than it would have if it had used FIFO.

C) recording lower earnings than it would have if it had used FIFO.

D) having operational problems, but no financial statement effects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

14

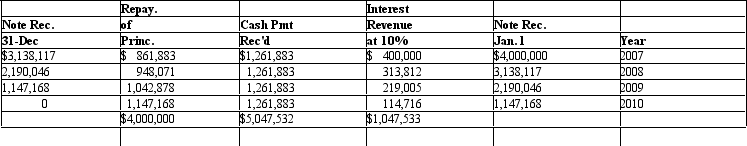

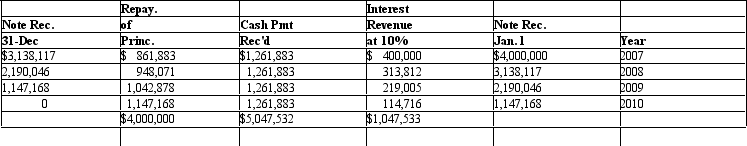

Folio Corp. Folio Corp. sold a paper machine to Library Inc. on January 1, 2007. The sale price of the machine was $4,000,000 and the machine cost $3,200,000 for Folio to manufacture. Library will make four payments at the end of each year, beginning with 2007, of $1,261,883 each. The four payments of $1,261,883 when discounted at 10% have a present value of $4,000,000. An amortization table appears below:

If Folio Corp. is certain that it will collect all four payments from Library Inc. what amount of gross profit should Folio recognize in 2007 from the sale?

If Folio Corp. is certain that it will collect all four payments from Library Inc. what amount of gross profit should Folio recognize in 2007 from the sale?

A) $0

B) $861,883

C) $172,377

D) $800,000

If Folio Corp. is certain that it will collect all four payments from Library Inc. what amount of gross profit should Folio recognize in 2007 from the sale?

If Folio Corp. is certain that it will collect all four payments from Library Inc. what amount of gross profit should Folio recognize in 2007 from the sale?A) $0

B) $861,883

C) $172,377

D) $800,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

15

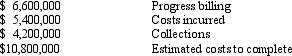

Tiger Company has consistently used the percentage-of-completion method of recognizing income. In 2005, Tiger started on an $18,000,000 construction contract that was completed in 2007. The following information was taken from Tiger's 2005 accounting records:  What amount of revenue should Tiger recognize on the contract in 2005?

What amount of revenue should Tiger recognize on the contract in 2005?

A) $6,000,000

B) $5,400,000

C) $9,000,000

D) $0

What amount of revenue should Tiger recognize on the contract in 2005?

What amount of revenue should Tiger recognize on the contract in 2005?A) $6,000,000

B) $5,400,000

C) $9,000,000

D) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

16

The installment method of revenue recognition can be used when cash collectibility is uncertain. The installment method

A) requires that no income is recognized until all installments are received.

B) requires that gross profit is recognized as each installment payment is received.

C) requires that entire cost of the sale be recovered prior to any income being recognized.

D) allows revenue recognition at the time of the sale.

A) requires that no income is recognized until all installments are received.

B) requires that gross profit is recognized as each installment payment is received.

C) requires that entire cost of the sale be recovered prior to any income being recognized.

D) allows revenue recognition at the time of the sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

17

An inventory pricing procedure in which the oldest costs incurred rarely have an effect on the ending inventory valuation is

A) FIFO

B) LIFO

C) Base stock

D) Weighted-average

A) FIFO

B) LIFO

C) Base stock

D) Weighted-average

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

18

When input prices are increasing, companies that use the LIFO method of accounting for inventory will report

A) Lower cost of goods sold amounts in comparison to the FIFO method

B) Higher sales amounts in comparison to the FIFO method

C) Higher ending inventory amounts in comparison to the FIFO method

D) Lower gross profit margins in comparison to the FIFO method

A) Lower cost of goods sold amounts in comparison to the FIFO method

B) Higher sales amounts in comparison to the FIFO method

C) Higher ending inventory amounts in comparison to the FIFO method

D) Lower gross profit margins in comparison to the FIFO method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

19

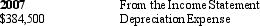

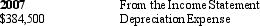

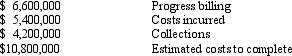

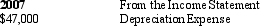

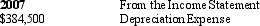

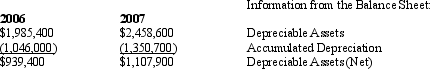

Using the information below calculate the average total depreciable life of the assets:

A) 6.54 years

B) 10.10 years

C) 6.91 years

D) 9.15 years

A) 6.54 years

B) 10.10 years

C) 6.91 years

D) 9.15 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

20

Assume that Playground Corp. has agreed to construct a new playground for Township County for $2,300,000 dollars. Construction of the new playground will begin on March 17, 2007 and is expected to be completed in August 2008. At the signing of the contract Playground Corp. estimates that the it will cost $1,600,000 dollars to build the playground. At the end of 2007 Playground provided the following information about the project:

What percentage is playground complete?

What percentage is playground complete?

A) 62.5%

B) 43.5%

C) 55.6%

D) 50.0%

What percentage is playground complete?

What percentage is playground complete?A) 62.5%

B) 43.5%

C) 55.6%

D) 50.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

21

One sign that a company may be recognizing sales too early is that it has unusually large amounts of ______________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

22

When cash collectibility is uncertain, a firm using the ____________________ method recognizes revenue as it collects portions of the selling price in cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

23

A company that uses LIFO will experience a ______________________________ during a period it sells more units than it purchases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

24

A company that uses LIFO will find that its ______________________________ account will be somewhat out of date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

25

Although LIFO generally provides higher quality earnings measures, FIFO generally provides higher _____________________________________________ measures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

26

Companies that engage in long-term contracts can recognize income using either the _____________________________________________ method or the ________________________________________ method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

27

Under current accounting rules an asset is ____________________ when its carrying amount is deemed "not recoverable".

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

28

Under the accrual method of accounting when a firm has substantially completed its value-adding activities it should recognize ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

29

Firms that capitalize routine maintenance and repair charges will end up with the result of having the current period's income being ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

30

A contractor would not use ________________________________________ method of income recognition when there is substantial uncertainty regarding the total costs it will incur in completing the project.

or

or

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

31

The process of allocating the historical cost of certain assets to the periods of their use in a reasonably systematic manner is referred to as ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

32

Most publicly traded firms in the United States use the _________________________ method of depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

33

Firms recognize an ______________________________ when the carrying amount of a fixed asset exceeds its fair value and is deemed not recoverable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

34

GAAP stipulates that firms should ____________________ expenditures that increase the service potential of an asset beyond that originally anticipated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

35

___________________________________ include trade and brand names, trademarks, patents, copyrights, franchise rights, customer lists and goodwill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

36

The difference between the economic resources received from customers and the economic resources paid to suppliers, employees and other providers of goods and services is called ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

37

Financial reporting requires firms to ____________________ immediately all R&D costs incurred internally.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

38

___________________________________ is primarily a question of timing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

39

When cash collectibility is uncertain the ___________________________________ method matches the costs of generating revenues dollar for dollar with cash receipts until the firm recovers all such costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

40

A Company that uses FIFO will find that its ___________________________________ account tends to be somewhat out of date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

41

A company may try to paint a favorable picture of itself by accelerating the timing of revenues or estimating the collectible amounts too aggressively. In these cases the quality of accounting information declines because it does not represent the company's true economic condition and may not be sustainable. List four conditions which might suggest that a company is recognizing revenues too early?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

42

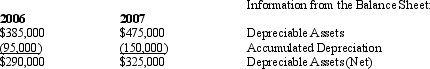

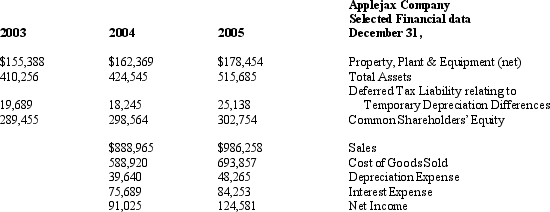

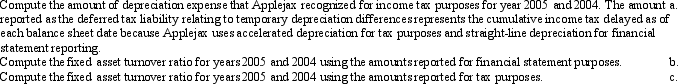

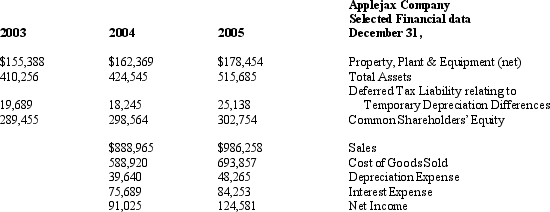

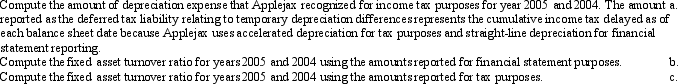

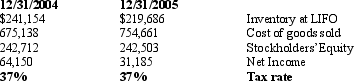

Applejax Company is a large international canning company. Applejax uses straight-line depreciation for financial reporting purposes and accelerated depreciation for tax reporting. The company's tax rate is 35%. Selected financial information about Applejax appears below.

Required:

Required:

Required:

Required:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

43

Many users of financial statements believe that the quality of accounting information for intangible assets is low because firms seldom report intangible asset resources on the balance sheet. However, from the perspective of accounting quality what are arguments in favor of expensing most intangibles and not recording them on the balance sheet?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

44

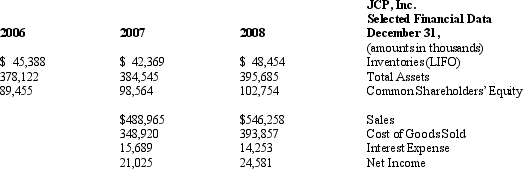

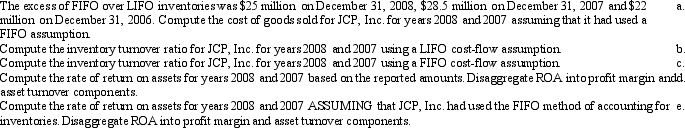

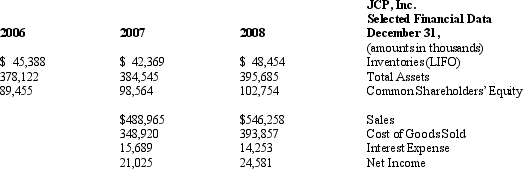

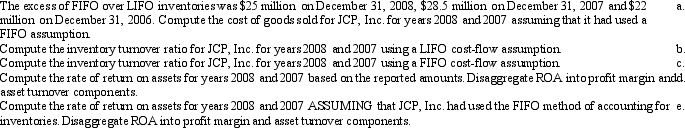

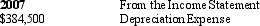

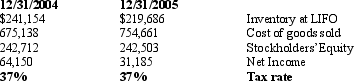

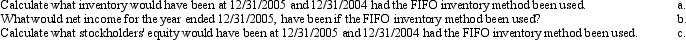

JCP, Inc. is a major producer of printing equipment. JCP uses a LIFO cost-flow assumption for inventories. The company's tax rate is 35%. Below is selected financial data for the company.

Required:

Required:

Required:

Required:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

45

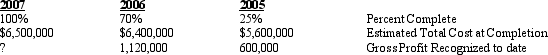

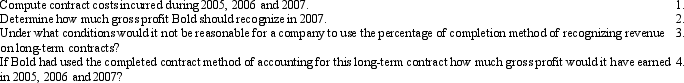

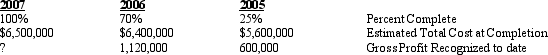

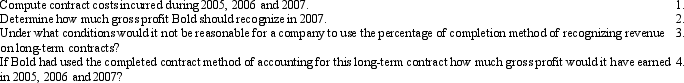

Bold Construction Comp. has consistently used the percentage-of-completion method for recognizing revenue on its long-term contracts. During 2005 Bold entered into a fixed-price contract to construct an office building for $8,000,000. Information relating to the contract is as follows:

Required (Show Calculations):

Required (Show Calculations):

Required (Show Calculations):

Required (Show Calculations):

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

46

Discuss how firms should account for intangible assets under GAAP. Your answer should include discussion of the following areas:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

47

Application of the LIFO and FIFO inventory methods result in differences in the balance sheet, income statement and cash flow statement. Compare and contrast the effect of the two methods on each financial statement and determine the advantages and disadvantages of each method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

48

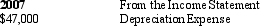

The following information is available from Sharp Corp.:

Use the information above to calculate the following:

Use the information above to calculate the following:

a. Average age of the depreciable assets

b. Average remaining useful life of the depreciable assets

Use the information above to calculate the following:

Use the information above to calculate the following:a. Average age of the depreciable assets

b. Average remaining useful life of the depreciable assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

49

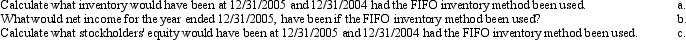

The following information is taken from Just Pants financial statements (amounts in thousands):

Inventory Footnote: If the first-in, first-out method of accounting for inventory had been used, inventory would have been approximately $26.9 million and $25.1 million higher than reported at 12/31/2005 and 12/31/2004, respectively.

Inventory Footnote: If the first-in, first-out method of accounting for inventory had been used, inventory would have been approximately $26.9 million and $25.1 million higher than reported at 12/31/2005 and 12/31/2004, respectively.

Required:

Inventory Footnote: If the first-in, first-out method of accounting for inventory had been used, inventory would have been approximately $26.9 million and $25.1 million higher than reported at 12/31/2005 and 12/31/2004, respectively.

Inventory Footnote: If the first-in, first-out method of accounting for inventory had been used, inventory would have been approximately $26.9 million and $25.1 million higher than reported at 12/31/2005 and 12/31/2004, respectively.Required:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

50

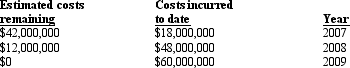

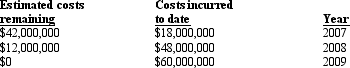

Assume that Arena Corp. has agreed to construct a new basketball arena for Hoop Town for $70 million dollars. Construction of the new arena begins in July, 2007 and is expected to be completed in March 2009. At the signing of the contract Arena Corp. estimates that the new arena will cost $60 million dollars to build. Given the following cost and building schedule determine the cumulative degree of completion and how much revenue and gross margin Arena Corp. should recognize in years 2007, 2008 and 2009.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

51

Note that this topic is covered in the Appendix

Currently financial reporting does not take into account changes in prices, either at the general level or at the specific level. Many analysts believe that not taking price changes into account distorts the meaningfulness of financial reports. How do changing prices affect financial reports?

Currently financial reporting does not take into account changes in prices, either at the general level or at the specific level. Many analysts believe that not taking price changes into account distorts the meaningfulness of financial reports. How do changing prices affect financial reports?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

52

Specifically identifiable intangible assets acquired from others may have either a ____________________ useful life or an ____________________ useful life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck