Deck 5: Risk Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/63

العب

ملء الشاشة (f)

Deck 5: Risk Analysis

1

Market equity beta measures the covariability of a firm's returns with the return's of

A) all industry competitors in the market.

B) risk free securities.

C) all securities in the market.

D) all firms of comparable market value.

A) all industry competitors in the market.

B) risk free securities.

C) all securities in the market.

D) all firms of comparable market value.

C

2

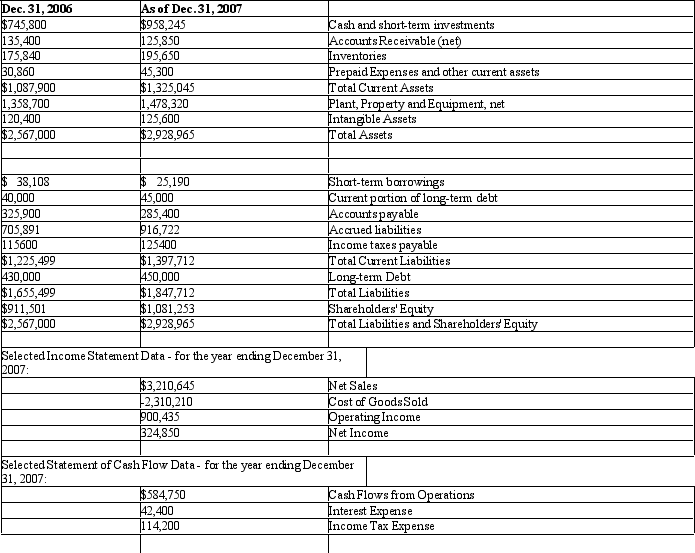

HighTech Company HighTech Company manufactures computer technology devices. Selected financial data for HighTech is presented below, use the information to answer the following questions:

Cash Flows from Operations Days of other financing required by HighTech at the end of 2005 would be

A) 54.36 days

B) (54.36 days)

C) 102.94 days

D) (5.27 days)

Cash Flows from Operations Days of other financing required by HighTech at the end of 2005 would be

A) 54.36 days

B) (54.36 days)

C) 102.94 days

D) (5.27 days)

54.36 days

3

HighTech Company HighTech Company manufactures computer technology devices. Selected financial data for HighTech is presented below, use the information to answer the following questions:

SelectedStatement of Cash Flow Data - for the year ending December 31, 2005:

CashFlows from Operations HighTech's Operating Cash Flow to Current Liabilities ratio in 2005 was

A) .70

B) 1.39

C) 1.00

D) .72

SelectedStatement of Cash Flow Data - for the year ending December 31, 2005:

CashFlows from Operations HighTech's Operating Cash Flow to Current Liabilities ratio in 2005 was

A) .70

B) 1.39

C) 1.00

D) .72

.72

4

Molitor Company currently has a current ratio of 1.1. The company decides to borrow $1,000,000 from City National Bank for a period of six months. After the borrowing Molitor's current ratio will be

A) greater than 1.1

B) 1.1

C) less than 1.1

D) unable to determine with out more information

A) greater than 1.1

B) 1.1

C) less than 1.1

D) unable to determine with out more information

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following states of financial distress would be considered the most troubling for an investor or creditor?

A) failing to make a required interest payment on time

B) paying an accounts payable after the billing date

C) restructuring debt

D) defaulting on a principal payment on debt

A) failing to make a required interest payment on time

B) paying an accounts payable after the billing date

C) restructuring debt

D) defaulting on a principal payment on debt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

6

HighTech Company HighTech Company manufactures computer technology devices. Selected financial data for HighTech is presented below, use the information to answer the following questions:

SelectedStatement of Cash Flow Data - for the year ending December 31, 2005:

CashFlows from Operations HighTech's days receivables outstanding at the end of 2005 was

A) 43.20 days

B) 40.50 days

C) 45.25 days

D) 8.50 days

SelectedStatement of Cash Flow Data - for the year ending December 31, 2005:

CashFlows from Operations HighTech's days receivables outstanding at the end of 2005 was

A) 43.20 days

B) 40.50 days

C) 45.25 days

D) 8.50 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

7

HighTech Company HighTech Company manufactures computer technology devices. Selected financial data for HighTech is presented below, use the information to answer the following questions:

SelectedStatement of Cash Flow Data - for the year ending December 31, 2005:

CashFlows from Operations HighTech's current ratio in 2005 was

A) 1.07

B) 1.45

C) 1

D) .69

SelectedStatement of Cash Flow Data - for the year ending December 31, 2005:

CashFlows from Operations HighTech's current ratio in 2005 was

A) 1.07

B) 1.45

C) 1

D) .69

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

8

Bankruptcy prediction research has identified three broad factors influencing long-term solvency risk, which of the following is not one of the factors?

A) Investment factors

B) Financing factors

C) Operating factors

D) Credit factors

A) Investment factors

B) Financing factors

C) Operating factors

D) Credit factors

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

9

The best indicator for assessing a firm's long-term solvency risk is its ability to generate what over a period of years?

A) Sales

B) Earnings

C) Positive cash flows

D) Income from continuing operations

A) Sales

B) Earnings

C) Positive cash flows

D) Income from continuing operations

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

10

Economic theory teaches that differences in market returns must relate to differences in

A) book value

B) perceived risk

C) price-earnings ratio

D) bankruptcy risk

A) book value

B) perceived risk

C) price-earnings ratio

D) bankruptcy risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

11

Dallas Corp. has a current ratio of 6, under which of the following scenarios might this indicate a problem

A) inventories are increasing due to the introduction of a new product

B) the company is holding cash in expectation of making a large investment in equipment

C) receivables are increasing due to increasing sales

D) inventories are increasing and the industry in which Dallas Corp. operates is experiencing a recession

A) inventories are increasing due to the introduction of a new product

B) the company is holding cash in expectation of making a large investment in equipment

C) receivables are increasing due to increasing sales

D) inventories are increasing and the industry in which Dallas Corp. operates is experiencing a recession

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following is not one of the three explanatory variables that determines a firm's market beta?

A) Degree of investing leverage.

B) Degree of operating leverage.

C) Degree of financial leverage.

D) Variability of sales.

A) Degree of investing leverage.

B) Degree of operating leverage.

C) Degree of financial leverage.

D) Variability of sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

13

HighTech Company HighTech Company manufactures computer technology devices. Selected financial data for HighTech is presented below, use the information to answer the following questions:

Cash Flows from Operations HighTech's days accounts payable outstanding at the end of 2005 is

A) 7.53 days

B) 48.09 days

C) 45.51 days

D) 50 days

Cash Flows from Operations HighTech's days accounts payable outstanding at the end of 2005 is

A) 7.53 days

B) 48.09 days

C) 45.51 days

D) 50 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following ratios is not a measure of long-term solvency risk?

A) Debt /Equity Ratio

B) Interest Coverage Ratio

C) Operating Cash Flows to Current Liabilities Ratio

D) Liabilities to Assets Ratio

A) Debt /Equity Ratio

B) Interest Coverage Ratio

C) Operating Cash Flows to Current Liabilities Ratio

D) Liabilities to Assets Ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following is a measure of market equity risk?

A) Bankruptcy

B) Beta

C) Overdue amounts

D) Defaults

A) Bankruptcy

B) Beta

C) Overdue amounts

D) Defaults

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

16

HighTech Company HighTech Company manufactures computer technology devices. Selected financial data for HighTech is presented below, use the information to answer the following questions:

Cash Flows from Operations HighTech's 2005 Inventory Turnover ratio is

A) 7.46

B) 11.83

C) 6.16

D) 5.62

Cash Flows from Operations HighTech's 2005 Inventory Turnover ratio is

A) 7.46

B) 11.83

C) 6.16

D) 5.62

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

17

One common problem with the current ratio is that it is susceptible to "window dressing". If prior to the end of the accounting period Streetwise Company has a current ratio of 1.5 and management wishes to boost its current ratio it may decide to

A) pay off accounts payable prior to year end.

B) purchase more inventory on account.

C) purchase short-term investments with cash.

D) purchase more inventory with cash.

A) pay off accounts payable prior to year end.

B) purchase more inventory on account.

C) purchase short-term investments with cash.

D) purchase more inventory with cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

18

Univariate bankruptcy prediction models help identify factors related to bankruptcy, but they do not provide information about

A) specific ratios that are important.

B) the amount of Type I and Type II errors.

C) which specific company will go bankrupt.

D) the relative importance of individual financial statement ratios.

A) specific ratios that are important.

B) the amount of Type I and Type II errors.

C) which specific company will go bankrupt.

D) the relative importance of individual financial statement ratios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

19

You calculate the following from Midas Company's financial statements: Days in Receivables = 43

Days in Payables = 38

Days in Inventory = 31

How many days of working capital financing does Midas need to obtain from other sources?

A) 112 days

B) 36 days

C) 56 days

D) 26 days

Days in Payables = 38

Days in Inventory = 31

How many days of working capital financing does Midas need to obtain from other sources?

A) 112 days

B) 36 days

C) 56 days

D) 26 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

20

HighTech Company HighTech Company manufactures computer technology devices. Selected financial data for HighTech is presented below, use the information to answer the following questions:

SelectedStatement of Cash Flow Data - for the year ending December 31, 2005:

CashFlows from Operations HighTech's quick ratio improved by what percentage from 2004 to 2005?

A) 30%

B) 107%

C) 25%

D) 82%

SelectedStatement of Cash Flow Data - for the year ending December 31, 2005:

CashFlows from Operations HighTech's quick ratio improved by what percentage from 2004 to 2005?

A) 30%

B) 107%

C) 25%

D) 82%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

21

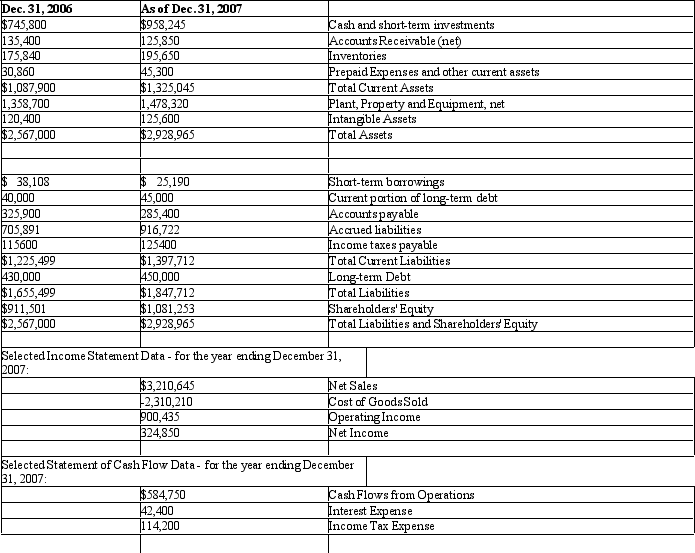

Below is selected information from DXI's 2007 financial statements:

DXI's 2007 Long-term Debt to Shareholders' Equity ratio is

A) 31.4%

B) 29.4%

C) 34.0%

D) 45.8%

DXI's 2007 Long-term Debt to Shareholders' Equity ratio is

A) 31.4%

B) 29.4%

C) 34.0%

D) 45.8%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

22

Below is selected information from DXI's 2007 financial statements:

DXI's 2007 Interest Coverage ratio is

A) 7.66

B) 1.00

C) 11.35

D) 4.35

DXI's 2007 Interest Coverage ratio is

A) 7.66

B) 1.00

C) 11.35

D) 4.35

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

23

The source of risk related to technology, regulation and availability of raw materials is ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

24

The beta coefficient measures the ____________________ of a firm's returns with those of all shares traded in the market (in excess of the risk-free interest rate).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

25

Common shareholders benefit with increasing proportions of debt in the capital structure as long as the firm maintains an excess of ____________________ over the after-tax cost of debt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

26

By adding the number of days that inventory is held to the number of days that accounts receivable is outstanding an analyst can calculate the number of days of _____________________________________________ the firm requires.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

27

The source of risk related to political unrest and exchange rate changes are _________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

28

One problem with debt ratios is that they provide no information about the ability of the firm to generate ________________________________________ to service debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

29

Below is selected information from DXI's 2007 financial statements:

DXI's Liabilities to Assets Ratio for 2007 is

A) 105.1%

B) 63.1%

C) 78.3%

D) 100.0%

DXI's Liabilities to Assets Ratio for 2007 is

A) 105.1%

B) 63.1%

C) 78.3%

D) 100.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

30

In bankruptcy prediction analysis a type ____________________ error is classifying a firm as bankrupt and it ultimately survives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

31

The operating cycle must not only generate cash to supply ________________________________________ needs, it must generate sufficient cash to service debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

32

The source of risk related interest rate changes and demographic changes is ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

33

In bankruptcy prediction analysis a type ____________________ error is classifying a firm as nonbankrupt when it ultimately goes bankrupt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

34

The source of risk related to management competence, strategic direction and lawsuits is _________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

35

In general, the shorter the number of days of needed financing, the ____________________ is the cash flow from operations to average current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

36

Below is selected information from DXI's 2007 financial statements:

DXI's 2007 Long-term Debt to Long-Term Capital ratio is

A) 31.4%

B) 29.4%

C) 34.0%

D) 25.4%

DXI's 2007 Long-term Debt to Long-Term Capital ratio is

A) 31.4%

B) 29.4%

C) 34.0%

D) 25.4%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

37

Short-term ____________________________ represents a firm's near-term ability to generate cash to service working capital needs and debt service requirements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

38

Below is selected information from DXI's 2007 financial statements:

DXI's 2007 Liabilities to Shareholders' Equity ratio is

A) 100.0%

B) 170.9%

C) 63.1%

D) 129.3%

DXI's 2007 Liabilities to Shareholders' Equity ratio is

A) 100.0%

B) 170.9%

C) 63.1%

D) 129.3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

39

When management takes deliberate steps at a balance sheet date to produce a better current ratio than is normal it is called ______________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

40

Long-term ______________________________ represents the longer-term ability of the firm to generate cash internally or from external sources to satisfy plant capacity and debt repayment needs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

41

Cash flow from operations indicates the amount of cash that the firm derived from operations after funding ______________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

42

The ________________________________________ ratio indicates the number of times that net income before interest expense and income taxes exceeds interest expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

43

Beta captures the _________________________ of the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

44

_________________________ concerns a firm's ability to make interest and principal payments on borrowings as they become due.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

45

Discuss the differences between Chapter 7 and Chapter 11 bankruptcy filings?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

46

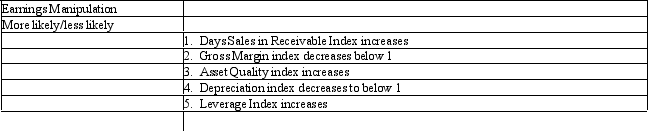

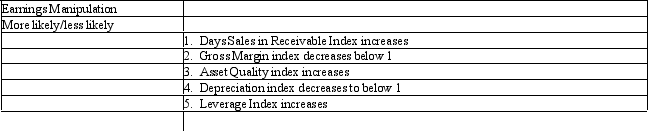

For each of the following factors determine if the given change or level of that factor would lead an analyst to believe that managers of a firm are more or less likely to engage in earnings manipulation:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

47

One criticism of the interest and fixed charges coverage ratios as measures of long-term solvency risk is that they use earnings rather than cash flows in the numerator. Detail how the interest coverage ratio and fixed charges coverage ratio are calculated. In addition, discuss why using earnings in the numerator is a problem and what method could be used to alleviate this problem.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

48

When a financial analyst examines the credit risk of a company it is common that he or she uses a set of factors that all begin with the letter "C". Each factor provides a consideration that enters into the lending decision. List and discuss how each of the factors affects a company's credit risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

49

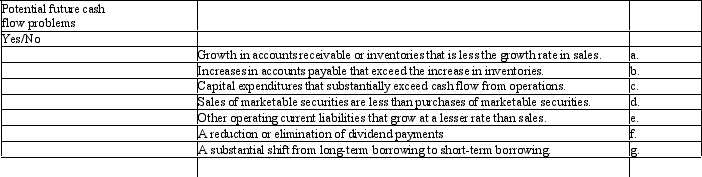

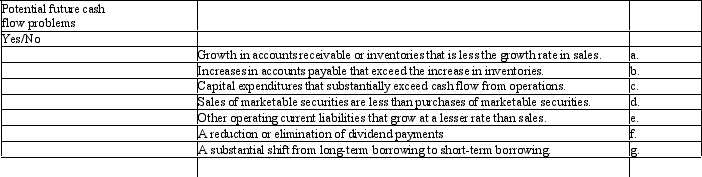

For each of the following scenarios determine if it is an indicator of potential cash flow problems:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

50

Large current ratios indicate the availability of cash and near cash assets to repay ____________________ coming due within the next year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

51

Financially healthy firms frequently close any cash flow gap in their operating cycles with ________________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

52

An analyst can view the revenues to cash ratio as a ________________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

53

The main ratio used by many financial analysts to examine a company's short-term liquidity risk is the current ratio. However, there are a number of problems that arise when this ratio is used to examine short-term liquidity risk that may make the current ratio less useful than initially thought. Discuss the interpretative problems of using the current ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

54

When the excess of ROA over the after-tax cost of borrowing declines, additional ________________________________________ begins to reduce the return to common shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

55

The current risk-free rate of return in the economy is 6.5%. In addition, the market rate of return is currently 10%. Given that a company's expected return on common stock is 12.5% what is the company's systemic risk level (beta)? Show your calculations. In addition, describe systemic risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

56

The current risk-free rate of return in the economy is 4%. In addition, the market rate of return is currently 9.5%. Given this information what would be the expected return on common stock for a company with a systemic risk level (Beta) of 1.2? Show your calculations. In addition, describe systemic risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

57

When calculating the quick ratio, an analyst would include in the numerator cash, ________________________________________, and receivables.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

58

Bankruptcy analysis research has gone through many iterations, from univariate bankruptcy prediction models to sophisticated logit models. However, after examining the results of the research there appear to be a number of common factors that consistently explain bankruptcy. These factors can be grouped into investment factors, financing factors, operating factors. For each of the three groups discuss specific factors that have been found to significantly explain bankruptcy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

59

In the empirical research on earnings manipulation discussed in the chapter a number of firm characteristics are found to be associated with the likelihood of engaging in earnings manipulation. For each of the characteristics listed below discuss the rationale for their inclusion in the model:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

60

The analysis of short-term liquidity risk requires an understanding of the _________________________ of a firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

61

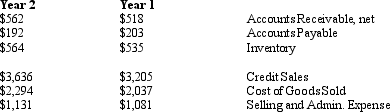

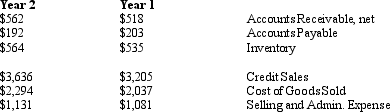

Given the following information, calculate for Year 2 the number of days of working capital financing the firm will need to obtain from other sources?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

62

Below is information from DXI's 2007 financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

63

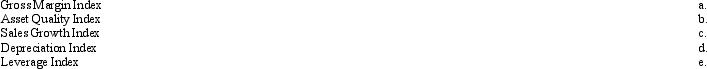

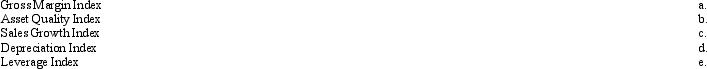

Refer to the financial statement data for Patriot Comp. for 2006 and 2005. Complete the table by computing the ratios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck