Deck 10: Forecasting Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/41

العب

ملء الشاشة (f)

Deck 10: Forecasting Financial Statements

1

To ensure that the financial statements articulate it is important that the change in the cash balance on the balance sheet each year agrees with

A) the cash collections from sales in the projected income statement.

B) the cash provided by or used by operations on the projected statement of cash flows.

C) the net change in cash on the projected statement of cash flows.

D) the net change in working capital from period to period.

A) the cash collections from sales in the projected income statement.

B) the cash provided by or used by operations on the projected statement of cash flows.

C) the net change in cash on the projected statement of cash flows.

D) the net change in working capital from period to period.

C

2

An analyst using the inventory turnover ratio to calculate future levels of inventory may face the problem that

A) the method reduces the potential understatement inherent in average balances.

B) the method can introduce artificial volatility in ending balances.

C) the method results in understating inventory each year.

D) the method results in overstating inventory each year.

A) the method reduces the potential understatement inherent in average balances.

B) the method can introduce artificial volatility in ending balances.

C) the method results in understating inventory each year.

D) the method results in overstating inventory each year.

B

3

Financial statement forecasts should rely on _________________________ across financial statements.

articulation

4

A firm in a mature industry with little expected change in its market share might anticipate volume increases equal to the growth rate in the _________________________ with in its geographic markets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

5

If a company has very low operating leverage (i.e. a low proportion of fixed costs the cost structure) and no changes are expected in operations

A) percentage change income statement percentages can serve as the basis for projecting operating expenses.

B) using common-size income statement percentages will overstate future projected operating expenses.

C) using common-size income statement percentages will understate future projected operating expenses.

D) using common-size income statement percentages can serve as a reasonable basis for projecting future operating expenses.

A) percentage change income statement percentages can serve as the basis for projecting operating expenses.

B) using common-size income statement percentages will overstate future projected operating expenses.

C) using common-size income statement percentages will understate future projected operating expenses.

D) using common-size income statement percentages can serve as a reasonable basis for projecting future operating expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

6

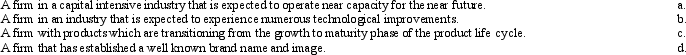

Projecting sales price changes depends on factors specific to the firm and its industry that might affect demand and price elasticity. Which of the following types of companies would most likely be able to increase prices?

A) A firm in a capital intensive industry that is expected to operate near capacity for the near future.

B) A firm in a capital intensive industry in which excess capacity exists.

C) A firm operating in an industry that is expected to experience technological improvements in its production process.

D) A firm operating in an industry that is transitioning from the high growth to the maturity phase of its life cycle.

A) A firm in a capital intensive industry that is expected to operate near capacity for the near future.

B) A firm in a capital intensive industry in which excess capacity exists.

C) A firm operating in an industry that is expected to experience technological improvements in its production process.

D) A firm operating in an industry that is transitioning from the high growth to the maturity phase of its life cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

7

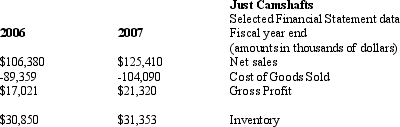

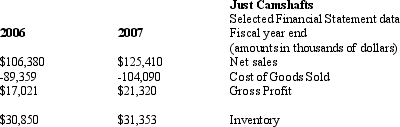

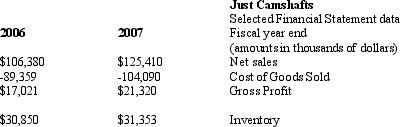

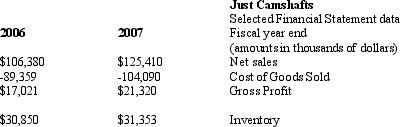

Just Camshafts sells auto parts. Provided below is selected financial information from the company's 2007 annual report:  Just Camshafts forecasts that sales will grow by 25% in 2008 and that its cost of goods sold to sales ratio will be the same in 2008 as it was in 2007. If these assumptions prove correct and Just Camshafts inventory turnover ratio for 2008 is 4.5 what will be the level of inventory at the end of 2008?

Just Camshafts forecasts that sales will grow by 25% in 2008 and that its cost of goods sold to sales ratio will be the same in 2008 as it was in 2007. If these assumptions prove correct and Just Camshafts inventory turnover ratio for 2008 is 4.5 what will be the level of inventory at the end of 2008?

A) $31,353

B) $38,320

C) $40,000

D) $42,314

Just Camshafts forecasts that sales will grow by 25% in 2008 and that its cost of goods sold to sales ratio will be the same in 2008 as it was in 2007. If these assumptions prove correct and Just Camshafts inventory turnover ratio for 2008 is 4.5 what will be the level of inventory at the end of 2008?

Just Camshafts forecasts that sales will grow by 25% in 2008 and that its cost of goods sold to sales ratio will be the same in 2008 as it was in 2007. If these assumptions prove correct and Just Camshafts inventory turnover ratio for 2008 is 4.5 what will be the level of inventory at the end of 2008?A) $31,353

B) $38,320

C) $40,000

D) $42,314

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

8

Financial statement forecasts rely on additivity within financial statements and articulation across financial statements. Given this information sales growth forecasts will most likely affect growth in

A) accounts receivables.

B) accounts payable.

C) depreciation.

D) salary payable.

A) accounts receivables.

B) accounts payable.

C) depreciation.

D) salary payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

9

Baseball Card Land, Inc. sells baseball cards and other memorabilia. The company tries to maintain a cash balance equivalent to approximately 30 days of sales. Sales in 2006 amounted to $352,412 and the company expects growth in 2007 of 33% and in 2008 of 40%. Given the information provided about Baseball Card Land what is the company's 2007 projected year-end cash balance?

A) $966

B) $28,965

C) $15,623

D) $38,524

A) $966

B) $28,965

C) $15,623

D) $38,524

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

10

Baseball Card Land, Inc. sells baseball cards and other memorabilia. The company tries to maintain a cash balance equivalent to approximately 30 days of sales. Sales in 2006 amounted to $352,412 and the company expects growth in 2007 of 33% and in 2008 of 40%. Given the information provided about Baseball Card Land what is the company's 2008 projected annual sales?

A) $656,191

B) $493,377

C) $187,483

D) $542,333

A) $656,191

B) $493,377

C) $187,483

D) $542,333

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

11

Realistic expectations are ____________________ and ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

12

Baseball Card Land, Inc. sells baseball cards and other memorabilia. The company tries to maintain a cash balance equivalent to approximately 30 days of sales. Sales in 2006 amounted to $352,412 and the company expects growth in 2007 of 33% and in 2008 of 40%. Given the information provided about Baseball Card Land what is the company's 2008 projected cash balance?

A) $53,934

B) $49,524

C) $21,873

D) $38,524

A) $53,934

B) $49,524

C) $21,873

D) $38,524

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

13

Nichols and Wahlen's 2004 study showed that superior forecasting provides the potential to earn superior security returns. Nichols and Wahlen's findings indicate

A) that an investor could earn excess returns if the investor could predict accurately the sign of the change in earnings one year ahead.

B) that an investor could earn excess returns if the investor could predict accurately the magnitude of the change in earnings one year ahead.

C) that an investor could earn excess returns if the investor could predict accurately the sign of the change in cash flows from operations one year ahead.

D) that an investor could earn excess returns if the investor could predict accurately the sign of the change in working capital one year ahead.

A) that an investor could earn excess returns if the investor could predict accurately the sign of the change in earnings one year ahead.

B) that an investor could earn excess returns if the investor could predict accurately the magnitude of the change in earnings one year ahead.

C) that an investor could earn excess returns if the investor could predict accurately the sign of the change in cash flows from operations one year ahead.

D) that an investor could earn excess returns if the investor could predict accurately the sign of the change in working capital one year ahead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

14

Projecting sales price changes depends on factors specific to the firm and its industry that might affect demand and price elasticity. Which of the following companies would most likely not be able to increase prices in the near future?

A) A firm in a capital intensive industry that is expected to operate near capacity for the near future.

B) A firm in a capital intensive industry in which excess capacity exists.

C) A firm operating in an industry that is expected to maintain its current production processes.

D) A firm operating in an industry that is transitioning from the introduction phase to the high growth phase of its life cycle.

A) A firm in a capital intensive industry that is expected to operate near capacity for the near future.

B) A firm in a capital intensive industry in which excess capacity exists.

C) A firm operating in an industry that is expected to maintain its current production processes.

D) A firm operating in an industry that is transitioning from the introduction phase to the high growth phase of its life cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

15

When projecting operating expenses it is important to determine the mix of fixed and variable costs, one clue suggesting the presence of fixed costs is

A) the percentage change in cost of goods sold in prior years is significantly greater than the percentage change in sales.

B) the percentage change in cost of goods sold in prior years is significantly less than the percentage change in sales.

C) low capital intensity in the production process.

D) the percentage change in sales in prior years is significantly greater than the percentage change in receivables.

A) the percentage change in cost of goods sold in prior years is significantly greater than the percentage change in sales.

B) the percentage change in cost of goods sold in prior years is significantly less than the percentage change in sales.

C) low capital intensity in the production process.

D) the percentage change in sales in prior years is significantly greater than the percentage change in receivables.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

16

The objective of forecasting is to develop

A) stand alone financial statements for future analysis.

B) a set of realistic expectations for future value-relevant payoffs.

C) a balance sheet and income statement that articulate.

D) financial statements for comparison to industry averages.

A) stand alone financial statements for future analysis.

B) a set of realistic expectations for future value-relevant payoffs.

C) a balance sheet and income statement that articulate.

D) financial statements for comparison to industry averages.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

17

Financial statement forecasts should rely on ____________________ within financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

18

Financial statement forecasts are important analysis tools because forecasts of ______________________________ play a central role in valuation and many other financial decision contexts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

19

Financial statement forecasts rely on additivity within financial statements and articulation across financial statements. Given this information forecasts of future growth in inventory will most likely affect growth in

A) accounts receivables.

B) accounts payable.

C) depreciation.

D) salary payable.

A) accounts receivables.

B) accounts payable.

C) depreciation.

D) salary payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

20

Just Camshafts sells auto parts. Provided below is selected financial information from the company's 2007 annual report:  Using Just Camshafts financial information what is the company's inventory turnover ratio for 2007?

Using Just Camshafts financial information what is the company's inventory turnover ratio for 2007?

A) 0.69

B) 1.00

C) 3.35

D) 4.03

Using Just Camshafts financial information what is the company's inventory turnover ratio for 2007?

Using Just Camshafts financial information what is the company's inventory turnover ratio for 2007?A) 0.69

B) 1.00

C) 3.35

D) 4.03

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

21

If a firm competes in a ___________________________________ industry that the analyst expects will operate near capacity for the next few years, then price increases will be more likely.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

22

For some types of assets, such as plant, property and equipment, asset growth typically ____________________ future sales growth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

23

To develop forecasts of individual assets, the analyst must first link historical growth rates for individual assets to historical growth rates in sales or other ___________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

24

One problem caused by using turnover ratios to calculate asset balances is that it can lead to volatility in projected ending balances. What might an analyst do to reduce the "sawtooth" pattern caused by using turnover ratios?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

25

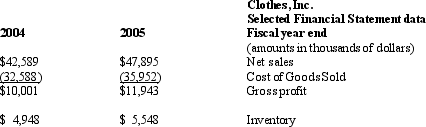

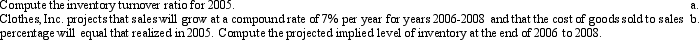

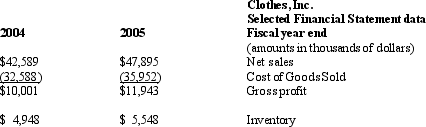

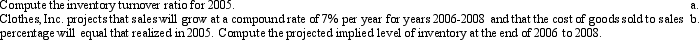

Clothes, Inc. sells women's clothes. Provided below is selected financial statement information:

Required:

Required:

Required:

Required:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

26

For some types of assets, such as accounts receivable asset growth typically ____________________ future sales growth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

27

A firm in transition from the high growth to the mature phase of its life cycle, or a firm with significant technological improvements in its production processes, might expect increases in ______________________________ but decreases in sales prices per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

28

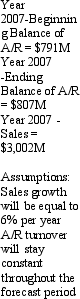

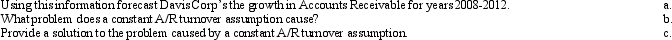

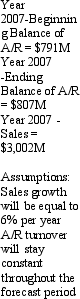

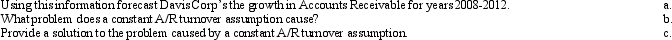

You are provided the following information about Davis Corp.s Accounts Receivable and Sales:

Required:

Required:

Required:

Required:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

29

When projecting ____________________, the analyst should consider economy-wide factors such as the expected rate of general price inflation in the economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

30

As an analyst it is important when projecting sales to make estimates about future changes in sales volume. Compare how you might make estimates about future sales value for a company in a mature industry and one in a rapidly growing industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

31

Cash, Inc. sells numerous office supply products through a national distribution center. The company has focused on maintaining a cash balance equivalent to approximately 14 days of sales. Sales in 2005 amounted to $125,980,673 and the company expects growth in 2006 of 11% and in 2007 of 15%. Given this information determine Cash, Inc.'s projected year-end cash balance for 2006 and 2007.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

32

Many times an analyst will compute ending accounts receivable or inventory balances using turnover ratios, discuss the advantage and disadvantage of using this methodology.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

33

It may be difficult to forecast sales for firms with _________________________ patterns because their historical growth rates reflect wide variations in both direction and amount from year to year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

34

To develop forecasts of individual assets the analyst must first link historical growth rates for individual assets to historical growth rates in ____________________ and other activity-based drivers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

35

The authors set forth a six step forecasting game plan for preparing pro forma financial statements. Discuss the six steps necessary to prepare the three principal financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

36

The first step in the forecasting game plan is to project sales and other revenues. Sales numbers are determined by both a volume component and price component. Projecting prices depends on factors specific to the firm and its industry that might affect demand and price elasticity. For the following types of firms discuss whether it would be likely that the firm would be able to raise future prices:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

37

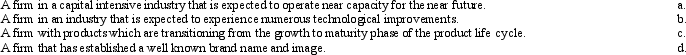

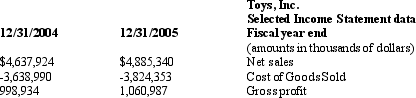

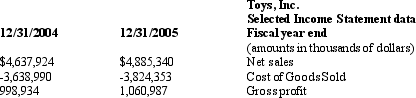

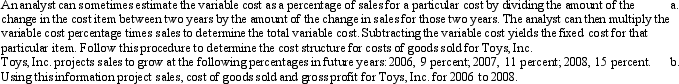

Toys, Inc. manufactures and markets toys. Selected income statement data from 2005 and 2004 appear below:

Required:

Required:

Required:

Required:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

38

A company that has a cost structure in which its costs grow at a lesser rate than its sale enjoys ___________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

39

Firms which have differentiated ___________________________________ for its products may have a greater potential to increase prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

40

The analyst can capture projected levels of operating activity by using ______________________________ to develop forecasts for individual assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

41

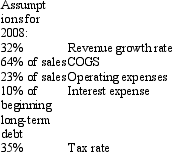

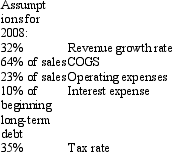

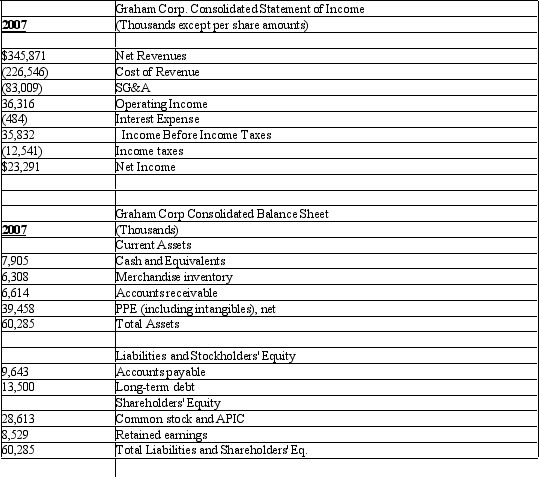

The following balance sheet and income statement pertain to Graham Corp., using the following assumptions complete a forecasted 2008 income statement:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck