Deck 10: Long-Lived Tangible and Intangible Assets

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/182

العب

ملء الشاشة (f)

Deck 10: Long-Lived Tangible and Intangible Assets

1

U.S.GAAP and IFRS provide firms considerable flexibility in choosing their depreciation method(s).

True

2

Expenditures for maintenance or repair of tangible long-lived assets are treated as asset improvements and subsequently depreciated.

False

3

U.S.GAAP and IFRS require firms to treat expenditures for maintenance and repairs as expenses of the period as incurred but treat expenditures for improvements as assets (which firms subsequently depreciate or amortize).

True

4

Market-to-book-value ratios tend to be large for firms that make substantial expenditures on internally developed assets, including research and development, advertising, and employee development.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

5

Depreciation is the accounting term used to refer to the periodic write-off of intangible assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

6

The laws governing patent protection are both jurisdiction-specific and subject to change, as is the process for obtaining approval to market a new drug.As a general rule, the longer the drug approval process, the longer is the useful life of the patent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

7

The depreciable or amortizable basis of long-lived assets is the acquisition cost less salvage value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

8

The amount of goodwill represents the excess of the total purchase price over the fair value of identifiable tangible and intangible net assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

9

Depreciation and amortization is a measure of the decline in economic value of a long-lived asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

10

Long-lived assets with extremely long useful lives, such as land and works of art, are treated as having an indefinite life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

11

With the exception of internally developed software costs, U.S.GAAP requires that the firm expense both research and development expenditures as incurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

12

For buildings, common depreciation practice assumes a zero salvage value on the assumption that the costs a firm will incur in tearing down the building will approximate the sales value of the scrap materials recovered.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

13

Firms sometimes acquire assets by exchanging an asset other than cash or by issuing common stock.In these cases, acquisition cost is either the fair value of the consideration given or the fair value of the asset received, depending on which value the firms can more reliably measure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

14

Although the legal life of a drug patent is 20 years, the expected economic life of the drug is often less than half of that period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

15

Firms must expense when incurred the transactions cost of acquiring a firm in a business combination under both U.S.GAAP and IFRS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

16

Long-lived financial assets include investments in securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

17

Opportunity costs are forgone profits, and U.S.GAAP and IFRS recognize this cost as part of an assets acquisition cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

18

The straight-line (use) method is the most common depreciation method for financial reporting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

19

The capitalization of interest in the acquisition cost of assets during construction delays expense recognition from the time periods of borrowing to the time periods of using the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

20

U.S.GAAP requires firms to expense research and development (R&D) costs in the period incurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

21

Sigma Company suffers a loss to its building in a fire and spends $100,000 on repairs and improvements.It judges that $80,000 of the expenditure replaces long-lived assets lost in the fire, and $20,000 represents improvements to the building.Which of the following is the single journal entry that Sigma Company will make?

A)Building ..........................................100,000 Cash ................................................. 100,000

B)Loss from Fire .......................... ......... 100,000 Cash ................................................ 100,000

C)Cash ............................................ 100,000 Building ............................................... 20,000

Loss from Fire .......................... .............. 80,000

D)Building ...........................................20,000 Loss from Fire .......................... ......... 80,000

Cash ................................................ 100,000

E)Cash .............................................100,000 Loss from Fire .......................... .............. 100,000

A)Building ..........................................100,000 Cash ................................................. 100,000

B)Loss from Fire .......................... ......... 100,000 Cash ................................................ 100,000

C)Cash ............................................ 100,000 Building ............................................... 20,000

Loss from Fire .......................... .............. 80,000

D)Building ...........................................20,000 Loss from Fire .......................... ......... 80,000

Cash ................................................ 100,000

E)Cash .............................................100,000 Loss from Fire .......................... .............. 100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following is/are not true regarding maintenance?

A)Maintenance includes routine costs such as for cleaning and adjusting.

B)Maintenance includes the costs of restoring an asset's service potential after breakdowns or other damage.

C)Maintenance does not extend the estimated service life or increase its productive capacity of an asset beyond original expectations.

D)U.S.GAAP and IFRS treat maintenance expenditures as expenses of the period when the firm makes the expenditure.

E)Distinguishing repairs from maintenance is difficult but typically not necessary because expenditures for both are period expenses.

A)Maintenance includes routine costs such as for cleaning and adjusting.

B)Maintenance includes the costs of restoring an asset's service potential after breakdowns or other damage.

C)Maintenance does not extend the estimated service life or increase its productive capacity of an asset beyond original expectations.

D)U.S.GAAP and IFRS treat maintenance expenditures as expenses of the period when the firm makes the expenditure.

E)Distinguishing repairs from maintenance is difficult but typically not necessary because expenditures for both are period expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

23

Accounting for the impairment of long-lived assets is complex because U.S.GAAP and IFRS requirements differ for various assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

24

IFRS permits upward asset revaluations, the recognition of unrealized increases in the fair value of long-lived assets under certain conditions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

25

Gains and losses on disposals of property, plant, and equipment and intangible assets appear on the income statement, often in "Other income and expense."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

26

Repairs and maintenance do not include

A)the costs of restoring an asset's service potential after breakdowns.

B)expenditures that increase the asset's life.

C)routine costs such as for cleaning and adjusting.

D)major tune-ups including labor and parts.

E)All of the above are not considered to be repairs or maintenance.

A)the costs of restoring an asset's service potential after breakdowns.

B)expenditures that increase the asset's life.

C)routine costs such as for cleaning and adjusting.

D)major tune-ups including labor and parts.

E)All of the above are not considered to be repairs or maintenance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following is/are not capitalized as an intangible asset?

A)costs of an internally developed patent

B)legal costs to defend a patent successfully

C)goodwill acquired when a company purchases another company

D)costs to purchase a patent

E)none of the above

A)costs of an internally developed patent

B)legal costs to defend a patent successfully

C)goodwill acquired when a company purchases another company

D)costs to purchase a patent

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

28

Tangible long-lived assets typically appear under the title Property, Plant, and Equipment, among the current assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

29

U.S.GAAP permits firms to increase the balance sheet carrying values of tangible and intangible long-lived assets when the fair values of their assets increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

30

U.S.GAAP and IFRS distinguish three categories of long-lived assets for purposes of measuring and recognizing impairment losses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

31

U.S.GAAP requires firms to recognize an impairment loss on a nonamortized intangible other than goodwill whenever the carrying value of the asset exceeds its fair value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

32

Firms with tangible long-term assets and less predictable cash flows, such as auto manufacturers and steel companies, whose sales vary with changes in economic conditions, tend to use

A)a more nearly equal mix of long-term debt and shareholders' equity financing.

B)a greater amount of long-term debt [80%] than shareholders' equity financing [20%].

C)a smaller amount of long-term debt [20%] than shareholders' equity financing [80%].

D)a greater amount of long-term debt [80%] than assets [20%].

E)a greater amount of shareholders' equity [80%] than assets [20%].

A)a more nearly equal mix of long-term debt and shareholders' equity financing.

B)a greater amount of long-term debt [80%] than shareholders' equity financing [20%].

C)a smaller amount of long-term debt [20%] than shareholders' equity financing [80%].

D)a greater amount of long-term debt [80%] than assets [20%].

E)a greater amount of shareholders' equity [80%] than assets [20%].

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following is not true regarding expenditures for improvements?

A)Improvements are sometimes called betterments.

B)Improvements may increase an asset's performance by increasing the service life.

C)Improvements may increase an asset's performance by reducing the operating costs.

D)Improvements may increase an asset's performance by increasing the rate of output.

E)When the firm makes the expenditure for improvements, it recognizes the cost of the improvement by debiting the Improvement Expense account.

A)Improvements are sometimes called betterments.

B)Improvements may increase an asset's performance by increasing the service life.

C)Improvements may increase an asset's performance by reducing the operating costs.

D)Improvements may increase an asset's performance by increasing the rate of output.

E)When the firm makes the expenditure for improvements, it recognizes the cost of the improvement by debiting the Improvement Expense account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

34

Firms with tangible long-term assets and predictable cash flows, such as electric utilities, tend to have balance sheets with a

A)high proportion of long-term debt (80% or more).

B)low proportion of long-term debt (20% or less).

C)high proportion of shareholders' equity (80% or more).

D)high proportion of cash (80% or more).

E)high proportion of retained earnings (80% or more).

A)high proportion of long-term debt (80% or more).

B)low proportion of long-term debt (20% or less).

C)high proportion of shareholders' equity (80% or more).

D)high proportion of cash (80% or more).

E)high proportion of retained earnings (80% or more).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

35

Both U.S.GAAP and IFRS distinguish the same three categories of long-lived assets for impairment analysis, and have the same procedures for assessing an asset for impairment and measuring the impairment loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following is/are not true regarding repairs?

A)Repairs include routine costs such as for cleaning and adjusting.

B)Repairs include the costs of restoring an asset's service potential after breakdowns or other damage.

C)Repairs do not extend the estimated service life or increase its productive capacity of an asset beyond original expectations.

D)U.S.GAAP and IFRS treat repair expenditures as expenses of the period when the firm makes the expenditure.

E)Distinguishing repairs from maintenance is difficult but typically not necessary because expenditures for both are period expenses.

A)Repairs include routine costs such as for cleaning and adjusting.

B)Repairs include the costs of restoring an asset's service potential after breakdowns or other damage.

C)Repairs do not extend the estimated service life or increase its productive capacity of an asset beyond original expectations.

D)U.S.GAAP and IFRS treat repair expenditures as expenses of the period when the firm makes the expenditure.

E)Distinguishing repairs from maintenance is difficult but typically not necessary because expenditures for both are period expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

37

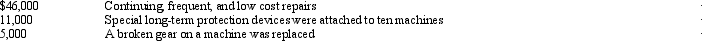

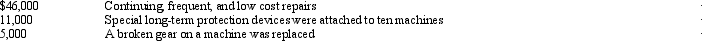

During Year 3, Carrington Company made the following expenditures relating to plant machinery and equipment:  How much should be charged to repairs and maintenance in Year 3?

How much should be charged to repairs and maintenance in Year 3?

A)$46,000

B)$51,000

C)$57,000

D)$41,000

E)none of the above

How much should be charged to repairs and maintenance in Year 3?

How much should be charged to repairs and maintenance in Year 3?A)$46,000

B)$51,000

C)$57,000

D)$41,000

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

38

Flagler Corporation replaces a roof damaged in a hurricane.The new roof is purposefully designed to be stronger than the old one so that it will support the air conditioning equipment the firm plans to install. Which of the following is/are true?

A)Part of the expenditure represents repair and part represents improvement.

B)The expenditure represents repair, only.

C)The expenditure represents improvement, only.

D)The expenditure represents asset, only.

E)The expenditure represents expense, only.

A)Part of the expenditure represents repair and part represents improvement.

B)The expenditure represents repair, only.

C)The expenditure represents improvement, only.

D)The expenditure represents asset, only.

E)The expenditure represents expense, only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following is/are not true regarding expenditures for improvements?

A)Improvements are sometimes called betterments.

B)Improvements may increase an asset's performance by increasing the service life.

C)Improvements may increase an asset's performance by reducing the operating costs.

D)Improvements may increase an asset's performance by increasing the rate of output.

E)none of the above

A)Improvements are sometimes called betterments.

B)Improvements may increase an asset's performance by increasing the service life.

C)Improvements may increase an asset's performance by reducing the operating costs.

D)Improvements may increase an asset's performance by increasing the rate of output.

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

40

Firms often incur costs to maintain, repair, and improve their tangible assets.U.S.GAAP and IFRS require firms to treat expenditures for _____ as _____ as incurred but _____ treat as _____.

A)maintenance and repairs; expenses of the period; expenditures for improvements; assets

B)maintenance and repairs; assets; expenditures for improvements; expenses of the period

C)maintenance and repairs; expenses of the period; expenditures for improvements; liabilities

D)maintenance and repairs; liabilities; expenditures for improvements; expenses of the period

E)maintenance and repairs; assets; expenditures for improvements; liabilities

A)maintenance and repairs; expenses of the period; expenditures for improvements; assets

B)maintenance and repairs; assets; expenditures for improvements; expenses of the period

C)maintenance and repairs; expenses of the period; expenditures for improvements; liabilities

D)maintenance and repairs; liabilities; expenditures for improvements; expenses of the period

E)maintenance and repairs; assets; expenditures for improvements; liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

41

Firms that incur research and development costs to develop a patented product:

A)must expense the costs as incurred.

B)must capitalize the costs and only reduce such costs if the patent becomes impaired.

C)must capitalize the costs and then amortize the costs over the expected economic life of the patent.

D)have a choice either to expense the costs as incurred or capitalize the costs and amortize the costs over the legal life of the patent.

E)have a choice either to expense the costs as incurred or capitalize the costs and amortize the costs over the expected economic life of the patent.

A)must expense the costs as incurred.

B)must capitalize the costs and only reduce such costs if the patent becomes impaired.

C)must capitalize the costs and then amortize the costs over the expected economic life of the patent.

D)have a choice either to expense the costs as incurred or capitalize the costs and amortize the costs over the legal life of the patent.

E)have a choice either to expense the costs as incurred or capitalize the costs and amortize the costs over the expected economic life of the patent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

42

Springfield Company purchases new factory equipment.Per the terms of the contract, Springfield must pay the freight charges, will receive a manufacturer's discount off the invoice price on the equipment, and will have some setup expenses to pay. As a result, the acquisition cost of equipment recorded on Springfield's books will be the sum of the invoice price

A)less any discounts, plus transportation costs, installation charges, and any other costs incurred before the equipment is ready for use.

B)less any discounts and transportation costs, plus installation charges and any other costs incurred after the equipment is ready for use.

C)plus transportation costs, installation charges, and any other costs incurred before the equipment is ready for use.

D)less transportation costs, installation charges, and any other costs incurred after the equipment is ready for use.

E)less any discounts and installation charges, plus transportation charges and any other costs incurred after the equipment is ready for use.

A)less any discounts, plus transportation costs, installation charges, and any other costs incurred before the equipment is ready for use.

B)less any discounts and transportation costs, plus installation charges and any other costs incurred after the equipment is ready for use.

C)plus transportation costs, installation charges, and any other costs incurred before the equipment is ready for use.

D)less transportation costs, installation charges, and any other costs incurred after the equipment is ready for use.

E)less any discounts and installation charges, plus transportation charges and any other costs incurred after the equipment is ready for use.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

43

Firms generally treat expenditures to develop intangibles internally as

A)expenses when incurred.

B)expenses over the useful life.

C)assets.

D)liabilities.

E)goodwill.

A)expenses when incurred.

B)expenses over the useful life.

C)assets.

D)liabilities.

E)goodwill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

44

Tangible long-lived assets include all of the following except

A)land.

B)buildings.

C)equipment.

D)factories.

E)franchise rights.

A)land.

B)buildings.

C)equipment.

D)factories.

E)franchise rights.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

45

Clarion Realty has decided to construct its own office building.The construction will be partially financed through a construction loan and any remainder will be financed from internally generated funds.The internal accountants have collected the following information concerning the construction.

The amount, if any, of capitalized interest cost for Year 2 is

A)$0

B)$50,000

C)$60,000

D)$180,000

E)$230,000

The amount, if any, of capitalized interest cost for Year 2 is

A)$0

B)$50,000

C)$60,000

D)$180,000

E)$230,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

46

Intangible long-lived assets include:

A)patents.

B)brand names.

C)trademarks.

D)customer lists.

E)all of the above

A)patents.

B)brand names.

C)trademarks.

D)customer lists.

E)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

47

For many technology and pharmaceutical firms:

A)a large portion of their value to an acquirer might relate to in-process research and development (IPR&D).

B)in-process research and development (IPR&D) acquired in a business combination that meets the separability criterion as an asset is recognized and measured initially at fair value.

C)The firm that developed the in-process research and development (IPR&D) expensed the costs as they were incurred.

D)all of the above

E)none of the above

A)a large portion of their value to an acquirer might relate to in-process research and development (IPR&D).

B)in-process research and development (IPR&D) acquired in a business combination that meets the separability criterion as an asset is recognized and measured initially at fair value.

C)The firm that developed the in-process research and development (IPR&D) expensed the costs as they were incurred.

D)all of the above

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

48

How are tangible long-lived assets' acquisition cost and accumulated depreciation disclosed?

A)Tangible long-lived assets typically appear under the title Property, Plant, and Equipment.

B)Information is displayed on the balance sheet.

C)Tangible long-lived assets typically appear under noncurrent assets.

D)Acquisition cost and accumulated depreciation are omitted from the balance sheet but are detailed in the notes.

E)all of the above

A)Tangible long-lived assets typically appear under the title Property, Plant, and Equipment.

B)Information is displayed on the balance sheet.

C)Tangible long-lived assets typically appear under noncurrent assets.

D)Acquisition cost and accumulated depreciation are omitted from the balance sheet but are detailed in the notes.

E)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

49

An expenditure qualifies as an asset if it has which of the following characteristics?

A)It embodies a probable future benefit.

B)A particular entity can obtain the benefit and control others' access to it.

C) The transaction or other event giving rise to the entity's right to, or control of, the benefit has already occurred.

D)The fair value of the item at the time of initial recognition can be measured with sufficient reliability.

E)all of the above

A)It embodies a probable future benefit.

B)A particular entity can obtain the benefit and control others' access to it.

C) The transaction or other event giving rise to the entity's right to, or control of, the benefit has already occurred.

D)The fair value of the item at the time of initial recognition can be measured with sufficient reliability.

E)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

50

Clarion Realty Clarion Realty has decided to construct its own office building.The construction will be partially financed through a construction loan and any remainder will be financed from internally generated funds.The internal accountants have collected the following information concerning the construction.

The amount, if any, of capitalized interest cost for Year 1 is

A)$0

B)$50,000

C)$60,000

D)$110,000

E)$170,000

The amount, if any, of capitalized interest cost for Year 1 is

A)$0

B)$50,000

C)$60,000

D)$110,000

E)$170,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

51

An expenditure qualifies as a(n) _____ if it has the following characteristics: 1.It embodies a probable future benefit.

2)A particular entity can obtain the benefit and control others' access to it.

3)The transaction or other event giving rise to the entity's right to, or control of, the benefit has already occurred.

4)The fair value of the item at the time of initial recognition can be measured with sufficient reliability.

A)asset

B)liability

C)shareholders' equity

D)revenue

E)expense

2)A particular entity can obtain the benefit and control others' access to it.

3)The transaction or other event giving rise to the entity's right to, or control of, the benefit has already occurred.

4)The fair value of the item at the time of initial recognition can be measured with sufficient reliability.

A)asset

B)liability

C)shareholders' equity

D)revenue

E)expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

52

Firms treat expenditures as assets when they:

A)have acquired rights to the future use of a resource as a result of a past transaction or event.

B)can reliably measure the cost of the expected benefits at the time of initial recognition.

C)can exercise the entity's right to, or control of, the benefit.

D)can obtain the future service potential and control others' access to it.

E)all of the above

A)have acquired rights to the future use of a resource as a result of a past transaction or event.

B)can reliably measure the cost of the expected benefits at the time of initial recognition.

C)can exercise the entity's right to, or control of, the benefit.

D)can obtain the future service potential and control others' access to it.

E)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

53

The Perma Company spent $300,000 on research and development during Year 8 to generate new product lines.One of the three projects looks like it will ultimately be technologically feasible while the other two projects resulted in unsuccessful efforts.For the project which may become technologically feasible, a total of $125,000 was incurred during Year 8.Under U.S.GAAP, how much of the $300,000 should be recognized as an expense in Year 8?

A)$300,000

B)$225,000

C)$175,000

D)$50,000

E)$0

A)$300,000

B)$225,000

C)$175,000

D)$50,000

E)$0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

54

Firms recognize expenditures to acquire intangibles externally from third parties as _____ if the intangibles are either separable or arise from contractual or other legal rights.

A)assets

B)liabilities

C)retained earnings

D)revenue

E)expenses

A)assets

B)liabilities

C)retained earnings

D)revenue

E)expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

55

Firms sometimes acquire assets by exchanging an asset other than cash or by issuing common stock.In these cases, acquisition cost is

A)the fair value of the asset received, only.

B)the fair value of the consideration given, only.

C)either the fair value of the consideration given or the fair value of the asset received, depending on which amount is lower.

D)either the fair value of the consideration given or the fair value of the asset received, depending on which the firms can more reliably measure.

E)either the fair value of the consideration given or the fair value of the asset received, depending on which amount is higher.

A)the fair value of the asset received, only.

B)the fair value of the consideration given, only.

C)either the fair value of the consideration given or the fair value of the asset received, depending on which amount is lower.

D)either the fair value of the consideration given or the fair value of the asset received, depending on which the firms can more reliably measure.

E)either the fair value of the consideration given or the fair value of the asset received, depending on which amount is higher.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

56

In a corporate acquisition the:

A)purchase price measures the fair value of the acquired enterprise.

B)goodwill reflects the fair value of assets that cannot be separately identify.

C)goodwill is an asset because it is part of the fair value of the acquired firm.

D)all of the above

E)none of the above

A)purchase price measures the fair value of the acquired enterprise.

B)goodwill reflects the fair value of assets that cannot be separately identify.

C)goodwill is an asset because it is part of the fair value of the acquired firm.

D)all of the above

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

57

Why is analysis of intangible assets more challenging than the analysis of tangible long-lived assets?

A)Except for software development costs under U.S.GAAP and development costs under IFRS, firms generally do not recognize internally developed intangibles as assets on the balance sheet.

B)U.S.GAAP and IFRS require firms to measure the fair values of identifiable intangibles acquired in a business combination and assess whether they have finite lives or indefinite lives.

C)Differences between U.S.GAAP and IFRS in the treatment of development costs mean that comparisons of firms that apply U.S.GAAP with firms that apply IFRS require consideration of and adjustment for those differences.

D)all of the above

E)none of the above

A)Except for software development costs under U.S.GAAP and development costs under IFRS, firms generally do not recognize internally developed intangibles as assets on the balance sheet.

B)U.S.GAAP and IFRS require firms to measure the fair values of identifiable intangibles acquired in a business combination and assess whether they have finite lives or indefinite lives.

C)Differences between U.S.GAAP and IFRS in the treatment of development costs mean that comparisons of firms that apply U.S.GAAP with firms that apply IFRS require consideration of and adjustment for those differences.

D)all of the above

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

58

Tangible long-lived assets include

A)land.

B)buildings.

C)equipment.

D)factories.

E)all of the above

A)land.

B)buildings.

C)equipment.

D)factories.

E)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

59

Firms treat expenditures to develop intangibles internally as assets under U.S.GAAP when _____ the point of technological feasibility; and under IFRS when _____ the point of technological feasibility.

A)software development costs are incurred after; development costs are incurred generally after

B)software development costs are incurred after; development costs are incurred generally before

C)software development costs are incurred before; development costs are incurred generally before

D)software development costs are incurred before; development costs are incurred generally after

E)none of the above.

A)software development costs are incurred after; development costs are incurred generally after

B)software development costs are incurred after; development costs are incurred generally before

C)software development costs are incurred before; development costs are incurred generally before

D)software development costs are incurred before; development costs are incurred generally after

E)none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

60

Focus Company decided to construct its own manufacturing building.Focus Company should capitalize which of the following interest costs?

A)Building interest costs incurred prior to construction while occupying another building.

B)Building interest costs incurred during construction.

C)Building interest costs incurred after construction.

D)All interest costs incurred.

E)No interest costs incurred.

A)Building interest costs incurred prior to construction while occupying another building.

B)Building interest costs incurred during construction.

C)Building interest costs incurred after construction.

D)All interest costs incurred.

E)No interest costs incurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following is/are true about goodwill?

A)Goodwill reflects the value of knowledgeable employees.

B)Goodwill reflects the value of a reputation for quality products.

C)Under both U.S.GAAP and IFRS, goodwill has an indefinite life, and firms do not amortize the amount recognized as goodwill.

D)Firms must test goodwill annually for a loss in value.

E)all of the above

A)Goodwill reflects the value of knowledgeable employees.

B)Goodwill reflects the value of a reputation for quality products.

C)Under both U.S.GAAP and IFRS, goodwill has an indefinite life, and firms do not amortize the amount recognized as goodwill.

D)Firms must test goodwill annually for a loss in value.

E)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following is/are true about holding gains on assets?

A)U.S.GAAP recognizes the holding gain on the assets for the increase in values.

B)IFRS permits recognition of the holding gains under certain circumstances.

C)IFRS precludes recognition of the holding gain on assets for the increase in values.

D)Under U.S.GAAP, if in a given period, an asset increases in value, the firm does not record depreciation and amortization during that period.

E)Under IFRS, if in a given period, an asset increases in value, the firm does not record depreciation and amortization during that period.

A)U.S.GAAP recognizes the holding gain on the assets for the increase in values.

B)IFRS permits recognition of the holding gains under certain circumstances.

C)IFRS precludes recognition of the holding gain on assets for the increase in values.

D)Under U.S.GAAP, if in a given period, an asset increases in value, the firm does not record depreciation and amortization during that period.

E)Under IFRS, if in a given period, an asset increases in value, the firm does not record depreciation and amortization during that period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

63

Goodwill that was internally developed should be amortized over a life not to exceed

A)100 years

B)40 years

C)20 years

D)10 years

E)No useful life, as such goodwill is not recorded as an asset

A)100 years

B)40 years

C)20 years

D)10 years

E)No useful life, as such goodwill is not recorded as an asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

64

Long-lived assets with an indefinite life include:

A)trade names.

B)trademarks.

C)certain renewable licenses.

D)goodwill arising from a business combination.

E)all of the above.

A)trade names.

B)trademarks.

C)certain renewable licenses.

D)goodwill arising from a business combination.

E)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which of the following is not true about goodwill?

A)Goodwill reflects the value of knowledgeable employees.

B)Goodwill reflects the value of a reputation for quality products.

C)Under IFRS, goodwill has an indefinite life, and firms do not amortize the amount recognized as goodwill.

D)Firms must test goodwill annually for a loss in value.

E)Under U.S.GAAP, goodwill has an indefinite life, and firms amortize the amount recognized as goodwill.

A)Goodwill reflects the value of knowledgeable employees.

B)Goodwill reflects the value of a reputation for quality products.

C)Under IFRS, goodwill has an indefinite life, and firms do not amortize the amount recognized as goodwill.

D)Firms must test goodwill annually for a loss in value.

E)Under U.S.GAAP, goodwill has an indefinite life, and firms amortize the amount recognized as goodwill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

66

The capitalization of interest in the acquisition cost of assets during construction

A)reduces otherwise reportable interest expense.

B)increases net income during periods of construction.

C)results in higher depreciation charges, reducing net income.

D)delays expense recognition from the times of borrowing to the times of using the asset.

E)all of the above

A)reduces otherwise reportable interest expense.

B)increases net income during periods of construction.

C)results in higher depreciation charges, reducing net income.

D)delays expense recognition from the times of borrowing to the times of using the asset.

E)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following is/are true about holding gains on assets?

A)U.S.GAAP recognizes the holding gain on the assets for the increase in values.

B)IFRS permits recognition of the holding gains under certain circumstances.

C)Under IFRS, if in a given period, an asset increases in value, the firm does not record depreciation and amortization during that period.

D)Under U.S.GAAP, if in a given period, an asset increases in value, the firm does not record depreciation and amortization during that period.

E)all of the above

A)U.S.GAAP recognizes the holding gain on the assets for the increase in values.

B)IFRS permits recognition of the holding gains under certain circumstances.

C)Under IFRS, if in a given period, an asset increases in value, the firm does not record depreciation and amortization during that period.

D)Under U.S.GAAP, if in a given period, an asset increases in value, the firm does not record depreciation and amortization during that period.

E)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following is not true regarding long-lived assets with a finite life?

A)The firm consumes the asset's services over time in generating revenues.

B)The balance sheet carrying value decreases over time as the firm recognizes the cost of the asset as an expense.

C)A portion of the acquisition cost is recognized as an expense each period.

D)Management must estimate the asset's finite life.

E)Remains on the balance sheet at net realizable value (unless an asset impairment occurs).

A)The firm consumes the asset's services over time in generating revenues.

B)The balance sheet carrying value decreases over time as the firm recognizes the cost of the asset as an expense.

C)A portion of the acquisition cost is recognized as an expense each period.

D)Management must estimate the asset's finite life.

E)Remains on the balance sheet at net realizable value (unless an asset impairment occurs).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following is/are true regarding long-lived assets with a finite life?

A)The firm consumes the asset's services over time in generating revenues.

B)The balance sheet carrying value decreases over time as the firm recognizes the cost of the asset as an expense.

C)A portion of the acquisition cost is recognized as an expense each period.

D)Management must estimate the asset's finite life.

E)all of the above

A)The firm consumes the asset's services over time in generating revenues.

B)The balance sheet carrying value decreases over time as the firm recognizes the cost of the asset as an expense.

C)A portion of the acquisition cost is recognized as an expense each period.

D)Management must estimate the asset's finite life.

E)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

70

Depreciation is the accounting term used to refer to

A)the periodic write-off of the acquisition cost of a tangible long-lived asset with a finite service life.

B)the periodic write-off of the current fair market value of a tangible long-lived asset with a finite service life.

C)the periodic write-off of the acquisition cost of an intangible long-lived asset with a finite service life.

D)the periodic write-off of the current fair market value of a intangible long-lived asset with a finite service life.

E)the periodic write-off of intangible assets.

A)the periodic write-off of the acquisition cost of a tangible long-lived asset with a finite service life.

B)the periodic write-off of the current fair market value of a tangible long-lived asset with a finite service life.

C)the periodic write-off of the acquisition cost of an intangible long-lived asset with a finite service life.

D)the periodic write-off of the current fair market value of a intangible long-lived asset with a finite service life.

E)the periodic write-off of intangible assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following is/are intangible assets with a finite useful life?

A)Customer List and User Base

B)Trade Names and Trademarks

C)Developed Technologies

D)Network Access Agreements

E)all of the above

A)Customer List and User Base

B)Trade Names and Trademarks

C)Developed Technologies

D)Network Access Agreements

E)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

72

(CMA adapted, Dec 86 #12) A patent is granted by the federal government to an inventor for a period of several years.Costs that are capitalized with regard to a patent would include

A)legal fees of obtaining the patent, incidental costs of obtaining the patent, and costs of successful patent infringement suits.

B)legal fees of obtaining the patent, incidental costs of obtaining the patent, and research and development costs incurred on the invention that is patented.

C)legal fees of obtaining the patent, costs of successful patent infringement suits, and research and development costs incurred on the invention that is patented.

D)legal fees of obtaining the patent, costs of successful and unsuccessful patent infringement suits, and research and development costs incurred on the invention that is patented.

E)legal fees of obtaining the patent, costs of successful and unsuccessful patent infringement suits, and development costs incurred on the invention that is patented.

A)legal fees of obtaining the patent, incidental costs of obtaining the patent, and costs of successful patent infringement suits.

B)legal fees of obtaining the patent, incidental costs of obtaining the patent, and research and development costs incurred on the invention that is patented.

C)legal fees of obtaining the patent, costs of successful patent infringement suits, and research and development costs incurred on the invention that is patented.

D)legal fees of obtaining the patent, costs of successful and unsuccessful patent infringement suits, and research and development costs incurred on the invention that is patented.

E)legal fees of obtaining the patent, costs of successful and unsuccessful patent infringement suits, and development costs incurred on the invention that is patented.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

73

The _____ of a long-lived asset is the cost of a series of future services.

A)present value of future cash flows

B)acquisition cost

C)current fair market value

D)liquidation value

E)current cost

A)present value of future cash flows

B)acquisition cost

C)current fair market value

D)liquidation value

E)current cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following is not true about goodwill?

A)Goodwill reflects the value of knowledgeable employees.

B)Goodwill reflects the value of a reputation for quality products.

C)Under U.S.GAAP, goodwill has an indefinite life, and firms do not amortize the amount recognized as goodwill.

D)Firms must test goodwill annually for a loss in value.

E)Under IFRS, goodwill has an indefinite life, and firms amortize the amount recognized as goodwill.

A)Goodwill reflects the value of knowledgeable employees.

B)Goodwill reflects the value of a reputation for quality products.

C)Under U.S.GAAP, goodwill has an indefinite life, and firms do not amortize the amount recognized as goodwill.

D)Firms must test goodwill annually for a loss in value.

E)Under IFRS, goodwill has an indefinite life, and firms amortize the amount recognized as goodwill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following is/are true regarding the fair value of long-lived assets?

A)U.S.GAAP does not permit firms to increase the balance sheet carrying values of tangible and intangible long-lived assets when the fair values of their assets increase.

B)IFRS permits upward asset revaluations, the recognition of unrealized increases in the fair value of tangible and intangible long-lived assets under certain conditions.

C)IFRS requires that firms credit the increase in the tangible and intangible revalued asset's balance sheet carrying value to other comprehensive income.

D)U.S.GAAP firms recognize the increase in the fair value of the tangible and intangible asset only as the firm realizes the value increase through either sale or continuing use.

E)all of the above

A)U.S.GAAP does not permit firms to increase the balance sheet carrying values of tangible and intangible long-lived assets when the fair values of their assets increase.

B)IFRS permits upward asset revaluations, the recognition of unrealized increases in the fair value of tangible and intangible long-lived assets under certain conditions.

C)IFRS requires that firms credit the increase in the tangible and intangible revalued asset's balance sheet carrying value to other comprehensive income.

D)U.S.GAAP firms recognize the increase in the fair value of the tangible and intangible asset only as the firm realizes the value increase through either sale or continuing use.

E)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

76

When a firm constructs its own buildings or equipment:

A) it recognizes the labor, material, and overhead costs incurred as an asset.

B)U.S.GAAP and IFRS require firms to include, or capitalize, interest costs during construction in the cost of a self-constructed asset.

C) it recognizes the labor, material, and overhead costs incurred as a period expense.

D)U.S.GAAP and IFRS require firms to expense interest costs incurred during construction of a self-constructed asset.

E)both choices a and b are correct.

A) it recognizes the labor, material, and overhead costs incurred as an asset.

B)U.S.GAAP and IFRS require firms to include, or capitalize, interest costs during construction in the cost of a self-constructed asset.

C) it recognizes the labor, material, and overhead costs incurred as a period expense.

D)U.S.GAAP and IFRS require firms to expense interest costs incurred during construction of a self-constructed asset.

E)both choices a and b are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following is/are not true regarding the fair value of long-lived assets?

A)U.S.GAAP does not permit firms to increase the balance sheet carrying values of tangible and intangible long-lived assets when the fair values of their assets increase.

B)IFRS permits upward asset revaluations, the recognition of unrealized increases in the fair value of tangible and intangible long-lived assets under certain conditions.

C)IFRS requires that firms credit the increase in the tangible and intangible revalued asset's balance sheet carrying value to net income.

D)U.S.GAAP firms recognize the increase in the fair value of the tangible and intangible asset only as the firm realizes the value increase through either sale or continuing use.

E)all of the above

A)U.S.GAAP does not permit firms to increase the balance sheet carrying values of tangible and intangible long-lived assets when the fair values of their assets increase.

B)IFRS permits upward asset revaluations, the recognition of unrealized increases in the fair value of tangible and intangible long-lived assets under certain conditions.

C)IFRS requires that firms credit the increase in the tangible and intangible revalued asset's balance sheet carrying value to net income.

D)U.S.GAAP firms recognize the increase in the fair value of the tangible and intangible asset only as the firm realizes the value increase through either sale or continuing use.

E)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

78

Assume the following long-term debt structure for Parton Stores: Construction Loan at 5% on Building Under Construction .........$2,000,000

Other Borrowings at 6% Average Rate .........................7,200,000

Total Long-Term Debt ....................................$9,200,000

The account Building Under Construction has an average balance during the year of $6,000,000.Parton Stores bases the amount of interest capitalized on the new construction-related borrowing, $2,000,000, and enough of the other borrowing to bring the total to $6,000,000.

How much does Parton Stores capitalize interest on the new construction?

A)$240,000

B)$300,000

C)$320,000

D)$340,000

E)$360,000

Other Borrowings at 6% Average Rate .........................7,200,000

Total Long-Term Debt ....................................$9,200,000

The account Building Under Construction has an average balance during the year of $6,000,000.Parton Stores bases the amount of interest capitalized on the new construction-related borrowing, $2,000,000, and enough of the other borrowing to bring the total to $6,000,000.

How much does Parton Stores capitalize interest on the new construction?

A)$240,000

B)$300,000

C)$320,000

D)$340,000

E)$360,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following is/are true regarding measuring changes in the fair values of long-lived assets?

A)U.S.GAAP requires firms to recognize decreases in fair values as an impairment loss, and to recognize unrealized increases in fair values.

B)IFRS requires firms to recognize decreases in fair values as an impairment loss, and to never recognize unrealized increases in fair value.

C)U.S.GAAP requires firms to not recognize decreases in fair values, but to recognize unrealized increases in fair value.

D)IFRS requires firms to not recognize decreases in fair values, but to recognize unrealized increases in fair value.

E)U.S.GAAP and IFRS requires firms to recognize decreases in fair values as an impairment loss, and differ as to the recognition of unrealized increases in fair values.

A)U.S.GAAP requires firms to recognize decreases in fair values as an impairment loss, and to recognize unrealized increases in fair values.

B)IFRS requires firms to recognize decreases in fair values as an impairment loss, and to never recognize unrealized increases in fair value.

C)U.S.GAAP requires firms to not recognize decreases in fair values, but to recognize unrealized increases in fair value.

D)IFRS requires firms to not recognize decreases in fair values, but to recognize unrealized increases in fair value.

E)U.S.GAAP and IFRS requires firms to recognize decreases in fair values as an impairment loss, and differ as to the recognition of unrealized increases in fair values.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

80

The cost of long-lived assets with an indefinite life

A)is not recognized as an expense each period.

B)remains on the balance sheet at acquisition cost (unless an asset impairment occurs).

C)is recognized as an expense each period.

D)presents a balance sheet carrying value that decreases over time as the firm recognizes the cost of the asset as an expense.

E)includes both choices a and b.

A)is not recognized as an expense each period.

B)remains on the balance sheet at acquisition cost (unless an asset impairment occurs).

C)is recognized as an expense each period.

D)presents a balance sheet carrying value that decreases over time as the firm recognizes the cost of the asset as an expense.

E)includes both choices a and b.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck